Financial reporting developments

A comprehensive guide

Certain

investments in

debt and equity

securities

May 2023

To our clients and other friends

This Financial reporting developments (FRD) publication summarizes the guidance on the accounting for

certain investments in debt and equity securities and includes excerpts from and references to the

Accounting Standards Codification (ASC or Codification), interpretive guidance and examples.

We have updated this publication to provide enhancements to our interpretive guidance. Refer to

Appendix E for further detail on the updates provided.

The accounting for investments in debt and equity securities continues to be an area of focus by preparers,

financial statement users, auditors and regulators. Questions continue to arise about the application of the

measurement alternative for equity securities, accounting for sales of held-to-maturity debt securities,

transfers between categories of debt securities and other topics.

This publication doesn’t address the accounting for credit impairment of debt securities under the guidance

in Accounting Standards Update (ASU) 2016-13.

1

Refer to Appendix A for a summary of the changes to

the credit impairment model for held-to-maturity and available-for-sale debt securities as a result of that

guidance. Additional guidance related to ASU 2016-13 can be found in our FRD, Credit impairment under

ASC 326. Public business entities (PBEs) that are Securities and Exchange Commission (SEC) filers and

are not smaller reporting companies (as defined by the SEC) were required to begin applying the

standard in 2020. All other entities are required to begin applying the standard in 2023.

We hope this publication will help you understand and apply the accounting for certain investments in

debt and equity securities. We are also available to answer your questions and discuss any concerns you

may have.

May 2023

1

ASU 2016-13, Financial Instruments — Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments.

Financial reporting developments Certain investments in debt and equity securities | i

Contents

1 Overview ................................................................................................................... 1

1.1 Overview ............................................................................................................................... 1

2 Accounting for investments in debt securities ............................................................. 2

2.1 Overview ............................................................................................................................... 2

2.2 Scope and scope exceptions ................................................................................................... 2

2.2.1 Scope and scope exceptions — entities ............................................................................ 2

2.2.2 Scope and scope exceptions — instruments ..................................................................... 3

2.2.2.1 Debt securities ................................................................................................. 3

2.2.2.1.1 Definition of a security ............................................................................. 4

2.2.2.1.1.1 Loans ........................................................................................ 5

2.2.2.1.2 Preferred stock ....................................................................................... 6

2.2.2.1.3 Beneficial interests in securitized financial assets ....................................... 7

2.2.2.1.3.1 Securities in the scope of ASC 325-40 .......................................... 9

2.2.2.1.3.2 Applicability of ASC 325-40 to trading securities ......................... 10

2.2.2.1.4 Certain purchased options and forward contracts .................................... 11

2.2.3 Instruments that are not in the scope of ASC 320 ......................................................... 12

2.2.3.1 Derivatives .................................................................................................... 12

2.2.3.2 Other common issues related to scope ............................................................ 13

2.2.3.2.1 Cash and cash equivalents...................................................................... 13

2.2.3.2.2 Short sales of debt securities .................................................................. 13

2.2.3.2.3 Contractual prepayment or settlement in such a way that the holder

would not recover substantially all of its recorded investment ................... 13

2.2.3.2.4 Look-through not permitted (updated May 2023) .................................... 13

2.3 Classification and measurement ........................................................................................... 13

2.3.1 Summary table of classification and measurement ........................................................ 14

2.3.2 Recognition and initial measurement ............................................................................ 15

2.3.2.1 Premiums and discounts ................................................................................. 15

2.3.2.2 Transaction costs........................................................................................... 16

2.3.2.3 Recognition date ............................................................................................ 16

2.3.3 Trading securities ....................................................................................................... 17

2.3.3.1 Entities with classified balance sheets .............................................................. 18

2.3.3.2 Subsequent measurement .............................................................................. 18

2.3.3.2.1 Interest income ..................................................................................... 18

2.3.3.3 Foreign currency gains and losses ................................................................... 18

2.3.3.4 Hedging securities classified as trading ............................................................ 18

2.3.3.5 Considerations for mortgage banking entities .................................................. 19

2.3.4 Held-to-maturity securities .......................................................................................... 19

2.3.4.1 Ability and intent to hold to maturity ............................................................... 19

2.3.4.1.1 Considerations for regulated entities ....................................................... 20

2.3.4.1.2 Considerations for specific instruments ................................................... 20

2.3.4.1.2.1 Pledged securities ..................................................................... 20

Contents

Financial reporting developments Certain investments in debt and equity securities | ii

2.3.4.1.2.2 Repurchase agreements and similar arrangements ...................... 20

2.3.4.1.2.3 Convertible debt ....................................................................... 21

2.3.4.1.2.4 Prepayable debt securities ......................................................... 21

2.3.4.1.2.5 Put and call features ................................................................. 21

2.3.4.1.2.6 Interest-only securities and other securities with principal risk ...... 21

2.3.4.1.2.7 Structured notes ...................................................................... 22

2.3.4.2 Additional considerations when assessing whether held-to-maturity

classification is appropriate ............................................................................ 22

2.3.4.2.1 Asset-liability management programs ..................................................... 22

2.3.4.2.2 Hedging programs ................................................................................. 23

2.3.4.2.3 Investment management policies ............................................................ 23

2.3.4.2.4 Future business plans ............................................................................ 23

2.3.4.2.5 Tax-planning strategies .......................................................................... 23

2.3.4.3 Entities with classified balance sheets .............................................................. 23

2.3.4.4 Subsequent measurement .............................................................................. 23

2.3.4.5 Foreign currency considerations ..................................................................... 23

2.3.4.6 Hedging securities classified as held to maturity ............................................... 24

2.3.5 Available-for-sale securities ......................................................................................... 24

2.3.5.1 Entities with classified balance sheets .............................................................. 25

2.3.5.2 Subsequent measurement .............................................................................. 25

2.3.5.3 Foreign currency considerations ..................................................................... 25

2.3.5.4 Hedging securities classified as available for sale .............................................. 26

2.3.5.5 Effect of available-for-sale security unrealized gains and losses on

certain insurance-related assets and liabilities of insurance companies ............... 26

2.3.6 Forward contracts and purchased options on debt securities ......................................... 26

3 Accounting for equity investments ............................................................................ 28

3.1 Scope and scope exceptions ................................................................................................. 28

3.1.1 Scope and scope exceptions — entities .......................................................................... 28

3.1.2 Scope and scope exceptions — instruments ................................................................... 28

3.1.2.1 Equity securities ............................................................................................ 29

3.1.2.1.1 Forward contracts and purchased options on equity securities .................. 29

3.1.2.1.2 Simple agreement for future equity (SAFE) (updated May 2023) ............... 30

3.1.2.1.3 SEC staff views on written options and combination options ..................... 31

3.1.2.2 Other ownership interests in an entity ............................................................. 32

3.1.2.2.1 Investments in limited partnerships (updated May 2023) .......................... 32

3.1.3 Instruments not in the scope of ASC 321 ...................................................................... 33

3.1.3.1 Derivatives .................................................................................................... 33

3.1.4 Common issues related to scope .................................................................................. 34

3.1.4.1 Look-through not permitted ............................................................................ 34

3.1.4.2 Cash and cash equivalents .............................................................................. 34

3.1.4.3 Short sales of equity securities ........................................................................ 34

3.2 Recognition and initial measurement .................................................................................... 34

3.2.1 Transaction costs ........................................................................................................ 35

3.2.2 Recognition date ......................................................................................................... 35

3.2.3 Entities with classified balance sheets .......................................................................... 37

3.2.4 Equity securities received in exchange for goods or services with customers ...................... 37

Contents

Financial reporting developments Certain investments in debt and equity securities | iii

3.3 Subsequent measurement .................................................................................................... 37

3.3.1 Equity investments with readily determinable fair values ............................................... 38

3.3.1.1 Readily determinable fair value ....................................................................... 38

3.3.1.1.1 Restricted stock .................................................................................... 39

3.3.2 Equity investments without readily determinable fair values .......................................... 40

3.3.2.1 Measurement alternative ................................................................................ 40

3.3.2.1.1 Eligibility ............................................................................................... 40

3.3.2.1.2 Reassessment and discontinuance of the election .................................... 42

3.3.2.1.3 Identifying observable price changes ....................................................... 42

3.3.2.1.3.1 Subsequent discovery of observable price changes ...................... 43

3.3.2.1.4 Identifying a similar investment of the same issuer ................................... 45

3.3.2.1.5 Forward contracts and purchased options on equity securities .................. 47

3.4 Foreign currency gains and losses......................................................................................... 47

3.5 Hedging securities ............................................................................................................... 48

3.6 Equity method investments .................................................................................................. 48

3.6.1 Initial carrying amount of equity securities previously accounted for under

the equity method ....................................................................................................... 48

3.6.2 Changing from ASC 321 accounting to the equity method of accounting ....................... 49

4 Transfers between categories and sales of debt securities ......................................... 51

4.1 Transfers between categories of debt securities .................................................................... 51

4.1.1 Summary table of accounting requirements for transfers between categories ................ 52

4.1.2 Transfers from available for sale to held to maturity ..................................................... 53

4.1.3 Transfers from held to maturity to available for sale ..................................................... 54

4.1.3.1 Transfers of held-to-maturity securities among members of a

consolidated group ........................................................................................ 55

4.1.4 Transfers involving trading securities ........................................................................... 55

4.1.5 Conversions of convertible bonds ................................................................................. 56

4.2 Sales of debt securities ........................................................................................................ 57

4.2.1 Sales of trading securities ............................................................................................ 57

4.2.2 Sales of available-for-sale securities ............................................................................. 57

4.2.2.1 Gain recognition on sales of securities with an arrangement to reacquire them ... 57

4.2.3 Sales of held-to-maturity securities .............................................................................. 58

4.2.3.1 Evaluation of the remaining portfolio following a sale or transfer ....................... 58

4.2.3.1.1 SEC staff views on sales or transfers of held-to-maturity securities ............ 59

4.2.3.2 Permitted sales or transfers ............................................................................ 60

4.2.3.2.1 Credit deterioration ............................................................................... 60

4.2.3.2.2 Change in tax law .................................................................................. 61

4.2.3.2.3 Major business combination or disposition ............................................... 61

4.2.3.2.4 Change in statutory or regulatory requirements regarding

permissible investments ......................................................................... 63

4.2.3.2.5 Significant change in regulatory capital requirements............................... 63

4.2.3.2.6 Isolated, nonrecurring and unusual events ............................................... 63

4.2.3.2.6.1 Tender offers for held-to-maturity securities ............................... 64

4.2.3.3 Sales deemed to be at maturity ....................................................................... 64

4.2.3.4 Secured borrowings ....................................................................................... 65

Contents

Financial reporting developments Certain investments in debt and equity securities | iv

5 Impairment .............................................................................................................. 67

5.1 Debt securities ..................................................................................................................... 67

5.1.1 Overview and scope .................................................................................................... 67

5.1.2 Determining whether a debt security is impaired ........................................................... 69

5.1.3 Evaluating whether an impairment is other than temporary ........................................... 70

5.1.3.1 Entity intends to sell the debt security ............................................................. 71

5.1.3.2 More likely than not the entity will be required to sell prior to

recovery of cost basis .................................................................................... 72

5.1.3.2.1 Sales after the balance sheet date .......................................................... 72

5.1.3.2.2 Third-party management of investment portfolio ..................................... 73

5.1.3.2.3 Securities classified as held to maturity ................................................... 73

5.1.3.3 Entity does not expect to recover the entire amortized cost basis ...................... 73

5.1.3.3.1 Need for detailed cash flow analysis at each report date ........................... 75

5.1.4 Measuring and recognizing an OTTI .............................................................................. 75

5.1.4.1 Recognizing an OTTI ...................................................................................... 75

5.1.4.2 Measuring the credit loss component of an OTTI............................................... 76

5.1.4.2.1 Best estimate of present value of expected cash flows .............................. 76

5.1.4.2.1.1 Single best estimate versus probability-weighted estimate ........... 77

5.1.4.2.1.2 Variable-rate debt securities ...................................................... 78

5.1.4.2.1.3 Use of practical expedients in ASC 310-10 .................................. 78

5.1.4.2.1.4 Examples of measuring the credit loss of a debt security .............. 78

5.1.4.2.1.4.1 Measuring the credit loss of a security not in

the scope of ASC 325-40 ................................................... 78

5.1.4.2.1.4.2 Measuring the credit loss of a debt security in

the scope of ASC 325-40 ................................................... 80

5.1.4.2.1.4.3 Variable-rate debt securities not in the scope of

ASC 325-40 ..................................................................... 81

5.1.4.2.1.4.4 Fair value of previously impaired debt security

increases but expected cash flows decrease ........................ 83

5.1.4.2.1.4.5 Total decline in fair value is less than decline in

expected cash flows .......................................................... 86

5.1.5 Foreign currency considerations .................................................................................. 87

5.1.6 Accounting after an OTTI ............................................................................................. 88

5.1.7 Presentation of OTTI for debt securities ....................................................................... 89

5.1.7.1 Presentation of subsequent changes in fair value of AFS securities

after an OTTI ................................................................................................. 89

5.1.7.2 Presentation of noncredit portions of OTTI for AFS and HTM securities .............. 90

5.2 Equity securities .................................................................................................................. 90

5.2.1 Equity securities measured using the measurement alternative ..................................... 90

5.2.1.1 Foreign currency considerations ..................................................................... 91

6 Presentation and disclosure ..................................................................................... 92

6.1 Presentation and disclosure — debt securities ........................................................................ 92

6.1.1 Balance sheet presentation — debt securities ................................................................ 92

6.1.2 Income statement presentation — debt securities .......................................................... 93

6.1.2.1 Dividend and interest income — debt securities ................................................. 93

6.1.2.2 Other-than-temporary impairment — debt securities ......................................... 93

6.1.3 Other comprehensive income presentation — debt securities ......................................... 94

Contents

Financial reporting developments Certain investments in debt and equity securities | v

6.1.4 Cash flow presentation and disclosure — debt securities ................................................ 95

6.1.5 Disclosures — debt securities ........................................................................................ 95

6.1.5.1 AFS and HTM securities — debt securities ......................................................... 96

6.1.5.2 Unrealized loss disclosures — debt securities .................................................... 99

6.1.5.3 Credit loss rollforward disclosures — debt securities ........................................ 102

6.1.5.4 Disclosing the fair value of debt securities ...................................................... 103

6.1.5.5 Additional footnote disclosure considerations for financial institutions —

debt securities ............................................................................................. 103

6.1.6 Disclosures about transfers between categories and sales of debt securities ................ 103

6.2 Presentation and disclosure — equity securities .................................................................... 104

6.2.1 Overview — equity securities ...................................................................................... 104

6.2.2 Balance sheet presentation — equity securities ............................................................ 105

6.2.3 Income statement presentation — equity securities ..................................................... 106

6.2.4 Cash flow presentation and disclosure — equity securities ............................................ 106

6.2.5 Disclosures — equity securities ................................................................................... 106

6.2.5.1 Equity securities without readily determinable fair values ................................ 106

6.2.5.2 Equity securities held at the reporting date .................................................... 107

6.2.6 Sales of equity securities ........................................................................................... 108

A Summary of ASU 2016-13 ...................................................................................... A-1

B Glossary ................................................................................................................. B-1

C ASC references ....................................................................................................... C-1

D ASC abbreviations .................................................................................................. D-1

E Summary of important changes ............................................................................... E-1

Contents

Financial reporting developments Certain investments in debt and equity securities | vi

Notice to readers:

This publication includes excerpts from and references to the Financial Accounting Standards Board

(FASB or Board) Accounting Standards Codification (Codification or ASC). The Codification uses a

hierarchy that includes Topics, Subtopics, Sections and Paragraphs. Each Topic includes an Overall

Subtopic that generally includes pervasive guidance for the Topic and additional Subtopics, as needed,

with incremental or unique guidance. Each Subtopic includes Sections that in turn include numbered

Paragraphs. Thus, a Codification reference includes the Topic (XXX), Subtopic (YY), Section (ZZ) and

Paragraph (PP).

Throughout this publication references to guidance in the Codification are shown using these reference

numbers. References are also made to certain pre-Codification standards (and specific sections or

paragraphs of pre-Codification standards) in situations in which the content being discussed is excluded

from the Codification.

This publication has been carefully prepared, but it necessarily contains information in summary form

and is therefore intended for general guidance only; it is not intended to be a substitute for detailed

research or the exercise of professional judgment. The information presented in this publication should

not be construed as legal, tax, accounting, or any other professional advice or service. Ernst & Young

LLP can accept no responsibility for loss occasioned to any person acting or refraining from action as a

result of any material in this publication. You should consult with Ernst & Young LLP or other

professional advisors familiar with your particular factual situation for advice concerning specific audit,

tax or other matters before making any decisions.

Portions of FASB publications reprinted with permission. Copyright Financial Accounting Standards Board, 801 Main Avenue,

P.O. Box 5116, Norwalk, CT 06856-5116, USA. Portions of AICPA Statements of Position, Technical Practice Aids and other AICPA

publications reprinted with permission. Copyright American Institute of Certified Public Accountants, 1345 Avenue of the Americas,

27

th

Floor, New York, NY 10105, USA. Copies of complete documents are available from the FASB and the AICPA.

Financial reporting developments Certain investments in debt and equity securities | 1

1 Overview

1.1 Overview

This publication addresses the financial accounting and reporting requirements for certain investments in

debt and equity securities. ASC 320, Investments — Debt Securities, provides accounting and reporting

guidance only for investments in debt securities, including those resulting from the securitization of other

financial instruments. ASC 321, Investments — Equity Securities, provides accounting and reporting

guidance for investments in equity securities and other ownership interests in an entity. This guidance

applies to entities in almost all industries.

This publication doesn’t address the accounting for credit impairment of debt securities under the new

guidance in ASU 2016-13. Refer to Appendix A for a summary of the changes to the credit impairment

model for held-to-maturity and available-for-sale debt securities as a result of that guidance. Additional

guidance related to ASU 2016-13 can be found in our FRD, Credit impairment under ASC 326. PBEs that

are SEC filers and are not smaller reporting companies (as defined by the SEC) were required to begin

applying the standard in 2020. All other entities are required to begin applying the standard in 2023.

Financial reporting developments Certain investments in debt and equity securities | 2

2 Accounting for investments in debt

securities

2.1 Overview

ASC 320 provides guidance on the financial accounting and reporting for investments in debt securities,

including those resulting from the securitization of other financial instruments. The guidance applies to

entities in almost all industries.

2.2 Scope and scope exceptions

2.2.1 Scope and scope exceptions — entities

Excerpt from Accounting Standards Codification

Investments — Debt Securities — Overall

Scope and Scope Exceptions

Entities

320-10-15-2

The guidance in the Investments — Debt Securities Topic applies to all entities, including the following

entities that are not deemed to belong to specialized industries for purposes of this Topic:

a. Cooperatives and mutual entities (such as credit unions and mutual insurance entities)

b. Trusts that do not report substantially all of their debt securities at fair value.

320-10-15-3

The guidance in this Topic does not apply to the following entities:

a. Entities in certain specialized industries. Entities whose specialized accounting practices include

accounting for substantially all investments in debt securities at fair value, with changes in value

recognized in earnings (income) or in the change in net assets.

320-10-15-4

Paragraphs 320-10-35-7 through 35-34 provide guidance on identifying and accounting for

impairment of certain securities and identify the scope application of that guidance for not-for-profit

entities (NFPs). No other part of this Topic applies to NFPs. Subtopic 958-320 establishes standards

for investments in debt securities by NFPs.

Pending content:

Transition Date: (P) December 16, 2019; (N) December 16, 2022 | Transition Guidance: 326-10-65-1

This Topic does not apply to not-for-profit entities (NFPs). Subtopic 958-320 establishes standards

for investments in debt securities by NFPs.

Entities are subject to the guidance, unless they follow certain specialized industry guidance and are

excluded from the scope of ASC 320. Entities in the scope of ASC 320 include commercial entities,

financial institutions, cooperatives and mutual entities and trusts that do not report substantially all of

their debt securities at fair value.

2 Accounting for investments in debt securities

Financial reporting developments Certain investments in debt and equity securities | 3

The following table lists some entities that follow certain specialized industry guidance and are excluded

from the scope of ASC 320.

Industry

Applicable guidance

Brokers and dealers in securities

ASC 940-320, Financial Services — Brokers and Dealers,

Investments — Debt and Equity Securities

Defined benefit pension plans

ASC 960-325, Plan Accounting — Defined Benefit Pension

Plans, Investments — Other

Investment companies

ASC 946-320, Financial Services — Investment Companies,

Investments — Debt and Equity Securities

ASC 958-320 provides guidance on accounting for investments in debt securities held by not-for- profit

entities (NFPs). Prior to the adoption of ASU 2016-13, certain NFPs followed the impairment guidance in

ASC 320-10-35-17 through 35-34. Refer to section 5, Impairment, for additional information. No other

guidance in ASC 320 applies to NFPs. After the adoption of ASU 2016-13, the guidance in ASC 320 does

not apply to NFPs and NFPs should apply guidance in ASC 958-320 for investments in debt securities.

2.2.2 Scope and scope exceptions — instruments

ASC 320 applies to all investments in debt securities, including those resulting from the securitization of

other financial instruments, and loans that meet the definition of a security.

2.2.2.1 Debt securities

The ASC Master Glossary defines a debt security as any security representing a creditor relationship with

an entity and provides examples of instruments that meet this definition. It also lists certain instruments

that do not meet the definition.

Excerpt from Accounting Standards Codification

Master Glossary

Debt Security

Any security representing a creditor relationship with an entity. The term debt security also includes

all of the following:

a. Preferred stock that by its terms either must be redeemed by the issuing entity or is redeemable

at the option of the investor

b. A collateralized mortgage obligation (or other instrument) that is issued in equity form but is

required to be accounted for as a nonequity instrument regardless of how that instrument is

classified (that is, whether equity or debt) in the issuer’s statement of financial position

c. U.S. Treasury securities

d. U.S. government agency securities

e. Municipal securities

f. Corporate bonds

g. Convertible debt

h. Commercial paper

2 Accounting for investments in debt securities

Financial reporting developments Certain investments in debt and equity securities | 4

i. All securitized debt instruments, such as collateralized mortgage obligations and real estate

mortgage investment conduits

j. Interest-only and principal-only strips.

The term debt security excludes all of the following:

a. Option contracts

b. Financial futures contracts

c. Forward contracts

d. Lease contracts

e. Receivables that do not meet the definition of security and, so, are not debt securities, for example:

1. Trade accounts receivable arising from sales on credit by industrial or commercial entities

2. Loans receivable arising from consumer, commercial, and real estate lending activities of

financial institutions.

The definition of debt security in ASC 320 includes instruments beyond legal-form debt. For example, preferred

stock that is either mandatorily redeemable or redeemable at the option of the investor is considered a

debt security under ASC 320, even though preferred stock is considered an equity security in legal form.

2.2.2.1.1 Definition of a security

Excerpt from Accounting Standards Codification

Master Glossary

Security

A share, participation, or other interest in property or in an entity of the issuer or an obligation of the

issuer that has all of the following characteristics:

a. It is either represented by an instrument issued in bearer or registered form or, if not represented

by an instrument, is registered in books maintained to record transfers by or on behalf of the issuer.

b. It is of a type commonly dealt in on securities exchanges or markets or, when represented by

an instrument, is commonly recognized in any area in which it is issued or dealt in as a medium

for investment.

c. It either is one of a class or series or by its terms is divisible into a class or series of shares,

participations, interests, or obligations.

Certain debt instruments must be evaluated carefully to determine whether they meet the definition of a

security, which requires that they have all three characteristics listed in the Master Glossary. For example,

while most certificates of deposit (CDs) do not meet the ASC 320 definition of a security, some negotiable

“jumbo” CDs may meet it. Likewise, certain guaranteed investment contracts (GICs) meet the definition

of a security, while others do not. When considering whether an instrument meets the ASC 320 definition

of a security, entities should consider the following:

• While the definition of security in ASC 320 is modeled after the definition in the Uniform Commercial

Code (UCC), the definitions are not the same because the UCC definition has changed since the

issuance of the ASC 320 definition.

2 Accounting for investments in debt securities

Financial reporting developments Certain investments in debt and equity securities | 5

• The FASB indicated in the Background Information and Basis for Conclusions of FAS 115 (FAS 115

was codified as ASC 320) that when deciding how to define a security for US GAAP purposes, it

decided not to use the definition in the Securities Exchange Act of 1934 because it considered that

definition too broad. For example, that definition includes instruments such as notes for routine

personal bank loans, which the FASB believed should not be included in the scope of ASC 320.

• The determination of whether an investment meets the definition of a security is not a legal

determination and does not require a legal analysis.

• When considering whether an instrument is a security, there is rarely one overriding characteristic

that is determinative. For example, an instrument could meet the second criterion in the ASC 320

definition (i.e., it is a medium for investment) even if it includes certain transfer restrictions.

Therefore, all facts and circumstances should be considered.

The SEC staff has also reiterated that ASC 320 provides its own definition of a security and does not

depend on whether the investment meets the UCC definition.

2

2.2.2.1.1.1 Loans

Excerpt from Accounting Standards Codification

Master Glossary

Loan

A contractual right to receive money on demand or on fixed or determinable dates that is recognized

as an asset in the creditor's statement of financial position. Examples include but are not limited to

accounts receivable (with terms exceeding one year) and notes receivable. This definition

encompasses loans accounted for as debt securities.

Only loans that meet the definition of a security are in the scope of ASC 320. Although certain loans can

be readily converted into securities (e.g., loans insured by the Federal Housing Administration, conforming

mortgage loans), a loan that does not meet the definition of a security is not in the scope of ASC 320

until it has been securitized.

For transferors, beneficial interests received as consideration for transferred loans may not be classified as

investment securities, unless the transfer of the loans meets the criteria for sale accounting under ASC 860.

Loans that do not meet the definition of a security are generally in the scope of ASC 310-10, unless they

are acquired with deteriorated credit quality, in which case they are in the scope of ASC 310-30.

ASC 310-10 applies to a variety of instruments and transactions, including trade account receivables,

loans, loan syndications, factoring arrangements, standby letters of credit, financing receivables

(e.g., notes receivables, credit cards) and rebates.

2

Remarks by Robert Uhl, SEC staff, before the Twenty-Fifth AICPA National Conference on Current SEC Developments, 10 December 1997.

2 Accounting for investments in debt securities

Financial reporting developments Certain investments in debt and equity securities | 6

2.2.2.1.2 Preferred stock

An investment in preferred stock that must be redeemed by the issuing entity or is redeemable at the

investor’s option is considered a debt security under ASC 320, despite its legal form. This is the case

regardless of how the issuer classified the instrument. If preferred stock is determined to be a debt

security, ASC 320 would apply to the instrument.

If the preferred stock is not mandatorily redeemable (i.e., there is no stated redemption date) and the

investor does not have the unilateral right to ultimately redeem it, the preferred stock is considered an

equity security subject to the provisions of ASC 321.

In some cases, the terms of a preferred stock give the investor the option to redeem it only after a certain

amount of time has passed. Even if it does not yet have a present right to redeem, the investor is still considered

to have a unilateral redemption right, and the stock would be classified as a debt security. In other cases, an

investor may have the right to redeem preferred stock only when an event that is not certain to occur occurs.

For example, an investor may have a right to redeem preferred stock only when a certain percentage

(e.g., majority, two-thirds) of investors elects to redeem their preferred stock. The preferred stock generally

would only be considered a debt security if and when the required percentage of interest is obtained, upon

which the investor has a unilateral right to redeem the preferred stock. If an uncertain event is within the control

of the investor, that fact should be considered in determining whether a unilateral redemption right exists.

Certain preferred shares may become redeemable at a future date if an event (e.g., a liquidity event)

does not occur by a specified date. In these cases, we believe that the preferred stock would generally be

classified as a debt security unless the issuer can control the occurrence of the event. Certain liquidity

events are not in the control of the issuer or the investor, such as an initial public offering (IPO).

To further illustrate these concepts, assume an investor holds a preferred stock that becomes

redeemable in five years by the investor unless an IPO of the issuer occurs before that date, in which

case the preferred stock is automatically converted into common stock of the issuer. In this case,

because the investor can redeem the preferred stock by passage of time in five years, the investor is

considered to have a unilateral redemption right, and therefore, the preferred stock would be classified

as a debt security. In contrast, if the issuer controls the occurrence of the event that prevents the

preferred stock from becoming redeemable by the investor, that fact should be considered in the

determination of whether a unilateral redemption right exists for the investor.

Preferred stock that is considered a debt security may be carried at amortized cost if it meets the held-to-

maturity (HTM) criteria. For example, when preferred stock has a fixed redemption date and the investor

has the intent and ability to hold the instrument until that redemption date, that instrument can be

classified as HTM.

The following illustrate the determination of whether an investor has a unilateral right to redemption and

the effect on whether preferred stock is classified as a debt or equity security.

2 Accounting for investments in debt securities

Financial reporting developments Certain investments in debt and equity securities | 7

Illustration 2-1: Preferred stock classified as an equity security

ABC Corporation is a publicly traded entity that issued preferred stock on 1 January 20X1. The preferred stock

is not mandatorily redeemable by ABC Corporation (that is, there is no stated redemption date). However,

beginning on 1 January 20X7, it may be redeemed if a majority of the preferred stockholders vote to do so.

Investor XYZ, which holds approximately 19% of the outstanding preferred stock, does not consider

them to be debt securities because they are not mandatorily redeemable and may only be redeemed if

a majority of preferred stockholders vote to do so, beginning on 1 January 20X7. Because Investor XYZ

holds less than a majority of the outstanding preferred stock, it does not have the unilateral right to

redeem them. Therefore, Investor XYZ classifies the preferred shares it holds as equity securities.

Illustration 2-2: Preferred stock classified as a debt security

Assume the same facts as above, except that Investor XYZ acquires an additional 40% of the outstanding

preferred stock, so it now owns 59% of the outstanding preferred stock.

In this case, the preferred stock meets the definition of a debt security because Investor XYZ owns

more than 50% of the outstanding preferred stock and therefore has the unilateral right to redeem its

preferred stock, as long as it continues to hold a majority interest until 1 January 20X7. Therefore,

Investor XYZ classifies the preferred shares it owns as debt securities as of the day it acquires the

additional 40% of outstanding preferred shares.

Illustration 2-3: Preferred stock classified as a debt security

Company A is a private entity that issued preferred stock on 1 January 20X1. The preferred stock is

redeemable at the option of the investor beginning on 31 December 20X5 if Company A has not

completed an IPO before then. The preferred stock will automatically convert into common stock upon

an IPO. Investor B invests in Company A’s preferred shares on 1 January 20X2. Neither Company A nor

Investor B can control the success of a Company A IPO.

Although a successful IPO by Company A would prevent Investor B from exercising the redemption right,

Company A does not control its ability to successfully complete an IPO. Therefore, because the preferred

stock will become redeemable by Investor B merely by the passage of time, Investor B is considered to

have a unilateral redemption right and classifies the preferred stock as a debt security.

2.2.2.1.3 Beneficial interests in securitized financial assets

Beneficial interests are defined as rights to receive all or portions of specified cash inflows received by a

trust or other entity. They include senior and subordinated shares of interest, principal or other cash

inflows to be passed through or paid through, and residual interests. Beneficial interests may be created

in connection with securitization transactions, such as those involving collateralized debt obligations or

collateralized loan obligations.

Entities must determine whether beneficial interests are in the scope of ASC 325-40. Beneficial interests subject

to the guidance in ASC 325-40 can be either (1) beneficial interests retained in securitization transactions

and accounted for as sales under ASC 860 or (2) purchased beneficial interests in securitized financial assets.

2 Accounting for investments in debt securities

Financial reporting developments Certain investments in debt and equity securities | 8

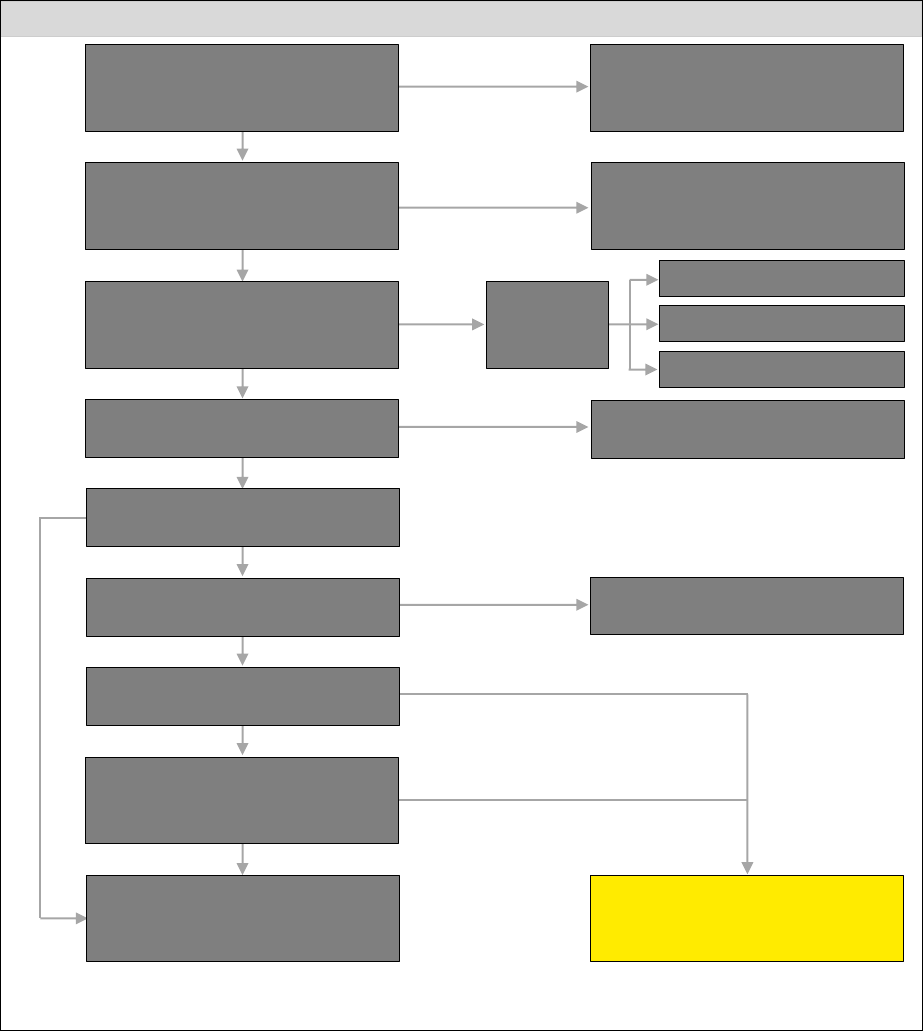

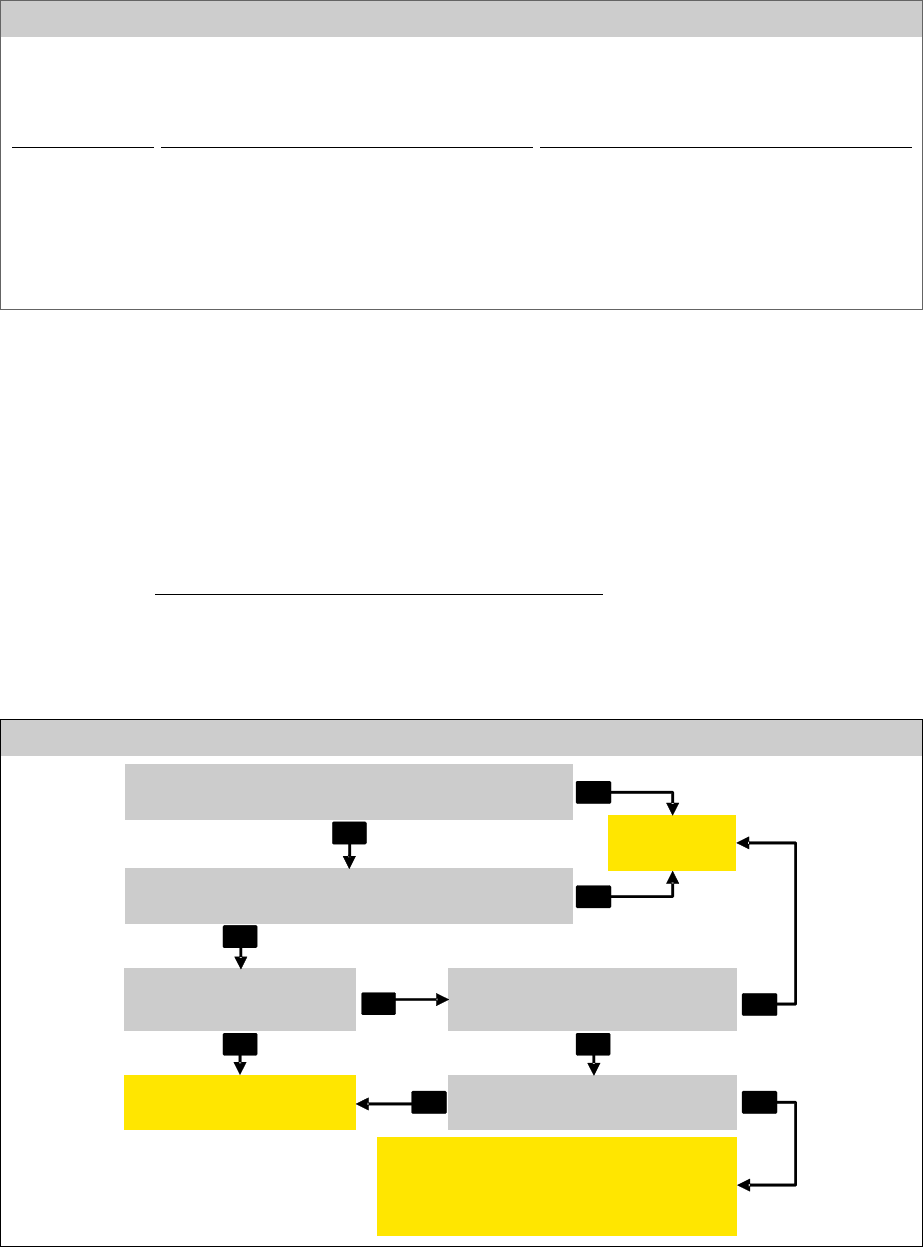

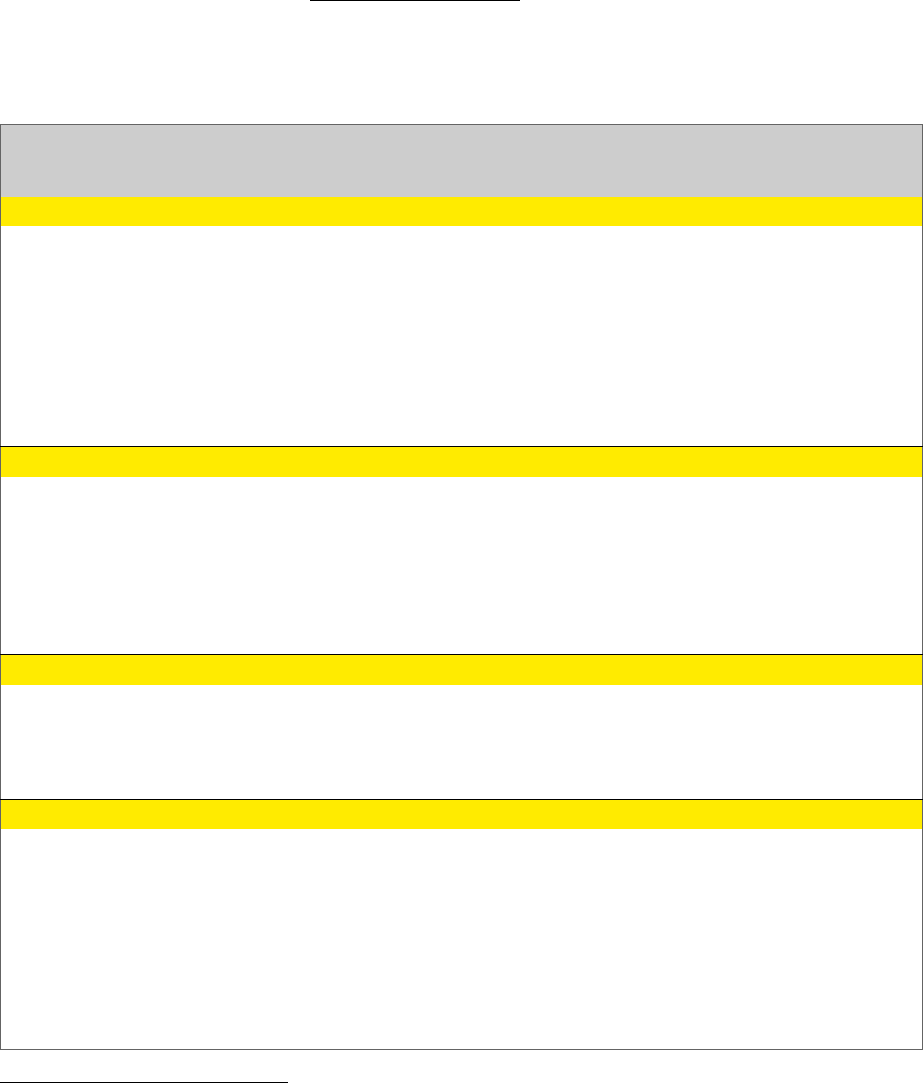

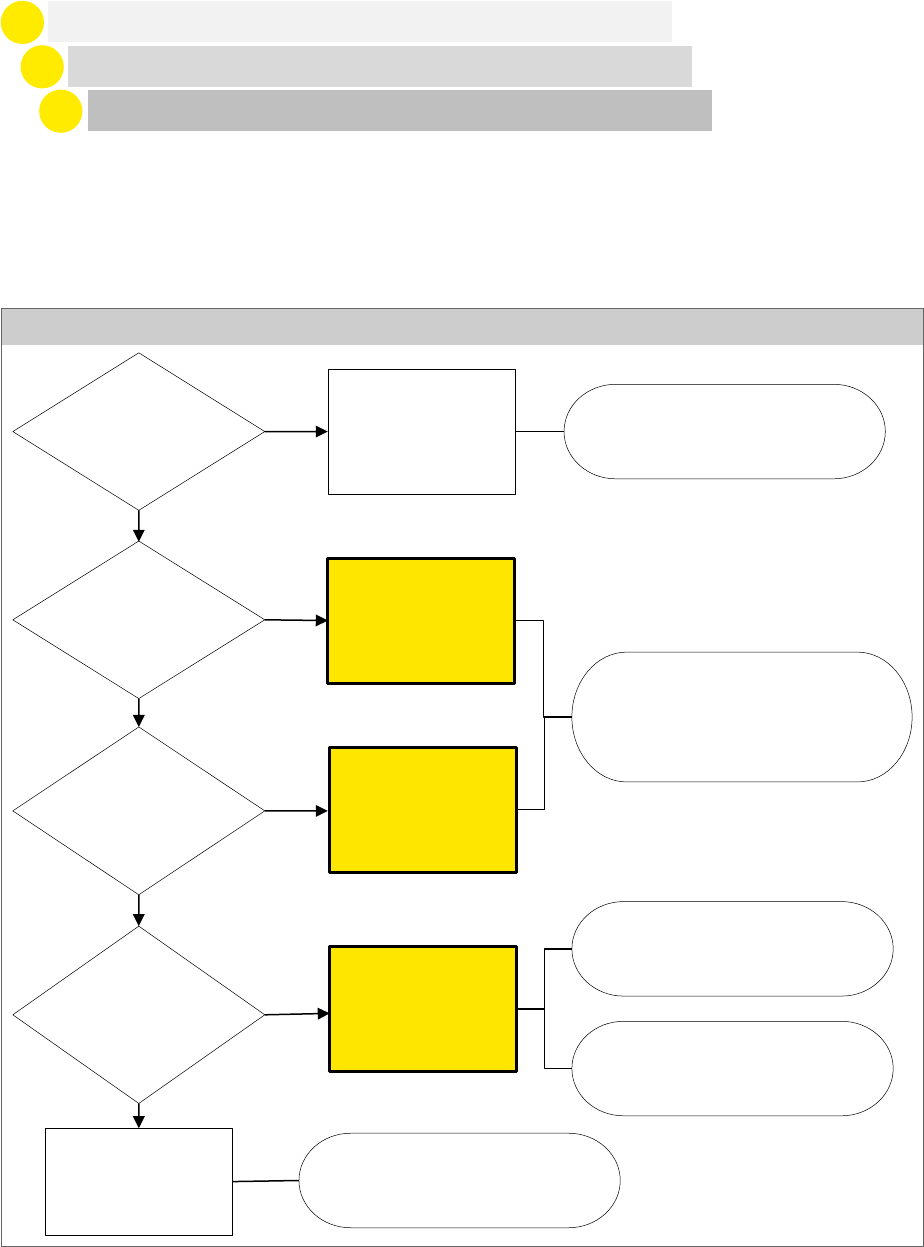

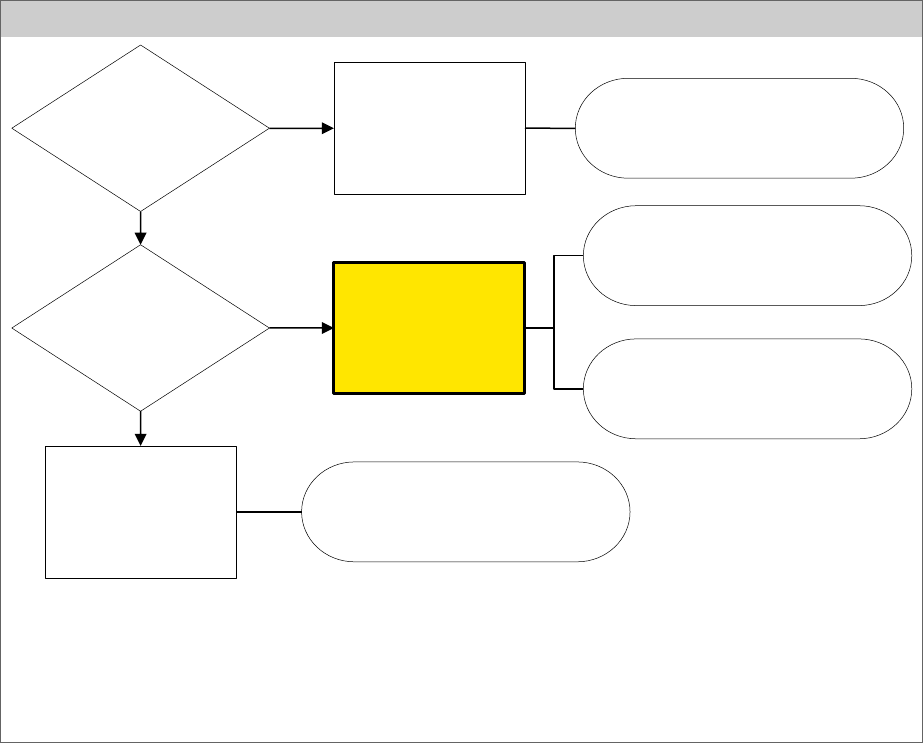

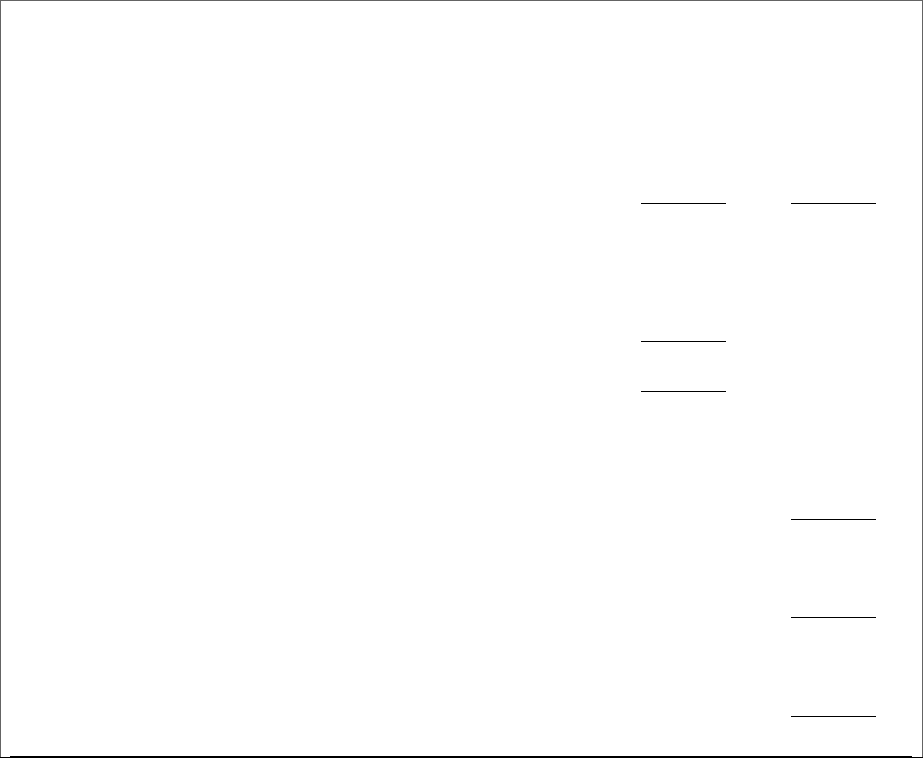

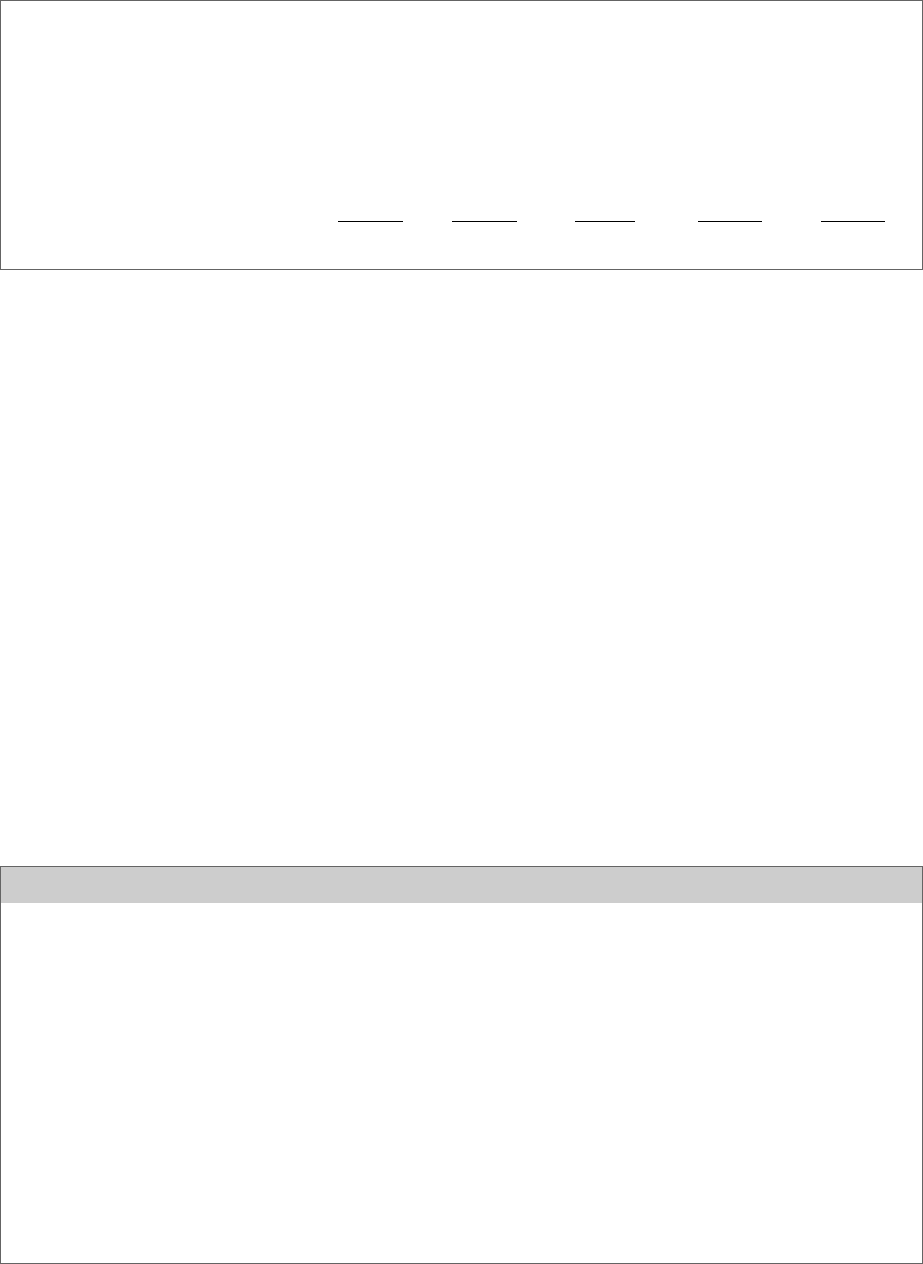

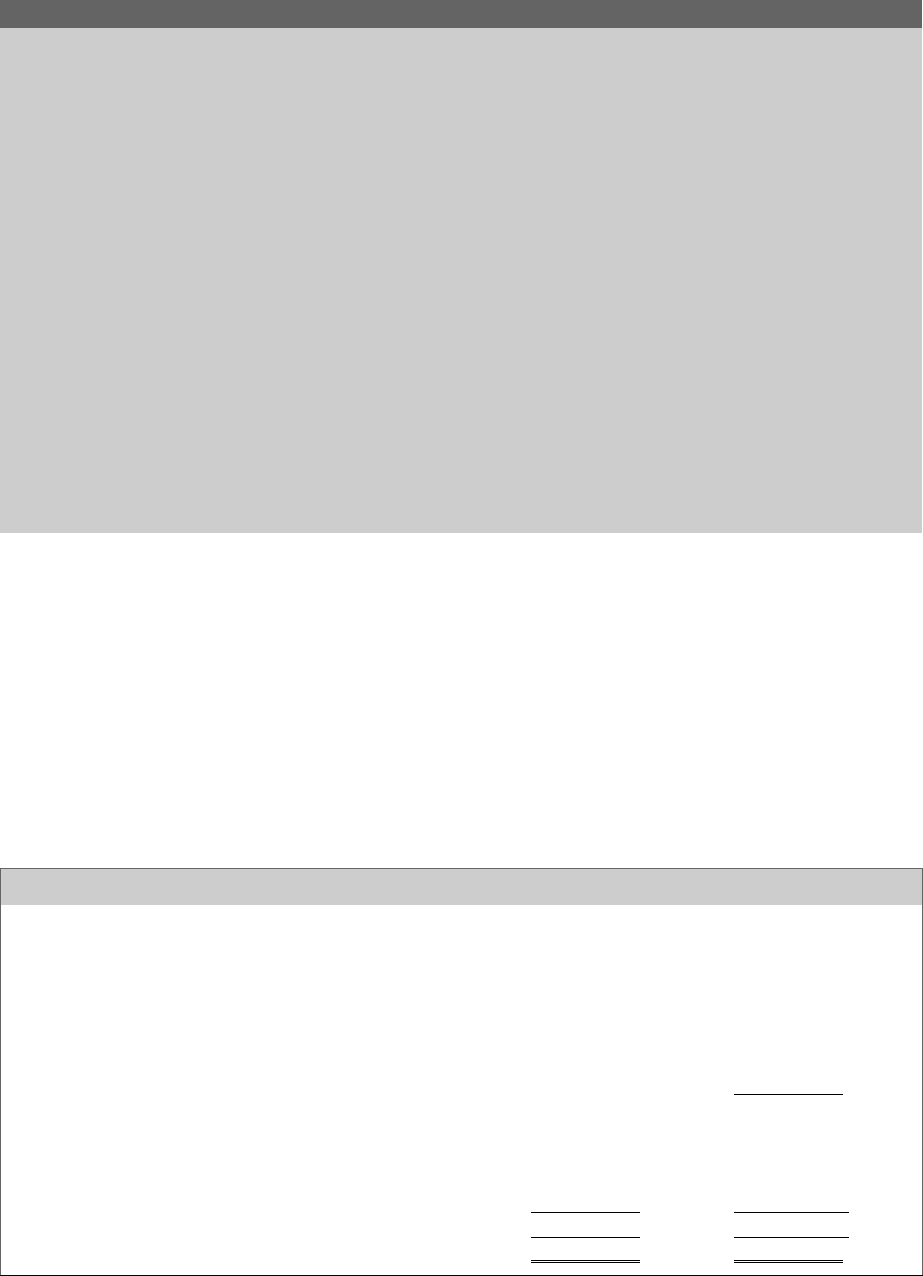

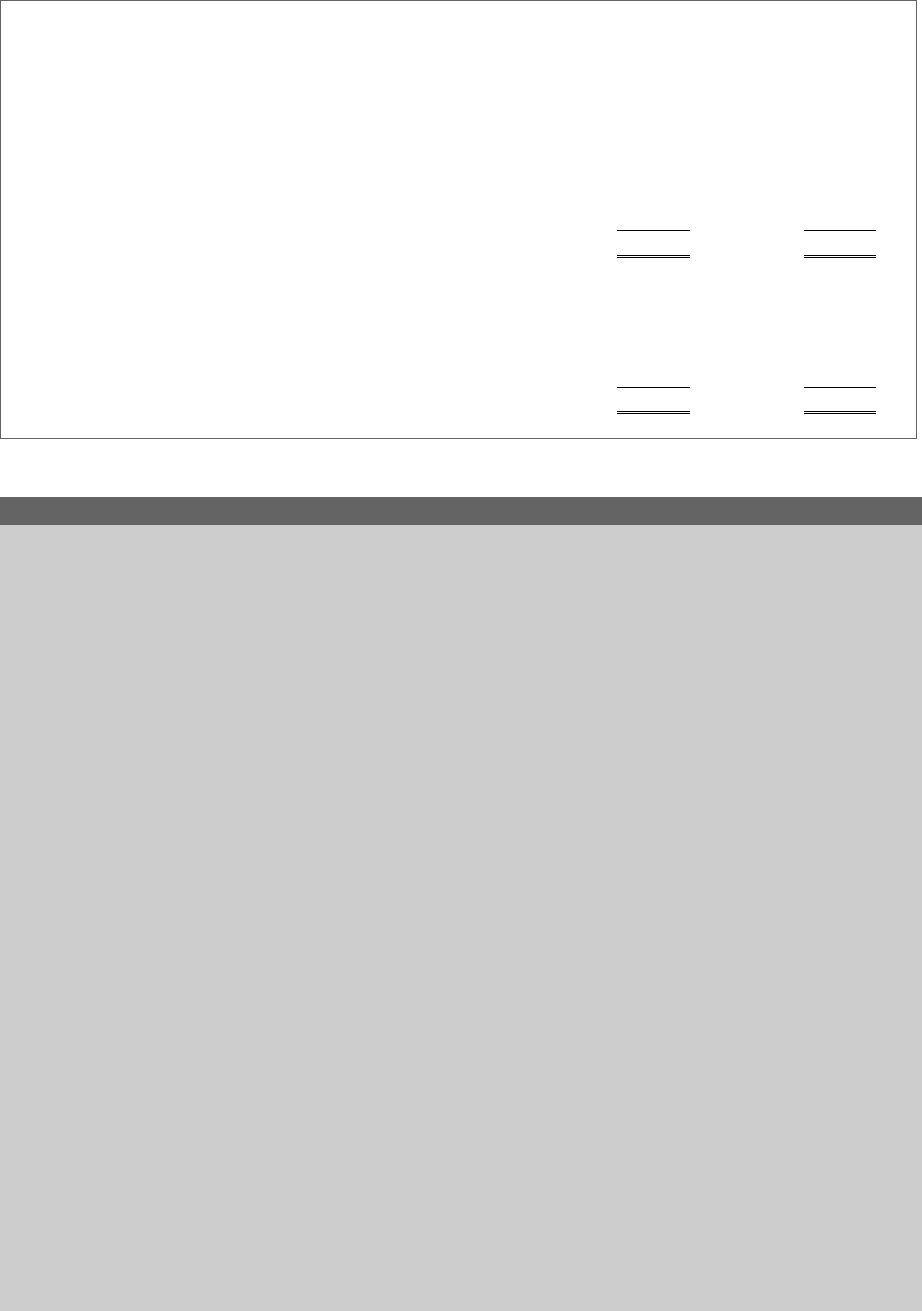

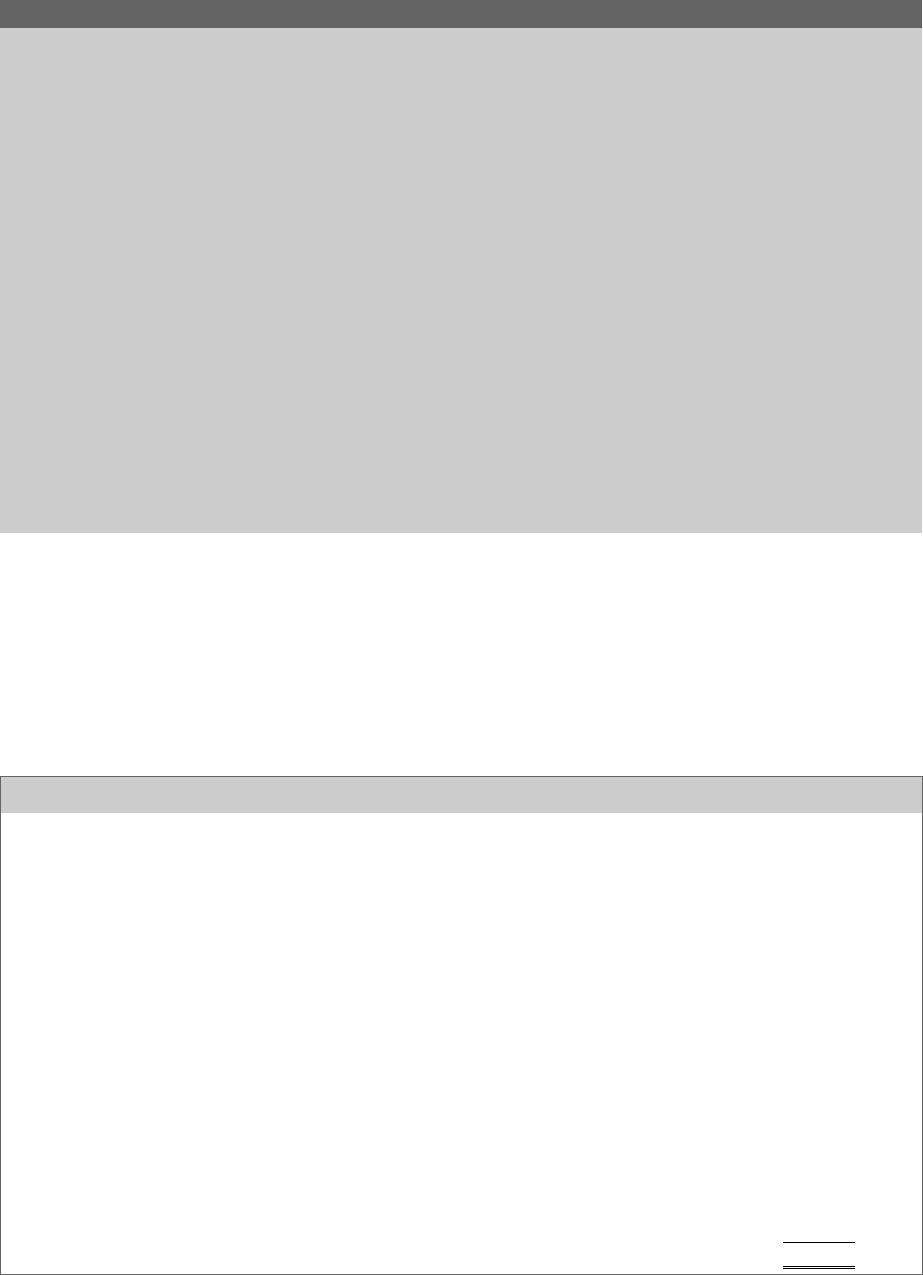

The following flowchart provides a framework for determining whether ASC 325-40 applies to an asset:

Illustration 2-4: Determining whether an asset is in the scope of ASC 325-40

[A]

If the beneficial interest is not subsequently measured at fair value through earnings, evaluate whether the beneficial interest

has embedded derivatives that require bifurcation in accordance with ASC 815-15.

No

No

Yes

No

Yes

Yes

Yes

No

Yes

Yes

No

Yes

No

No

Yes

No

Is the beneficial interest an investment in

an entity that is consolidated by the holder

of the beneficial interest?

Is the beneficial interest a debt security

under ASC 320 or required to be accounted

for as one under ASC 860-20—35-2?

Does the beneficial interest, in its entirety,

meet the definition of a derivative

under ASC 815?

Is the beneficial interest in the scope of

ASC 310-30?

Does the beneficial interest involve securitized

financial assets?

Do the securitized financial assets have

contractual cash flows?

Is the beneficial interest of high credit quality?

Can the beneficial interest be contractually

prepaid or otherwise settled in a way that

the holder would not recover substantially

all of its recorded investment?

Apply guidance under ASC 320-10, and for

interest income recognition the guidance

under ASC 310-20.

[A]

Apply guidance under ASC 325-40.

[A]

Apply the guidance in ASC 320-10-35-38

through 35-43.

[A]

Apply guidance under ASC 310-30.

[A]

Apply guidance under ASC 815.

Beneficial interests are eliminated in

consolidation.

Determine what

other guidance

applies

Apply guidance under ASC 310.

[A]

Apply guidance under ASC 323.

[A]

Apply guidance under ASC 321.

[A]

2 Accounting for investments in debt securities

Financial reporting developments Certain investments in debt and equity securities | 9

2.2.2.1.3.1 Securities in the scope of ASC 325-40

Excerpt from Accounting Standards Codification

Investments — Other — Beneficial Interests in Securitized Financial Assets

Scope and Scope Exceptions

Instruments

325-40-15-3

The guidance in this Subtopic applies to beneficial interests that have all of the following

characteristics:

a. Are either debt securities under Subtopic 320-10 or required to be accounted for like debt

securities under that Subtopic pursuant to paragraph 860-20-35-2.

b. Involve securitized financial assets that have contractual cash flows (for example, loans, receivables,

debt securities, and guaranteed lease residuals, among other items). Thus, the guidance in this

Subtopic does not apply to securitized financial assets that do not involve contractual cash flows

(for example, common stock equity securities, among other items). See paragraph 320-10-35-38

for guidance on beneficial interests involving securitized financial assets that do not involve

contractual cash flows.

c. Do not result in consolidation of the entity issuing the beneficial interest by the holder of the

beneficial interests.

d. Are not within the scope of Subtopic 310-30.

e. Are not beneficial interests in securitized financial assets that have both of the following

characteristics:

1. Are of high credit quality (for example, guaranteed by the U.S. government, its agencies, or

other creditworthy guarantors, and loans or securities sufficiently collateralized to ensure

that the possibility of credit loss is remote)

2. Cannot contractually be prepaid or otherwise settled in such a way that the holder would not

recover substantially all of its recorded investment.

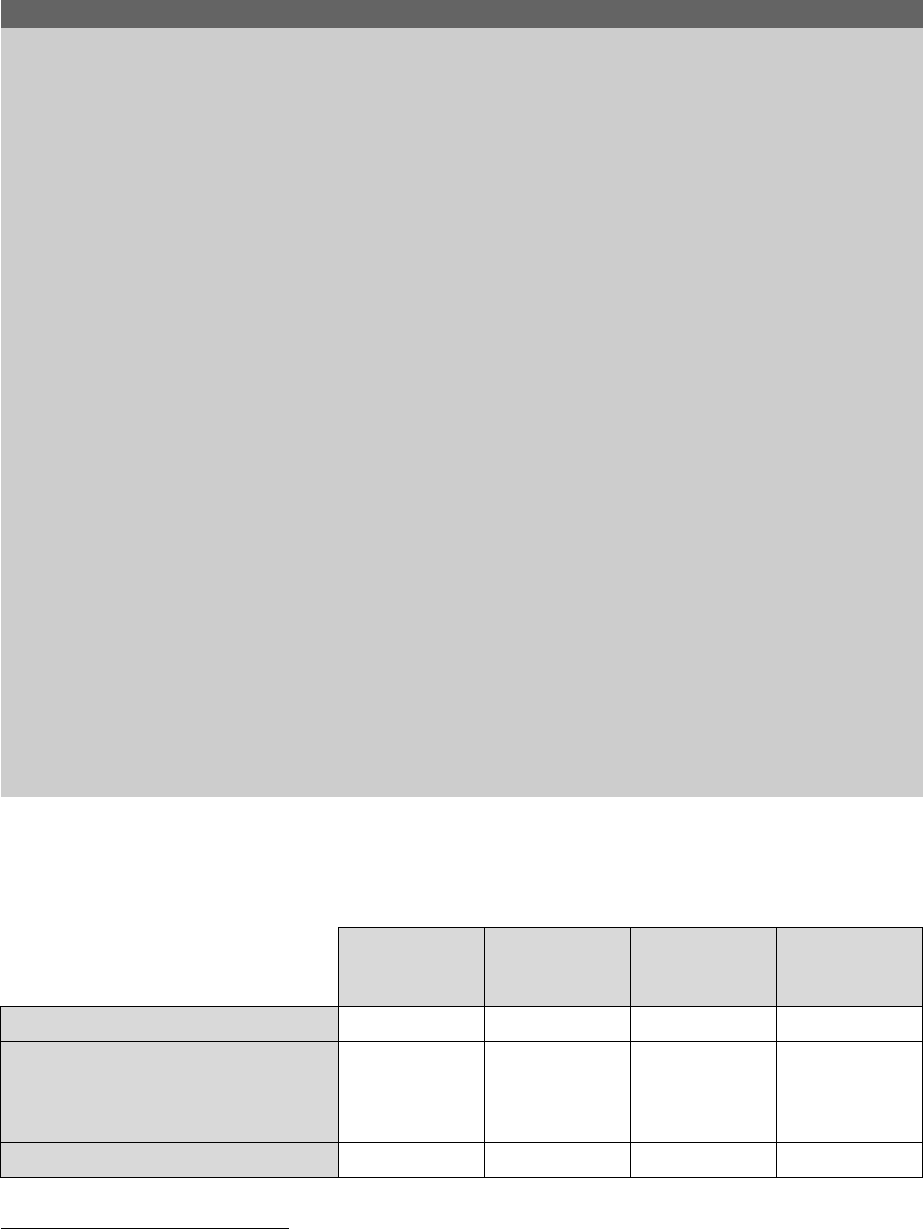

ASC 325-40 does not apply to beneficial interests that (1) are of high credit quality and (2) cannot be

contractually prepaid or otherwise settled in such a way that the holder would not recover substantially

all of its recorded investment. The following table provides examples of how the guidance may be applied

to certain securities.

Security type

AAA-rated

senior security

Agency

3

interest-only

strip

BBB-rated

subordinated

interest

Residual

interest

High credit quality

Yes

Yes

No

No

Contractually prepaid or otherwise

settled in a way that the holder would

not recover substantially all of its

recorded investment

No

Yes

No

Yes

In the scope of ASC 325-40

No

Yes

Yes

Yes

3

Refers to US government agencies and government-sponsored enterprises, including Government National Mortgage Association

(Ginnie Mae), Federal National Mortgage Association (Fannie Mae) and Federal Home Loan Mortgage Corporation (Freddie Mac).

2 Accounting for investments in debt securities

Financial reporting developments Certain investments in debt and equity securities | 10

ASC 325-40 states that beneficial interests guaranteed by the US government, its agencies or other

creditworthy guarantors and loans or securities that are sufficiently collateralized to make sure that the

possibility of credit loss is remote are considered to be of high credit quality.

Although ASC 325-40 does not specify a minimum credit rating, the SEC staff believes that only beneficial

interests rated AA or higher should be considered of “high credit quality.”

4

There are situations when a beneficial interest may have a so-called split rating, in which one credit

rating agency has rated the instrument as AA or higher, but another credit rating agency has rated it

below AA. In these situations, we understand the SEC staff would not consider the beneficial instrument

to be of high credit quality for purposes of applying ASC 325-40 (i.e., the instrument would be in the

scope of ASC 325-40).

To evaluate whether an investor might not recover substantially all its recorded investment due to a

prepayment or other settlement, an entity considers the contractual terms of the beneficial interest,

rather than the likelihood of prepayments or other settlements occurring. If the underlying borrowers

(i.e., the debtors in the securitized debt instruments) could exercise contractual rights permitting them to

prepay or otherwise settle their debt instruments in a way that would cause the holder of a beneficial

interest in those underlying debt instruments to not recover substantially all of its recorded investment,

this criterion is met. The likelihood of the event occurring that could cause the investor in the beneficial

interest to not recover substantially all of its recorded investment is not considered.

For example, an interest-only strip could meet the definition of “high credit quality” if the structure is supported

by a guarantee from a creditworthy guarantor (e.g., a government-sponsored enterprise). However, because

the holder of the strip only receives cash flows when underlying loans are outstanding, loan prepayments

could result in the holder of the security not recovering substantially all of its recorded investment.

How we see it

ASC 325-40 does not address whether an entity should reevaluate the scope criteria, including the

evaluation of whether a beneficial interest is of high credit quality, after the acquisition date of the

beneficial interest. Some entities evaluate the scope criteria in ASC 325-40 at acquisition and in

connection with the recognition of any other-than-temporary impairment, while others perform a

continual reassessment. An entity should apply its elected accounting policy consistently.

2.2.2.1.3.2 Applicability of ASC 325-40 to trading securities

Excerpt from Accounting Standards Codification

Investments — Other — Beneficial Interests in Securitized Financial Assets

Scope and Scope Exceptions

Instruments

Beneficial Interests Classified as Trading

325-40-15-7

For income recognition purposes, beneficial interests classified as trading are included in the scope of

this Subtopic because it is practice for certain industries (such as banks and investment companies) to

report interest income as a separate item in their income statements, even though the investments

are accounted for at fair value.

4

Remarks by John M. James, SEC staff, before the Thirty-First AICPA National Conference on Current SEC Developments,

11 December 2003.

2 Accounting for investments in debt securities

Financial reporting developments Certain investments in debt and equity securities | 11

Host Contract Portion of a Hybrid Beneficial Interest

325-40-15-8

Included in the scope of this Subtopic are the host contract portion of a hybrid beneficial interest that

requires separate accounting for an embedded derivative under paragraphs 815-15-25-1; 815-15-25-11

through 25-14; and 815-15-25-26 through 25-29 when the host contract otherwise meets the scope

of this Subtopic. The issue of when and how a hybrid contract is to be separated into its component

parts is an implementation issue of Topic 815 and, therefore, not within the scope of this Subtopic.

325-40-15-9

The guidance in this Subtopic does not apply to hybrid beneficial interests measured at fair value

pursuant to paragraphs 815-15-25-4 through 25-6 for which the transferor does not report interest

income as a separate item in its income statements.

ASC 325-40 applies to beneficial interests that are classified as trading or that have been designated to

be measured at fair value with changes in fair value recognized in earnings under the fair value option in

ASC 825-10 (not the fair value option in ASC 815-15, which is discussed below) or that are accounted

for that way under industry-specific guidance. For example, investment companies are generally required

by ASC 946 to report their investments at fair value with changes in fair value reported in earnings.

Some of those entities elect to report interest income separately from other changes in fair value in a

separate line item in their income statements.

The host contract portion of a hybrid beneficial interest that requires separate accounting for the

embedded derivative under ASC 815 may be in the scope of ASC 325-40. However, this guidance does

not apply to a hybrid beneficial interest if the entire instrument is measured at fair value with changes in

fair value recognized in earnings under the fair value option in ASC 815-15 and the entity does not

separately report interest income. An entity that presents interest income separately for these hybrid

beneficial interests applies ASC 325-40, consistent with assets measured at fair value with changes in

fair value recognized in earnings, as discussed in the preceding paragraph.

2.2.2.1.4 Certain purchased options and forward contracts

Excerpt from Accounting Standards Codification

Derivatives and Hedging — Overall

Instruments

Certain Contracts on Debt and Equity Securities

815-10-15-141

The guidance in the Certain Contracts on Debt and Equity Securities Subsections applies only to those

forward contracts and purchased options having all of the following characteristics:

a. The contract is entered into to purchase securities that will be accounted for under either

Topic 320 or Topic 321.

b. The contract’s terms require physical settlement of the contract by delivery of the securities.

c. The contract is not a derivative instrument otherwise subject to this Subtopic.

d. The contract, if a purchased option, has no intrinsic value at acquisition.

2 Accounting for investments in debt securities

Financial reporting developments Certain investments in debt and equity securities | 12

Recognition

Certain Contracts on Debt and Equity Securities

815-10-25-17

Forward contracts and purchased options on debt securities within the scope of this Subsection (see

the Certain Contracts on Debt and Equity Securities Subsection of Section 815-10-15) shall, at

inception, be designated as held to maturity, available for sale, or trading in a manner consistent with

the accounting prescribed by Topic 320 for debt securities. Such forward and option contracts are not

eligible to be hedging instruments.

Although not in the scope of ASC 320, certain physically settled purchased options and forward contracts

to acquire debt securities must be accounted for in a manner consistent with the guidance in ASC 320.

Purchased options and forward contracts often meet the definition of a derivative, and those that do are in

the scope of ASC 815’s guidance on derivative financial instruments. However, an option or forward contract

to acquire a debt security that is not considered to be a derivative should be evaluated based on the criteria

in ASC 815-10-15-141 (see above). If the option or forward contract meets the criteria, the contracts are

required to be classified and measured in a manner similar to debt securities. Refer to section 2.3.6,

Forward contracts and purchased options on debt securities, for additional information.

2.2.3 Instruments that are not in the scope of ASC 320

Excerpt from Accounting Standards Codification

Investments — Debt Securities — Overall

Scope and Scope Exceptions

Instruments

320-10-15-7

The guidance in this Topic does not apply to any of the following:

a. Derivative instruments that are subject to the requirements of Topic 815, including those that

have been separated from a host contract as required by Section 815-15-25. If an investment

would otherwise be in the scope of this Topic and it has within it an embedded derivative that is

required by that Section to be separated, the host instrument (as described in that Section)

remains within the scope of this Topic.

b. Subparagraph superseded by Accounting Standards Update No. 2016-01.

c. Subparagraph superseded by Accounting Standards Update No. 2016-01.

d. Investments in consolidated subsidiaries.

2.2.3.1 Derivatives

Hybrid financial instruments should be analyzed to determine whether any embedded derivatives should

be bifurcated under ASC 815-15. This analysis includes: (1) determining whether the host instrument is

considered a debt or equity host and (2) evaluating whether the embedded feature is clearly and closely

related to the host instrument and, if not, whether it meets the definition of a derivative on a freestanding

basis. The analysis does not need to be performed for hybrid financial instruments classified as trading (or

when the fair value option is elected) since the entire instrument is marked to market through earnings.

For more information on analyzing embedded derivatives, see our FRD, Derivatives and hedging.

Any embedded derivative that is bifurcated is not in the scope of ASC 320. However, when a hybrid

financial instrument would otherwise be in the scope of ASC 320 (because it is a debt security), the host

instrument that remains after an embedded derivative is bifurcated remains subject to ASC 320.

2 Accounting for investments in debt securities

Financial reporting developments Certain investments in debt and equity securities | 13

Refer to section 2.3.6, Forward contracts and purchased options on debt securities, for additional information.

2.2.3.2 Other common issues related to scope

2.2.3.2.1 Cash and cash equivalents

Cash equivalents are short-term, highly liquid investments that are both:

• Readily convertible to known amounts of cash

• So close to maturity that they present insignificant risk of changes in value because of changes in

interest rates

Generally, only short-term, highly liquid investments with original maturities of three months or less

qualify for treatment as cash equivalents. Examples include US Treasury bills, commercial paper and

federal funds sold (for an entity with banking operations).

Even if determined to be cash equivalents, investments in debt securities that are in the scope of

ASC 320-10 are subject to all of the accounting and disclosure requirements in ASC 320-10. However,

since cash equivalents represent short-term, highly liquid investments that are readily convertible to

known amounts of cash, the amortized cost is generally expected to approximate the fair value.

2.2.3.2.2 Short sales of debt securities

Short sales of debt securities represent obligations to deliver securities and are not investments.

However, such transactions are generally marked to market, with changes in fair value recorded in

earnings, under either certain industry guidance (e.g., ASC 940, Financial Services — Brokers and

Dealers) or ASC 815-10-55-57 (if they meet the definition of a derivative).

2.2.3.2.3 Contractual prepayment or settlement in such a way that the holder would not recover

substantially all of its recorded investment

Financial assets (except those that are derivatives under ASC 815-10) that can contractually be prepaid

or otherwise settled in a way that the holder would not recover substantially all of its recorded investment

(e.g., interest-only strips) should be measured like investments in debt securities classified as available

for sale or trading (and not held to maturity), even if they do not meet the definition of a security (ASC 860-

20-35-2; ASC 320-10-25-5a). However, if the financial assets are not in the form of securities, only the

recognition and measurement provisions of ASC 320 apply, not the disclosure requirements (ASC 860-

20-35-3). ASC 320 disclosure requirements apply if the financial assets meet the definition of a security.

2.2.3.2.4 Look-through not permitted (updated May 2023)

When determining whether an investment is in the scope of ASC 320, an entity should not look through

the form of its investment to the nature of the securities held by the investee. For example, an

investment in equity shares of a mutual fund that holds solely debt securities should not be classified as a

debt security because the legal form of the investment is equity.

Refer to section 3.1.4.1 and section 5.1.1 for further discussions on look-through guidance relating to

equity securities.

2.3 Classification and measurement

At acquisition, an entity must classify each acquired debt security in the scope of ASC 320 into one of

three categories:

• Trading — debt securities bought and held primarily to be sold in the near term

2 Accounting for investments in debt securities

Financial reporting developments Certain investments in debt and equity securities | 14

• Held to maturity — debt securities for which management has both the positive intent and ability to

hold until the maturity of the security

• Available for sale — the residual category for debt securities not classified as held to maturity or trading

The classification of each security determines the subsequent measurement basis (i.e., amortized cost

versus fair value) of the security and how it is presented and disclosed in the financial statements.

An entity should carefully consider how it classifies its investment securities based on future business plans

or opportunities that may affect the classification. For example, an entity should consider the possibility

that it might need to sell securities to take advantage of potential business or investment opportunities.

Other factors to consider include regulatory capital requirements for certain financial institutions and the

potential volatility in earnings or OCI that could result from temporary fluctuations in the market value of

securities classified as trading or available for sale, respectively. For example, certain regulated financial

institutions may be subject to additional regulatory capital requirements depending on the amount of

securities classified as trading. In addition, volatility in OCI could result in debt covenant violations arising

from unrealized holding losses when shareholders’ equity is included in debt covenant computations. To

address this issue, many entities’ loan agreements exclude OCI from debt covenant computations.

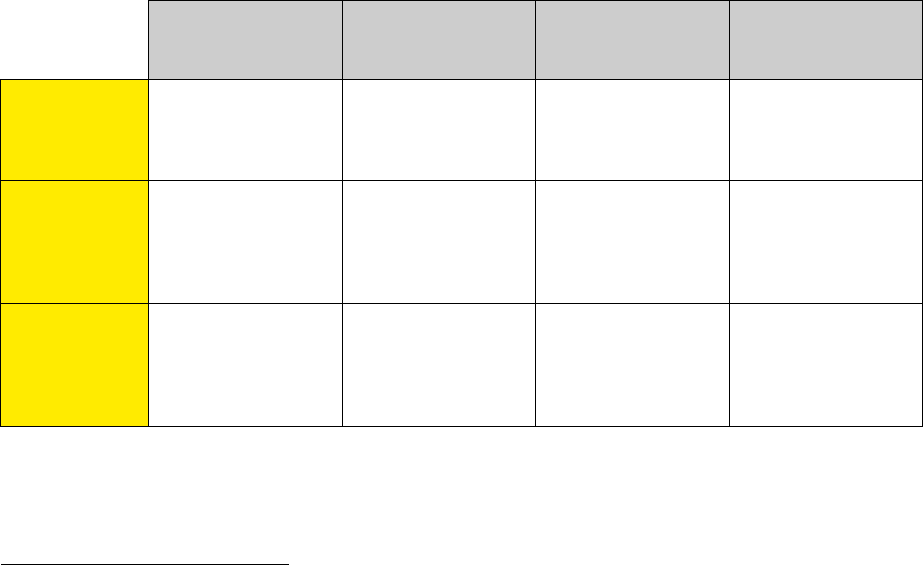

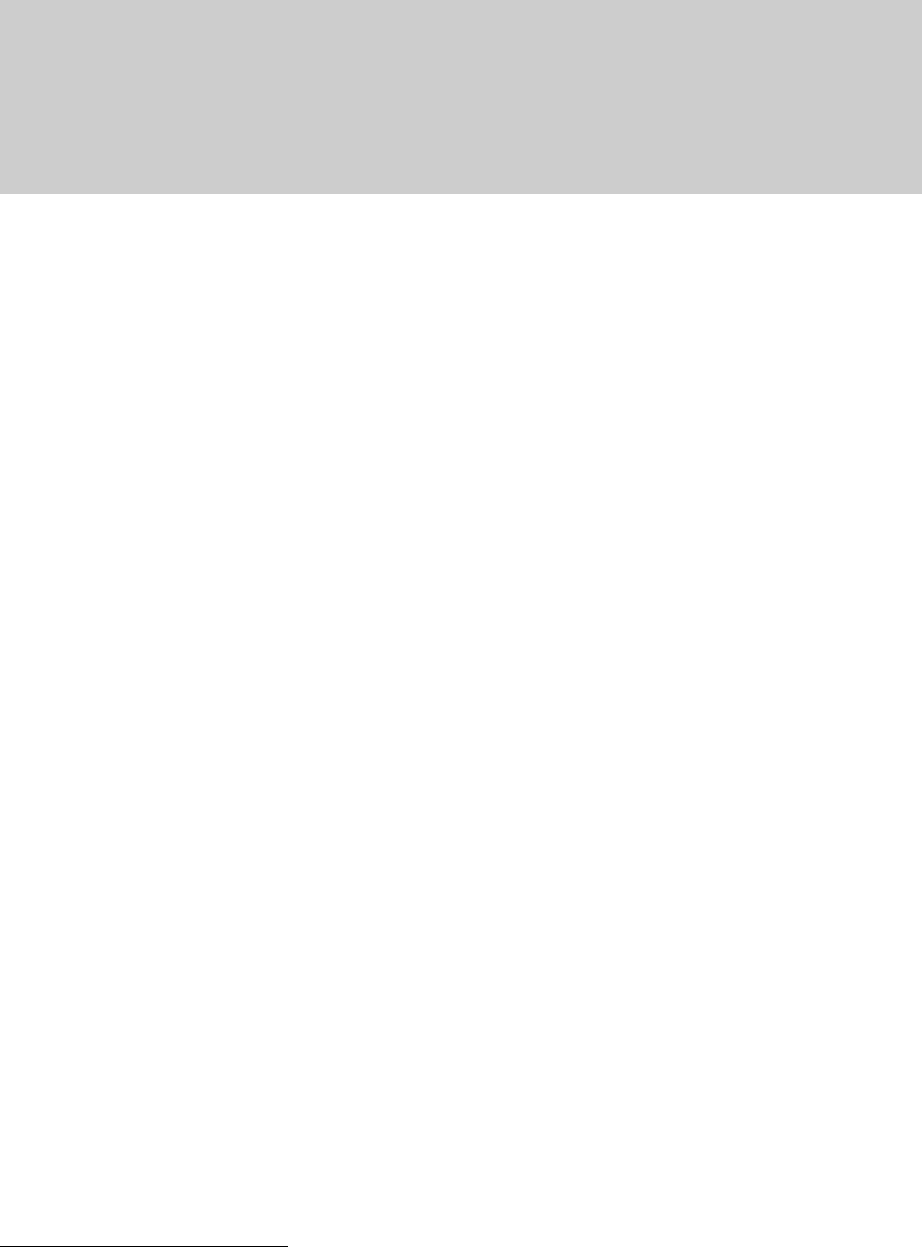

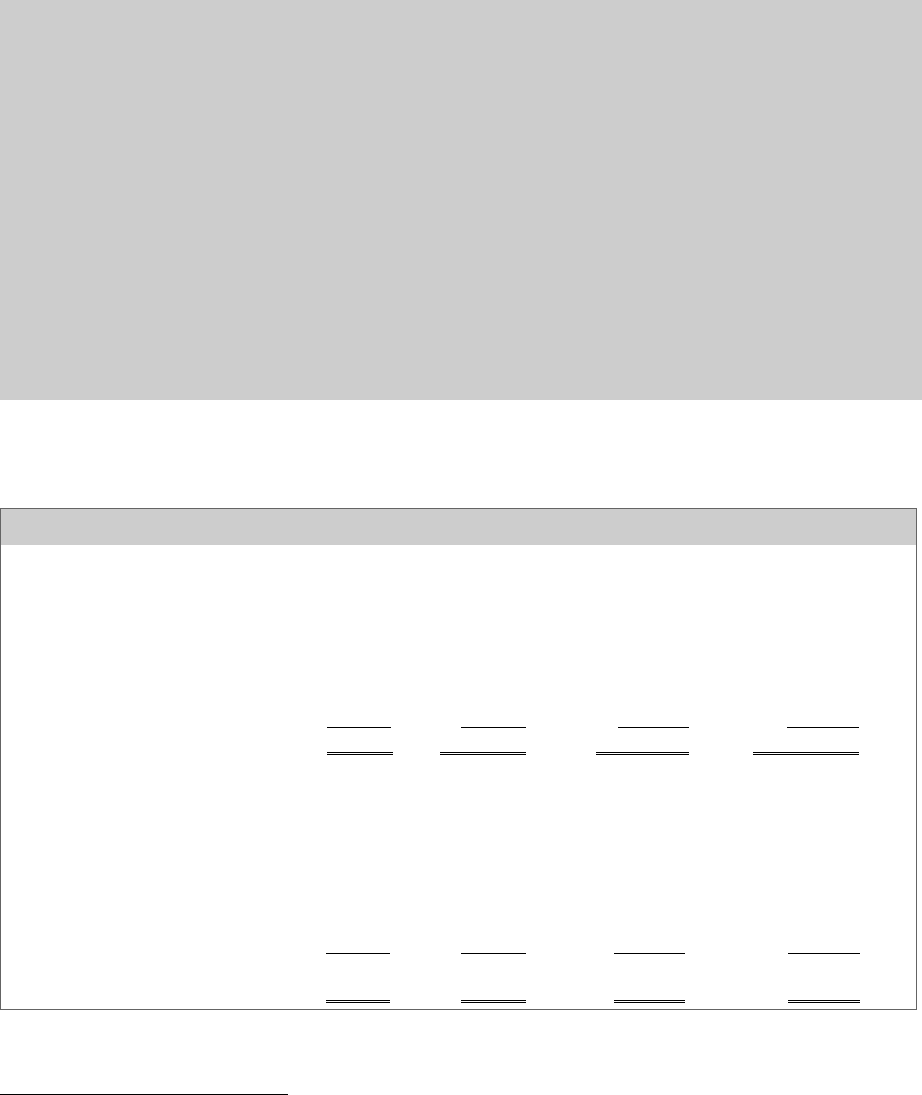

2.3.1 Summary table of classification and measurement

The table below summarizes the three classifications of investments in debt securities as defined in

ASC 320 and the accounting treatment for each category:

Description

Carrying value in the

statement of

financial position

Classification in the

statement of

financial position

Unrealized gains and

losses

Trading

Debt securities bought

and held principally for

the purpose of selling

in the near term

5

Fair value

Classified as current or

noncurrent,

6

as

appropriate (see

section 2.3.3.1)

Included in earnings

immediately

Held-to-

maturity

Debt securities that

the entity has both the

positive intent and

ability to hold to

maturity

Amortized cost

7

Classified as current or

noncurrent, based on

maturity or

redemption date

Disclosed in the notes

to the financial

statements but not

recognized until

realized

8

Available-for-

sale

Debt securities not

classified as either

held to maturity or

trading

Fair value

Classified as current or

noncurrent, as

appropriate (see

section 2.3.5.1)

Included in

accumulated other

comprehensive

income, net of tax

effect, until realized

10

5

Classification of debt securities as trading is not precluded because the entity does not intend to sell in the near term.

6

Trading securities maturing more than one year after the reporting date should be classified as noncurrent assets if the company

has no intention of selling those securities in the next 12 months.

7

Amortized cost is the cost as adjusted for accretion, amortization, collection of cash, previous other-than-temporary impairment

recognized in earnings, less any cumulative-effect adjustments, foreign exchange and hedging, if any.

8

Certain unrealized losses that are determined to be other than temporary should be recognized in earnings (see further

discussion in section 5, Impairment).

2 Accounting for investments in debt securities

Financial reporting developments Certain investments in debt and equity securities | 15

2.3.2 Recognition and initial measurement

ASC 320 provides guidance on the subsequent measurement of securities but is silent on recognition and

initial measurement.

Generally, in practice, securities are initially measured at the transaction price plus transaction costs.

In many cases, the transaction price (excluding transaction costs discussed below) equals the fair value

at acquisition.

2.3.2.1 Premiums and discounts

Securities are often purchased at a discount to or at a premium above the instruments’ par amount or

face value. Premiums and discounts on debt securities classified as available for sale or held to maturity

are generally accounted for as yield adjustments over the life of the related security, in accordance with

ASC 310-20.

9

Premiums and discounts on debt securities classified as trading are not in the scope of

ASC 310-20 and are generally considered part of the security’s fair value.

ASC 310-20 provides guidance for certain callable debt securities held at a premium. It defines a premium

for these callable debt securities as the amount by which the amortized cost basis of the security exceeds

the amount repayable at the earliest call date. The premium on purchased debt securities that have

explicit, noncontingent call features and are callable at a fixed price and on a preset date should be

amortized to the next call date, unless the entity applies the guidance in ASC 310-20 allowing it to

consider estimated prepayments. The entity should perform a reassessment at each call date. If the call

option is not exercised at the next call date, the effective yield is reset prospectively. That is, after the

first call date, the entity amortizes any excess of the amortized cost basis over the next call price to the

next call date. If there are no other call dates, or if the amortized cost basis does not exceed the next call

price, the entity amortizes any excess of the amortized cost basis over par to maturity. Discounts should

be amortized to maturity (i.e., over the contractual life of the security).

ASU 2020-08

10

further clarifies that an entity should reevaluate whether a callable debt security is

within the scope of this guidance each reporting period. That is, the conclusion about whether a callable

debt security is subject to this guidance can change from one period to the next. The ASU also clarifies

that the next call date is the first date when a call option at a specified price becomes exercisable. When

that date has passed, the next call date is when the next call option at a specified price becomes

exercisable, if applicable.

Municipal bonds are often callable at a fixed price “on or after” a specific date. In response to a technical

inquiry, the FASB staff said that the guidance in ASC 310-20 for callable debt securities held at a premium

applies if the amortized cost basis of municipal bonds is above the call amount at the next call date. The

following example illustrates this point.

9

Investment companies applying ASC 946 should amortize premiums and discounts using the interest method pursuant to ASC

946-320-35-20. The amortization of premiums on purchased callable debt securities that have explicit, noncontingent call

features that are callable at fixed prices on preset dates shall be consistent with the guidance in paragraph 310-20-35-33.

10

ASU 2020-08, Codification Improvements to Subtopic 310-20, Receivables — Nonrefundable Fees and Other Costs, is effective for

PBEs. For all other entities, it is effective for fiscal years beginning after 15 December 2021 and interim periods within fiscal

years beginning after 15 December 2022. Early adoption is permitted for these entities for fiscal years, and interim periods

within those fiscal years, beginning after 15 December 2020.

2 Accounting for investments in debt securities

Financial reporting developments Certain investments in debt and equity securities | 16

Illustration 2-5: Municipal bonds callable at a fixed price on or after a specific date

An entity purchases 10-year municipal bonds with a par value of $100 for $110 on 1 January 20X1

that are callable at $105 on or after 31 December 20X2 and at $103 on or after 31 December 20X5.

The entity amortizes the excess of the amortized cost basis over the next call price (i.e., $5 ($110 –

$105)) over the first two years, ending 31 December 20X2. If the first call is not exercised, the entity

amortizes the excess of the amortized cost basis over the next call price (i.e., $2 ($105 – $103)) over

the next three years, ending 31 December 20X5. If the bonds are not called on the second call date,

the entity must amortize the remaining $3 ($103 – $100) premium, which represents the excess of

the amortized cost basis over par, over the remaining five years (i.e., to maturity).

2.3.2.2 Transaction costs

ASC 320 does not provide guidance on how entities account for transaction costs related to investments

in debt securities. For debt securities classified as available for sale or held to maturity, some entities may

have a policy of applying the guidance in ASC 310-20 to account for these costs, which results in them

being deferred and accounted for as yield adjustments over the life of the related securities. Generally,

transaction costs for trading securities are recognized in net income in the first reporting period after the

acquisition as a result of the period-end adjustment to measure trading securities at fair value.

While there is diversity in practice in the treatment of transaction costs, entities should account for them

consistently for all investments in debt securities. The Codification provides certain industry-specific

guidance on the treatment of these costs. For example, ASC 946-320-30-1, which provides guidance for

investment companies, states that the transaction price of a debt security should include commissions

and other charges that are part of the purchase transaction. Because investment companies are required

to subsequently measure all investments at fair value and recognize changes in fair value in earnings, they

immediately recognize transaction costs as unrealized losses.

2.3.2.3 Recognition date

ASC 320 does not provide guidance on when an entity should recognize the acquisition of a security.

Entities recognize purchased securities on either the trade date or the settlement date. Agreements to

purchase or sell a security should be evaluated to determine whether they are derivatives under ASC 815.

In general, ASC 815 provides a scope exception for regular-way securities trades, which are defined as

contracts that provide for delivery of a security within a period of time (after the trade date) generally

established by regulations or conventions in the marketplace or exchange in which the transaction is

being executed. For example, in the US, most corporate securities are regularly settled in three business

days. The regular settlement cycle length may vary by country, exchange, instrument or issuer. Refer to

section 3.2.2, Recognition date, for additional information.