GOVERNMENT OF KARNATAKA

DEPARTMENT OF HOUSING

RAJIV GANDHI HOUSING CORPORATION LIMITED

STATE LEVEL NODAL AGENCY

Date: 28.11.2019

Time: 04.30 PM

Venue: Conference Hall, RGHCL, Bangalore

AFFORDABLE HOUSING –

PPP MODELS

PRADHAN MANTRI AWAS YOJANA (URBAN)

Rajiv Gandhi Housing Corporation Limited (RGHCL) was established during 2000 as a special

purpose vehicle “To provide housing to social and economical weaker section of the society

through Central and State housing schemes”

So far around 41 Lakh houses have been constructed successfully across the state (Urban &

Rural) .

OBJECTIVES:

1. Providing financial assistance directly to beneficiaries for construction of houses in rural

& urban areas.

2. Channelizing Central & State assistance to implementing agencies to provide integrated

group housing including infrastructure for site-less beneficiaries.

3. Brining transparency in implementation/selection/fund transfer, innovative

technologies in construction.

4. Monitoring the progress.

RAJIV GANDHI HOUSING CORPORATION LIMITED

URBAN HOUSING SCHEMES

Land purchase scheme

Grant

( Rs. In lakh)

Vajapayee

Urban

scheme

Rs.12

Lakh per acre to Rs.37.50 lakh per

acre (depending upon city)

Other schemes

Grant

( Rs. In lakh)

Infrastructure

scheme

Rs. 40

lakh per acre

Site formation scheme (per site)

Urban: 3000/

-

Urban Scheme

Grant per

unit (Rs. In lakh)

Vajapayee

Housing scheme

Gen: 1.20

Dr. B.R.

Ambedkar Housing scheme

SC/ST:2.00

Devaraju

Urs Special Housing scheme

Gen: 1.20, SC/ST: 1.50

Pradhan

Mantri Awas Yojana (Urban)

1.50

1

lakh Multi-storied Housing project in B’lore

Gen: 2.70, SC/ST:3.50

• GoI has launched PMAY (U) Mission on 25.06.2015 with a vision of HOUSING FOR ALL

• The Mission will be implemented through four verticals:

• Affordable Housing in Partnership (AHP).

• Credit Linked Subsidy scheme.

• In-situ slum redevelopment using land as resource.

• Beneficiaries Led Construction or enhancement

• Rajiv Gandhi Housing Corporation Limited is State Level Nodal Agency.

• ULBs, KSDB, KHB, UDAs & Private developer are identified as Implementing Agencies.

• All 275 ULBs from the State are covered.

• Eligibility Criteria:

• A family comprising husband, wife, unmarried children (below 18 years) not owning

pucca house any where in India

• Adult earning member (married/unmarried) having no house any where in India

• Family residing in ULB limit/ planning /special/development/industrial area

• Income Criteria :

• EWS Upto Rs. 3.00 lakh p.a

• LIG Rs. 3.00 lakh to Rs. 6.00 lakh p.a

• MIG-1 Rs. 6.00 lakh to Rs. 12.00 lakh p.a

• MIG -2 Rs. 12.00 lakh to Rs. 18.00 lakh p.a

PRADHAN MANTRI AWAS YOJANA (U)

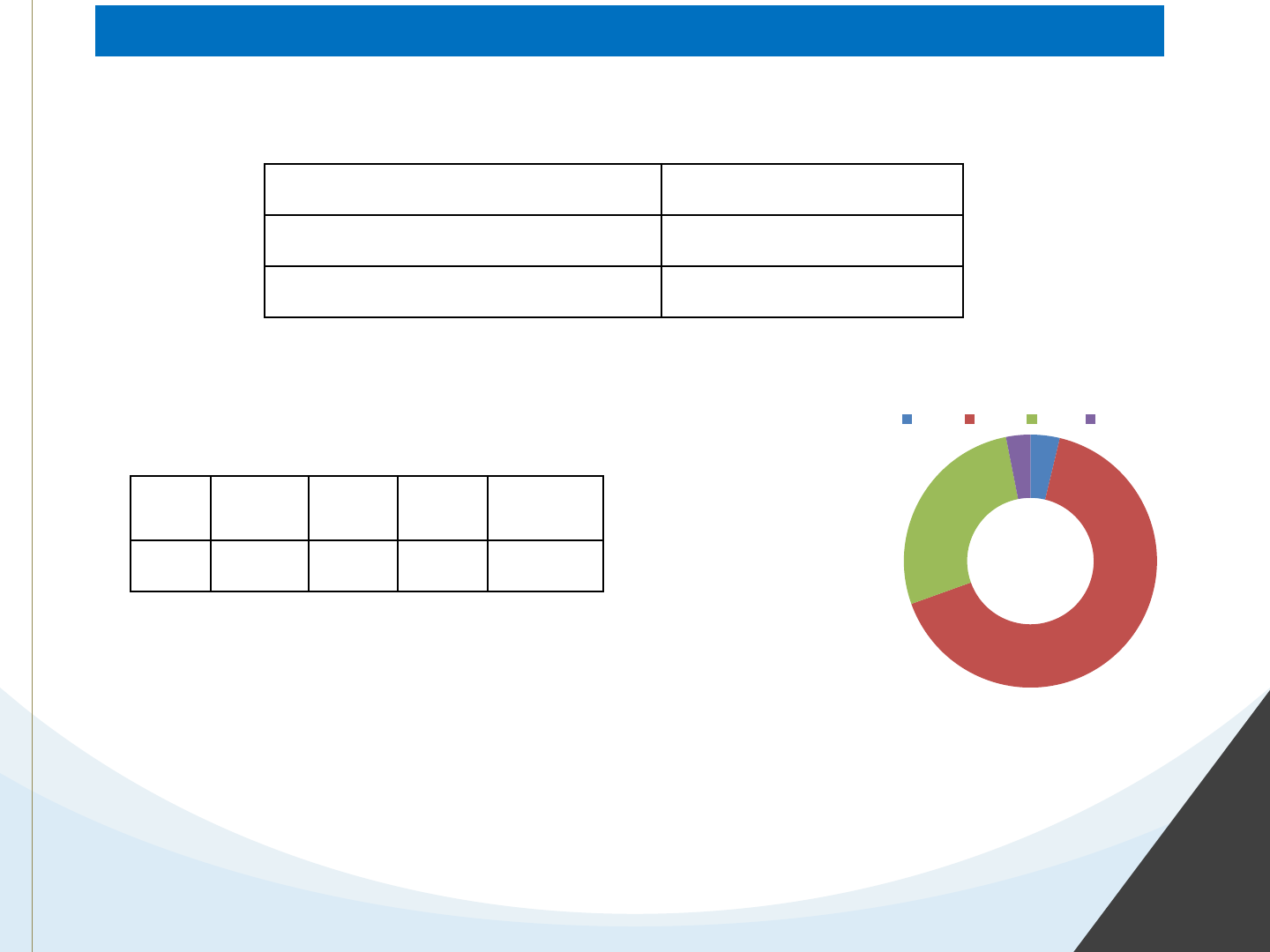

URBAN HOUSING DEMAND

5

Extent of housing shortage

Number (in

lakh)

Current Housing Shortage

12.58

Projection

for 2022

13.83

• Karnataka State stands 2nd place in India (housing demand).

• Till date, projects for construction of 5.65 houses are got approved under PMAY (U)

• Balance demand is still 6.93 lakh

• By 2022, State has to meet huge demand .

4%

66%

27%

3%

Vertical Wise

ISSR AHP BLC CLSS

ISSR

AHP

BLC

CLSS

Total

0.47

8.26

3.44

0.39

12.58

65% comprises site-less beneficiaries

• Demand survey was conducted during 2016-17 & 2017-18 across the state

PUBLIC PRIVATE PARTNERSHIP MODELS FOR

AFFORDABLE HOUSING

UNDER PMAY (U)

AFFORDABLE HOUSING

• Challenges in Affordable housing:

• Huge demand for housing

• High cost of land / underutilization of privately own land

• Huge fund requirement

• Enhancing Pvt Dev participation

• To address these problems, GoI set up a committee on “ PPP in Affordable Housing

Sector”

• After several consultation with stakeholders, MoHUA has framed “ PPP models for

Affordable housing in India”

• There are 8 Models

• 6 Model on Govt land

• 2 Models on private land

• Govt will provide financial assistance, land, option to Pvt Dev. for cross subsidization by

constructing high cost houses etc , option to bring in private land, incentives through

higher FAR/ FSI/ TDR single window clearance , tax benefit etc

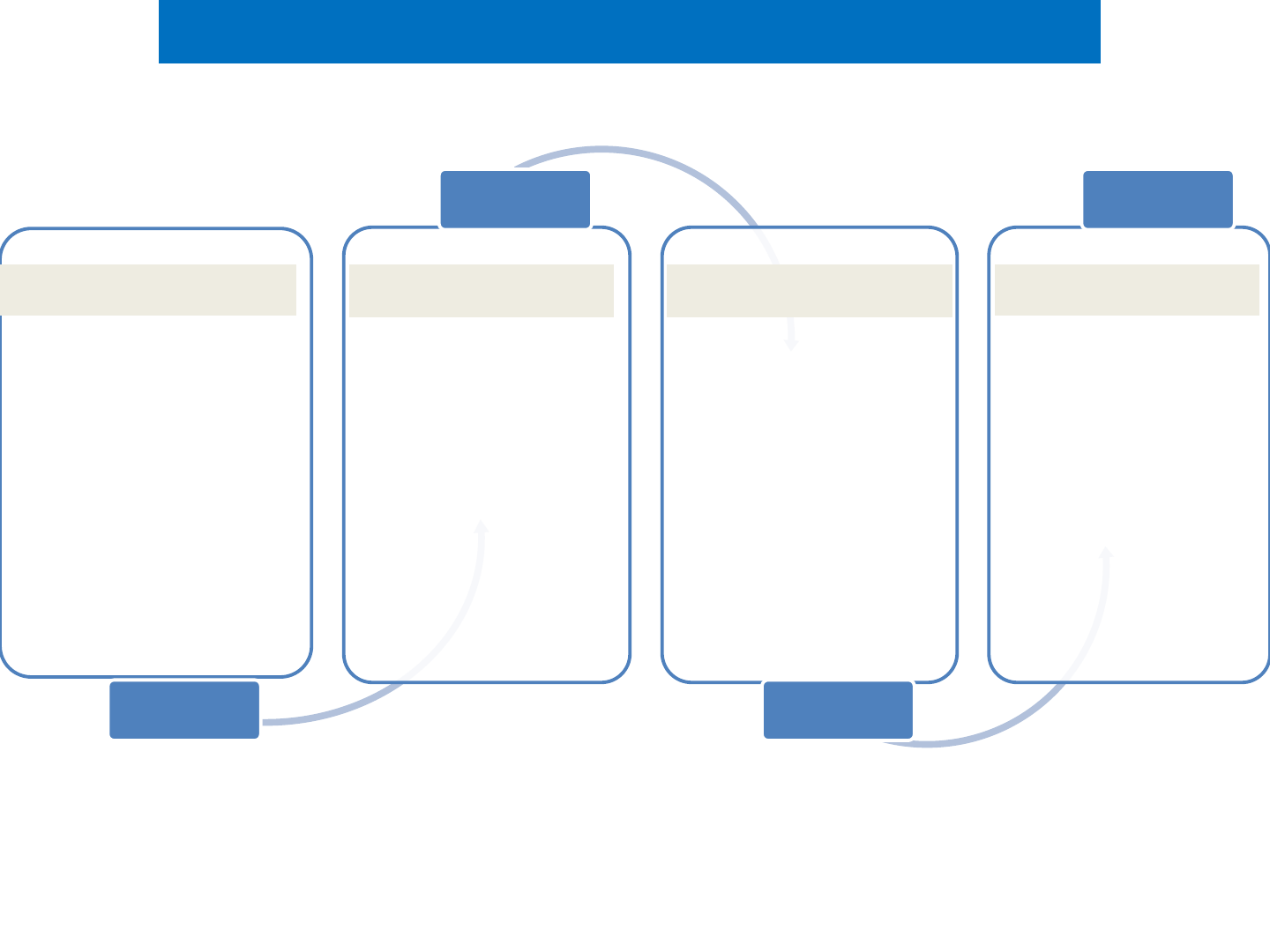

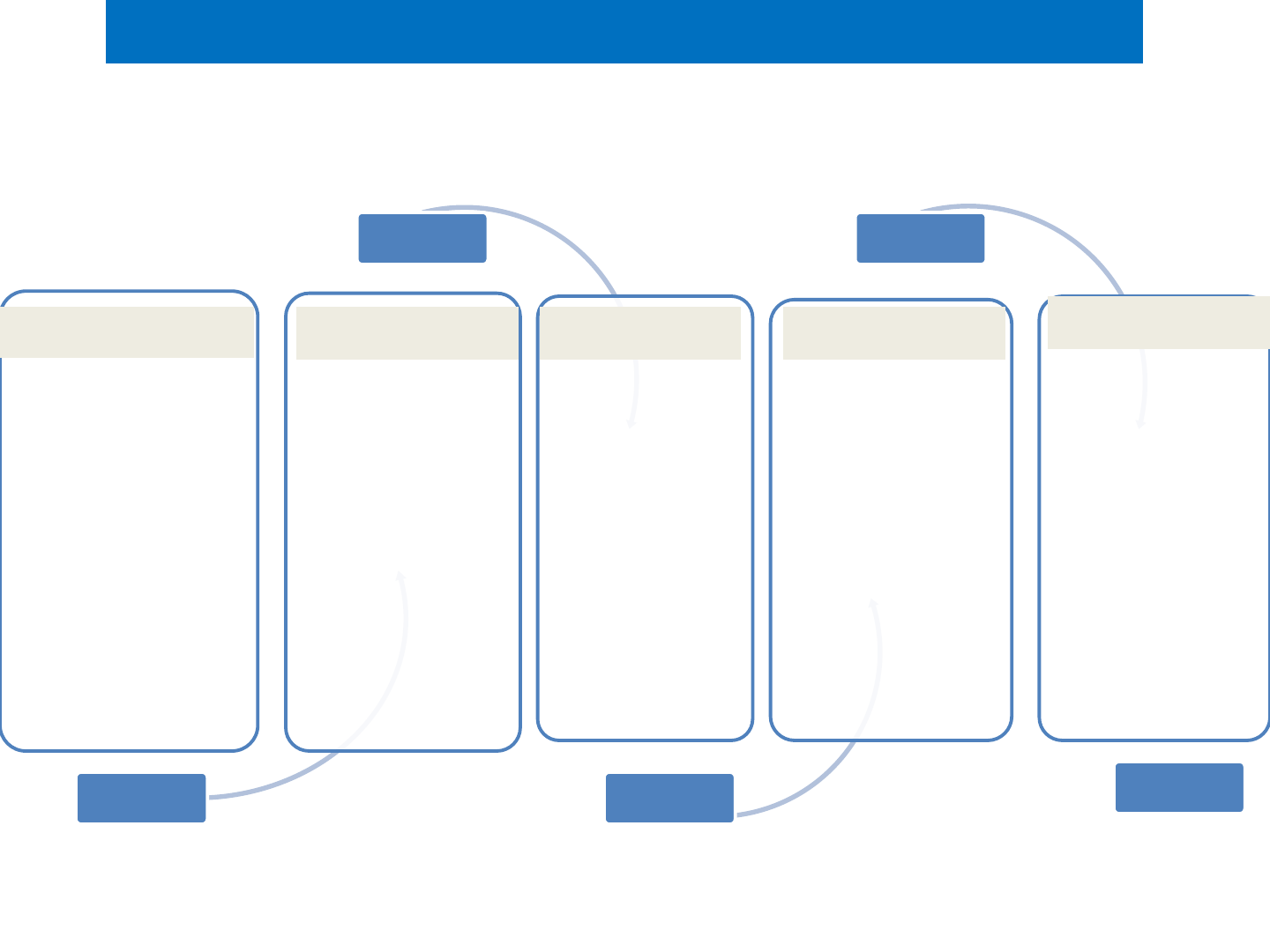

• Provide land

• Select Pvt Dev &

enter MoU

• Give technical

specification

1st

• Invest &

construct EWS

DUs

• Hand over to

Govt

2nd

• Make payment

to Pvt Dev

• Select

beneficiaries

3rd

• Pay

contribution to

Govt.

• Bank linkage

• Maintain asset

(RWA)

4th

MODEL 1:

Govt Pvt Developer Govt Beneficiary

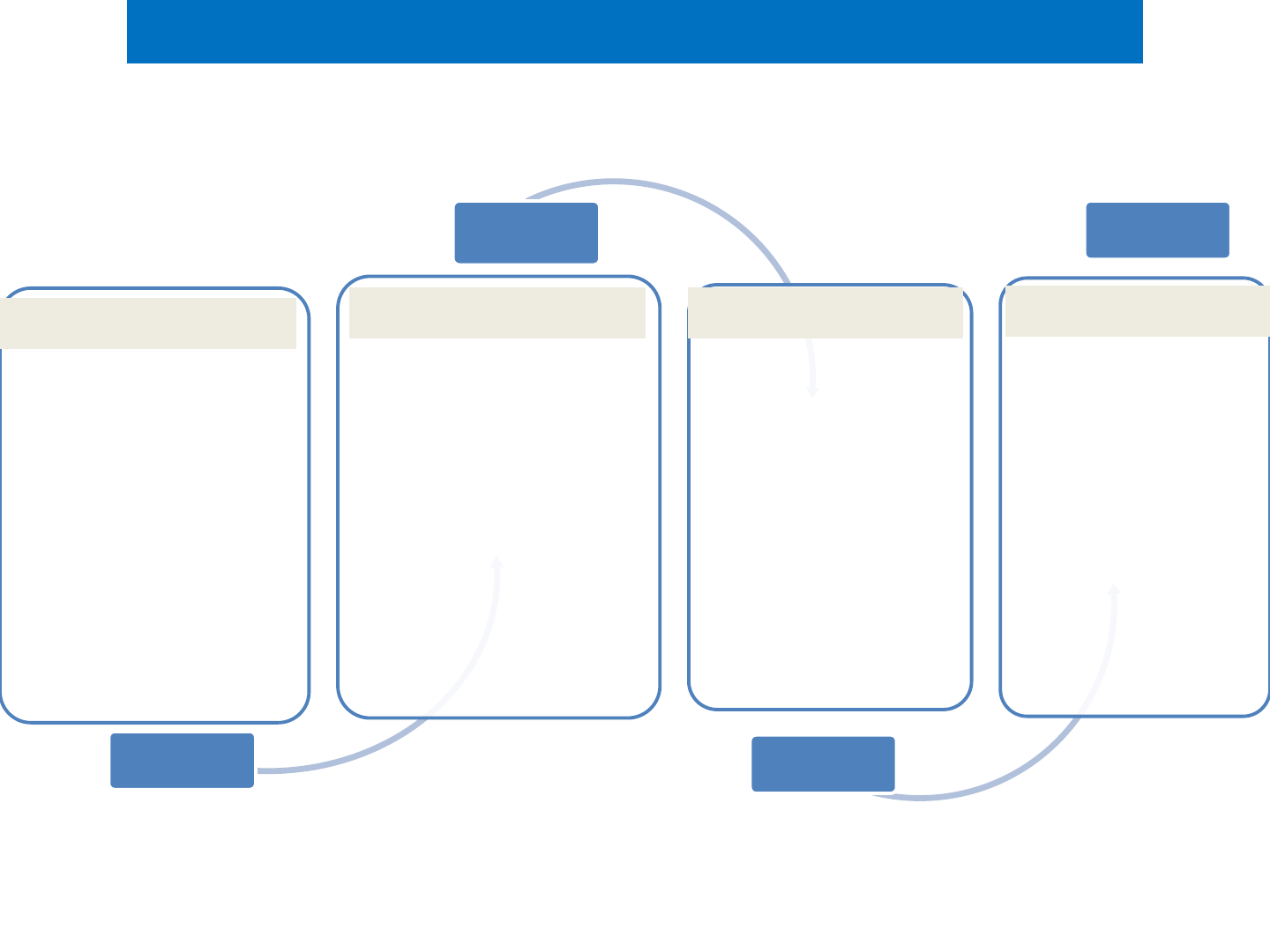

• Provide land

• Select Pvt Dev &

enter MoU

• Give technical

specification

1st

• Construct LIG/ MIG

on Govt land & sell

• EWS on same

/other land

• Hand over EWS

DUs to Govt at free

of cost

2nd

• No fund from

Govt to Pvt Dev

• Select

beneficiaries

• Collect

contribution

3rd

• Pay

Contribution

to Govt

• Bank linkage

• Maintain asset

(RWA)

4th

MODEL 2

Govt

Pvt Developer Govt

Beneficiary

• Provide land

• Select Pvt Dev

& Enter MoU

• Give technical

specification

1st

• Invest &

construct

EWS DUs

• Hand over

to Govt

2nd

• Make

payment

on yearly

basis

• Select

beneficiari

es

• Collect

contributio

n

3rd

• Pay

contribution

to Govt

• Bank linkage

4th

• Maintain

the asset

• Yearly

payment

based upon

maintenanc

e

5th

MODEL 3:

Govt Pvt Developer Govt Beneficiary Pvt Developer

• Provide land

• Select Pvt

Dev & Enter

MoU

• Give technical

specification

1st

• Invest

• Construct

EWS DUs

• Hand over

to Govt

2nd

• Pay 40-50%

during

construction

• Balance on

yearly basis

• Select

beneficiaries

• Collect

contribution

3rd

• Pay

contribution

to Govt

• Bank linkage

4th

• Maintain

the asset

• Yearly

payment

based upon

maintenanc

e

5th

MODEL 4:

Govt

Pvt Developer

Govt Beneficiary Pvt Developer

• Provide land

• Select Pvt

Dev & Enter

MoU

• Give

technical

specification

1st

• Invest

• Construct

EWS & LIG

• Hand over

to

beneficiary

2nd

• No

payment

from Govt

• Select

beneficiari

es with

Pvt Dev

3rd

• Pay

contribution

to Pvt dev.

• Bank linkage

• After

complete

payment, he

become

owner

4th

• Maintain

the asset

• May levy

penalty if

beneficiary

delay

payment

5th

MODEL 5:

Govt

Pvt Developer Govt

Beneficiary

Pvt Developer

Rs. In

lakh

Items

EWS

LIG

MIG

-1

MIG

-2

Purpose

Construction/

purchase/

enhancement

Construction/

purchase/

enhancement

Construction

/

purchase/

Construction

/

purchase/

Income

limit (Per Annam)

up

to 3.00

3

.01 to 6.00

6

.01 to 12.

00

12

.01

to

18

.00

Carpet

Area: (Sqmt)

up

to 30

up

to 60

160

sqmt

200

sqmt

Mission

Period

17

.06.2015 to 31.03.2022

01

.01.2017 to 31.03.2020

Max

. Loan (considered for

interest

subsidy

calculation)

6

.00

6

.00

9

.00

12

.00

Purpose

Construction/

Purchase/

Repair

Extension

Construction/ Purchase/

Repurchase

Loan

period

20

Year

20

Year

20

year

20

year

Interest

subsidy (Per Annam)

6

.5%

6

.5%

4

%

3

%

Interest

subsidy amount

2

.67

2

.67

2

.35

2

.30

Incentive

in lieu of

Loan

processing

fee

3000

/-

3000

/-

2

,000/-

2

,000/-

Additional

loan

Additional

loan beyond limit will be at non subsidized rate

CREDIT LINKED SUBSIDY SCHEME

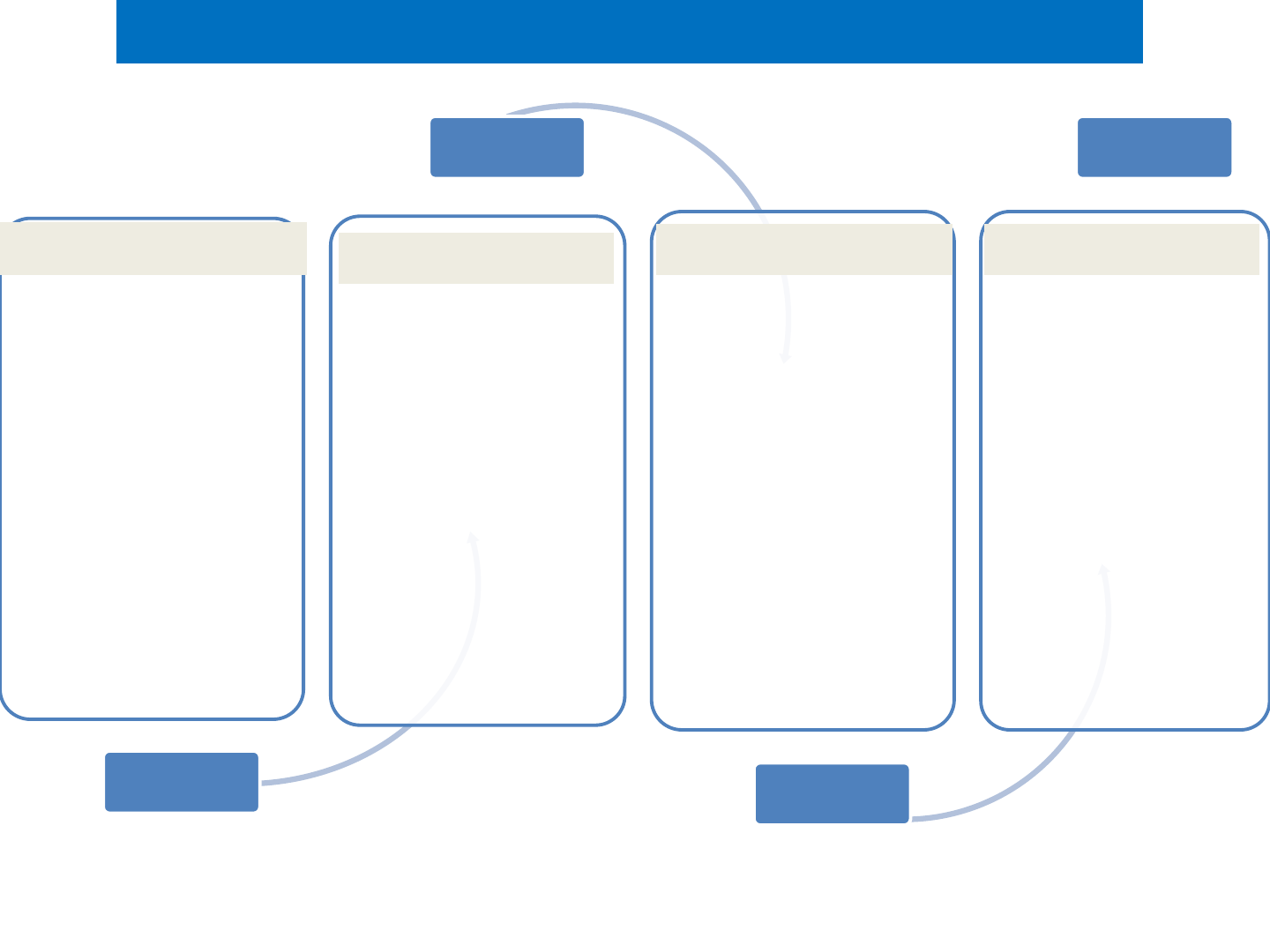

• Provide land

• Select Pvt

Dev & Enter

MoU

• Give

technical

specification

1st

• Invest

• Construct

EWS & LIG

• Continuousl

y own DUs

2nd

• No

payment

from Govt

• Select

beneficiari

es with

Pvt Dev

3rd

• Pay Rent to

Pvt Dev

• If

beneficiary

moves out,

new will

stay

4th

• Maintain

asset

• May levy

penalty if

beneficiary

delay

payment

/Evict

5th

MODEL 6:

Govt

Pvt Developer Govt Beneficiary Pvt Developer

MODEL A:

• Provide

technical

specification

1st

• Provide

land

• Invest

• Construct

EWS/ LIG/

MIG

• Hand over

to

beneficiary

2nd

• No

payment

from Govt

to PVt Dev.

• Facilitate

in

selection

/getting

document

3rd

• Provide loan

under CLSS

(EWS/ LIG/

MIG)

4th

• Pay EMI Pvt

Dev/ Bank

• Bank loan

• Beneficiary

will

maintain

asset (RWA)

5th

Govt Pvt Developer Govt Bank

Beneficiary

• Provide technical

specification

1st

• Provide land

• Invest

• Construct EWS

& hand over to

Govt

• Construct LIG/

MIG to cross

subside

• Pvt Dev will give

UC-

2nd

• Fix sale price for

EWS

• SLAC/ SLSMC

approval

• Release 1.50 lakh

fund to Pvt Dev

• Appoint TPQMA

• If project

stopped, recover

& repay to GoI

• Collect

contribution

3rd

• Pay

contribution to

Govt

• Bank loan

• Beneficiary will

maintain asset

(RWA)

4th

MODEL B:

Govt

Pvt Developer

Govt Beneficiary

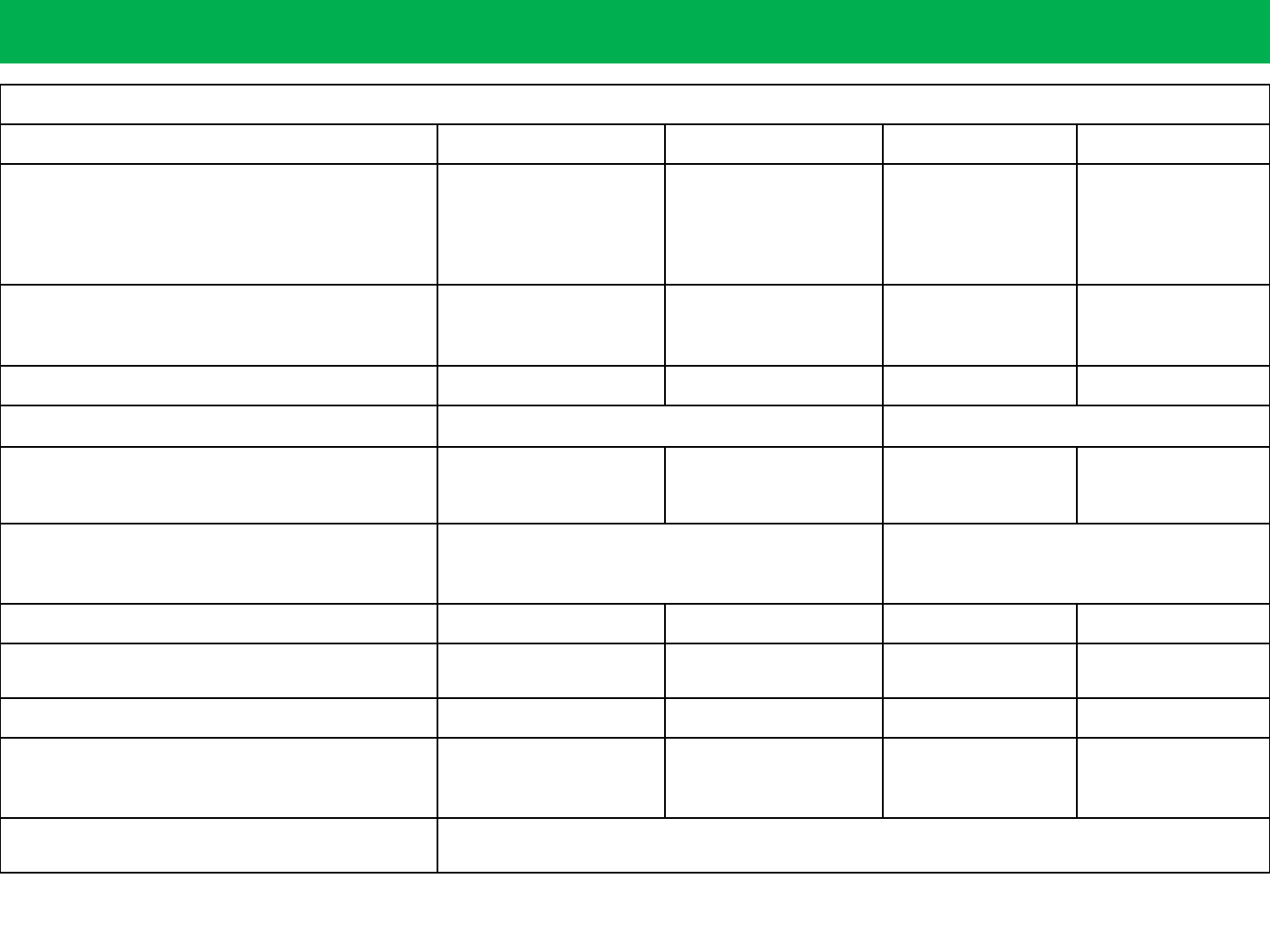

Reform

under HFA

Nodal Agency

Status

State

to make suitable changes in the procedure/ rules for obviating the

need

for

separate Non Agricultural (NA) Permission if land already falls in

the

residential

zone earmarked in Master Plan of city or area.

Rev. Dept

Completed

States/UTs

would either legislate or amend existing rental laws on the lines

of

model

Tenancy Act being prepared by Ministry.

Rev. Dept

Under

Progress

States/UTs

shall adopt the approach of deemed building permission and

layout

approval

on the basis of pre-approved lay outs and building plans for

EWS/LIG

housing

or exempt approval for houses below certain built up area or plot area

.

UDD

Under

Progress

A

system should be put in place to ensure single window, time bound

clearance

for

layout approval and building permission at ULB level.

UDD

Completed

States

shall amend their Master Plans earmarking land for Affordable Housing.

DTCP (UDD)

Under

Progress

State

shall provide additional FAR/FSI/ TDR and relaxed density norms for

slum

redevelopment

and low cost housing if required

DTCP (UDD)

Under

Progress

MANDATORY CONDITIONS (REFORMS)

CREDIT LINKED SUBSIDY SCHEME

GoI has launched CLSS scheme on 17.06.2015.

Period

• CLSS (EWS/ LIG) :17.06.2018 to 31.03.2022.

• CLSS (MIG1/MIG2) : 01.01.2017 to 31.03.2020 (recently extended)

RGRHCL is SLNA, NHB/ HUDCO are CNAs

Eligibility criteria :

• A family comprising husband, wife, unmarried children not owning pucca house

any where in India.

• Adult earning member (married/unmarried) having no house any where in India

• Family residing in 275 ULB limit/ planning /special/development/industrial area

Annul income as follows:

Category

Income

EWS

0

- 3 lakh

LIG

3

-6 lakh

MIG 1

6

-12 lakh

MIG 2

12

-18 lakh

EWS/LIG beneficiary may construct larger house. But extension/ repair limited to 30sqmt/ 60 sqmt

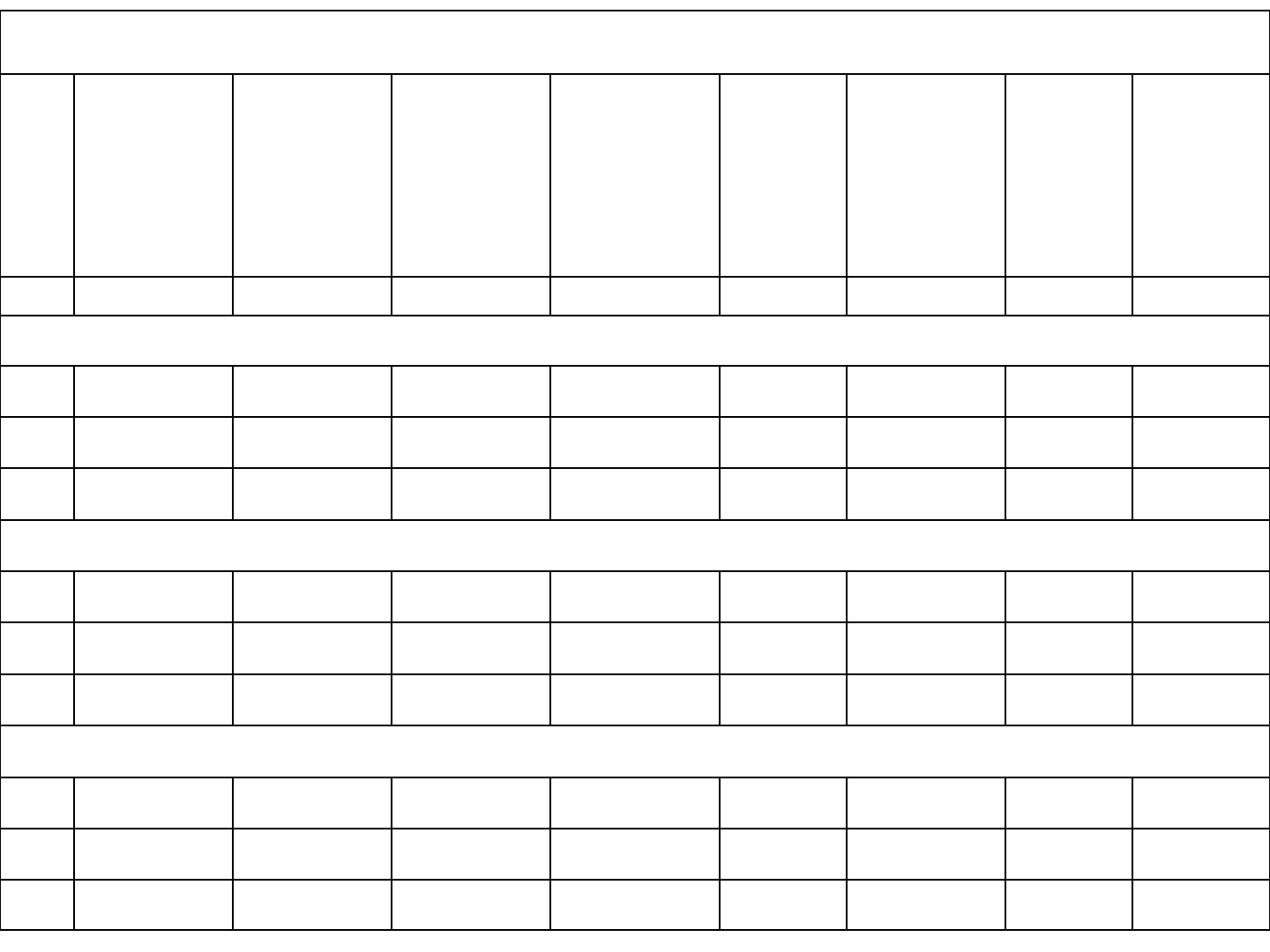

CREDIT LINKED SUBSIDY SCHEME

Rs. In

lakh

Items

EWS

LIG

MIG

-1

MIG

-2

Purpose

Construction/

purchase/

enhancement

Construction/

purchase/

enhancement

Construction

/

purchase/

Construction

/

purchase/

Income

limit (Per Annam)

up

to 3.00

3

.01 to 6.00

6

.01 to 12.

00

12

.01

to

18

.00

Carpet

Area: (Sqmt)

up

to 30

up

to 60

160

sqmt

200

sqmt

Mission

Period

17

.06.2015 to 31.03.2022

01

.01.2017 to 31.03.2020

Max

. Loan (considered for

interest

subsidy

calculation)

6

.00

6

.00

9

.00

12

.00

Purpose

Construction/

Purchase/

Repair

Extension

Construction/ Purchase/

Repurchase

Loan

period

20

Year

20

Year

20

year

20

year

Interest

subsidy (Per Annam)

6

.5%

6

.5%

4

%

3

%

Interest

subsidy amount

2

.67

2

.67

2

.35

2

.30

Incentive

in lieu of

Loan

processing

fee

3000

/-

3000

/-

2

,000/-

2

,000/-

Additional

loan

Additional

loan beyond limit will be at non subsidized rate

CLSS - Illustrative Example ( Loan tenure -20* years/240 months )

Loan

Amount

Loan

Amount

eligible

for

Subsidy

Interest

Subsidy

Balance

Loan

Initial

EMI

@10%

Reduced

EMI after

crediting

Subsidy

Monthl

y

savings

Annual

savings

EG (1) (2) (3) (4)=(1-3) (5) (6) (7) = (5-6) (8)= (7) x 12

EWS/LIG

I

3,00,000

3,00,000

1,33,640

1,66,360

2,895

1,605

1,290

15,480

II

6,00,000

6,00,000

2,67,280

3,32,720

5,790

3,211

2,579

30,948

III

10,00,000

6,00,000

2,67,280

7,32,720

9,650

7,071

2,579

30,948

MIG 1

I

6,00,000

6,00,000

1,56,712

4,43,288

5,790

4,278

1,512

18,144

II

9,00,000

9,00,000

2,35,068

6,64,932

8,685

6,417

2,268

27,216

III

12,00,000

9,00,000

2,35,068

9,64,932

11,580

9,312

2,268 27,216

MIG 2

I

9,00,000

9,00,000

1,72,617

7,27,383

8,685

7,019

1,666

19,992

II

12,00,000

12,00,000

2,30,156

9,69,844

11,580

9,359

2,221

26,652

III

15,00,000

12,00,000

2,30,156

12,69,844

14,475

12,254

2,221

26,652

• Regular housing loans sanctioned on & after the launch of the scheme can be

converted into CLSS (if eligible)

• Central Nodal Agencies: HUDCO/ NHB

• Details of MoU signed:

• Banks:

Scheduled Commercial banks, Housing Finance Companies

Regional Rural Banks. State Cooperative Banks

Urban Cooperative Banks. Small Finance Banks

Non Banking Finance Company-Micro Finance Institutions

• Beneficiaries will submit self –certificate /affidavit as proof of income

• Beneficiary has to submit application

• Directly to bank (EWS/LIG/MIG)

• Through ULB (EWS/LIG).

• Bankers will sanction loan after due diligence

• Construction should complete within 36 months. ( from date of loan disbursement)

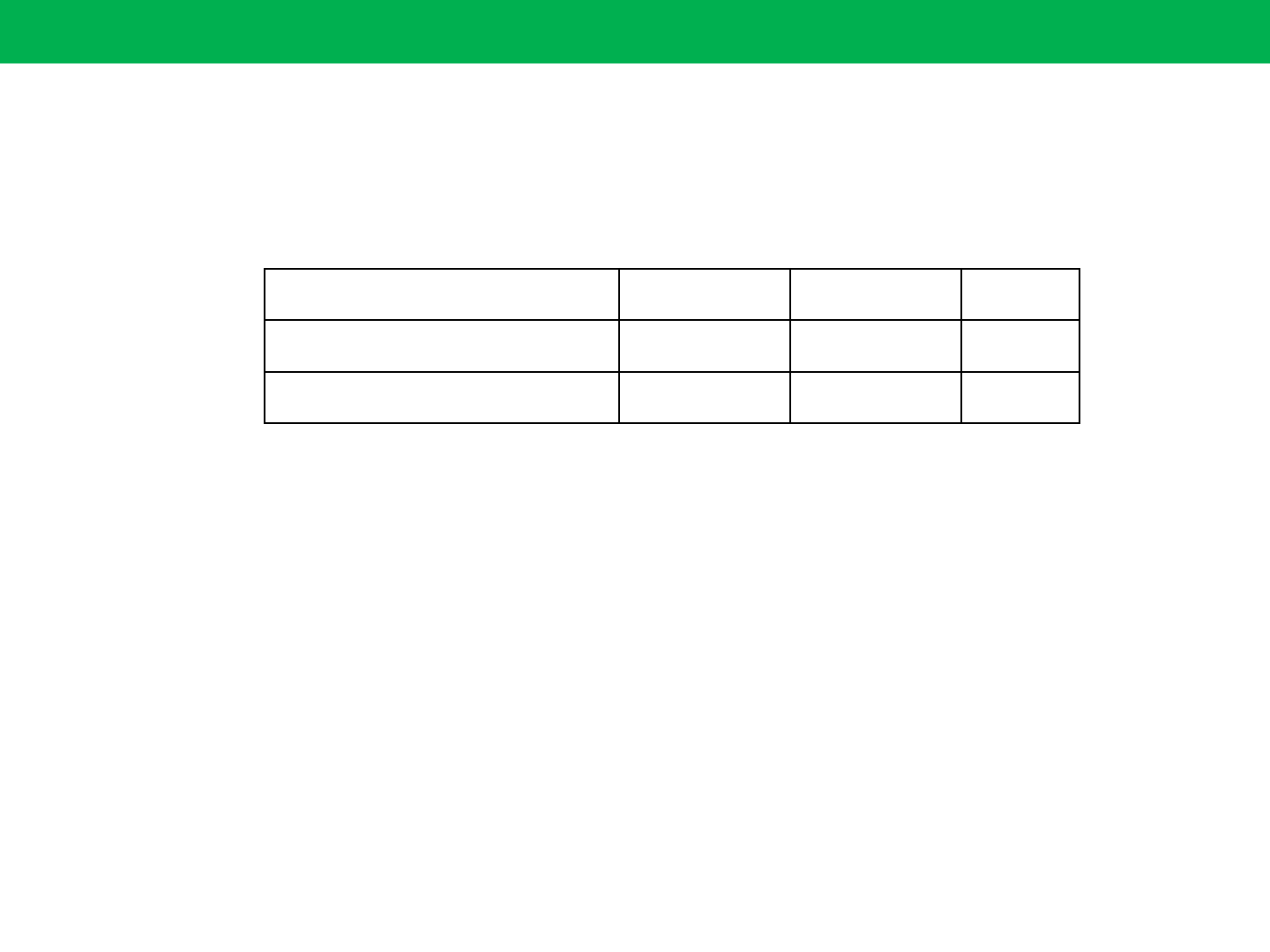

CENTRAL NODAL AGENCY & BANKS

Scheme

NHB

HUDCO

Total

CLSS

(EWS/ LIG

190

70

260

CLSS (MIG1 & MIG2)

180

64

244

• Subsidy will be claimed by banks from HUDCO / NHB. NHB/ HUDCO will release

interest subsidy to Bank. Then bank will credit to Beneficiary account.

• Subsidy will be released to beneficiaries account upfront.

• Rs.250 per sanctioned application would be paid as incentive to ULBs (EWS/LIG

only).

RELEASE OF INTEREST SUBSIDY

CLAP –NEW WEBSITE

MOHUA, GoI has developed Credit Awas Portal (CLAP) to provide a transparent and robust real

time web-based system for CLSS beneficiaries.

Features of CLAP Portal

• Transparent mechanism.

• Applicant can check his eligibility for CLSS, know about the process to apply, Check his

subsidy, track his/her application status”, upload his house photos, selfies and success

stories through PMAY(U) mobile application. Lodge their grievance, View latest news,

updates & progress of PMAY(U)

• Aadhaar verification of borrower/co-borrower & their spouse at the time of receiving

application at PLI.

• De-duplication of borrower,/co-borrower & their spouse with the beneficiaries of other

three verticals of PMAY (U).

• Generation of unique Application ID & Beneficiary ID to borrower.

• SMS Alerts at every stage starting from generation of application ID up to credit of subsidy

amount will be sent to borrower/co-borrower.

• Dashboard, reports, FAQs on CLSS and CLAP to monitor the progress for various

stakeholders.

• Real time integration with UIDAI, PMAY (U) MIS, CAN & PLIs servers.

• Individual processing of records is introduced avoiding clubbing and delay in payments.