A GUIDE TO ACCOUNTING FOR DEBT MODIFICATIONS

AND RESTRUCTURINGS

June 2023

A GUIDE TO ACCOUNTING

FOR DEBT MODIFICATIONS

AND RESTRUCTURINGS

June 2023

A GUIDE TO ACCOUNTING FOR DEBT MODIFICATIONS

AND RESTRUCTURINGS

is edition of A Guide to Accounting for Debt Modifications and Restructurings has been produced

by the National Professional Standards Group of RSM US LLP.

We would like to acknowledge the efforts of the contributors to the June 2023 edition of this publication:

• Brian Marshall, Partner

• RoAnna Pascher, Senior Director

We would also like to acknowledge the contributions of Patricia Baldowski, Partner, and Alpesh Shah, Senior Manager.

June 2023

e FASB material is copyrighted by the Financial Accounting Foundation, 801 Main Avenue, Norwalk, CT 06851,

and is used with permission.

i

JUNE 2023

TABLE OF CONTENTS

1 Introduction ..................................................................................................................... 1

1.1 Determining whether the same lender is involved before and after changes are made to the

debt .................................................................................................................................................... 3

1.2 Convertible debt ............................................................................................................................... 4

1.3 Effective interest method ................................................................................................................. 4

2 Relevant literature and general concepts ..................................................................... 6

2.1 Liability derecognition ..................................................................................................................... 6

2.1.1 Liability derecognition threshold ........................................................................................... 6

2.1.2 Continuing term loans with the same lender ........................................................................ 7

2.2 TDR accounting ................................................................................................................................ 7

2.2.1 Nature, scope and unit of account ....................................................................................... 7

2.2.2 Determining whether a TDR exists ...................................................................................... 9

2.2.3 Series of restructurings on same debt ............................................................................... 14

2.2.4 TDR accounting model ....................................................................................................... 14

2.2.5 Direct costs incurred with third parties in a TDR ................................................................ 23

2.2.6 Lender fees incurred in the restructuring ........................................................................... 24

2.2.7 Preexisting unamortized debt discount .............................................................................. 24

2.2.8 Classification considerations .............................................................................................. 24

2.2.9 Disclosures ......................................................................................................................... 25

2.3 Extinguishment and modification accounting models for term loans ...................................... 25

2.3.1 Scope ................................................................................................................................. 25

2.3.2 Which model applies? ........................................................................................................ 27

2.3.3 Extinguishment accounting model ..................................................................................... 36

2.3.4 Modification accounting model ........................................................................................... 38

2.3.5 Accounting for fees and costs incurred .............................................................................. 39

2.3.6 Fees between borrower and lender trigger accounting assessment ................................. 41

2.3.7 Loan participations and syndications ................................................................................. 42

2.3.8 Third-party intermediaries .................................................................................................. 42

2.3.9 Transactions between lenders ........................................................................................... 43

2.4 Modification of a line-of-credit arrangement ............................................................................... 43

2.4.1 Modifications of undrawn delayed-draw term loan commitments ........................................... 44

2.5 Changing from term loan to line-of-credit and vice versa .......................................................... 44

2.6 Debt disclosures ............................................................................................................................. 45

3 Examples ........................................................................................................................46

3.1 Liability derecognition threshold .................................................................................................. 46

3.2 TDR with modification of terms in which no gain is recognized ............................................... 47

3.3 TDR with modification of terms in which a gain is recognized ................................................. 50

3.4 TDR with transfer of assets and modification of terms .............................................................. 52

3.5 Changes to prepayable debt that result in modification accounting ........................................ 55

3.6 Changes to prepayable debt including incremental borrowings .............................................. 58

3.7 Changes to prepayable delayed-draw term loan (DDTL) ............................................................ 62

3.8 Changes to prepayable debt with partial repayment of principal ............................................. 65

3.9 Changes to debt that result in extinguishment accounting ....................................................... 69

3.10 Changes to prepayable loans in a syndication ........................................................................... 71

ii

JUNE 2023

3.11 Multiple changes to prepayable debt within a one-year period ................................................. 77

3.12 Multiple changes to prepayable debt with a prepayment fee based on a percentage of

principal within a one-year period ................................................................................................ 80

3.13 Line-of-credit modification with decrease in borrowing capacity ............................................. 84

3.14 Line-of-credit arrangement modification with increase in borrowing capacity ....................... 85

Appendix A: Acronyms, literature and technical accounting guide and whitepaper

references ..........................................................................................................87

Appendix B: Definitions .........................................................................................................89

Appendix C: U.S. GAAP vs. IFRS Comparison .....................................................................93

Appendix D: Summary of significant changes .....................................................................97

1

JUNE 2023

1 Introduction

Borrowers may seek to renegotiate the terms of existing loans because they are not able to meet current

loan covenants or cash flow requirements under their loans, or because they want to increase the amount

borrowed or obtain lower interest rates. Lenders may be willing to renegotiate the terms of existing loans

because they realize that it may be in their best interests to reconsider the terms of a loan instead of: (a)

losing the borrower to a competitor that is willing to provide a reduced interest rate because of an

improvement in the borrower’s credit quality or a reduction in market interest rates, (b) forcing the

borrower to find another lender or file for bankruptcy or (c) foreclosing on any collateralized assets. As a

result of the renegotiations, the borrower and lender may agree to modify or restructure an existing loan

or exchange one loan for another. The degree of change introduced by the modification, restructuring or

exchange (collectively referred to as changes) depends on any number of factors, first and foremost

being the financial condition and prospects of the borrower.

Naturally, there are accounting implications when the borrower and lender agree to modify or restructure

an existing loan or exchange one loan for another. The accounting implications differ depending on

whether the borrower’s or lender’s accounting is being considered. This guide deals solely with the

borrower’s accounting for changes made to its loans. Depending on the facts and circumstances, different

accounting outcomes could result for the borrower. For example, the borrower may be required to

recognize a gain or loss in the period of the changes, or the borrower may be required to recognize the

effects of the changes in future periods through an adjustment to the effective interest rate. A thorough

analysis of the borrower’s facts and circumstances and the relevant authoritative accounting literature is

required to ultimately determine how the borrower should account for changes to its loans. In some

circumstances, a significant amount of professional judgment must be exercised in making this

determination.

To identify the appropriate accounting model to apply to changes to a loan, the borrower must first

determine whether it has met the threshold to remove a liability from its books (i.e., derecognize the

liability and apply the extinguishment accounting model). Typically, this liability derecognition threshold is

met when the changes involve an old loan being paid off with proceeds from a new loan with a new

lender (i.e., an unrelated party that was not considered a lender with respect to the old loan), provided

there is no continuing debt with the old lender. In contrast, this threshold is not met just because the

borrower and the same lender exchange cash to satisfy an existing loan and issue a new loan. For

additional information about determining whether the same lender is involved in the loan before and after

changes are made, see Section 1.1. For additional information about determining whether the liability

derecognition threshold has been met, see Section 2.1.

If the liability derecognition threshold has not been met, then the borrower must determine whether it

should apply the accounting model for a troubled debt restructuring (TDR), which is discussed in detail in

Section 2.2. In some cases, a TDR results from the full settlement of debt through the transfer of cash,

noncash assets or equity (i.e., the debt is derecognized in the TDR). While the net effect on the income

statement is the same regardless of whether the extinguishment or TDR accounting model is applied in

these cases, there are additional accounting and disclosure requirements for a TDR. As such,

consideration should be given to whether the derecognition of debt meets the conditions present in a

TDR.

If the liability derecognition threshold has not been met and the TDR accounting model does not apply,

then for term loans the borrower must determine whether it should apply the accounting model for a debt

modification or extinguishment, discussed in detail in Section 2.3. The accounting for changes to a line-of-

credit arrangement (which also encompasses a revolving debt or revolver arrangement when used

throughout this guide) that is not a TDR is discussed in detail in Section 2.4. Changes to a delayed-draw

term loan (DDTL) that is not a TDR will either be accounted for under the term loan or the line-of-credit

accounting model as discussed in detail in Section 2.3.1.2.

2

JUNE 2023

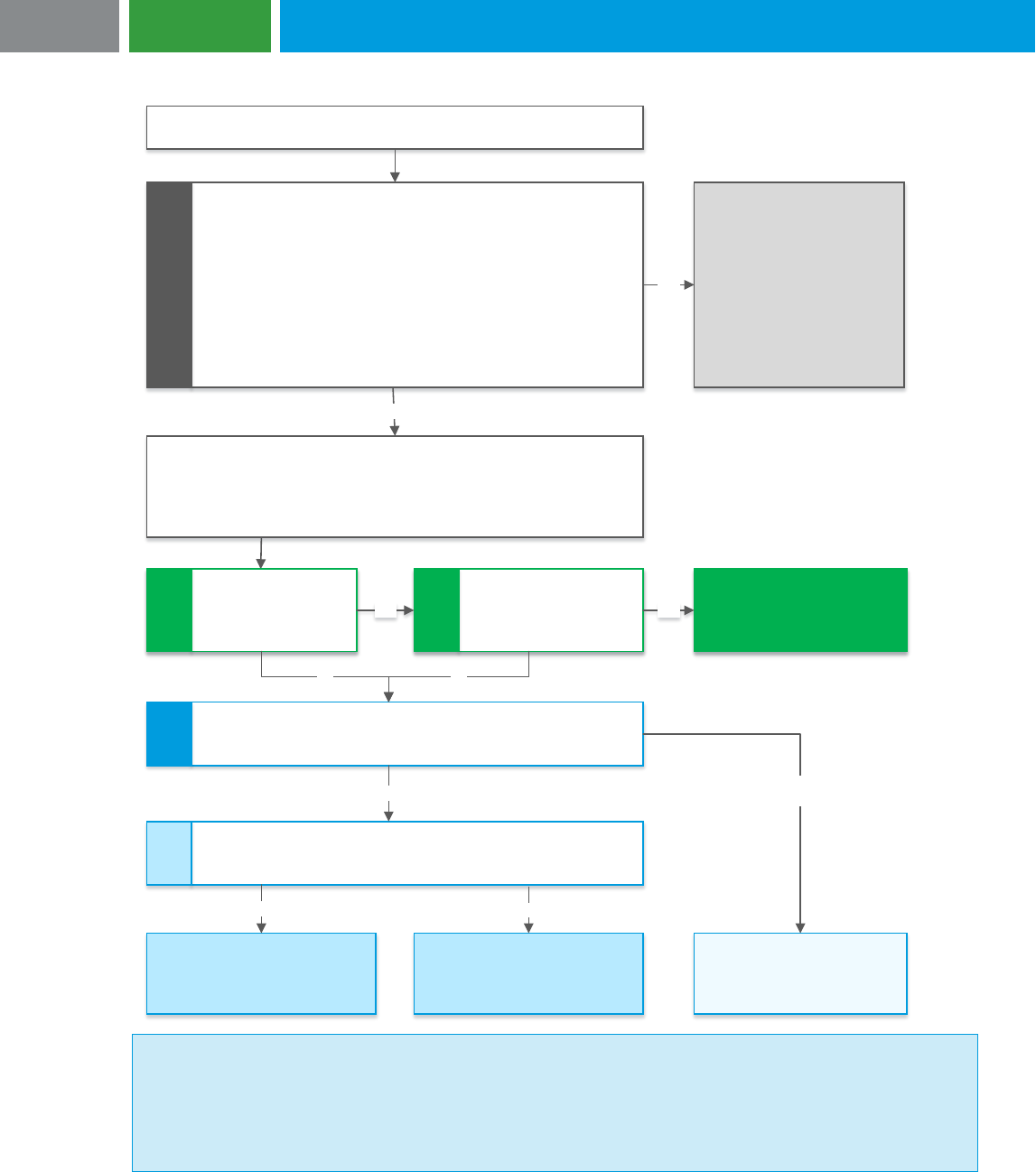

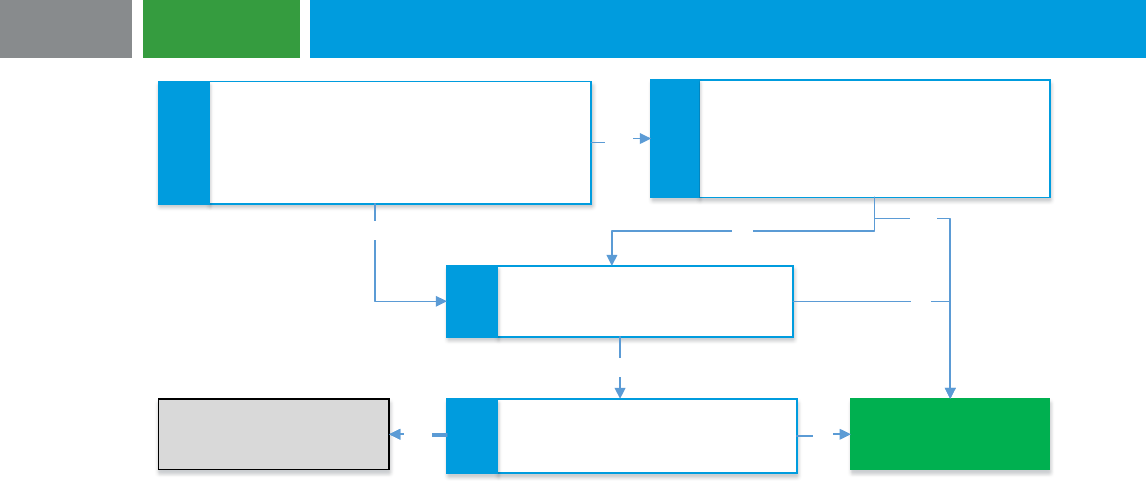

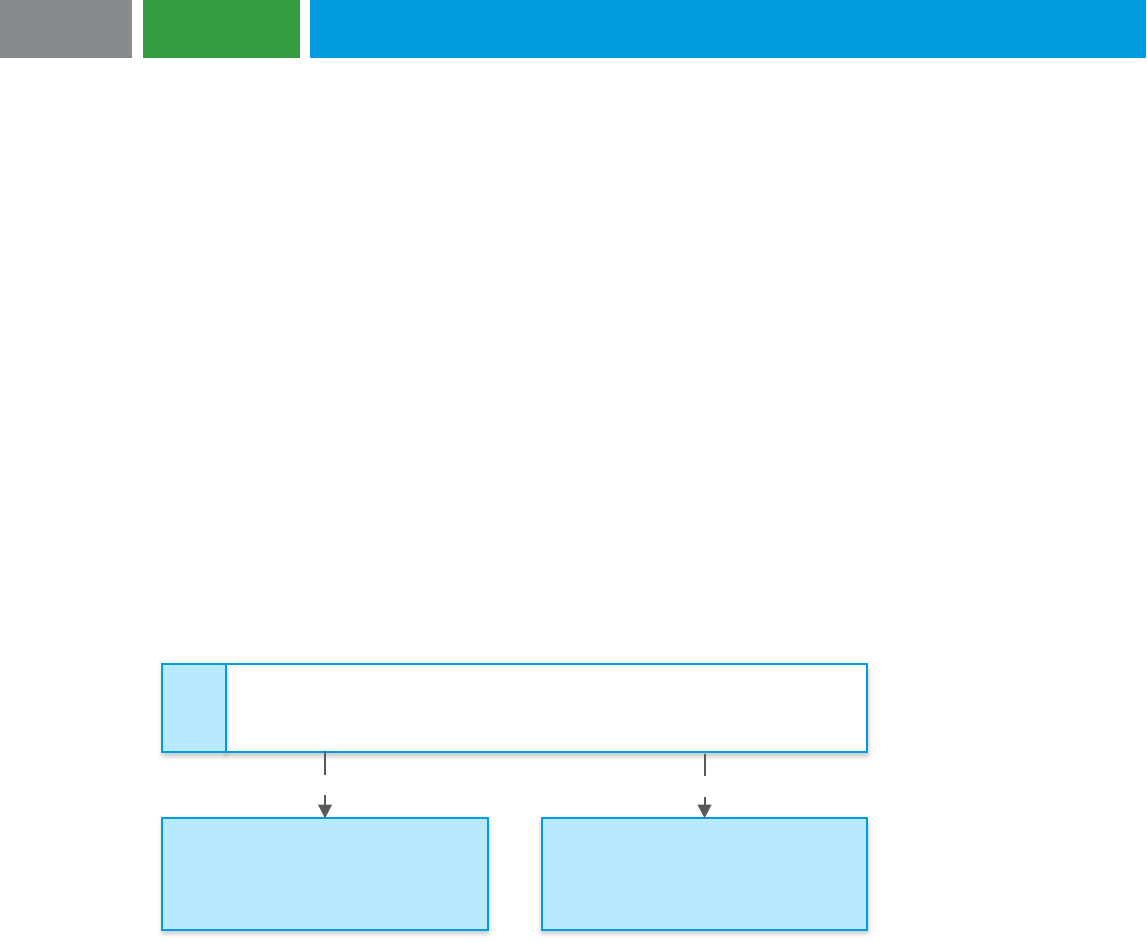

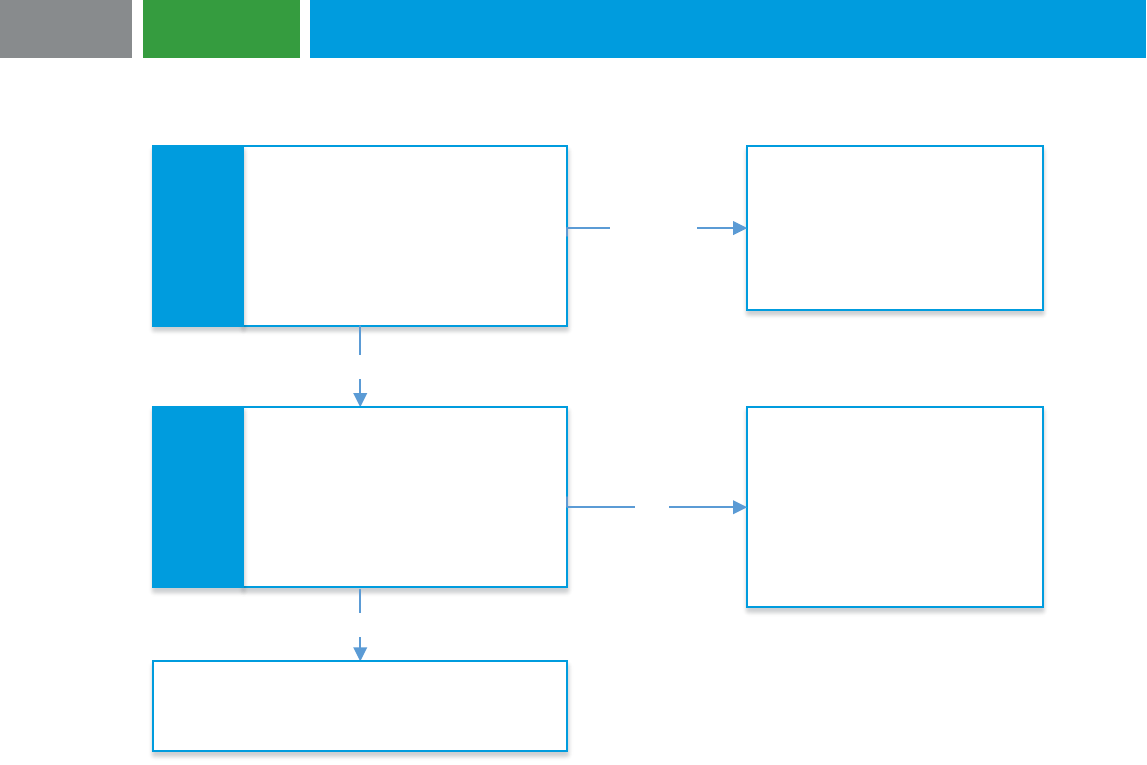

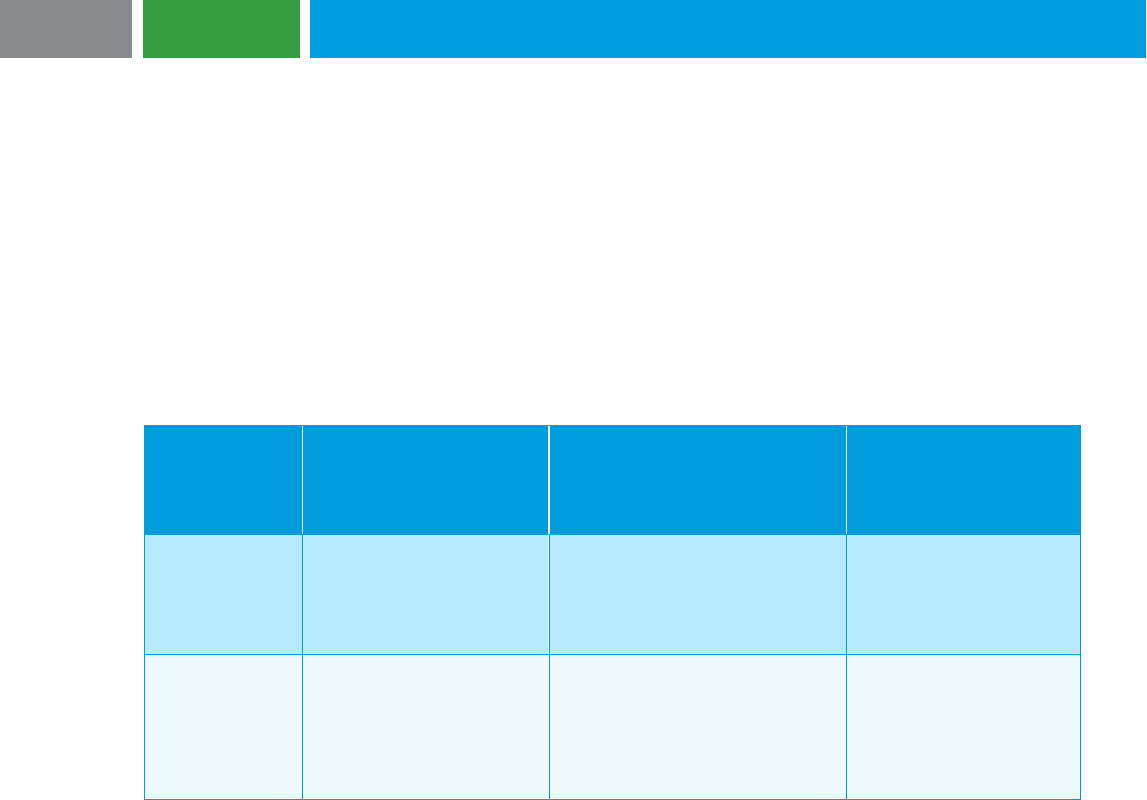

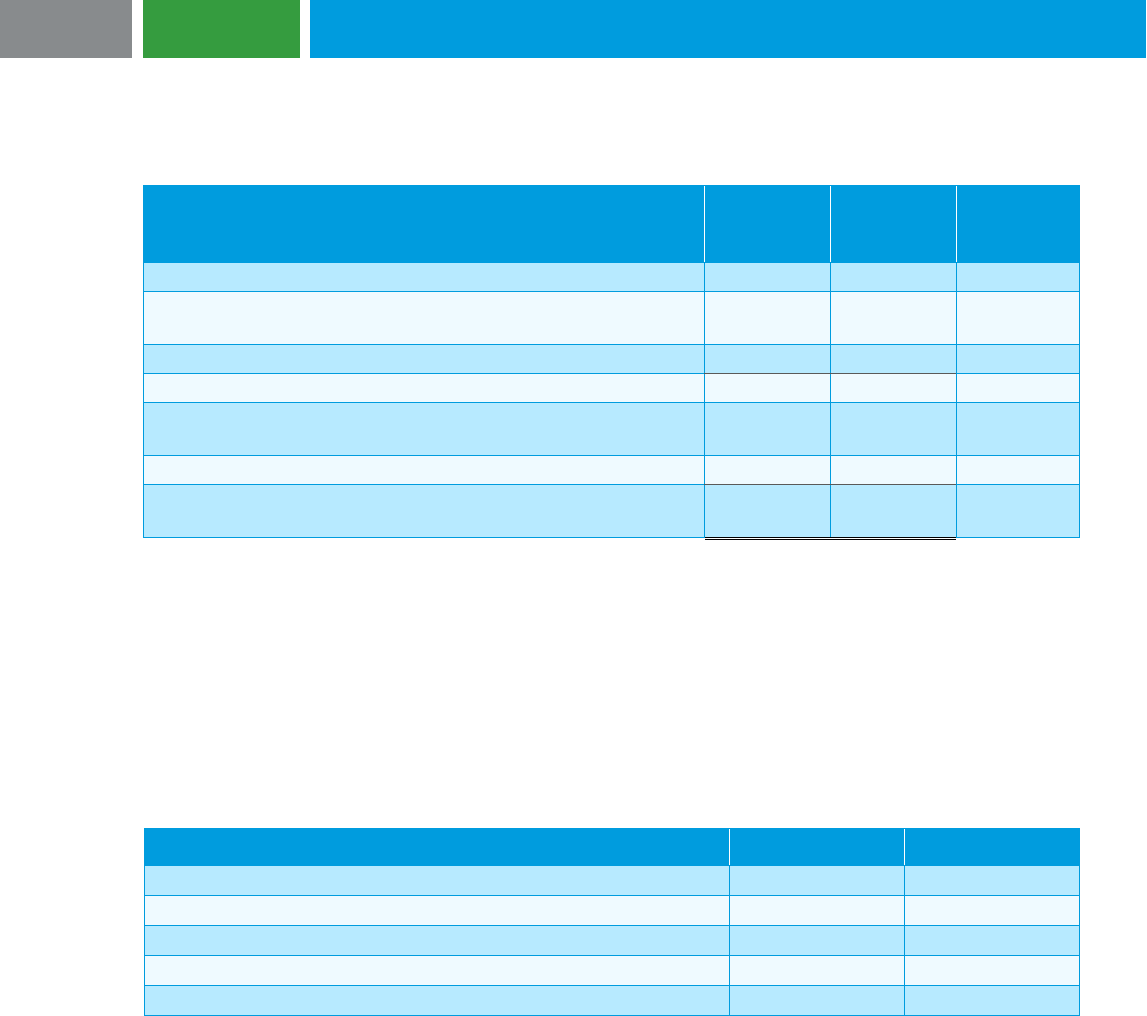

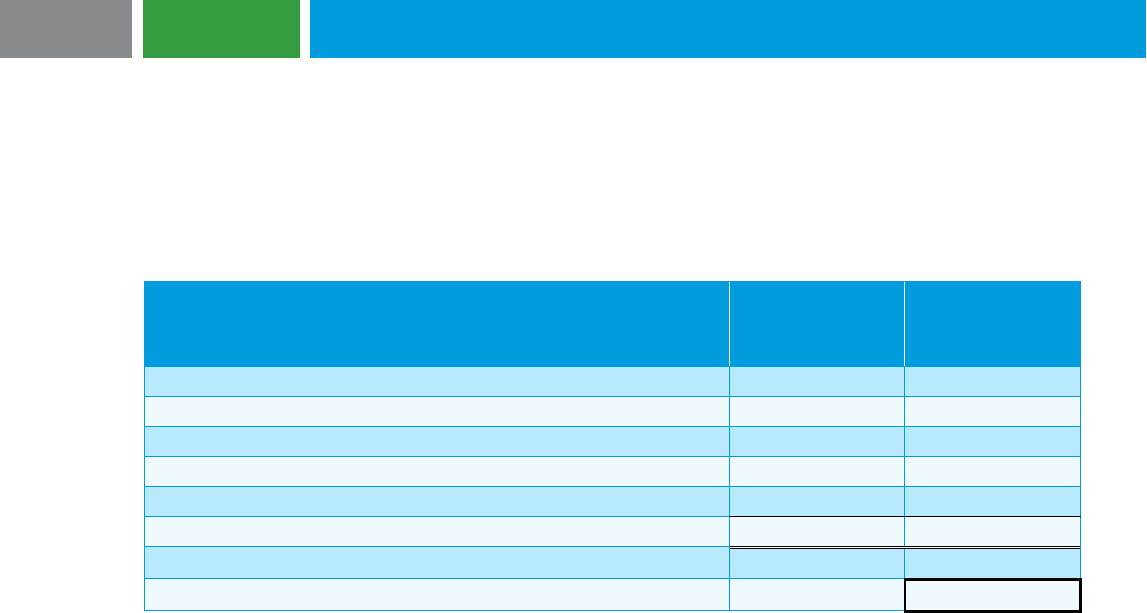

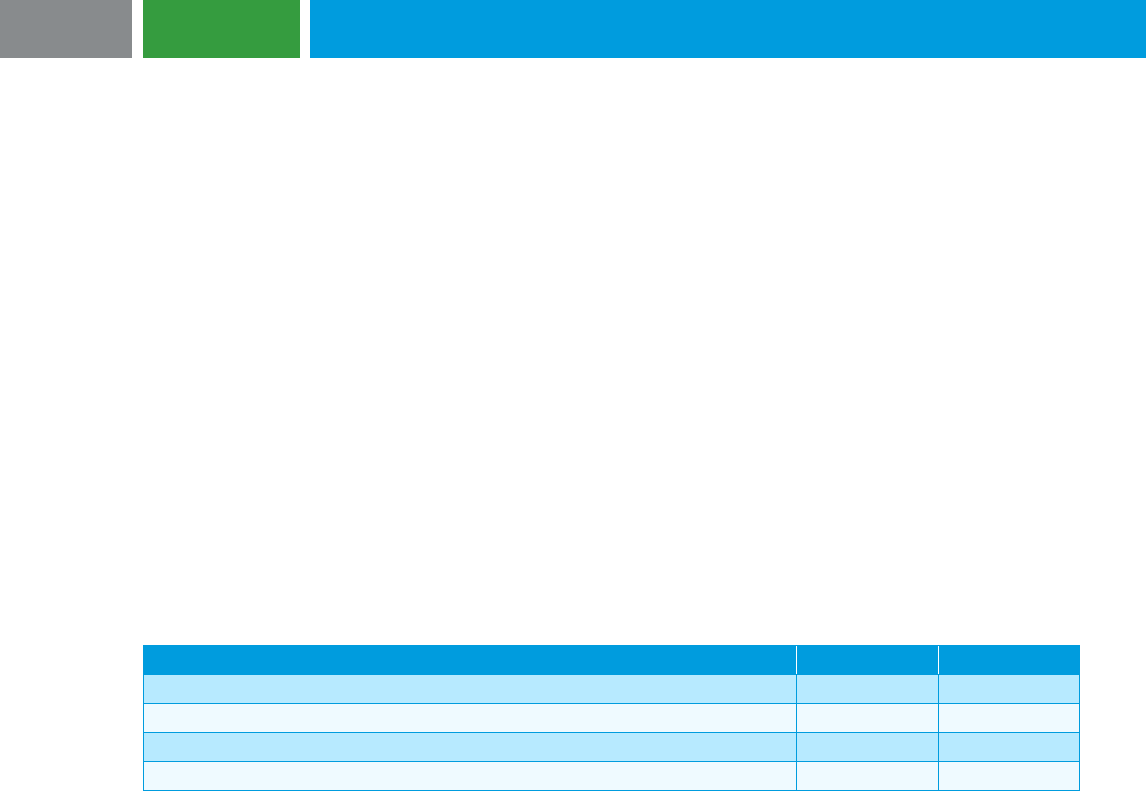

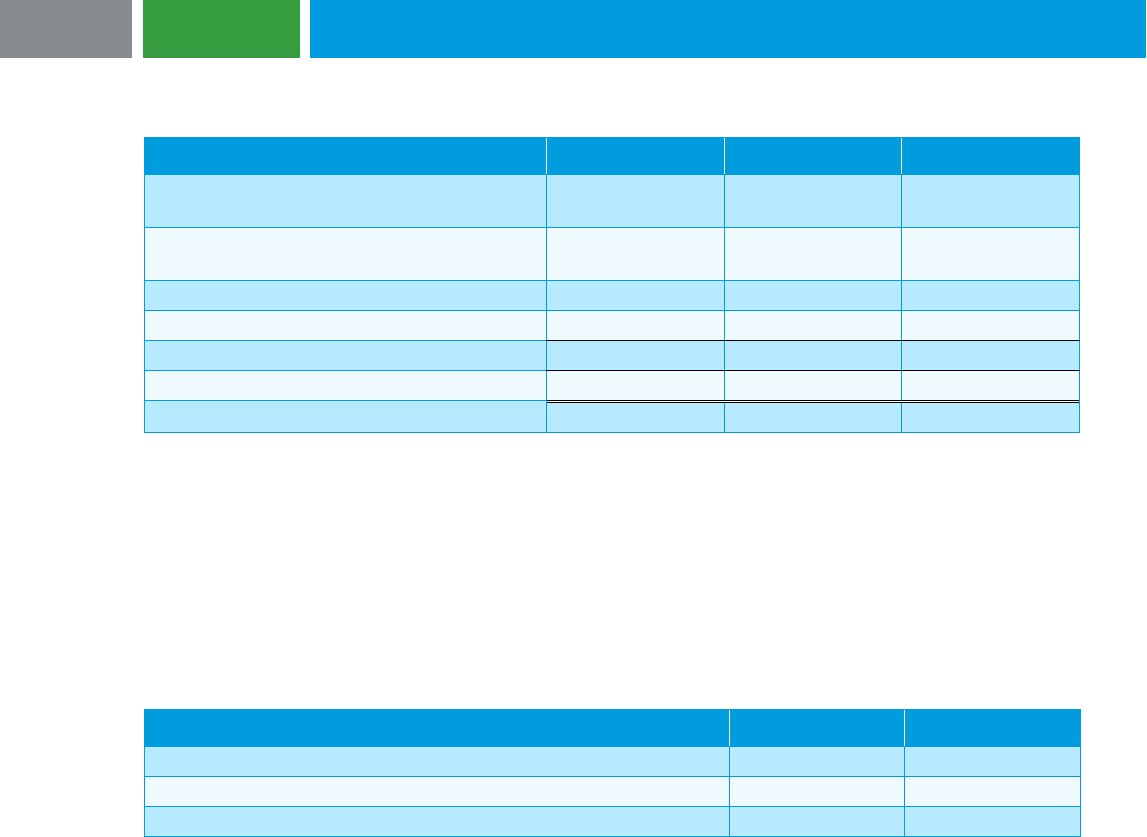

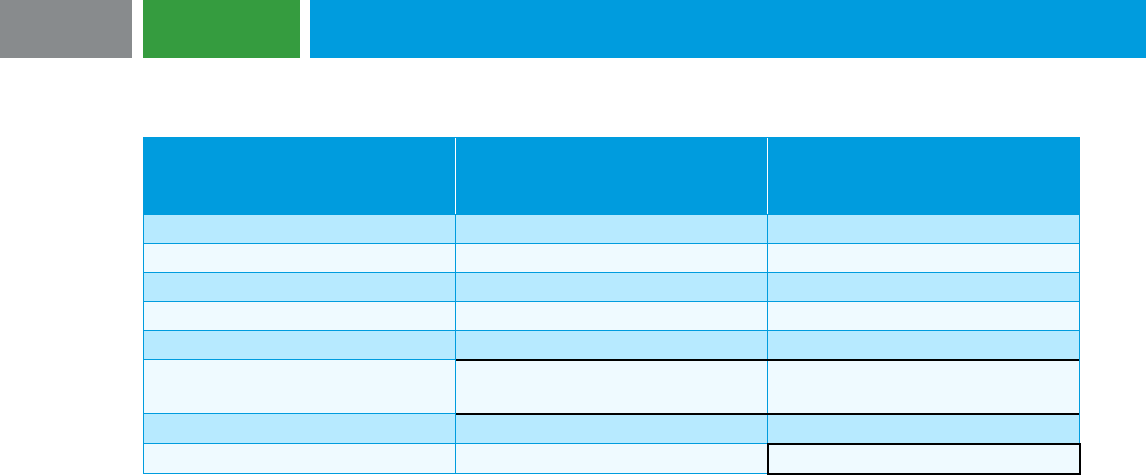

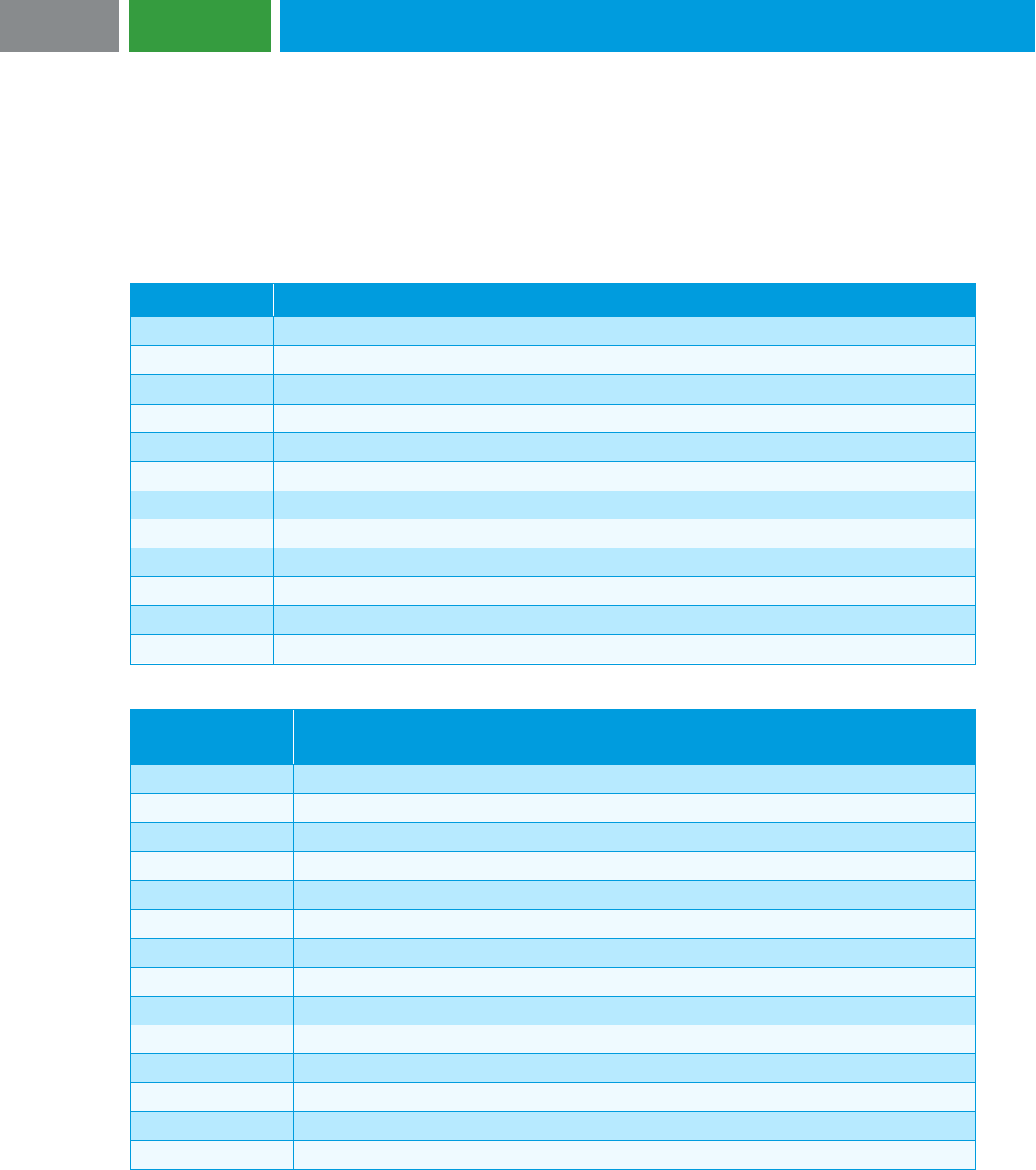

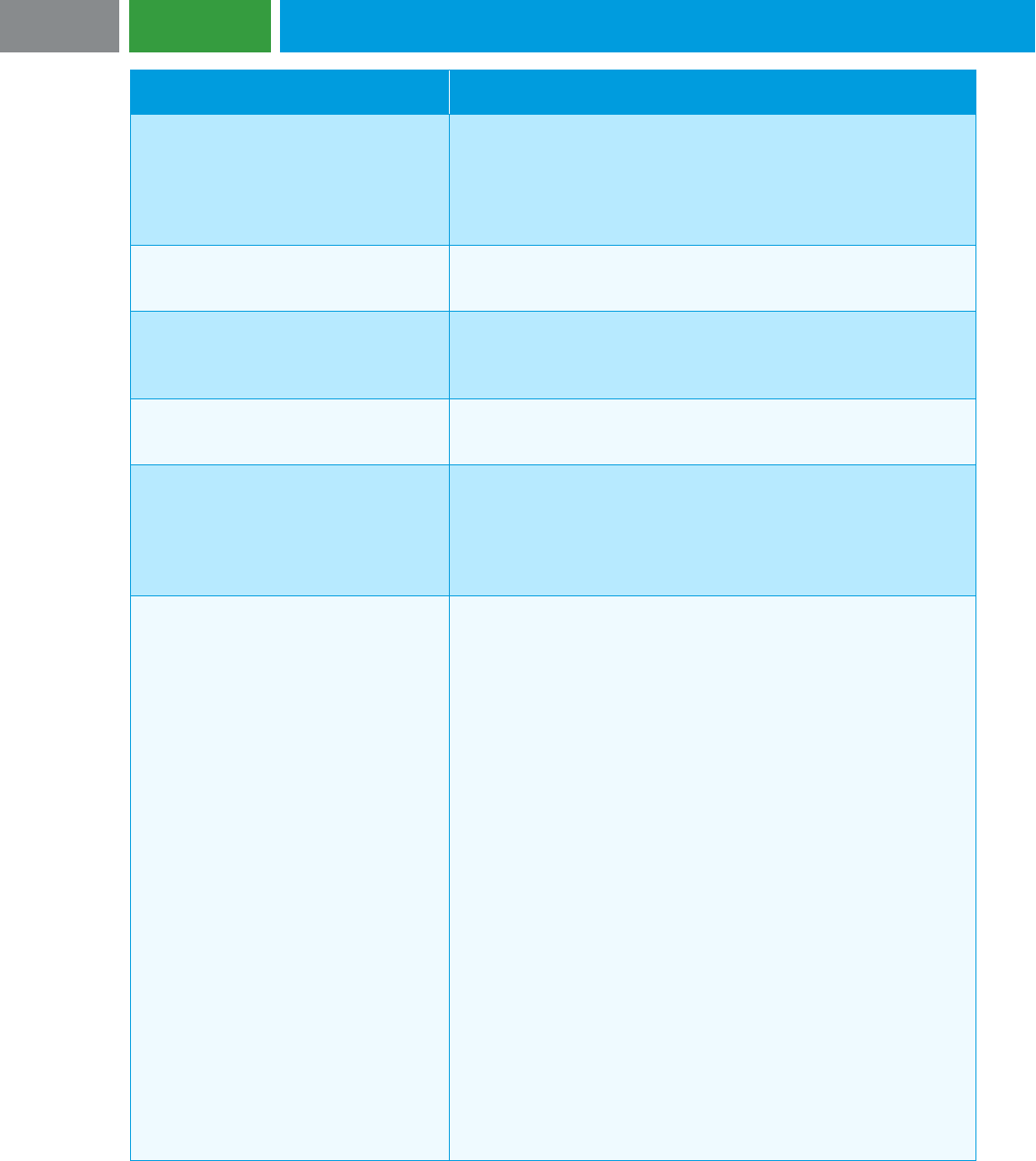

The following flowchart illustrates these considerations and the order in which they should occur:

Changes are made to the terms of the borrower s debt that affect the debt s cash

flows

Apply the extinguishment accounting

model (see Section 2.3.3)

Apply the modification accounting

model (see Section 2.3.4)

Is the new or changed debt substantially different from the old debt (see

Section 2.3.2)?

?

No

Yes

Did any of the following happen in conjunction with the changes being

made to the debt (see Sections 1.1 and 2.1)?

• Borrower has been legally released as the primary obligor either

judicially or by the lender and there is no other continuing debt with the

same lender.

• Borrower repaid the debt (and has been relieved of the related

obligation) using proceeds from debt with a new lender and there is no

other continuing debt with the old lender.

• Borrower repaid the debt (and has been relieved of the related

obligation) without entering into new debt with the old lender and there

is no other continuing debt with the old lender.

?

The liability derecognition

threshold has been met (see

Section 2.1.1).

Borrower applies extinguishment

accounting and considers whether

the accounting and disclosure

requirements applicable to a TDR

apply (see Sections 2.1.1 and

2.2.9).

Yes

No

The liability derecognition threshold is not met because there continues to be debt

with the old lender after the changes to the borrower s debt.

Borrower next considers whether the changes to its debt should be accounted for as

a TDR (see Section 2.2), and if not, whether the changes should be accounted for as

an extinguishment or modification (see Section 2.3).

Is the borrower

experiencing financial

difficulties (see Section

2.2.2.1)?

?

Has the lender granted a

concession (see Section

2.2.2.2)?

?

Apply the TDR accounting model

(see Section 2.2.4)

Yes Yes

Is the old debt a term loan or a line-of-credit arrangement (see Section 2.5)?

?

Apply the borrowing capacity model

(see Section 2.4)

Term debt

Line-of-credit

arrangement

No No

Note 1: Many of the terms used in this flowchart (e.g., financial difficulties, concessions, substantially

different) have specific meanings and related implementation guidance. This guide explains and

illustrates those meanings and guidance.

Note 2: As noted earlier in this section, changes to a DDTL that is not a TDR will either be accounted

for under the term loan or the line-of-credit accounting model.

3

JUNE 2023

The conclusions reached by a borrower in determining the appropriate accounting for changes made to a

loan could significantly affect its financial statements. Depending on the facts and circumstances, one or

more of the following may be required of the borrower:

• Adjust the carrying amount of the loan

• Derecognize the loan and recognize a new loan

• Change the amount of interest expense recognized in the income statement on a going-forward

basis or recognize a gain or loss in the income statement in the period the changes were made to

the loan

• Expense some of the costs incurred to execute the changes and (or) defer and amortize other

costs

The borrower must also consider classification questions related to the old loan and the new or changed

loan. Classification of debt is discussed in detail in our debt classification whitepaper.

As mentioned earlier, this guide deals solely with the borrower’s accounting for changes to its loans.

Guidance applicable to the lender, which differs, is discussed in Chapter 5 of our financial assets guide.

The relevant accounting literature on accounting for the changes made to loans by the borrower

(including term loans and line-of-credit arrangements) is primarily included in the following sections of the

Financial Accounting Standards Board’s (FASB) Accounting Standards Codification (ASC):

• ASC 405-20, Liabilities – Extinguishments of Liabilities

• ASC 470-50, Debt – Modifications and Extinguishments

• ASC 470-60, Debt – Troubled Debt Restructurings by Debtors

The remainder of Chapter 1, Introduction, discusses pervasive issues relevant to the accounting for

changes a borrower makes to its debt. The relevant guidance in ASC 405-20, 470-50 and 470-60 is

explained in Chapter 2, Relevant literature and general concepts. Several detailed examples of how to

apply this guidance are included in Chapter 3, Examples.

1.1 Determining whether the same lender is involved before and after changes are

made to the debt

Commentary: The two key parties to a loan are the borrower and its lender. Reading and understanding

the terms of the agreements that underlie a loan and any related changes to the loan should clearly

identify these and other relevant parties. Identifying the relevant parties factors into determining the

accounting model that should be applied in a particular situation. For example, if an old term loan is paid

off with proceeds from a new term loan with a new lender (i.e., an unrelated party that was not considered

a lender with respect to the old loan), then there are two separate accounting events for the borrower

(provided there are no other term loans with the old lender):

a) derecognition of the old term loan (which would be accounted for as an extinguishment) and

b) entering into the new term loan with a new lender (which would be accounted for as any other

issuance of new debt).

On the other hand, if the old term loan is paid off with proceeds from a new term loan that is with the

same lender, then consideration must be given to whether the borrower should account for the exchange

of the term loans using the TDR, modification or extinguishment accounting model. (Further discussion of

identifying the unit of account in a TDR or modification or extinguishment is included in Section 2.2.1.1

and Section 2.3.1.1.) If the loan in this example was a line-of-credit, and the old line-of-credit was paid off

with the proceeds from a new line-of-credit with the same lender, then consideration must be given to

4

JUNE 2023

whether the borrower should account for the exchange of the lines-of-credit using the TDR or borrowing

capacity accounting model.

Typically, determining whether the same lender is involved in a loan before and after any changes are

made to the loan is a straightforward exercise involving looking at the name of the lender and seeing that

the name of the lender is the exact same before and after the changes. However, in other cases, it may

not be as straightforward. For example, if an affiliate of the old lender is the new lender, or if the old

lender and new lender are two subsidiaries or two divisions within the same consolidated entity, making

the determination as to whether the same lender is involved in a loan before and after any changes are

made to it requires additional analysis. To determine whether the same lender is involved in a loan before

and after any changes are made to the loan in these less-than-straightforward situations, such as when

there are multiple funds in a private equity group acting as lenders, requires careful consideration of the

relevant facts and circumstances, including but not limited to addressing the following questions:

• Are the new and old lenders separate legal entities?

• Are the new and old lenders not included in the same consolidated entity?

• Are management of the new and old lenders responsible as fiduciaries to manage the lenders

solely for the benefit of the owners and equity holders of each individual lender?

If the answer to each of these questions is yes, there are indications that the old and new lenders

operated separately and should not be considered the same lender for accounting purposes.

Alternatively, when the new and old lenders are part of the same consolidated group and use the same

representative to negotiate the debt modification with the borrower, there are indications that the old and

new lenders operated together and should be considered the same lender for accounting purposes.

Additional information about identifying the lender(s) in loan participations and loan syndications, as well

as identifying the roles of the parties involved, including third-party intermediaries, is provided in Section

2.3.7 and Section 2.3.8, respectively.

1.2 Convertible debt

This guide covers the guidance in ASC 470-50 related to the modification or exchange of debt with an

embedded conversion option. Chapters 2 and 3 of our debt and equity guide address the following related

to convertible debt:

• conversions in accordance with the terms of the debt,

• induced conversions, and

• modifications and extinguishments when the conversion feature was given separate recognition

as a derivative, a cash conversion feature or a beneficial conversion feature.

1.3 Effective interest method

Relevant guidance: ASC 835-30-35-1 to 35-4

U.S. GAAP requires interest expense on debt to be recognized using the effective interest method. Under

this method, any debt discount (which includes lender fees and third-party costs related to the original

issuance of the debt) is amortized into interest expense using a constant interest rate over the life of the

debt, which is known as the effective interest method. U.S. GAAP permits the use of other methods of

amortization if the results are not materially different than those resulting from the effective interest

method.

In practice, some borrowers amortize the debt discount on a straight-line basis, which is only appropriate

if doing so generates results that are not materially different from the results using the effective interest

method. For purposes of the discussion in this guide, it is assumed that the borrower is recognizing

5

JUNE 2023

interest expense using the effective interest method and that the carrying amount of the debt reflects use

of that method to amortize the debt discount.

6

JUNE 2023

2 Relevant literature and general concepts

2.1 Liability derecognition

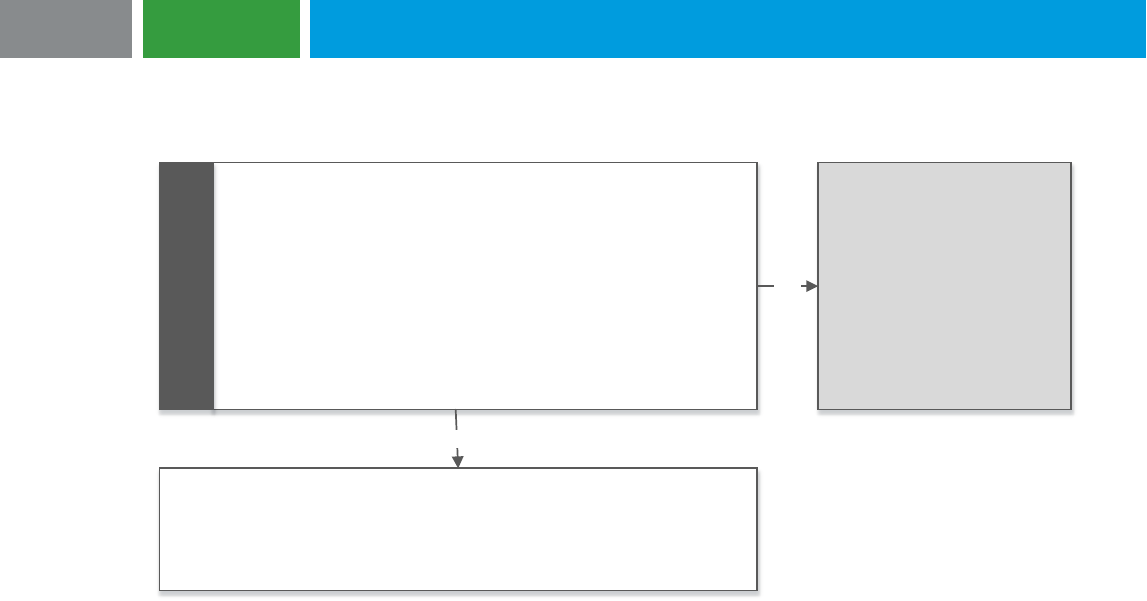

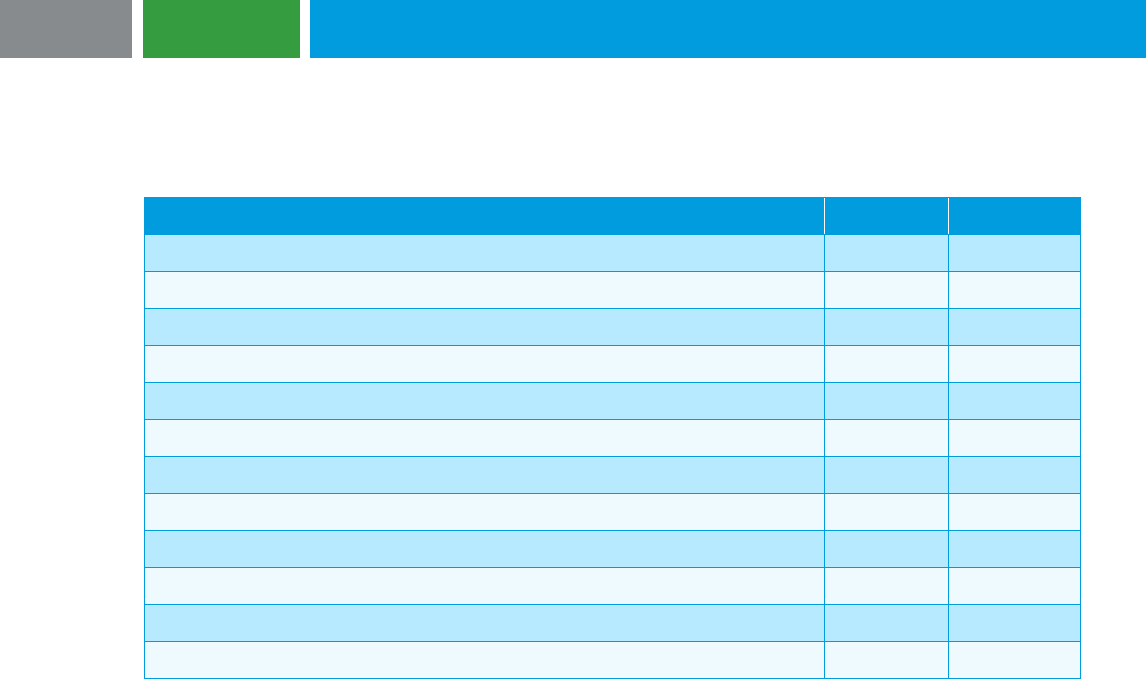

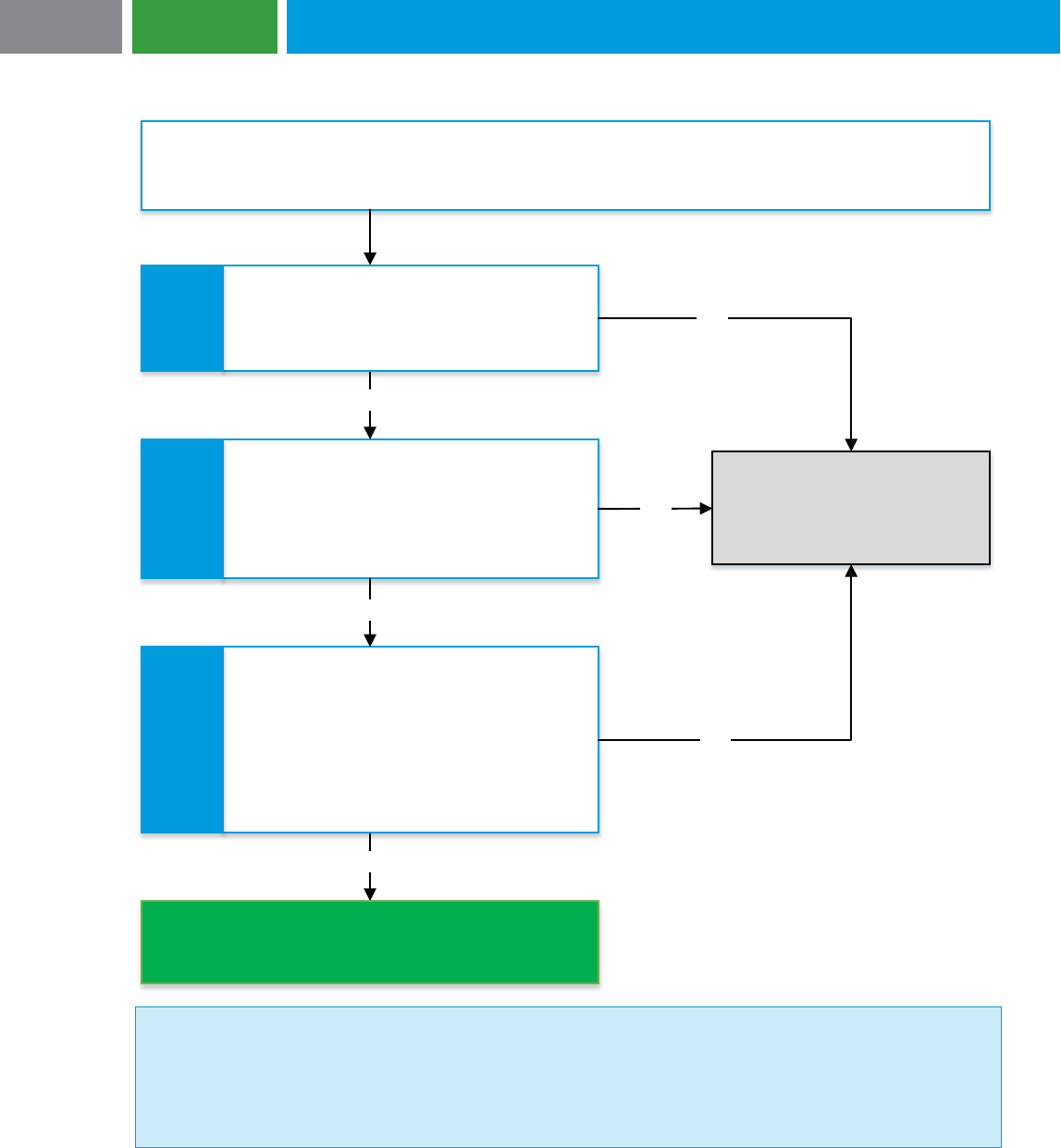

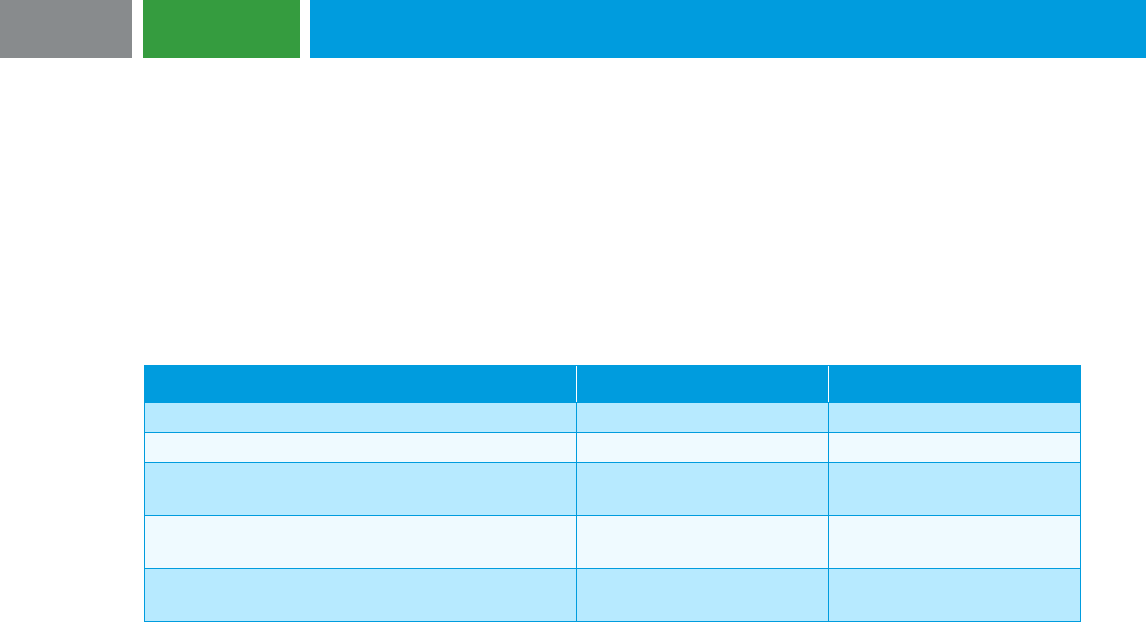

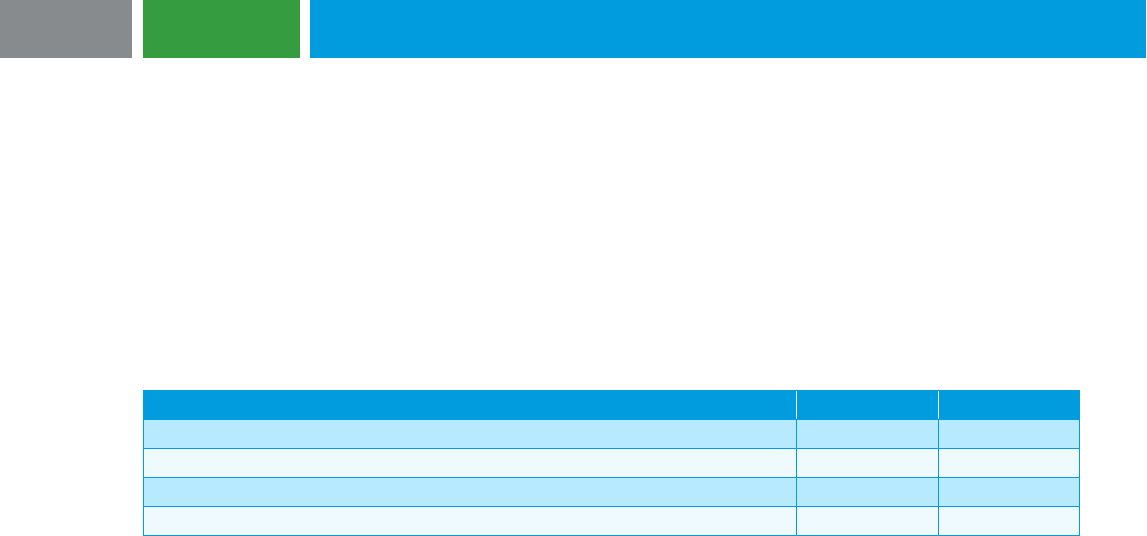

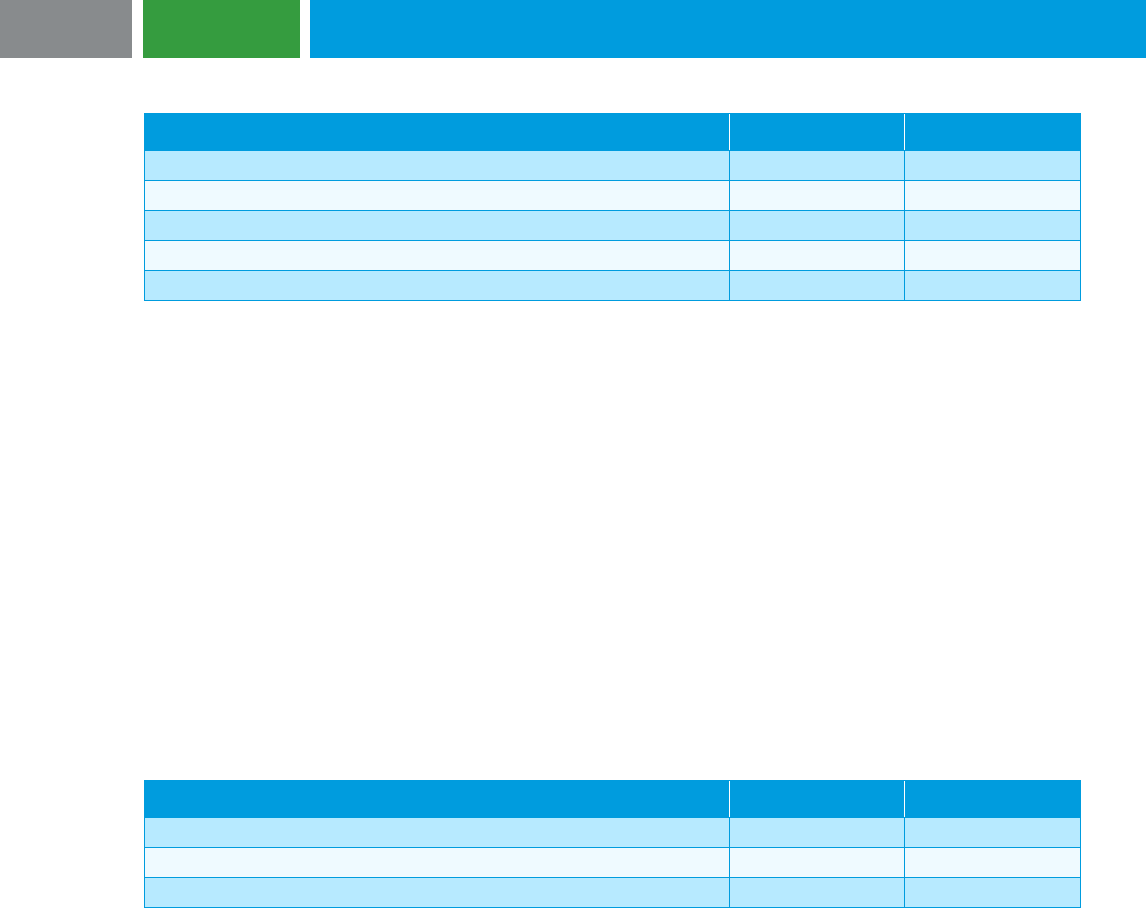

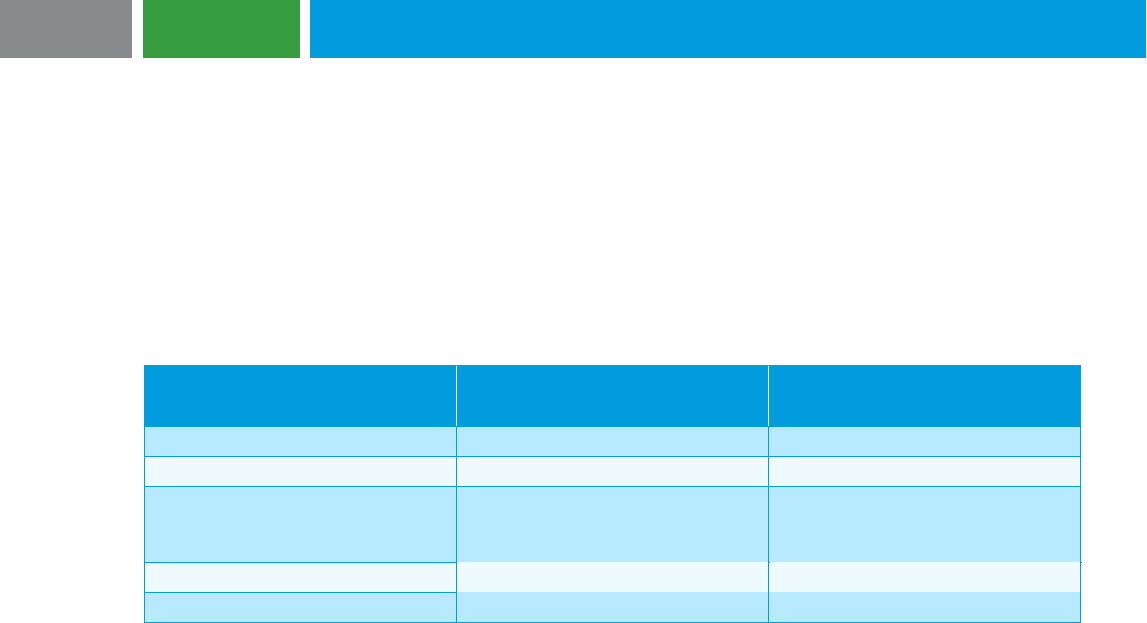

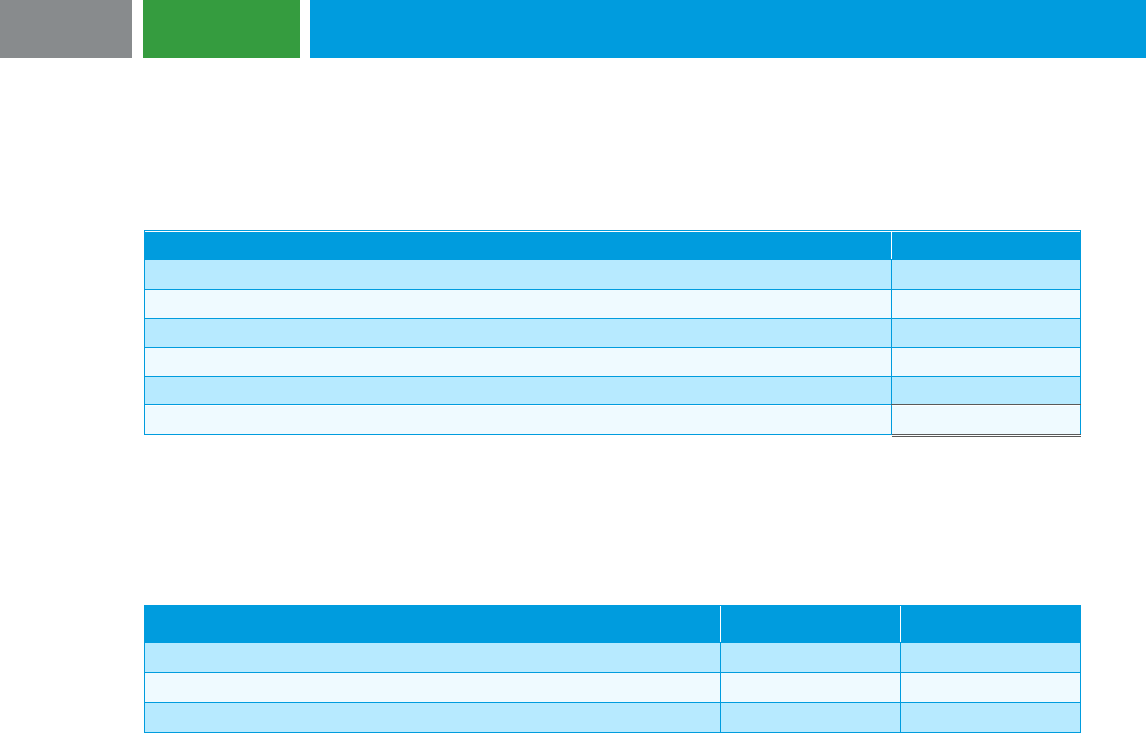

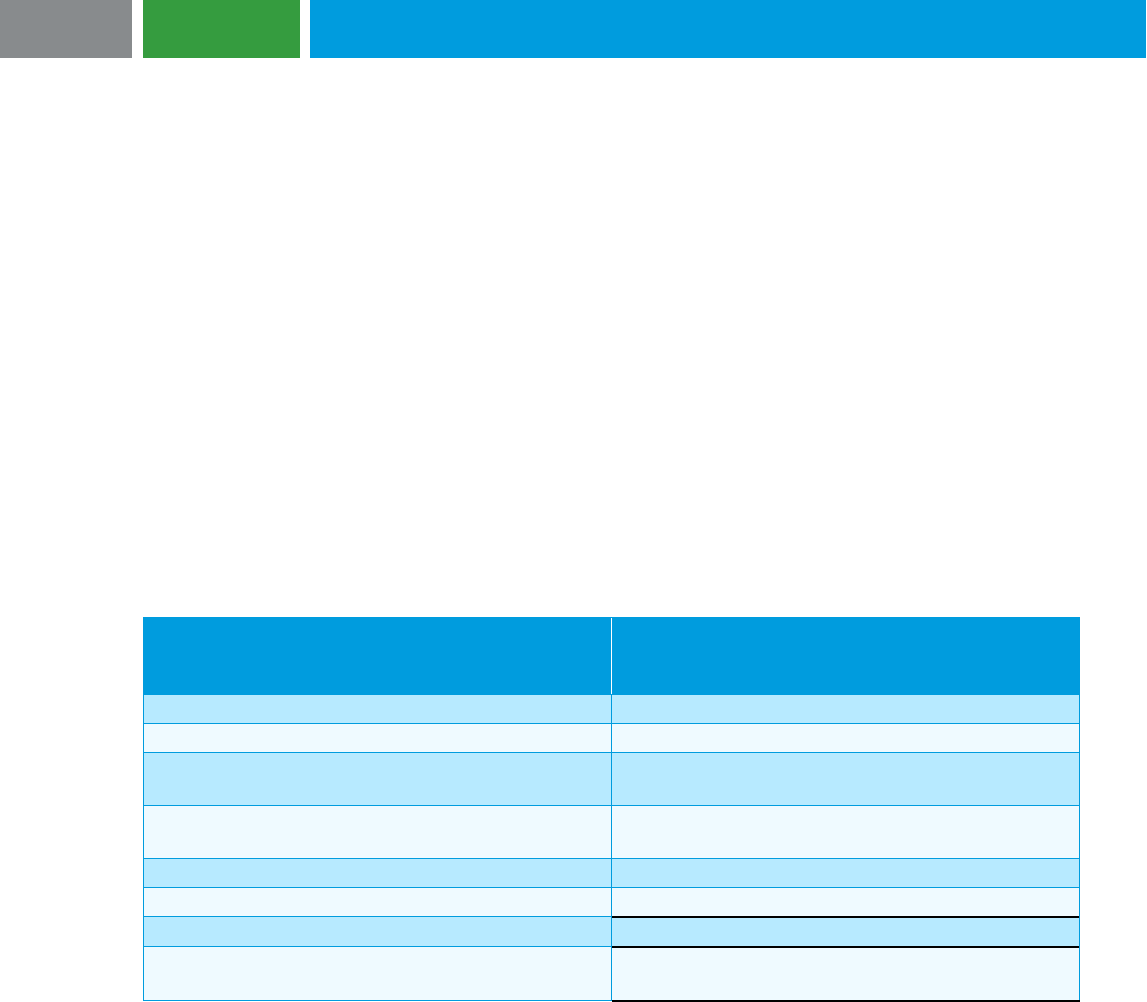

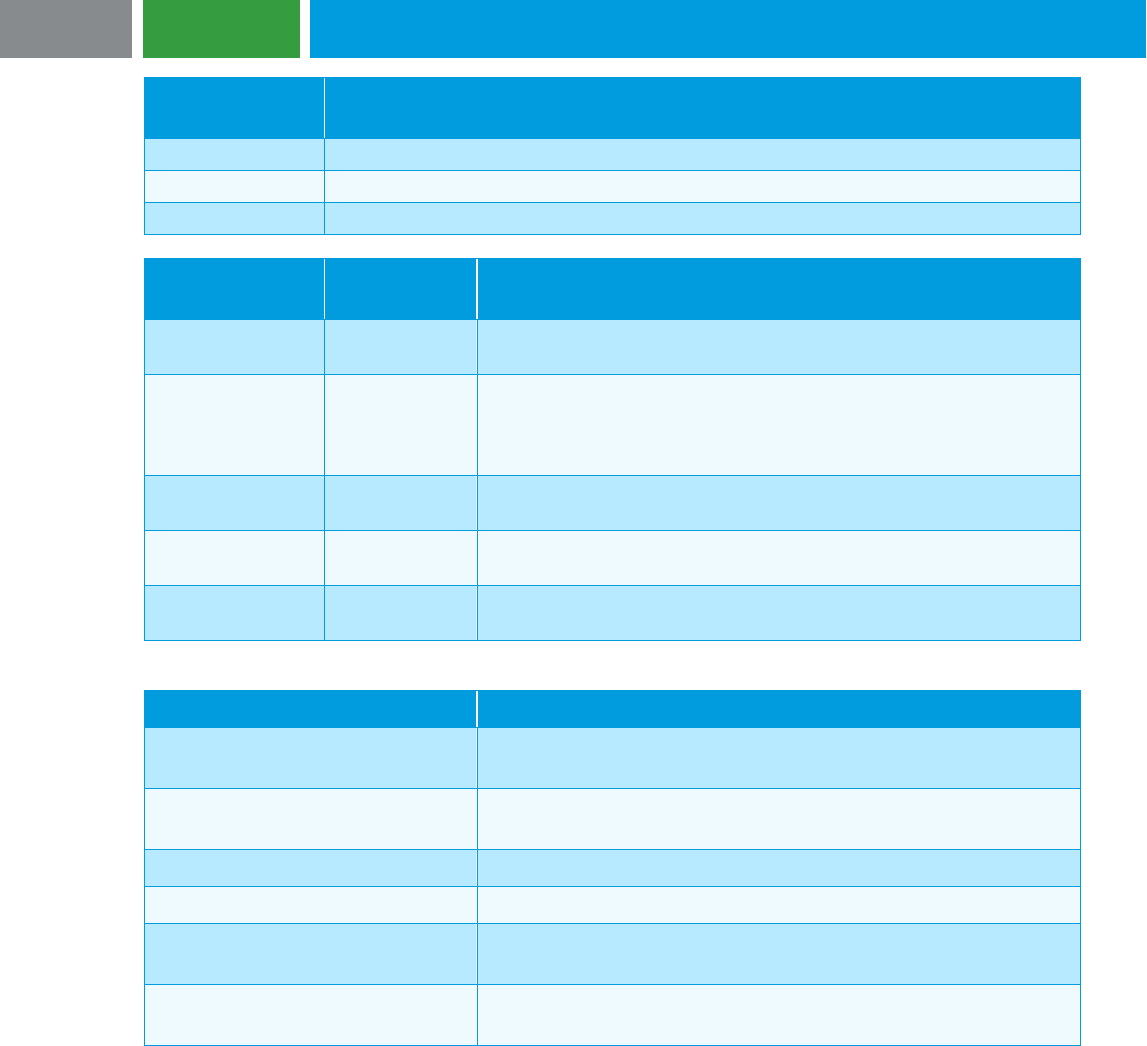

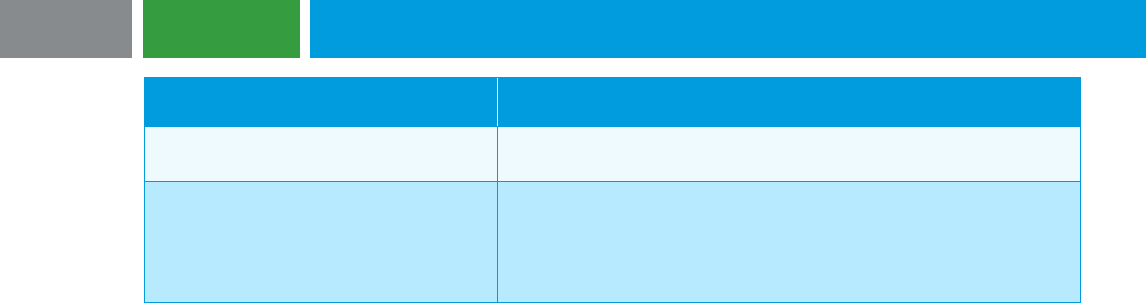

Did any of the following happen in conjunction with the changes being

made to the debt (see Sections 1.1 and 2.1)?

• Borrower has been legally released as the primary obligor either

judicially or by the lender and there is no other continuing debt with the

same lender.

• Borrower repaid the debt (and has been relieved of the related

obligation) using proceeds from debt with a new lender and there is no

other continuing debt with the old lender.

• Borrower repaid the debt (and has been relieved of the related

obligation) without entering into new debt with the old lender and there

is no other continuing debt with the old lender.

?

The liability derecognition

threshold has been met (see

Section 2.1.1).

Borrower applies extinguishment

accounting and considers whether

the accounting and disclosure

requirements applicable to a TDR

apply (see Sections 2.1.1 and

2.2.9).

Yes

No

The liability derecognition threshold is not met because there continues to be debt

with the old lender after the changes to Borrower s debt.

Borrower next considers whether the changes to its debt should be accounted for as

a TDR (see Section 2.2), and if not, whether the changes should be accounted for as

an extinguishment or modification (see Section 2.3).

2.1.1 Liability derecognition threshold

Relevant guidance: ASC 405-20-40-1 to 40-2 and ASC 470-50-15-4

Extinguishment is the derecognition of a liability. Derecognizing a liability simply means to take the liability

off, or remove the liability from, the borrower’s books. The liability derecognition threshold is met only if:

a) The borrower pays the lender and is relieved of its obligation, or

b) The borrower is legally released as the primary obligor.

Payment to a lender may occur upon the delivery of cash, other financial assets, or goods or services.

Payment may also occur if the borrower reacquires its outstanding debt securities and cancels them or

holds them as treasury bonds. Legal release as the primary obligor may be granted by the lender or may

occur judicially. If the liability derecognition threshold has been met, then the borrower should apply the

extinguishment accounting model (see Section 2.3.3). Refer to the commentary later in this section for

discussion about considering whether the extinguishment resulted from a TDR.

Questions arise regarding whether the following circumstances constitute an extinguishment: (a) the

borrower is legally released by the lender as the primary obligor, (b) a third party agrees to assume the

obligation and (c) the borrower agrees to become secondarily liable for the obligation. While the

occurrence of all these circumstances extinguishes the borrower’s original obligation, it also creates a

new obligation. This new obligation is a guarantee and must be accounted for as such (i.e., initially

recognized and measured at fair value in accordance with ASC 460-10-30-2).

Commentary: As discussed further in Section 2.2.4 some TDRs may result in debt being fully settled

either through the transfer of cash, noncash assets, equity or a combination thereof. For these TDRs, the

liability derecognition threshold has been met. While the net effect on the income statement is the same

regardless of whether the extinguishment accounting model or TDR accounting model is applied in these

situations, there are additional accounting (related to settlement of the debt by transferring noncash

assets or equity [see Section 2.2.4.1 and Section 2.2.4.2, respectively]) and disclosure requirements for a

7

JUNE 2023

TDR. As such, when the changes to debt meet the liability derecognition threshold, consideration should

also be given to whether those changes meet the definition of a TDR.

If the borrower and lender agree to change the terms of debt to allow the borrower to settle the debt by

transferring equity-linked instruments to the lender, the borrower must determine whether those

instruments should be classified as equity or a liability for accounting purposes (see our debt and equity

guide). When the equity-linked instruments should be classified as equity, the discussion in the preceding

paragraph applies. However, when the equity-linked instruments should be classified as a liability, the

borrower has exchanged debt for a different liability with the same lender and additional considerations

apply (see Section 2.1.2).

See Example 3.1 for application of this guidance.

2.1.2 Continuing term loans with the same lender

Commentary: There may be continuing term loans with the same lender either because the old loan was

modified or exchanged with the same lender, or because there are other term loans with the same lender.

(See Section 1.1 for discussion regarding whether two lenders should be considered the same lender for

accounting purposes.) When there are continuing term loans with the same lender, the borrower has not

met the substance of the liability derecognition threshold and should next consider whether the changes

made to the borrower’s loans should be accounted for as a TDR. In other words, the mere fact that the

borrower and lender concurrently exchange cash to satisfy an existing term loan (cash from borrower to

lender) and issue a new term loan (cash from the same lender to borrower) should not lead the borrower

to automatically conclude that the liability derecognition threshold has been met and the extinguishment

accounting model should be applied. The borrower may need to account for this exchange of cash and

term loans using the TDR accounting model for situations in which there has been a change to the loan’s

terms (with or without partial settlement of that debt) or the modification accounting model instead of the

extinguishment accounting model. In addition, when the borrower has more than one term loan with the

same lender and settles one or more (but less than all) of those term loans, the borrower may not have

met the substance of the liability derecognition threshold (see Section 2.2.1.1).

Further, when a borrower has a term loan with multiple lenders (e.g., a syndicated loan), the borrower

could meet the threshold for liability derecognition with a lender leaving the syndicate but not with the

remaining lenders (see Section 2.3.7).

2.2 TDR accounting

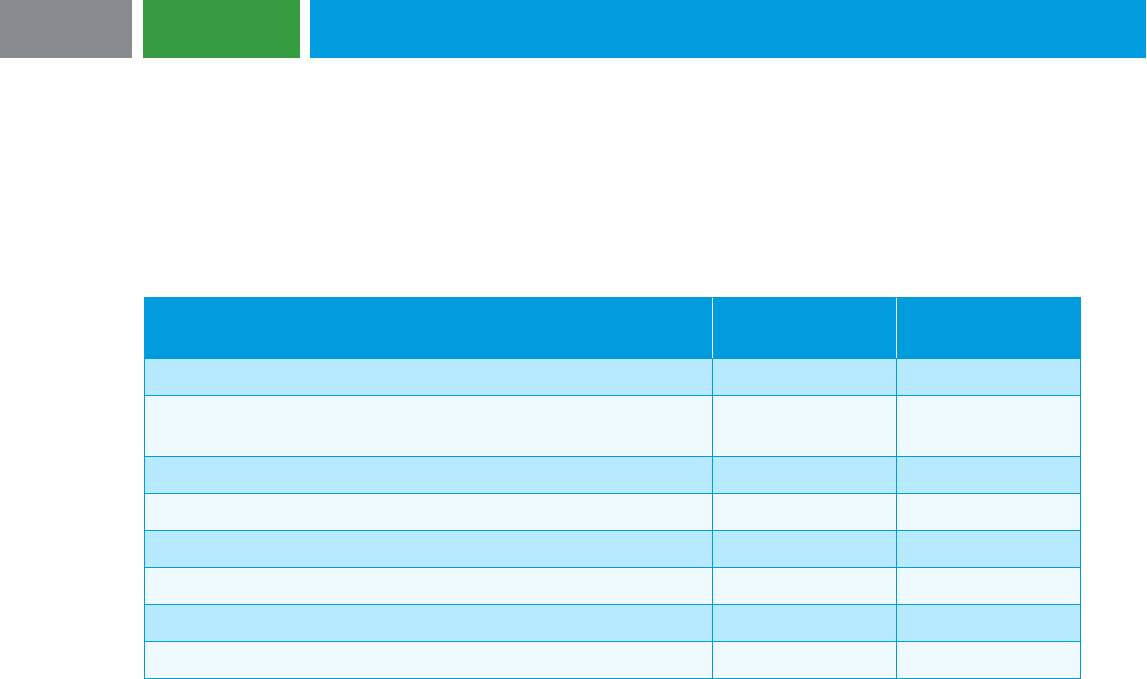

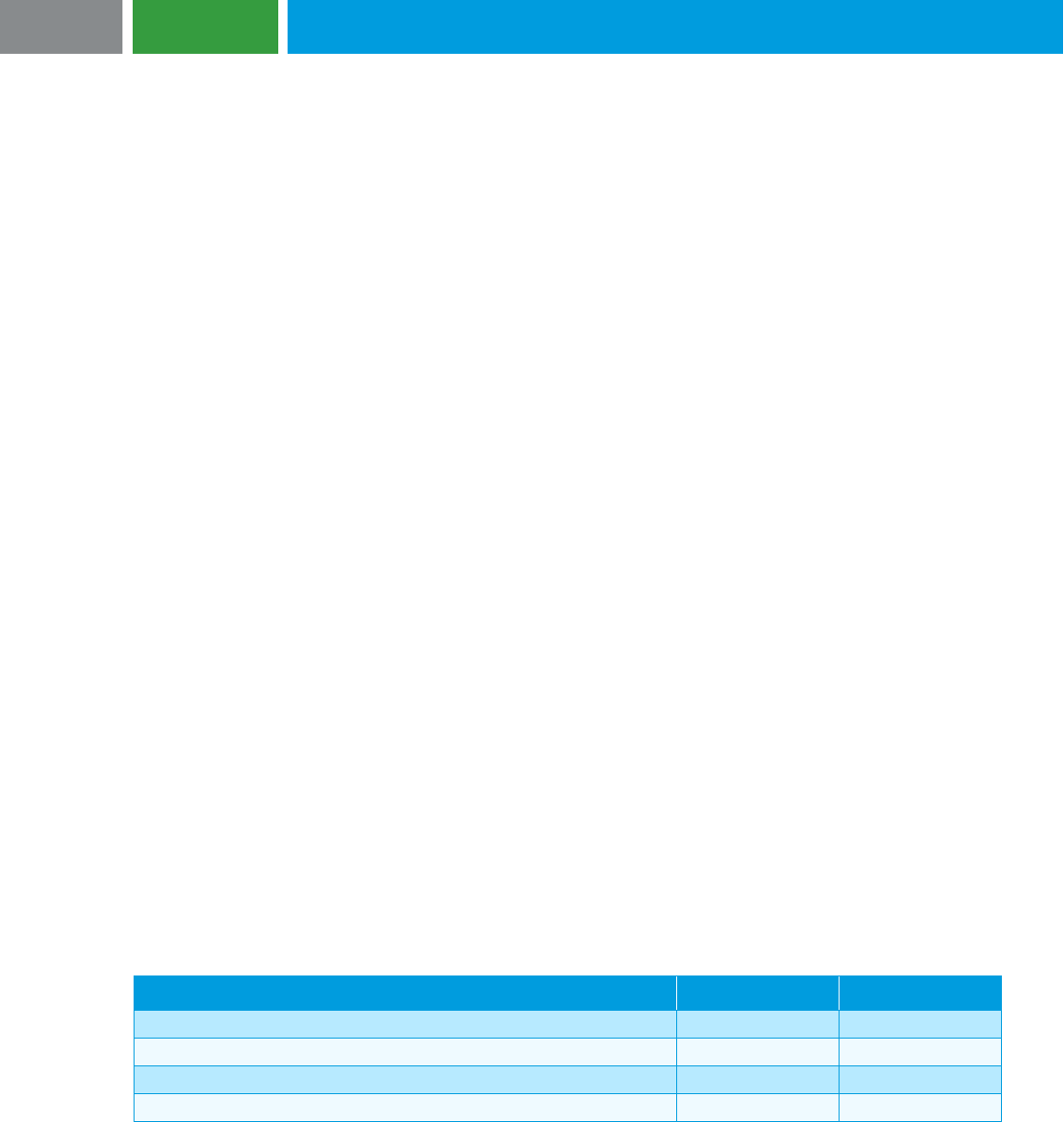

Is the borrower

experiencing financial

difficulties (see Section

2.2.2.1)?

?

Has the lender granted a

concession (see Section

2.2.2.2)?

?

Apply the TDR accounting model

(see Section 2.2.4)

Yes Yes

2.2.1 Nature, scope and unit of account

Relevant guidance: ASC 470-60-10-1 to 10-2, ASC 470-60-15-4 to 15-7, ASC 470-60-15-9 to 15-11

and ASC 470-60-55-1 to 55-3

As noted in Appendix B, the Master Glossary of the Codification defines a TDR as follows: “A

restructuring of a debt constitutes a troubled debt restructuring if the creditor for economic or legal

reasons related to the debtor’s financial difficulties grants a concession to the debtor that it would not

otherwise consider.” The concession granted by the lender will affect both the borrower’s and lender’s

cash flows related to the debt. The cash flows may be affected by changing: (a) the amount or timing of

cash flows paid by the borrower, (b) how much of the cash flows will be designated as interest and (c)

how much of the cash flows will be designated as principal, which will affect the lender’s total return and

its effective interest rate as well as the borrower’s total cost and effective interest rate.

8

JUNE 2023

A TDR may involve debt, bonds, notes or accounts payable relating to purchasing goods or services on

credit. It is not limited solely to loans or debt.

For liabilities other than bonds payable, the evaluation of whether a TDR has occurred should take place

on a lender-by-lender basis, even in cases where the restructuring of a group of similar liabilities is

negotiated at the same time across a number of lenders (see Section 2.2.1.1 regarding situations in

which there are multiple term loans with the same lender). For bonds payable that are part of a TDR, the

bond constitutes one payable (and unit of account) even though there are many bondholders.

A lender’s incentive in agreeing to a TDR rests on the theory that it is better to get something instead of

nothing. In other words, if the only way a lender will get any payments from a borrower is if they agree to

a concession, then they may be incented to agree to the TDR to get at least some of the amount owed to

them. Of course, the lender is only motivated to grant a concession that protects as much of its

investment as possible. Any of the following could take place in a TDR:

• The lender agrees to settle the debt for less cash than the outstanding balance of the debt.

• The lender agrees to settle the debt by accepting assets (other than cash) whose fair value is

less than the carrying amount of the debt. The assets could be accounts receivable from routine

sales made by the borrower, real estate or other assets. These assets may come to the lender as

a result of foreclosure, repossession or other transfers.

• The lender agrees to settle the debt by accepting a grant of equity securities issued by the

borrower, provided the grant is not occurring in accordance with preexisting terms that would

have permitted conversion of the debt to an equity interest.

• The borrower and lender agree to modify the terms of the debt and not transfer any assets or

equity. The cash requirements under the debt may be reduced as a result of one or more of the

following types of changes: (a) a reduction in the stated interest rate on the debt, (b) an extension

of the maturity dates when the stated interest rate is lower than the market rate for comparable

new debt, (c) a reduction in the face amount of the debt or, (d) a reduction in accrued interest

owed on the debt.

• The borrower and lender agree to extend the maturity date of the debt and defer required interest

payments until that date.

• The borrower and lender agree to: (a) the partial settlement of the debt through the transfer of

noncash assets or equity and (b) the modification of terms for the debt that remains.

The borrower and lender may initiate the discussions that lead to a TDR or those discussions may be

forced by law or by a court. As such, a TDR may exist for accounting purposes if it was carried out under

various provisions of the Federal Bankruptcy Act (e.g., reorganization) or other related federal statutes.

When the borrower in a TDR is undergoing bankruptcy proceedings, a quasi-reorganization or corporate

readjustment at the same time as the TDR, it is important to understand whether such activities will result

in a general restatement of the borrower’s liabilities. If so, a TDR does not exist for accounting purposes.

Our bankruptcy whitepaper includes an overview of bankruptcy proceedings under Chapter 11, and

guidance and examples related to financial reporting while in Chapter 11 bankruptcy and fresh start

accounting upon emergence from bankruptcy.

The following situations are not in the scope of the TDR guidance:

• Lease modifications under ASC 842. Refer to our lessee guide for information about the

accounting for lease modifications.

• Changes in employment-related agreements (e.g., pension plans, deferred compensation

contracts)

9

JUNE 2023

• Failure by the borrower to pay its trade accounts according to their terms without reaching an

agreement with its creditors to change the terms

• Deferral of legal action by the lender to collect past due amounts of interest and principal from the

borrower without reaching an agreement with the borrower

• Application of bankruptcy accounting by the borrower and a general restatement of its liabilities

(see our bankruptcy whitepaper)

2.2.1.1 Unit of account when there are multiple term loans with the same lender

Commentary: When there are multiple term loans with the same lender (see Section 1.1) and changes

are made to one or more of those loans, we believe the changes should be evaluated for TDR purposes

as if they were a single term loan with the lender. Not taking this approach could result in the borrower

accounting for changes to one term loan as a TDR (and potentially recognizing a gain) when such

changes might not be considered a TDR (or not result in gain recognition under the TDR accounting

model) if those changes were evaluated in the context of all the term loans with that specific lender.

2.2.2 Determining whether a TDR exists

Relevant guidance: ASC 470-60-15-13 and ASC 470-60-55-4 to 55-5

Determining whether the accounting for a TDR applies in a particular situation is a matter of professional

judgment. An analysis of all the facts and circumstances must be performed and no one fact or

circumstance should itself be considered determinative in the face of a preponderance of contrary

evidence. The accounting literature provides guidelines that should be used in this analysis. These

guidelines focus on the definition of a TDR (see Section 2.2.1). Based on that definition, the following two

questions must be answered to determine whether the accounting model for a TDR applies in a particular

situation:

1. Is the borrower experiencing financial difficulties? (see Section 2.2.2.1)

2. Is the lender granting a concession? (see Section 2.2.2.2)

If the answer to both questions is yes, then the changes to the debt should be accounted for as a TDR. If

the answer to either of these questions is no, then the changes to the debt should not be treated as a

TDR for accounting purposes. In the latter situation, the borrower must determine whether the

modification or extinguishment accounting model is appropriate (see Section 2.3).

For efficiency purposes, the borrower should first evaluate the question above that is easiest to answer,

because a “no” response to either question means that the changes to the debt should not be treated as

a TDR by the borrower for accounting purposes. We believe that for most borrowers, the question of

whether the borrower is experiencing financial difficulties is easiest to answer and should be answered

first. Thus, a borrower’s conclusion that they are not experiencing financial difficulties would obviate the

need to determine whether the lender is granting a concession.

2.2.2.1 Is the borrower experiencing financial difficulties?

Relevant guidance: ASC 470-60-15-8, ASC 470-60-55-4 and ASC 470-60-55-7 to 55-8

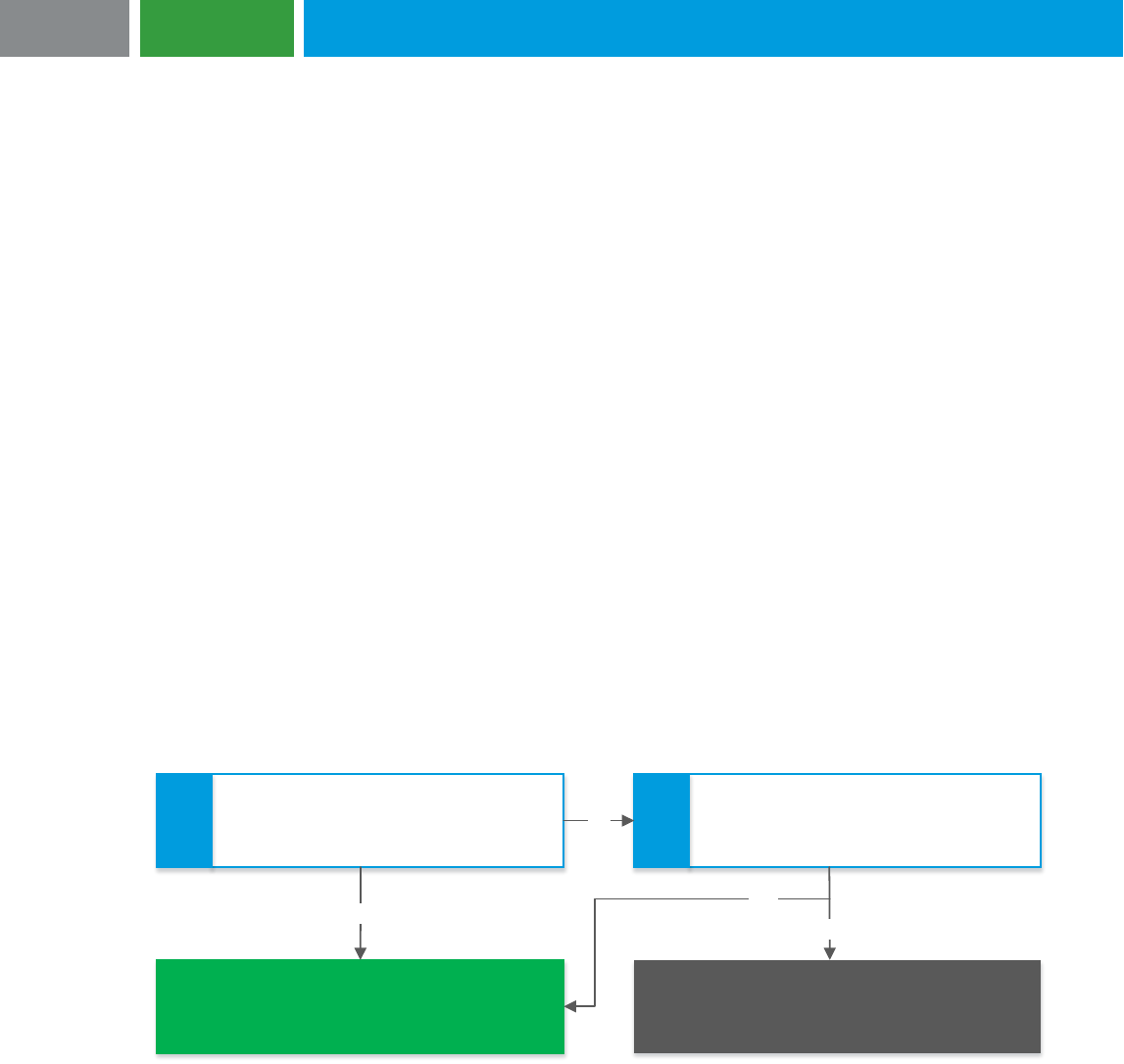

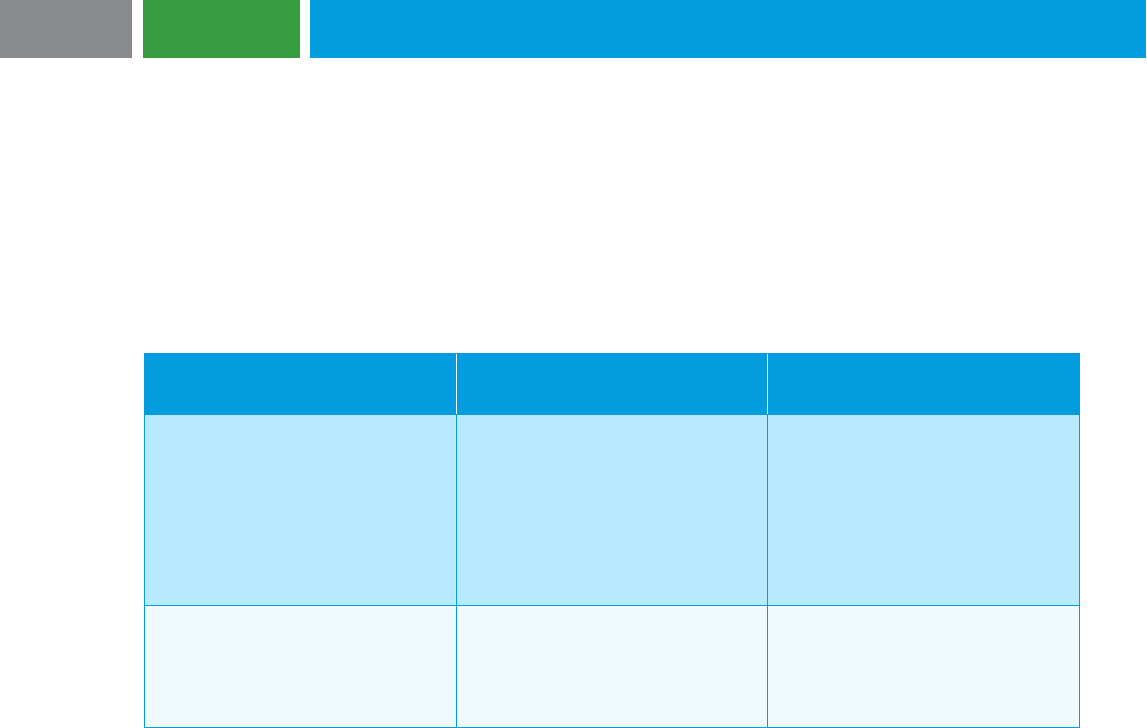

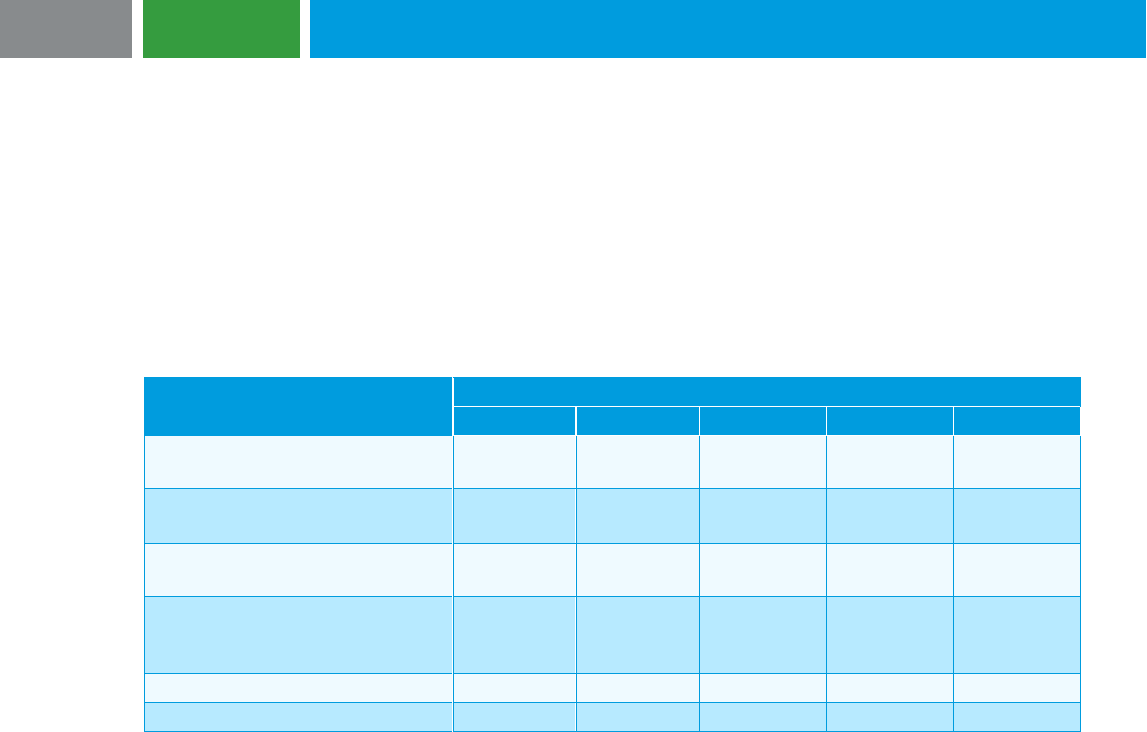

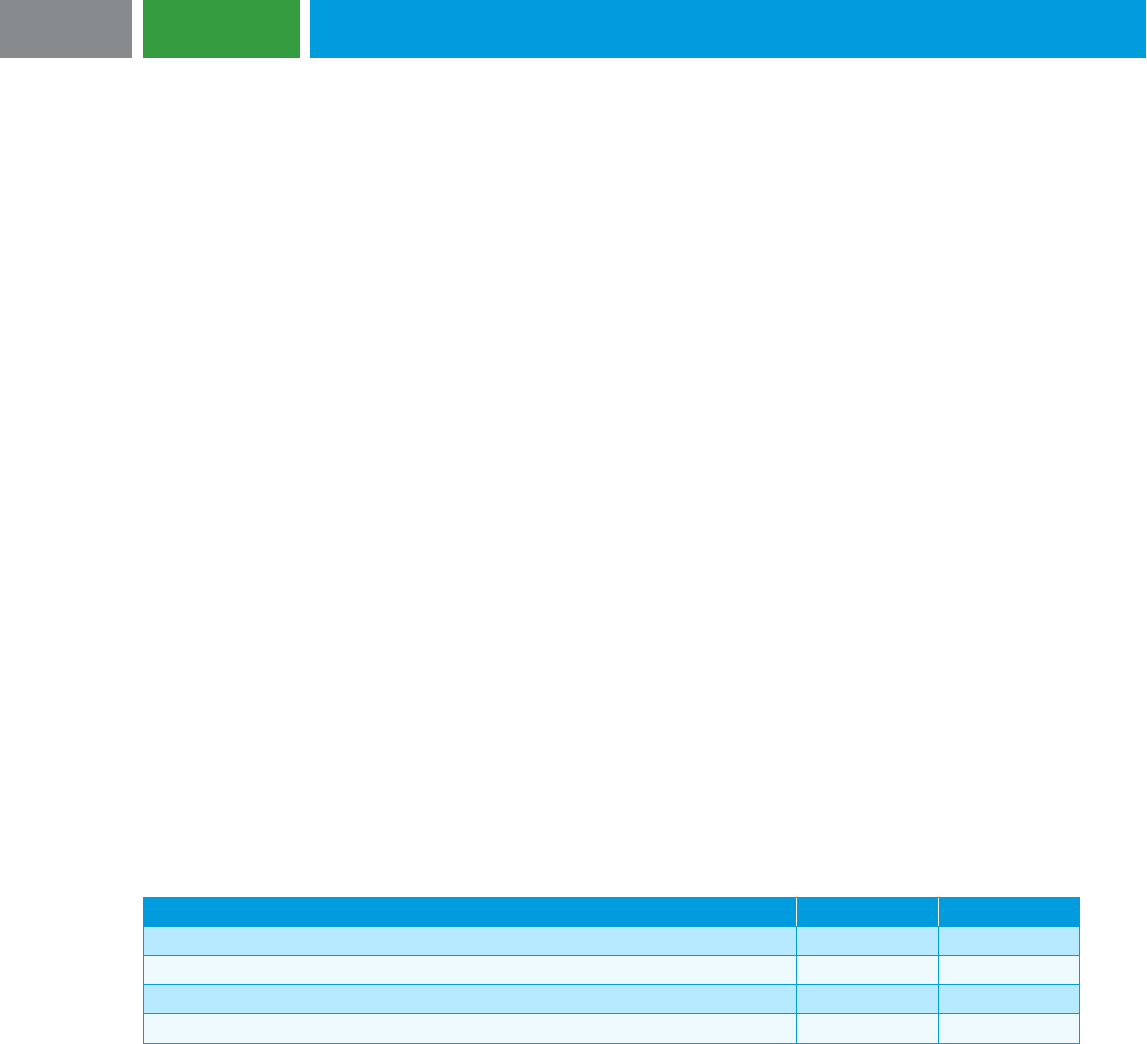

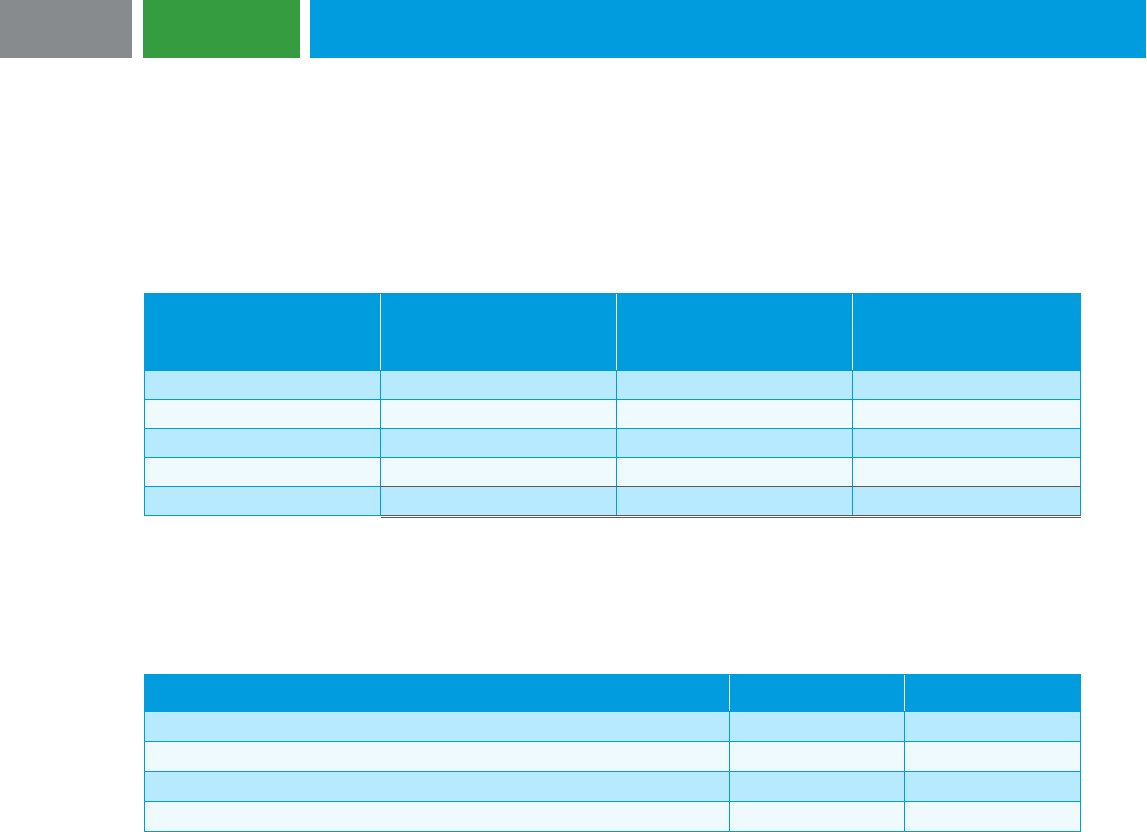

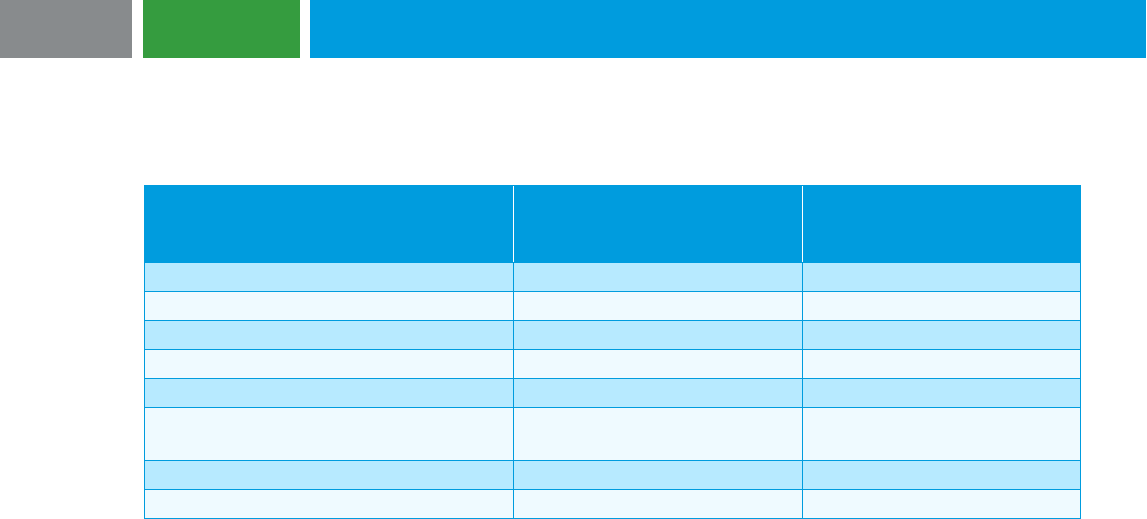

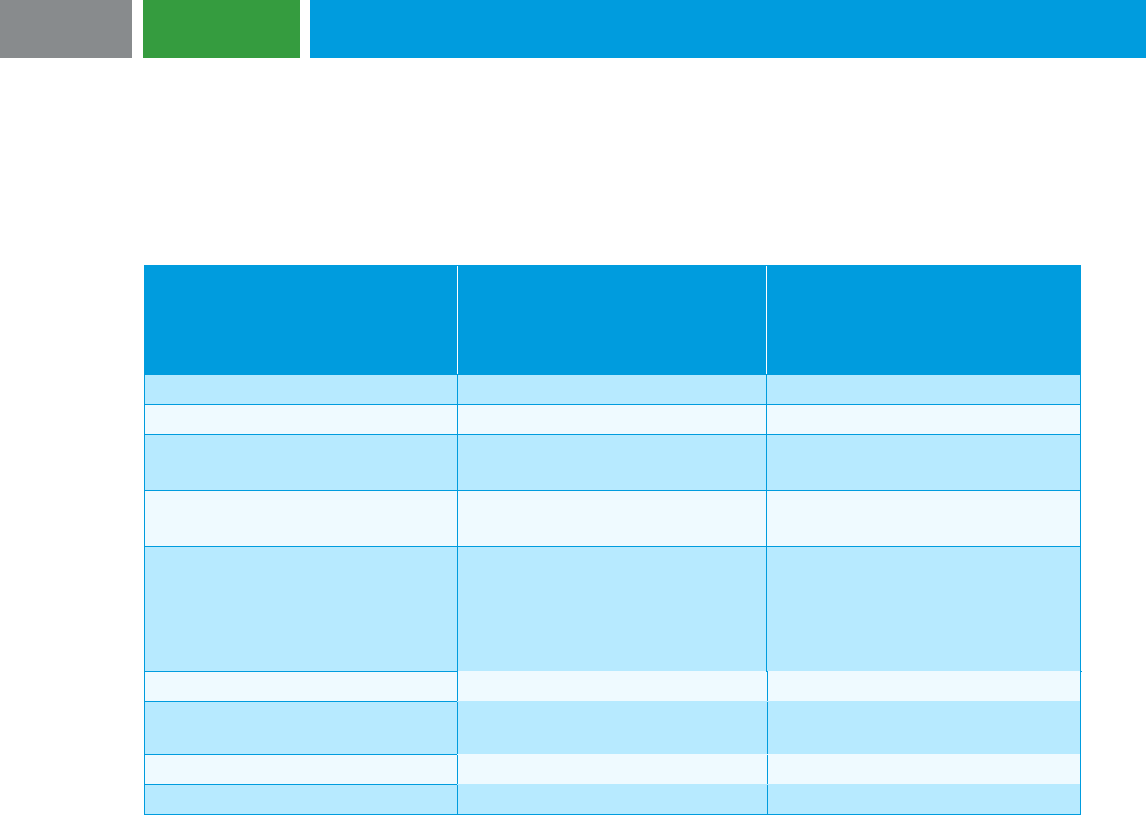

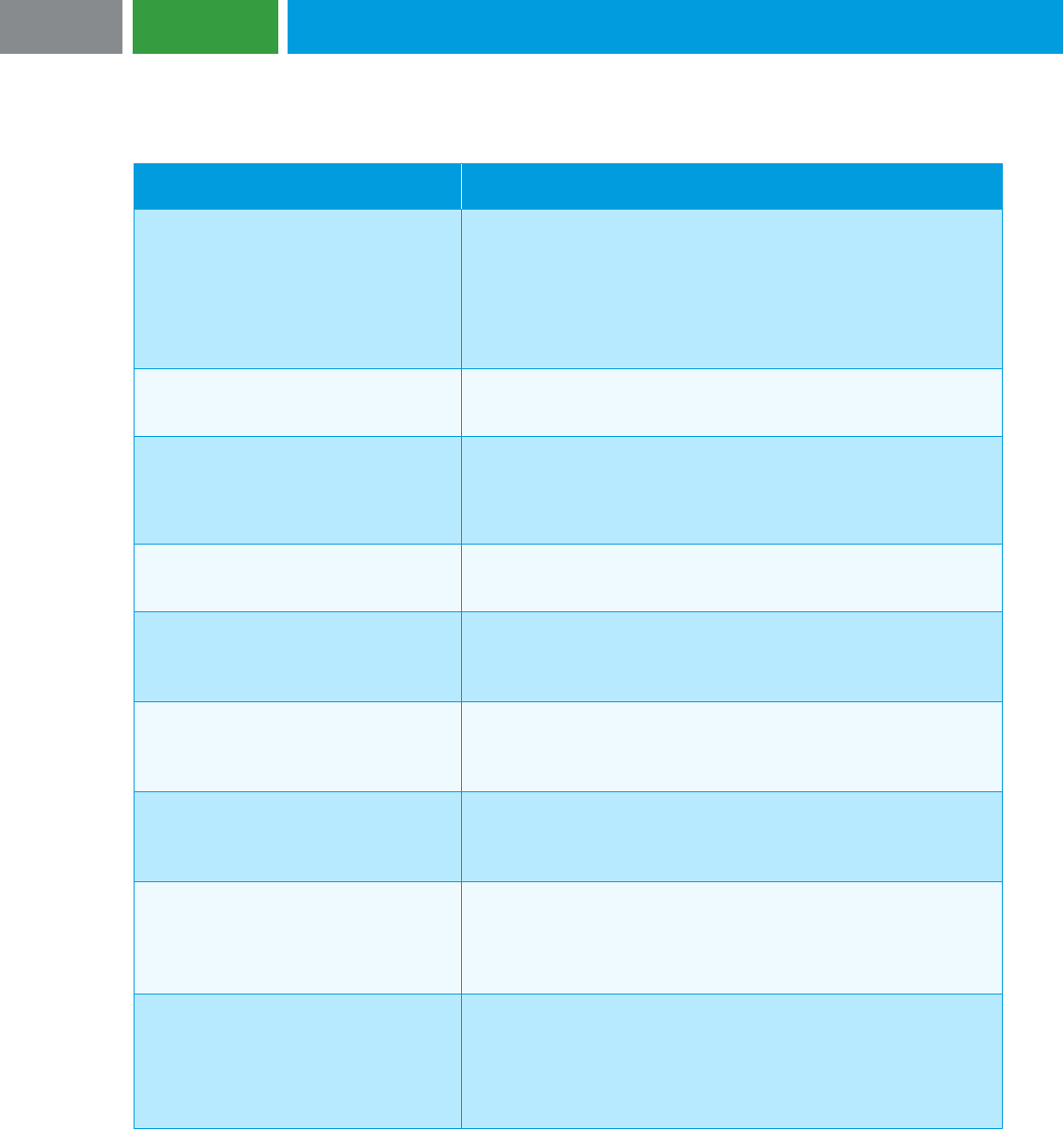

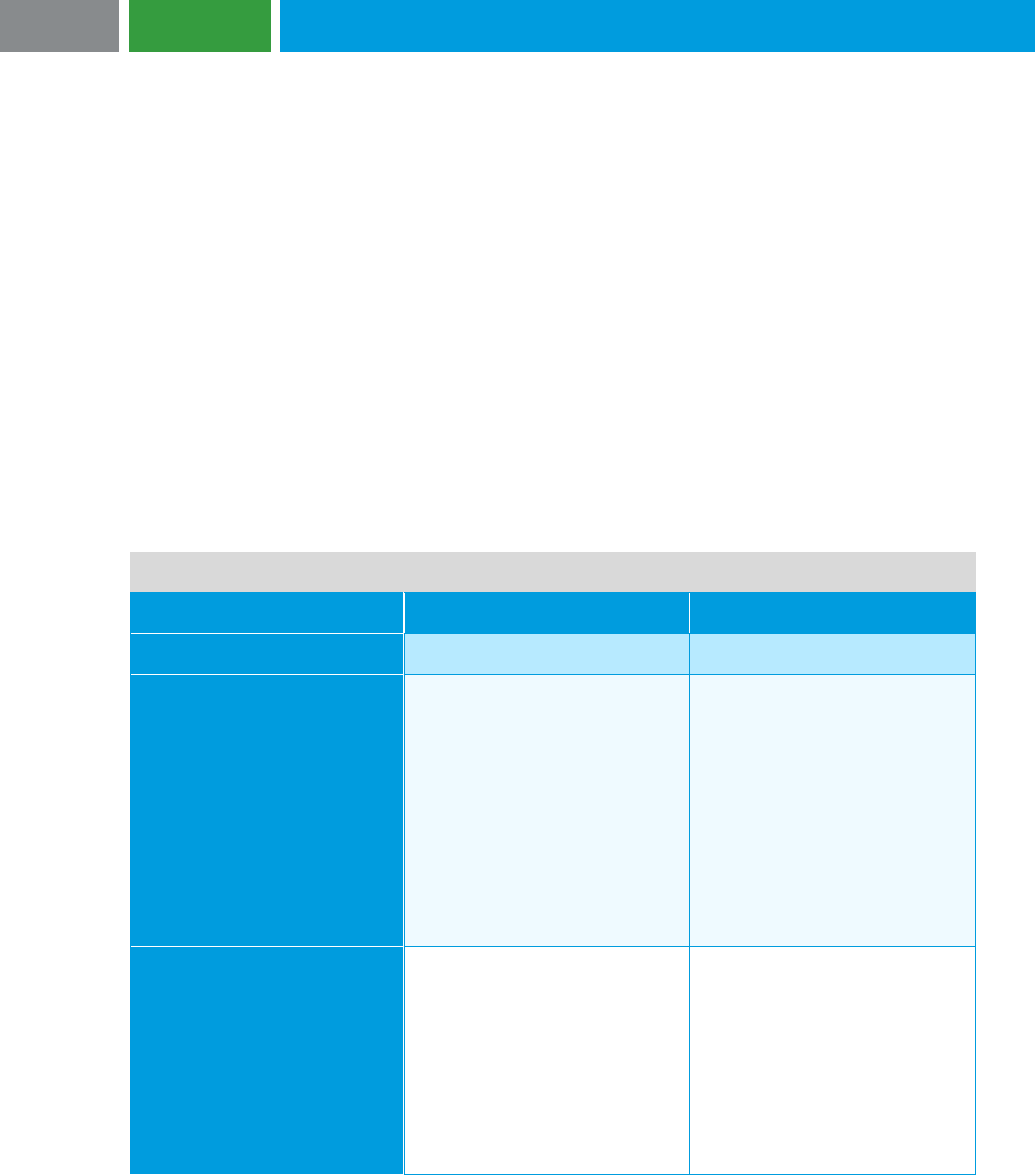

The following flowchart captures how a borrower should assess whether it is experiencing financial

difficulties as that term is used in ASC 470-60:

10

JUNE 2023

Has the lender agreed to restructure debt only to

reflect: (a) decreases in current market interest rates

at which the borrower could obtain funds or (b)

improvements in the borrower s creditworthiness

since original issuance of the loan?

?

Has the borrower been servicing the debt and

can it obtain debt from other lenders at market

rates offered on comparable debt to nontroubled

borrowers?

?

Has the borrower s creditworthiness

deteriorated? ?

Does an in-depth qualitative analysis

indicate that the borrower is experiencing

financial difficulties?

?

Financial difficulties exist

No financial difficulties,

therefore no TDR

No

Yes

Yes

Yes

No

No

No

Yes

The top two questions in the flowchart are focused on why the debt was changed. So, if the debt was

changed just to reflect decreases in current market interest rates at which the borrower could obtain funds

or improvements in the borrower’s creditworthiness since the original issuance of the debt, and the

borrower has been servicing the debt and can obtain debt from other lenders at market rates offered on

comparable debt to nontroubled borrowers, there is determinative evidence that the changes to the debt

were not made because the borrower was experiencing financial difficulties. When these are not the

reasons the debt was changed, further analysis is required to determine whether the borrower is

experiencing financial difficulties. This further analysis involves the borrower determining whether there

has been a deterioration in its creditworthiness since it originally issued the debt. For purposes of

assessing whether the borrower’s creditworthiness has deteriorated:

• If the borrower’s credit rating changes but remains an investment-grade credit rating (e.g.,

Standard & Poor’s credit rating on the borrower drops from an A to a BBB), then its

creditworthiness has not deteriorated.

• If the borrower’s credit rating declines from investment grade to noninvestment grade (e.g.,

Standard & Poor’s credit rating on the borrower drops from a BBB to a BB), then its

creditworthiness has deteriorated.

In many cases, a borrower’s creditworthiness has not been evaluated by a nationally recognized rating

agency. This is particularly true of many privately held companies. Assessing whether a borrower’s

creditworthiness has deteriorated in these cases requires the consideration of other factors in the context

of the borrower’s specific facts and circumstances. Examples of other questions that should be

considered in determining whether the borrower’s creditworthiness has deteriorated when the borrower’s

credit has not been evaluated by a nationally recognized rating agency include the following:

• If the borrower’s debt is collateralized, has there been a significant decrease in the value of that

collateral?

• If the borrower has a guarantee issued by a related party or third party (or other credit

enhancement) on its debt, has there been a significant decrease in the value of that guarantee or

other credit enhancement? For example, if the borrower has a guarantee on its debt from a third

party, has there been a decline in the financial standing of the third party that has led to a

significant decrease in the value of the guarantee?

• Is the borrower part of an industry whose sector risk has deteriorated?

11

JUNE 2023

• Is the borrower unable to obtain new debt at reasonable terms?

• Is the borrower unable to meet the debt covenants in its existing loan agreements?

• Is the borrower experiencing liquidity issues? For example, has its working capital ratio

worsened?

• Has there been a general decline in the borrower’s financial performance? For example, has the

borrower recently experienced recurring net losses?

Answering yes to any of these questions is an indicator that the borrower’s creditworthiness has

deteriorated. The final assessment as to whether the borrower’s creditworthiness has deteriorated should

take into consideration the responses to all of these questions, as well as other relevant facts and

circumstances specific to the borrower.

If the borrower’s creditworthiness has not deteriorated, then the borrower is not experiencing financial

difficulties. Conversely, if the borrower’s creditworthiness has deteriorated, then additional factors must

be considered. Answering yes to any of the following questions is an indicator that the borrower is

experiencing financial difficulties:

• Is the borrower currently in default on any of its debt?

• Has the borrower declared bankruptcy or is the borrower in the process of declaring bankruptcy?

• Is there doubt about the borrower’s ability to continue as a going concern?

• Have any of the borrower’s securities been delisted from an exchange?

• Are any of the borrower’s securities in the process of being delisted from an exchange?

• Does the threat exist for any of the borrower’s securities to be delisted from an exchange?

• Are the borrower’s projected cash flows (based on current business capabilities) insufficient to

cover payments required on the debt through maturity?

• Is the borrower unable to obtain debt from other lenders in which the effective interest rate

charged by the lender is equal to the current market interest rate charged on comparable debt

issued to a nontroubled borrower?

The final assessment as to whether the borrower is experiencing financial difficulties should take into

consideration the responses to all of these questions, as well as other relevant facts and circumstances

specific to the borrower. Refer also to Section 2.2.2.3, which discusses the significance of certain factors

to the overall analysis as to whether a TDR exists.

From a practical perspective, when a borrower’s debt is not formally rated by a nationally recognized

rating agency and there is not determinative evidence that the borrower is not experiencing financial

difficulties, the borrower may perform the qualitative analyses related to whether there has been a

deterioration in the borrower’s creditworthiness and whether the borrower is experiencing financial

difficulties at the same time given the interrelated nature of the analyses. Refer also to Section 2.2.2.3,

which discusses the significance of certain factors to the overall analysis as to whether a TDR exists.

12

JUNE 2023

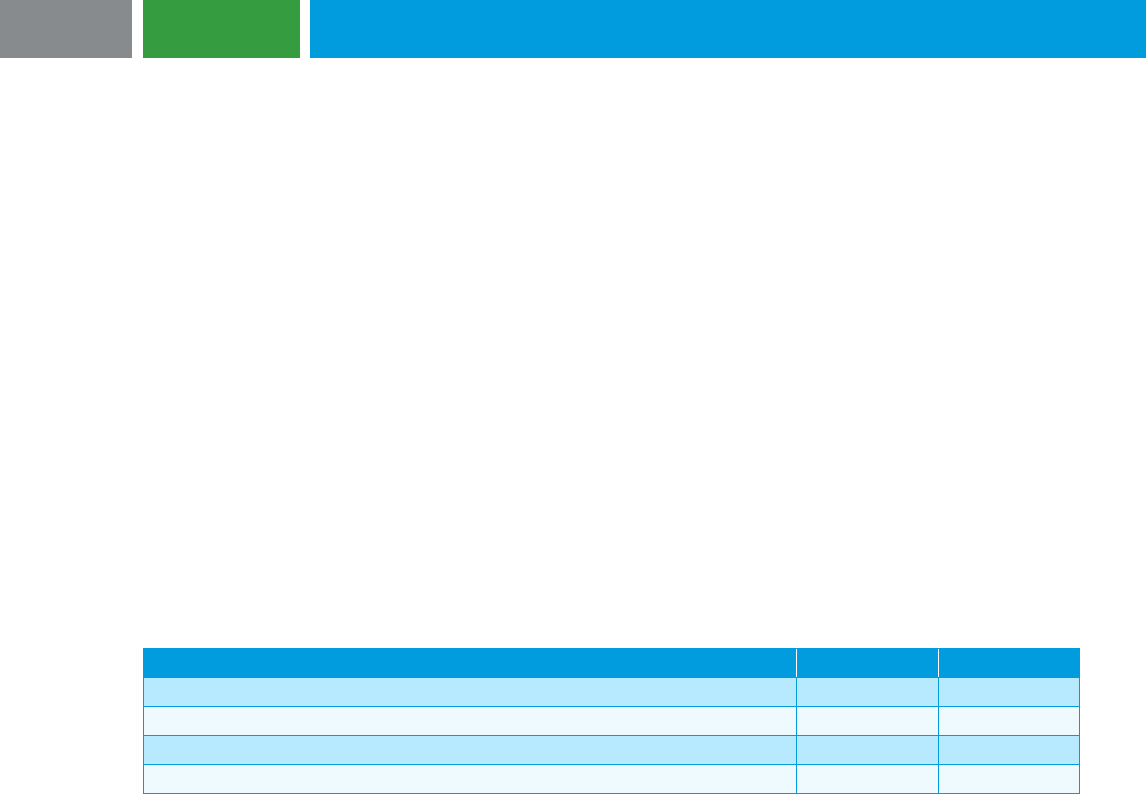

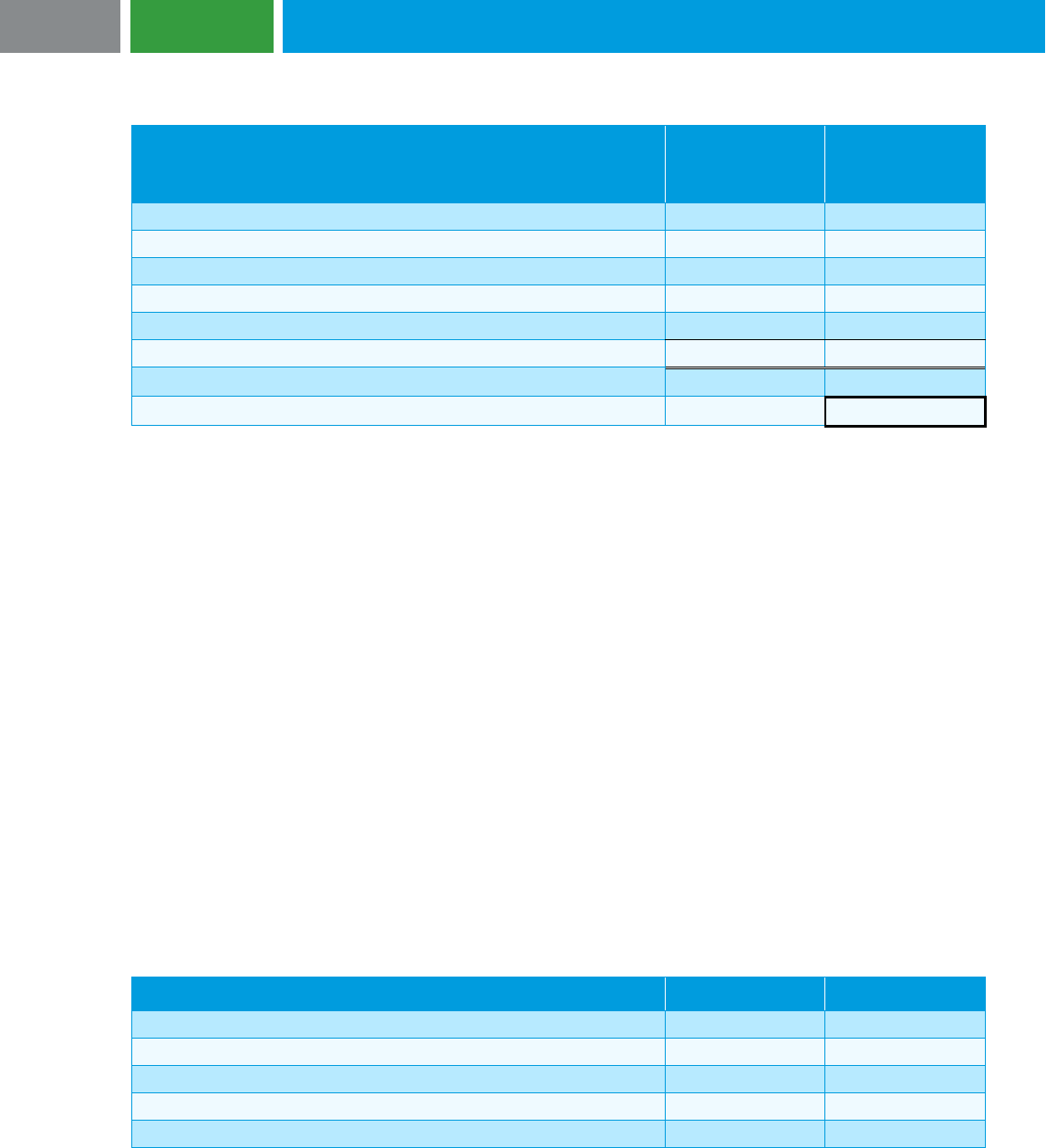

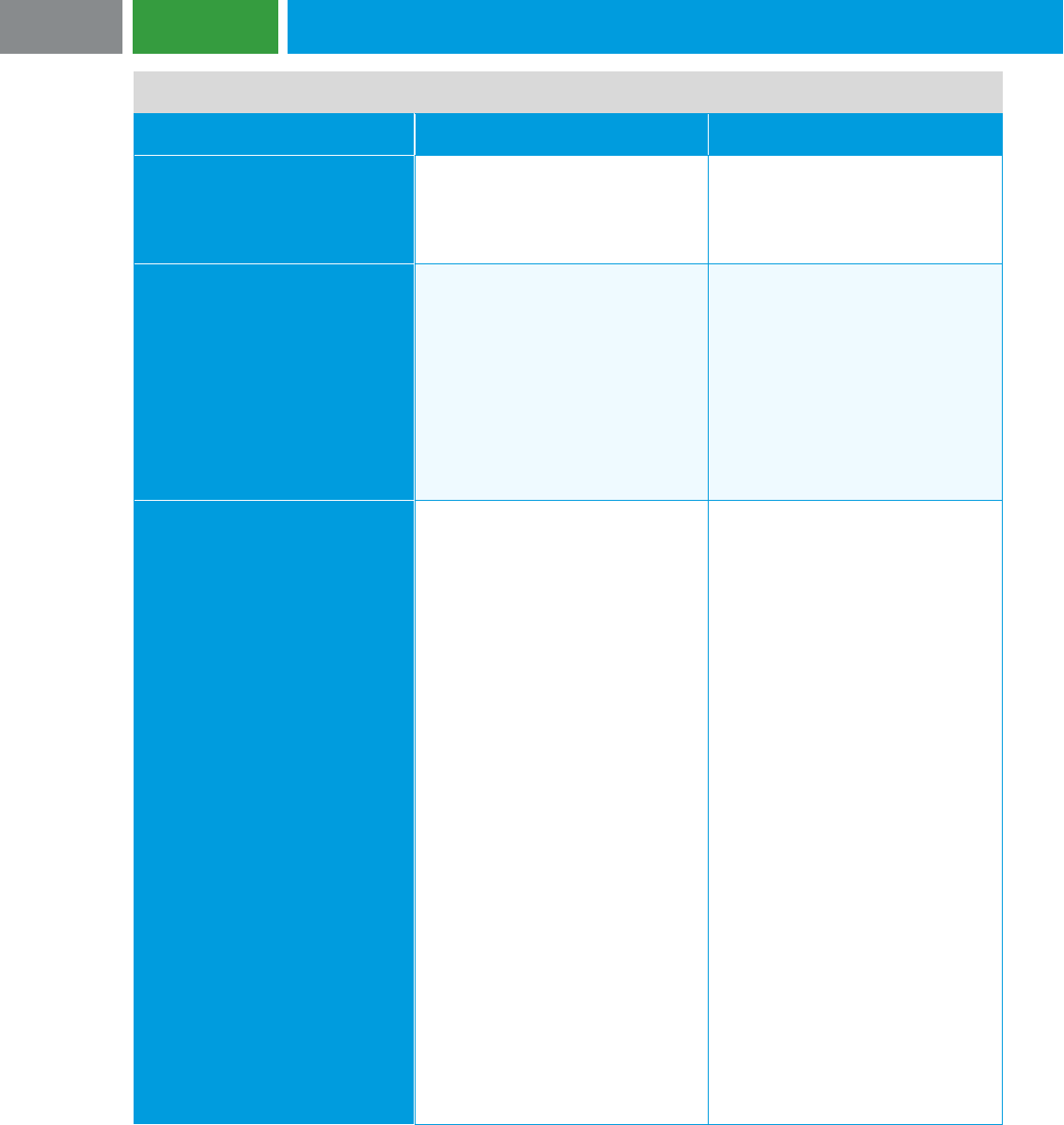

2.2.2.2 Is the lender granting a concession?

Relevant guidance: ASC 470-60-55-10 to 55-13

A concession has been granted by the lender if the debt’s effective (not stated) interest rate after changes

are made to it is less than the debt’s effective (not stated) interest rate prior to those changes being

made.

However, there may be rare situations in which a decrease in the effective interest rate is attributable to a

factor not reflected in the mathematical calculation of the effective interest rate. Adding more collateral to

the debt may give rise to this situation. Provided there is persuasive evidence in support of these rare

situations, a concession may not have occurred even though there has been a decrease in the borrower’s

effective interest rate. The accounting in such a situation should reflect the substance of the changes

made to the debt.

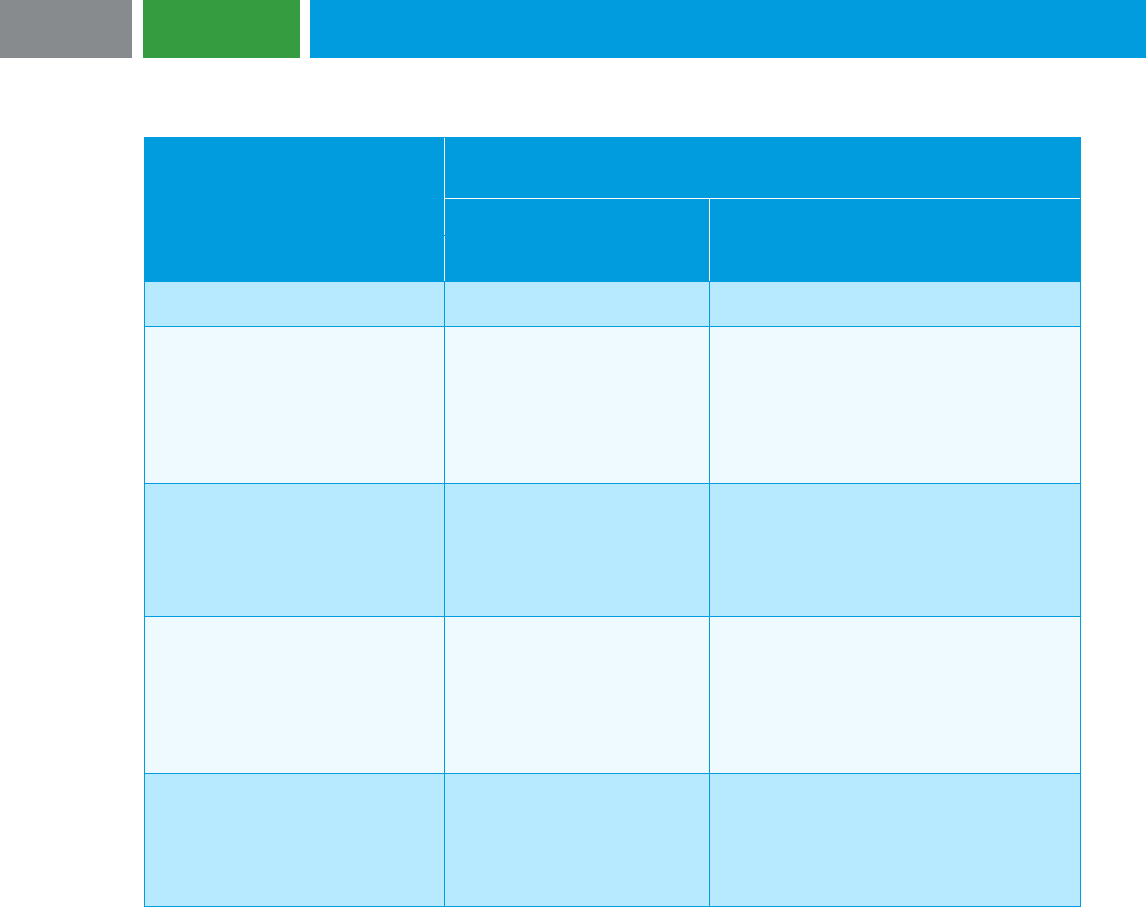

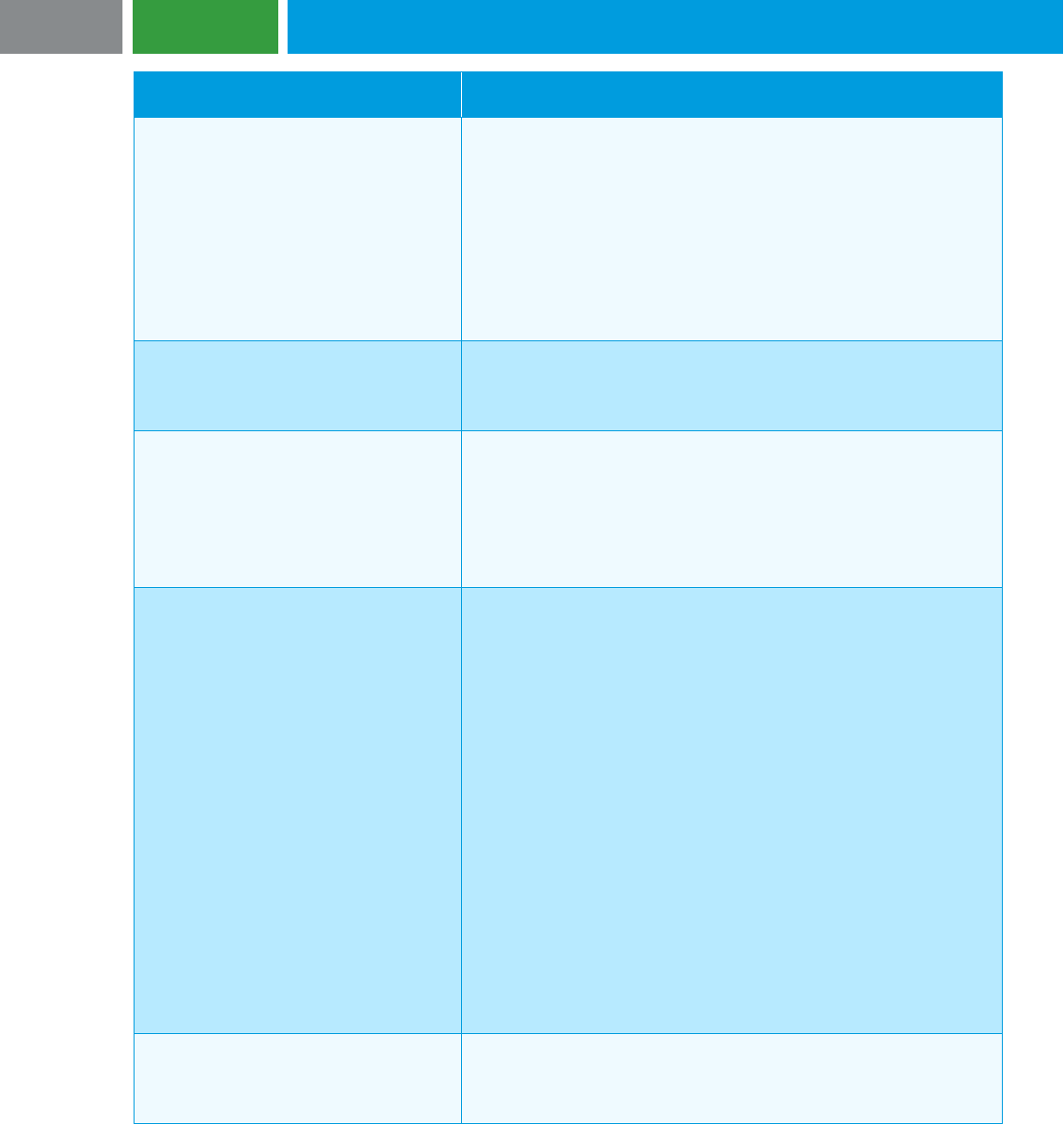

The effective interest rate after changes are made to the debt should give effect to all of the terms of the

changed debt, which should include any new or revised options, warrants, guarantees and letters of

credit. The following steps should be taken when calculating the effective interest rate after the changes

are made to the debt:

• Project all cash flows required under the changed debt

• Solve for the discount rate that makes the present value of the projected cash flows equal to the

carrying amount of the borrower’s debt before it was changed

Reflected in the carrying amount of the borrower’s debt should be any unamortized premium, discount or

issuance costs, and any accrued interest payable. However, hedging effects related to the debt should

not be included in its carrying amount. For example, the borrower may have previously elected fair-value

hedge accounting for an interest rate derivative (such as an interest rate swap) related to the debt.

Adjustments to the carrying amount of the debt to record changes in fair value associated with the

hedging relationship should be excluded from the carrying amount of the debt when calculating the

changed debt’s effective interest rate.

Reflected in the projected cash flows required under the changed debt should be any future principal and

interest payments, as well as any fees paid or payable by the borrower to the lender. In addition, the

projected cash flows required under the changed debt should include the effects of any new or revised

enhancements (i.e., sweeteners) included in the debt. Examples of sweeteners include options, warrants,

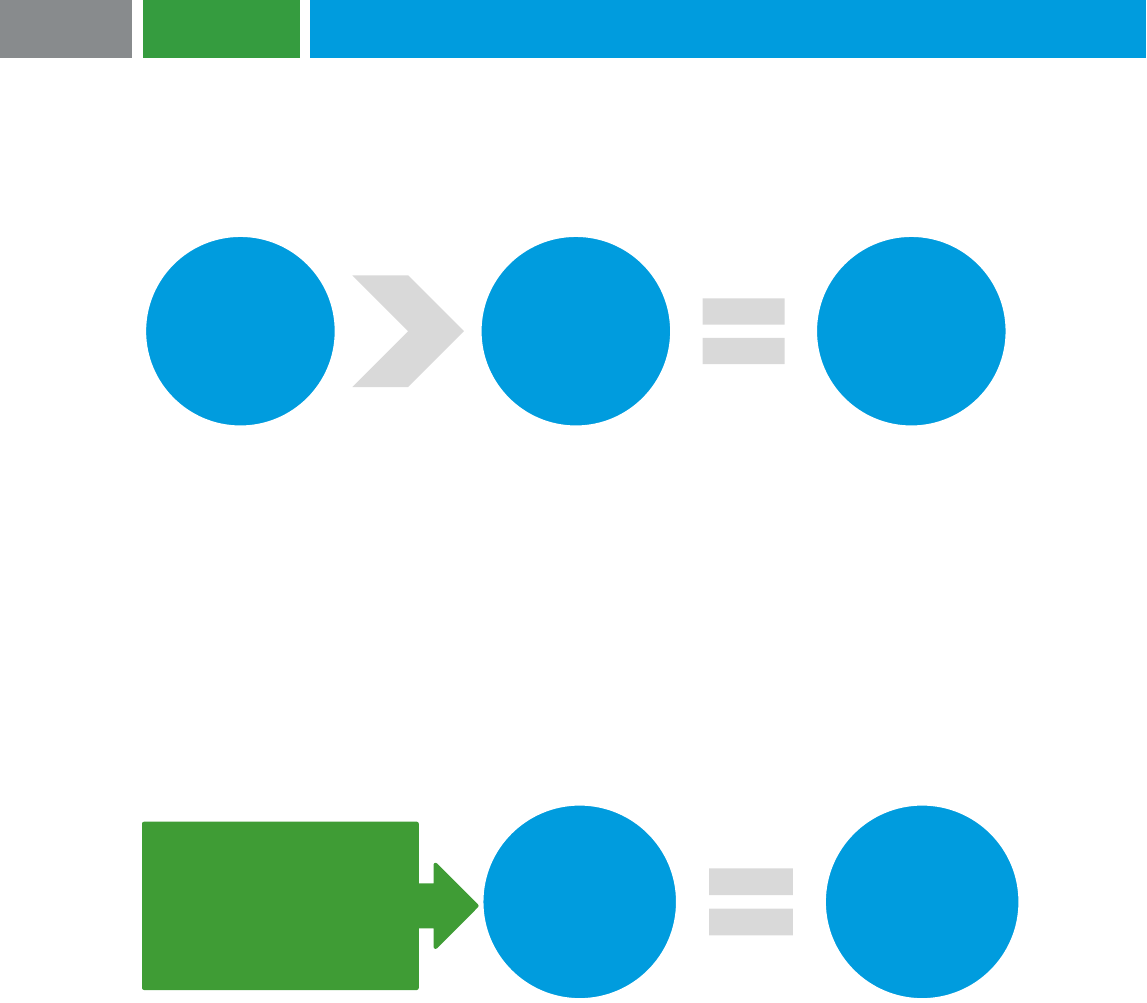

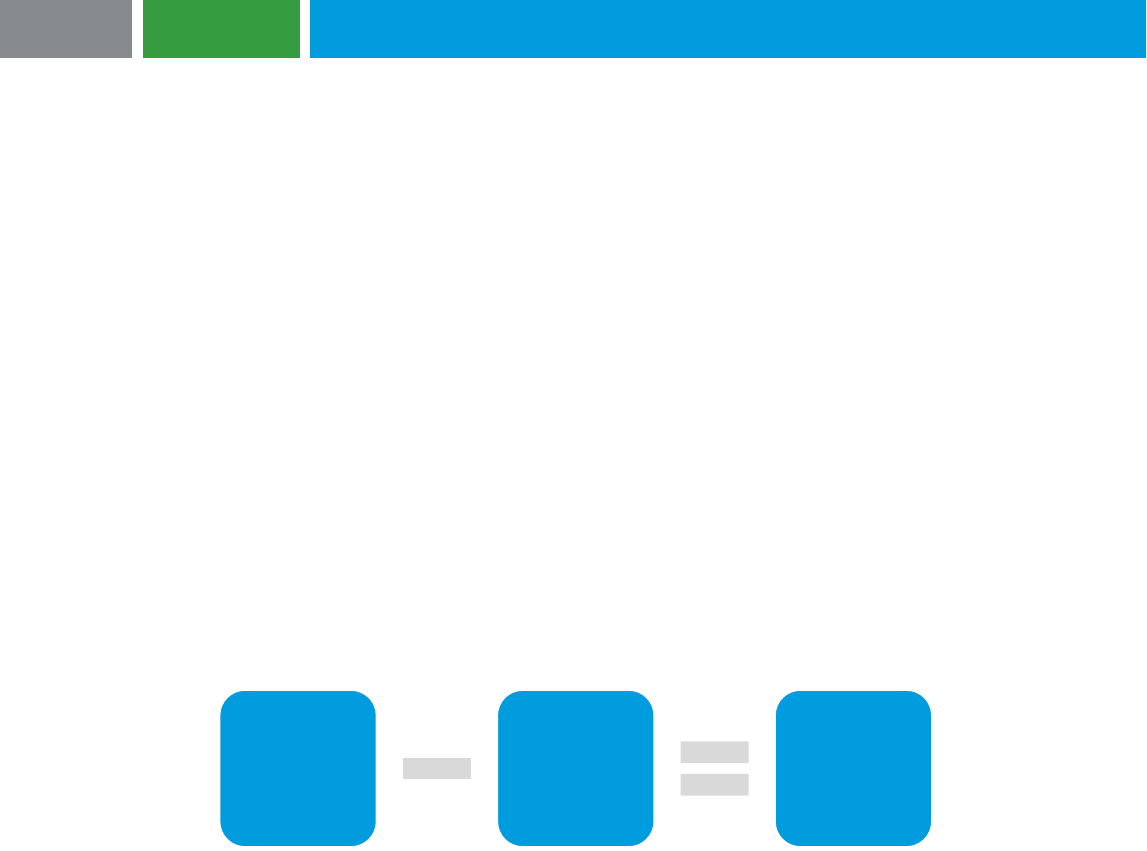

Effective

interest rate

BEFORE

changes are

made to the

debt

Effective

interest rate

AFTER

changes are

made to the

debt

Concession

Present value

of projected

cash flows

required under

the changed

debt

Carrying

amount of debt

before it was

changed

The effective interest rate

after changes are made to

the debt is the discount rate

used in this present value

calculation that results in

these two amounts equaling

each other.

13

JUNE 2023

guarantees and letters of credit. One way in which adding a sweetener would directly affect cash flows is

if the borrower added a new financially-sound guarantor to the debt, and as a result, the lender agreed to

reduce the interest rate charged on the debt. Adding, deleting or changing a sweetener may not always

have a direct effect on cash flows. Nonetheless, the FASB believes that adding, deleting or changing a

sweetener should be taken into consideration when determining whether the lender has granted a

concession. As such, the day-one projected cash flows required under the changed debt for purposes of

determining whether a concession has been granted should include a new sweetener’s fair value or the

change in a revised sweetener’s fair value, along with any future principal and interest payments and any

fees paid or payable by the borrower to the lender. The length of time until a sweetener becomes

exercisable should be taken into consideration in estimating its fair value on the date the restructuring

occurs.

2.2.2.3 Overall indicators of whether a TDR exists for accounting purposes

Relevant guidance: ASC 470-60-15-8, ASC 470-60-15-12, ASC 470-60-55-4 and ASC 470-60-55-9

Overall indicators that a TDR does not exist for accounting purposes include the following:

• Other lenders are willing to loan the borrower funds at market interest rates at or near the interest

rates available for debt that is not troubled.

• The fair value of the assets (including cash) or equity interest either:

a) Accepted by the lender in full satisfaction of its receivable is equal to or more than the

lender’s recorded investment (before the adoption of ASC 326), or amortized cost basis (after

the adoption of ASC 326) in the receivable, or

b) Transferred by the borrower in full satisfaction of its debt is equal to or more than the carrying

amount of the borrower’s debt (see Chapter 6 of our financial assets guide for information

about ASC 326).

• To maintain its relationship with the borrower, the lender agrees to reduce the effective interest

rate on the debt solely because the borrower could go elsewhere to obtain funds at a current

market interest rate that is less than the effective interest rate on the debt (such decrease in the

current market interest rate could be due to the occurrence of a general decrease in market

interest rates or a decrease in the risk being taken on by the lender with respect to the borrower).

• The new marketable debt issued by the borrower in exchange for its old debt has an effective

interest rate that is at or near current market interest rates on comparable debt issued by

nontroubled borrowers.

To the extent any of these indicators exist, we believe it would take a preponderance of evidence to the

contrary to conclude that a TDR does, in fact, exist for accounting purposes.

An overall indicator that a TDR exists for accounting purposes is if other lenders are only willing to loan

the borrower funds at effective interest rates that are so high that the borrower would not be able to make

all the required payments under the debt. To the extent this indicator exists, we believe it would take a

preponderance of evidence to the contrary to conclude that a TDR does not, in fact, exist for accounting

purposes.

2.2.2.4 Factors that should not be considered in TDR determination

Relevant guidance: ASC 470-60-55-6

Factors that should not enter into the determination as to whether a TDR exists for accounting purposes

include:

• How much do the current lenders have invested in the debt before the restructuring?

14

JUNE 2023

• What is the fair value of the debt immediately before and after the changes are made?

• What transactions have occurred among the lenders affected by the changes?

In general, how long the current lenders have held their investment in the debt should also not enter into

the determination as to whether a TDR exists for accounting purposes. However, a TDR could exist for

accounting purposes if the lenders recently came to their current position through what was, in substance,

a planned refinancing.

2.2.3 Series of restructurings on same debt

Relevant guidance: ASC 470-60-55-14

Changes to debt that occur in the same recent time frame should be evaluated on a cumulative basis to

determine whether a TDR occurred. Although GAAP does not define what is considered recent for

purposes of determining whether a TDR has occurred, we generally believe a one-year period should be

considered recent, which is the same period prescribed in GAAP for modifications and exchanges that

are not TDRs (see Section 2.3.2.2).

For purposes of determining whether the lender granted a concession in these situations, the borrower

should solve for the discount rate that makes the present value of the projected cash flows (including

those required as a result the most recently changed debt) equal to the carrying amount of the borrower’s

debt before the first changes were made to the debt in the recent time frame. The borrower should

compare this effective interest rate to the effective interest rate prior to the first changes made to the debt

in the recent timeframe to determine whether the lender granted a concession. Analyzing the changes to

the debt on a cumulative basis prevents the borrower from reaching a different accounting conclusion by

executing the changes in stages.

2.2.4 TDR accounting model

Relevant guidance: ASC 360-10-35, ASC 470-60-35-1 to 35-2, ASC 470-60-35-4 to 35-5 and ASC

470-60-35-8 to 35-9

How a borrower accounts for a TDR depends on whether the borrower: (a) transfers assets in the TDR,

(b) transfers equity in the TDR or, (c) modifies the terms of the debt (e.g., the borrower and lender agree

to modify the cash requirements under the debt on a going-forward basis). The remaining discussion in

this section focuses on the accounting when:

• Full settlement of the debt occurs through the borrower’s transfer of assets (which would include

a repossession or foreclosure by the lender [see commentary later in this section for discussion of

the timing related to the accounting for a TDR and the timing related to recognizing an impairment

(if necessary) on the asset being foreclosed upon]) (see Section 2.2.4.1)

• Full settlement of the debt occurs through the borrower’s transfer of equity (see Section 2.2.4.2)

• Modification of the debt’s terms occurs with no assets or equity transferred in settlement (see

Section 2.2.4.3)

• Partial settlement of the debt occurs through the borrower’s transfer of assets or equity or

modification of terms (see Section 2.2.4.4)

For purposes of this discussion, the carrying amount of the borrower’s debt includes any unamortized

premium, discount, or issuance costs and any accrued interest payable.

Commentary: Foreclosure by the lender may result in full or partial settlement of debt through the

transfer of assets (see Section 2.2.4.1 and Section 2.2.4.4). While the accounting for debt fully or partially

settled through foreclosure does not take place until the foreclosure occurs, the borrower may be required

to recognize an impairment loss on the asset group that includes the asset subject to foreclosure prior to

15

JUNE 2023

the foreclosure occurring. Consider a situation in which an impairment loss should be recognized in 20X1

on an asset group that includes an asset about to be foreclosed upon, but the foreclosure and recognition

of the related gain on restructuring is not expected to occur until 20X2. A question arises in this situation

about whether the portion of the impairment loss allocated to the asset subject to foreclosure may be

deferred until the gain on restructuring is recognized in 20X2. The answer to that question is no. There is

no link between the timing of when an impairment loss allocated to an asset that may be subject to

foreclosure should be recognized and the timing of when a gain on restructuring related to settling debt

through foreclosing on the asset should be recognized.

2.2.4.1 Full settlement of debt through borrower’s transfer of assets

Relevant guidance: ASC 470-50-40-2, ASC 470-60-35-2 to 35-3 and ASC 470-60-35-9

In a TDR in which the borrower agrees to transfer assets, the assets could be accounts receivable from

routine sales made by the borrower, real estate or other assets (including cash). If the debt is fully settled

by the transfer of assets:

• The borrower recognizes a gain on restructuring for the difference between the carrying amount

of the debt and the more clearly evident fair value of the transferred assets or the settled debt.

The gain on restructuring should be included as a separate line item in the income statement and

should be reduced by the amount of any fees paid or payable to the lender.

• The borrower recognizes a gain or loss on the transfer of assets for any difference between the

carrying amount of the transferred assets and the fair value of the transferred assets. Whether

the gain or loss affects operating income depends on the nature of the assets transferred. For

these purposes, the carrying amount of the transferred assets should reflect any related valuation

allowances (e.g., allowance for doubtful accounts before the adoption of ASC 326 or the

allowance for credit losses after the adoption of ASC 326 [see Chapter 6 of our financial assets

guide for information about ASC 326]) and any related unamortized premium, discount or

acquisition costs.

To illustrate the accounting described above, consider a TDR in which accounts receivable are being

transferred to settle outstanding debt. The carrying amount of the debt being settled is $1.2 million on the

date of the restructuring. Information related to the accounts receivable being transferred on the date of

the restructuring is as follows:

• Gross balance is $1 million,

• Related allowance for doubtful accounts (or credit losses) determined as of the date of transfer is

$100,000, and

• Fair value is $850,000.

If the borrower concludes that this scenario represents a TDR, the borrower would record the following

journal entry on the date the assets are transferred to settle the debt:

Note 1: ($1 million gross balance in accounts receivable − $100,000 allowance for doubtful accounts) − $850,000

fair value of accounts receivable

Note 2: $1.2 million carrying amount of the debt − $850,000 fair value of accounts receivable transferred

Debit

Credit

Debt

$1,200,000

Allowance for doubtful accounts (or credit losses)

100,000

Loss on transfer of assets (Note 1)

50,000

Accounts receivable

$1,000,000

Gain on troubled debt restructuring (Note 2)

350,000

16

JUNE 2023

In this example, the gain on restructuring should be included as a separate line item in the income

statement. The loss on transfer of assets should be included in operating income given that the assets

transferred (i.e., accounts receivable) are operating assets.

Determining the fair value of debt

The fair value of a liability is based on its transfer price. It is not appropriate to assume that the price to

transfer the liability is the same as the price to settle the liability or the same as the carrying amount of

the liability. How a borrower estimates the amount at which it would be able to transfer one of its

liabilities may present unique challenges given the lack of market information on transfer prices for

entity-specific liabilities. Oftentimes, there is little market information available because contractual or

other legal restrictions prevent the transfer of such liabilities. Guidance on measuring the fair value of

liabilities is included in ASC 820-10-35.

2.2.4.2. Full settlement of debt through borrower’s transfer of equity

Relevant guidance: ASC 470-60-35-2, ASC 470-60-35-4 and ASC 470-60-35-12

In a TDR in which the borrower agrees to transfer equity to fully settle the debt, the borrower recognizes a

gain for the difference between the carrying amount of the debt and the more clearly evident fair value of

the transferred equity or the settled debt. See Section 2.2.4.1 for information about determining the fair

value of debt. Any fees paid or payable to the lender and any direct costs incurred with third parties

related to the issuance of equity to settle the debt reduce the amount recorded in equity. All other fees

and direct costs incurred unrelated to the issuance of equity either: (a) are included in expense for the

period, if no gain on restructuring is recognized, or (b) reduce the amount of the gain, if a gain on

restructuring is recognized.

Commentary: For purposes of this discussion, equity includes equity-linked instruments that should be

classified as equity, but not equity-linked instruments that should be classified as liabilities. The

classification of equity-linked instruments is discussed in detail in our debt and equity guide. Settling debt

with equity-linked instruments that should be classified as liabilities results in there being continuing debt

with the same lender, the implications of which are discussed in Section 2.1.2 and Section 2.2.1.1.

2.2.4.3 Borrower and lender only change the debt’s terms

Relevant guidance: ASC 470-60-35-5 to 35-7 and ASC 470-60-35-11

In a TDR in which the borrower and lender agree to change the terms of the debt (and not transfer assets

or equity), the accounting depends on whether the total cash outflows required under the restructured

debt are more or less than the carrying amount of the debt prior to the restructuring. In some cases, total

cash outflows required under the restructured debt may fluctuate (e.g., the interest rate varies over time

depending on changes in the prime rate). In these cases, total cash outflows required under the

restructured debt should be based on the interest rate in effect at the time of the restructuring. Additional

discussion about debt with a variable interest rate is provided later in this section.

To the extent the borrower must pay the lender any fees in conjunction with the restructuring, those fees

should be included in the total projected cash outflows because they are essentially equivalent to

additional principal and interest payments. In other words, the lender could decrease (or increase) the

lender fee and retain the same economics by increasing (or decreasing) the principal or interest

payments.

Total cash outflows required for restructured debt > Carrying amount of debt prior to restructuring

If total cash outflows required under the restructured debt are greater than the carrying amount of the

debt prior to the restructuring, then no gain or loss is recognized and there is no adjustment to the

carrying amount of the debt. The fact that no gain or loss is recognized and no adjustment is made to the

17

JUNE 2023

carrying amount of the debt does not affect the conclusion that a TDR has occurred. The change in cash

outflows resulting from the restructuring is accounted for on a prospective basis (i.e., the changes are

recognized in future periods) by calculating a new effective interest rate on the restructured debt and

using it to recognize lower interest expense over the restructured debt’s remaining term.

As mentioned earlier, a lender fee that must be paid by the borrower in conjunction with the restructuring

is included in the total cash outflows required under the restructured debt. Those total cash flows are

used to calculate the effective interest rate on the restructured debt. As a result, a lender fee increases

the effective interest rate, which leads to the fee being recognized over the restructured debt’s remaining

term.

The new effective interest rate used to account for the debt on a going-forward basis is the effective

interest rate calculated on the restructured debt for purposes of determining whether the lender granted a

concession to the borrower (see Section 2.2.2.2).

Example 3.2 illustrates the application of this guidance.

Total cash outflows required for restructured debt < Carrying amount of debt prior to restructuring

If total cash outflows required under the restructured debt are less than the carrying amount of the debt

prior to the restructuring, then a gain is generally recognized and there is an adjustment to the carrying

amount of the debt. However, as explained later in this section, gain recognition may not be appropriate

when contingent payments are included in the terms of the restructured debt. In addition, as discussed in

Section 2.2.4.5, incremental considerations arise with respect to gain recognition when the lender is also

an equity holder in the borrower.

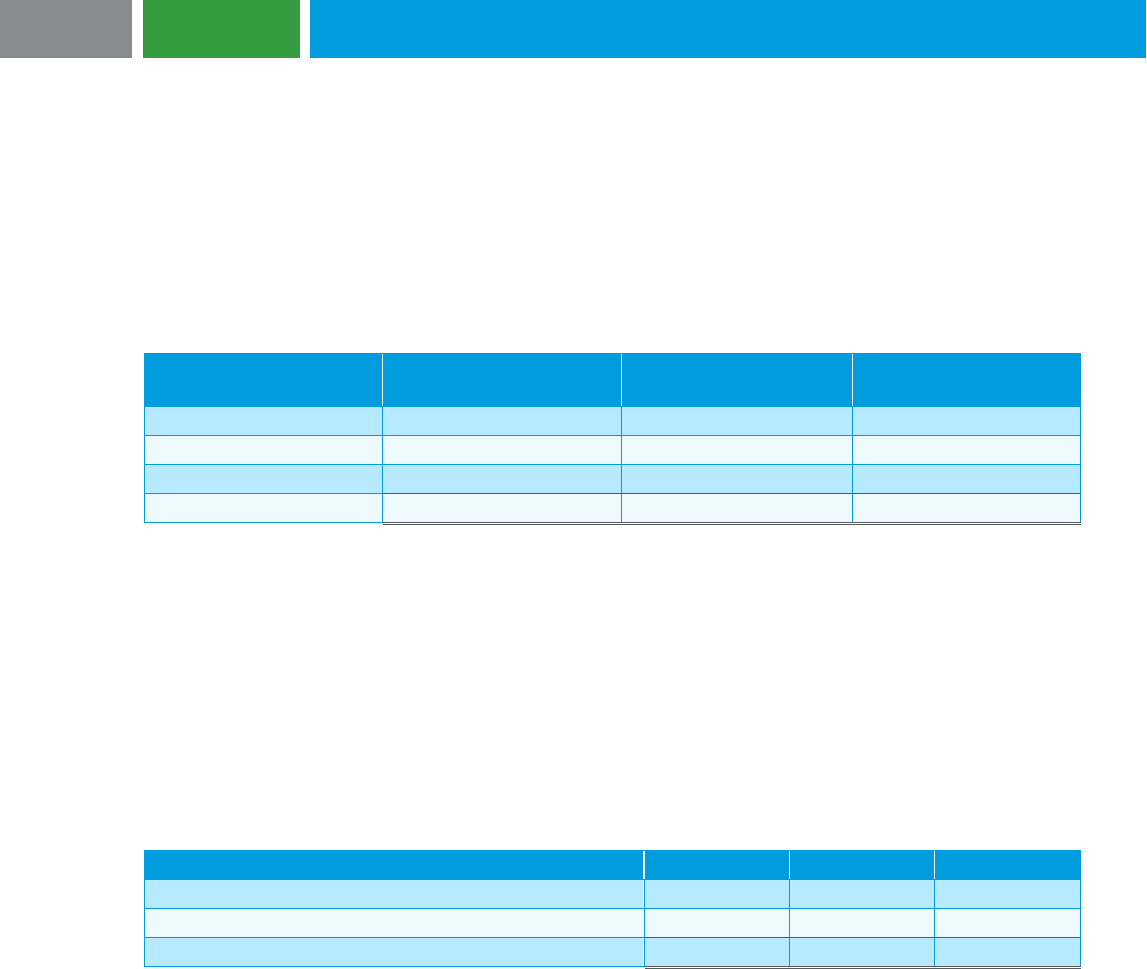

When there are no contingent payments, the amount of the recognized gain and the adjustment to the

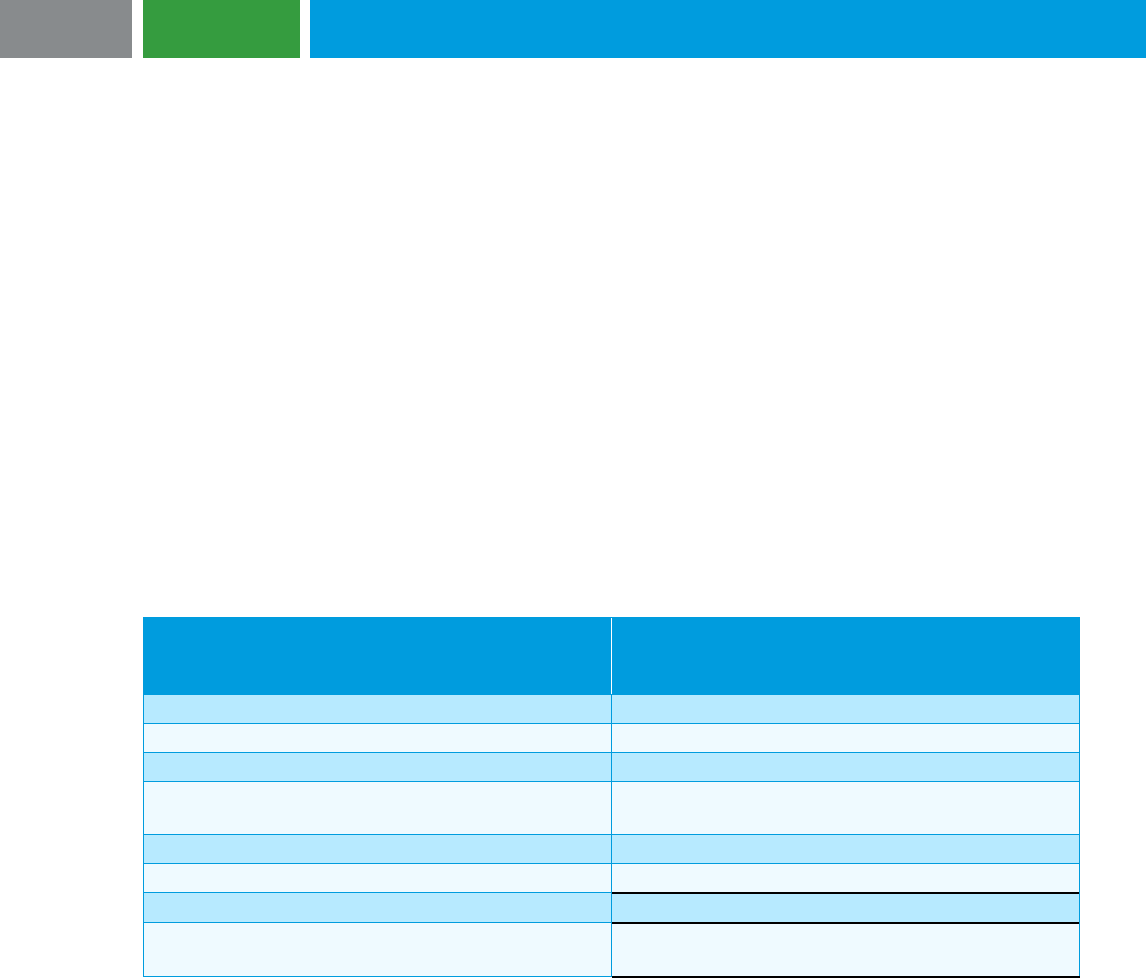

carrying amount of the debt is determined as follows:

More than one account (e.g., debt and the related debt discount or premium) may be affected by the

adjustment to the carrying amount of the debt. These accounts may either be retained or combined after

the restructuring. If they are retained, the adjustment should be allocated among those accounts that

remain after the restructuring using their previous balances for allocation purposes.

Going forward, all cash payments under the terms of the restructured debt must be accounted for as

reductions of the carrying amount of the debt, and no interest expense should be recognized on the debt

for any period between the restructuring and maturity of the debt. The only exception is to recognize

interest expense according to ASC 470-60-35-10.

Example 3.3 illustrates the application of this guidance.

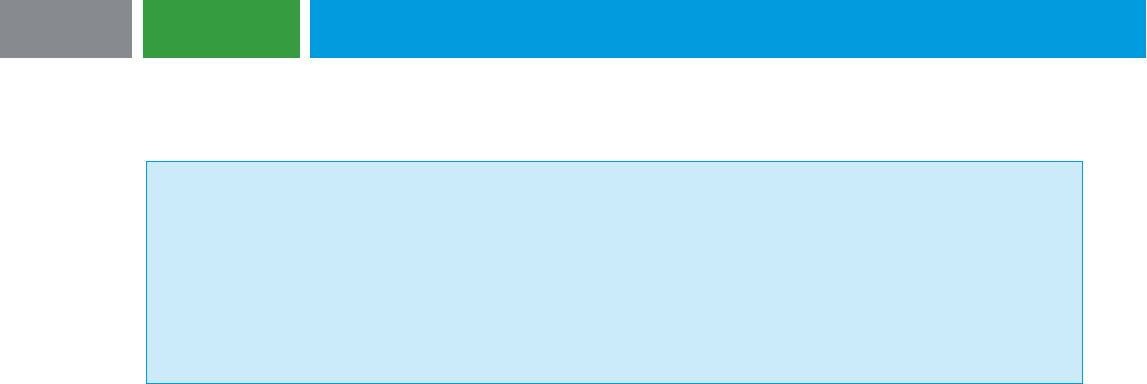

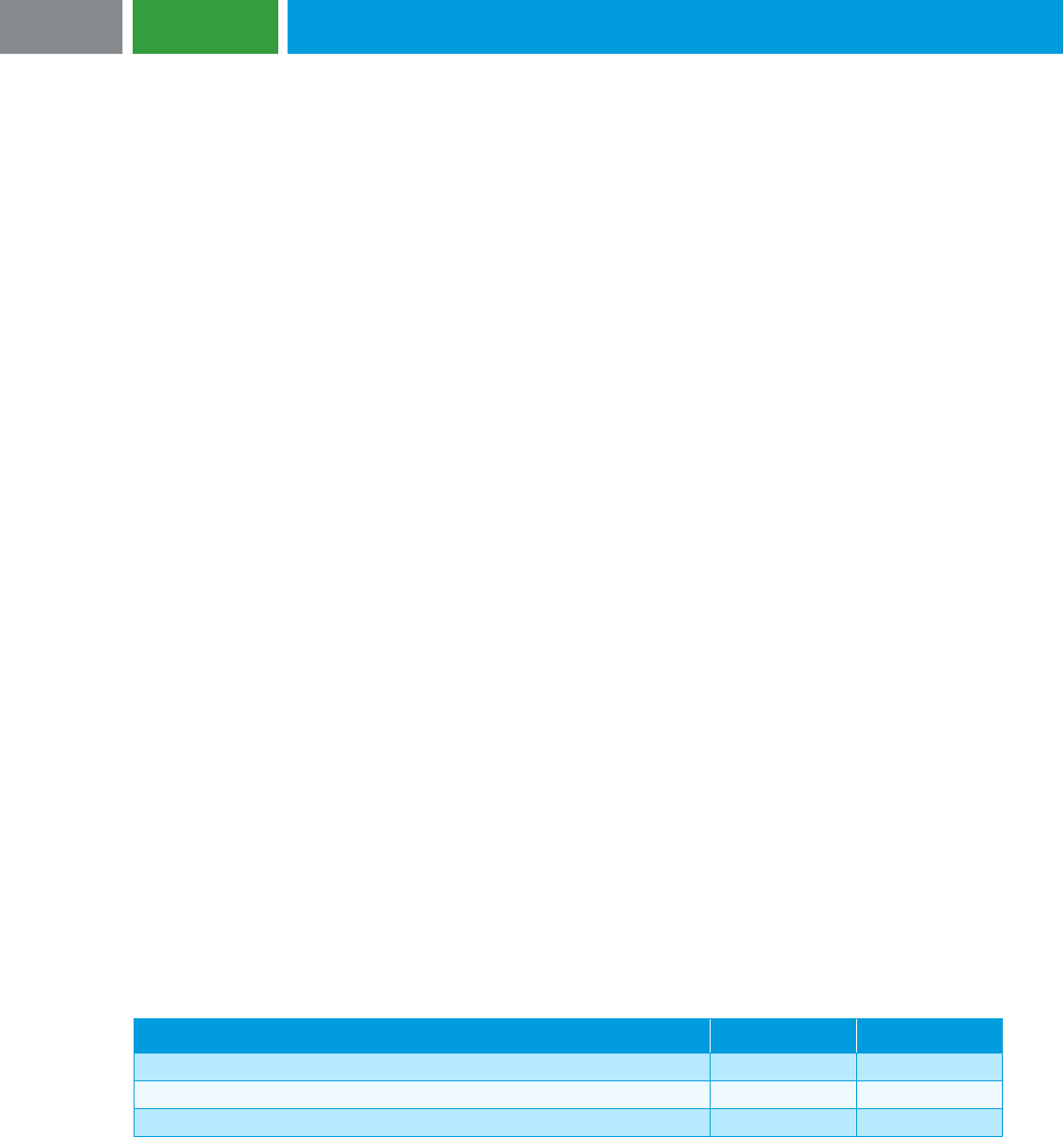

Contingent payments

Contingent payments, or what are essentially contingent payments, may be included in the terms of the

restructured debt. Examples of such contingent payments include: (a) amounts the borrower is required

to pay if its financial condition improves (based on a specified, measurable metric) by a specific date and

Carrying

amount of debt

prior to

restructuring

Total cash

outflows

required under

terms of

restructured

debt

Amount of

recognized

gain and

adjustment to

carrying

amount of debt

18

JUNE 2023

(b) indeterminate interest payments the borrower has to make because the restructured debt is due on

demand.

When contingent payments are included in the terms of the restructured debt and the total projected

noncontingent cash outflows required under the restructured debt are less than the carrying amount of

the debt prior to the restructuring, the borrower should not recognize a gain on the restructuring if the

maximum total future cash payments (total projected noncontingent cash outflows plus all contingent

amounts that could become payable) is greater than the carrying amount of the debt prior to the

restructuring. If a gain is not recognized as a result of this guidance, a new effective interest rate must be

calculated for purposes of recognizing interest expense in future periods. In some cases, this new

effective interest rate may be at or near zero. When determining the new effective interest rate, only those

contingent payments necessary to prevent gain recognition are included in the calculation. For example,

assume in a TDR that: (a) the carrying amount of the debt prior to the restructuring is $1 million, (b) the

total projected noncontingent cash outflows required under the restructured debt are $900,000 and (c) the

maximum contingent payments that could be made under the restructured debt are $200,000 (two

payments of $100,000 each). In this example, only $100,000 of the maximum contingent payments is

included in calculating the new effective interest rate because that is the amount that would prevent gain

recognition.

The probable and reasonably estimable thresholds applied to the recognition of other contingent liabilities

should be applied to determine if and when a liability should be recognized for the contingent payments

included in the terms of the restructured debt. If a liability should be recognized, or when the contingent

payments are actually made, consideration must be given to whether those amounts should serve to

reduce the carrying amount of the restructured debt. This would be the case if those amounts were

included in the total projected cash payments under the restructured debt for purposes of preventing the

recognition of a gain at the time of the restructuring.

Variable interest rate

When total cash outflows required under the restructured debt may fluctuate because the interest rate

varies over time (e.g., based on changes in the prime rate), the total maximum cash outflows required

under the restructured debt should be based on the interest rate in effect at the time of the restructuring. If

these cash outflows are less than the carrying amount of the debt prior to the restructuring, a gain is

recognized for the difference, provided there are no contingent payments (other than those related to the

debt’s variable interest rate) that could be required in the future that would reduce the gain.

After the TDR, a debtor should not recognize a gain on the restructured debt that involves indeterminate

future cash payments as long as the maximum cash payments may equal or exceed the carrying amount

of the debt. Fluctuations in the debt’s effective interest rate after the restructuring due to changes in the

underlying benchmark or index (e.g., the prime rate) or other causes are accounted for as changes in

estimates in the periods in which the changes occur. However, the accounting for those fluctuations

should not result in recognizing a gain on restructuring that may be offset by future cash payments.

Rather, the carrying amount of the restructured debt should remain unchanged, and future cash

payments should reduce the carrying amount until the time that any gain recognized cannot be offset by

future cash payments. Based on this guidance, if the debt’s variable interest rate after the TDR increases

to a rate above the rate on the date that the TDR occurred (the TDR variable interest rate), the

incremental interest expense is recognized in the period the increase occurs. Conversely, if the debt’s

variable interest rate decreases below the TDR variable interest rate, all interest accrued offsets the

carrying amount of the debt, and any additional gain is not recognized until the debt is settled.

Commentary: As discussed in the preceding paragraph, when there is a decrease in the debt’s variable

interest rate after a TDR, a gain is not recognized until settlement of the debt, in case there is a

subsequent increase in the variable interest rate that offsets the effects of the previous decrease. If there

19

JUNE 2023

is such a subsequent increase, we believe the borrower should continue to defer the recognition of any

gain until settlement of the debt and elect one of the following two accounting policies:

(a) Recognize interest expense when the variable interest rate increases above the TDR variable

interest rate where such interest expense would be based on the excess of the increased variable

interest rate over the TDR variable interest rate, or

(b) Recognize the effects of the increase in the variable interest rate as a reduction in the carrying

amount of the debt until the effects of the previous decrease in the variable interest rate has been

offset, at which point the incremental interest is recognized as an expense.

The accounting policy elected by the borrower should be disclosed and consistently applied in similar

facts and circumstances.

To illustrate the accounting discussed above, consider a situation in which the borrower and lender

changed a loan with a carrying amount of $133,000, and it was determined that these changes met the

definition of a TDR. Pertinent information related to the loan after the restructuring included the following:

• Interest is paid annually at a variable interest rate (which is reset at the beginning of each year),

with the first interest payment being due one year after the restructuring.

• Principal amount is $100,000.

• Remaining term is four years.

• Variable interest rate on the date of the restructuring is 7%

• Estimated interest related cash flows are $28,000 ($100,000 principal x 7% variable interest rate

on the date of the TDR x 4-year remaining term)

Borrower recognized a gain on restructuring of $5,000, calculated based on the excess of the carrying

amount of the debt immediately before the restructuring ($133,000) over the total projected cash outflows

required under the terms of the restructured debt ($128,000), which represents the principal amount

repayable of $100,000 plus $28,000 of total estimated interest payments over the term of the restructured

debt.

20

JUNE 2023

Subsequent to the restructuring:

The variable rate of interest remained at 7% throughout Year 1; however, at the beginning of Year 2, the

debt’s variable interest rate changed to 6% and remained at that rate throughout the year. The following

journal entries were recorded in Year 1 and 2 related to the debt:

Debit

Credit

Interest accrued during Year 1 (Note 1)

Debt (Note 1)

$7,000

Accrued interest

$7,000

Interest paid at the end of Year 1 (Note 1)

Accrued interest

$7,000

Cash

$7,000

Interest accrued during Year 2 (Note 2)

Debt (Notes 1 and 2)

$6,000

Accrued interest

$6,000

Interest paid at the end of Year 2 (Note 2)

Accrued interest

$6,000

Cash

$6,000

Note 1: Entry to recognize interest accrued during Year 1 and then paid at the end of Year 1 is based on a

variable rate of interest of 7%. The offsetting entry to accrued interest is debt, rather than interest

expense, because upon the debt’s restructuring, the carrying amount of the loan was adjusted to equal

the total estimated cash outflows for both the remaining principal and interest payable over the term of the

restructured loan.

Note 2: Entry to recognize interest accrued during Year 2 and then paid at the end of Year 2 is based on a

variable rate of interest of 6%. The offsetting entry to accrued interest is debt, rather than interest

expense, because upon the debt’s restructuring, the carrying amount of the loan was adjusted to equal

the total estimated cash outflows for both the remaining principal and interest payable over the term of the

restructured loan. In accordance with ASC 470-60-35-7, no gain is recognized for the decrease in the

variable interest rate (from 7% to 6%) because the variable interest rate could subsequently increase in

Years 3 or 4 and offset the effects of the decrease in Year 2.

At the beginning of Years 3 and 4 and throughout these years, the debt’s variable interest rate is 9% and

7%, respectively. The borrower’s accounting for the interest due during Years 3 and 4 depends on

whether it elects accounting policy (a) or (b) discussed earlier.

Under accounting policy (a):

• In Year 3, the borrower reduces the carrying amount of the debt by the original estimated annual

interest payment of $7,000 and records interest expense of $2,000 for the excess of the variable

interest payment based on a 9% interest rate over the original estimated annual interest

payment.

• In Year 4, the borrower pays $7,000 of interest and $100,000 of principal and reduces the

carrying amount of the debt to zero and recognizes a $1,000 gain on restructuring.

21

JUNE 2023

Under accounting policy (b):

• In Year 3, the borrower reduces the carrying amount of the debt by the original estimated annual

interest payment of $7,000 plus the shortfall of $1,000 between the interest payment made in the

prior year ($6,000) and the original estimated interest payment for that year ($7,000). Borrower

also records interest expense of $1,000 for the difference between actual interest payment for the

year ($9,000) and the amount for which debt was reduced as noted above ($8,000).

• In Year 4, the borrower pays $7,000 of interest and $100,000 of principal and reduces the

carrying amount of the debt to zero with no gain or loss recorded as the interest paid in year 4

was based on a 7% variable interest rate, which is consistent with the original variable interest

rate.

The following summarizes the journal entries that would be recorded in Years 3 and 4 depending on the

accounting policy elected by the borrower: