Financial Reporting

Through the Lens of a

Property/Casualty Actuary

Kathleen C. Odomirok, FCAS, MAAA

Gareth L. Kennedy, ACAS, MAAA

Cosimo Pantaleo, FCIA, FCAS

EY

© Casualty Actuarial Society, 2020

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Foreword

1

FOREWORD

EY was originally retained by the Casualty Actuarial Society (CAS) to write a text on financial

reporting and taxation as it affects reserving and statutory reporting for use in the CAS basic

education process. The CAS had two key objectives for this text:

1. Replace a number of readings that existed on the CAS Syllabus of Basic Education as

of 2011 with a single educational publication.

2. Refine the content of the syllabus material to focus on financial accounting and

taxation topics that are of particular relevance to the property/casualty actuary.

The CAS specified that the text would focus on the learning objectives contained within the

syllabus as of 2011.

This publication has been prepared from an actuary’s lens, highlighting those areas of

financial reporting and taxation deemed to be relevant by the CAS Syllabus Committee and

the authors of this text. The learning objectives contained within the 2011 syllabus provided

the underlying direction of the content contained herein. Further, the core content was

originally developed based on the NAIC Annual Statement Instructions in 2011.

Subsequently, EY was requested to update the original textbook to:

Ø Add specific examples to illustrate differences between SAP and GAAP

Ø Include tax implications of investment strategies

Ø Reflect the new tax law enacted in the U.S. in December 2017

Ø Bring IFRS and Solvency II current (to 2018) and include discussion of the NAIC’s Own

Risk and Solvency Assessment (ORSA)

Ø Bring Schedule F current (to 2018)

Ø Provide discussion as to why companies use intercompany pooling arrangements and

their impact on surplus

Ø Reflect any resolution of discrepancies between the NAIC’s written and electronic

instructions for risk-based capital (RBC) regarding Asset Risk associated with

insurance company subsidiaries

Ø Bring the Canadian chapter current (to 2018)

Ø Reflect comments and questions received by the CAS from candidates and others, as

well as errata previously submitted

This version of the text reflects the above specified changes. In doing so, we have updated the

Annual Statement for Fictitious Insurance Company to 2018. No other changes have been

incorporated, other than minor typographical edits. Further, we have not accounted for any

changes to the Exam 6 Syllabus, other than those resulting in the above requested updates

from the CAS. The Exam 6 learning objectives and examination material may have changed

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Foreword

2

and may continue to change in the future. Therefore, the content of this publication may

need to be updated in the future.

This text does not represent the position of EY or the authors with respect to interpretations

of accounting or tax guidance. Nor is this text intended to be a substitute for authoritative

accounting or insurance regulatory and related guidance issued by the National Association of

Insurance Commissioners (NAIC), American Institute of Certified Public Accountants (AICPA),

Financial Accounting Standards Board (FASB), Governmental Accounting Standards Board

(GASB), Securities and Exchange Commission (SEC), Internal Revenue Service (IRS),

Chartered Professional Accountants Canada (CPA Canada)

1

, International Federation of

Accountants (IFAC), Global Accounting Alliance (GAA), International Financial Reporting

Standards Foundation (IFRS)/International Accounting Standards Board (IASB), or any other

regulatory body. Authoritative guidance from regulatory bodies trumps the writings

contained herein. Furthermore, accounting standards are continuously evolving. As a result,

readers of this text should be aware that the accounting standards referenced in this

publication may have changed since the time of writing. The CAS may request that this

publication be updated to reflect such changes.

While the authors of this publication have taken reasonable measures to verify references,

content and calculations, it is possible that we may have inadvertently missed something. We

would appreciate being informed of any inaccuracies so that an errata sheet(s) may be issued,

and/or future editions of this publication may be corrected.

This publication has been prepared for general informational purposes only, and is not

intended to be relied upon as accounting, tax or other professional advice. It is not intended

to be a substitute for detailed research or the exercise of professional judgement. Neither

Ernst & Young LLP nor any other member of the global Ernst & Young organization can

accept any responsibility for loss occasioned to any person acting or refraining from action as

a result of any material in this publication. Please refer to your advisors for specific advice.

1

In October 2014, the Certified General Accountants Association of Canada (CGA-Canada) joined Chartered

Professional Accountants of Canada (CPA Canada) to complete the integration of the country’s national accounting

bodies. CPA Canada was established the previous year by the Canadian Institute of Chartered Accountants (CICA)

and The Society of Management Accountants of Canada (CMA Canada).

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Acknowledgements

3

ACKNOWLEDGEMENTS

The authors of this publication would like to thank the CAS Syllabus Committee for its review

of this publication and feedback provided. Special thanks goes to Sarah McNair-Grove, Laura

Cali, George Levine, Michel Trudeau, Miriam Fisk, Brandon Basken, Stephane McGee, Sarah

Chevalier and Mei-Hsuan Chao who reviewed the various drafts. We would also like to thank

Wendy Germani who spent countless hours creating and editing the 2011 Annual Statement

excerpts for Fictitious Insurance Company. The amount of personal time spent by these

individuals demonstrates their tremendous dedication to the actuarial profession.

The authors would also like to acknowledge those individuals within EY who assisted us by

creating certain content, tables and exhibits and performing editorial reviews. These

individuals include Dave Osborn, Kishen Patel, and Yan Ren. Particular credit goes to David

Payne, who rewrote Chapter 19. Risk-Based Capital, Ian Sterling and Mike McComis, who

contributed to Part VI. Differences from Statutory to other Financial/Regulatory Reporting

Frameworks in the U.S., and Liam McFarlane and Shams Munir, who contributed to Part VII.

Canadian-Specific Reporting.

Finally, the authors of this text would like to express their deep gratitude to the actuarial

professionals who have invested their time writing publications for the CAS examination

process. Although this publication will serve as a consolidation of many of the papers formerly

on the Exam 6 Syllabus, we acknowledge the significant contributions that those papers have

made in advancing the actuarial profession, as well as the knowledge of the authors of the

text.

In preparing Financial Reporting through the Lens of a Property/Casualty Actuary, we relied

extensively on the following publications and resources:

PUBLICATIONS

2018 Insurance Expense Exhibit.

American Academy of Actuaries Committee on Property and Liability Financial Reporting,

Statements of Actuarial Opinion on P&C Loss Reserves, Washington, DC: American Academy

of Actuaries, December 2018.

Blanchard, Ralph S., “Basic Reinsurance Accounting — Selected Topics,” CAS Exam Study

Note, Arlington, VA: Casualty Actuarial Society, October 2010,

http://www.casact.org/library/studynotes/6US_Blanchard_Oct2010.pdf.

Canadian Institute of Actuaries, “Educational Note: Premium Liabilities”, http://www.cia-

ica.ca/docs/default-source/2016/216076e.pdf.

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Acknowledgements

4

Cantin, Claudette, and Phillippe Trahan. “Study Note on the Actuarial Evaluation of Premium

Liabilities,” Journal of Actuarial Practice, 1999: 7, pp. 5- 72,

http://www.casact.org/library/studynotes/cantin7can.pdf.

Feldblum, Sholom. “Completing and Using Schedule P,” CAS Exam Study Note, Arlington, VA:

Casualty Actuarial Society, 2003, 8th Edition,

http://www.casact.org/library/studynotes/feldblum7usP.pdf.

Feldblum, Sholom. “Reinsurance Accounting: Schedule F,” CAS Exam Study Note, Arlington,

VA: Casualty Actuarial Society, 2003, 8th Edition,

http://www.casact.org/library/studynotes/feldblum7usF.pdf.

Feldblum, Sholom. “Computing Taxable Income for Property-Casualty Insurance Companies,”

CAS Exam Study Note, Arlington, VA: Casualty Actuarial Society, 2007, pp. 1-13,

http://www.casact.org/library/studynotes/7U_Feldblum2007.pdf.

Feldblum, Sholom. “Federal Income Taxes and Investment Strategy,” CAS Exam Study Note,

Arlington, VA: Casualty Actuarial Society, 2007, pp. 1-12,

http://www.casact.org/library/studynotes/7U_Feldblum_Tax2007.pdf.

Feldblum, Sholom, “The Insurance Expense Exhibit and the Allocation of Investment Income,”

CAS Exam Study Note, Arlington, VA: Casualty Actuarial Society, May 1997,

http://www.casact.org/library/studynotes/feldblum7can3.pdf.

Feldblum, Sholom, “IRS Loss Reserve Discounting,” CAS Exam Study Note, Arlington, VA:

Casualty Actuarial Society, 2007, pp. 1-13,

http://www.casact.org/library/studynotes/7U_Feldblum_IRS_2007.pdf.

Insurance Accounting and Systems Association, Property-Casualty Insurance Accounting, 8th

ed., 2003.

MSA Research Inc., “MSA Report on Property & Casualty, Canada,” 2018.

National Association of Insurance Commissioners, Accounting Practices and Procedures

Manual, March 2019.

National Association of Insurance Commissioners, NAIC Insurance Regulatory Information

System (IRIS) Ratios Manual, 2017 edition.

National Association of Insurance Commissioners, Official 2011 NAIC Annual Statement

Blanks, Property and Casualty, 2011.

National Association of Insurance Commissioners, Official 2018 NAIC Annual Statement

Blanks, Property and Casualty, 2018.

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Acknowledgements

5

National Association of Insurance Commissioners, Property and Casualty Risk-Based Capital

Forecasting and Instructions, 2018.

Steeneck, Lee R., “Commutation of Claims," CAS Exam Study Note, Arlington, VA: Casualty

Actuarial Society, 1998, pp. 1-26,

http://www.casact.org/library/studynotes/steeneck6.pdf.

Troxel, Terrie T., and George E. Bouchie, Property-Liability Insurance Accounting and Finance.

3rd ed. Malvern, PA: American Institute for Property and Liability Underwriters, 1990.

RESOURCES

Actuarial Standards Board, Canada, http://www.actuaries.ca/ASB/index.cfm.

Website of Office of the Superintendent of Financial Institutions, http://www.osfi-bsif.gc.ca/

• MCT effective January 1, 2018

• The Canadian Annual Statement Blank — P&C

Website of Chartered Professional Accountants Canada (CPA Canada),

https://www.cpacanada.ca/.

Canadian Institute of Actuaries, http://www.actuaries.ca/

• Dynamic Capital Adequacy Testing, Educational Note, November 2017

• Draft Educational Note – Financial Condition Testing, December 2019

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Table of Contents

6

TABLE OF CONTENTS

Part I. Introduction ........................................................................................... 8

Chapter 1. Financial Reporting in the Property/Casualty Insurance Industry ......................... 8

Chapter 2. Relevance of Financial Reporting to the Actuary ................................................ 12

Chapter 3. Overview of this Publication .............................................................................. 14

Part II. Overview of Basic Accounting Concepts ................................................ 18

Introduction to Part II ......................................................................................................... 18

Chapter 4. Primary Financial Statements ............................................................................ 19

Chapter 5. Key Accounting Concepts ................................................................................... 22

Part III. SAP in the U.S.: Fundamental Aspects of the Annual Statement ............. 23

Introduction to Part III ........................................................................................................ 23

Chapter 6. Introduction to Statutory Financial Statements .................................................. 24

Chapter 7. Statutory Balance Sheet: A Measure of Solvency............................................... 25

Chapter 8. The Statutory Income Statement: Income and Changes to Surplus .................... 41

Chapter 9. Capital and Surplus Account .............................................................................. 57

Chapter 10. Notes to Financial Statements ......................................................................... 62

Chapter 11. General Interrogatories ................................................................................... 76

Chapter 12. Five-Year Historical Data Exhibit ...................................................................... 83

Chapter 13. Overview of Schedules and Their Purpose........................................................ 93

Chapter 14. Schedule F ..................................................................................................... 110

Chapter 15. Schedule P ..................................................................................................... 150

Part IV. Statutory Filings to Accompany the Annual Statement ........................ 200

Introduction to Part IV ...................................................................................................... 200

Chapter 16. Statement of Actuarial Opinion ...................................................................... 201

Chapter 17. Actuarial Opinion Summary Supplement........................................................ 214

Chapter 18. Insurance Expense Exhibit.............................................................................. 218

Chapter 19. Risk-Based Capital .......................................................................................... 241

Chapter 20. IRIS Ratios ...................................................................................................... 305

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Table of Contents

7

Part V. Financial Health of Property/Casualty Insurance Companies in the U.S. . 308

Introduction to Part V ....................................................................................................... 308

Chapter 21. Measurement Tools ....................................................................................... 309

Part VI. Differences from Statutory to other Financial/Regulatory Reporting

Frameworks in the U.S. ................................................................................. 319

Introduction to Part VI ...................................................................................................... 319

Chapter 22. U.S. GAAP, including Additional SEC Reporting ............................................... 320

Chapter 23. Fair Value Under Purchase GAAP ................................................................... 339

Chapter 24. International Financial Reporting Standards................................................... 345

Chapter 25. Solvency II ..................................................................................................... 349

Chapter 26. Taxation in the U.S. ........................................................................................ 357

Part VII. Canadian-Specific Reporting............................................................. 364

Introduction to Part VII ..................................................................................................... 364

Chapter 27. Overview of Financial Reporting in Canada .................................................... 365

Chapter 28. Canadian Annual RETURN .............................................................................. 369

Chapter 29. Financial Health of Property/Casualty Insurance Companies in Canada .......... 386

Part VIII. The Future of SAP .......................................................................... 400

Introduction to Part VIII .................................................................................................... 400

Chapter 30. The Future of Financial Reporting and Solvency Monitoring of Insurance

Companies........................................................................................................................ 401

Appendices .................................................................................................. 427

Appendix I. Fictitious Insurance Company

Excerpts from the 2018 Annual Statement for Fictitious Insurance Company

Excerpts from the 2018 Insurance Expense Exhibit for Fictitious Insurance Company

2018 Statement of Actuarial Opinion for Fictitious Insurance Company

2018 Actuarial Opinion Summary for Fictitious Insurance Company

Results of IRIS Ratio Tests for Fictitious Insurance Company

Appendix II. Canadian Financial Statements

2018 Balance Sheet for all Property/Casualty Insurance Companies

2018 Income Statement for all Property/Casualty Insurance Companies

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part I. Introduction

8

PART I. INTRODUCTION

CHAPTER 1. FINANCIAL REPORTING IN THE PROPERTY/CASUALTY INSURANCE

INDUSTRY

IMPORTANCE AND OBJECTIVES OF FINANCIAL REPORTING

Financial reporting serves as a means to communicate a company’s financial results and

health. Financial reporting is accomplished through a series of financial statements that

consolidate a company’s transactions and events into a summarized form under specified

accounting rules. The purpose of these rules is to provide companies with a framework for

measuring and recording transactions and the related revenue, expenses, assets and

liabilities on a consistent basis.

Financial reports enable stakeholders and regulators to track financial performance, compare

a company’s performance to others and make informed financial decisions under a set of

common rules. The stakeholders of an insurance company include policyholders, claimants,

investors, directors of the board and company management. The regulators primarily include

state governmental authorities, as we shall see below.

OVERVIEW OF THE BASES OF FINANCIAL REPORTING (STATUTORY, GAAP, IFRS, TAX,

CANADIAN) AND DIFFERENCES IN TERMS OF USE

The accounting standards that govern financial reporting for insurance companies are

numerous and complex. As we write this publication these standards are evolving, and this

evolution is resulting in much debate among industry participants. Regardless, the intent of

accounting standards is to promote a consistent framework for reporting insurance company

transactions such that comparisons of financial performance and health of insurance

companies can be made within the industry.

In the U.S., insurance companies are regulated by the individual state governments within

which they are licensed to transact business. Within each state government there is an

insurance division led by an insurance commissioner, director, superintendent or

administrator (commissioner). The National Association of Insurance Commissioners (NAIC)

serves as an organization of state regulators that facilitates and coordinates governance

across the U.S. The NAIC itself is not a regulator; regulatory authority remains with the

individual states. Therefore, model laws and regulations established by the NAIC are not law;

individual states have the authority to decide whether to adopt NAIC model laws and

regulations.

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part I. Introduction

9

Statutory Accounting Principles (SAP) is a framework of “accounting principles or practices

prescribed or permitted by an insurer’s domiciliary state.”

2

Most insurance companies are

licensed to transact business in more than one state. Having to follow the accounting rules

and regulations of each state in which the company is licensed can be cumbersome and result

in inconsistent reporting practices. To minimize the varying complexities of different rules

and facilitate commonality in reporting practices, the NAIC adopted Codification of SAP

effective January 1, 2001. Codification does not prevent individual state regulation but

rather provides a common set of principles that individual states can follow to ease the

regulatory burden on companies and promote consistency.

Statements of Statutory Accounting Principles (SSAPs) are published by the NAIC in its

Accounting Practices and Procedures Manual. The manual includes more than 100 SSAPs and

references related statutory interpretations, NAIC model laws and actuarial guidelines which

collectively serve as the basis for preparing and issuing statutory financial statements for

insurance companies in the U.S. in accordance with, or in the absence of, specific statutes or

regulations promulgated by individual states.

From a financial reporting perspective, regulatory oversight by state governments focuses on

insurance company solvency to ensure that policyholders receive the protection they are

entitled to and claimants receive the applicable compensation for damages incurred. SAP and

associated monitoring tools are intended to provide regulators with early warning of

deterioration in an insurance company’s financial condition. SAP tends to be conservative in

order to provide that early warning. For example, certain illiquid assets are not admitted

(excluded from the balance sheet) under SAP, despite having economic value.

Generally Accepted Accounting Principles (GAAP) provides another set of common rules

under which publicly traded insurance companies and privately held companies report their

financial transactions and operating results. GAAP does have certain specialized rules for

insurance companies, but unlike SAP, this framework is not built on the principle of

conservatism. Rather, the primary focus of GAAP is the presentation of a company’s financial

results in a manner that more closely aligns with the company’s financial performance during

the period. Historically, this has been accomplished by matching revenues and expenses. For

example, under GAAP, expenses incurred by an insurance company in conjunction with

successful acquisition of business are deferred to match the earning of associated premium.

In contrast, under SAP, all costs associated with policy acquisition are expensed at the time

they are incurred by the insurance company.

The Securities and Exchange Commission (SEC) is the authoritative body for establishing

accounting and reporting standards for publicly traded companies in the U.S., including

publicly traded insurance or insurance holding companies. As highlighted on the SEC’s

website, “The mission of the U.S. Securities and Exchange Commission is to protect investors,

2

Preamble to the NAIC Accounting Practices and Procedures Manual, March 2019 version.

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part I. Introduction

10

maintain fair, orderly and efficient markets, and facilitate capital formation.”

3

The SEC has

designated the Financial Accounting Standards Board (FASB) with the responsibility of

developing and establishing GAAP, with the SEC operating in an overall monitoring role. The

FASB is the private organization providing authoritative accounting guidance for

nongovernmental entities.

The Governmental Accounting Standards Board (GASB) is the private organization providing

authoritative accounting guidance for the public sector. According to the GASB’s website, the

GASB “is the independent organization that establishes and improves standards of accounting

and financial reporting for U.S. state and local governments ... the official source of generally

accepted accounting principles (GAAP) for state and local governments.”

4

Although this

publication does not discuss accounting for governmental entities, we note that the

accounting for such entities differs from the accounting for insurance companies. Knowledge

of the GASB as it relates to insurance-related activities of governmental entities is important

for the property/casualty actuary who performs actuarial services for the public sector.

The Internal Revenue Service (IRS) is the U.S. government agency responsible for enforcing

tax laws and collecting taxes. Every business paying taxes in the U.S. must compute taxable

income based on the tax laws passed by Congress and the related regulations issued by the

IRS. For insurance companies, the starting point for taxable income is income determined

under SAP. SAP income is adjusted based on the provisions of the various tax laws and

regulations. While SAP is generally conservative, tax-basis accounting may be more or less

conservative depending on how political and other factors affect tax legislation. While some

adjustments result in a decrease to taxable income (e.g., tax-exempt income), adjustments

specific to the insurance industry tend to focus on the acceleration of income for tax purposes

(e.g., the discounting of loss reserves and the reduction of unearned premiums).

The Canadian Institute of Chartered Accountants is the body in Canada that defines Canadian

Generally Accepted Accounting Principles (CGAAP). At one time, SAP applied to the

preparation of the Annual Return for Canadian-domiciled insurers. However, this is no longer

the case, and the financial statements included in the Annual Return are prepared in

accordance with CGAAP.

Under CGAAP, policy liabilities can be recorded in accordance with accepted actuarial practice

in Canada, which means that the recorded liabilities are discounted to reflect the time value of

money and include a provision for adverse deviation.

3

U.S. SEC, The Investor’s Advocate: How the SEC Protects Investors, Maintains Market Integrity, and Facilitates

Capital Formation, http://www.sec.gov/about/whatwedo.shtml, March 30, 2020.

4

GASB, Facts About GASB,

http://www.gasb.org/cs/BlobServer?blobcol=urldata&blobtable=MungoBlobs&blobkey=id&blobwhere=11758240

06278&blobheader=application%2Fpdf, 2012.

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part I. Introduction

11

International Financial Reporting Standards (IFRS) provide an accounting framework used by

many countries outside the U.S. IFRS are established by the International Accounting

Standards Board (IASB).

IFRS already affects companies in the U.S. that currently have international subsidiaries or

are subsidiaries of IFRS filers. At the time of the writing of this publication, IFRS 4, which

pertains to the recognition and measurement of insurance contracts, permits insurance

companies to report under the current accounting rules of their local country with slight

modifications. An example of one such modification is requiring companies to establish

premium deficiency reserves, as needed, regardless of local requirements. Given the current

lack of a detailed measurement model under IFRS for insurance contracts, one of the key

initiatives of the IASB is the development of a new accounting standard for insurance

contracts. We will discuss the standard developed by the IASB (and the FASB developments in

this area) and how it differs from the measurement of insurance liabilities today.

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part I. Introduction

12

CHAPTER 2. RELEVANCE OF FINANCIAL REPORTING TO THE ACTUARY

IMPORTANCE AND OBJECTIVES OF FINANCIAL REPORTING

Actuaries estimate the financial impact of insurable events. As such, actuaries need to

understand the accounting rules under which the financial impact is being reported. Consider

the actuary providing an estimate of an insurance company’s unpaid claims for purposes of

comparison to recorded loss reserves on the company’s balance sheet. If the balance sheet is

prepared under Statutory Accounting Principles (SAP), then the loss reserves are recorded on

a net of reinsurance basis. If the company’s financial statements are prepared under

Generally Accepted Accounting Principles (GAAP), then the loss reserves are recorded gross

of reinsurance. For comparison purposes, the actuarial estimate of unpaid claims would need

to be prepared on a net basis for SAP and gross basis for GAAP. The actuary might also

provide an estimate of unpaid claims ceded to the company’s reinsurers, for comparison to

the reinsurance recoverable amount recorded as an asset on a GAAP basis.

Actuaries providing estimates of unpaid claims on a SAP basis must also be aware of state

regulations under which the company is recording its loss reserves. For example, while the

National Association of Insurance Commissioners Accounting Practices and Procedures

Manual permits companies to discount workers’ compensation reserves on a tabular basis,

5

certain states have varying requirements with respect to whether and how the tabular

discount is applied. For instance, as of December 31, 2018, the state of Montana permitted

discounting of both workers’ compensation indemnity and medical tabular reserves (excluding

LAE) but required use of a specific interest rate in the calculation (4%).

6

To take this one step further, actuaries issuing Statements of Actuarial Opinion should include

a statement within the opinion stating that the company’s recorded loss and loss adjustment

expense reserves “meet the requirements of the insurance laws of (state of domicile).”

7

The

opining actuary is therefore required to read the state regulations and confirm that the

recorded reserves meet the state laws.

The accounting convention is not only important to the reserving actuary for an insurance

company, but also to actuaries who perform other jobs, including but not limited to the

following:

• Working with regulators to monitor the financial health of insurance companies

5

According to page C-3 of the American Academy of Actuaries, 2018 Property/Casualty Loss Reserve Law Manual,

tabular reserves are defined as “indemnity reserves that are calculated using discounts determined with reference

to actuarial tables that incorporate interest and contingencies such as mortality, remarriage, inflation, or recovery

from disability applied to a reasonably determinable payment stream. This definition shall not include medical loss

reserves or any loss adjustment expense reserves.”

6

American Academy of Actuaries, Property/Casualty Loss Reserve Law Manual, 2018, page 250.

7

NAIC, Annual Statement Instructions Property/Casualty, 2018, page 12.

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part I. Introduction

13

• Pricing and designing insurance products, including development of profit margins

• Determining capital requirements to support the various risks of an insurer

• Evaluating risk transfer of reinsurance contracts

• Assessing reserve adequacy for non-insurance entities, such as organizations that

self-insure or retain a portion of their property/casualty insurance exposures

• Preparing tax returns

• Appraising and valuing insurance companies in merger and acquisitions

For each of the above, the result of the work performed will differ depending on the

accounting framework used, illustrating the need for actuaries in different disciplines to be

knowledgeable about the various accounting and financial reporting frameworks.

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part I. Introduction

14

CHAPTER 3. OVERVIEW OF THIS PUBLICATION

ROADMAP

This publication begins with an overview of basic accounting concepts (Part II. Overview of

Basic Accounting Concepts) and then delves into the fundamental aspects of the statutory

Annual Statement and certain supplemental filings, that provide the means for financial

reporting in the U.S. under Statutory Accounting Principles (SAP) (Part III. SAP in the U.S.:

Fundamental Aspects of the Annual Statement and Part IV. Statutory Filings to Accompany

the Annual Statement). Measurement tools used to evaluate the financial health of a

property/casualty insurance company are discussed in Part V. Financial Health of

Property/Casualty Insurance Companies in the U.S. These tools are particularly important to

regulators in monitoring solvency for the purpose of protecting the stakeholders of an

insurance company. We then investigate differences between statutory reporting and other

financial reporting frameworks in the U.S., namely Generally Accepted Accounting Principles,

International Financial Reporting Standards and tax accounting in Part VI. Differences from

Statutory to other Financial/Regulatory Reporting Frameworks in the U.S. We move on to

Canada to provide a discussion of Canadian accounting principles (Part VII. Canadian-Specific

Reporting). The publication closes with a discussion of the future of SAP and evolution of new

accounting frameworks, differentiating between what is “real” and what is only in the

discussion phase at the time of publication of this text (Part VIII. The Future of SAP).

ANNUAL STATEMENTS REFERENCED THROUGHOUT THE PUBLICATION

The Casualty Actuarial Society (CAS) Syllabus Committee and authors of this publication

agreed that it would be helpful for students studying for the CAS exams to be able to rely as

much as possible on one insurance company throughout the publication to illustrate the major

concepts. For the U.S. examples, the CAS Syllabus Committee has assisted us in creating

excerpts of a 2011 Annual Statement for a fictional insurance company named Fictitious

Insurance Company (Fictitious). The excerpts of this statement are contained in Appendix I of

this publication.

We have relied on the Annual Statement excerpts for Fictitious for the more detailed

examples and calculations. We also referenced the National Association of Insurance

Commissioners 2011 Property and Casualty Annual Statement Blank, which was also included

on the CAS Exam 6 U.S. Syllabus at the time this publication was originally written. We have

updated the dates in the Fictitious Annual Statement to year-end 2018, as well as specific

schedules noted in the Foreword of this edition. We recommend that the current version of

the Annual Statements (Blank and those for specific companies referenced on the current

Exam 6 U.S. Syllabus) be viewed side by side with this publication when reading and working

through examples and following the flow of exhibits, notes, interrogatories, and schedules

within the Annual Statement.

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part I. Introduction

15

For Canada, we have used the 2018 aggregate experience of Canadian insurers as published

on the website of the Office of the Superintendent of Financial Institutions (OSFI). As with the

U.S. chapters, we recommend that the student have this information by his or her side when

reading the Canadian chapters of this publication.

We also acknowledge that there may be differences between exhibits within an Annual

Statement; such differences are due to rounding.

BACKGROUND ON FICTITIOUS INSURANCE COMPANY

The authors of this publication felt it important to provide some background information on

Fictitious and describe the landscape in which Fictitious was operating during the time period

covered when the Annual Statement was originally compiled (December 31, 2011). This will

provide additional context for students when reading and interpreting the figures contained

therein.

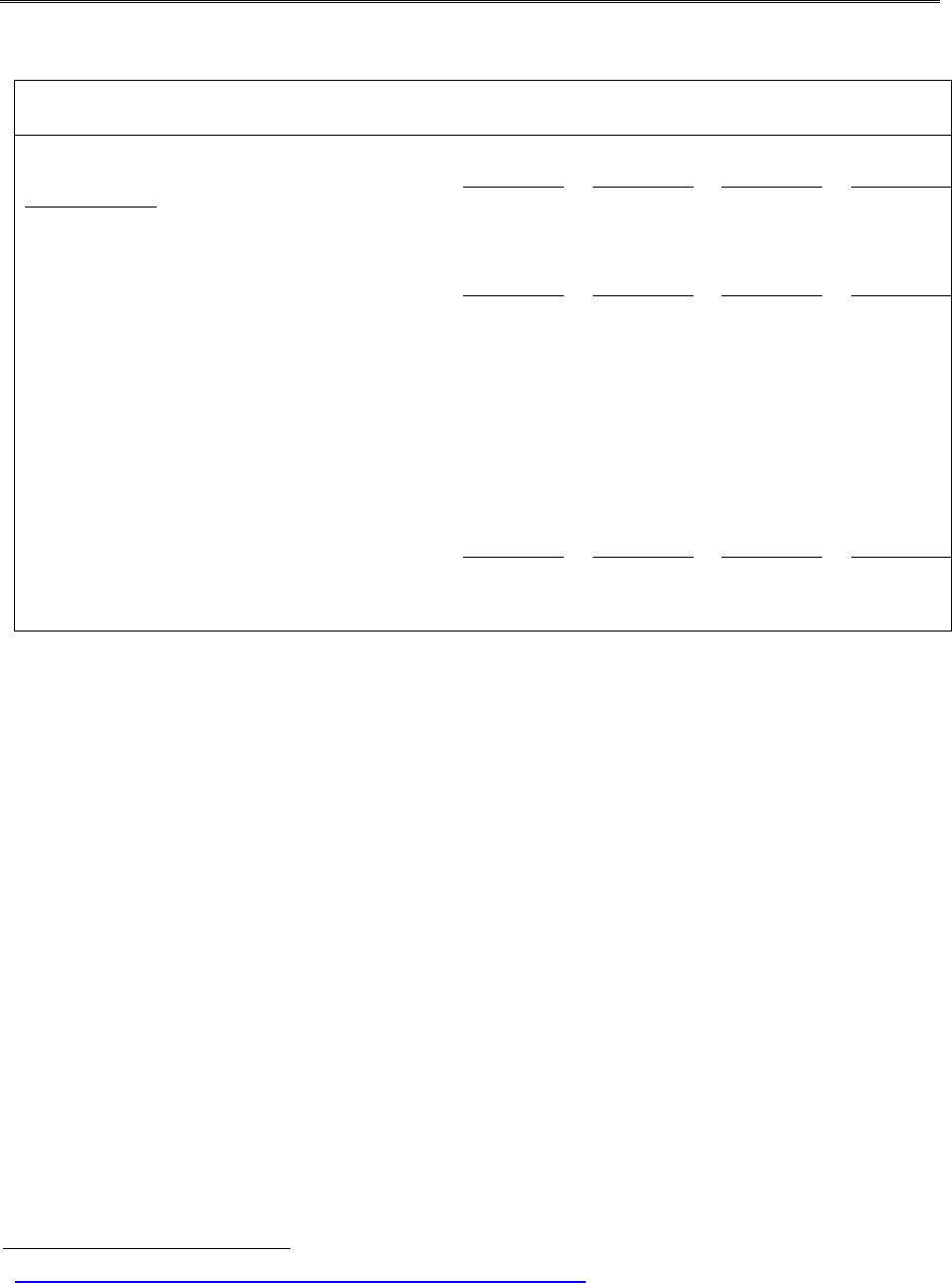

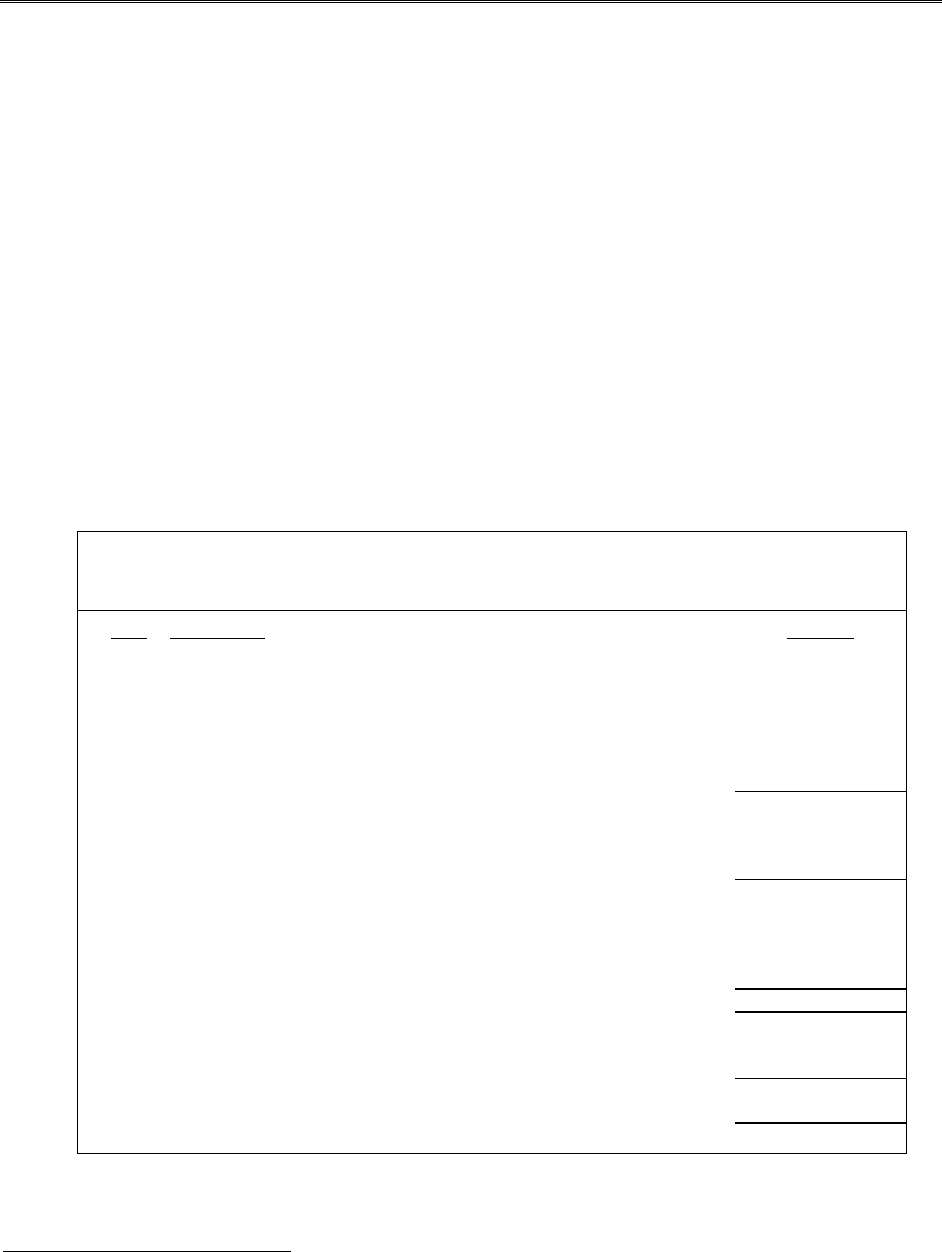

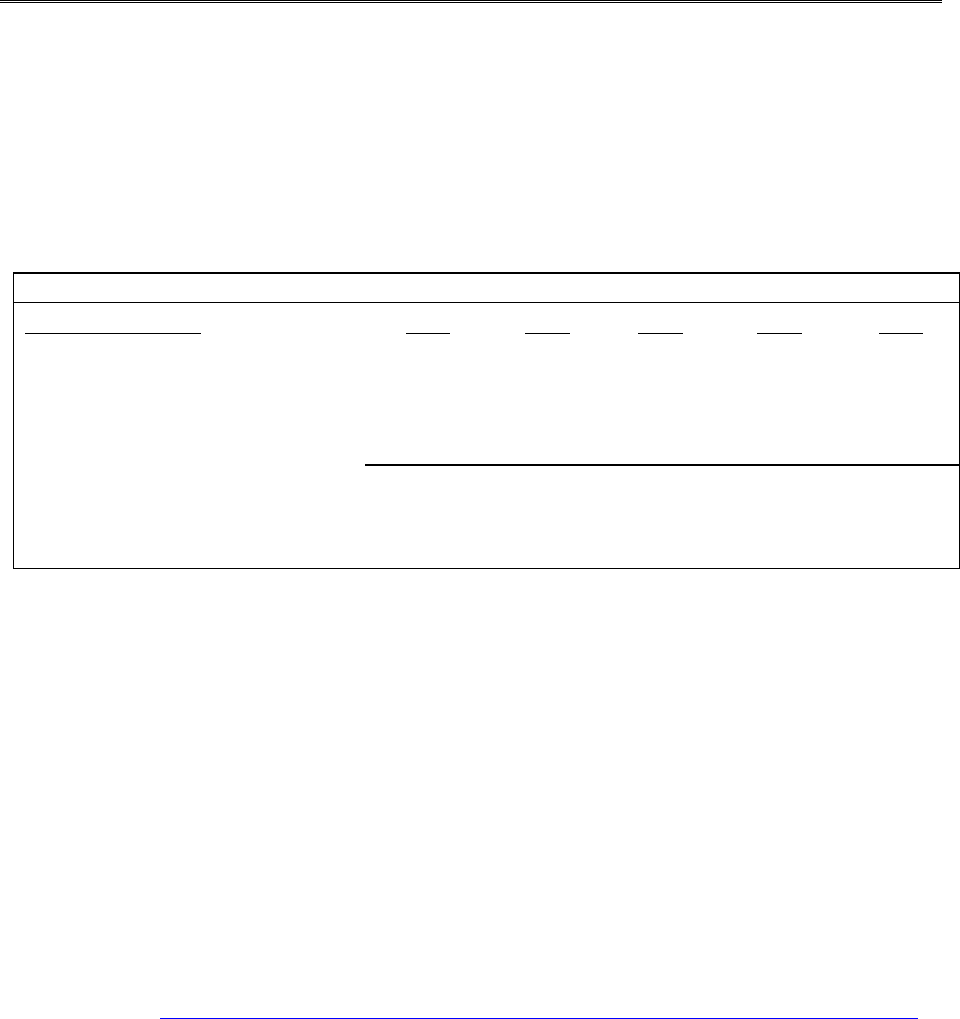

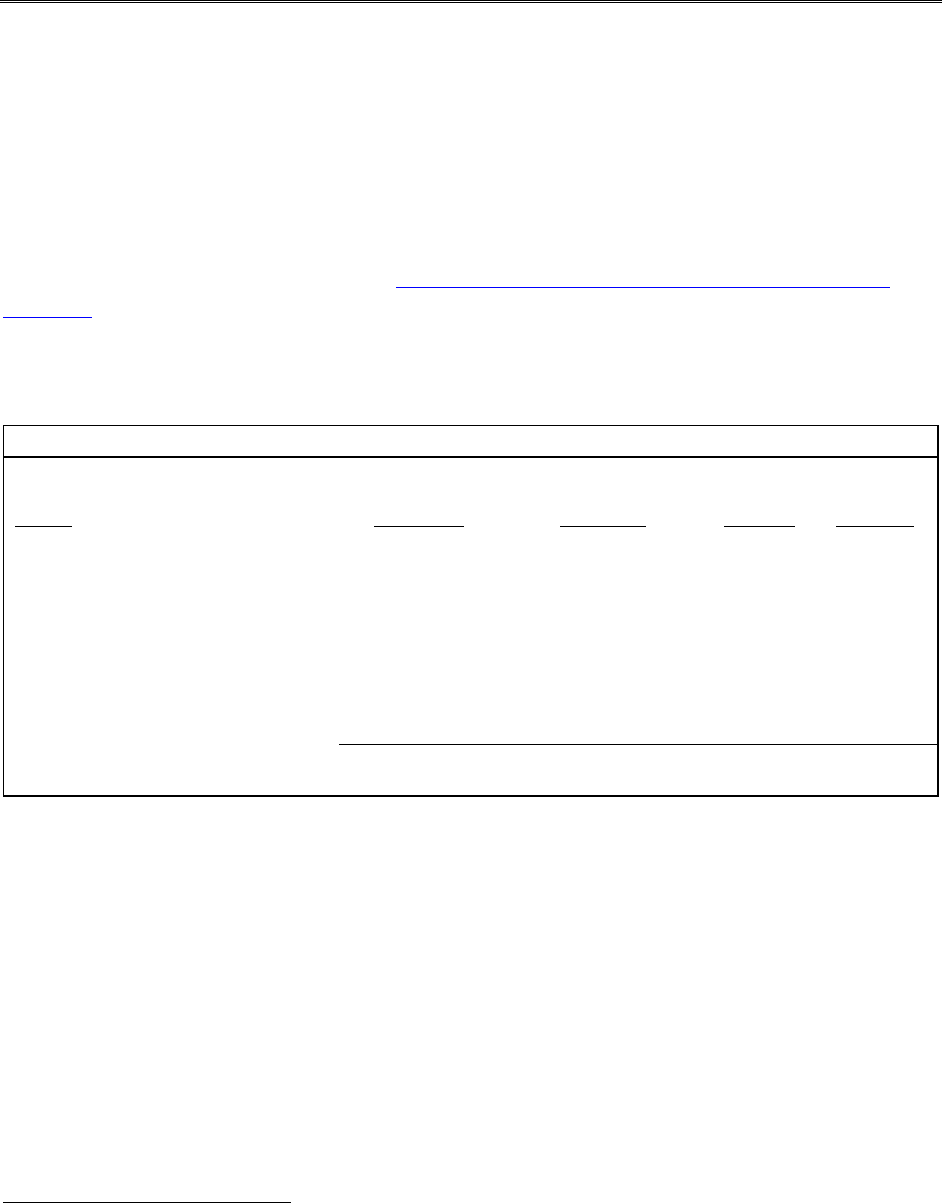

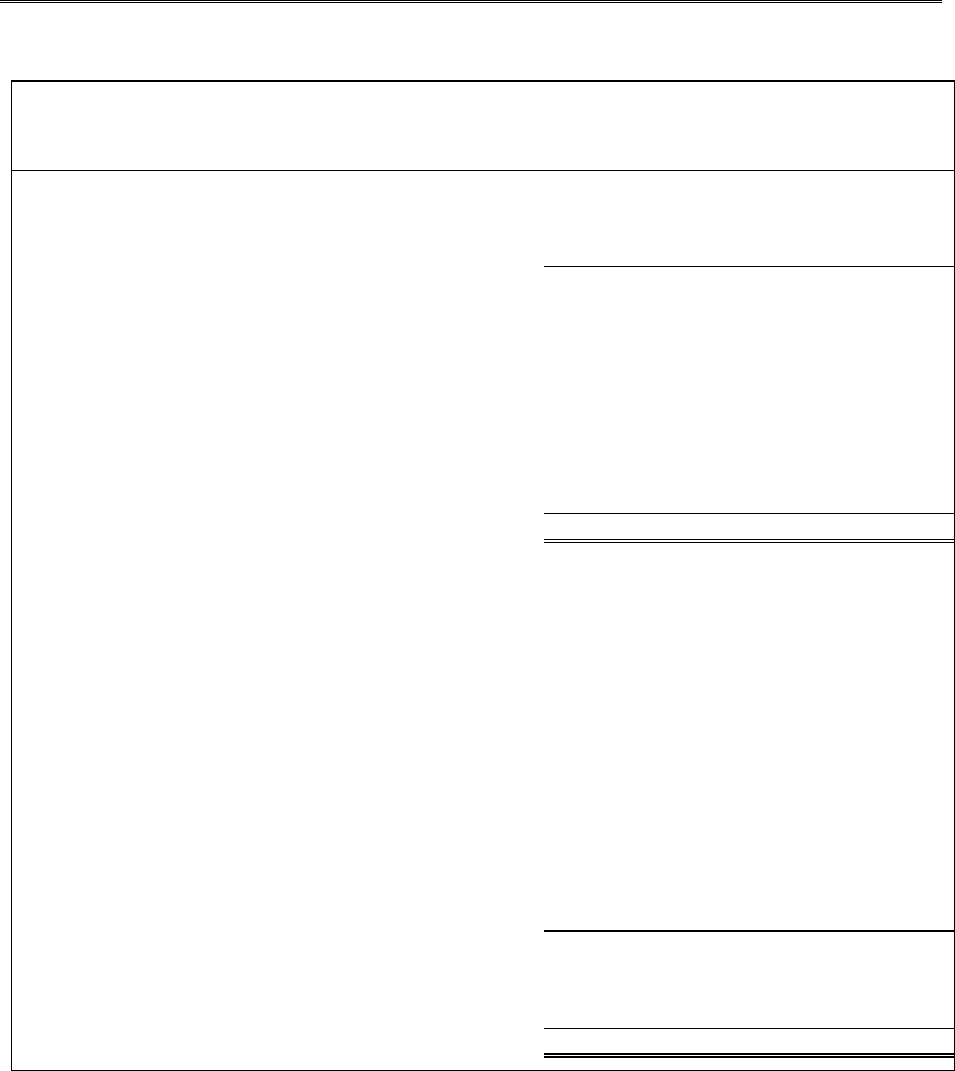

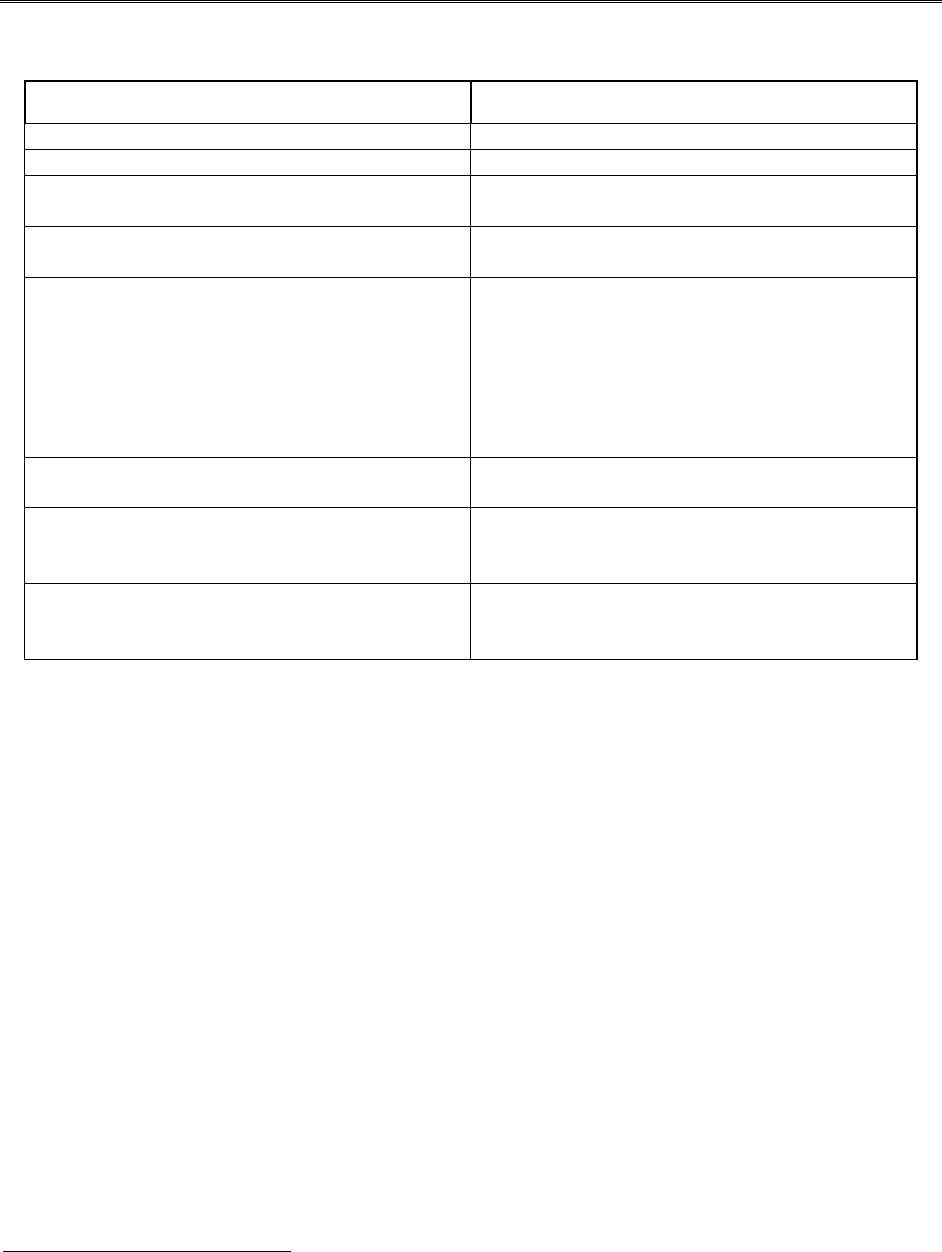

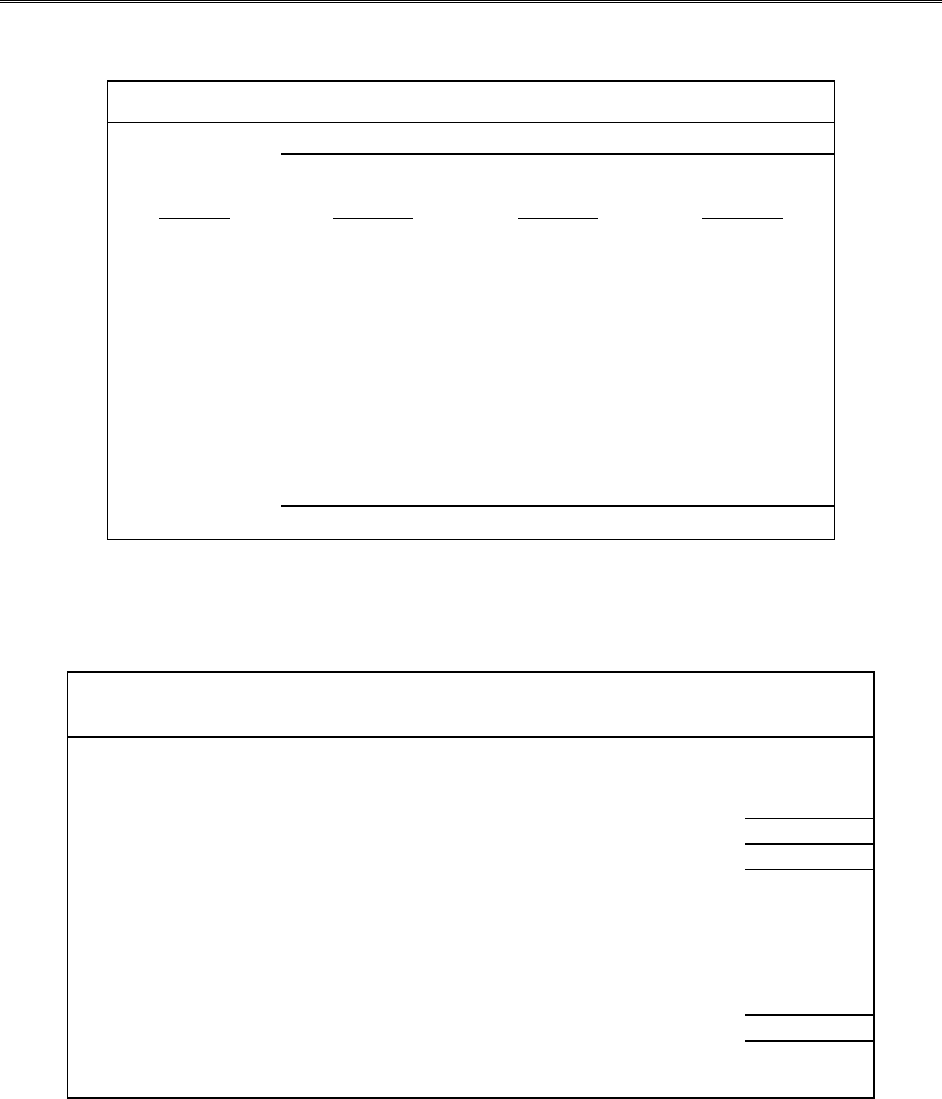

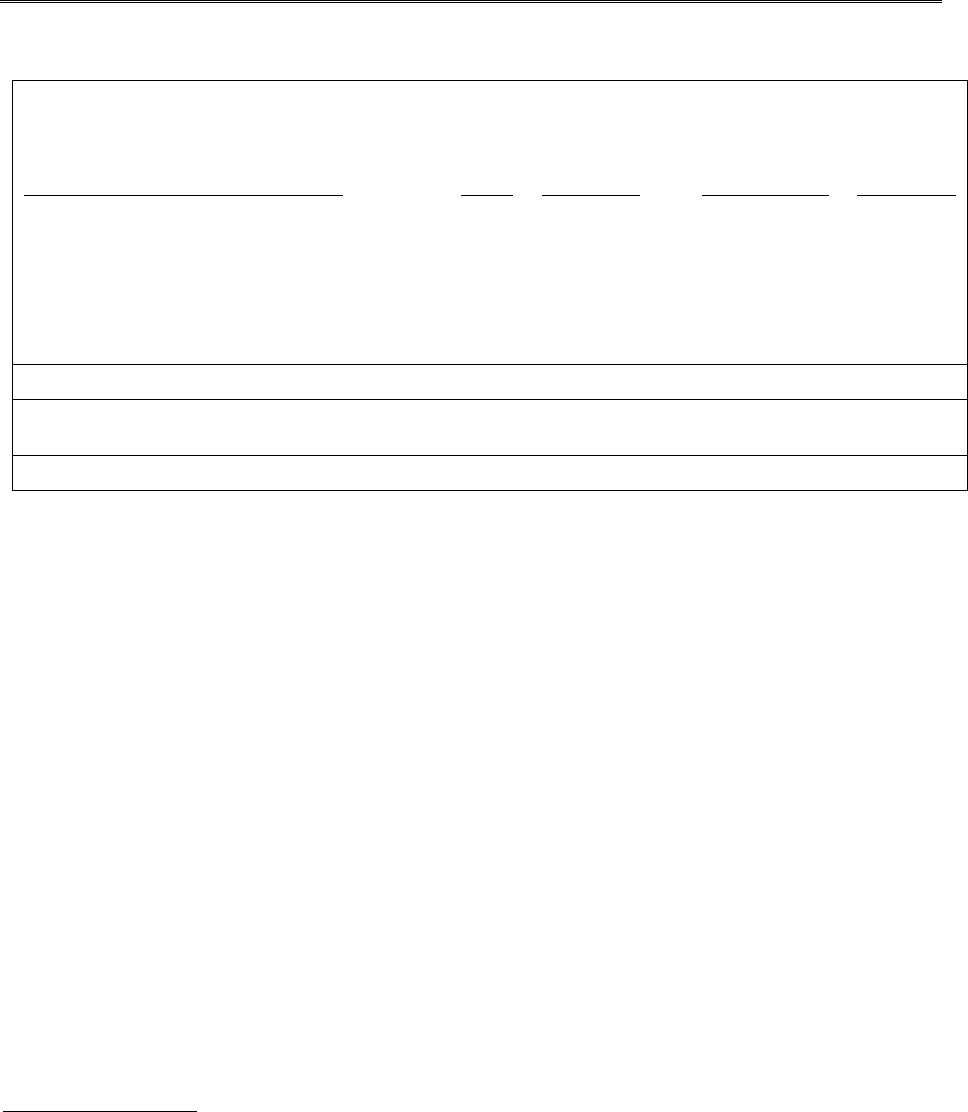

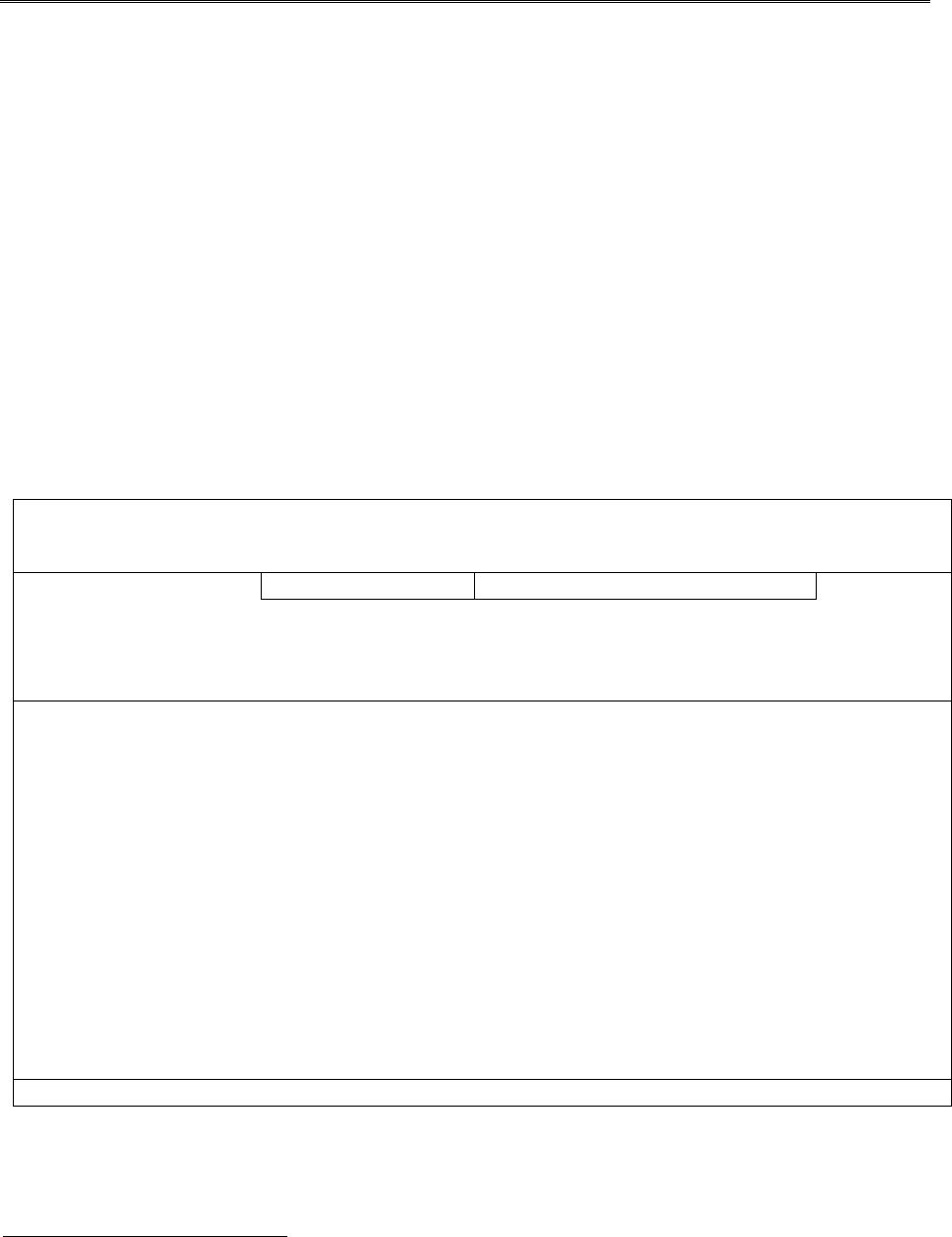

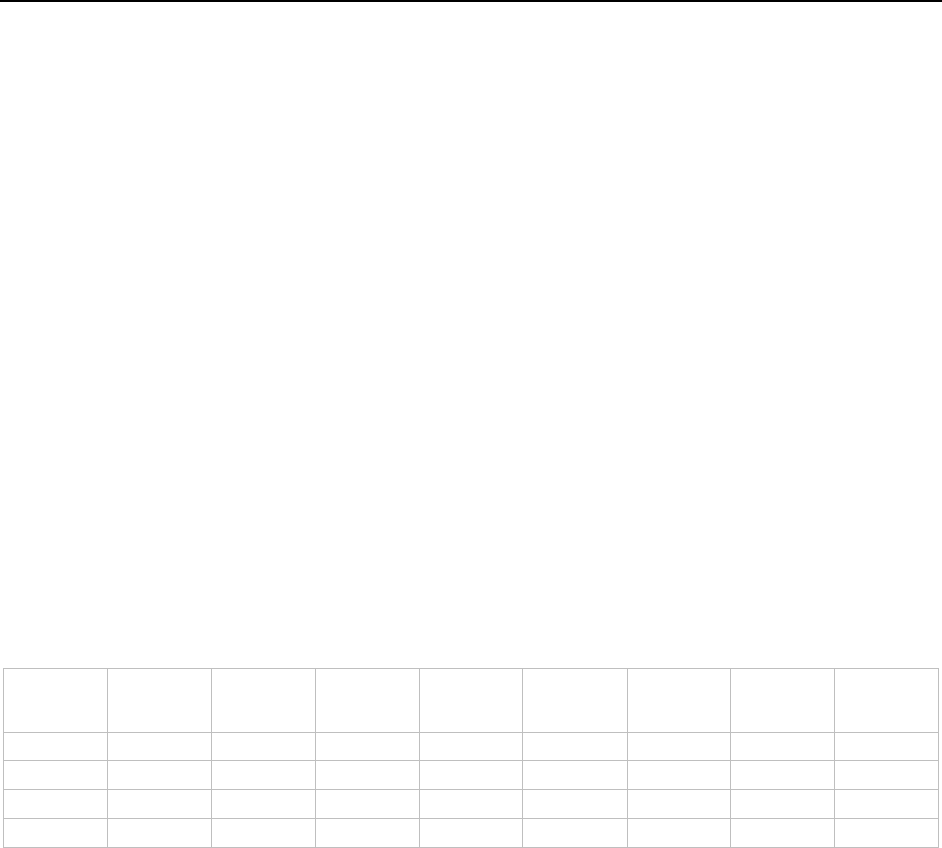

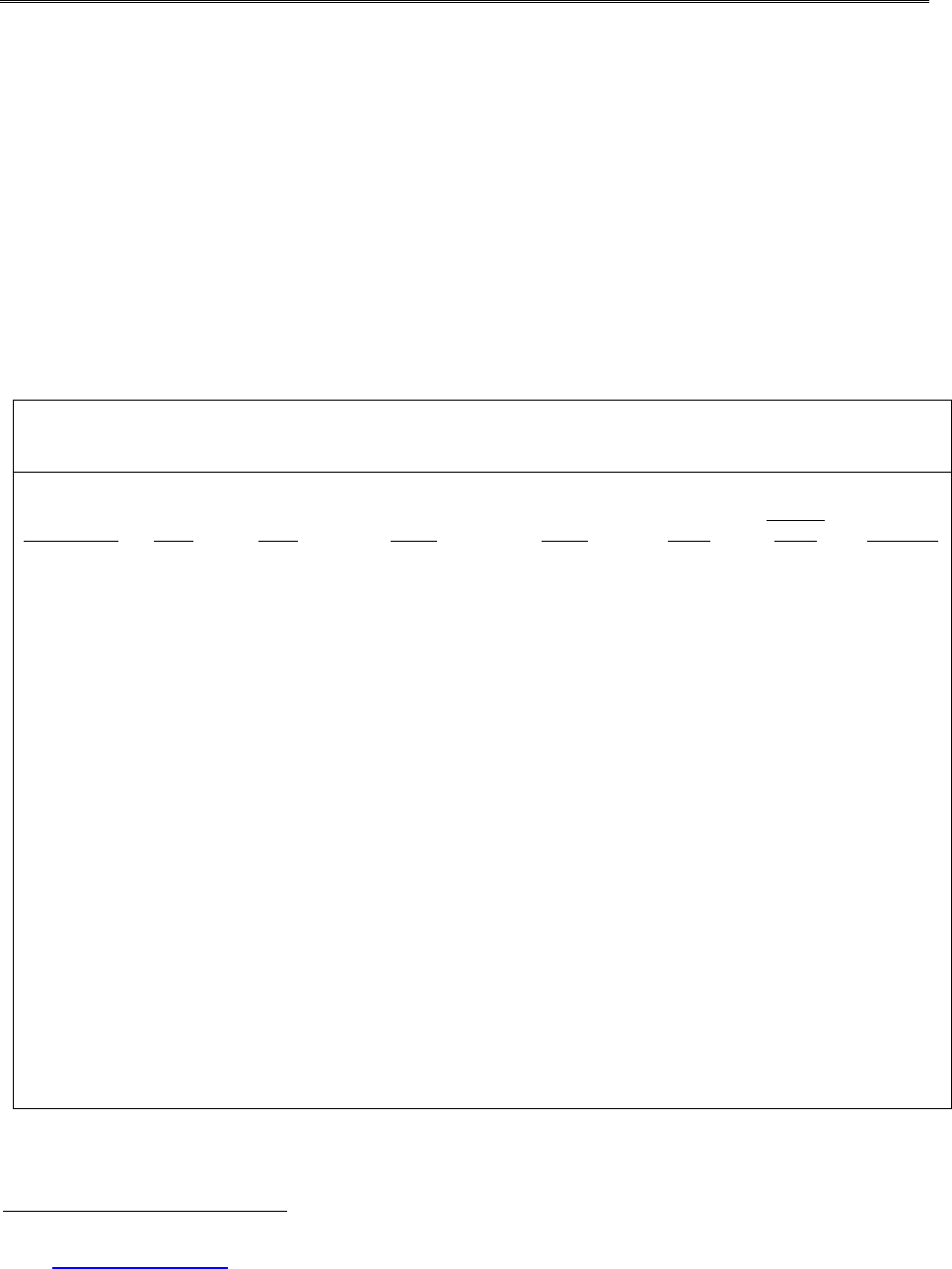

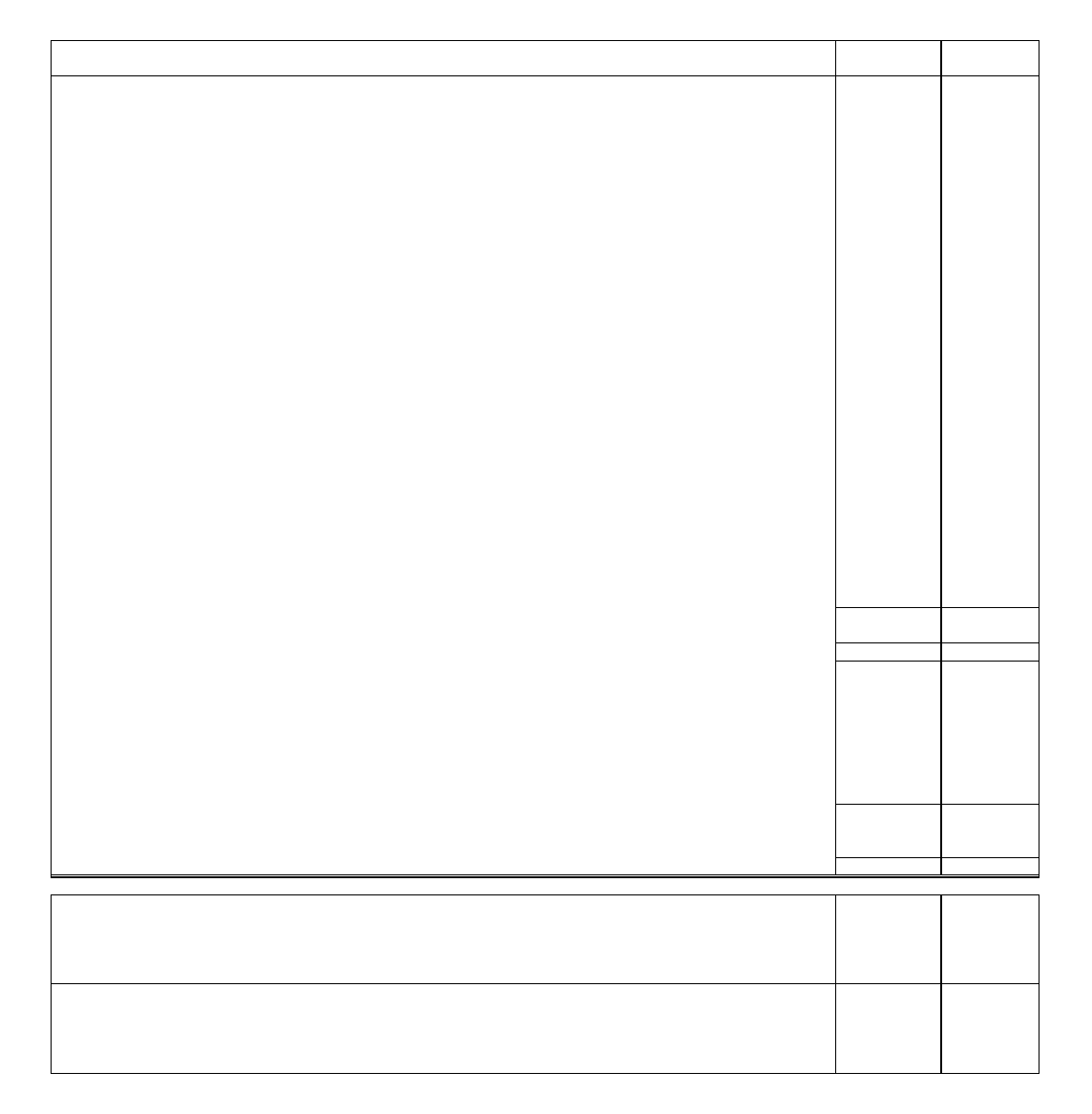

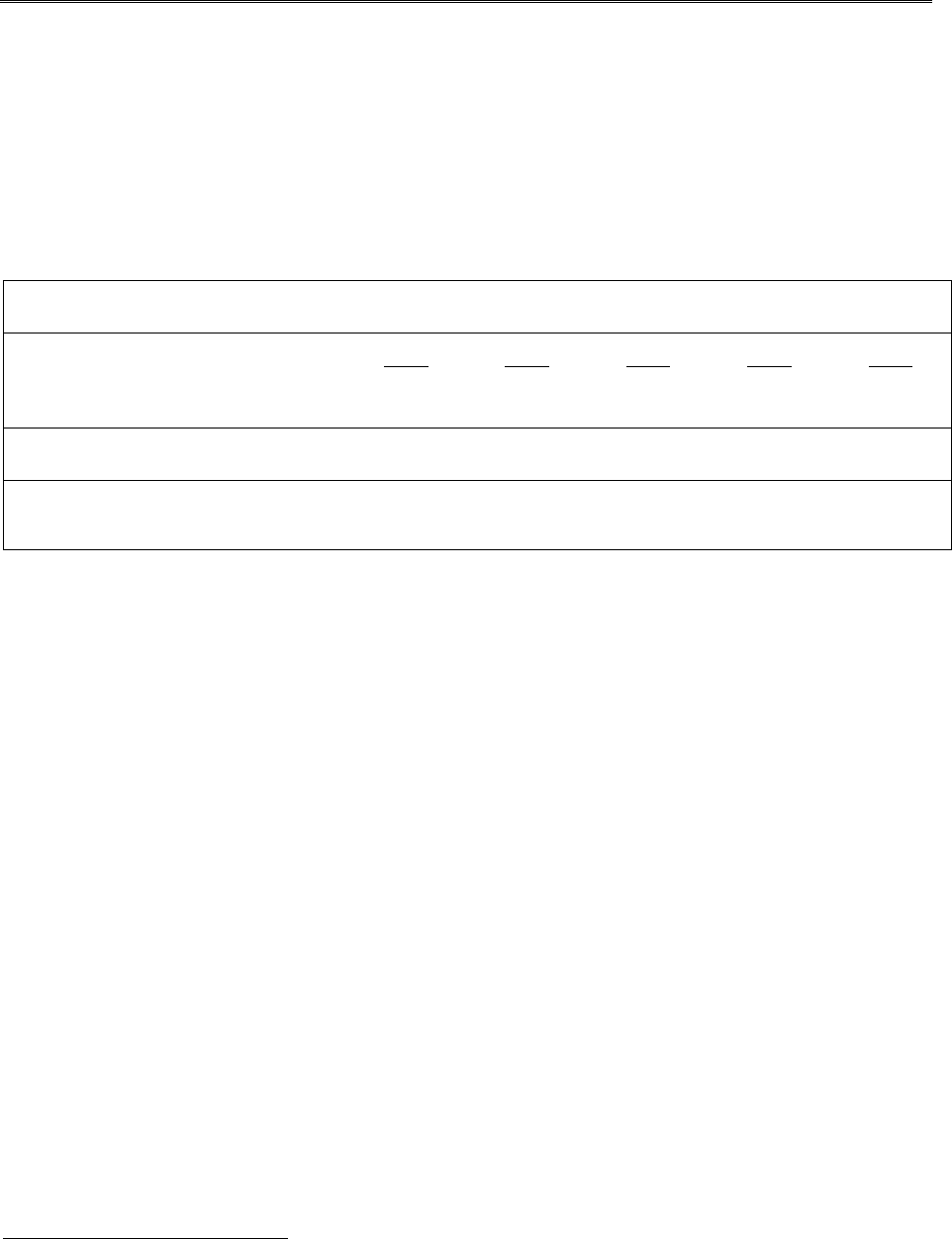

Fictitious is a publicly held property/casualty insurance company in the U.S. As displayed in

Table 1, approximately one-third of the company’s writings in 2018 were in personal lines

markets, with the remainder in commercial markets. Homeowners multiple peril

(homeowners) was the largest single line written in 2018 on a net of reinsurance basis (17%

of net written premium), followed by workers’ compensation (15% of net written premium)

and other liability — occurrence (13% of net written premium). The company wrote business in

all 50 states in the U.S. and was therefore exposed to natural catastrophes and weather-

related events in 2018.

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part I. Introduction

16

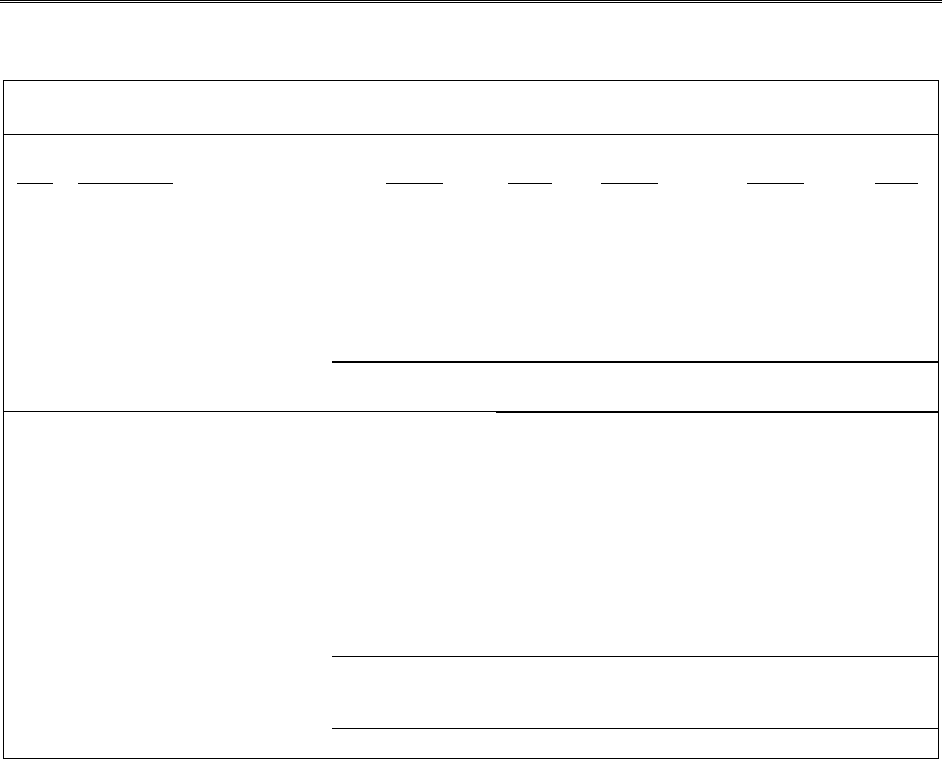

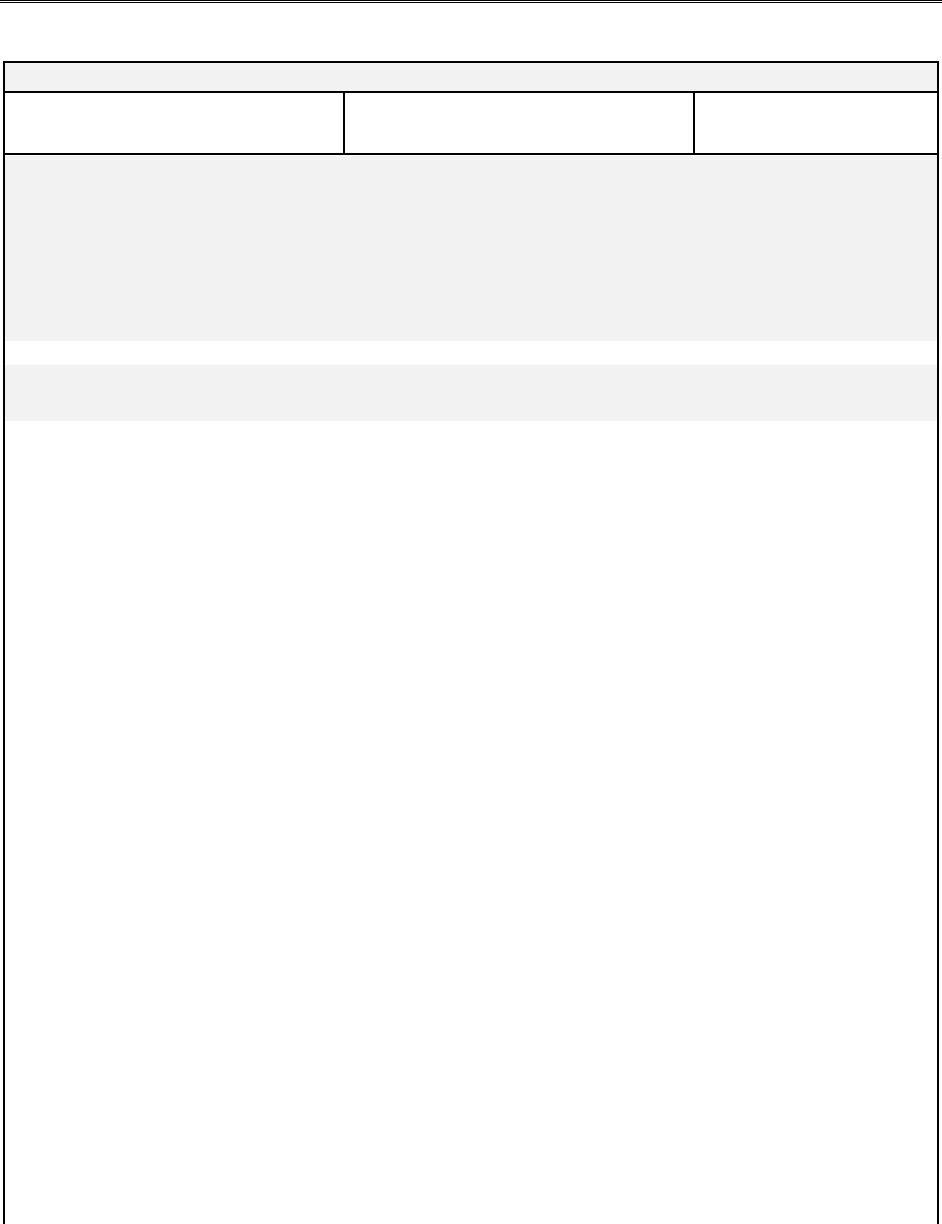

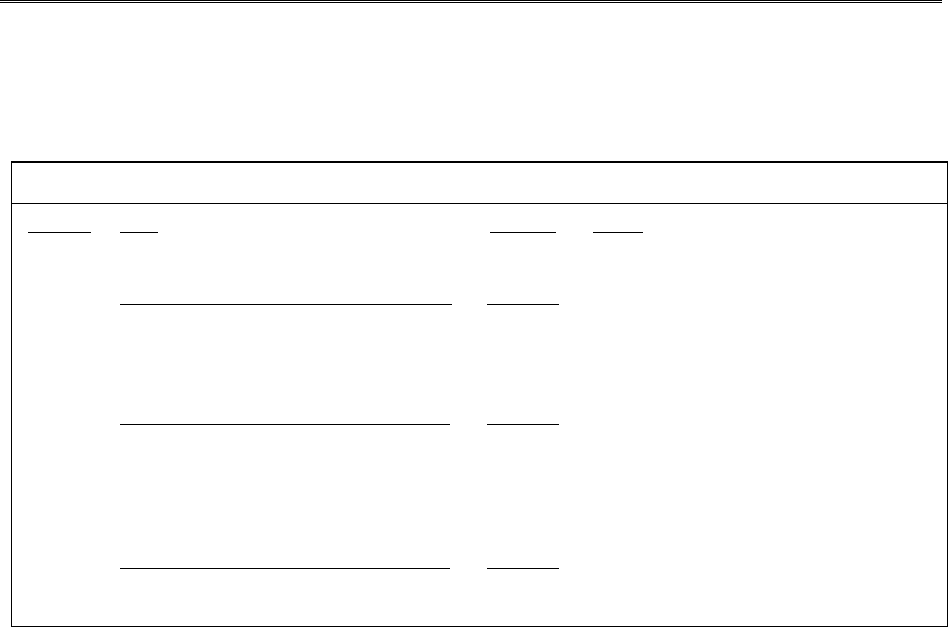

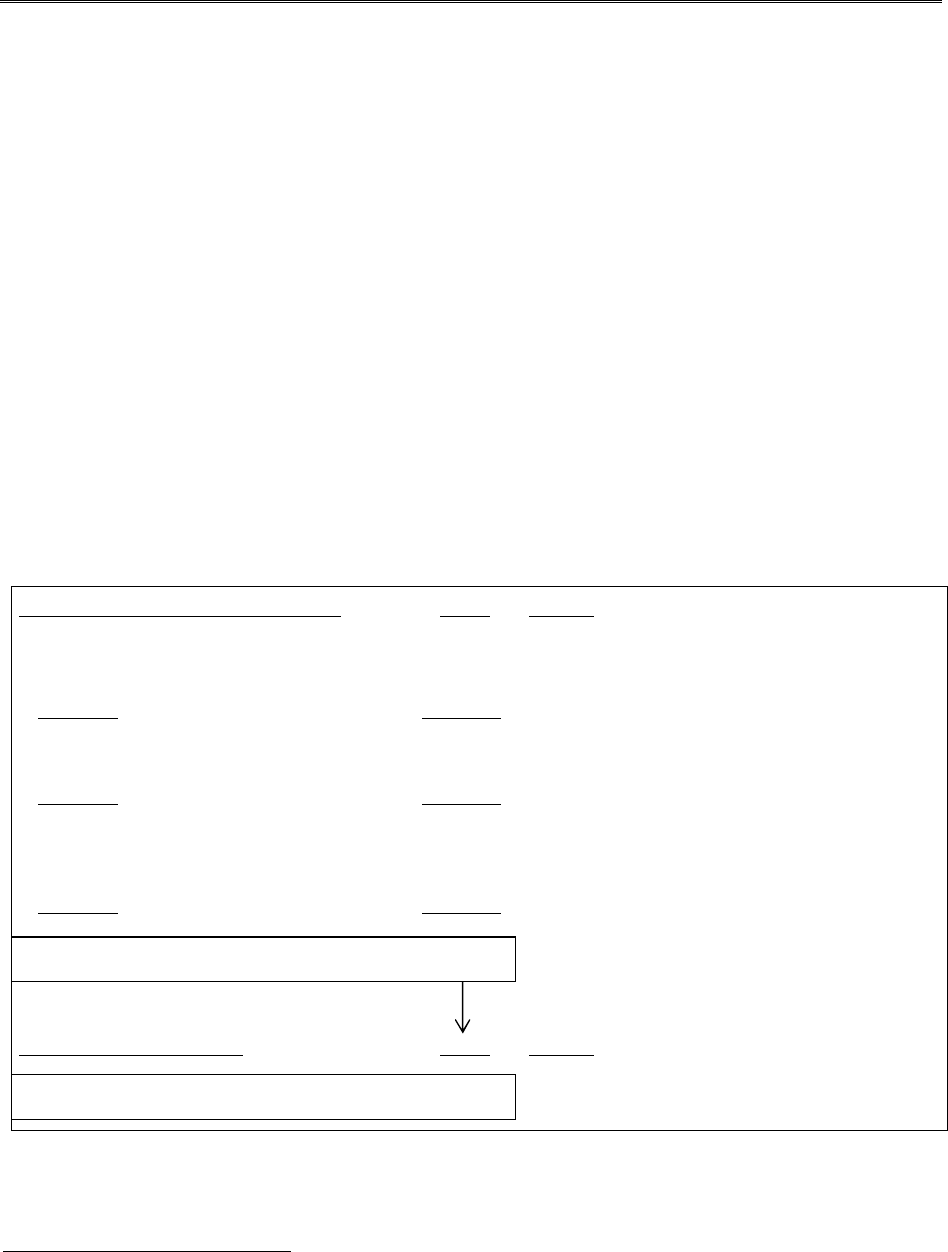

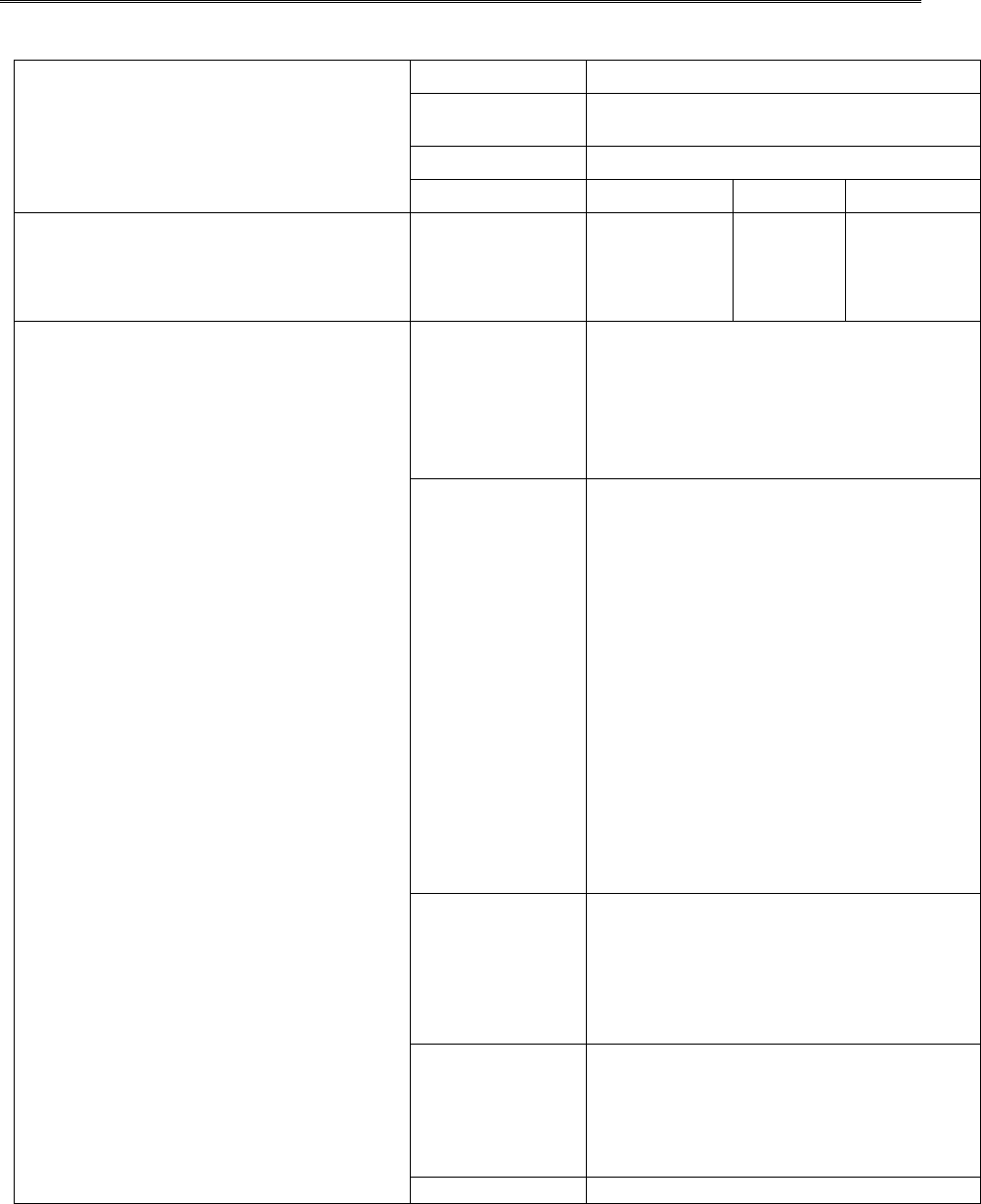

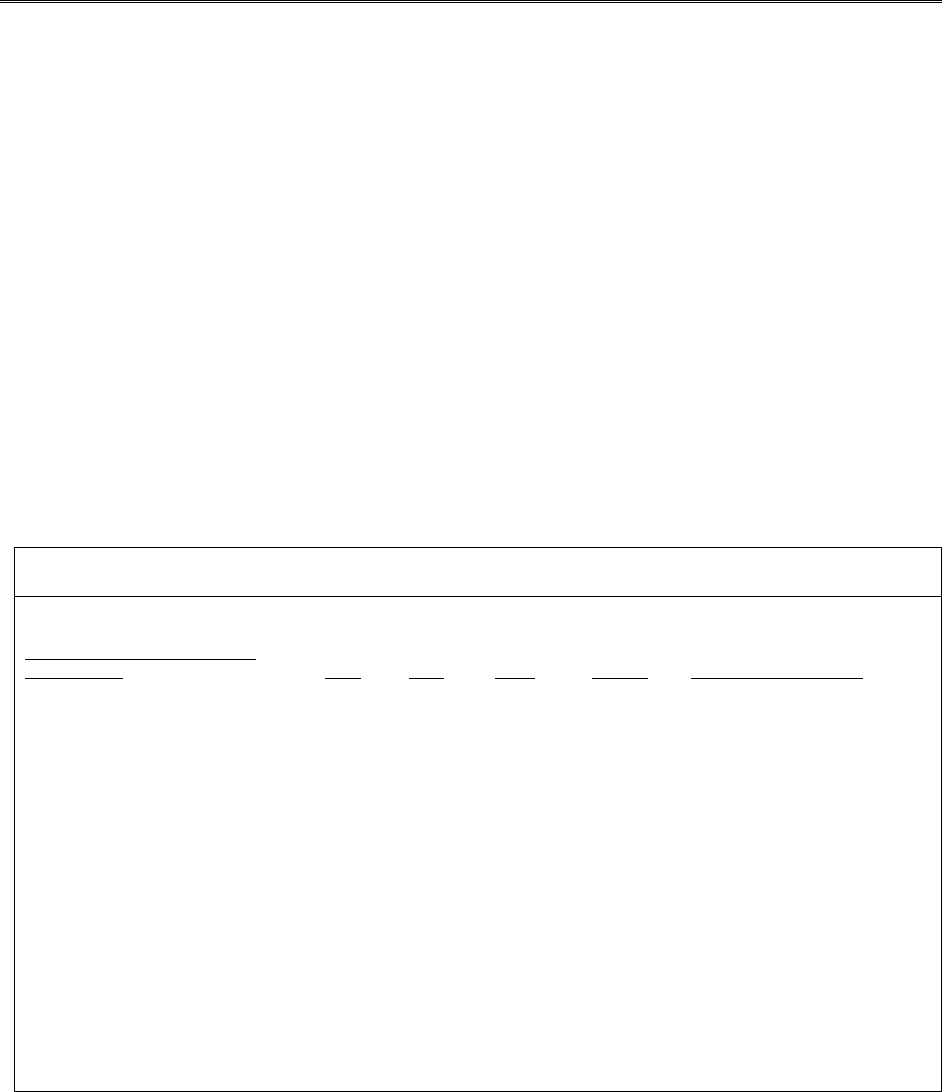

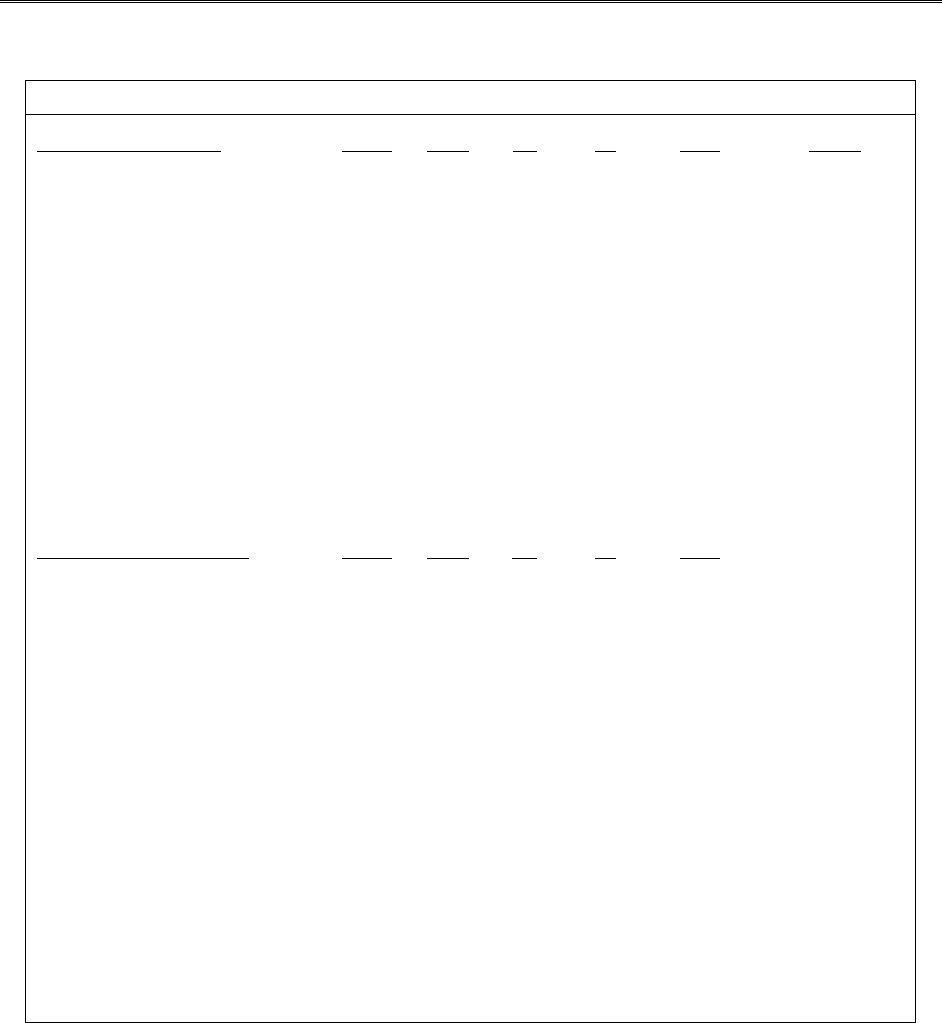

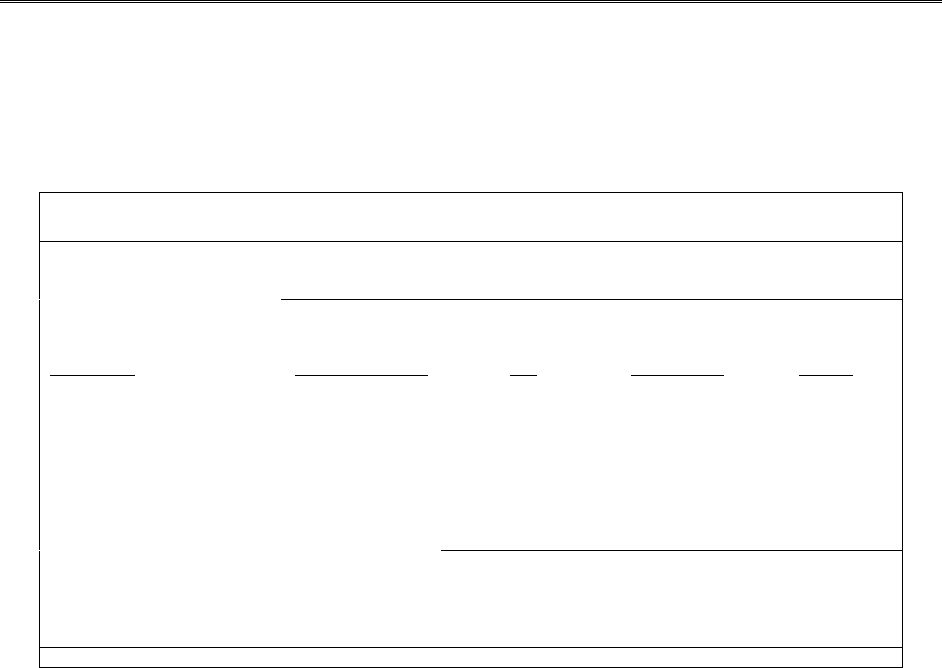

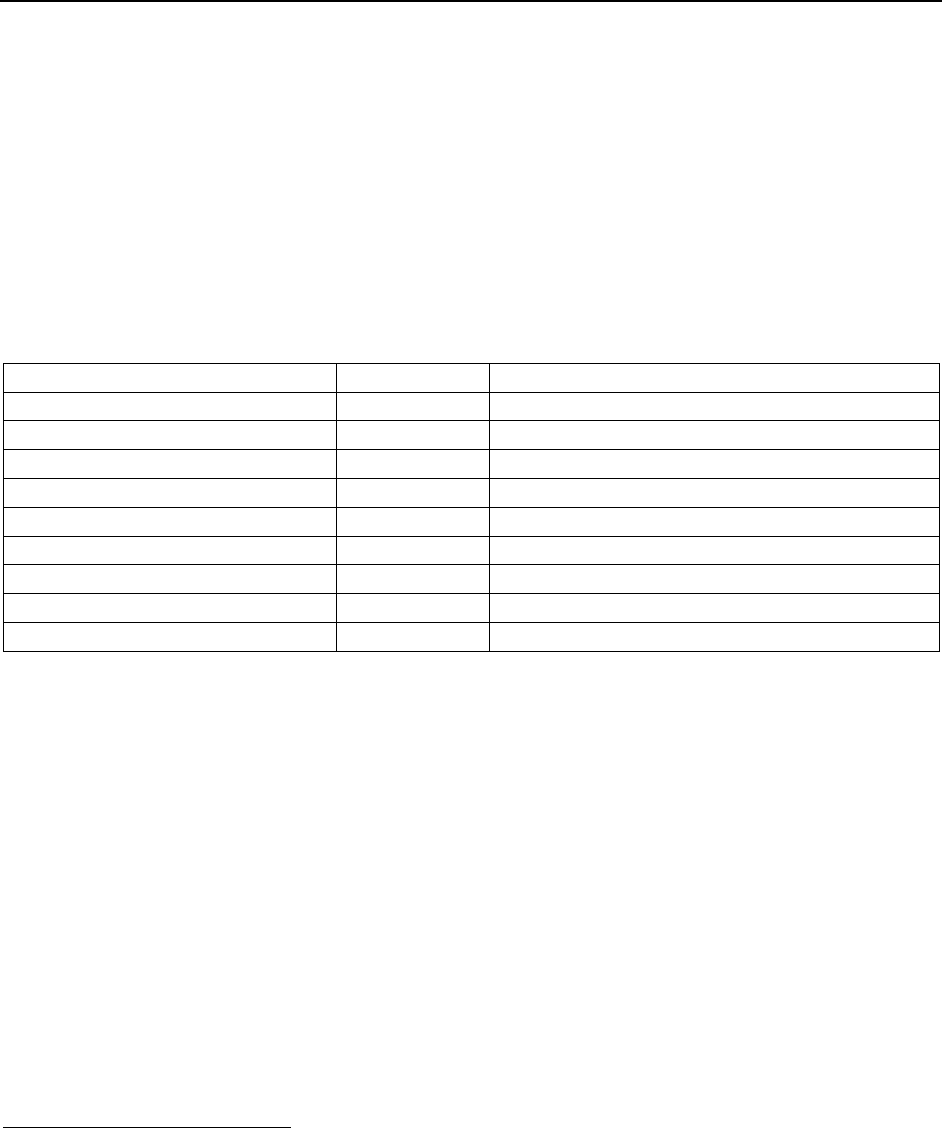

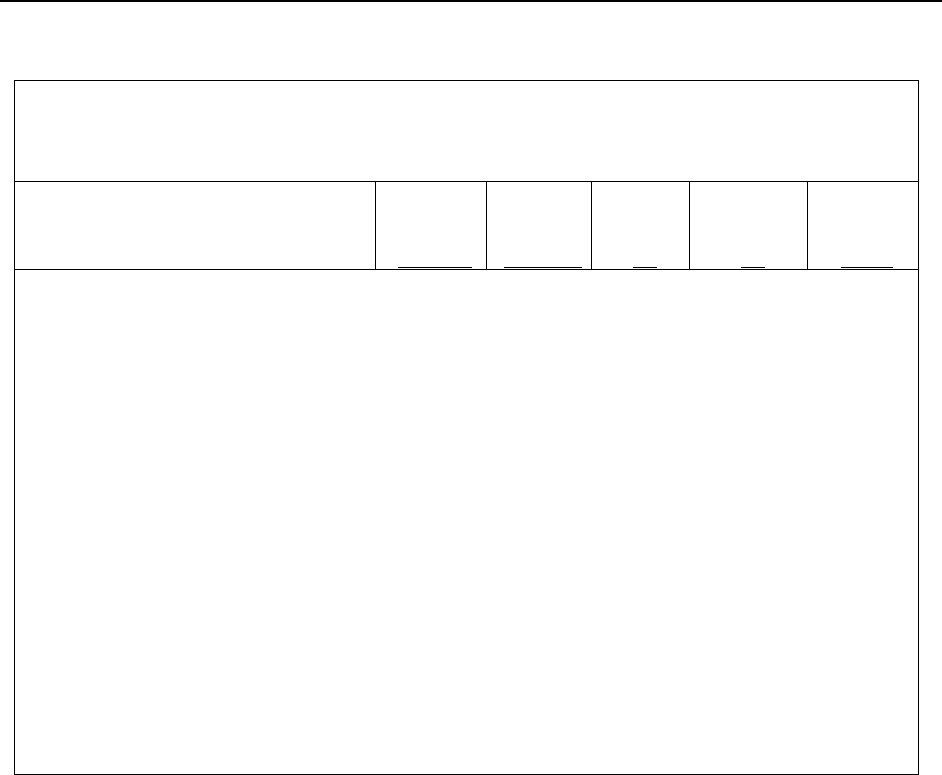

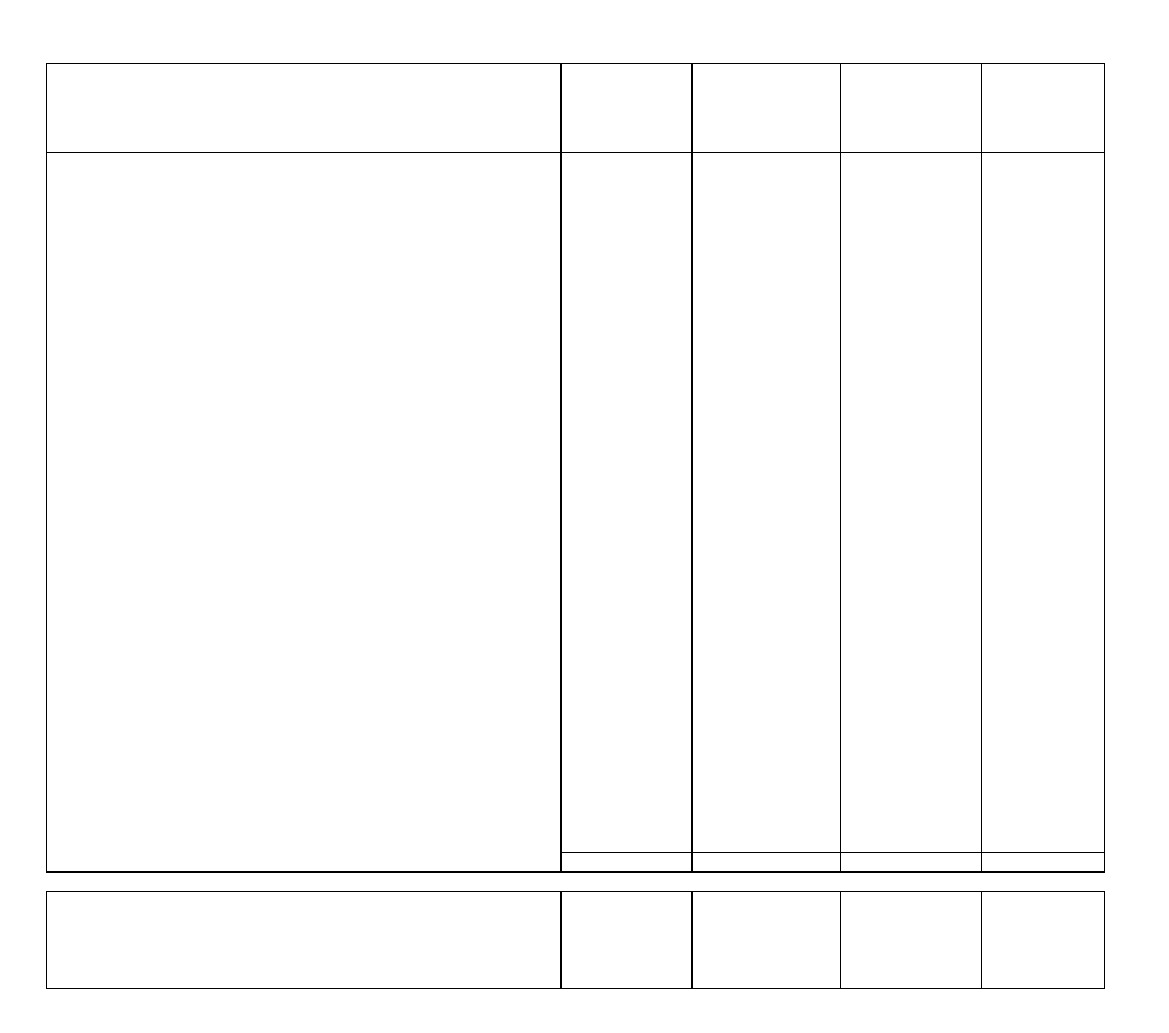

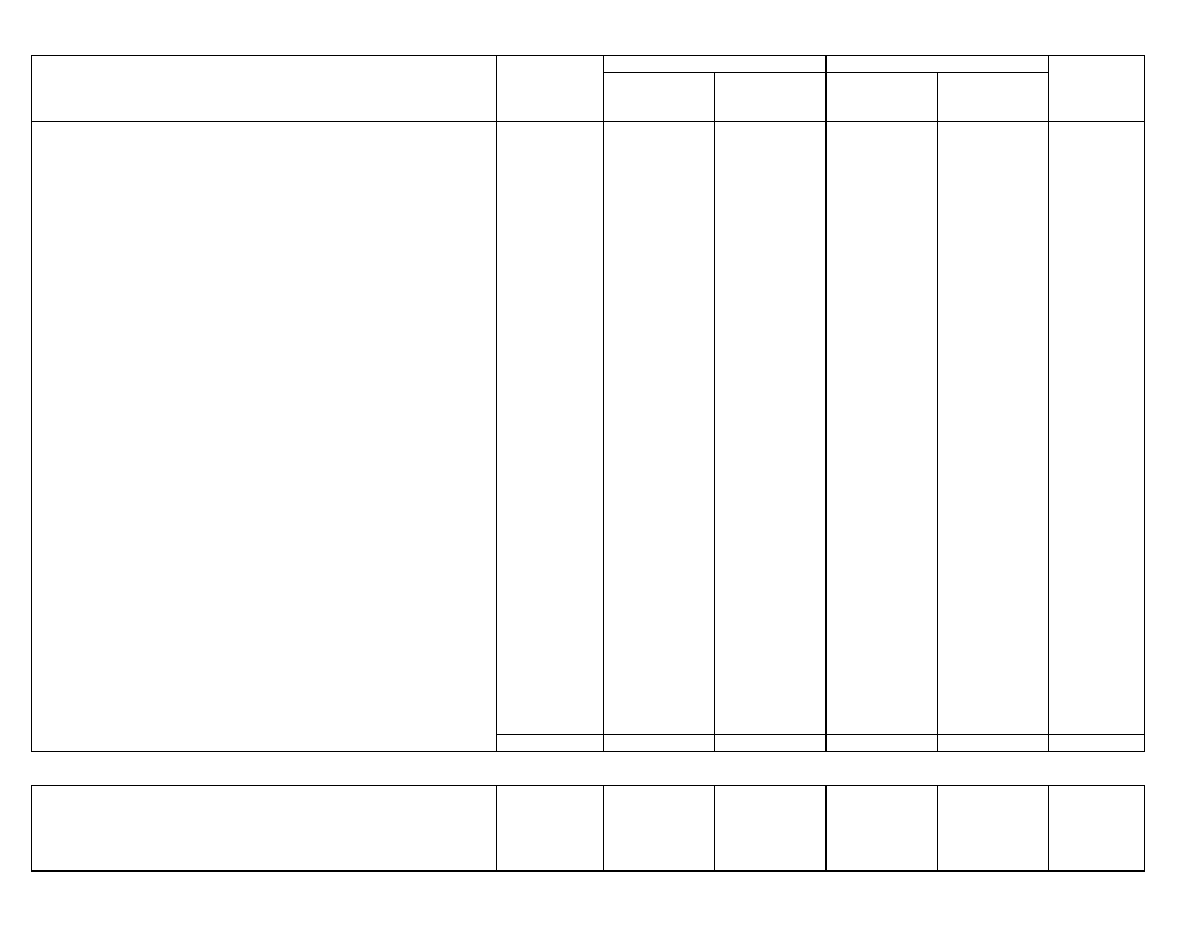

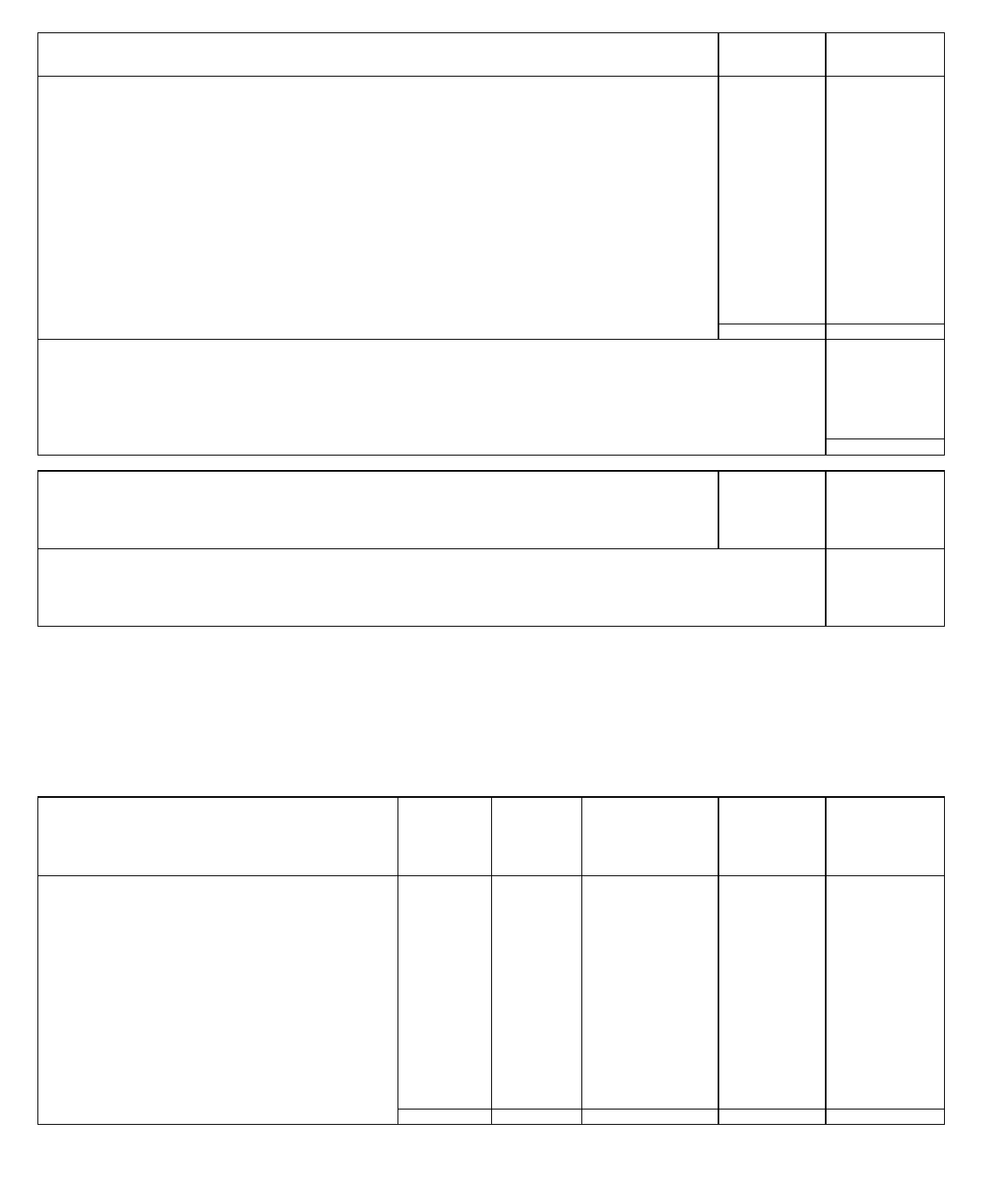

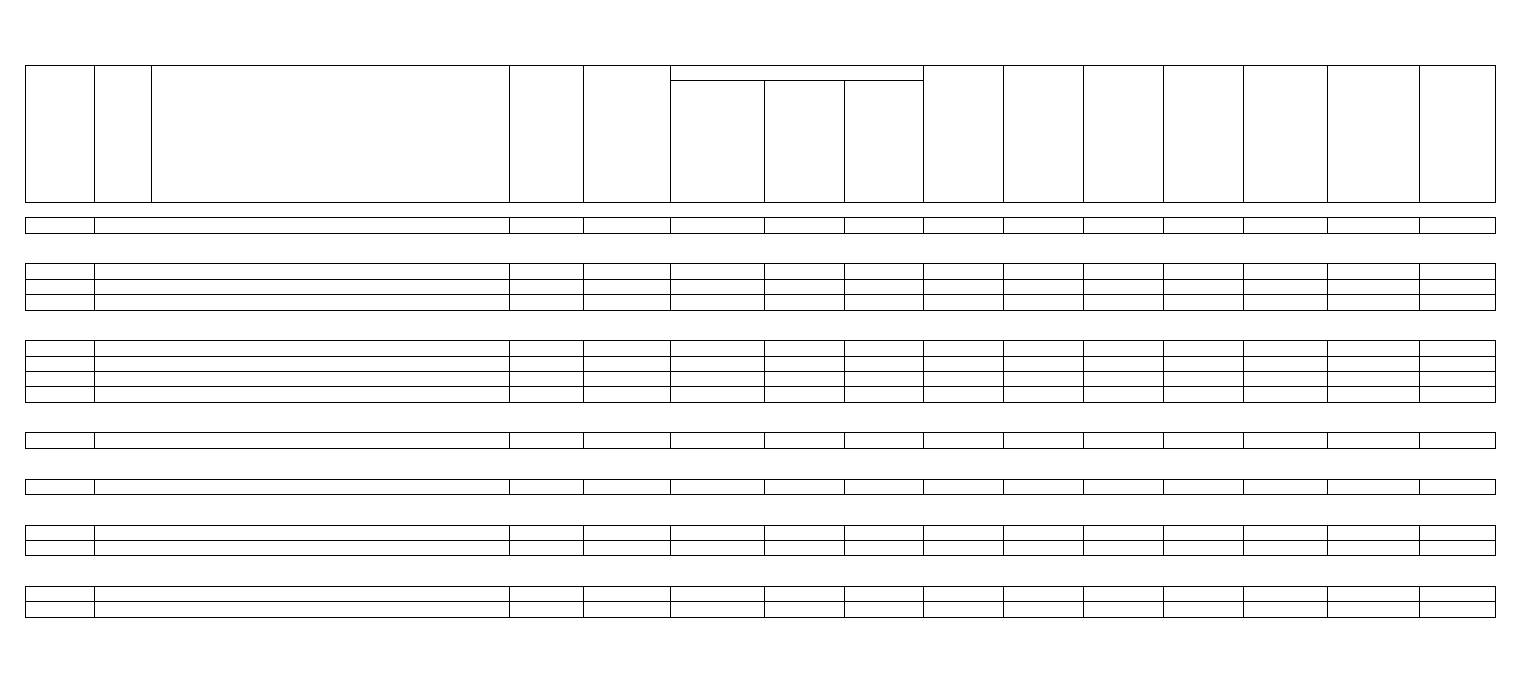

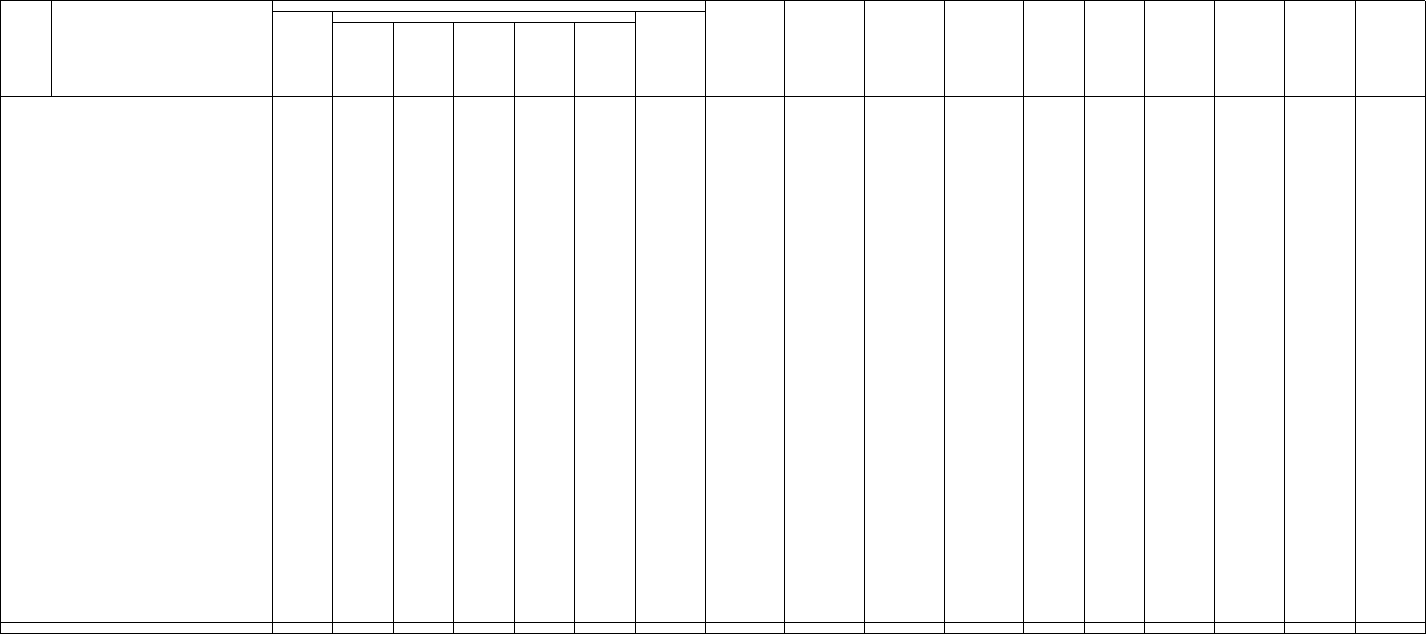

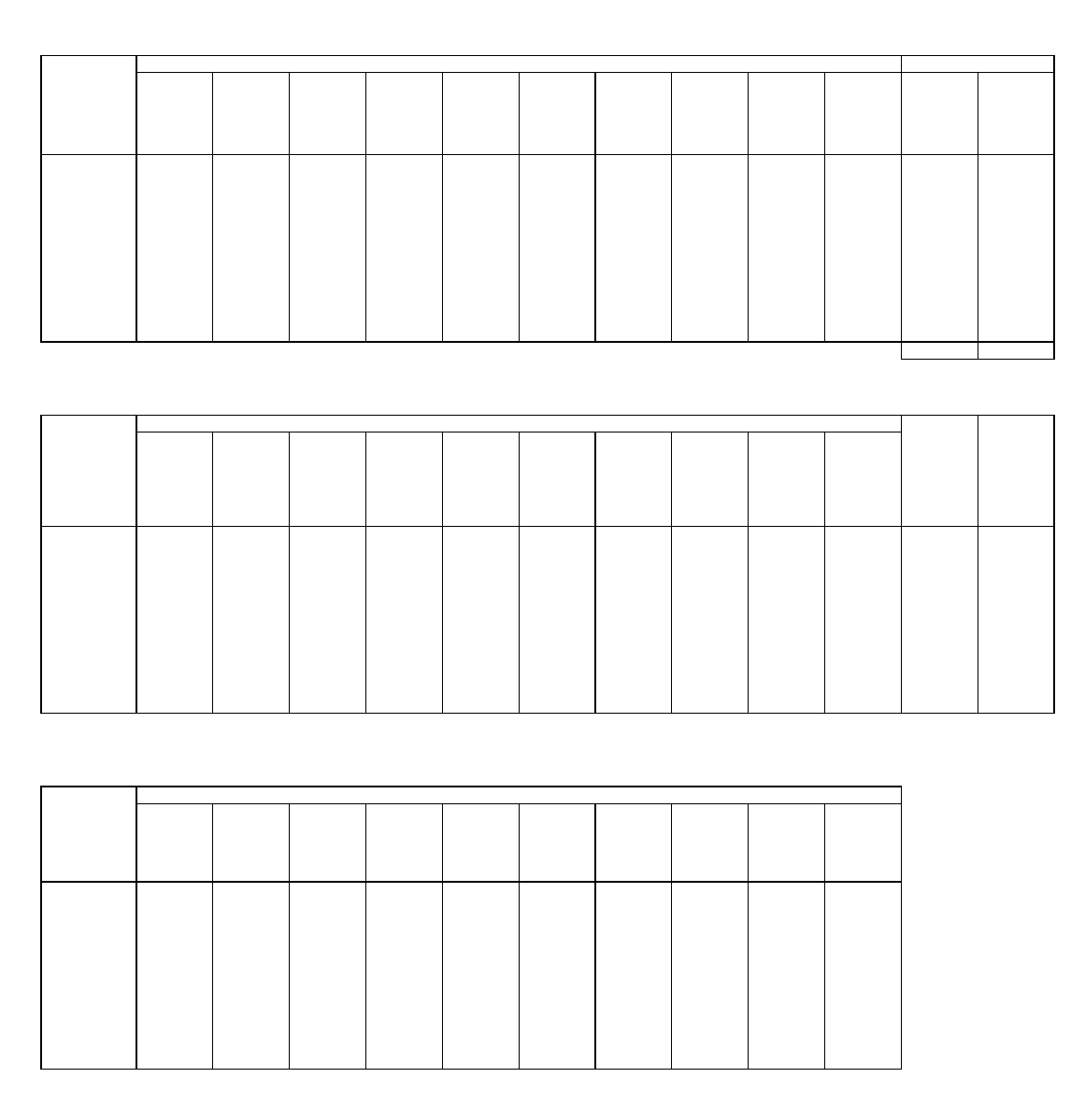

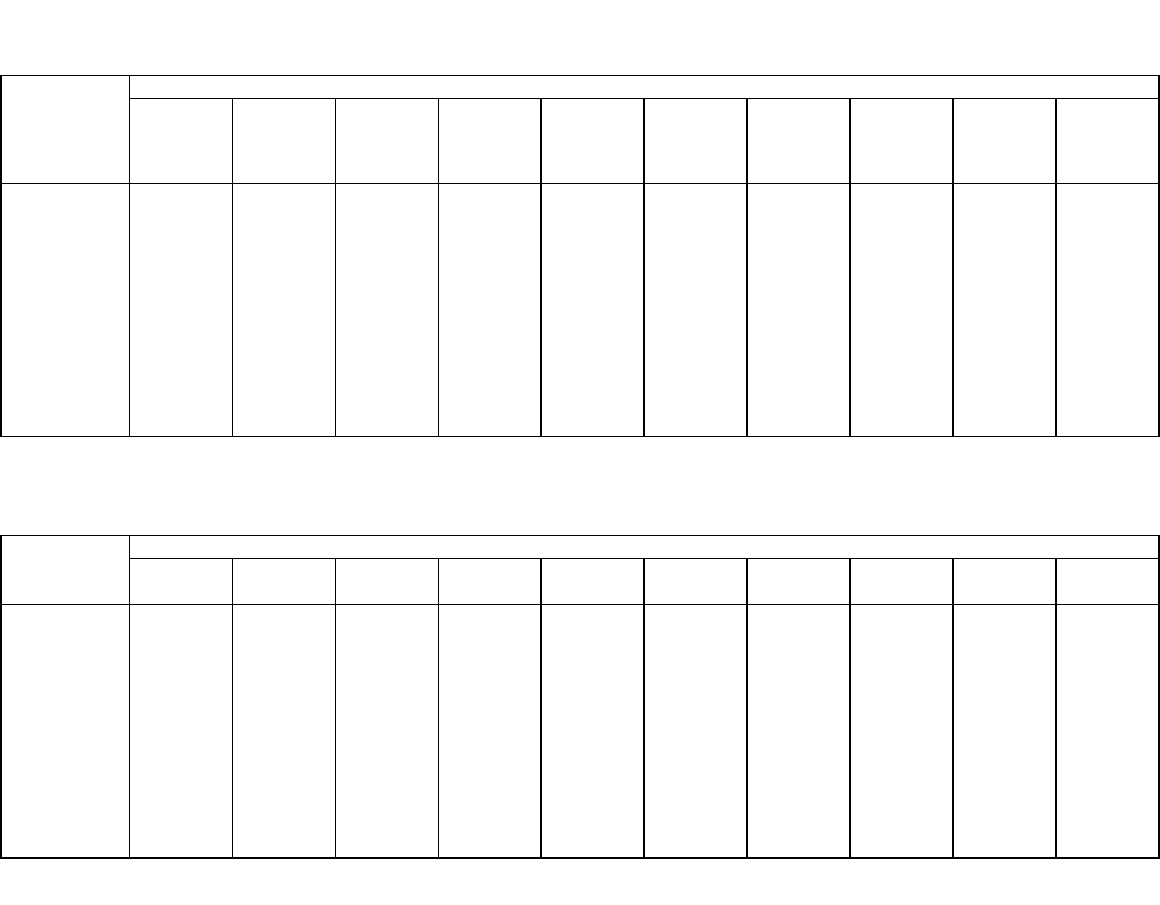

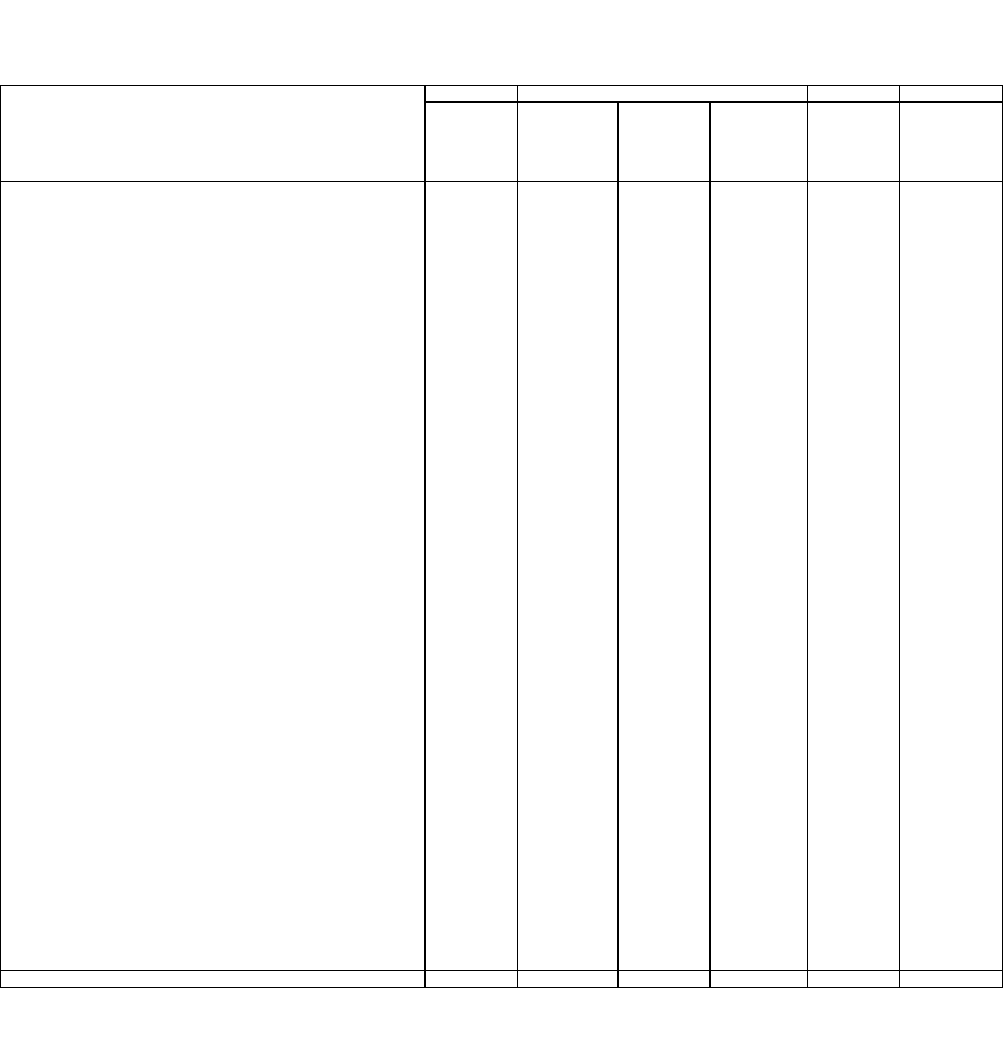

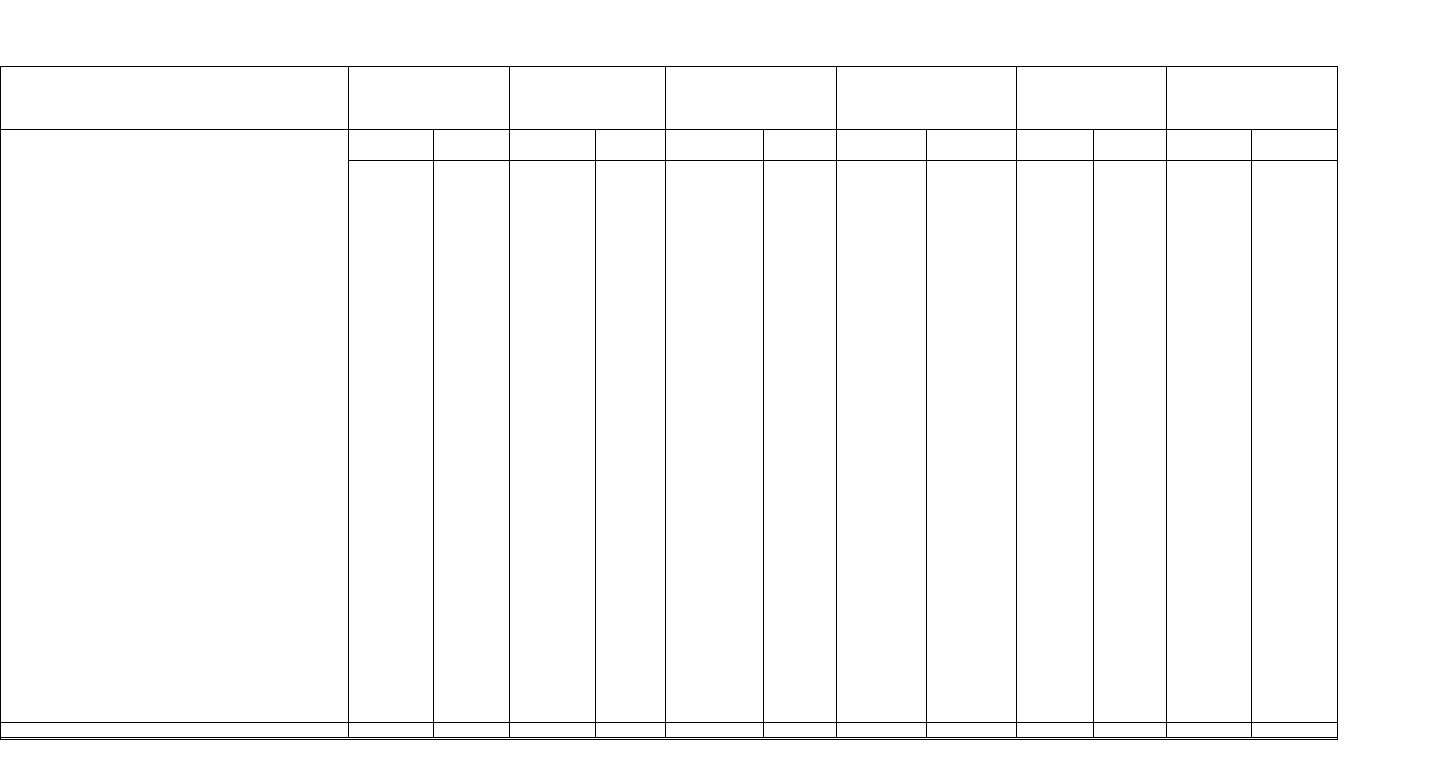

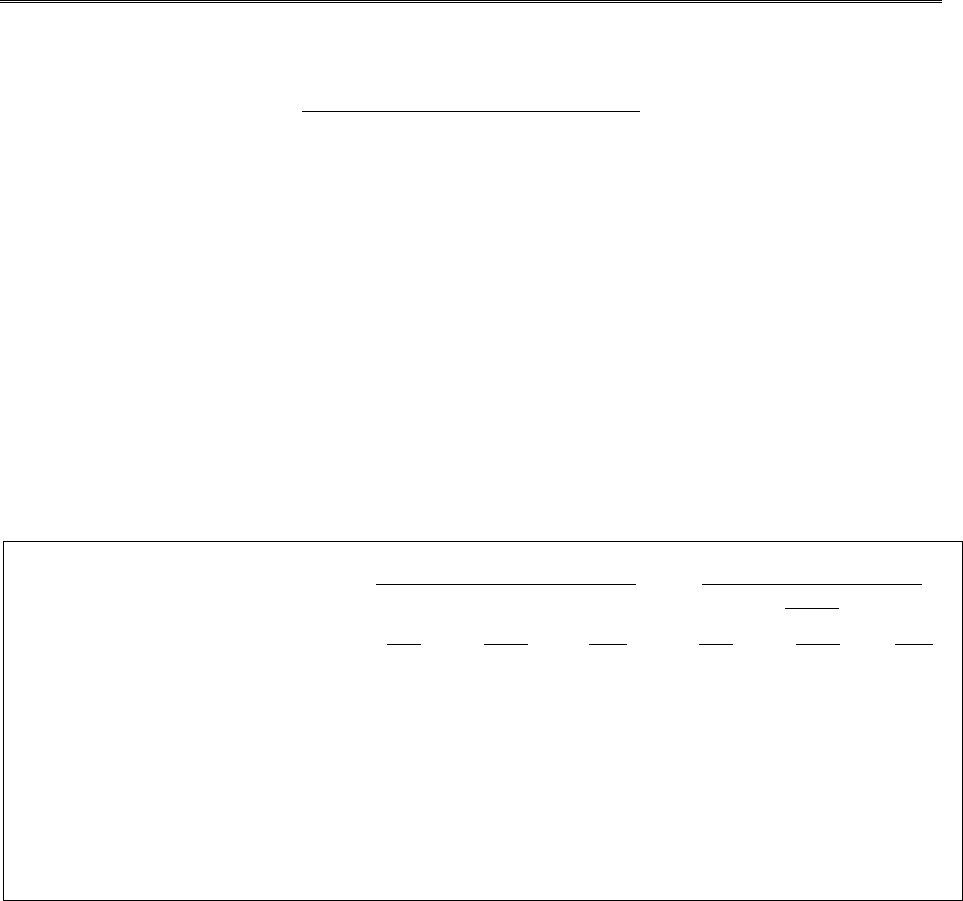

TABLE 1

Fictitious Insurance Co

mpany

Distribution of 201

8

Written Premium (WP) by Line of Business (USD in 000s)

Direct

Direct

Net

Net

WP $

WP %

WP $

WP%

Line of

Business

Personal lines

Homeowners multiple peril

4,646

16%

4,555

17%

Private passenger auto

liability

2,804

10%

2,804

10%

Private passenger auto physical damage

1,661

6%

1,665

6%

Subtotal, personal lines

9,111

32%

9,024

34%

Commercial lines

Fire

3,254

11%

2,484

9%

Commercial multiple peril (non

-

liability portion)

3,243 11% 3,032 11%

Commercial multiple peril (liability portion)

1,760

6%

1,645

6%

Workers’ compensation

4,394

15%

4,022

15%

Other liability

—

occurrence

3,749

13%

3,502

13%

Commercial auto liability

2,334

8%

2,250

8%

Commercial auto p

hysical damage

651

2%

647

2%

Fidelity

138

0%

146

1%

Subtotal, commercial lines

19,523

68%

17,728

66%

Total

28,634

100%

26,752

100%

Insurers were hit hard by record levels of catastrophe losses in 2017 and 2018, following a

sustained period of benign activity from 2012 through 2016. Headline events included

hurricane activity in North America (Harvey, Irma and Maria in 2017; Florence and Michael in

2018) and Japan (Jebi, Trami and Mangkhut in 2018). California saw its most costly wildfire

season for the second year running, with the Camp Fire alone leading to approximately $10

billion of insured losses.

2017 events in the U.S. are estimated to have cost the (re)insurance industry approximately

$106 billion, with a further $50 billion in 2018, significantly exceeding the prior 10-year

average of just under $20 billion.

8

As we shall see through examination of the company’s 2018 Annual Statement, Fictitious did

not escape the financial impact of the natural catastrophes in the U.S., but surprisingly was

relatively unscathed by the events in 2017. During 2018, Fictitious experienced a net loss

from underwriting of $2 million, largely due to events including Hurricanes Florence and

Michael and the California wildfires. The company’s net loss and loss adjustment expense

(LAE) ratio for accident year 2018 was about 10 percentage points higher than that for

accident year 2017.

8

https://www.iii.org/article/spotlight-on-catastrophes-insurance-issues, December 20, 2019

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part I. Introduction

17

When reading this publication and reviewing the 2018 Annual Statement for Fictitious

Insurance Company, note that Fictitious tightened its underwriting standards in reaction to

the soft insurance market in commercial lines.

9

Despite the company’s efforts, soft market

conditions also contributed to the increasing loss and LAE ratio in 2018.

9

A soft market is one where insurance prices are low and therefore insurance is cheaper for the consumer. The

insurance industry tends to observe increasing loss ratios in a soft market because the consumer is paying less in

premiums for the same level of insurance protection.

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part II. Overview of Basic Accounting Concepts

18

PART II. OVERVIEW OF BASIC ACCOUNTING CONCEPTS

INTRODUCTION TO PART II

Part II of this publication will provide a detailed discussion on the construction, use and

interpretation of an insurance company’s financial statements and other financial

information. Before beginning that detailed discussion, we will introduce two important

accounting topics: primary financial statements and key accounting concepts. Both are

recurring topics throughout this publication, and a basic understanding will be helpful to

students.

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part II. Overview of Basic Accounting Concepts

19

CHAPTER 4. PRIMARY FINANCIAL STATEMENTS

PRIMARY FINANCIAL STATEMENTS

Although there are numerous accounting frameworks, they generally rely on a few primary

financial statements. Of these, the two most commonly referenced are the balance sheet and

the income statement. Other primary financial statements include the statement of capital

and surplus (or equity) and the statement of cash flow. The financial statements are

accompanied by subsequent pages of notes, which provide additional information that helps

explain balances within the financial statements.

BALANCE SHEET

The balance sheet presents all of a company’s assets and liabilities as of a specific point in

time. Assets are defined as resources obtained or controlled by a company as a result of past

events that have a probable future economic benefit to the company. Liabilities are probable

sacrifices of economic benefits arising from present obligations of a company to transfer

assets or provide services to other entities in the future as a result of past events. The

relationship between the assets and the liabilities of a company is important, because it is a

measure of the company’s ability to use its assets to fully satisfy its liabilities. The difference

between assets and liabilities is generally referred to as net worth (or equity); in the case of

an insurance company reporting under Statutory Accounting Principles (SAP), this difference

is referred to as statutory surplus (or policyholders’ surplus)

10

.

One unique aspect of insurance companies’ balance sheets is the inherent uncertainty

associated with the estimation of the liability for unpaid claims and claim adjustment

expenses (loss reserves). While a certain amount of estimation is involved in other industries’

accounting, the more significant estimates are generally with respect to asset valuation and

collectability and pale in comparison to the uncertainties involved in estimating loss reserves.

Actuaries typically have an important role in valuing insurance company liabilities and are

therefore critical to the accurate preparation of the balance sheet.

INCOME STATEMENT

While the balance sheet presents the financial balances of a company at a point in time, the

income statement reveals a company’s financial results during a specific time period. The

general types of accounts that are used as a means to measure these results are revenue and

expenses. Revenues are inflows or enhancements of assets or settlement of liabilities (or a

combination of both) from delivering goods or services during the specific time period.

Expenses are outflows or other use of assets or incurrence of liabilities (or a combination of

10

Note that the assets reflected in this relationship only include “admitted" assets because Statutory Accounting

Principles (SAP) do not allow insurers to take credit for nonadmitted assets in surplus. Admitted versus

nonadmitted assets are discussed later in this text.

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part II. Overview of Basic Accounting Concepts

20

both) from delivering or producing the goods and services that were provided during the

specific time period. The difference between the amount of the revenues and expenses during

the period is referred to as net income if it is positive or net loss if it is negative.

The nature of the service provided by insurance companies, which is a promise to pay claims

in the future if some specific criteria are met, creates unique accounting challenges.

Insurance accounting standards address how to earn the premiums insurance companies are

paid and how to measure and when to record claim costs resulting from the insurance

coverage. Again, actuaries usually play a significant role in the estimation of the amount and

timing of these future payments and therefore are critical to the accurate preparation of the

income statement. Another important source of revenue for insurance companies is

investment income, which will be discussed in Chapter 8. The Statutory Income Statement:

Income and Changes to Surplus.

CAPITAL AND SURPLUS

The statement of capital and surplus reflects certain changes in surplus that are not recorded

in the income statement and reconciles the beginning surplus to the ending surplus for the

reporting period. This statement is similar for insurance companies and for other types of

companies; however, there are several items within the statement of capital and surplus, such

as those related to nonadmitted assets and the provision for reinsurance, that are unique to

insurers. These items and others will be discussed in Chapter 7. Statutory Balance Sheet: A

Measure of Solvency and Chapter 8. The Statutory Income Statement: Income and Changes to

Surplus.

CASH FLOW

The cash flow statement receives less attention but is also important. This financial statement

is necessary because the timing of the receipt or payment of cash for a revenue or expense

does not necessarily coincide with the recognition of that revenue or expense from an income

statement perspective. In other words, even if the cash payment is received sometime before

or sometime after the good or service is provided, the associated revenue is generally

recognized at the time the good or service is provided. The cash flow statement presents all

operations strictly from a cash perspective.

In other industries, companies face liquidity issues when they cannot collect revenue in cash

on a timely basis, and this type of liquidity issue would be made evident by the statement of

cash flows. An example of this would be a manufacturing company that sold products on

credit but was not able to collect the cash on a timely basis to pay their expenses. For

insurance companies, this specific type of liquidity issue is less likely to occur due to the

collection of premiums at the onset of the policy and the subsequent payment of losses. This

difference in the order of cash receipts and disbursements somewhat diminishes the

importance of cash flow statements for insurance companies. Further, actuaries are not

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part II. Overview of Basic Accounting Concepts

21

generally involved in or necessary for the preparation of the cash flow statement, so this

financial statement is not covered in detail in this publication.

NOTES TO FINANCIAL STATEMENTS

In addition to the four primary financial statements already discussed, another important

element is the notes to financial statements. The notes include quantitative and qualitative

disclosures regarding the significant accounts presented in the financial statements. This

includes matters that are relevant or may be relevant to the users of the financial statements.

For instance, the notes will typically describe the basis of accounting used in the preparation

of the financial statements, as well as any important details on specific aspects of the

financial statements that are based on estimates or subject to uncertainty. We will discuss

several of the footnotes to the financial statements that are of specific importance to

actuaries in Chapter 10. Notes to Financial Statements.

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part II. Overview of Basic Accounting Concepts

22

CHAPTER 5. KEY ACCOUNTING CONCEPTS

Throughout each major accounting framework, there are several common key concepts.

Understanding these key concepts will be beneficial to anyone who is involved in using or

preparing financial statements because it will allow them to appreciate the purposes of and

the differences between each framework. A few of the most important and relevant concepts

are below.

• Liquidation vs. going concern: When preparing financial statements, it is possible to

view the company as either an ongoing business (going concern) or as a run-off of the

current assets and liabilities (liquidation). Either perspective may be appropriate

depending on the user and purpose of the financial statements. For instance, investors

would generally be most interested in the value of a business as a going concern,

whereas regulators may think in terms of a liquidation perspective, given that they are

primarily interested in the ability of the company to satisfy its policyholder obligations.

• Fair value vs. historical cost: There are often multiple possible approaches to valuing a

given asset or liability. The choice of approach is of particular importance when the

value of that asset or liability is uncertain. Recording an asset or liability at fair value

means recording it at a value that it would be bought or sold for in the open market,

while recording at historical cost means valuing it at the original purchase price less

depreciation. In cases where the value of an asset or liability is uncertain, there is a

trade-off between the reliability of the historical cost method (in that it is objectively

verifiable) and accuracy of the fair value approach (in that it is more consistent with

the actual market value).

• Principle-based vs. rule-based: Each aspect of any accounting framework is generally

guided by either a principle or a rule. A principle describes a general accounting

approach that must be interpreted and applied, while a rule provides specific

accounting guidance on how something should be done. There is a trade-off because

the rules-based guidance may be easier to understand and to audit, but a principles-

based approach is generally more adaptable to changes in the business environment.

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part III. SAP in the U.S.: Fundamental Aspects of the Annual Statement

23

PART III. SAP IN THE U.S.: FUNDAMENTAL ASPECTS OF THE ANNUAL

STATEMENT

INTRODUCTION TO PART III

In the U.S., property/casualty insurance companies report their financial results to state

insurance regulators in what is called the Annual Statement. For those who have never used

or seen an Annual Statement, it is an 8.5” x 14” book. The Property/Casualty Annual

Statement is identified by its yellow cover, while the Life Annual Statement’s cover is blue

(known as the yellow book and blue book, respectively). Both types of Annual Statements are

publicly available documents.

The Annual Statement is developed and maintained by the National Association of Insurance

Commissioners and is often referred to as “the Blank.” The Blank is the template that

insurance companies use to report under Statutory Accounting Principles (SAP), and is

uniformly adopted by all states. This allows insurance companies licensed in multiple states to

prepare one Annual Statement for filing with all states. The Annual Statement is accompanied

by NAIC instructions that are generally adopted by all states, though there are instances of

specific differences and exceptions.

The first page in the Annual Statement is the Jurat page, which provides basic information

about the reporting entity, such as name, NAIC code, address, name of preparer and title, and

officers of the reporting entity. The notarized signatures of officers of the reporting entity are

included on this page, attesting to the accuracy of the information contained therein.

Following the Jurat page are the statutory financial statements. The statutory Annual

Statement contains other exhibits and schedules that provide further insight into the

insurance company’s statutory financial statements and historical experience. These include

General Interrogatories; Five-Year Historical Data; and Schedules A, B, BA, D, DA, F, P, T and

Y.

In Part III. SAP in the U.S.: Fundamental Aspects of the Annual Statement, we will walk

through the Property/Casualty Annual Statement, beginning with the financial statements,

and discuss the related accounting requirements. We provide examples to illustrate the uses

of the Annual Statement and how certain amounts are calculated and compiled.

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part III. SAP in the U.S.: Fundamental Aspects of the Annual Statement

24

CHAPTER 6. INTRODUCTION TO STATUTORY FINANCIAL STATEMENTS

INTRODUCTION

This chapter focuses on Statutory Accounting Principles (SAP) and specifically discusses the

fundamental aspects of the Annual Statement, including the financial statements themselves

(the balance sheet and income statement, for example), as well as the other exhibits and

filings that accompany the Annual Statement (such as various schedules, the Insurance

Expense Exhibit and the Risk-Based Capital calculation). Part V. Financial Health of

Property/Casualty Insurance Companies in the U.S. will discuss how this information can be

used to assess the financial health of an insurance company and Part VI. Differences from

Statutory to other Financial/Regulatory Reporting Frameworks in the U.S. will focus on

differences between SAP and the other financial and relevant regulatory reporting regimes.

SAP AND THE NAIC

The National Association of Insurance Commissioners (NAIC) operates through various

committees that comprise state insurance commissioners and their staff. Through these

committees, the NAIC regularly updates SAP and creates model insurance laws and

regulations that individual states may elect (or be required) to adopt. While this generally

leads to a good deal of uniformity in insurance regulation, there are still instances of

differences between states. For example, individual states have the ability to permit

accounting practices that differ from NAIC SAP (“permitted practices”) and model laws and

regulations are not always enacted by all states exactly as adopted by the NAIC.

It is worth noting that the NAIC may revise the Annual Statement each year, and these

changes are described on the NAIC website. The basis of the examples and exhibits provided

in this section of the publication are based in part on the structure and information provided

in the 2011 industry Annual Statement, with specified updates based on the 2018 Annual

Statement as noted in Foreword of this publication.

11

11

Accessed via a sector-specific information and research firm in the financial information marketplace.

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part III. SAP in the U.S.: Fundamental Aspects of the Annual Statement

25

CHAPTER 7. STATUTORY BALANCE SHEET: A MEASURE OF SOLVENCY

As previously noted, the primary focus of statutory accounting is to highlight potential

solvency issues (an insurance company’s capability to meet its obligations to its policyholders

and creditors when due). Consequently, the most important aspect of an insurance company’s

financial statements to an insurance regulator is the strength of its balance sheet (i.e., the

extent to which its admitted assets are sufficient to meet all liabilities).

RELEVANCE TO ACTUARIES

Solvency and the balance sheet are relevant to the actuary for two primary reasons.

First, actuaries traditionally have some responsibility for the loss and loss adjustment expense

(LAE) reserves, which represent the majority of the liabilities for property/casualty insurance

companies. Actuaries may either participate directly in the reserve-setting process, or they

may assess the reasonableness of the reserves established by company management.

Actuaries involved in either of these functions are focused on the liabilities for losses and LAE

on the Liabilities, Surplus and Other Funds page of the Annual Statement (page 3).

Second, actuaries often have a role in determining or assessing the amount of capital that an

insurance company requires to support the risks that it has taken through its business

operations. In the context of statutory accounting, this would be based on an actuary’s

understanding of the Risk-Based Capital (RBC) framework to calculate the required capital at

a given point in time (see Chapter 19. Risk-Based Capital). More broadly speaking, actuaries

may evaluate the surplus needs on other bases, including on an economic basis, which is

guided by the insurer meeting some economically defined criteria for solvency. In both of

these cases, an actuary who is evaluating an insurance company’s capital will need to be

familiar with the admitted assets and the liabilities on the balance sheet (pages 2 and 3), as

well as the risk characteristics of each of those items.

This chapter will provide an overview of the composition of the two main categories in the

statutory balance sheet:

• Assets (page 2)

• Liabilities, Surplus and Other Funds (page 3)

ASSETS

12

Assets can be broadly defined as a property, right or claim arising from past events that has

future value. From an individual perspective, we are all accustomed to the concept of owning

12

In general, this section aligns with Chapter 2 (Assets) of Property Casualty Insurance Accounting by the Insurance

Accounting and Systems Association (IASA). References to other sections in IASA that were previously on the CAS

Syllabus will be included throughout. Readers seeking additional detail may consult with IASA on these topics or

other topics.

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part III. SAP in the U.S.: Fundamental Aspects of the Annual Statement

26

financial assets, such as stocks and bonds, and owning real assets, such as a home or vehicle.

Insurance companies own various assets in the same way that an individual does, and those

assets are summarized on page 2 of the Annual Statement Blank (the balance sheet). Some of

these assets are consistent with assets of non-insurance entities, and some are specific to

insurance companies.

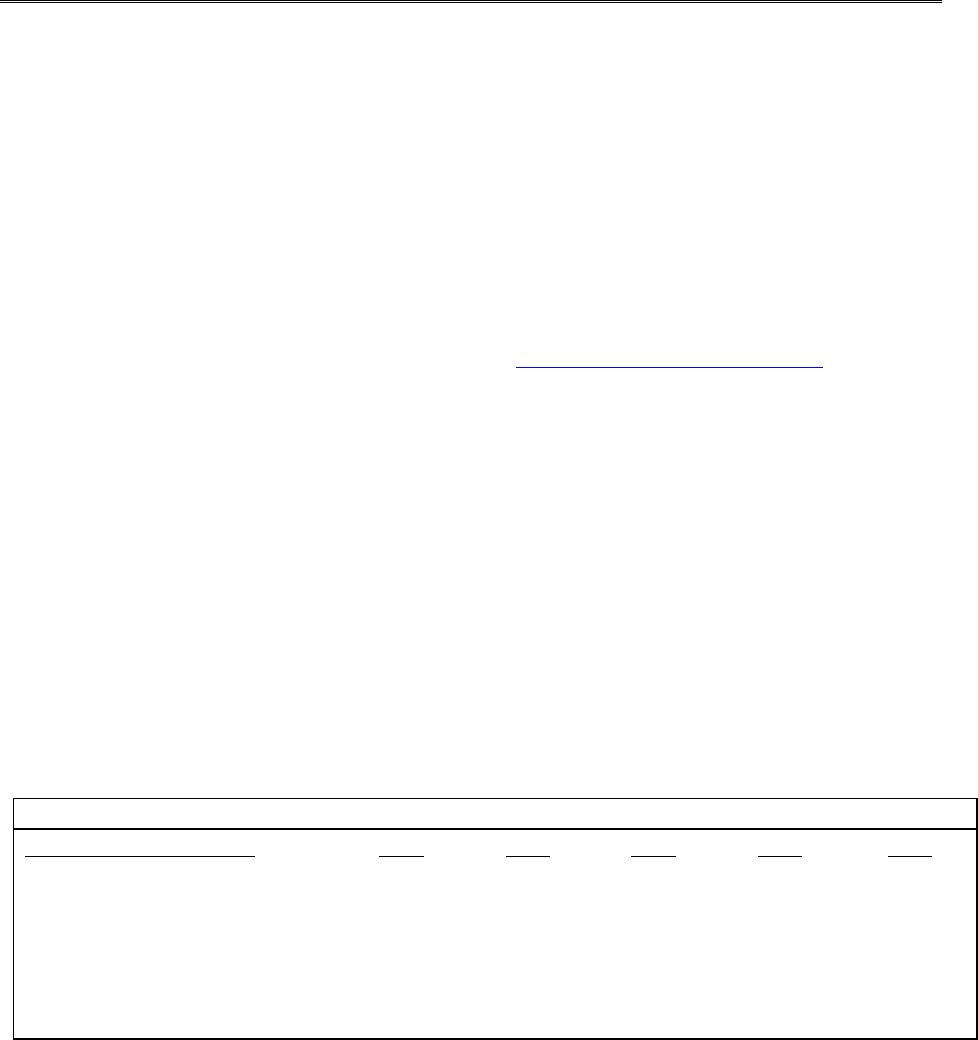

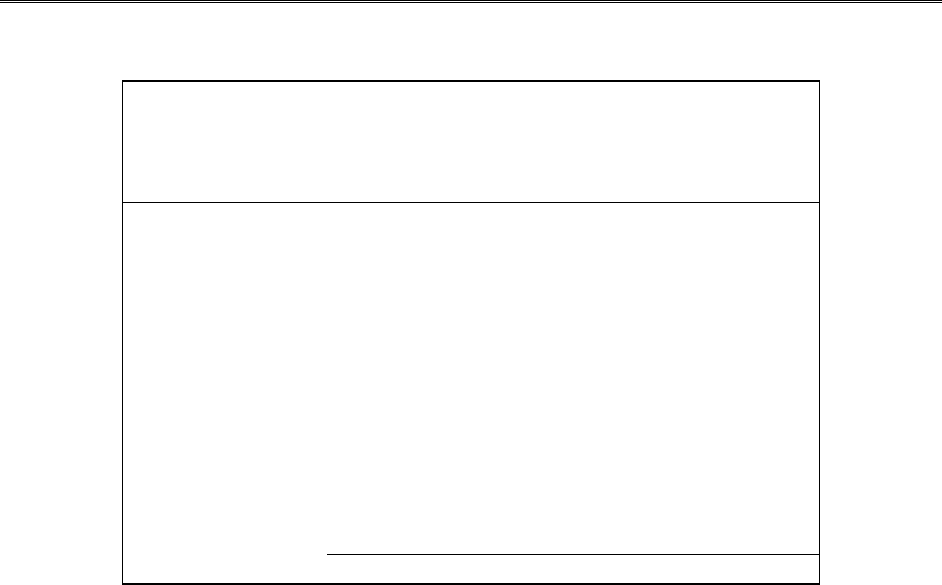

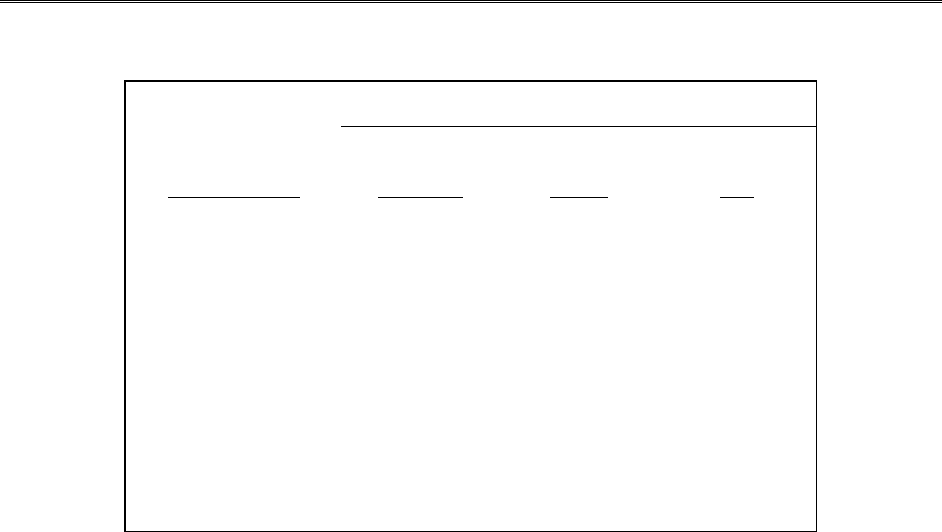

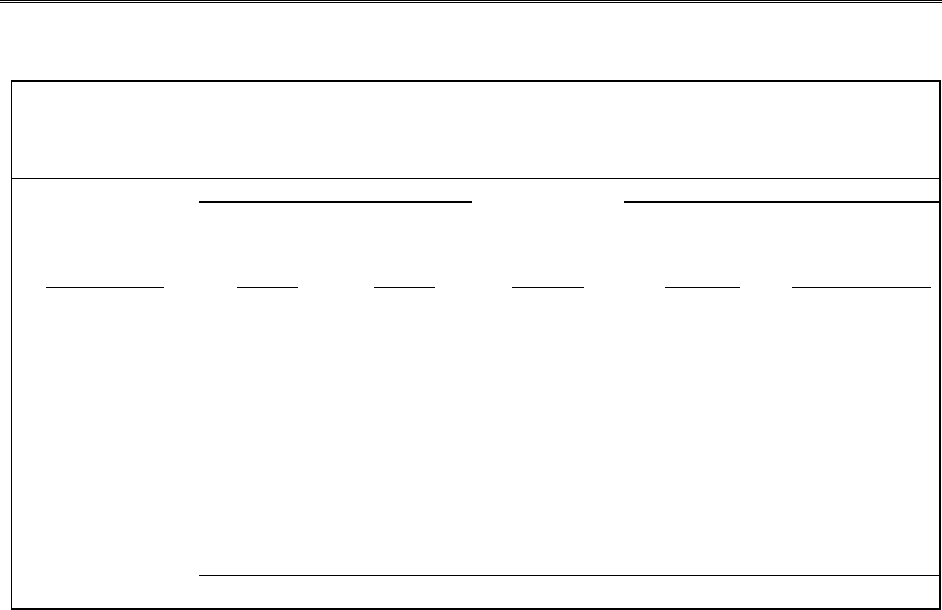

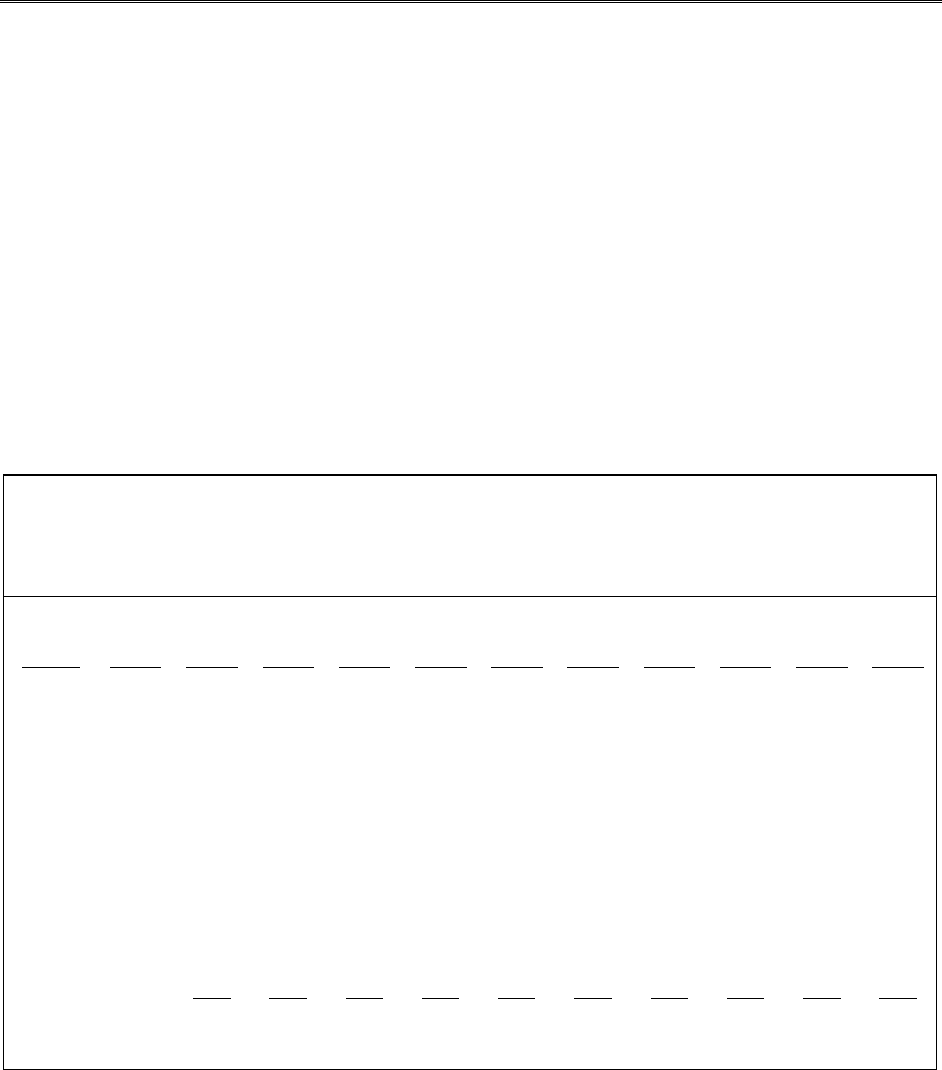

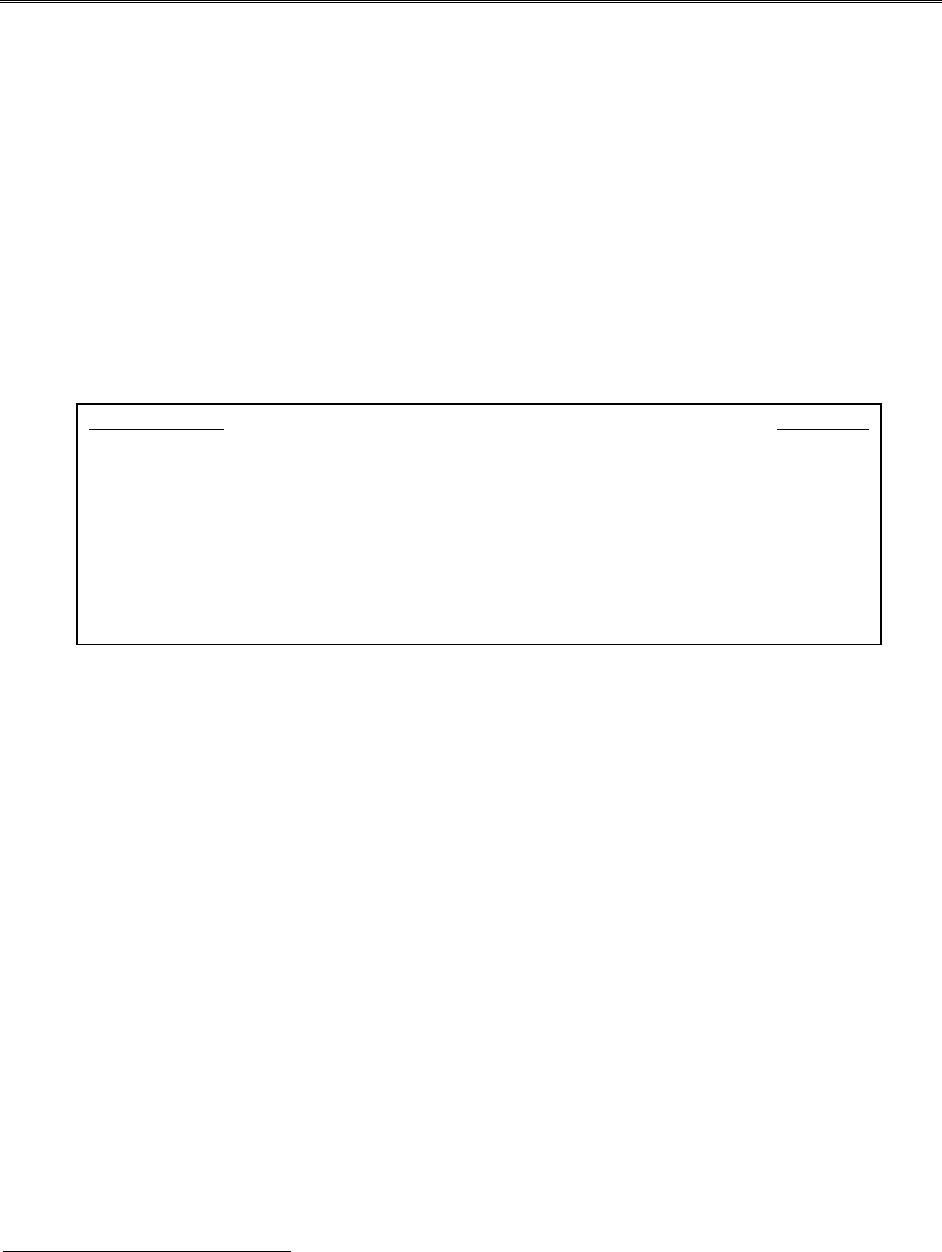

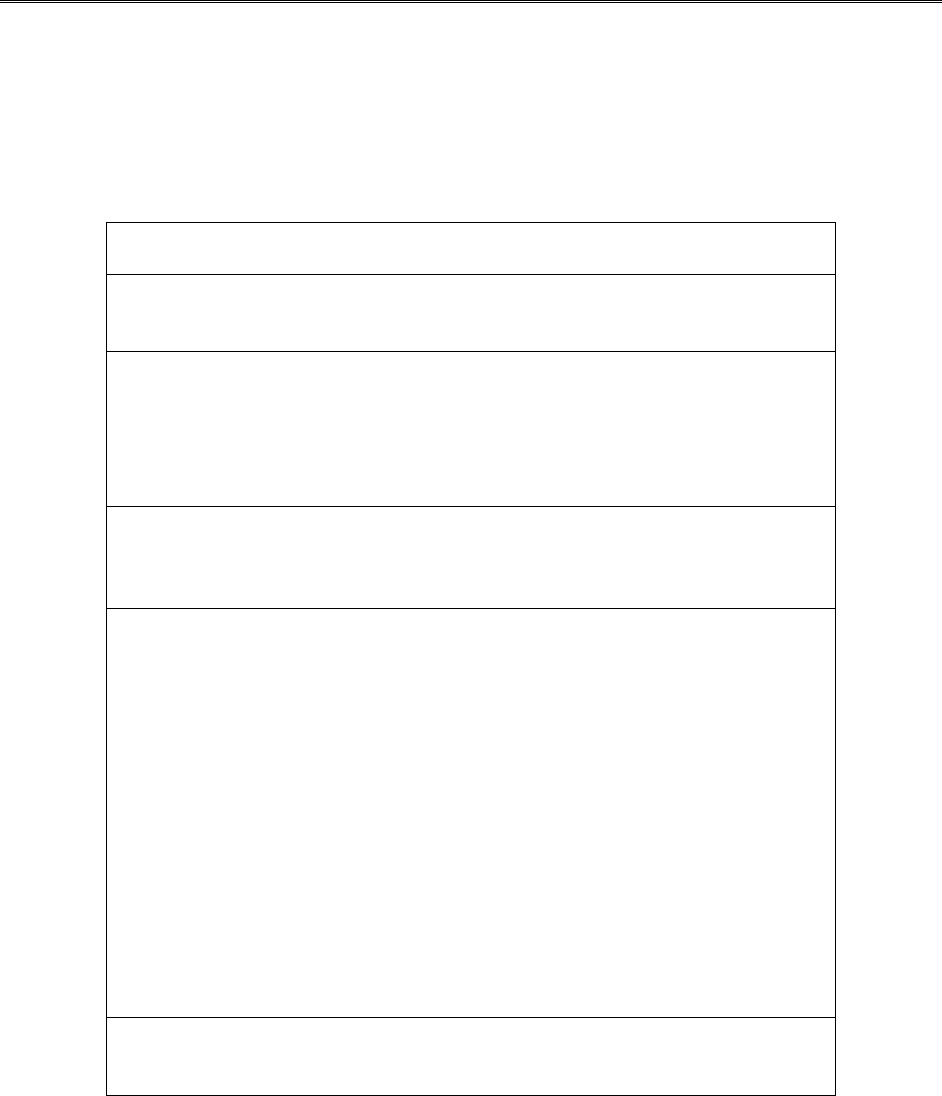

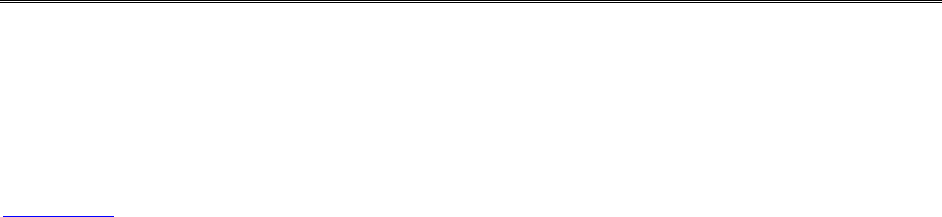

Table 2 summarizes the major assets held by the U.S. property/casualty insurance industry as

of December 31, 2018.

13

The first column indicates the numerical label for each item, as

presented on page 2 of the Annual Statement. Only the material line items are shown in this

summary.

13

Accessed via a sector-specific information and research firm in the financial information marketplace.

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part III. SAP in the U.S.: Fundamental Aspects of the Annual Statement

27

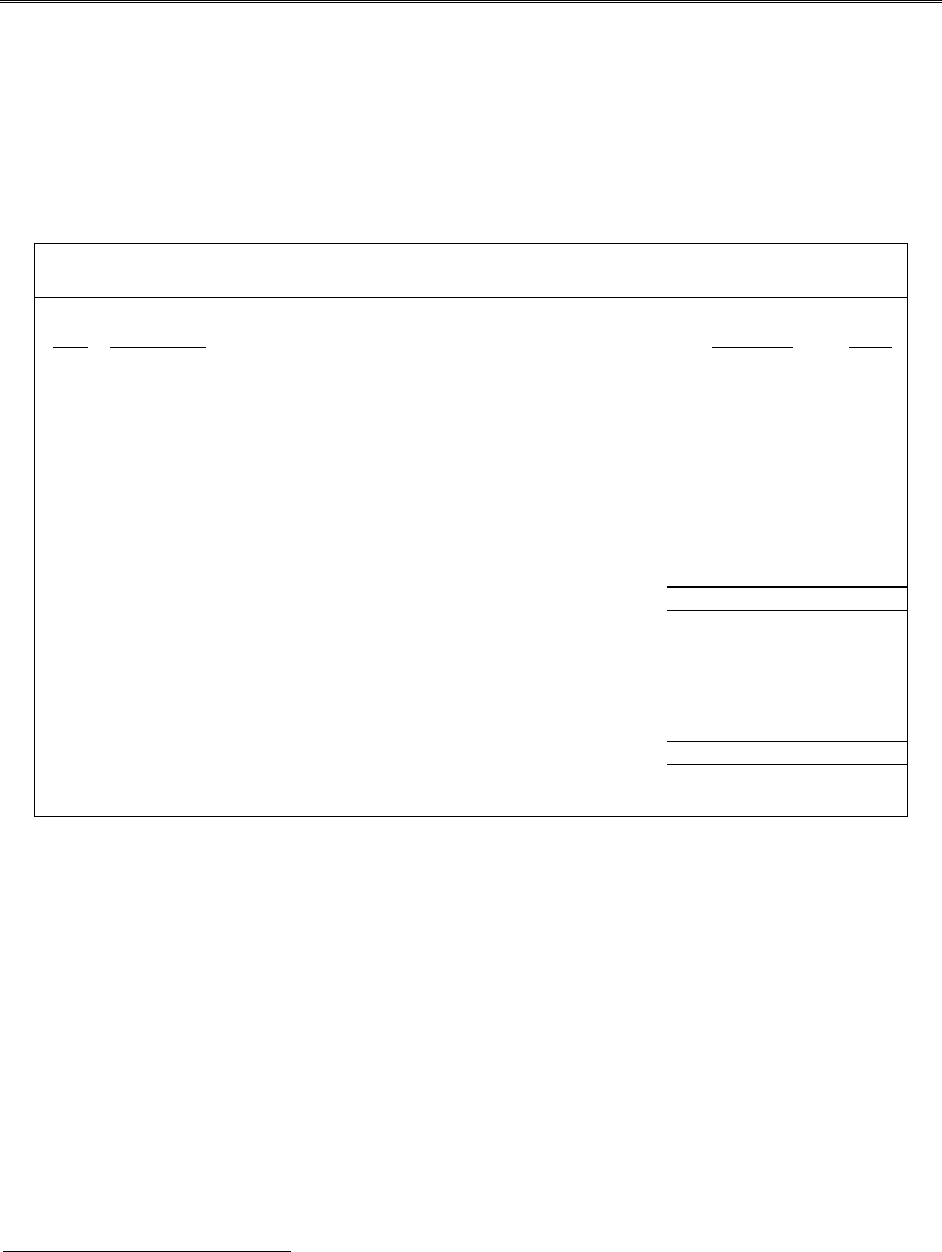

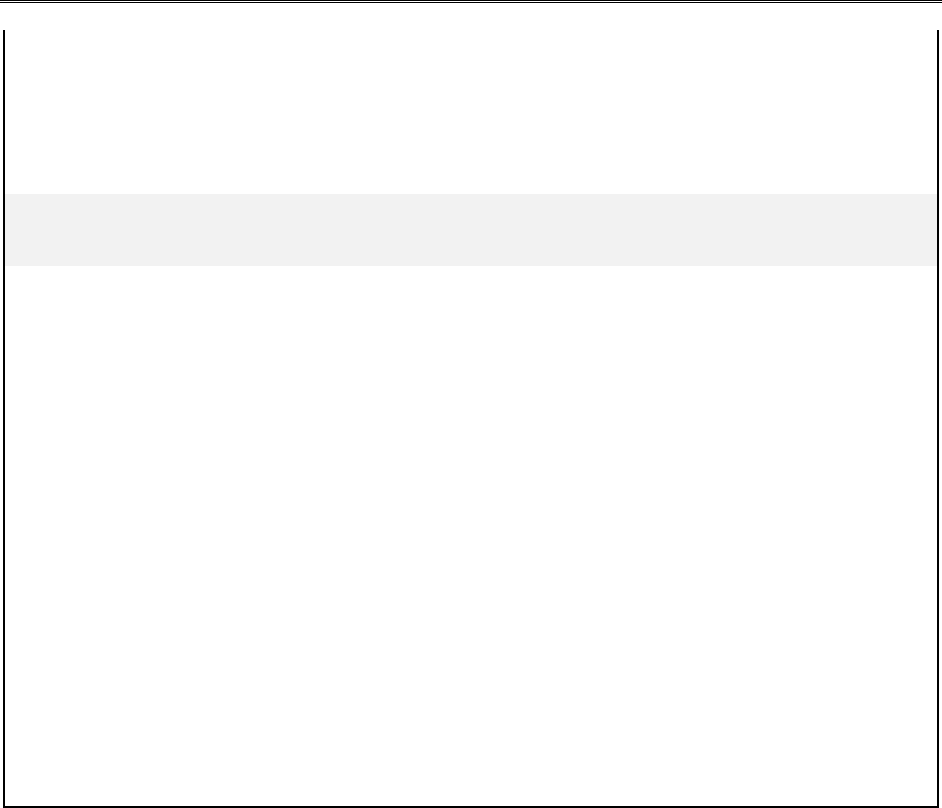

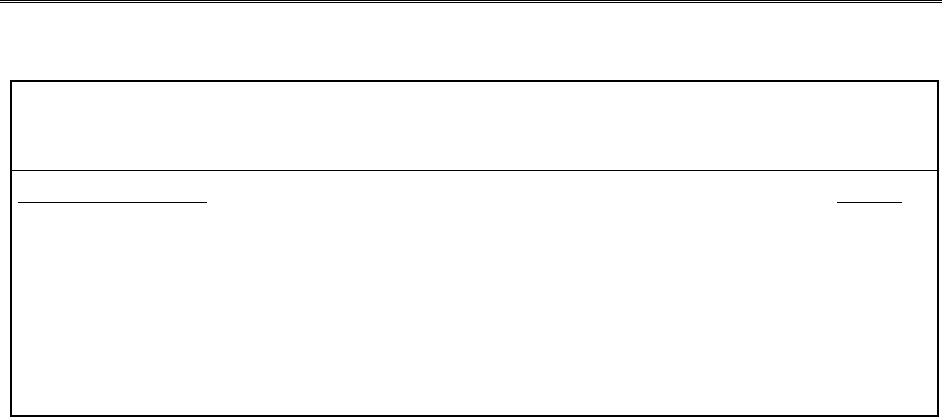

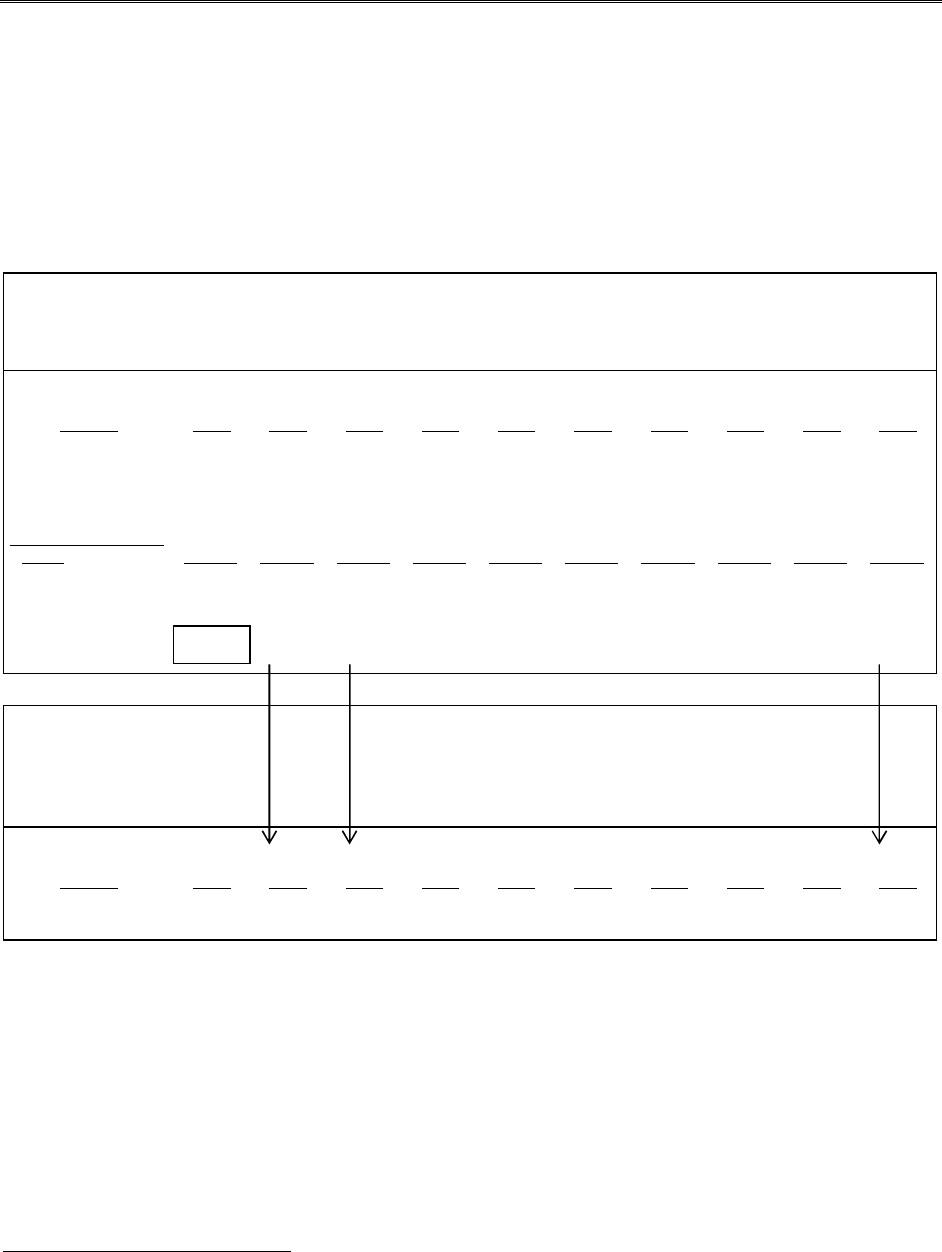

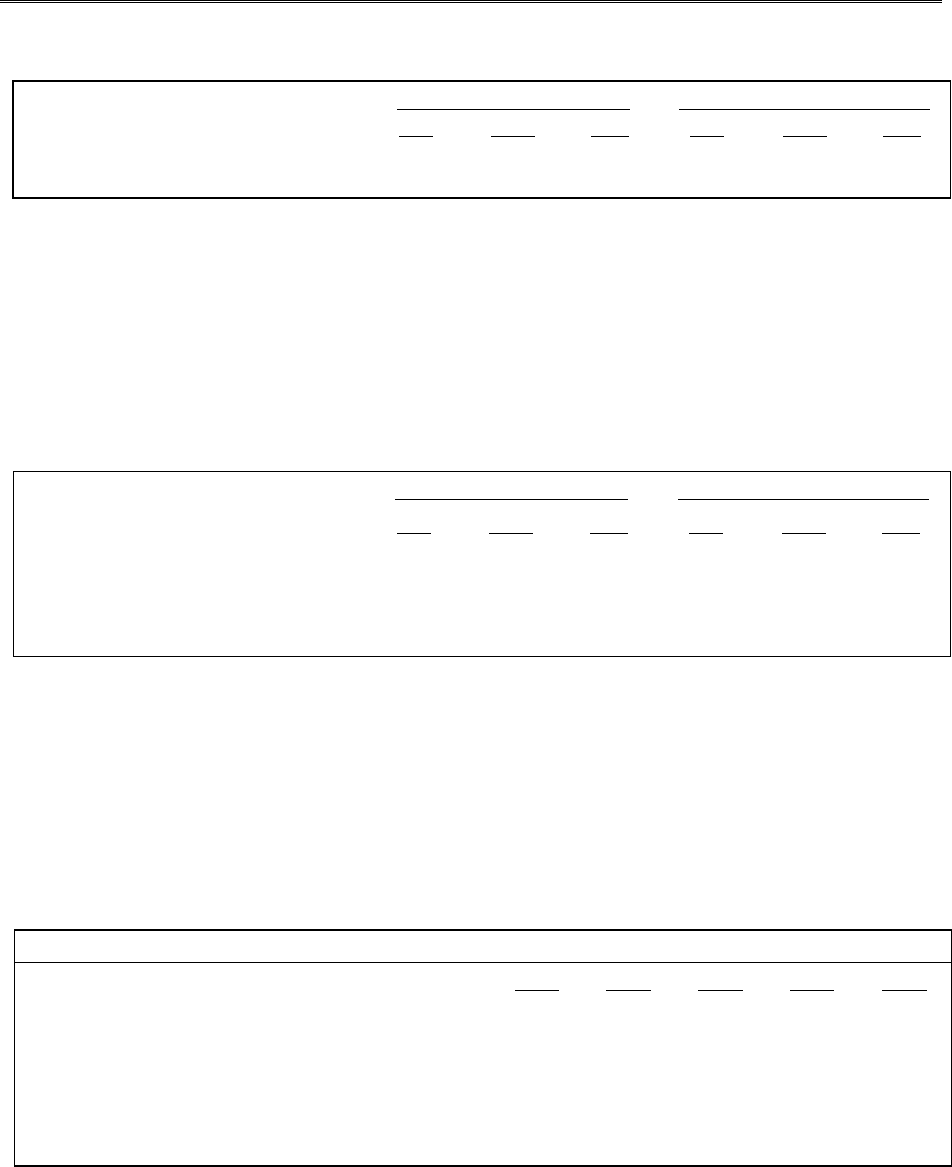

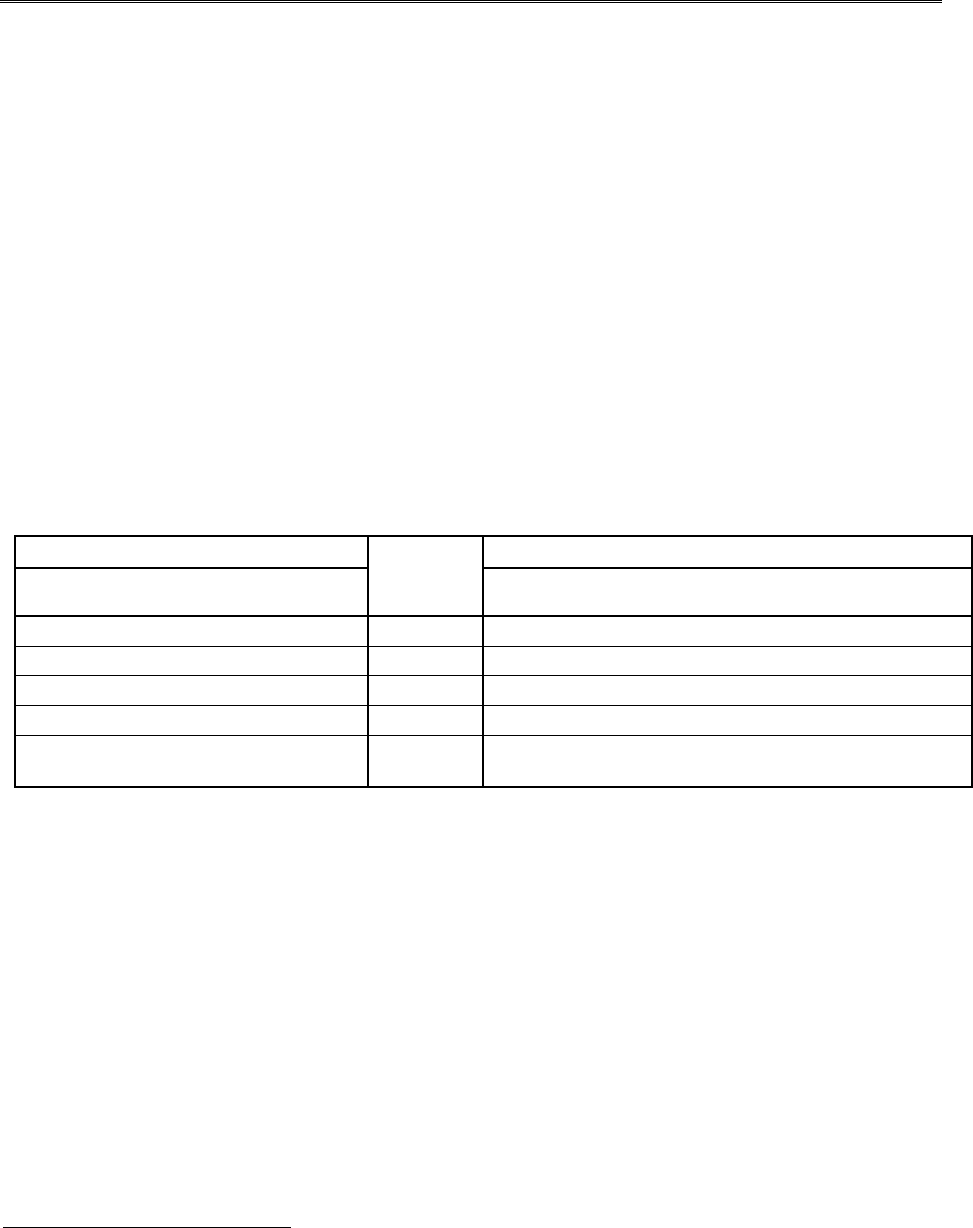

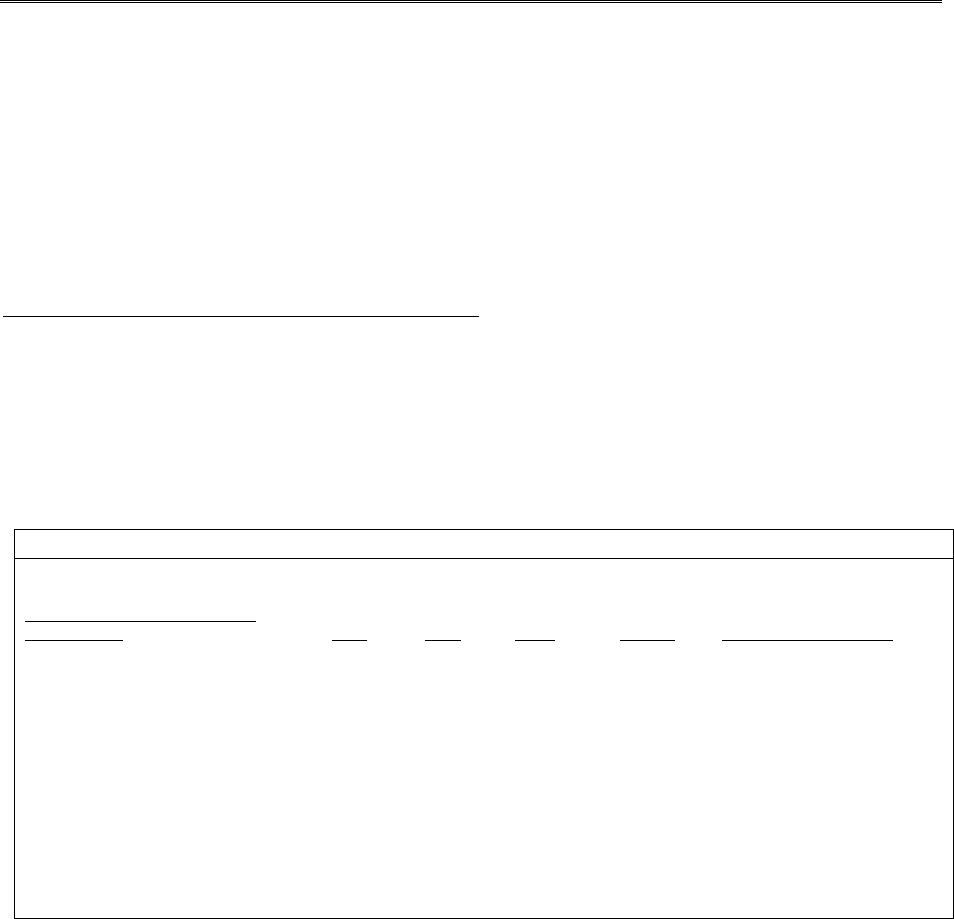

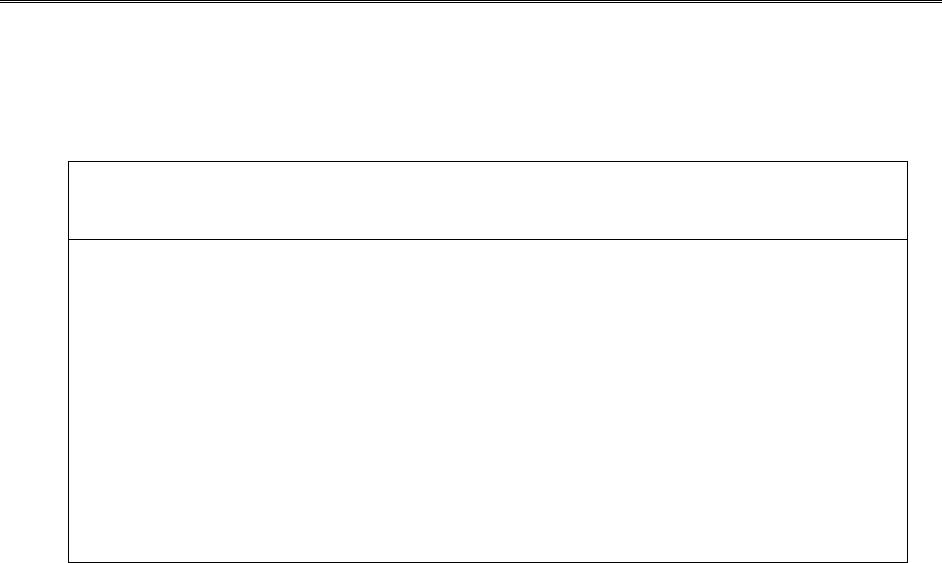

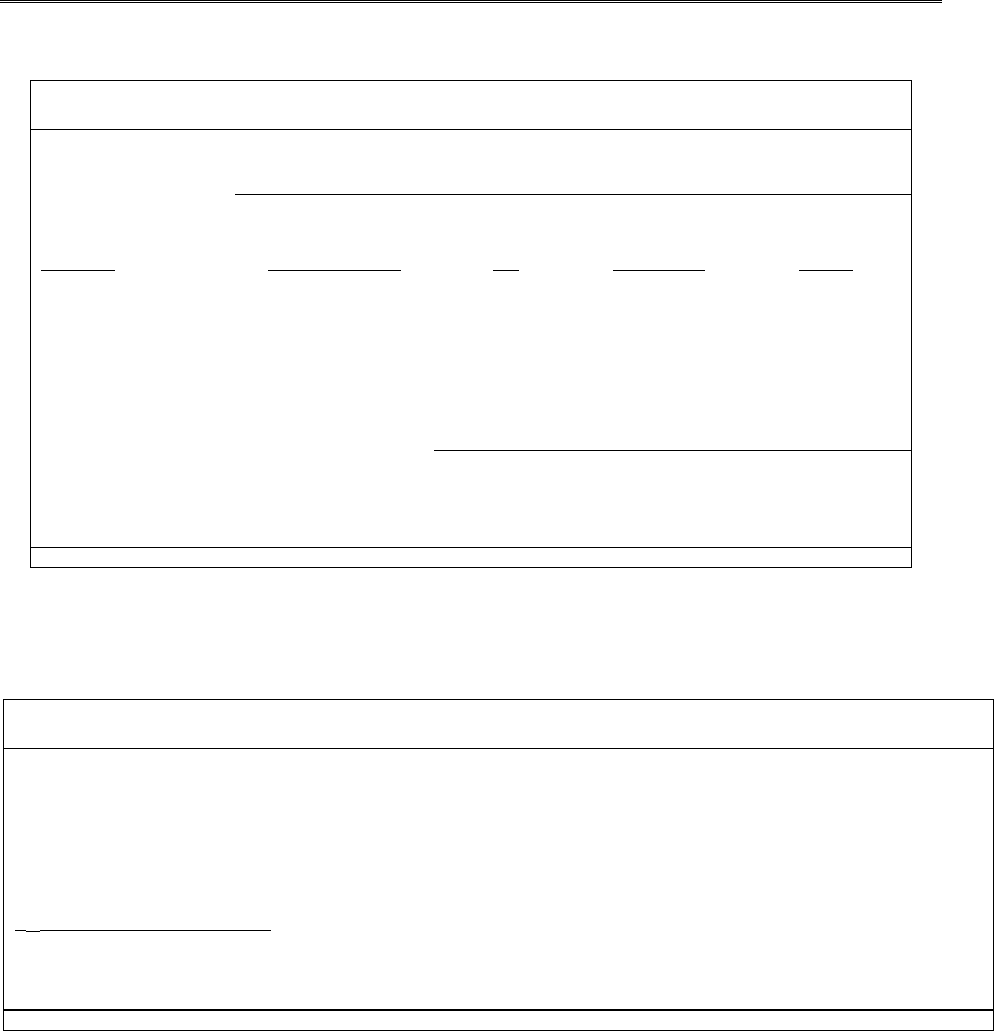

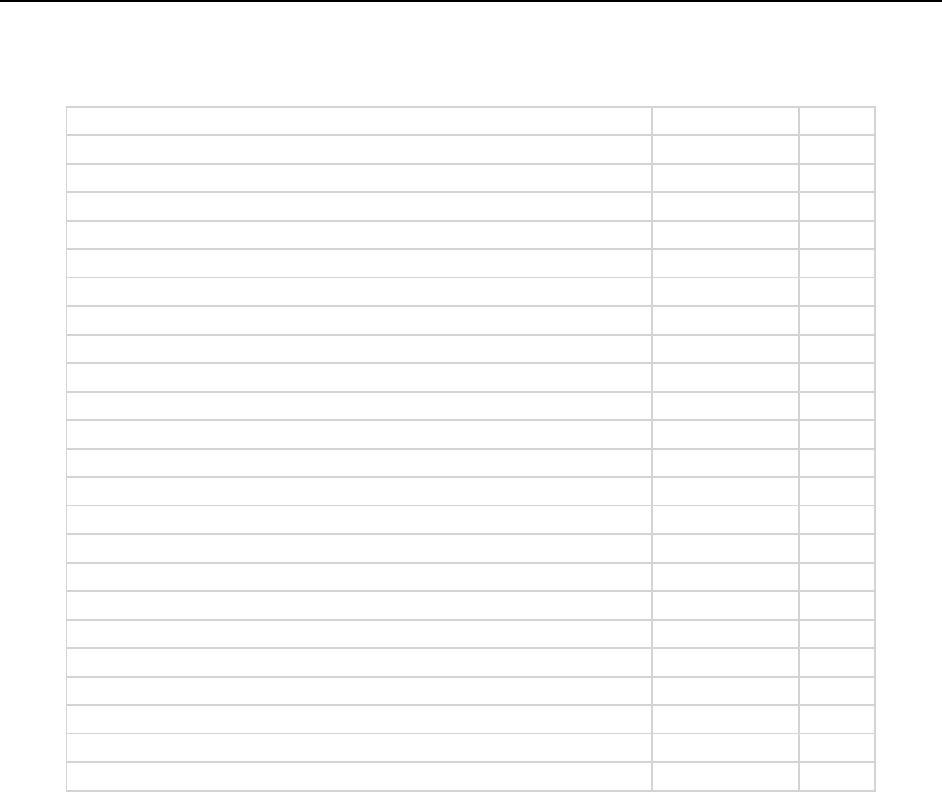

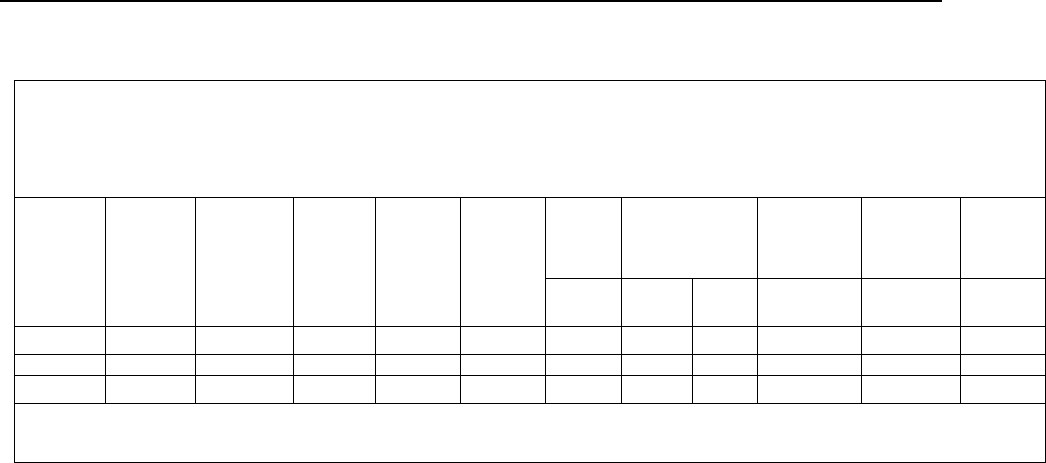

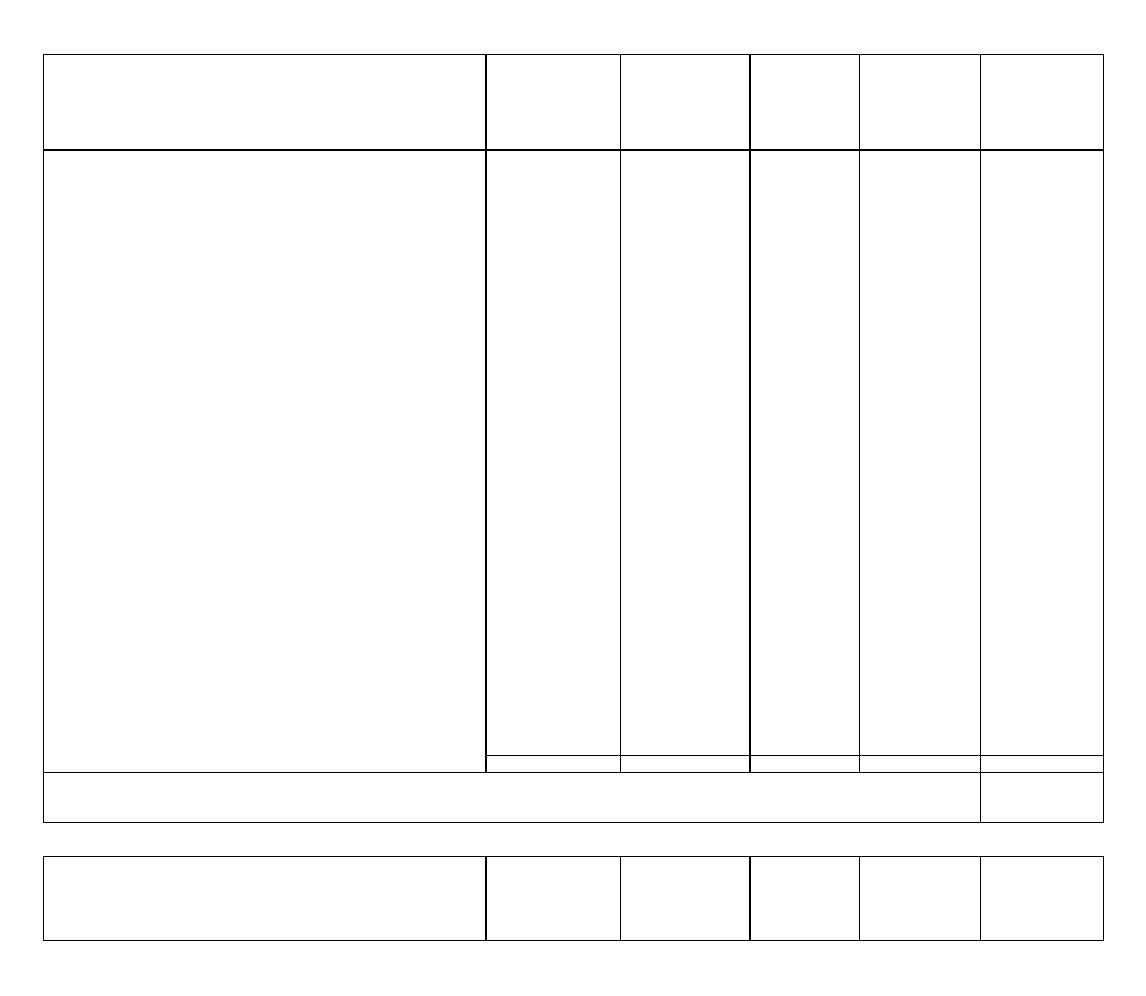

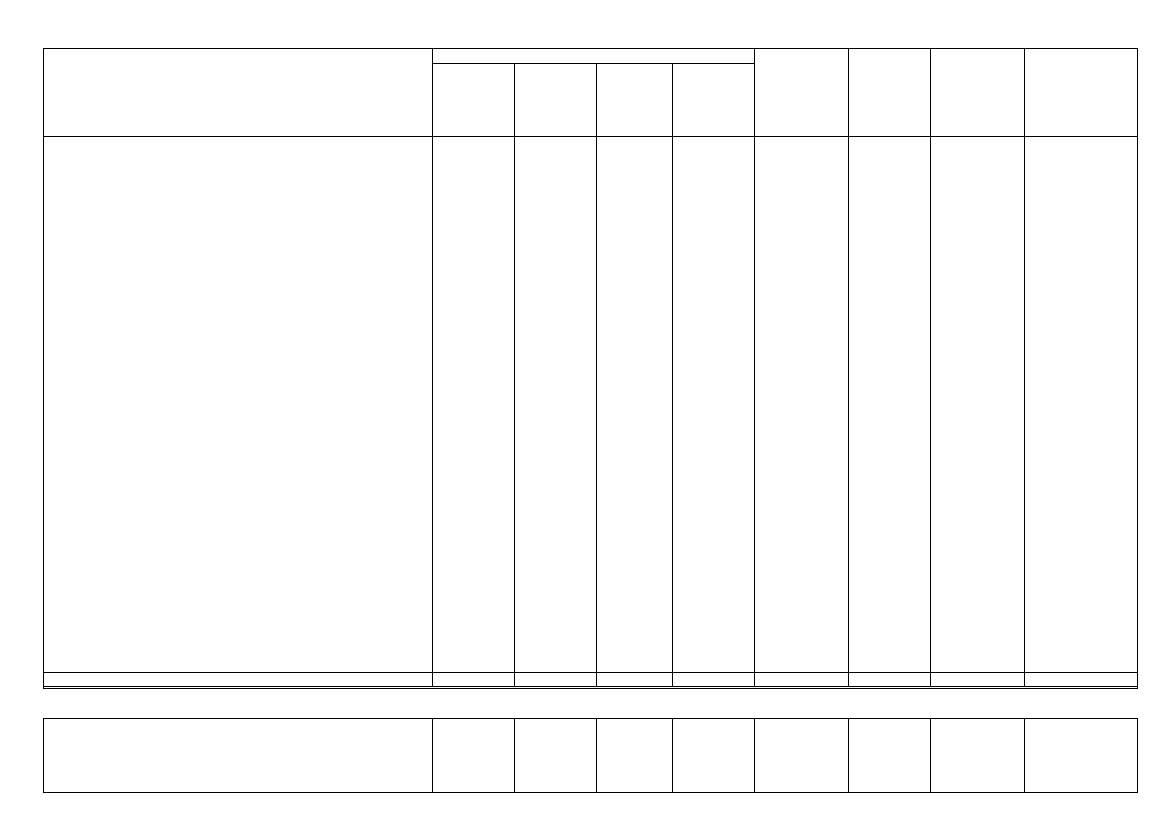

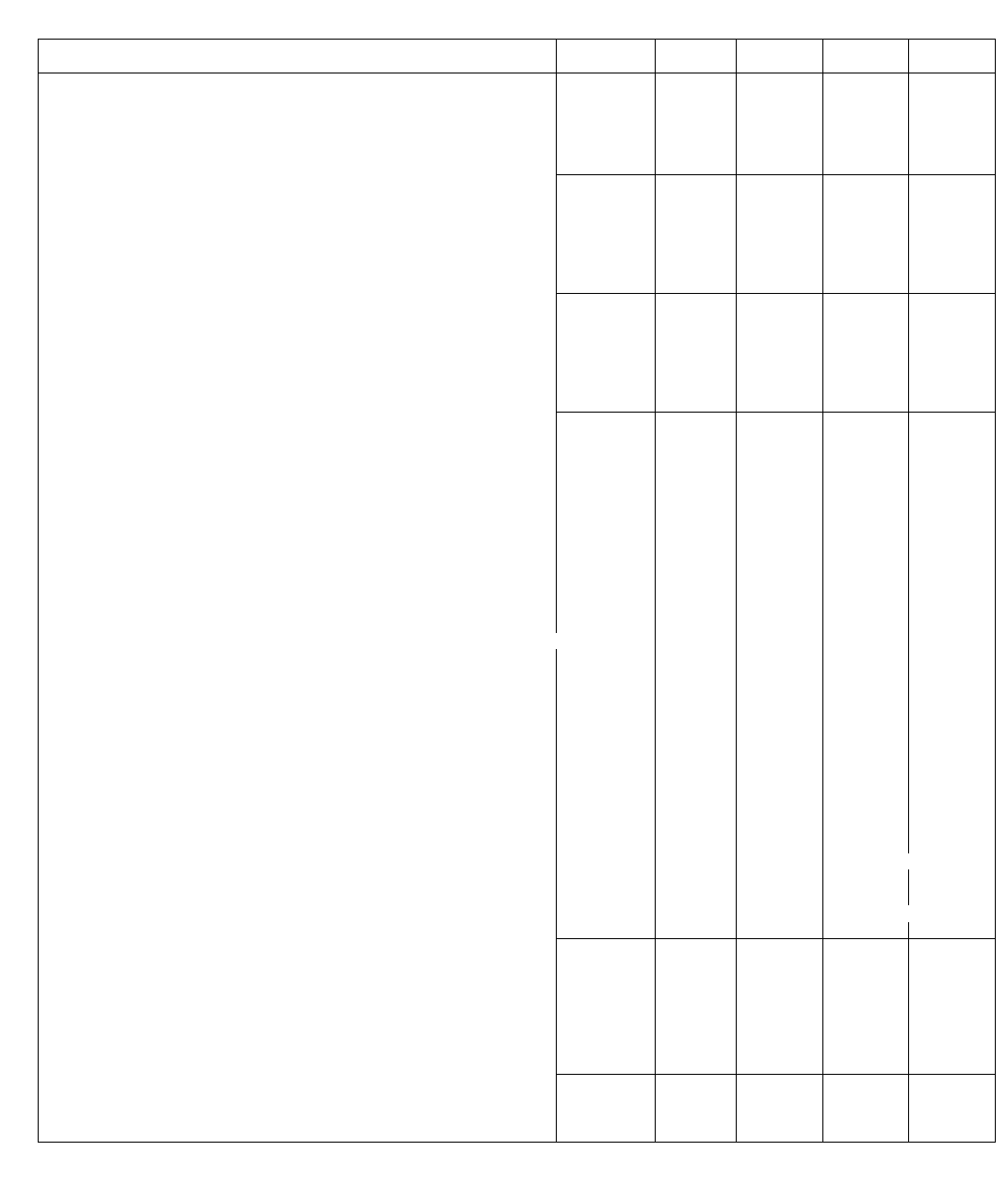

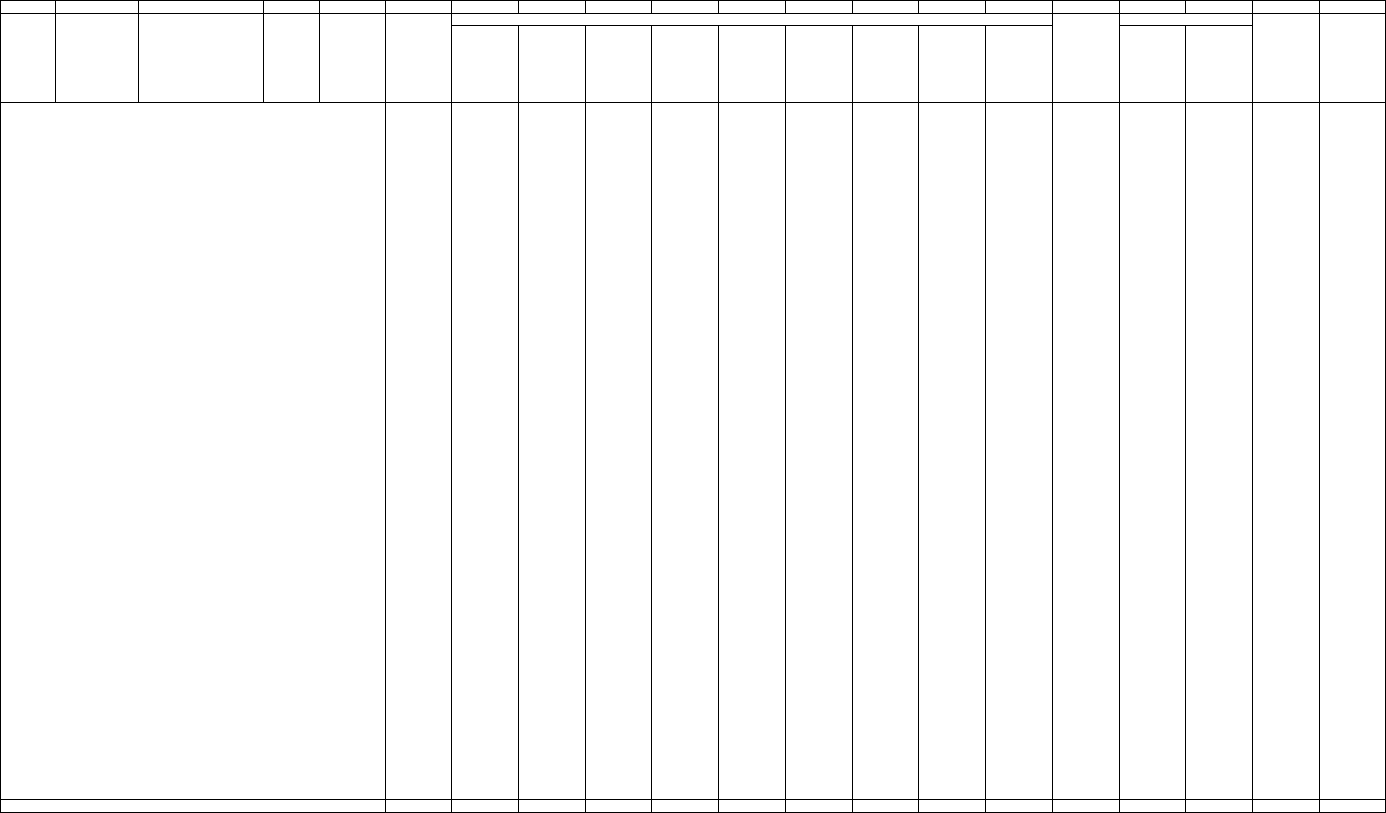

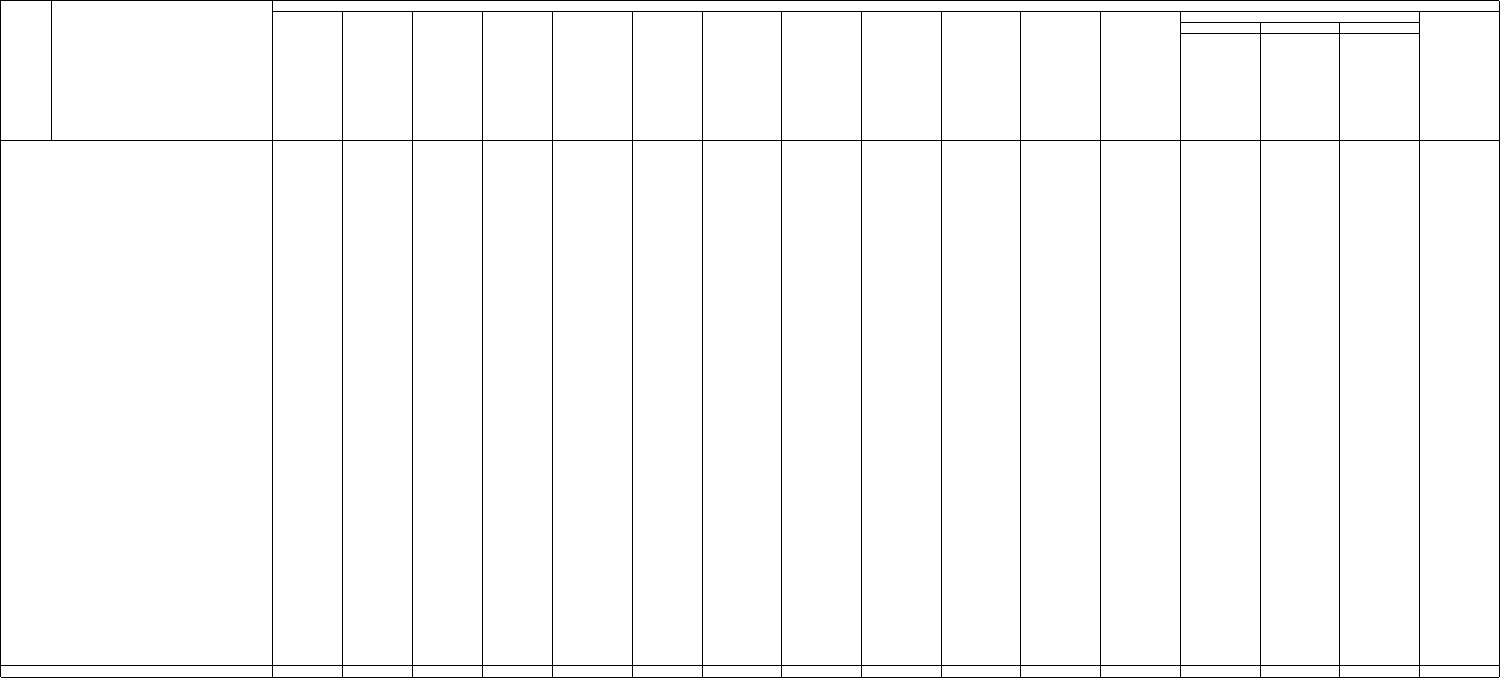

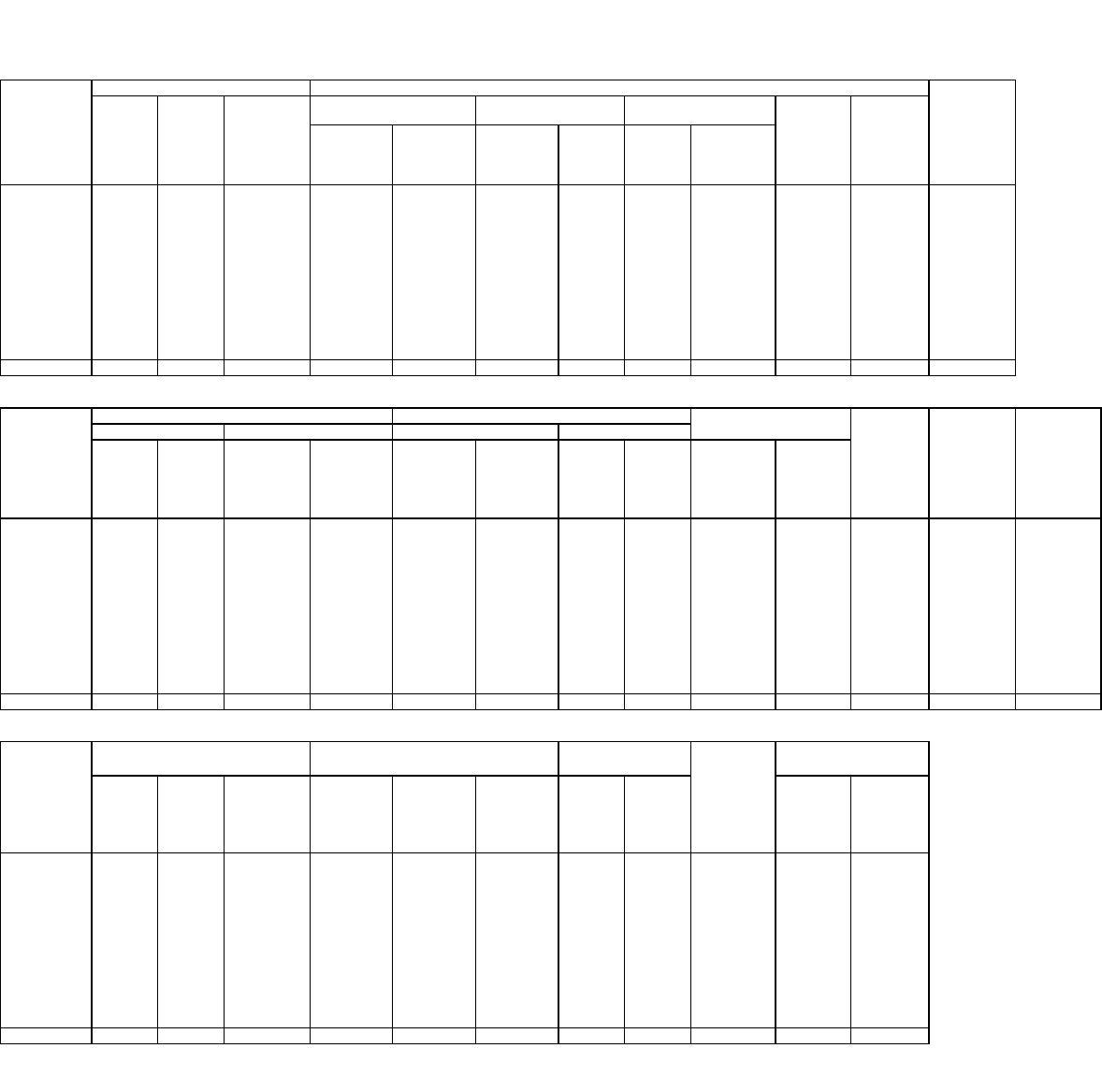

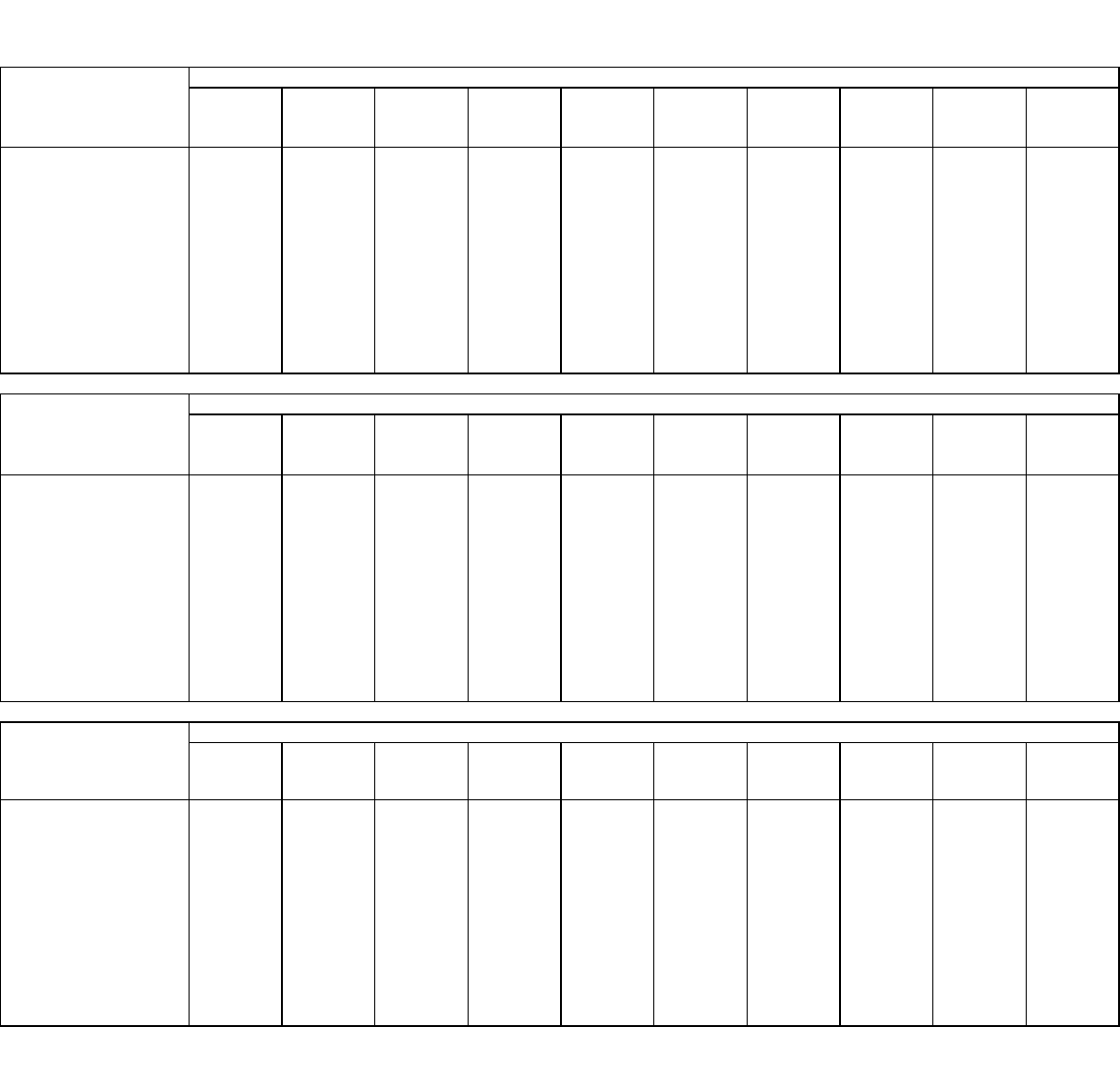

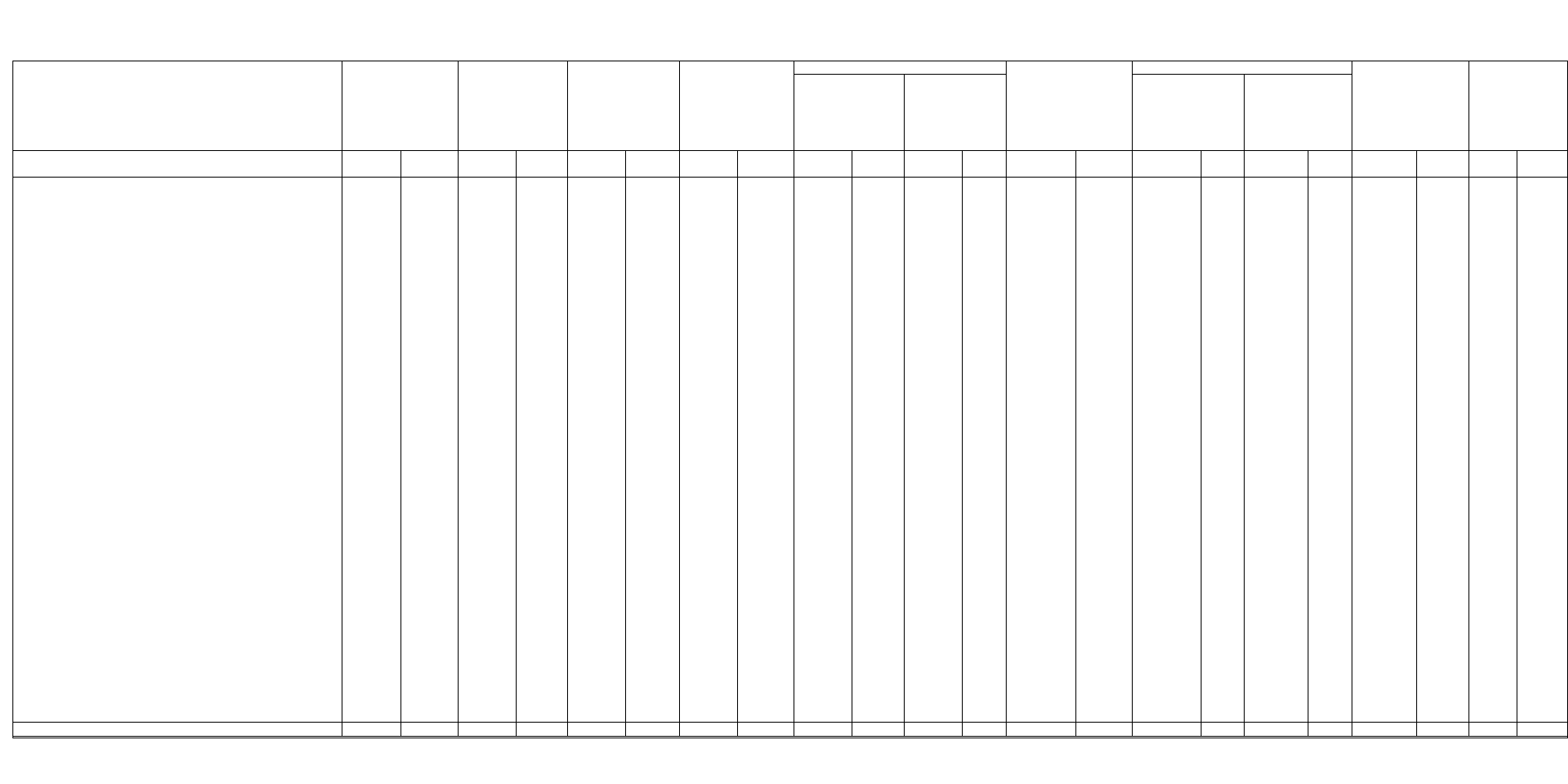

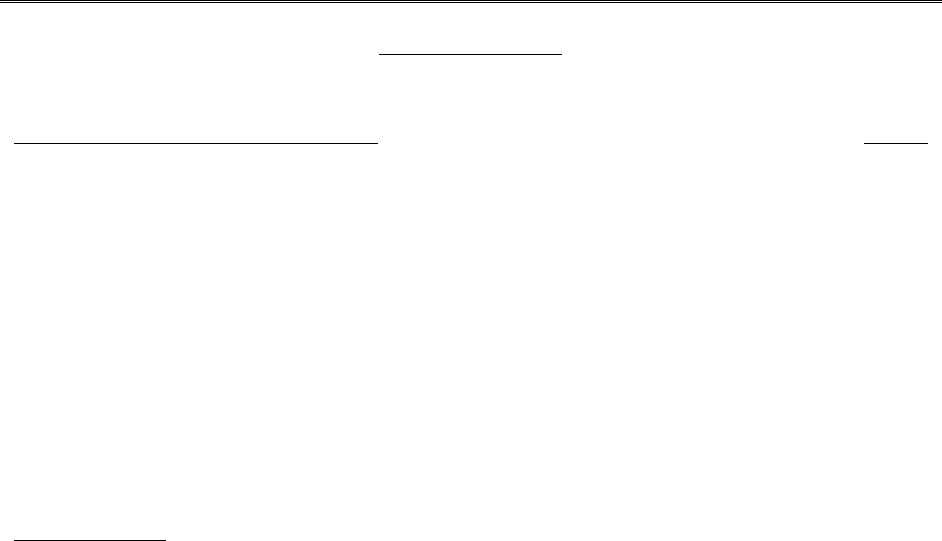

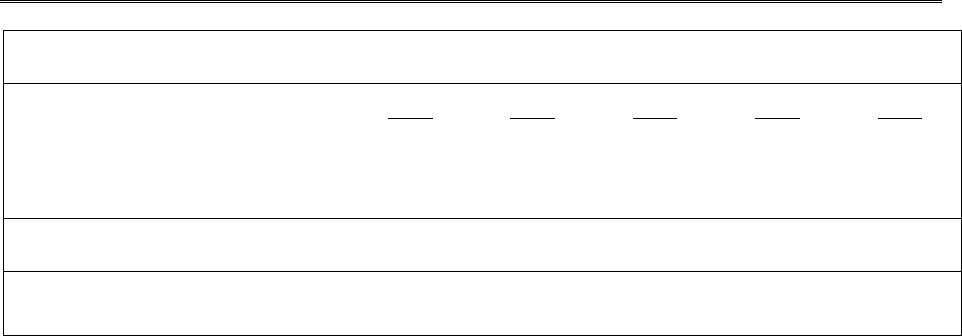

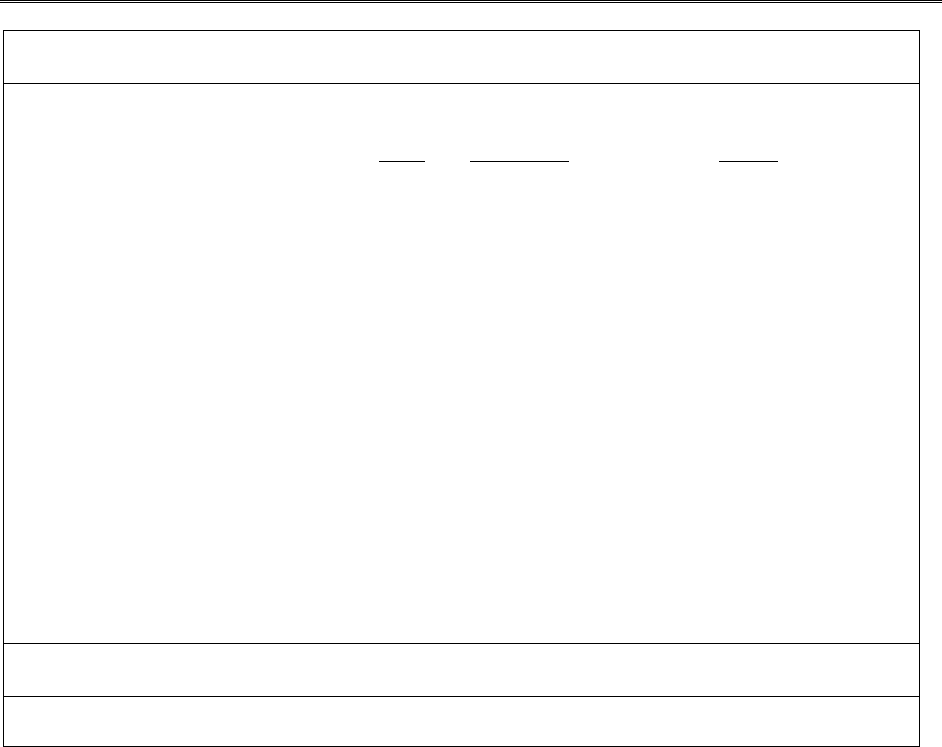

TABLE 2

Assets: Total U.S. P&

C Insurance Industry

U.S. 201

8

Statutory Financials, NAIC Format (USD in OOOs)

Line Description Assets

% of

Total

Nonadmitted

Assets

Net Admitted

Assets

% of

Total

1.

Bonds

1,027,815,046

49%

312,840

1,027,502,206

5

1

%

2.1

Preferred

stocks

5,454,309

0

%

7,203

5,447,106

0

%

2.2

Common stocks

395,451,664

19

%

5,734,811

389,716,853

1

9

%

4.

Real estate

13,727,077

1%

43,525

13,683,552

1%

5.

Cash, cash equivalents and

short-term investment 101,993,264 5% 29,624 101,963,640 5%

8.

Other invested assets

149,642,333

7

%

14,765,778

134,876,555

7%

12.

Subtotal, cash and invested

assets 1,725,865,280 83% 22,972,981 1,702,892,299 84%

15.1

Uncollected premiums and

agents balances 66,184,809 3% 3,309,043 62,875,766 3%

15.2

Deferred premiums and

agents balances 121,849,858 6% 316,170 121,533,688 6%

16.1

Amounts recoverable from

reinsurers 42,558,949 2% 4,258 42,554,691 2%

18.2

Net deferred tax ass

et

25,779,026

1

%

6,952,286

18,826,740

1

%

23.

Receivables from parent

,

subsidiaries and affiliates 22,055,541 1% 427,692 21,627,850 1%

25.

Aggregate write

-

ins

33,353,894

2%

10,307,386

23,046,508

1%

Other non

-

invested assets

41,352,758

2

%

9.766,723

31,586,035

2%

Subtotal, non

-

invested

assets 353,134,835 17% 31,083,558 322,051,277 16%

28.

Total

2,079,000,115

100%

54,056,540

2,024,943,576

100%

As shown in Table 2, the U.S. property/casualty industry held $2.1 trillion dollars of assets as

of December 31, 2018. The statutory balance sheet makes two broad distinctions regarding

assets held by insurers:

• Cash and invested assets vs. non-invested assets: Assets are categorized by this

criterion to identify the proportion of an insurer’s asset that is readily convertible to

cash. The “cash and invested assets” are assets that could be readily sold in near term

to meet the insurer’s liabilities, while the “non-invested assets” are less liquid. This

distinction is in line with the emphasis that statutory accounting places on solvency.

Rows 1 through 12 on the Assets page include cash and invested assets, while rows

13 through 25 include non-invested assets.

• Admitted vs. nonadmitted assets: As shown in Table 2, there are separate columns

that depict the amount of assets that are nonadmitted. These nonadmitted assets,

which represent about 3% of total assets, are not recognized by state insurance

departments in evaluating the solvency of an insurance company for statutory

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part III. SAP in the U.S.: Fundamental Aspects of the Annual Statement

28

accounting purposes. The rationale for this exclusion is that those nonadmitted assets

are not readily convertible for use to meet an insurer’s liabilities now or in the future

and thus would not be reasonable to consider in evaluating a company’s solvency. In

many cases nonadmitted assets are determined by formulae established by the

National Association of Insurance Commissioners (NAIC). As shown in Table 2, there

are nonadmitted assets in the cash and invested assets categories and the non-

invested assets categories, though the proportion of nonadmitted assets is much

lower for cash and invested assets. Several common examples of nonadmitted assets

will be discussed in the description of the specific asset classes below (such as certain

uncollected and deferred premiums and agents’ balances and net deferred tax assets),

which will help to demonstrate this point.

Those distinctions aside, it is clear from Table 2 that the largest asset class for the

property/casualty industry in 2018 was bonds, which represented 49% of the industry’s total

assets, followed by common stocks, which represented 19% of the industry’s total assets.

These statistics have remained relatively consistent over the years. While most actuaries will

not need to have a deep understanding of each of the asset classes on the balance sheet, is it

worthwhile to know a few relevant details on the largest classes to have a fundamental

understanding of the balance sheet.

Bonds (Line 1)

Bonds are securities that pay one or more future interest payments according to a fixed

schedule. The face value of a bond refers to the amount that is to be paid in the final single

payment at the maturity of a bond. When an insurance company purchases a bond, the

current value of that bond is recorded as the actual cost, including brokerage and other fees.

This purchase price may be more or less than the face value of the bond.

To the extent that the purchase price is higher (or lower) than the face value of the bond, a

bond premium (or discount) is recorded as a part of the recorded amount. Over the life of the

bond, that bond premium or bond discount will be amortized according to a constant yield

approach. The reason for this amortization is that when the bond ultimately matures, the

amortized value will be equal to the face value, eliminating a lump sum gain or loss at the

maturity of the bond.

After the purchase, statutory accounting indicates that bonds be recorded at one of the

following bases:

• Amortized cost

• The lower of amortized cost or fair value

The designation that the NAIC’s Security Valuation Office (SVO) assigns to the bond

determines the applicability of the two bases above. The six possible designations are NAIC 1

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part III. SAP in the U.S.: Fundamental Aspects of the Annual Statement

29

through NAIC 6, which range from the “highest quality” bonds to “bonds in or near default,”

respectively. Bonds with the two highest designations (NAIC 1 and 2) are carried at amortized

cost, while bonds with designations of NAIC 3 (“medium quality”) and below are carried at the

lower of amortized cost or fair value. The amount at which a bond is recorded, following these

criteria, is referred to as the adjusted carrying value.

Schedule D of the Annual Statement provides details on the specific bonds that are held by an

insurance company, including the following:

• Type of issuer (e.g., federal, state or corporate)

• Maturity (e.g., one year, one year to five years)

• NAIC Class (Class 1 through Class 6)

Based on the industry aggregate Annual Statement as of December 31, 2018, insurance

companies’ bond portfolios were made up of approximately 44% industrial bonds, 24% special

revenue bonds, and 17% U.S. government bonds. By maturity, just over half of bonds held

were 5 years to maturity or less, with the majority of the remainder having maturities

between 5 and 10 years. Furthermore, approximately 80% of bonds held by insurers were in

the NAIC Class 1.

Given that bonds are the largest asset class for property/casualty insurers, an actuary or

other user of the financial statements who is reviewing the financial health of an insurance

company may benefit from reviewing the detail in Schedule D.

Stocks (Lines 2.1 and 2.2)

As shown in Table 2, approximately 19% of insurers’ assets were in common or preferred

stock. Stocks are securities that represent an ownership share in a company. Those

ownership shares are subordinate to bondholders and creditors. Common stock ownership

confers voting privileges and may pay a dividend, though the dividend is not guaranteed.

Preferred stock does not confer voting privileges but usually provides a guarantee on

dividends to be paid, and usually has preference to common stock in the event of liquidation.

At purchase, stocks are valued at cost plus any brokerage or related fees. After purchase,

publicly traded stocks are recorded at fair value, which is based on the market price that is

readily available to the public and which can generally be determined from external pricing

services. If a stock is not publicly traded or a price is not available, the NAIC’s SVO will

determine a fair value. Preferred stocks are assigned similar NAIC designations as bonds with

six rating levels, which dictate whether they are valued at cost, amortized cost or fair value

based on the NAIC designation.

An actuary or other user of the financial statements who is evaluating the financial health of

an insurance company should take note of a property and investigate further if an insurance

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part III. SAP in the U.S.: Fundamental Aspects of the Annual Statement

30

company has a relatively larger portion of their assets in stocks, compared to the overall

industry.

Real Estate (Line 4)

Three classes of real estate are presented separately on the Assets page of the Annual

Statement:

• Properties occupied by the company

• Properties held for the production of income

• Properties held for sale

These classes are relatively self-explanatory, though one detail to be aware of is that if a

company and its affiliates occupy less than 50% of a property, it is classified as either a

property held for production of income or a property held for sale (as opposed to a property

occupied by the company). Properties in the first two categories are generally recorded at

depreciated cost, while properties that are held for sale are recorded at the lower of

depreciated cost (i.e., carrying amount) or fair value less encumbrances and estimated costs

to sell the property.

Details of a company’s real estate transactions and holdings are presented in Schedule A of

the Annual Statement.

Cash, Cash Equivalents and Short-Term Investments (Line 5)

This asset class generally includes assets that are immediately convertible to cash. As of

December 31, 2018, these assets represented nearly 5% of insurers’ total assets, and

approximately two-thirds of these assets were in short-term investments.

Cash equivalents must have an original maturity of less than three months, and short-term

investments must have an original maturity of one year or less. In the Annual Statement,

details on cash are provided in Schedule E-1, cash equivalents are described in Schedule E-2,

and short-term investments are found in Schedule DA. Further, a reconciliation is made in the

Cash Flow statement showing cash, cash equivalents and short-term investments at the

beginning of the year, adjusted for net cash (inflows minus outflows from operations,

investments, financing and miscellaneous sources) during the year. The result is the amount

of cash, cash equivalents and short-term investments at the end of the year, which is shown

in line 5 of the Assets page.

Uncollected and Deferred Premiums and Agents’ Balances (Lines 15.1 and 15.2)

These two asset classes represent premiums that have been written but have not yet been

received. Although the names of the asset classes refer to “agents’ balances” (or balances

due from policies sold by insurance agents, as intermediaries between the insurance company

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part III. SAP in the U.S.: Fundamental Aspects of the Annual Statement

31

and the policyholder), both asset classes may also include uncollected premiums for policies

sold directly to policyholders.

Uncollected premiums and agents’ balances include premiums due on or before the financial

statement date, while deferred premiums and agents’ balances include premiums due after

the financial statement date. Both classes include installment premiums that meet those

timing criteria as well.

Premiums that are more than 90 days past due from an agent or a direct policyholder are

considered nonadmitted assets. Furthermore, an insurer may determine that agents’ balances

that are 90 days or more overdue are unlikely to be collected (or “impaired”). In this event,

the insurer should write-off the uncollectable balance.

These two classes together represented nearly 10% of the industry assets as of December 31,

2018, highlighting that collectability of these assets is relevant to a company’s financial

health and a measure of the efficiency of its collections’ department. An actuary or other user

of the financial statements who is reviewing the financial health of an insurer may consider

the overall magnitude of a company’s uncollected and deferred agents’ balances and the

percentage of agents’ balances that are nonadmitted. Either one of these metrics could be

benchmarked to the overall industry; a company having a significantly higher portion of its

assets in these two classes relative to the industry would warrant further analysis to

understand the impact to liquidity.

Amounts Recoverable from Reinsurers (Line 16.1)

This asset class reflects amounts that are expected to be recovered from a reinsurer on

losses and LAE that have been paid by the company, but do not include expected reinsurance

recoveries for loss and LAE reserves. The reason that expected recoveries for loss and LAE

reserves are not included is that loss and LAE are already reflected net of reinsurance on the

balance sheet. Additional detail on expected recoveries for both paid amounts and reserves

are included in Schedule F, which will be discussed in detail in Chapter 14. Schedule F. The

detail included in Schedule F allows an actuary or other user of the financial statements to

assess the quality and collectability of the reinsurance recoverables.

Net Deferred Tax Assets (Line 18.2)

Deferred tax assets (DTAs) represent expected future tax benefits related to amounts

previously recorded in the statutory financial statements and not expected to be reflected in

the tax return as of the reporting date. They are referred to as “net” DTAs because they are

recorded net of any deferred tax liabilities (DTLs) that exist. Two common sources of DTAs

relevant to the actuary are the following:

• The difference in tax accounting and statutory accounting for loss reserves

• The carryforward of net operating losses from previous years

FINANCIAL REPORTING THROUGH THE LENS OF A PROPERTY/CASUALTY ACTUARY

Part III. SAP in the U.S.: Fundamental Aspects of the Annual Statement

32

The first source of DTAs is particularly relevant to actuaries. For tax reporting purposes, loss

reserves are discounted when determining taxable income. This means that an insurance

company is not able to deduct from taxable income the full amount of losses that are incurred

during a year. Therefore, assuming loss reserves are growing, a company’s income on a tax

basis is higher than the company’s pre-tax income on a statutory basis in the current year. In

the future, as this discounting unwinds, the insurer will get a tax deduction, which will not be