Financial reporting developments

A comprehensive guide

Segment

reporting

Accounting Standards Codification 280

April 2023

To our clients and other friends

Segment reporting continues to be an important element of financial reporting for public companies. A

fundamental principle of Accounting Standards Codification (ASC or Codification) 280, Segment Reporting,

is that a company’s segment disclosures should be consistent with management’s reporting structure.

The objective is to allow users to “see through the eyes of management” a company’s business. By

highlighting the risks and opportunities that management views as important, the Financial Accounting

Standards Board (FASB or Board) believes that financial statement users will be better positioned to

understand the public entity’s performance, to assess its prospects for future net cash flows and to make

more informed judgments about the entity as a whole.

While the requirements of ASC 280 have been effective for many years, segment disclosures continue

to be a frequent area of emphasis in Securities and Exchange Commission (SEC) staff comment letters.

In these reviews, the SEC staff continues to focus on how companies identify and aggregate operating

segments and whether companies have inappropriately included non-GAAP measures in their segment

disclosures. Companies also are frequently asked about the adequacy of their entity-wide disclosures

with respect to products and services, revenues attributable to individual foreign countries and revenues

from major customers.

We encourage public companies to continue to evaluate their segment reporting practices, especially in

situations in which an entity has undertaken a reorganization or when there are inconsistencies between

an entity’s management reporting structure and its segment disclosures. EY professionals are prepared

to help you identify and understand the issues related to segment reporting.

April 2023

Financial reporting developments Segment reporting | i

Contents

1 Scope and overview ................................................................................................... 1

1.1 Competitive harm .................................................................................................................. 3

1.2 Operating segments ............................................................................................................... 3

1.3 Aggregation criteria ............................................................................................................... 4

1.4 Reportable segments ............................................................................................................. 5

1.5 Annual disclosure requirements .............................................................................................. 5

1.5.1 First-level disclosures .................................................................................................... 7

1.5.1.1 Segment profit or loss and related information .............................................. 7

1.5.1.2 Segment assets .......................................................................................... 7

1.5.1.3 Reconciliations ........................................................................................... 8

1.5.2 Entity-wide disclosures .................................................................................................. 8

1.5.2.1 Information about major customers .............................................................. 8

1.6 Interim disclosure requirements ............................................................................................. 8

1.7 SEC considerations ................................................................................................................ 9

1.8 Transition for initial adoption of ASC 280 .............................................................................. 10

2 Operating segments ................................................................................................. 11

2.1 Determination of operating segments ................................................................................... 11

2.1.1 Engages in business activities ...................................................................................... 12

2.1.2 Operating results are regularly reviewed by the CODM to allocate resources

and assess performance .............................................................................................. 13

2.1.3 Discrete financial information is available ..................................................................... 16

2.1.4 CODM uses multiple types of segment information ........................................................ 16

2.2 Discontinued operations ....................................................................................................... 18

2.3 Unconsolidated businesses ................................................................................................... 19

2.3.1 Inclusion of separate financial statements of other entities ............................................ 20

2.4 Reportable segments of public subsidiaries ........................................................................... 20

2.5 Goodwill considerations ........................................................................................................ 21

3 Reportable segments ............................................................................................... 22

3.1 Aggregation criteria ............................................................................................................. 23

3.1.1 Consistent with the objective and basic principles of ASC 280 ....................................... 25

3.1.2 Economic characteristics ............................................................................................. 25

3.1.3 Qualitative characteristics ........................................................................................... 27

3.2 Determining amounts included in segment measures for the quantitative threshold tests ........ 29

3.2.1 Operating segment accounting principles ..................................................................... 30

3.2.2 Allocations to operating segments ............................................................................... 30

3.2.3 CODM uses more than one measure of segment profit/loss or segment assets ............... 31

3.2.4 CODM uses different measures for different segments .................................................. 31

3.2.5 Changes in segment measurements (updated April 2023) ............................................. 32

Contents

Financial reporting developments Segment reporting | ii

3.3 Quantitative thresholds ........................................................................................................ 33

3.3.1 Revenues ................................................................................................................... 33

3.3.2 Profit or loss ............................................................................................................... 34

3.3.2.1 Use of a consistent measure of profit or loss ............................................... 35

3.3.2.2 Aggregation may change reportable segments ............................................ 36

3.3.3 Assets ........................................................................................................................ 37

3.4 Combination of operating segments that do not meet quantitative thresholds ......................... 37

3.5 Meeting the 75% of consolidated revenue test ....................................................................... 38

3.6 Determining whether an equity method investment is a reportable segment ........................... 39

3.7 The ‘all other’ category ........................................................................................................ 40

3.8 Change in the quantitative thresholds from year to year ........................................................ 40

3.9 Number of reportable segments ........................................................................................... 41

4 Segment disclosure requirements ............................................................................. 42

4.1 Disclosure of segment profit or loss and segment assets ........................................................ 43

4.1.1 What is required to be disclosed ................................................................................... 45

4.1.2 What is not required to be disclosed ............................................................................. 46

4.1.3 Non-GAAP measures ................................................................................................... 46

4.1.4 CODM uses more than one measure of segment profit/loss or segment assets ............... 47

4.1.5 Materiality .................................................................................................................. 49

4.1.6 Interest ...................................................................................................................... 50

4.1.7 Segment assets .......................................................................................................... 50

4.2 Explanation of measurements .............................................................................................. 51

4.3 Reconciliations .................................................................................................................... 52

4.4 Disclosures and reconciliations related to equity method investments..................................... 54

4.5 Interim period information.................................................................................................... 55

4.6 Changes in reportable segments ........................................................................................... 56

4.6.1 Interim restatement .................................................................................................... 58

4.6.2 Timing of a change in segment reporting ...................................................................... 58

4.6.3 SEC reporting considerations (added April 2023) .......................................................... 58

4.6.3.1 New registration statements and proxy statements...................................... 58

4.6.3.2 Effective shelf registration statements ....................................................... 59

4.6.4 Non-SEC offerings (added April 2023) .......................................................................... 59

4.7 Interaction with other ASC Topics ......................................................................................... 59

4.7.1 Goodwill ..................................................................................................................... 59

4.7.2 Business combinations ................................................................................................ 61

4.7.3 Exit or disposal activities.............................................................................................. 61

4.7.4 Discontinued operations .............................................................................................. 62

4.7.5 Revenue recognition (updated April 2022) ................................................................... 62

4.7.6 Impairment of intangible assets ................................................................................... 63

4.7.7 Impairment or disposal of long-lived assets ................................................................... 63

5 Entity-wide disclosures ............................................................................................ 65

5.1 Information about products and services ............................................................................... 66

5.2 Information about geographic areas ..................................................................................... 67

5.2.1 Meaning of ‘material’ ................................................................................................... 68

5.2.2 Revenues from external customers .............................................................................. 68

5.2.3 Long-lived assets ........................................................................................................ 68

Contents

Financial reporting developments Segment reporting | iii

5.3 Information about major customers ...................................................................................... 69

5.4 Restatement of entity-wide disclosures ................................................................................. 70

5.5 SEC disclosure rules ............................................................................................................. 70

6 Industry supplements ............................................................................................... 71

6.1 Introduction ........................................................................................................................ 71

6.2 Banking and capital markets ................................................................................................. 71

6.2.1 Operating segments .................................................................................................... 71

6.2.2 Reportable segments .................................................................................................. 72

6.2.3 Entity-wide disclosures ................................................................................................ 72

6.3 Insurance (updated April 2022) ............................................................................................ 73

6.3.1 Operating segments .................................................................................................... 73

6.3.2 Aggregation criteria .................................................................................................... 73

6.3.3 Measurements used in segment disclosures.................................................................. 75

6.3.4 Scope ......................................................................................................................... 75

6.4 Retail (updated April 2022) .................................................................................................. 75

6.4.1 General considerations ................................................................................................ 75

6.4.2 Aggregation considerations ......................................................................................... 76

6.4.3 Geographic segments in the same country ................................................................... 77

6.4.4 Real estate operations ................................................................................................. 77

6.5 Real estate .......................................................................................................................... 77

6.6 Health ................................................................................................................................. 78

6.6.1 Scope ......................................................................................................................... 78

6.6.2 Determining operating segments ................................................................................. 78

6.6.3 Segment disclosures ................................................................................................... 78

6.6.4 Entity-wide disclosures ................................................................................................ 79

6.7 Oil and gas........................................................................................................................... 79

6.8 Telecommunications (updated April 2022) ............................................................................ 80

6.9 Casinos ............................................................................................................................... 80

7 Comprehensive example ........................................................................................... 81

A Diagram to determine segments .............................................................................. A-1

B Abbreviations used in this publication ...................................................................... B-1

C Index of ASC references in this publication ............................................................... C-1

D Summary of important changes ............................................................................... D-1

Contents

Financial reporting developments Segment reporting | iv

Notice to readers:

This publication includes excerpts from and references to the Financial Accounting Standards Board

(FASB or the Board) Accounting Standards Codification (the Codification or ASC). The Codification

uses a hierarchy that includes Topics, Subtopics, Sections and Paragraphs. Each Topic includes an

Overall Subtopic that generally includes pervasive guidance for the Topic and additional Subtopics, as

needed, with incremental or unique guidance. Each Subtopic includes Sections that in turn include

numbered Paragraphs. Thus, a Codification reference includes the Topic (XXX), Subtopic (YY),

Section (ZZ) and Paragraph (PP).

Throughout this publication references to guidance in the Codification are shown using these reference

numbers. References are also made to certain pre-Codification standards (and specific sections or

paragraphs of pre-Codification standards) in situations in which the content being discussed is excluded

from the Codification.

This publication has been carefully prepared, but it necessarily contains information in summary form

and is therefore intended for general guidance only; it is not intended to be a substitute for detailed

research or the exercise of professional judgment. The information presented in this publication should

not be construed as legal, tax, accounting, or any other professional advice or service. Ernst & Young

LLP can accept no responsibility for loss occasioned to any person acting or refraining from action as a

result of any material in this publication. You should consult with Ernst & Young LLP or other

professional advisors familiar with your particular factual situation for advice concerning specific audit,

tax or other matters before making any decisions.

Portions of FASB publications reprinted with permission. Copyright Financial Accounting Standards Board, 801 Main Avenue,

P.O. Box 5116, Norwalk, CT 06856-5116, USA. Portions of AICPA Statements of Position, Technical Practice Aids and other AICPA

publications reprinted with permission. Copyright American Institute of Certified Public Accountants, 1345 Avenue of the Americas,

27

th

Floor, New York, NY 10105, USA. Copies of complete documents are available from the FASB and the AICPA.

Financial reporting developments Segment reporting | 1

1 Scope and overview

Excerpt from Accounting Standards Codification

Segment Reporting — Overall

Scope and Scope Exceptions

280-10-15-2

The guidance in the Segment Reporting Topic applies to all public entities, with certain exceptions

noted below. Entities other than public entities are also encouraged to provide the disclosures described

in this Subtopic.

280-10-15-3

The guidance in this Subtopic does not apply to the following entities:

a. Parent entities, subsidiaries, joint ventures, or investees accounted for by the equity method if

those entities’ separate company statements also are consolidated or combined in a complete set

of financial statements and both the separate company statements and the consolidated or

combined statements are included in the same financial report. However, this Subtopic does apply

to those entities if they are public entities and their financial statements are issued separately.

b. Not-for-profit entities (regardless of whether the entity meets the definition of a public entity as

defined above).

c. Nonpublic entities.

Glossary

280-10-20

Public Entity

A business entity or a not-for-profit entity that meets any of the following conditions:

a. It has issued debt or equity securities or is a conduit bond obligor for conduit debt securities that

are traded in a public market (a domestic or foreign stock exchange or an over-the-counter

market, including local or regional markets).

b. It is required to file financial statements with the Securities and Exchange Commission (SEC).

c. It provides financial statements for the purpose of issuing any class of securities in a public market.

Conduit Debt Securities

Certain limited-obligation revenue bonds, certificates of participation, or similar debt instruments issued

by a state or local governmental entity for the express purpose of providing financing for a specific third

party (the conduit bond obligor) that is not a part of the state or local government's financial reporting

entity. Although conduit debt securities bear the name of the governmental entity that issues them, the

governmental entity often has no obligation for such debt beyond the resources provided by a lease or

loan agreement with the third party on whose behalf the securities are issued. Further, the conduit

bond obligor is responsible for any future financial reporting requirements.

The segment reporting requirements apply only to public entities, as defined above, which includes

companies making filings with a regulatory agency in preparation for the sale of securities in a public

market (e.g., an initial public offering). Although they are not required to apply ASC 280, certain

nonpublic entities and not-for-profit entities are encouraged to provide the disclosures described therein.

1 Scope and overview

Financial reporting developments Segment reporting | 2

In addition to the consolidated financial statements, some entities present in their annual reports

additional information such as “separate company” financial statements of the parent entity, subsidiaries,

joint ventures or equity method investees. ASC 280 does not apply to those entities’ separate company

financial statements. However, if the subsidiaries are public entities themselves (as defined in ASC 280),

ASC 280 still applies to the separate financial statements of the public subsidiaries. See section 2.3 for

further discussion of unconsolidated businesses.

Excerpt from Accounting Standards Codification

Segment Reporting — Overall

Objectives

General

280-10-10-1

The objective of requiring disclosures about segments of a public entity and related information is to

provide information about the different types of business activities in which a public entity engages

and the different economic environments in which it operates to help users of financial statements do

all of the following:

a. Better understand the public entity’s performance

b. Better assess its prospects for future net cash flows

c. Make more informed judgments about the public entity as a whole.

Overview and Background

General

280-10-05-3

A public entity could provide complete sets of financial statements that are disaggregated in several

different ways, for example, by products and services, by geography, by legal entity, or by type of

customer. However, it is not feasible to provide all of that information in every set of financial

statements. The guidance in this Subtopic requires that general-purpose financial statements include

selected information reported on a single basis of segmentation. The method for determining what

information to report is referred to as the management approach. The management approach is based

on the way that management organizes the segments within the public entity for making operating

decisions and assessing performance. Consequently, the segments are evident from the structure of

the public entity’s internal organization, and financial statement preparers should be able to provide

the required information in a cost-effective and timely manner.

ASC 280 requires public entities to disclose certain information about reportable operating segments

in complete sets of financial statements of the entity and in condensed financial statements of interim

periods. It also requires public entities to present certain “entity-wide” information, including revenues

related to products and services and geographic areas in which they operate. Information about major

customers also is required.

A public entity also is required to present disaggregated information by segment using the management

approach. The objective of this approach is to allow users to see the company’s business through the

eyes of management based upon the way management reviews performance and makes decisions.

The management approach requires segment information to be reported based on how management

internally evaluates the operating performance of the company’s business units or segments (i.e., its

management reporting structure).

1 Scope and overview

Financial reporting developments Segment reporting | 3

The FASB believes users consider the management approach to be preferable for many reasons,

including the following:

1) The management approach is based on an entity’s internal organization, which is valuable because it

highlights the risks and opportunities that management believes are important and allows users to

assess the performance of individual operating segments in the same way that management reviews

performance and makes decisions.

2) The management approach provides users with the opportunity to see the entity from management’s

vantage point and enhances users’ ability to predict actions or reactions of management that can

significantly affect the entity’s prospects for future cash flows.

3) Because the information is already generated for management’s use, the incremental cost of

reporting segment information should be relatively low. Other than some of the entity-wide

disclosures (see chapter 5 for a discussion of these disclosure requirements), management should

not need to prepare any new reports to comply with the segment disclosure requirements.

4) Segment reporting under the management approach is consistent with other significant sections of an

entity’s annual report, such as the business review section and the chairman’s letter. These sections of

the annual report usually describe the company’s businesses the way that management views and runs

these businesses, which is how segment information is presented under the management approach.

1.1 Competitive harm

Certain entities have expressed concern that making disclosures under the management approach may put

them at a competitive disadvantage. Some entities believe that disclosing this information could affect their

bargaining position in negotiations. Others believe that because some competitors may not have to make the

same disclosures, the competitors will have a strategic advantage. Competitors may not have similar disclosures

because their organizations are managed differently, resulting in different reportable segments, or because

they are nonpublic or foreign and reporting under a framework that doesn’t require similar segment reporting.

ASC 280 does not provide a “competitive harm” exemption for providing segment information because the

FASB was concerned that such an exemption might be overused.

1

The SEC staff has stated that some

registrants have contended that they should not be required to apply a US GAAP standard because the

result would be “competitively harmful” or “misleading.” The staff stated that these arguments are

troubling as they disregard the thoughtful balance taken by the accounting standard setters in crafting

reporting standards that provide transparent, useful information to investors.

2

As such these concerns

do not provide a rationale to not provide the disclosures required by ASC 280.

1.2 Operating segments

Excerpt from Accounting Standards Codification

Segment Reporting — Overall

Overview and Background

General

280-10-05-4

The management approach facilitates consistent descriptions of a public entity in its annual report and

various other published information. It focuses on financial information that a public entity’s decision

makers use to make decisions about the public entity’s operating matters. The components that

management establishes for that purpose are called operating segments.

1

See paragraph 111 of Statement 131.

2

Remarks by Wesley R. Bricker, SEC Deputy Chief Accountant, Office of the Chief Accountant, at the 2015 AICPA National

Conference on Current SEC and PCAOB Developments, 9 December 2015.

1 Scope and overview

Financial reporting developments Segment reporting | 4

While the concept of operating segments is fundamental to segment reporting, the identification of operating

segments often is one of the biggest challenges in applying ASC 280. To properly determine the operating

segments, the first step is to identify the entity’s chief operating decision maker (CODM). The term CODM

identifies the decision-making role within an organization and not necessarily an individual with a specific title.

Often the CODM of an entity is its chief executive officer (CEO) or chief operating officer, but it may be a group of

executives. The CODM is the individual or individuals within the organization who evaluate an entity’s operating

results to assess performance and allocate resources. The focus on “operating results” (e.g., revenues,

margin) is consistent with the concept in ASC 280-10-05-4 regarding making decisions about the entity’s

operating matters. Consideration should be given to the measures used by the CODM to allocate resources.

Once the CODM is identified, an entity will be able to determine its operating segments. ASC 280 defines an

operating segment as a component of a business entity that has each of the three following characteristics:

1) The component engages in business activities from which it may recognize revenues and incur

expenses (including startup operations and revenues and expenses relating to transactions with

other components of the same entity).

2) The operating results of the component are regularly reviewed by the entity’s CODM to assess the

performance of the individual component and make decisions about resources to be allocated to

the component.

3) Discrete financial information about the component is available.

For many entities, application of these three characteristics clearly will identify their operating segments.

If the CODM assesses performance and makes resource allocation decisions based on only one type of

segment information (e.g., products or services, geographic), the components reflected by that type of

information constitute the operating segments of the entity. However, in some cases, the CODM may

assess performance based on more than one type of operating result. For example, the CODM may

review one type of result based on product lines and another type based on geographic area. In those

situations, segment information is required to be presented for the type for which there are segment

managers that are held accountable. If both types of segments have managers that are held accountable to

the CODM, the types of segments based on products or services would be disclosed.

1.3 Aggregation criteria

ASC 280 permits operating segments to be aggregated for reporting purposes even though they may be

individually material, if (1) aggregation is consistent with the objective and basic principles of ASC 280,

(2) the operating segments have similar economic characteristics (e.g., comparable long-term average

gross margin) and (3) the operating segments are similar in each (i.e., all) of the following areas:

• The nature of the products or services

• The nature of the production processes

• The type or class of customer for their products or services

• The methods used to distribute their products or provide their services

• If applicable, the nature of the regulatory environment (e.g., banking, insurance)

Illustration 1-1: Aggregation

Assume a retailer has eight stores, each of which meets the definition of an operating segment and

each of which is similar in each of the five areas listed above. If each store also has similar economic

characteristics and aggregation would be consistent with the objective and basic principles of ASC 280,

the stores can be aggregated into one reportable segment. However, if there were differences between

the stores, such as demographics (which generally would affect the economic characteristics of the

markets), aggregation might not be allowed even if all of the other criteria were met.

1 Scope and overview

Financial reporting developments Segment reporting | 5

In our experience, we have noted that the SEC staff questions whether aggregation of operating segments

into one or just a few reportable segments is consistent with the objective and basic principles of

ASC 280. In evaluating the aggregation of operating segments, the SEC staff presumes that investors

would prefer receiving disaggregated information about the operating segments. In addition, the SEC staff

often requires registrants to provide historical and forecasted economic measures, such as sales growth,

gross margins, operating margins and any additional financial information, to help the SEC staff assess

whether individual operating segments are economically similar. ASC 280 does not prescribe a specific

threshold for economic similarity, and therefore, there is no bright line when making this evaluation.

However, the greater the percentage difference, the more evidence the company should have to support

economic similarity of its operating segments. The SEC staff has stated that the aggregation criteria are

intended to be a high hurdle

3

and should be viewed from the perspective of investors.

1.4 Reportable segments

Unless the aggregation criteria described in section 1.3 above, and in greater detail in section 3.1, are

met, a public entity is required to report each material operating segment. The materiality thresholds for

reporting individual or aggregated operating segments are based on 10% or more of segment revenues,

segment absolute profit or loss, or segment assets. If any individual or properly aggregated operating

segments do not meet the materiality thresholds, ASC 280 permits two or more of these immaterial

operating segments to be combined into a single reportable segment if (1) combination is consistent with

the objective and basic principles of ASC 280, (2) the operating segments have similar economic

characteristics (e.g., comparable long-term average gross margin) and (3) the operating segments

share a majority of the five specific aggregation criteria discussed in the preceding paragraphs.

In addition, a public entity is required to report separate operating segments until the external revenue

attributable to reportable segments is at least 75% of total consolidated revenue. For example, if an entity

identifies four operating segments that have combined revenues of 60% of total consolidated revenue, the

entity must disclose additional operating segments (even if they do not individually meet the quantitative

thresholds) that have combined revenue of at least 15% of total consolidated revenue such that the

reportable segments in the aggregate account for at least 75% of total consolidated revenue.

1.5 Annual disclosure requirements

Proposed amendment to the standard

In October 2022, the FASB issued an exposure draft that would require public entities to disclose

more segment information, including significant segment expenses and other segment items, on an

annual and interim basis and provide in interim periods all disclosures about a reportable segment’s

profit or loss and assets that are currently required annually. The proposal would also permit public

entities to disclose multiple measures of segment profit or loss, and public entities with a single

reportable segment would have to provide all the disclosures required by ASC 280, including the

proposed disclosures.

Readers should monitor developments.

3

Remarks by Dan Murdock, SEC Deputy Chief Accountant, Office of the Chief Accountant, at the 2014 AICPA National

Conference on Current SEC and PCAOB Developments, 8 December 2014.

1 Scope and overview

Financial reporting developments Segment reporting | 6

Excerpt from Accounting Standards Codification

Segment Reporting — Overall

Overview and Background

General

280-10-05-5

To provide some comparability between public entities, this Subtopic requires that an entity report

certain information about the revenues that it derives from each of its products and services (or

groups of similar products and services) and about the countries in which it earns revenues and holds

assets, regardless of how the entity is organized. As a consequence, some entities are likely to be

required to provide limited information that may not be used for making operating decisions and

assessing performance.

Other Presentation Matters

General

280-10-45-1

This Subtopic does not require that a public entity report segment cash flow. However, paragraphs

280-10-50-22 and 280-10-50-25 require that a public entity report certain items that may provide an

indication of the cash-generating ability or cash requirements of an entity’s operating segments.

280-10-45-2

Nothing in this Subtopic is intended to discourage a public entity from reporting additional information

specific to that entity or to a particular line of business that may contribute to an understanding of the entity.

ASC 280 requires certain “first-level” disclosures (e.g., revenue by segment, a measure of profit or loss

and assets by segment) for reportable segments (see chapter 4 for a discussion of these disclosure

requirements) and additional “entity-wide” disclosures (e.g., revenues for the entire entity, organized

by products and services and by geographic area) if such information is not subject to the first-level

disclosures. Entity-wide disclosures are required regardless of whether that information is provided to or

used by the CODM (see chapter 5 for a discussion of these disclosure requirements).

ASC 280 requires segment information to be reported for each period for which a complete set of

financial statements is provided and in condensed financial statements of interim periods. Also, to ensure

comparability, if there are changes in the composition of reportable segments in the current period, those

changes are required to be retrospectively applied to earlier periods. However, restatement is not required

when it is impracticable (i.e., when the necessary information is not available and the cost to develop it

would be excessive). For example, restatement might not be practicable when a public entity undergoes a

fundamental reorganization and redesigns its internal financial reporting system. Disclosure is required if

an entity has changed its segment presentation as a result of a change in the composition of reportable

segments. Furthermore, if the segment information for earlier periods is not restated because it is impractical,

the entity must disclose its current year segment information under both the old basis and new basis of

segmentation unless such information is not available and is impracticable to maintain. We note that the

SEC staff views “impracticable” as a very high standard and often challenges registrants that do not recast

the prior year’s segment information consistent with its segment reporting in the current year. As a result,

companies should carefully evaluate whether it is impracticable to present comparable segment information

for earlier periods as the SEC staff has an expectation that the information will be disclosed.

1 Scope and overview

Financial reporting developments Segment reporting | 7

1.5.1 First-level disclosures

ASC 280 requires that a public entity disclose the factors that management considers most significant in

determining its reportable segments, such as differences in products or services, geographic areas of

operations or regulatory environments. A public entity also must disclose the types of products and

services generating revenues for each reportable segment. In addition to these general requirements,

first-level disclosures include reported segment profit or loss and related information and segment assets.

Adjustments and eliminations made in preparing a public entity’s general-purpose financial statements

and allocations of specific revenues, expenses, gains, losses and assets are included in the determination

of segment amounts only if those items are included in the information provided to the CODM. For

example, an entity that accounts for interest expense only on a consolidated basis (i.e., it is not included

in the segment information) would not report interest expense for each reportable segment. Rather, the

unallocated amount of interest expense, if material, would be separately reported in the reconciliation to

consolidated amounts.

1.5.1.1 Segment profit or loss and related information

Under ASC 280, a public entity reports segment profit or loss for each reportable segment based upon

the performance measure provided to and used by the CODM for purposes of making decisions about

allocating resources to the segment and assessing its performance. Therefore, the performance measure

is company specific and may vary by company.

ASC 280 requires certain components of segment profit or loss that are reported to the CODM to be

separately reported for each reportable segment, including revenue, depreciation, interest revenue and

expense, income taxes, and significant noncash items.

The segment information reporting in the footnotes should follow the same accounting policies used in

generating the information used in the reports reviewed by the CODM, even if those accounting policies

are different from the ones used to prepare the consolidated financial statements. For example, first-in,

first-out (FIFO) basis may be used in reporting to the CODM and in the segment disclosures even though

last-in, first-out (LIFO) is used in consolidation. Segment information also is not required to comply with

GAAP. For example, pension expense might be reported on a cash basis to the CODM and in the segment

disclosures though appropriate pension accounting would be required in the consolidated financial

statements. However, an entity is required to make certain disclosures regarding how it has measured

segment profit or loss and segment assets if these measures differ from the basis used in the preparation

of the consolidated financial statements.

If the CODM uses more than one measure of a segment’s profit or loss and more than one measure of a

segment’s assets, the reported measures should be those that management believes are determined in

accordance with the measurement principles most consistent with those used in measuring the corresponding

amounts in the consolidated financial statements. See section 3.2.3 for further discussion when there is

more than one measure of segment profit/loss or segment assets.

1.5.1.2 Segment assets

Under ASC 280, a public entity reports a measure of assets for each reportable segment for those assets

that are included in the measure of the segment’s assets provided to the CODM. If no asset information is

provided for a reportable segment, disclosure of segment assets is not required, but that fact and the

reason for its exclusion should be disclosed. In addition, an entity is required to disclose its equity

investments and capital expenditures if these items are included in the measure of segment assets

reviewed by the CODM.

1 Scope and overview

Financial reporting developments Segment reporting | 8

1.5.1.3 Reconciliations

Under ASC 280, a public entity is required to provide a reconciliation of:

• The total of the reportable segments’ profit or loss to the consolidated income before income taxes

and discontinued operations (if an entity allocates these items to segments, the entity may reconcile

to income or loss after these items)

• The total of the reportable segments’ revenues to the entity’s consolidated revenues

• The total of the reportable segments’ assets to the entity’s consolidated assets

• The total of the reportable segments’ amounts for every other significant item of information

disclosed to the corresponding consolidated amount

Significant reconciling items should be disclosed separately.

1.5.2 Entity-wide disclosures

Although ASC 280 requires a management approach, certain additional information must be disclosed,

even if that information is not provided to or used by the CODM to manage the public entity. For example,

if an entity is not managed based on differences in products or services (e.g., a geographical approach is

used), certain information about products or services is nonetheless required to be disclosed. On the

other hand, if a public entity manages its worldwide operations based on differences in products or

services, certain geographic information nonetheless must be disclosed. The amounts reported should be

based on the financial information used to produce the public entity’s general-purpose financial statements.

If providing entity-wide disclosures is impracticable (which is expected to be rare), the disclosures are not

required, but that fact and the reason should be disclosed.

1.5.2.1 Information about major customers

ASC 280 requires all public entities to provide information about reliance on major customers

(i.e., external customers that represent 10% or more of the public entity’s revenue), even if such entities

operate in only one segment.

To the extent the disclosures coincide with disclosures required in other ASC Topics (e.g., ASC 275) the

disclosures could be combined. For example, the disclosures under ASC 275 on the description of

products and services and concentration in volume of business transacted with a particular customer

could be integrated with the disclosures regarding segments.

1.6 Interim disclosure requirements

Proposed amendment to the standard

In October 2022, the FASB issued an exposure draft that would require public entities to disclose

more segment information, including significant segment expenses and other segment items, on an

annual and interim basis and provide in interim periods all disclosures about a reportable segment’s

profit or loss and assets that are currently required annually. The proposal would also permit public

entities to disclose multiple measures of segment profit or loss, and public entities with a single

reportable segment would have to provide all the disclosures required by ASC 280, including the

proposed disclosures.

Readers should monitor developments.

1 Scope and overview

Financial reporting developments Segment reporting | 9

ASC 280 requires selected segment information to be reported on an interim basis. The disclosures

include information on revenues, profit or loss, total assets for which there has been a material change

from the amount disclosed in the last annual report, differences since year end in the measurement of

segment profit or loss, and a reconciliation of combined segment profit or loss to consolidated income

(before income taxes and discontinued operations, unless these items are already allocated to individual

segments). This information must be disclosed in the condensed financial statements included in a

registrant’s Form 10-Q.

Entity-wide disclosures are not required for interim reporting purposes. Consistent with annual reporting,

segment information for earlier periods is restated (unless impracticable) when an entity changes the

composition of its reportable segments.

1.7 SEC considerations

The SEC staff has continued to focus on segment disclosures and the application of ASC 280. SEC staff

members have discussed

4

their approach in their review of segment disclosures and encouraged registrants

to adopt a similar mindset when evaluating the appropriateness of segment disclosures. Some of the

areas highlighted by the SEC staff have included (1) the identification of the CODM, (2) the identification

of operating segments, (3) the aggregation or combination of operating segments, (4) internal controls

over segment reporting, (5) use of non-GAAP measures and (6) entity-wide disclosures. SEC representatives

said that segment reporting continues to be a critical focus area because investors continue to identify it

as the most important disclosure area in SEC filings.

The SEC staff

5

has emphasized the objectives and principles outlined in the guidance on segment

reporting, including whether the design and operation of internal controls over the segment reporting

judgments are appropriate. The SEC staff highlighted that the guidance on segment reporting requires

the application of reasonable judgment and that input from, and interaction with, the CODM may be an

important element in the design of effective internal controls over financial reporting, specifically how the

CODM allocates resources and assesses performance. Documenting the design and effective operation of

management’s controls over these judgments is an integral part of management’s support for the

effectiveness of its internal controls over financial reporting and will be essential to the auditor’s ability

to evaluate these controls.

The following sections highlight remarks from the SEC staff:

• Identification of the CODM — see section 2.1.2

• Identification of operating segments — see section 2.1

• Aggregation of operating segments — see section 3.1

• Non-GAAP measures — see section 4.1.3

• Entity-wide disclosures — see section 5

4

Remarks by Dan Murdock, SEC Deputy Chief Accountant, Office of the Chief Accountant, at the 2014 AICPA National Conference

on Current SEC and PCAOB Developments, 8 December 2014; remarks by Courtney D. Sachtleben, SEC Professional Accounting Fellow,

Office of the Chief Accountant, at the 2015 AICPA National Conference on Current SEC and PCAOB Developments, 9 December 2015;

comments by Nili Shah, SEC Deputy Chief Accountant, Division of Corporation Finance, at the 2016 AICPA National Conference on

Current SEC and PCAOB Developments; comments by Patrick Gilmore, SEC Deputy Chief Accountant, Division of Corporation Finance, at

the 2020 AICPA Conference on Current SEC and PCAOB Developments; comments by Melissa Rocha, SEC Deputy Chief Accountant,

Division of Corporation Finance, at the 2021 and 2022 AICPA & CIMA Conference on Current SEC and PCAOB Developments.

5

Remarks by Courtney D. Sachtleben, SEC Professional Accounting Fellow, Office of the Chief Accountant, at the 2015 AICPA

National Conference on Current SEC and PCAOB Developments, 9 December 2015.

1 Scope and overview

Financial reporting developments Segment reporting | 10

We continue to see the SEC staff review publicly available information about registrants beyond the

information included in public filings, including content from earnings calls, registrant websites and

industry or analyst presentations. The review of additional information is often focused on identifying

any potential inconsistencies between the way that management describes its business to the public

(e.g., in its earnings releases) and the information contained in the company’s segment footnote. The

SEC staff often requests that registrants explain any potential inconsistencies between the information

that is available elsewhere in the public domain and the information included in the segment footnote.

The staff also has said that entities should consider the total mix of information that is reviewed by the

CODM when determining its operating segments.

In light of the SEC staff’s continued focus on segment reporting, we encourage public companies to

continue to challenge their segment reporting practices, including the design and operation of their

internal controls over financial reporting.

1.8 Transition for initial adoption of ASC 280

For entities that have not previously applied the provisions of ASC 280 (that is, non-public entities or not-

for-profit entities that voluntarily adopt or become required to adopt ASC 280), the segment disclosures

are required for all years presented in the entity’s financial statements, unless it is impracticable to

prepare prior year information.

Financial reporting developments Segment reporting | 11

2 Operating segments

2.1 Determination of operating segments

Excerpt from Accounting Standards Codification

Segment Reporting — Overall

Disclosure

Operating Segments

280-10-50-1

An operating segment is a component of a public entity that has all of the following characteristics:

a. It engages in business activities from which it may recognize revenues and incur expenses

(including revenues and expenses relating to transactions with other components of the same

public entity).

b. Its operating results are regularly reviewed by the public entity’s chief operating decision maker to

make decisions about resources to be allocated to the segment and assess its performance.

c. Its discrete financial information is available.

280-10-50-2

An operating segment shall include components of a public entity that sell primarily or exclusively to

other operating segments of the public entity if the public entity is managed that way. Information

about the components engaged in each stage of production is particularly important for understanding

vertically integrated public entities in certain businesses, for example, oil and gas entities. This

information is also important because different activities within the entity may have significantly

different prospects for future cash flows.

280-10-50-3

An operating segment may engage in business activities for which it has yet to recognize revenues, for

example, start-up operations may be operating segments before recognizing revenues.

280-10-50-4

Not every part of a public entity is necessarily an operating segment or part of an operating segment.

For example, a corporate headquarters or certain functional departments may not recognize revenues

or may recognize revenues that are only incidental to the activities of the public entity and would not

be operating segments. For purposes of this Subtopic, a public entity’s pension and other

postretirement benefit plans are not considered operating segments.

280-10-50-5

The term chief operating decision maker identifies a function, not necessarily a manager with a

specific title. That function is to allocate resources to and assess the performance of the segments of a

public entity. Often the chief operating decision maker of a public entity is its chief executive officer or

chief operating officer, but it may be a group consisting of, for example, the public entity’s president,

executive vice presidents, and others.

2 Operating segments

Financial reporting developments Segment reporting | 12

The determination of an entity’s operating segments is the first step in determining what segment

information needs to be reported in the entity’s financial statements and is often the primary focus of

the SEC staff in the review of an entity’s segment disclosures. ASC 280 says individual business

components are operating segments if they meet all of the following criteria:

• It engages in business activities from which it may recognize revenues and incur expenses (section 2.1.1).

• Its operating results are regularly reviewed by the public entity’s CODM to allocate resources and

assess performance (section 2.1.2).

• Its discrete financial information is available (section 2.1.3).

Sometimes, application of the guidance will result in identification of a single operating segment. In such

circumstances, management should carefully evaluate whether its conclusion is consistent with the guidance

and the way in which the company presents itself to investors. For example, the SEC staff has cautioned that

it would seem counter to the objectives of segment reporting if the entity’s business description indicates the

entity is diversified across businesses or products but is not managed in a disaggregated way.

6

See chapter 4

for disclosure considerations when an entity is organized as a single operating segment.

2.1.1 Engages in business activities

To be an operating segment, a component engages in business activities from which it may recognize

revenues and incur expenses (including revenues and expenses relating to transactions with other

components of the same public entity).

Certain functional departments that do not recognize revenues or that recognize revenues that are incidental

to the entity’s activities would not be operating segments. Corporate headquarters, corporate shared services

and centralized treasury operations generally would not qualify as operating segments. Conversely, a

division that earns revenues, even if its revenues are all intercompany revenues, as might be the case in

a vertically integrated operation (such as in the extractive industry) might be an operating segment.

In certain circumstances, a division that only performs research and development activities might be

considered an operating segment if there is discrete financial information available and the operating

results are reviewed regularly by the CODM (as discussed further below). Even a startup operation that

has not yet earned revenues may meet the requirement of engaging in business activities. Further,

ASC 280 does not preclude such a division from being a reportable segment if management believes the

additional information may contribute to a better understanding of the entity, even if the revenues are

considered incidental (ASC 280-10-55-3 and 55-4).

Components that recognize revenues and incur expenses are not required to have assets to be considered

operating segments. The focus of the criterion is whether the component engages in business activities

from which it may recognize revenues and incur expenses provided it otherwise meets the definition of

an operating segment. For example, Division A, which meets the ASC 280 definition of an operating

segment, leases assets from Division B. The leased assets are presented in the internal financial reports

of Division B. In this case, Division A is an operating segment despite the fact that no assets are allocated

to it. However, if no asset information is provided for a reportable segment, that fact and the reason for

it should be disclosed (ASC 280-10-55-5 and 55-6).

6

Remarks by Courtney D. Sachtleben, SEC Professional Accounting Fellow, Office of the Chief Accountant, at the 2015 AICPA

National Conference on Current SEC and PCAOB Developments, 9 December 2015.

2 Operating segments

Financial reporting developments Segment reporting | 13

2.1.2 Operating results are regularly reviewed by the CODM to allocate resources

and assess performance

To be an operating segment, the operating results of the component are regularly reviewed by the public

entity’s CODM in order to assess the performance of the individual segment and make decisions about

resources to be allocated to the segment. That is, the CODM makes key operating decisions based on

financial information for the component.

Identification of the CODM

The term “chief operating decision maker” defines a function rather than an individual with a specific

title. The function of the CODM is to allocate resources to and assess the operating results of the

operating segments of an entity and may not necessarily be the individual responsible for strategic

decisions or the individual who has ultimate decision-making authority. It is important to think about what

the key operating decisions are and who is making those decisions for the entity to properly identify the

CODM. Often, an entity’s CODM is its chief executive officer or chief operating officer, but the CODM also

could be a group consisting of top executives (e.g., a management committee or the executive committee

of the board of directors). The SEC staff has encouraged registrants to take a fresh look at their CODM

determination and not default to the entity’s CEO.

Identifying the CODM is critical to the evaluation of operating segments because it is the information

used by the CODM for purposes of allocating resources and assessing performance that would provide

the basis for determining the operating segments.

The function of the CODM is to allocate resources and assess performance for each segment but not

necessarily how these resources are allocated within the individual segments. For example, the CODM

may assess the performance of and allocate resources to an operating segment but delegate the

allocation of those resources within the operating segment to the segment manager.

In most circumstances, the identification of the CODM is rather straightforward based upon clearly defined

operational and reporting protocols of the organization. However, the determination of an entity’s CODM may

be more difficult when the organizational structure of the entity is complex. Consider the following illustration:

Illustration 2-1: Identification of the CODM

Assume that a public entity has a president, a chief executive officer and a chief operating officer and

that these positions are held by different individuals. Also assume that all three of these individuals serve

on a management committee, which exists to make operating decisions related to the operating

segments of the entity, and that each has an equal vote in decisions made by the committee. In this case,

the CODM would be the management committee because the committee, which is evenly controlled by

its members, makes the operating decisions rather than any individual executive. Thus, the internal

financial information that is provided to the members of the management committee in order to make

operating decisions and assess performance would constitute the operating segment information.

While the CODM may be a committee, it is important to note that the mere existence of a management

committee does not necessarily mean that the management committee is the CODM. We believe the

FASB intended to include the management committee concept for situations in which executives were,

in effect, sharing decision-making authority in an entity. When a management committee is used as a

mechanism to provide input to the chief executive officer, the chief executive officer would be the CODM

if they are responsible for assessing performance and making the key operating decisions. However,

if the management committee is the level at which the key operating decisions are made, then the

management committee may be the CODM. In these circumstances, it’s important to understand the

relationship and interaction between the management committee and the level at which the key

operating decisions are being made.

2 Operating segments

Financial reporting developments Segment reporting | 14

The CODM’s assessment of performance and allocation of resources

The periodic financial reporting package provided to the CODM provides insight into how management

has organized the company for purposes of making operating decisions and assessing performance.

Historically, the SEC staff has placed emphasis on the financial information included in the reporting

package reviewed by the CODM, with the presumption that if information was included in the reporting

package provided to the CODM, it must be used by the CODM to assess performance and allocate

resources. However, a company must assess how that financial information is being used by the CODM in

making key operating decisions, and the SEC staff has stated that inclusion of information in a reporting

package should not be the only factor considered in the analysis.

7

Although it’s important to consider the financial information available and used by the CODM when

identifying an entity’s operating segments, the level in which financial information is presented on a

disaggregated basis in the reporting package given to the CODM is just one data point to consider in the

determination of operating segments. That is, the lowest level of disaggregation presented in the CODM

reporting package would not be determinative. Other factors to consider include the overall management

structure (i.e., the organizational chart, including the roles and responsibilities of those who report

directly to the CODM), how an organizational structure may have changed in recent years due to

acquisitions, dispositions or changes in business strategy, the basis on which budgets and forecasts are

prepared, and the basis for how executive compensation is determined (e.g., performance criteria

underlying compensation plans). However, the SEC staff may continue to request the reporting package

reviewed by the CODM, as well as the company’s organizational structure, to understand how

management makes operating decisions and assesses performance. Consider the following example:

Illustration 2-2: Process for making key operating decisions

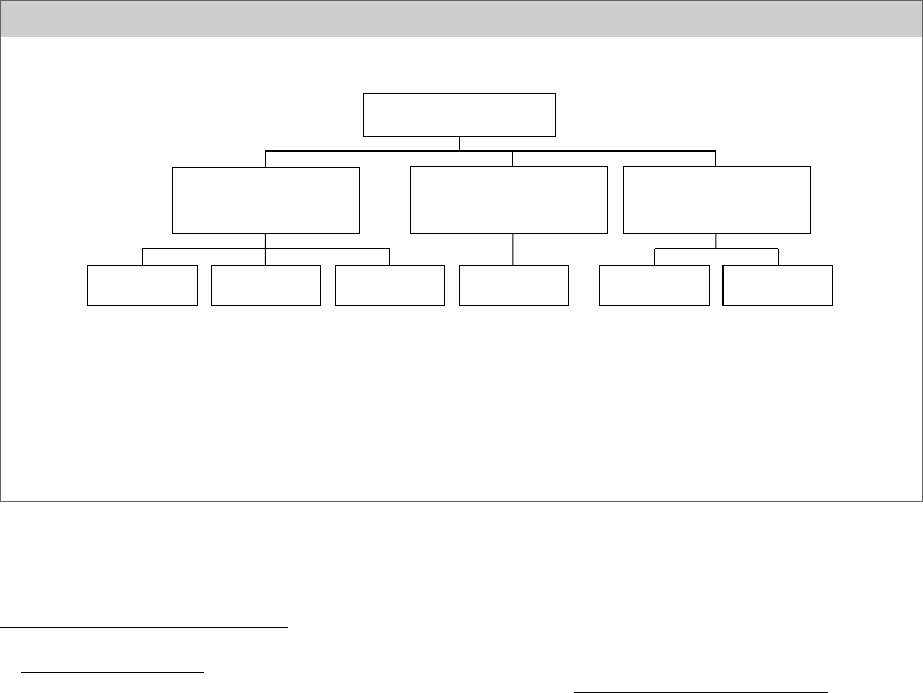

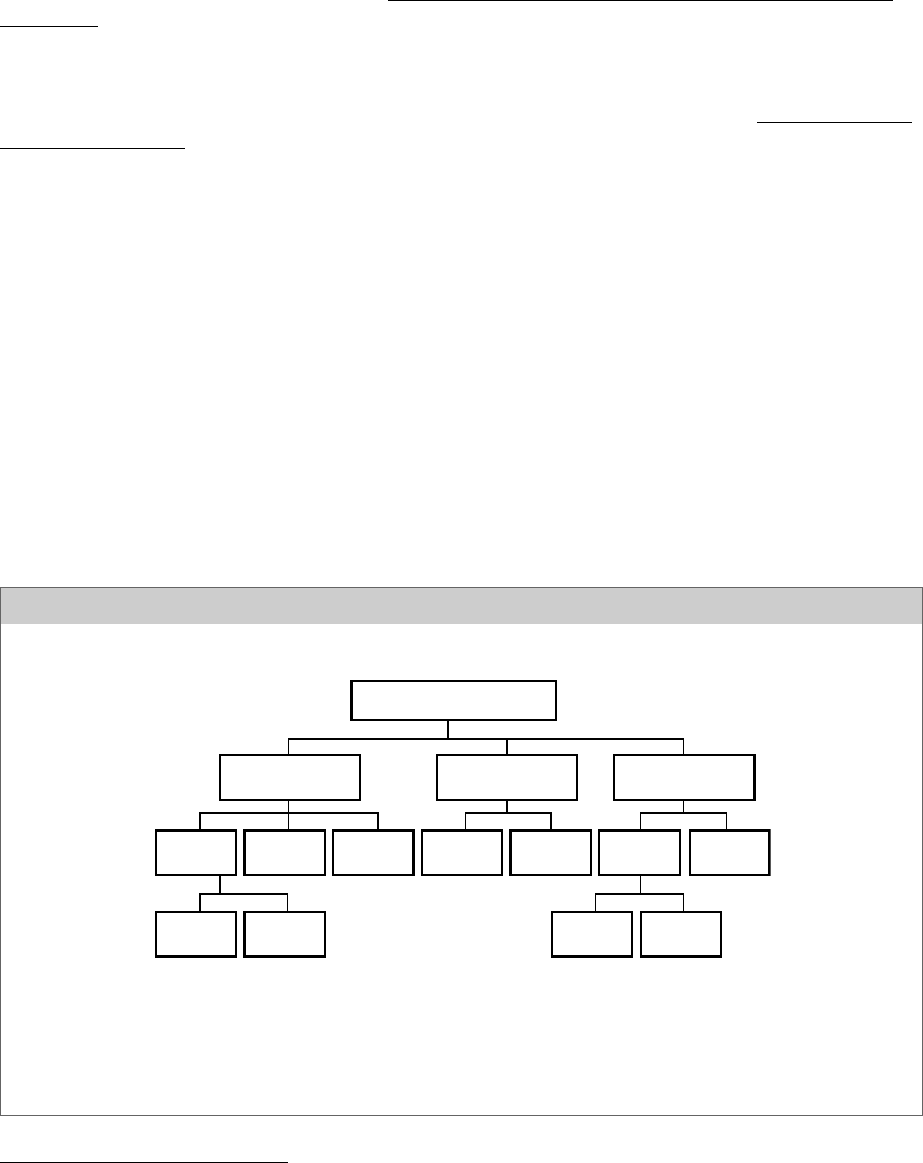

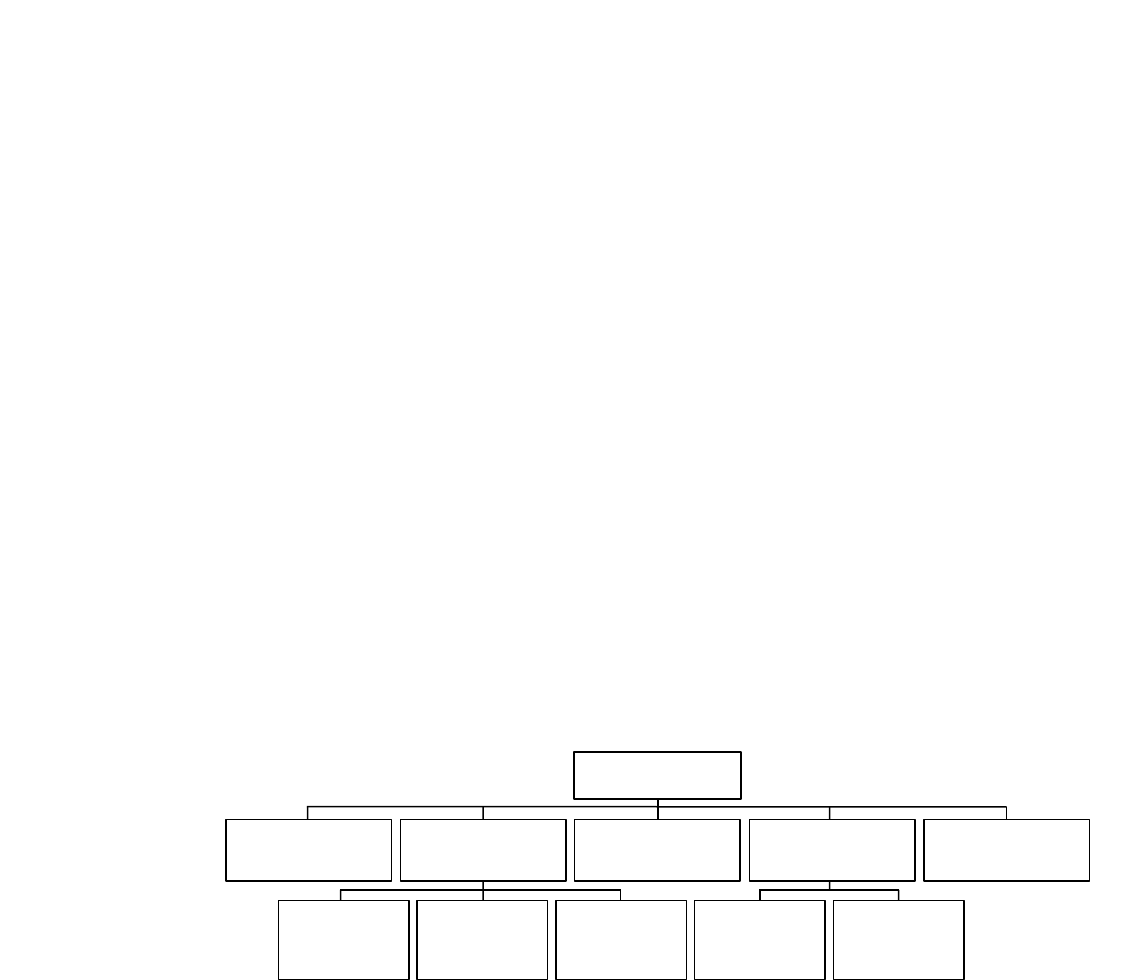

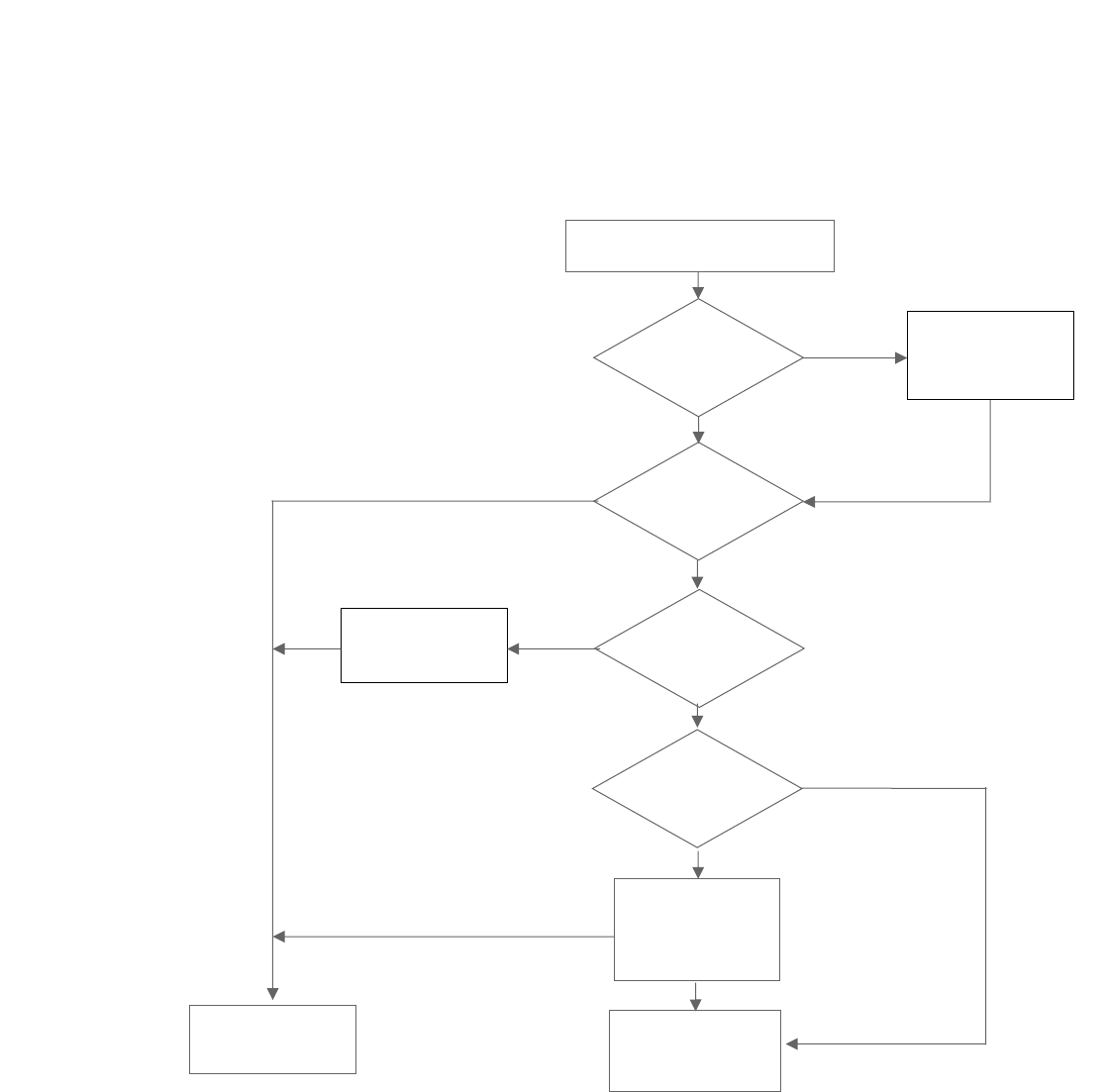

Below is the reporting structure for a public entity:

Assume that the six operating units (shoes, pants, shirts, watches, equipment and souvenirs) are

grouped into three divisions (clothing, accessories and sporting goods) and that each of the three

divisions has a segment manager who reports directly to the CODM. The CODM receives discrete

financial information at both the division and component level every month. Even though the CODM

receives discrete financial information for the six components, the company must assess how the

CODM makes key operating decisions and at what level those decisions are made.

7

Remarks by Dan Murdock, SEC Deputy Chief Accountant, Office of the Chief Accountant, at the 2014 AICPA National

Conference on Current SEC and PCAOB Developments, 8 December 2014; and remarks by Courtney D. Sachtleben, SEC

Professional Accounting Fellow, Office of the Chief Accountant, at the 2015 AICPA National Conference on Current SEC and

PCAOB Developments, 9 December 2015.

Souvenirs

Souvenirs

Pants

Shirts

Watches

Equipment

Shoes

Clothing Division

Segment Manager

Accessories Division

Segment Manager

Sporting Goods

Segment Manager

CODM

2 Operating segments

Financial reporting developments Segment reporting | 15

The company determines that operating decisions are made at the division level by the CODM. For

example, marketing strategies are determined by the CODM for each division, and each segment

manager is responsible for deploying that strategy at the component level. Also, quarterly financial

information is presented to the board of directors and investors at the division level, which is consistent

with the level at which the CODM makes decisions. In addition, the company determines the following:

• Budgets and forecasts are prepared at the division level, and the CODM reviews budget-to-actual

variances at that level on a monthly basis.

• The segment managers are compensated in accordance with the company’s bonus plan, which

sets targets for each division.

Therefore, the company concludes that while the CODM receives financial information for the

components, performance is assessed and resources are allocated at the division level so the three

divisions are the operating segments.

Some registrants have asserted that the component (the operating units in the example above) could not

be an operating segment because the operating unit managers do not report directly to the CODM. The

SEC staff has historically rejected such assertions when the CODM bases their decisions on the information

provided at the component level (operating unit level) despite the absence of segment managers at that

level. Rather, the registrant must demonstrate that the CODM does not use the individual component

information received, but instead uses information at the more aggregated level (the division level in the

example above) to assess performance and allocate resources. Therefore, it is important to understand

the operating decisions made by the CODM and what information is used to make those decisions.

It is also important to understand the key metrics (e.g., gross margin, EBITDA, operating margin, return

on investment) on which the CODM bases their evaluation of performance and allocation of resources.

In some circumstances, the CODM may emphasize one or two metrics in making their decisions. In

other circumstances, the CODM may use a suite of metrics or performance indicators. Consider the

following example:

Illustration 2-3: Metrics used in key operating decisions

Assume the CODM receives a monthly financial results package that includes metrics for three product

lines and also includes metrics for five geographical areas. The package includes certain metrics for

each product and each of the geographical areas (e.g., revenues, operating margins). However, the

package includes only a measure of earnings before interest, taxes, depreciation and amortization

(EBITDA) for each product line. Although the CODM receives multiple metrics, they assess performance

and allocate resources of the components based on EBITDA results for each product line. This is

corroborated by the existence of a performance bonus plan (i.e., bonuses are based on EBITDA

targets) and is further evidenced by the existence of three product segment managers that report to

the CODM. In this case, although the CODM receives information for the five geographical areas, the

three product lines would appear to be the operating segments.

Registrants should be able to provide verifiable evidence supporting the level at which operating

decisions are made. An analysis of the information presented to the board of directors, the budgeting

process (including the level at which the budget is approved and reviewed), the performance objectives

and criteria underlying compensation plans, the level of autonomy given to segment managers and

recent actions taken by segment managers based on their authority are important factors that will

contribute to the determination of operating segments and support that conclusion.

2 Operating segments

Financial reporting developments Segment reporting | 16

2.1.3 Discrete financial information is available

To be an operating segment, the CODM must have discrete financial information available about the

component in order to assess performance and make resource allocation decisions. It is not necessary

that assets be allocated to a component for it to have discrete financial information. Discrete financial

information can constitute as little as operating information. This financial information must be sufficiently

detailed to allow the CODM to make decisions. At the 2015 AICPA National Conference on Current SEC and

PCAOB Developments, the SEC staff stated that a company shouldn’t conclude that discrete financial

information is not available simply because certain costs are shared and not allocated specifically to each

component. Gross profit information, or other operating measures, provided to the CODM and used to assess

performance and make resource allocation decisions could be considered discrete financial information.

A question that can arise is whether a component for which the CODM receives only revenue information

can be defined as an operating segment. For example, a CODM may receive revenue information by

product line as part of the package of information that the CODM uses to make operational decisions

relating to the entity. In general, the fact that a CODM receives revenue information provided by

component (e.g., by product line, by major customer) would likely mean that the component isn’t an

operating segment because this information isn’t sufficient for the CODM to make decisions about

allocating resources to the component and to assess its performance. However, the facts and

circumstances of each entity should be carefully considered when operating segments are being

determined. We believe it is important for all entities to evaluate how the CODM uses the revenue-only

information in the CODM package, as well as what factors influence the operational decisions the CODM

makes with regard to the allocation of resources and the assessment of each component’s performance.

Illustration 2-4: Discrete financial information

Assume the CODM of an entity receives information that shows revenue for three different products

produced by an operating unit. Operating expense information is not available for each of the products.

Because the CODM does not have a measure of profit or loss by product, they likely would not have

enough information to assess the performance or make resource allocation decisions regarding the

individual products. In this case, the operating segment would need to be at a level where discrete

financial information is available and provided to the CODM for use in making operational decisions.

2.1.4 CODM uses multiple types of segment information

Excerpt from Accounting Standards Codification

Segment Reporting — Overall

Disclosure

Operating Segments

280-10-50-6

For many public entities, the three characteristics of operating segments described in paragraph

280-10-50-1 clearly identify a single set of operating segments. However, a public entity may produce

reports in which its business activities are presented in a variety of different ways. If the chief operating

decision maker uses more than one set of segment information, other factors may identify a single set

of components as constituting a public entity’s operating segments, including the nature of the

business activities of each component, the existence of managers responsible for them, and

information presented to the board of directors.

280-10-50-7

Generally, an operating segment has a segment manager who is directly accountable to and maintains

regular contact with the chief operating decision maker to discuss operating activities, financial

results, forecasts, or plans for the segment. The term segment manager identifies a function, not

necessarily a manager with a specific title.

2 Operating segments

Financial reporting developments Segment reporting | 17

280-10-50-8

The chief operating decision maker also may be the segment manager for certain operating segments.

A single manager may be the segment manager for more than one operating segment. If the

characteristics in paragraphs 280-10-50-1 and 280-10-50-3 apply to more than one set of

components of a public entity but there is only one set for which segment managers are held

responsible, that set of components constitutes the operating segments.

280-10-50-9