CHICAGO TRANSIT AUTHORITY

FINANCIAL STATEMENTS AND

SUPPLEMENTARY INFORMATION

December 31, 2007 and 2006

(With Independent Auditors’ Report Thereon)

CHICAGO TRANSIT AUTHORITY

Chicago, Illinois

FINANCIAL STATEMENTS

December 31, 2007 and 2006

CONTENTS

Independent Auditors’ Report............................................................................................................. 1

Management’s Discussion and Analysis ............................................................................................ 3

Basic Financial Statements

Balance Sheets .................................................................................................................................. 15

Statements of Revenues, Expenses, and Changes in Net Assets .............................................. 17

Statements of Cash Flows............................................................................................................... 18

Statements of Fiduciary Net Assets .............................................................................................. 20

Statements of Changes in Fiduciary Net Assets.......................................................................... 21

Notes to Financial Statements........................................................................................................ 22

Required Supplementary Information

Schedules of Funding Progress ..................................................................................................... 61

Schedules of Employer Contributions – Employees’ Plan ........................................................ 63

Schedules of Employer Contributions – Supplemental Plans................................................... 65

Supplementary Schedules

Schedule of Expenses and Revenues – Budget and Actual –

Budgetary Basis – 2007.................................................................................................................. 66

Schedule of Expenses and Revenues – Budget and Actual –

Budgetary Basis – 2006.................................................................................................................. 67

Crowe Chizek and Company LLC

Member Horwath International

1.

Independent Auditors’ Report

Chicago Transit Board

Chicago Transit Authority

Chicago, Illinois

We have audited the accompanying financial statements of the business-type and fiduciary

activities of the Chicago Transit Authority (CTA) as of and for the year ended December 31,

2007, which collectively comprise the CTA’s basic financial statements, as listed in the table of

contents. These financial statements are the responsibility of the CTA’s management. Our

responsibility is to express opinions on these financial statements based on our audit. The

financial statements of the CTA as of December 31, 2006, were audited by other auditors whose

report dated April 30, 2007, expressed an unqualified opinion on those statements.

We conducted our audit in accordance with auditing standards generally accepted in the

United States of America and the standards applicable to financial audits contained in

Government Auditing Standards, issued by the Comptroller General of the United States. Those

standards require that we plan and perform the audit to obtain reasonable assurance about

whether the financial statements are free of material misstatement. An audit includes

consideration of internal control over financial reporting as a basis for designing audit

procedures that are appropriate in the circumstances, but not for the purpose of expressing an

opinion on the effectiveness of the CTA’s internal control over financial reporting. Accordingly,

we express no such opinion. An audit also includes examining, on a test basis, evidence

supporting the amounts and disclosures in the financial statements, assessing the accounting

principles used and significant estimates made by management, as well as evaluating the

overall financial statement presentation. We believe that our audit provide a reasonable basis

for our opinions.

In our opinion, the basic financial statements referred to above present fairly, in all material

respects, the financial position of the business-type and fiduciary activities of the CTA as of

December 31, 2007, and the respective changes in financial position and, where applicable, cash

flows thereof for the years then ended, in conformity with U.S. generally accepted accounting

principles.

CHICAGO TRANSIT AUTHORITY

MANAGEMENT’S DISCUSSION AND ANALYSIS

December 31, 2007 and 2006

(Continued)

3.

Introduction

The following discussion and analysis of the financial performance and activity of the Chicago

Transit Authority (CTA) provide an introduction and understanding of the basic financial

statements of the CTA for the fiscal years ended December 31, 2007 and 2006. This discussion

was prepared by management and should be read in conjunction with the financial statements

and the notes thereto, which follow this section.

Financial Highlights for 2007

• Net assets totaled $1,412,258,000 at December 31, 2007.

• Net assets decreased $331,265,000 in 2007, which compares to a decrease of $103,559,000 in

2006.

• Total net capital assets were $3,445,706,000 at December 31, 2007, an increase of 7.61% over

the balance at December 31, 2006 of $3,202,171,000.

Financial Highlights for 2006

• Net assets totaled $1,743,523,000 at December 31, 2006.

• Net assets decreased $103,559,000 in 2006, which compares to a decrease of $153,572,000 in

2005.

• Total net capital assets were $3,202,171,000 at December 31, 2006, an increase of 7.54% over

the balance at December 31, 2005 of $2,977,603,000.

The Financial Statements

The basic financial statements provide information about the CTA’s business-type activities and

the Open Supplemental Retirement Fund (fiduciary activities). The financial statements are

prepared in accordance with U.S. generally accepted accounting principles as promulgated by

the Governmental Accounting Standards Board (GASB).

Overview of the Financial Statements for Business-Type Activities

The financial statements consist of the (1) balance sheet, (2) statement of revenues, expenses,

and changes in net assets, (3) statement of cash flows, and (4) notes to the financial statements.

The financial statements are prepared on the accrual basis of accounting, meaning that all

expenses are recorded when incurred and all revenues are recognized when earned, in

accordance with U.S. generally accepted accounting principles.

CHICAGO TRANSIT AUTHORITY

MANAGEMENT’S DISCUSSION AND ANALYSIS

December 31, 2007 and 2006

(Continued)

4.

Balance Sheet

The balance sheet reports all financial and capital resources for the CTA (excluding fiduciary

activities). The statement is presented in the format where assets equal liabilities plus net assets,

formerly known as equity. Assets and liabilities are presented in order of liquidity and are

classified as current (convertible into cash within one year) and noncurrent. The focus of the

balance sheet is to show a picture of the liquidity and health of the organization as of the end of

the year.

The balance sheet (the unrestricted net assets) is designed to present the net available liquid

(noncapital) assets, net of liabilities, for the entire CTA. Net assets are reported in three

categories:

• Net Assets Invested in Capital Assets, Net of Related Debt—This component of net assets

consists of all capital assets, reduced by the outstanding balances of any bonds, notes, or other

borrowings that are attributable to the acquisition, construction, or improvement of those assets.

• Restricted Net Assets—This component of net assets consists of restricted assets where

constraints are placed upon the assets by creditors (such as debt covenants), grantors,

contributors, laws, and regulations, etc.

• Unrestricted Net Assets—This component consists of net assets that do not meet the definition

of net assets invested in capital assets, net of related debt, or restricted net assets.

Statement of Revenues, Expenses, and Changes in Net Assets

The statement of revenues, expenses, and changes in net assets includes operating revenues,

such as bus and rail passenger fares, rental fees received from concessionaires, and the fees

collected from advertisements on CTA property; operating expenses, such as costs of operating

the mass transit system, administrative expenses, and depreciation on capital assets; and

nonoperating revenue and expenses, such as grant revenue, investment income, and interest

expense. The focus of the statement of revenues, expenses, and changes in net assets is the

change in net assets. This is similar to net income or loss and portrays the results of operations

of the organization for the entire operating period.

Statement of Cash Flows

The statement of cash flows discloses net cash provided by or used for operating activities,

investing activities, noncapital financing activities, and from capital and related financing

activities. This statement also portrays the health of the CTA in that current cash flows are

sufficient to pay current liabilities.

CHICAGO TRANSIT AUTHORITY

MANAGEMENT’S DISCUSSION AND ANALYSIS

December 31, 2007 and 2006

(Continued)

5.

Notes to Financial Statements

The notes to financial statements are an integral part of the basic financial statements and

describe the significant accounting policies, related-party transactions, deposits and

investments, capital assets, capital lease obligations, bonds payable, long-term liabilities,

defined-benefit pension plans, derivative financial instruments, and the commitments and

contingencies. The reader is encouraged to review the notes in conjunction with the

management discussion and analysis and the financial statements.

Financial Analysis of the CTA’s Business-Type Activities

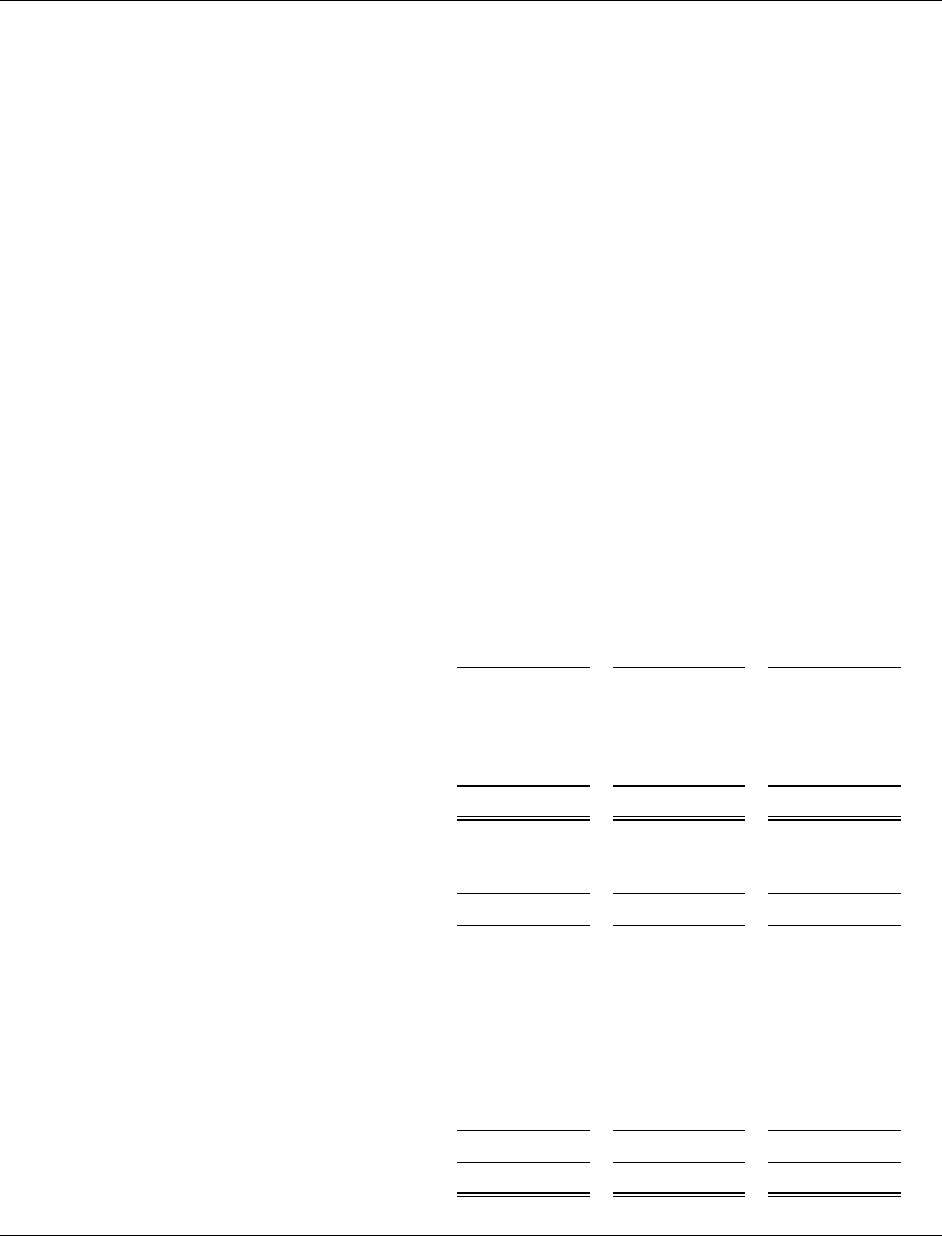

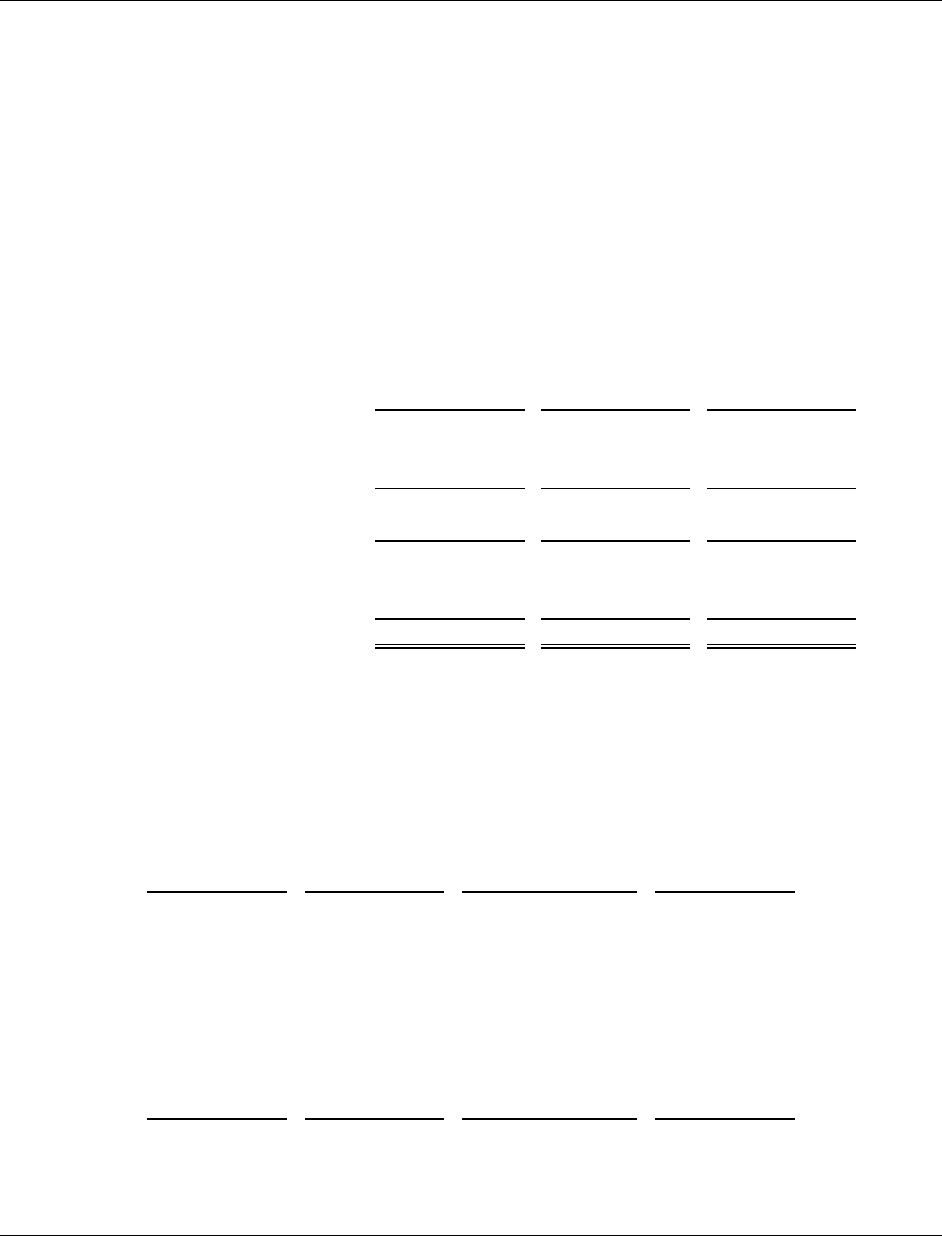

Balance Sheet

The following table reflects a condensed summary of assets, liabilities, and net assets of the CTA

as of December 31, 2007, 2006, and 2005:

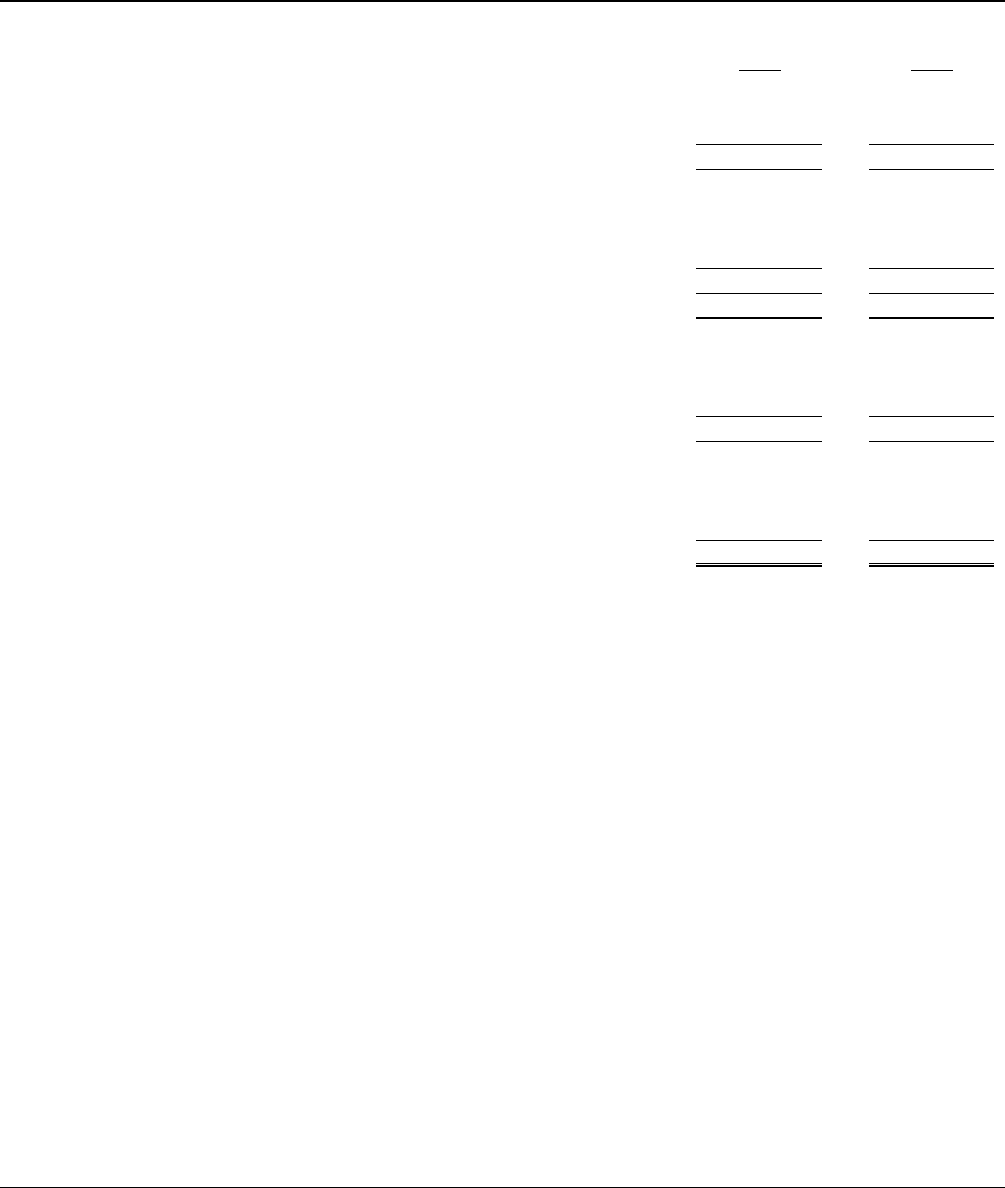

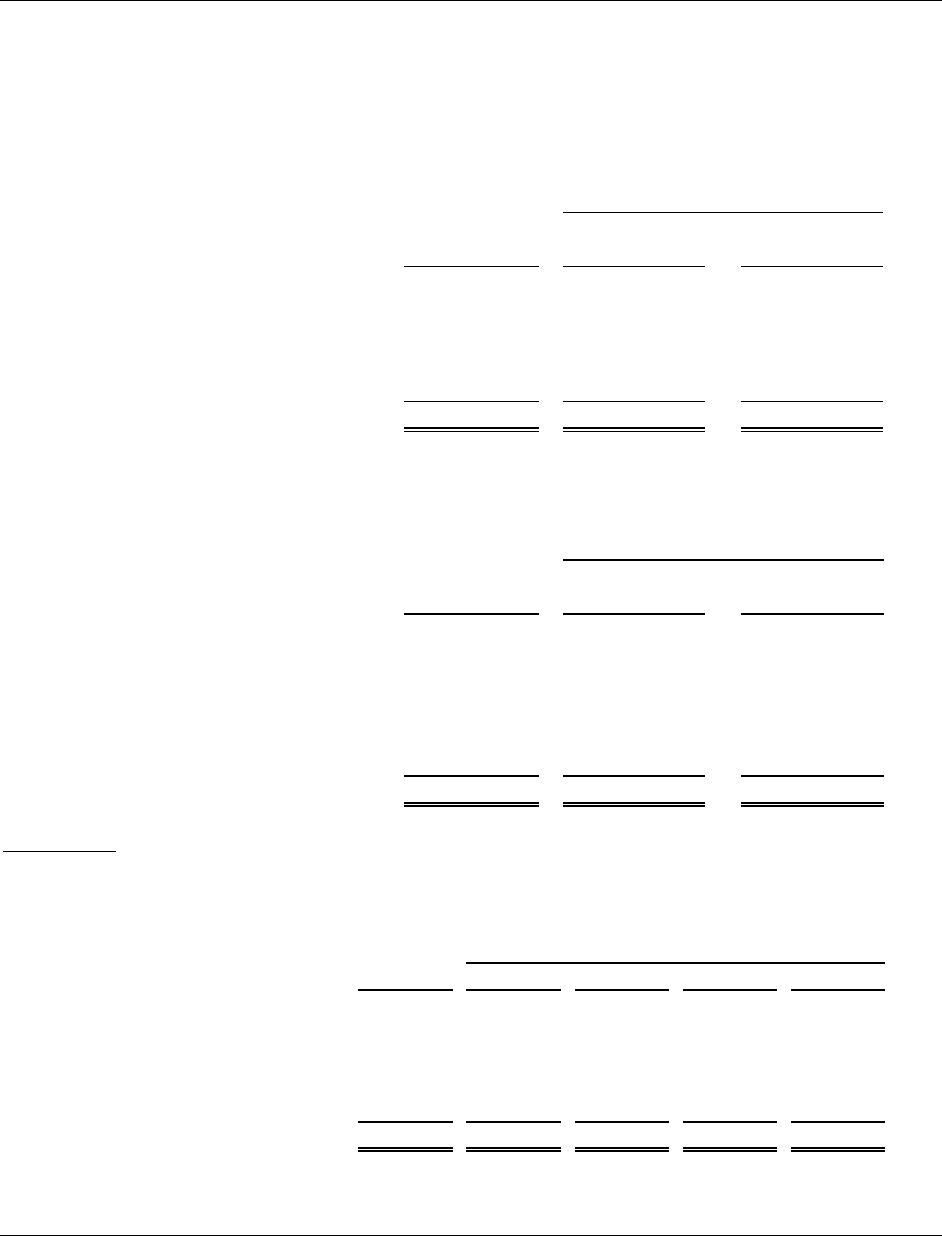

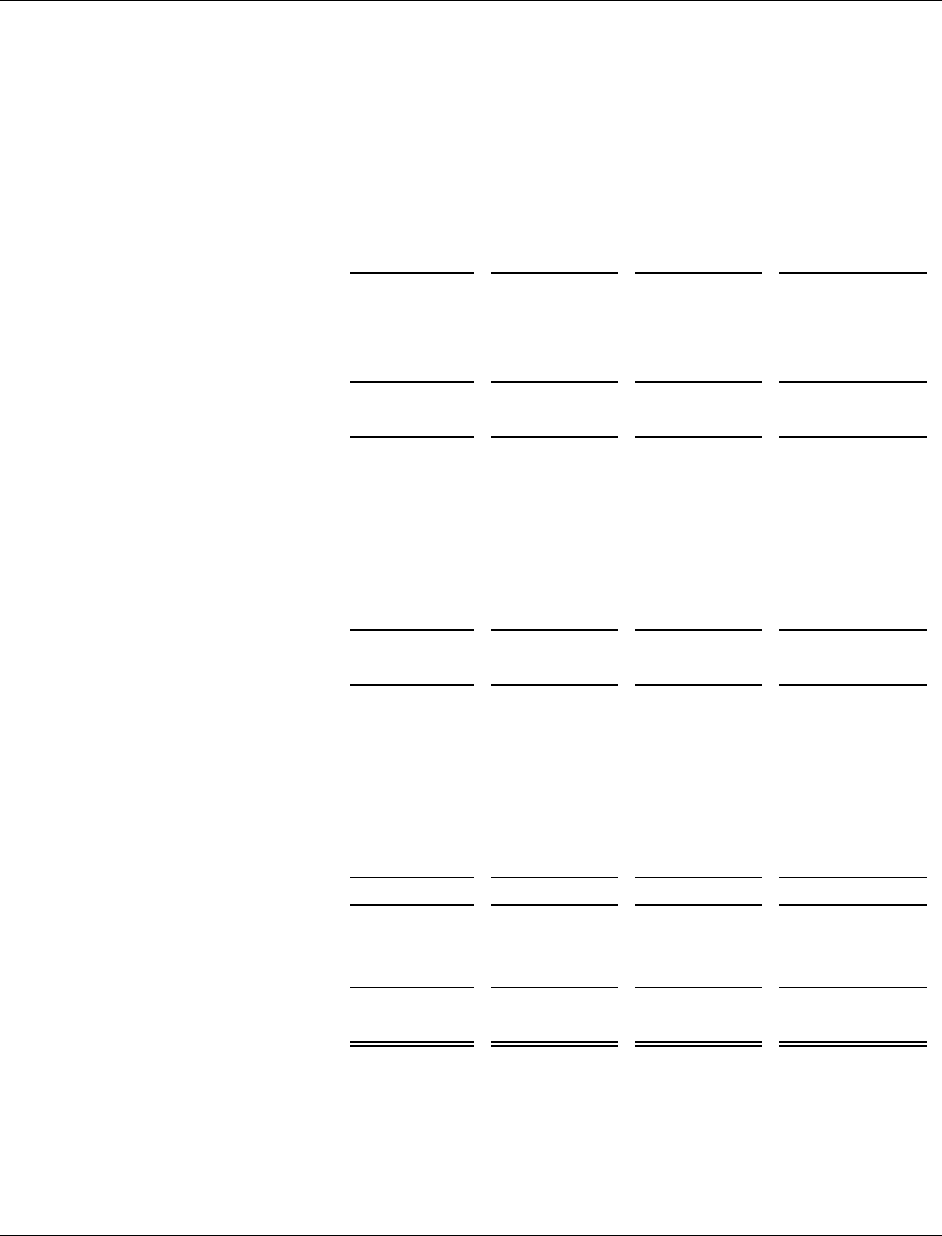

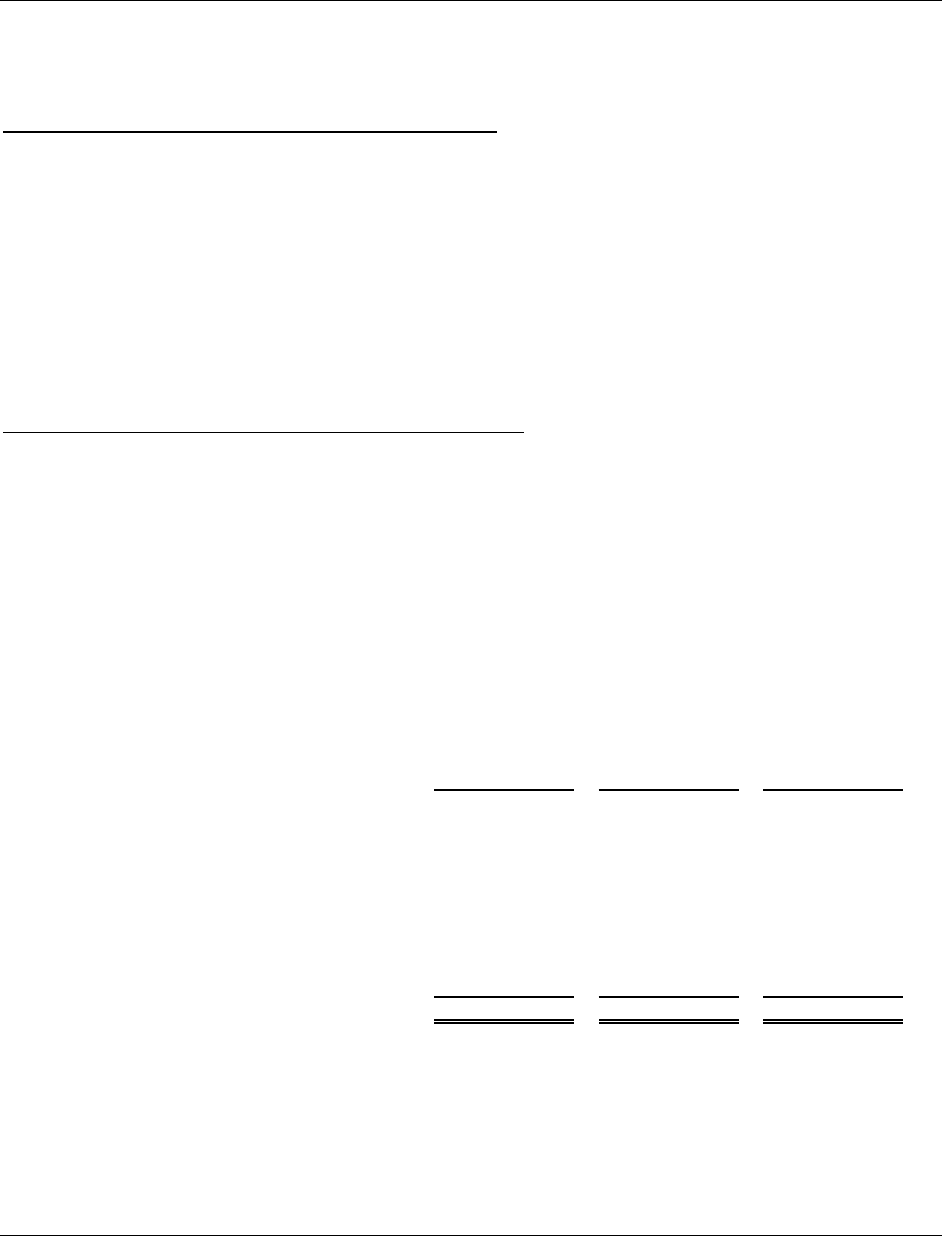

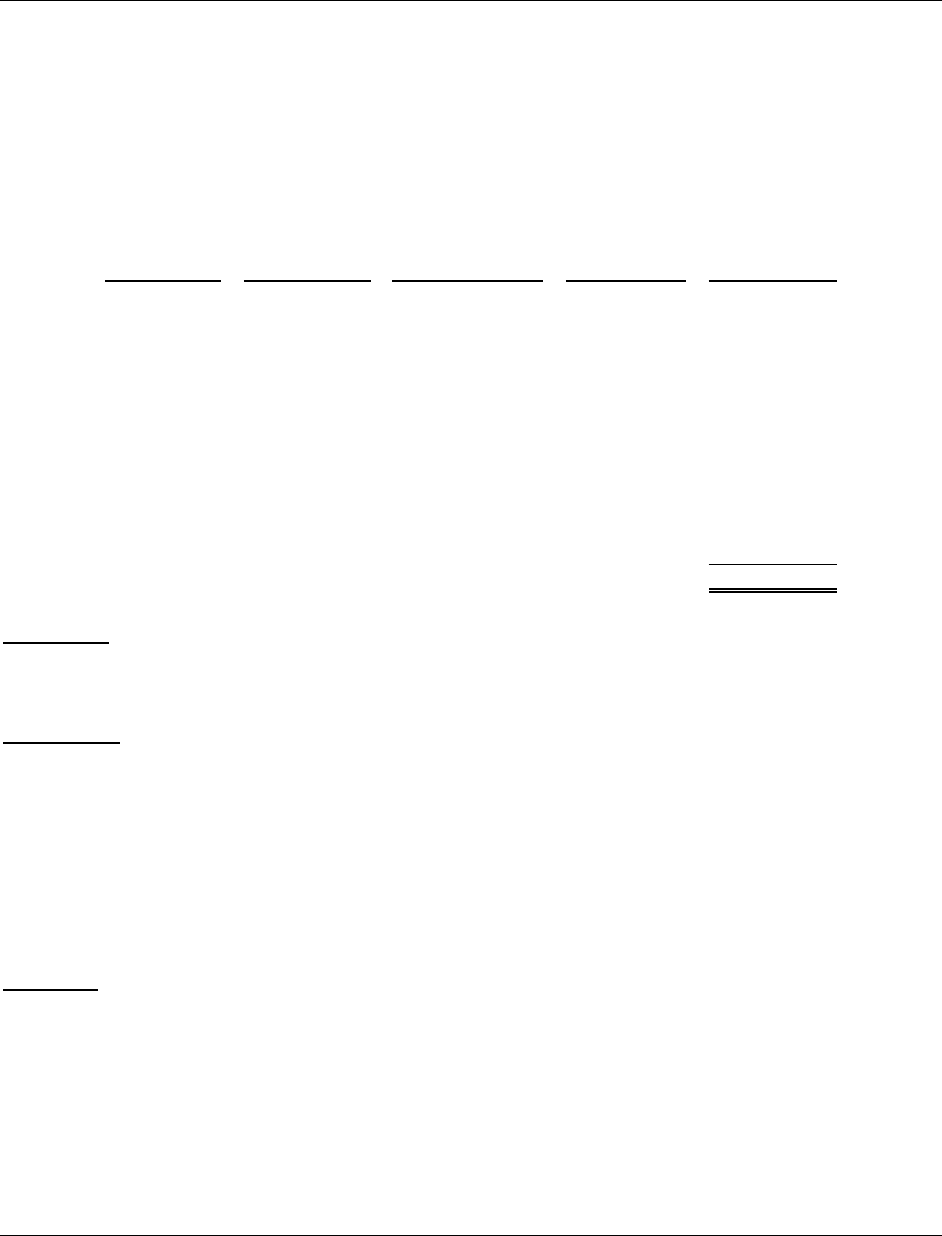

T

a

bl

e

1

Summary of Assets, Liabilities, and Net Assets

December 31, 2007, 2006, and 2005

(In thousands of dollars)

2007 2006 2005

Assets:

Current assets 496,326

$

418,591

$

407,698

$

Restricte

d

assets 1,941,364 2,190,409 2,052,990

Other assets 15,177 16,101 16,390

Capital assets, net 3,445,706 3,202,171 2,977,603

Total assets 5,898,573$ 5,827,272$ 5,454,681$

Liabilities:

Current liabilities 710,765

$

501,238

$

429,054

$

Long-term liabilities 3,775,550 3,582,511 3,178,545

Total liabilities 4,486,315 4,083,749 3,607,599

Net assets:

Invested in capital assets, net

of related debt 2,912,748

$

2,933,473

$

2,767,809

$

Restricted for payment of leasehold

o

bl

igations 37,992 33,017 24,211

Restricte

d

f

or

d

e

b

t service 32,233 31,379 32,840

Restricte

d

b

y RTA

f

or operations an

d

capita

l

improvements 5,430 5,818 7,460

Unrestricted (unrestricted) (1,576,145) (1,260,164) (985,238)

Total net assets 1,412,258 1,743,523 1,847,082

Total liabilities and net assets 5,898,573$ 5,827,272$ 5,454,681$

CHICAGO TRANSIT AUTHORITY

MANAGEMENT’S DISCUSSION AND ANALYSIS

December 31, 2007 and 2006

(Continued)

6.

Year Ended December 31, 2007

Current assets increased by 18.57% to $496,326,000. The change in current assets is primarily

due to the increase in cash and investments.

Restricted assets decreased by 11.37% to $1,941,364,000 due to the utilization of bond proceeds

during 2007.

Other assets decreased by 5.74% to $15,177,000 primarily due to the amortization of bond issue

costs and decrease in net pension asset.

Capital assets (net) increased by 7.61% to $3,445,706,000 due to the CTA’s capital improvement

projects. The CTA’s capital improvement projects were funded primarily by the Federal Transit

Administration (FTA), the Illinois Department of Transportation (IDOT), the Regional

Transportation Authority (RTA), and CTA bonds.

Current liabilities increased 41.8% to $710,765,000 primarily due to an increase in accounts

payable, advances, and the current portion of capital lease obligations.

Long-term liabilities increased 5.39% to $3,775,550,000 due primarily to an increase in net

pension obligation.

Net assets invested in capital assets, net of related debt consists of capital assets, net of

accumulated depreciation, and reduced by the amount of outstanding indebtedness attributable

to the acquisition, construction, or improvement of those assets.

The net asset balances restricted for other purposes include amounts restricted for three distinct

purposes. The first restriction is for the assets restricted for future payments on the lease

obligations. The second restriction is for the assets restricted for debt service payments. The

third restriction is for operating grants received from the RTA that are restricted for future

operations and capital improvements.

Unrestricted net assets (deficit), which represent assets available for operations, increased

25.07% over the prior year, primarily due to unfunded pension and postemployment healthcare

expense (i.e. increase in the net pension obligation) of $305,126,000.

CHICAGO TRANSIT AUTHORITY

MANAGEMENT’S DISCUSSION AND ANALYSIS

December 31, 2007 and 2006

(Continued)

7.

Year Ended December 31, 2006

Current assets increased by 2.67% to $418,591,000. The change in current assets is primarily due

to the increase in grants receivable which is offset by a decrease in cash, investments, and

inventory.

Restricted assets increased by 6.69% to $2,190,409,000 due to the receipt of bond proceeds that

were not yet expended at year-end. During 2006, CTA issued Capital Grant Receipts Revenue

Bonds, “2006 Project,” in the amount of $275,000,000, along with a premium of $19,652,000, in

anticipation of the receipt of grants from the federal government pursuant to a full funding

grant agreement. The bonds were issued to provide funds to finance the costs of capital

improvements to the transportation system referred to as the “2006 Project.” At December 31,

2006, approximately $291,000,000 of the proceeds from this bond were unspent.

Other assets decreased by 1.76% to $16,101,000 primarily due to the amortization of bond issue

costs and decrease in net pension asset.

Capital assets (net) increased by 7.54% to $3,202,171,000 due to the CTA’s capital improvement

projects. The CTA’s capital improvement projects were funded primarily by the Federal Transit

Administration (FTA), the Illinois Department of Transportation (IDOT), the Regional

Transportation Authority (RTA), and CTA bonds.

Current liabilities increased 16.82% to $501,238,000 primarily due to an increase in accounts

payable and accrued expenses.

Long-term liabilities increased 12.71% to $3,582,511,000 due primarily to an increase in net

pension obligation and the issuance of Capital Grant Receipts Revenue Bonds in 2006.

Net assets invested in capital assets, net of related debt consists of capital assets, net of

accumulated depreciation, and reduced by the amount of outstanding indebtedness attributable

to the acquisition, construction, or improvement of those assets. This category increased 5.99%

from the prior year primarily due to capital assets, acquisitions during the year that were

funded by capital grants of $522,040,000, offset by depreciation expense of $376,910,000.

The net asset balances restricted for other purposes include amounts restricted for three distinct

purposes. The first restriction is for the assets restricted for future payments on the lease

obligations. The second restriction is for the assets restricted for debt service payments. The

third restriction is for operating grants received from the RTA that are restricted for future

operations and capital improvements.

Unrestricted net assets (deficit), which represent assets available for operations, increased

27.90% over the prior year, primarily due to unfunded pension expense (i.e. increase in the net

pension obligation) of $241,202,000.

CHICAGO TRANSIT AUTHORITY

MANAGEMENT’S DISCUSSION AND ANALYSIS

December 31, 2007 and 2006

(Continued)

8.

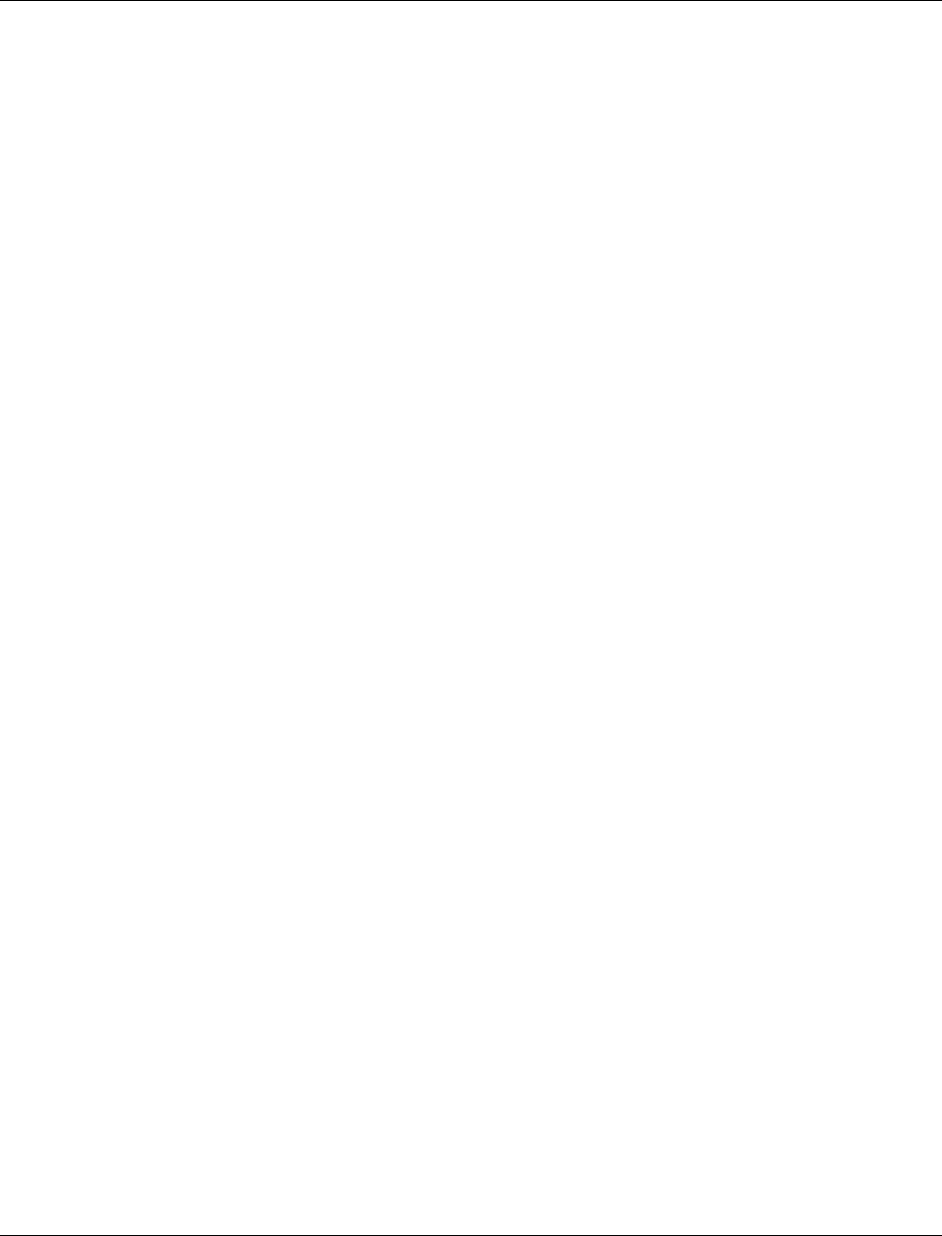

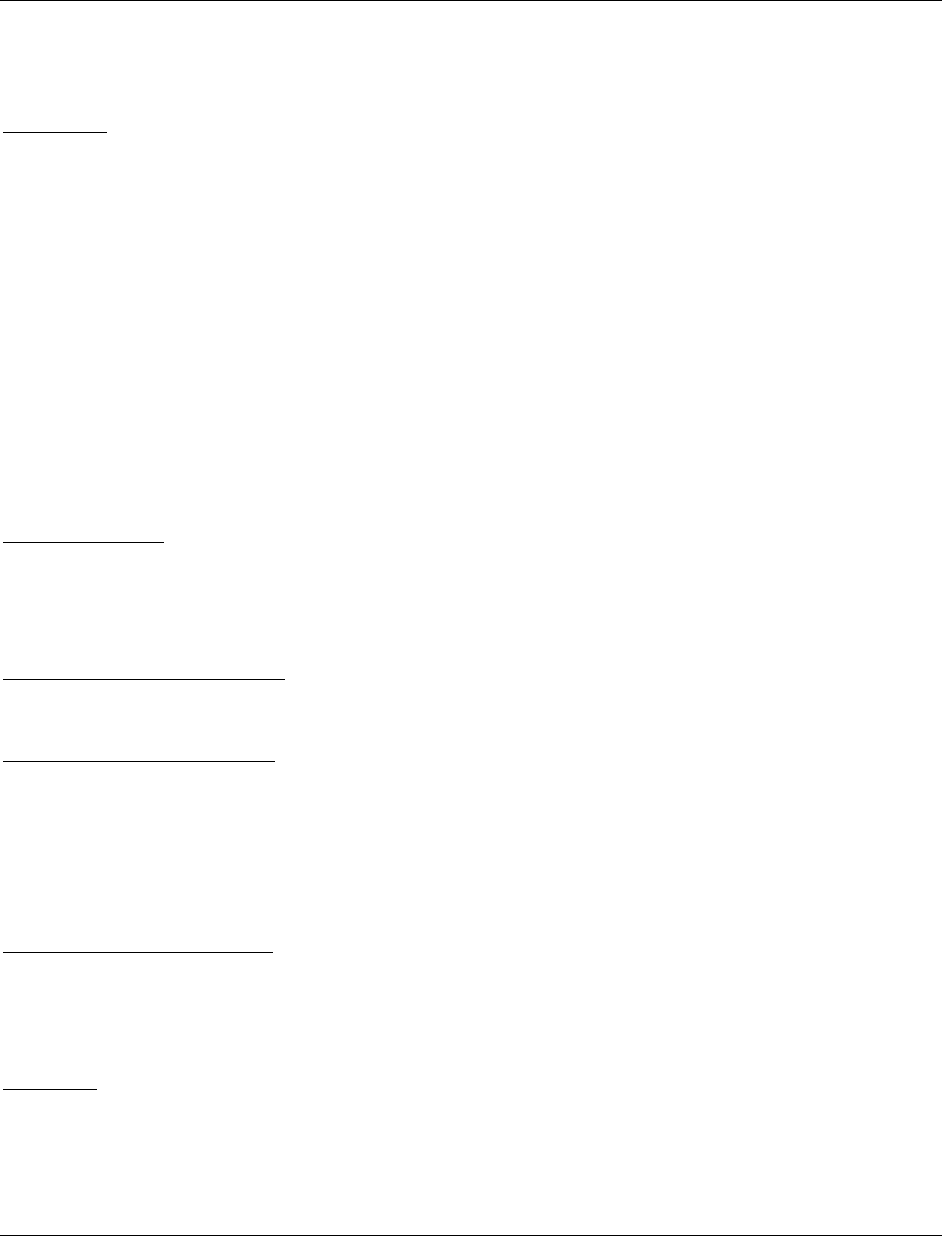

Statement of Revenues, Expenses, and Changes in Net Assets

The following table reflects a condensed summary of the revenues, expenses, and changes in net

assets (in thousands) for the years ended December 31, 2007, 2006, and 2005:

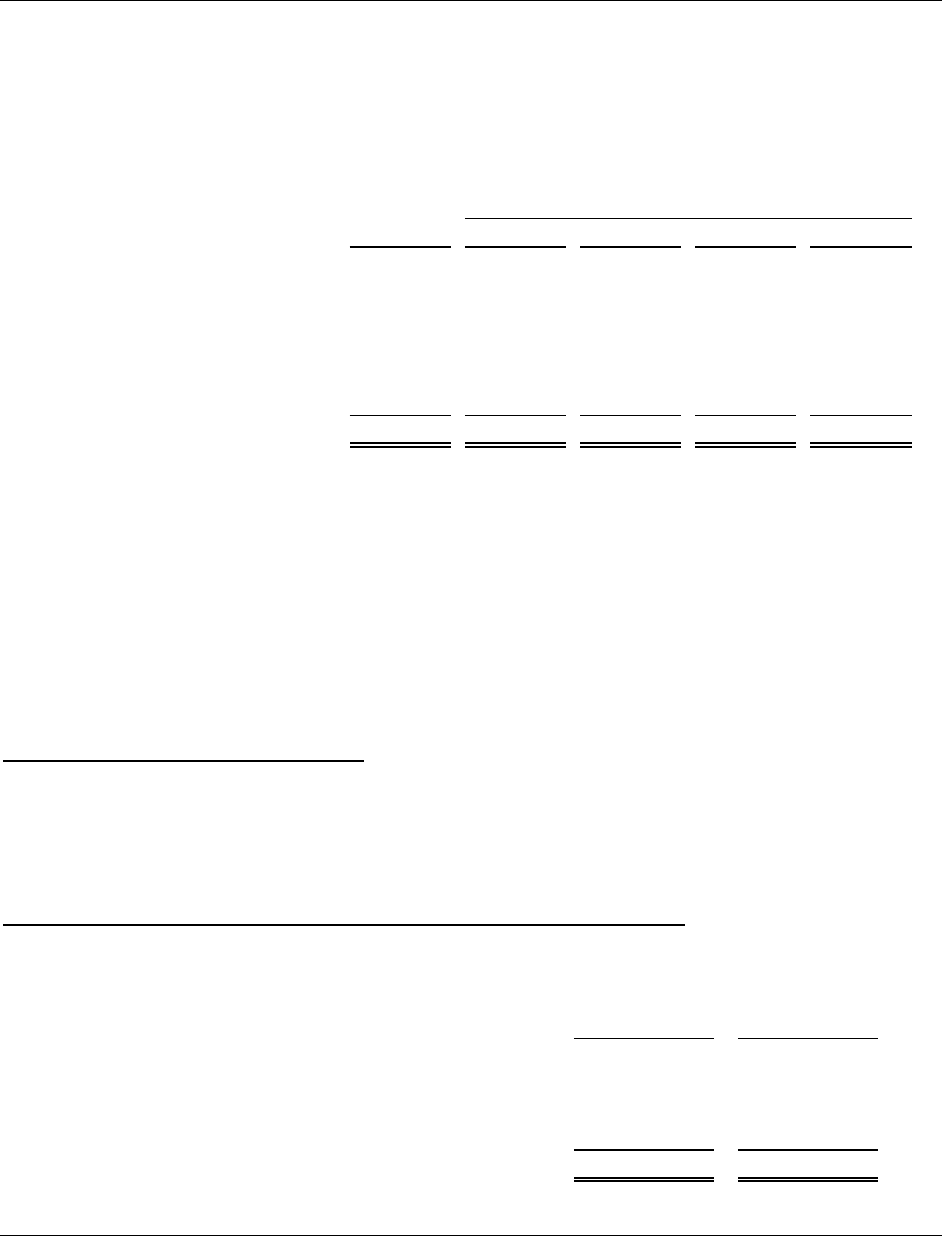

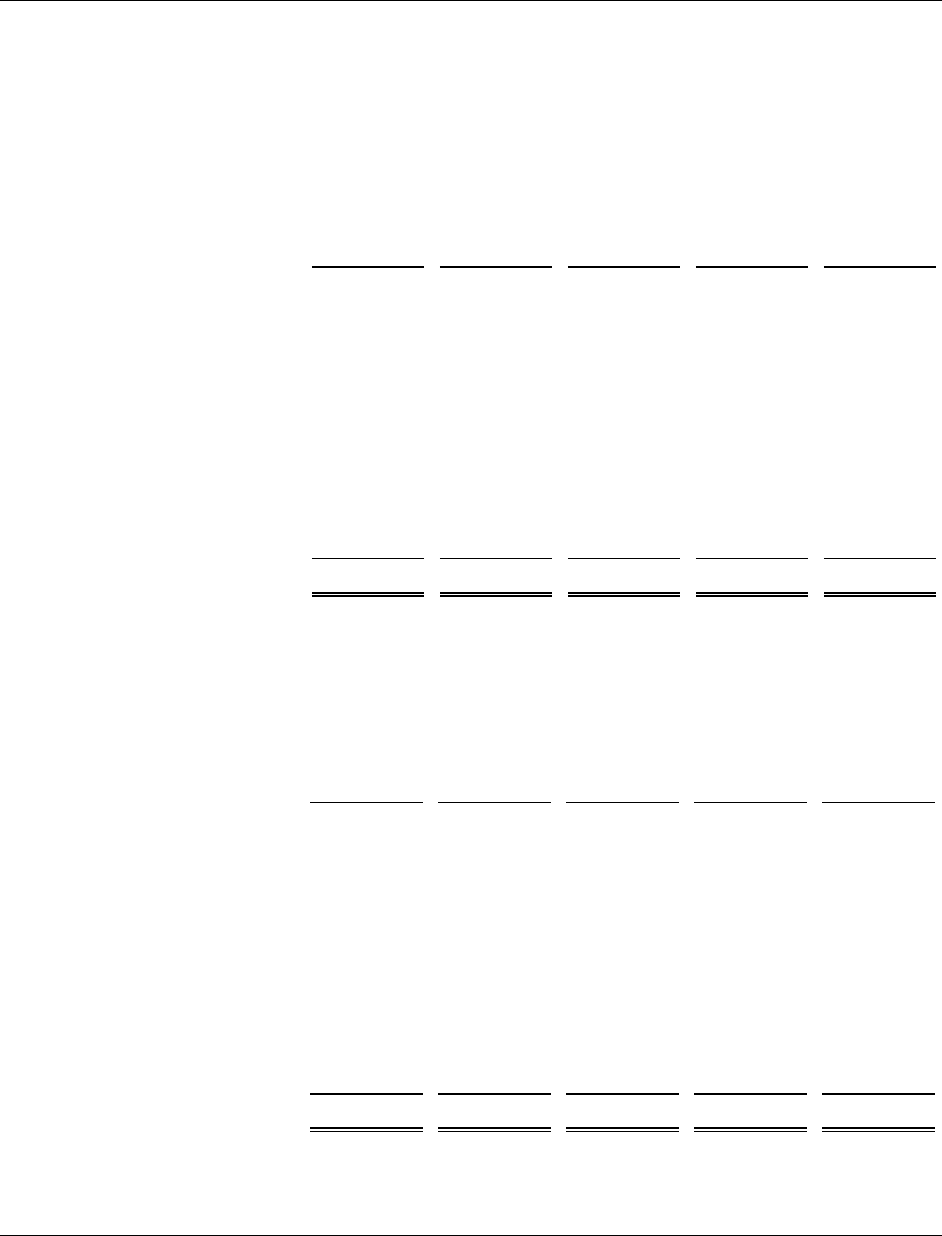

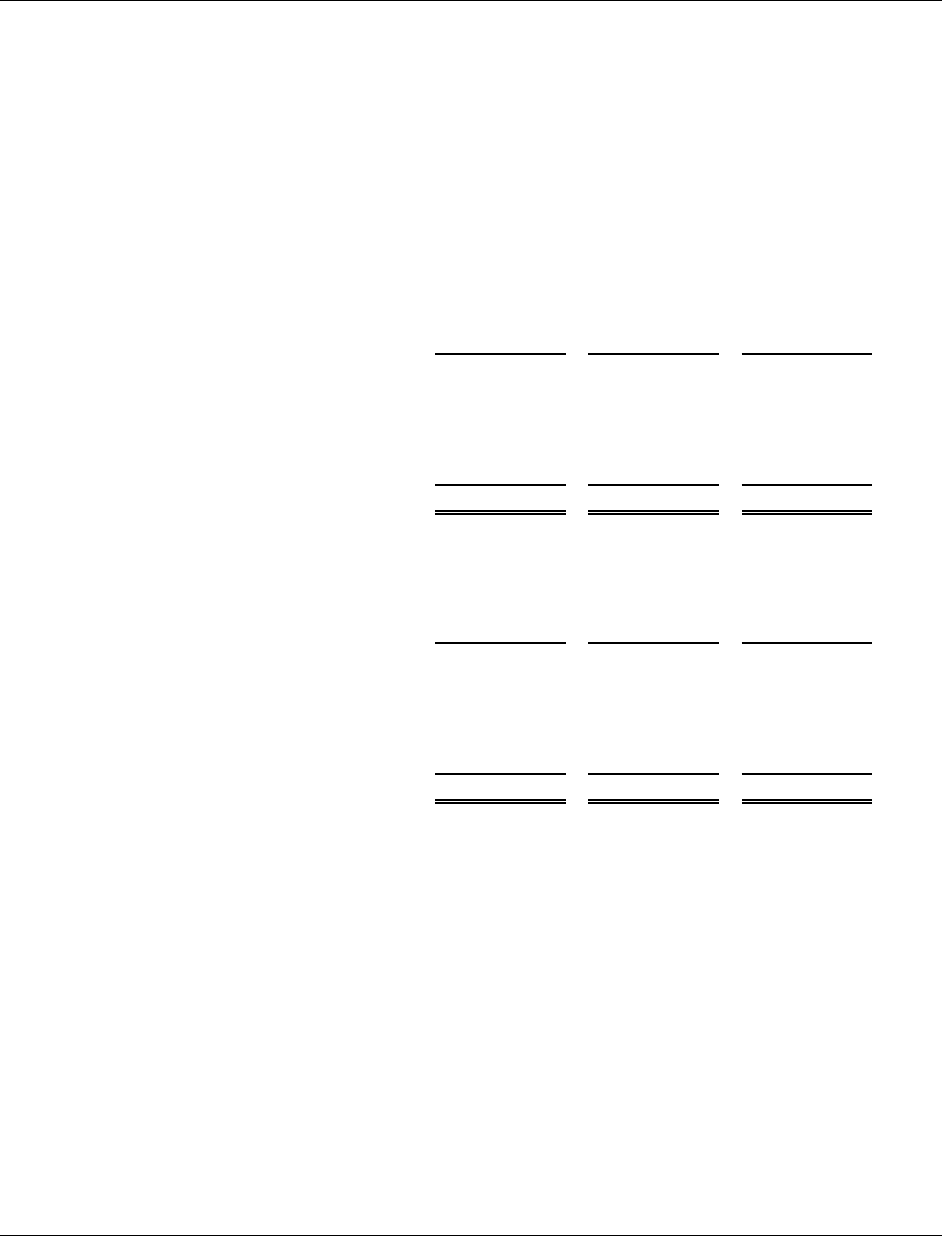

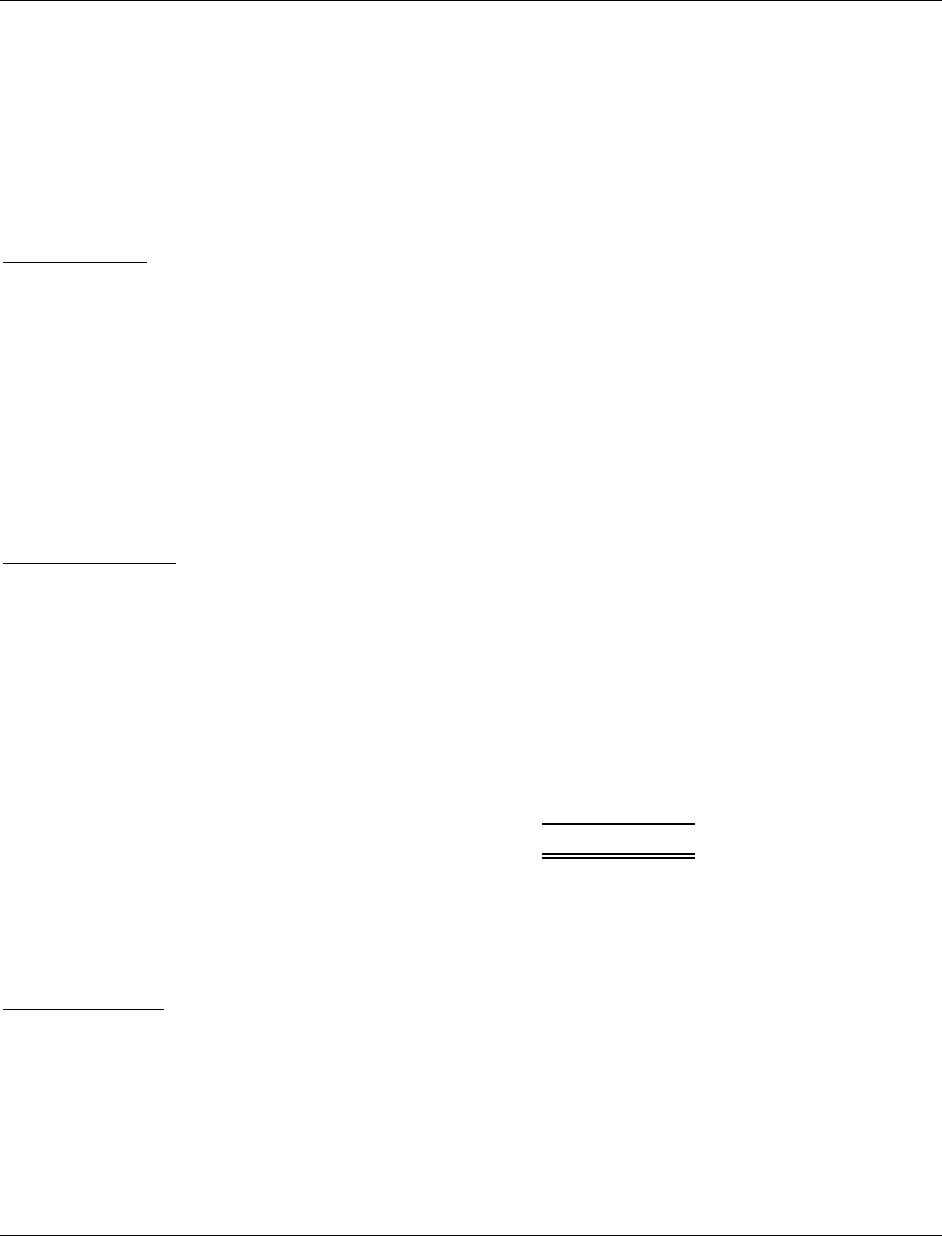

T

a

bl

e

2

Condensed Summary of Revenues, Expenses, and Changes in Net Assets

Years ended December 31, 2007, 2006, and 2005

(In thousands of dollars)

2007 2006 2005

Operating revenues 493,350$ 493,023$ 448,411$

Operating expenses:

Operating expenses 1,412,842 1,344,133 1,216,217

Depreciation 387,738 376,910 360,559

Total operating expenses 1,800,580 1,721,043 1,576,776

Operating loss (1,307,230) (1,228,020) (1,128,365)

Nonoperating revenues/expenses, net 600,051 602,421 576,139

Capital contributions 375,914 522,040 398,654

Change in net assets (331,265) (103,559) (153,572)

Total net assets, beginning of year 1,743,523 1,847,082 2,000,654

Total net assets, end of year 1,412,258$ 1,743,523$ 1,847,082$

Year Ended December 31, 2007

Total operating revenues increased by $327,000, or 0.07% due to a one-time utility settlement

received in 2007. Farebox revenue decreased over the prior year by approximately $5,000,000 or

1.1% despite an increase in ridership of approximately 4.7 million rides or 1.0%. The fare

structure implemented on January 1, 2006 resulted in many riders transitioning from a per ride

fare to an unlimited pass thereby driving the average fare down from $0.934 in 2006 to $0.915 in

2007.

Total operating expenses increased $79,537,000, or 4.62%. The increase is primarily driven by

higher labor, materials, electric power, and fuel expense.

Labor expense increased due to higher healthcare, pension, and workers’ compensation

expenses. Materials expense increased $1,028,000 due to increasing commodity prices, higher

mileage and the aging life of the fleet. Electric power increased $5,873,000 due to the end of the

decade long rate freeze in Illinois. Fuel expense increased $13,711,000 due to a higher average

cost per gallon due to market driven forces. In 2007, the average fuel price increased $0.50 to

CHICAGO TRANSIT AUTHORITY

MANAGEMENT’S DISCUSSION AND ANALYSIS

December 31, 2007 and 2006

(Continued)

9.

$2.82 per gallon. Other expense increased due to higher utilities, rent and facilities

maintenances costs. The provision for injuries and damages decreased by $10,000,000 due to

cost containment initiatives implemented by the CTA such as surveillance cameras and

aggressive case management practices.

At the direction of the Illinois General Assembly, on July 1, 2006, the responsibility for

providing paratransit service in the region was transitioned to Pace Suburban Bus. As a result,

there is no paratransit expense for 2007.

Year Ended December 31, 2006

Operating revenues increased by $44,612,000, or 9.95%. The revenue increase is primarily due

to higher ridership and a higher average fare. The higher average fare is due to the new fare

structure which eliminated cash transfers and increased cash and rail transit card fares.

Additionally, systemwide ridership increased by 0.5% in 2006.

Total operating expenses increased $144,267,000, or 9.15%. The increase is primarily driven by

higher labor, materials, and fuel expense.

Labor expense increased due to higher wages, pension, and workers’ compensation expenses.

Materials expense increased $11,784,000 due to increasing commodity prices, higher mileage

and the aging life of the fleet. Fuel expense increased $11,682,000 due to a higher average cost

per gallon due to market driven forces. In 2006, the average fuel price increased $0.45 to $2.32

per gallon.

At the direction of the Illinois General Assembly, on July 1, 2006, the responsibility for

providing paratransit service in the region was transitioned to Pace Suburban Bus. As a result,

paratransit expense declined by $24,800,000 or 46% over the prior year.

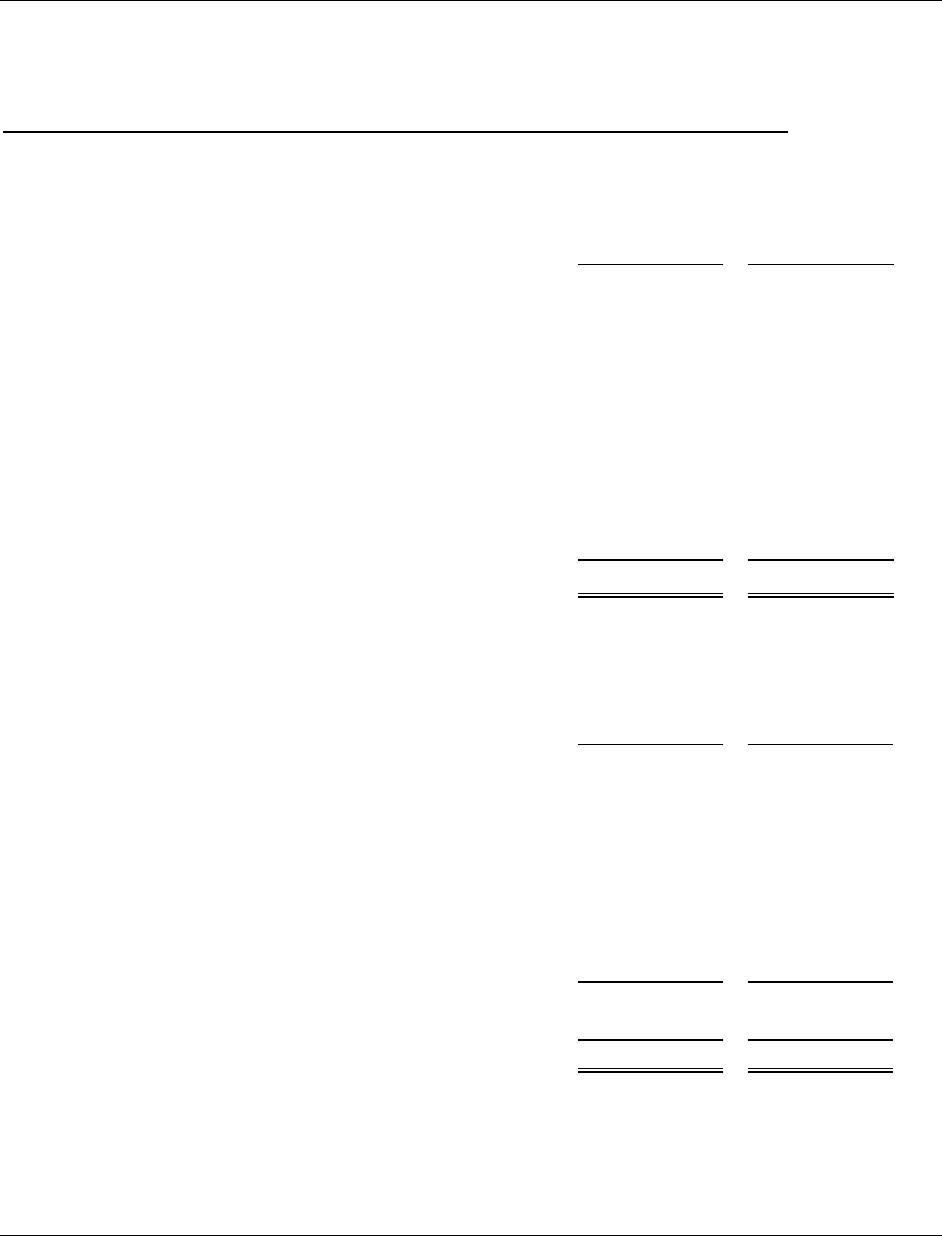

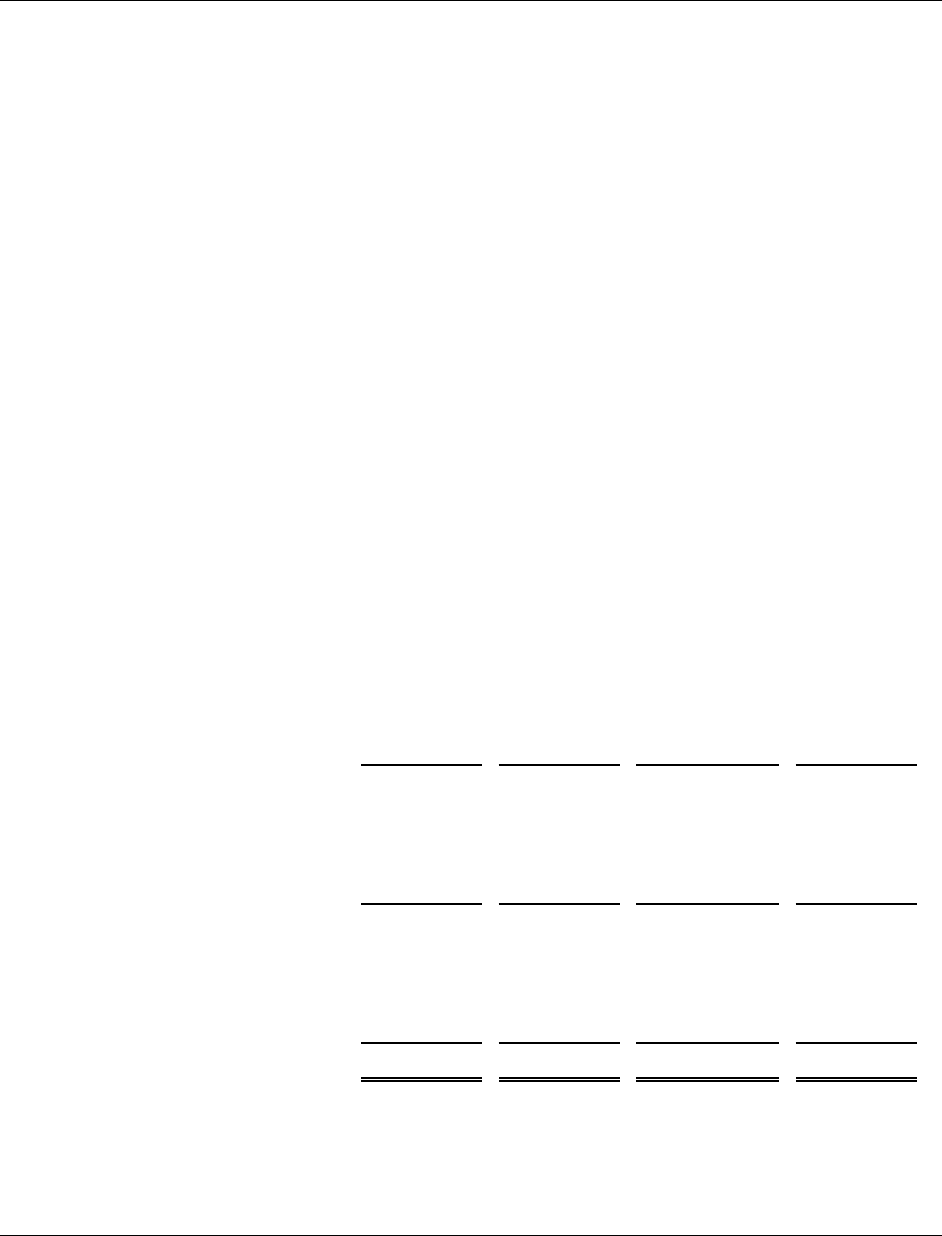

Table 3, which follows, provides a comparison of amounts for these items:

CHICAGO TRANSIT AUTHORITY

MANAGEMENT’S DISCUSSION AND ANALYSIS

December 31, 2007 and 2006

(Continued)

10.

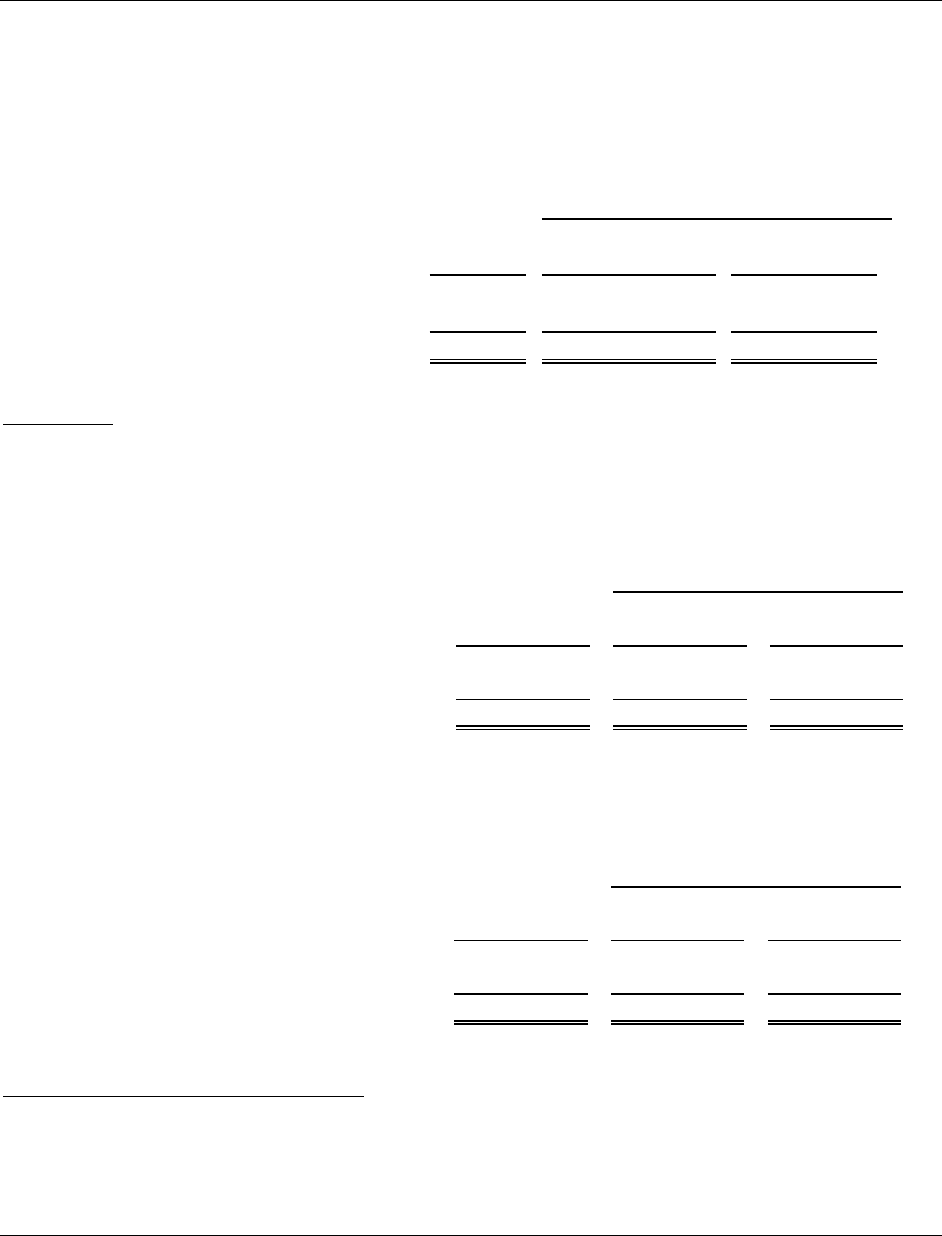

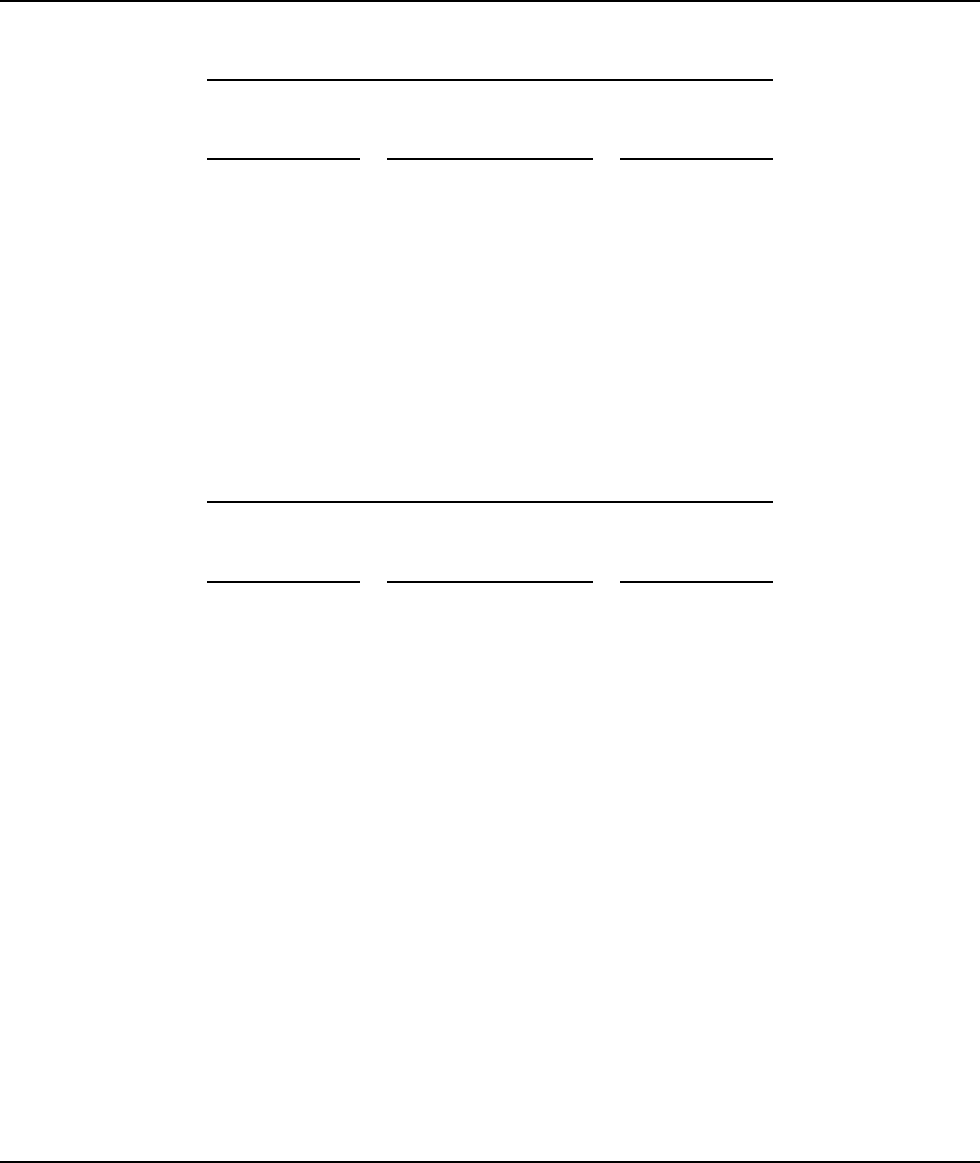

T

a

bl

e

3

Operating Expenses

Years ended December 31, 2007, 2006, and 2005

(In thousands of dollars)

2007 2006 2005

Labor and fringe benefits 1,112,290$ 1,047,445$ 914,034$

Materials and supplies 84,178 83,150 71,366

Fuel 71,181 57,470 45,788

Electric power 28,141 22,268 22,909

Purchase of securit

y

services 31,363 30,831 31,221

Purchase of paratransit - 28,415 53,257

Maintenance and repairs, utilities,

rent, and other 69,465 48,288 51,069

Operating expense before

provisions 1,396,618 1,317,867 1,189,644

Provision for injuries and damages 16,224 26,266 26,573

Provision for depreciation 387,738 376,910 360,559

Total operating expenses 1,800,580$ 1,721,043$ 1,576,776$

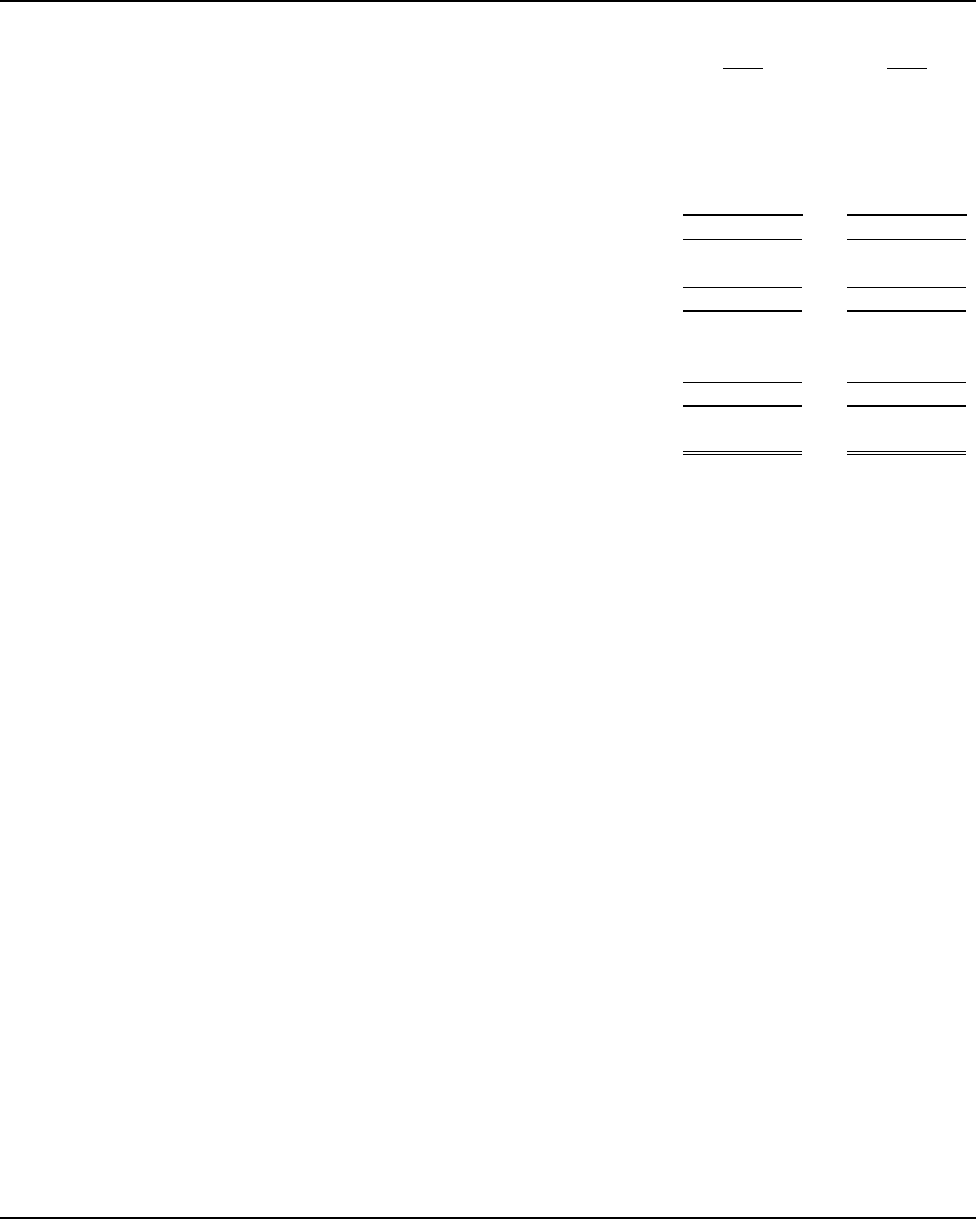

Capital Asset and Debt Administration

Capital Assets

The CTA invested $6,908,803,000 (not adjusted for inflation) in capital assets, including

buildings, vehicles, elevated railways, signal and communication equipment, as well as other

equipment as of December 31, 2006. Net of accumulated depreciation, the CTA’s capital assets

at December 31, 2006 totaled $3,202,171,000 (see Table 4). This amount represents a net increase

(including additions and disposals, net of depreciation) of $224,568,000, or 7.54%, over the

December 31, 2005 balance of $2,977,603,000.

CHICAGO TRANSIT AUTHORITY

MANAGEMENT’S DISCUSSION AND ANALYSIS

December 31, 2007 and 2006

(Continued)

11.

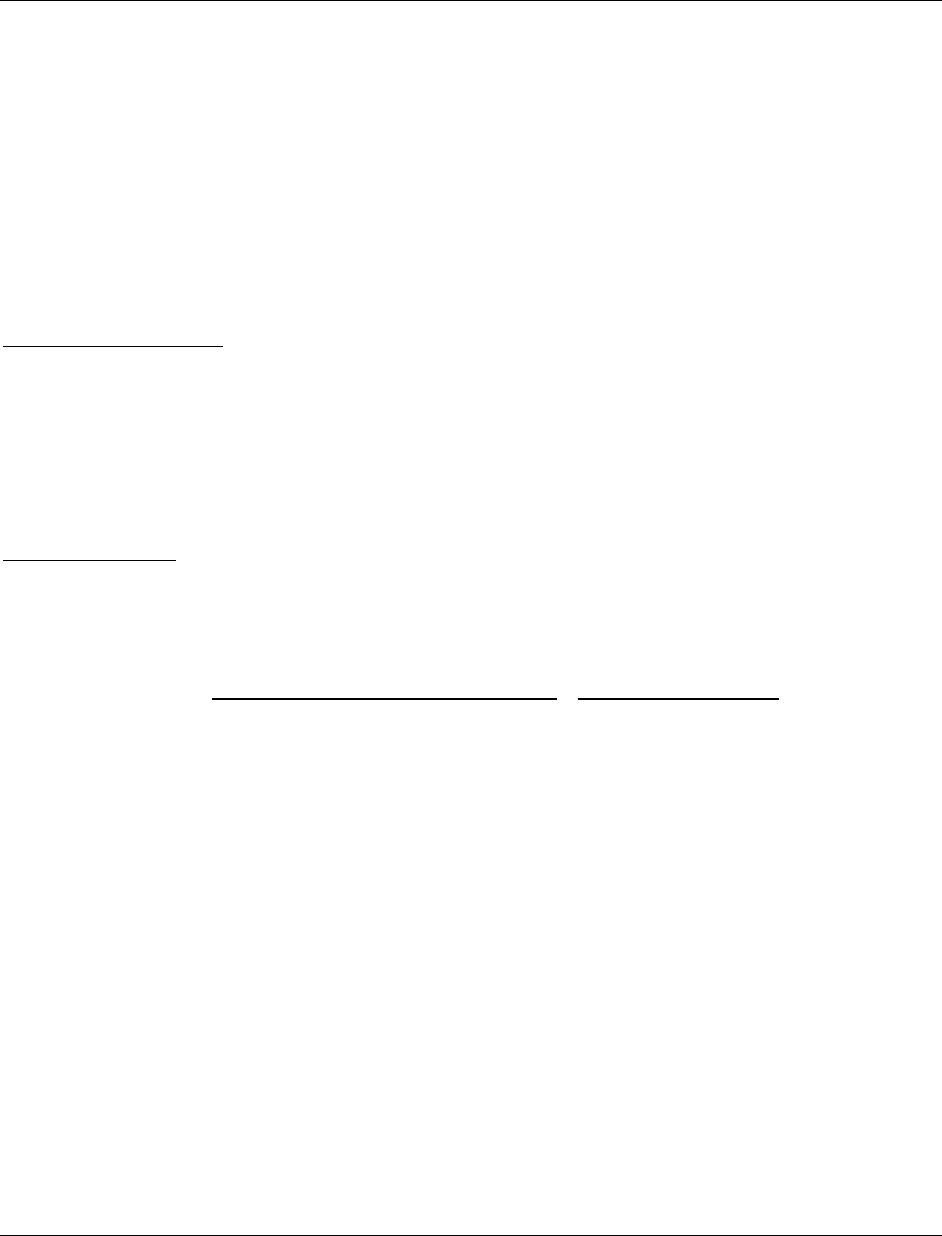

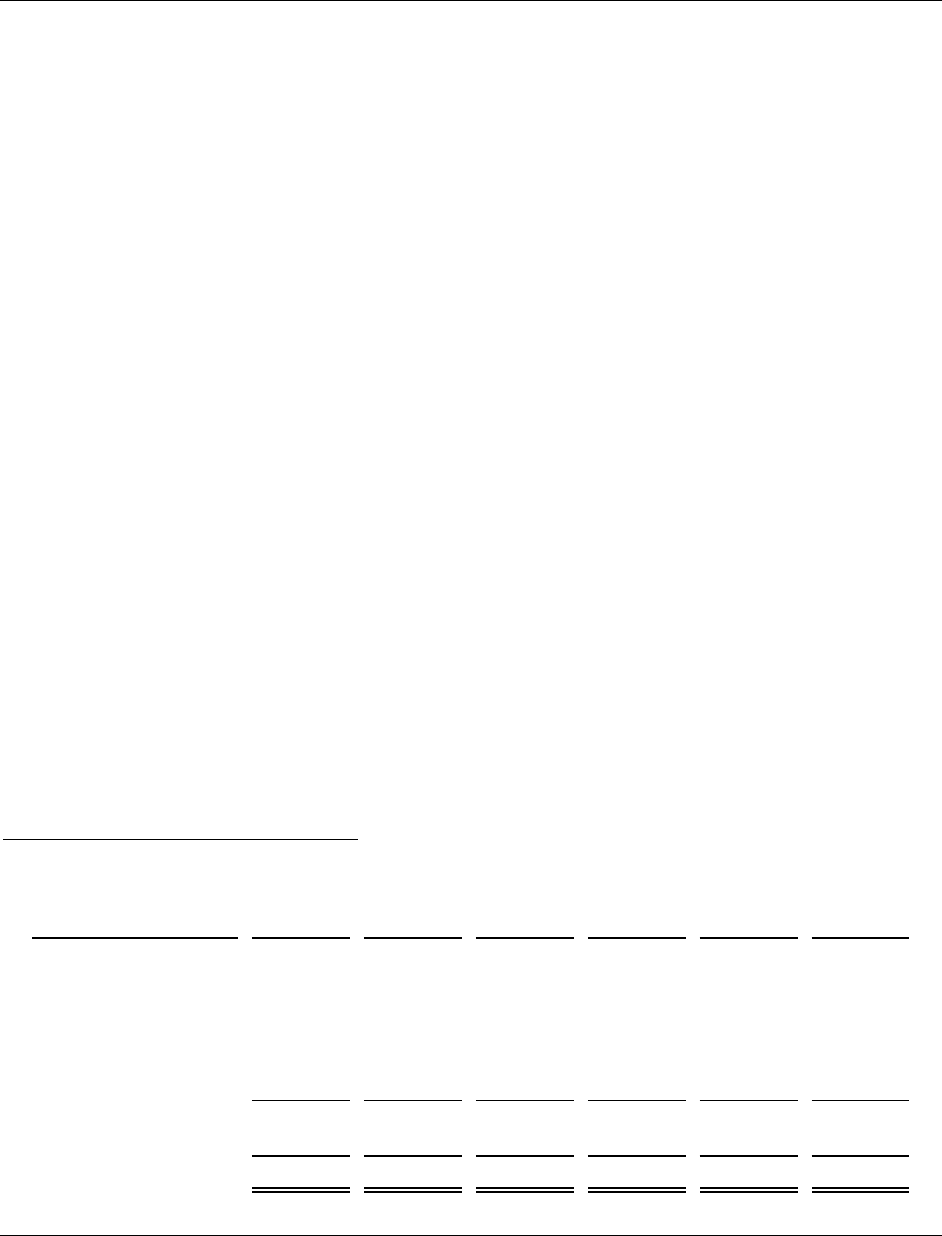

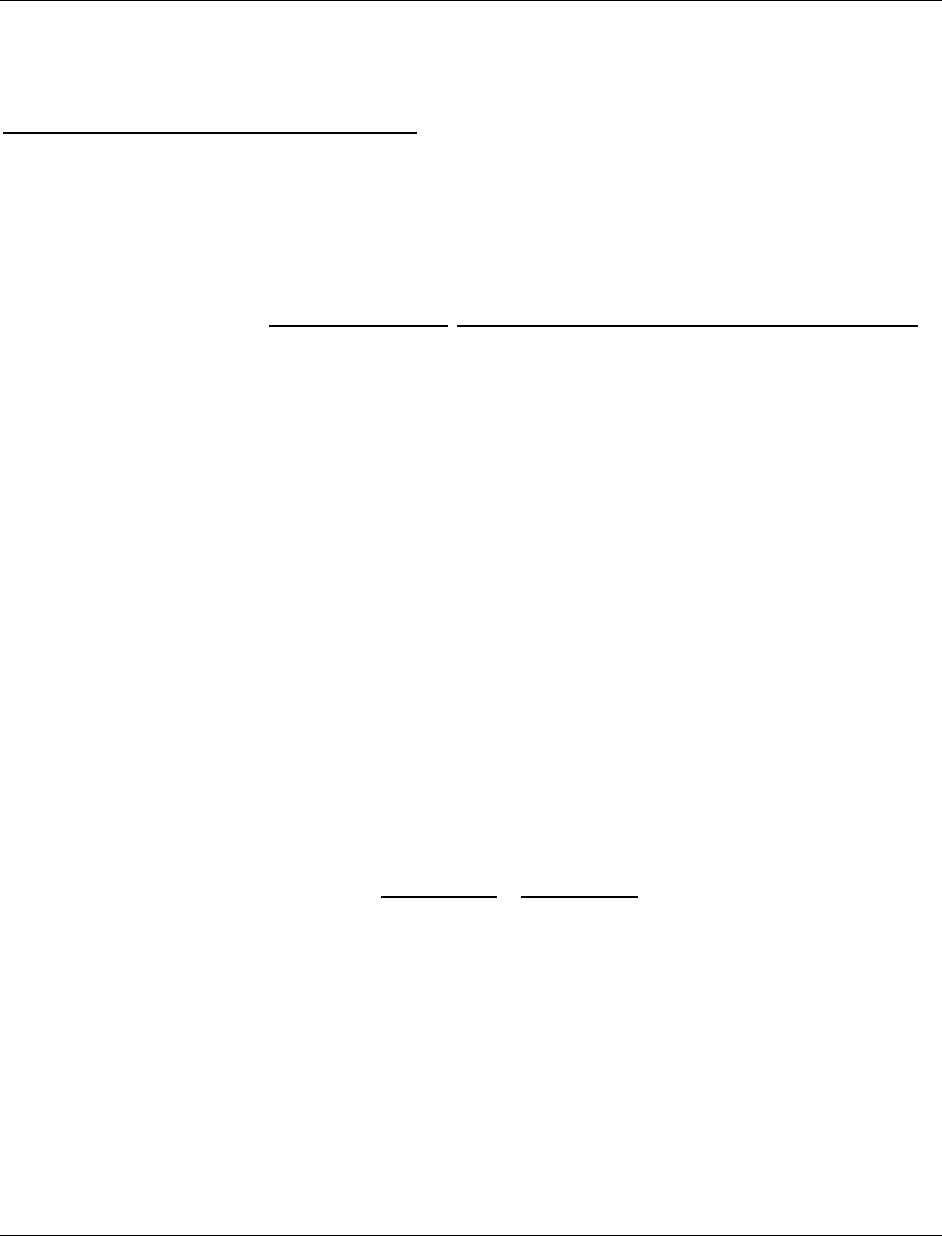

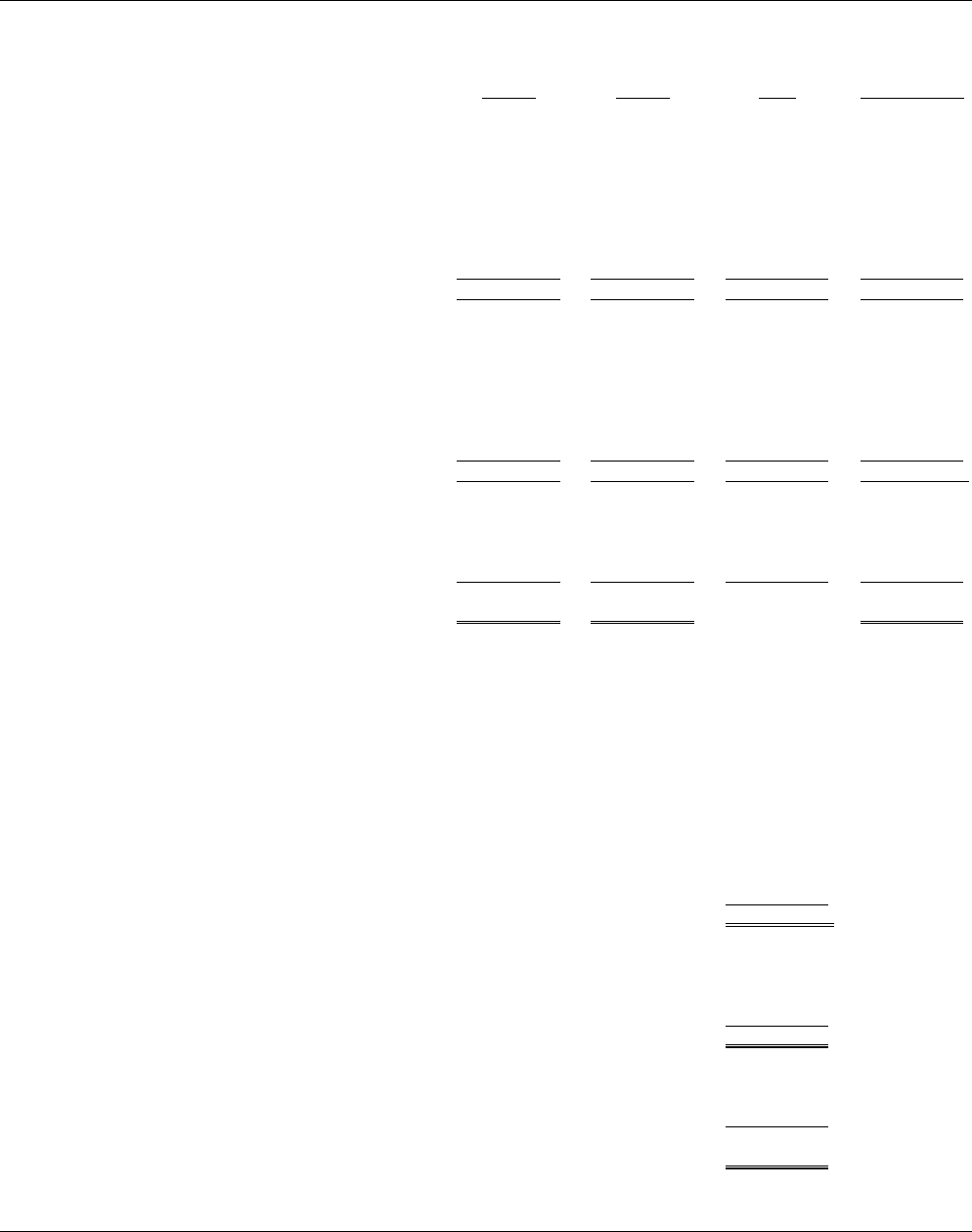

Table 4

Capital Assets by Funding Source

December 31, 2007, 2006, and 2005

(In thousands of dollars)

2007 2006 2005

Funding source:

Federal (FTA) $4,766,864 4,296,228$ 3,912,142$

State (principally IDOT) 570,408 557,261 527,502

RTA 1,736,990 1,670,859 1,556,002

CTA (generally prior to 1973) 124,854 126,573 126,573

Other 264,248 257,882 243,921

Total capital assets 7,463,364 6,908,803 6,366,140

Accumulated depreciation 4,017,658 3,706,632 3,388,537

Total capital assets, net 3,445,706$ 3,202,171$ 2,977,603$

The year-over-year increase in capital assets resulted primarily from rolling stock purchases,

overhauls of railcars and buses, and the infrastructure improvement projects identified in the

2007 portion of the Five-Year Capital Plan.

Debt Administration

Long-term debt includes capital lease obligations payable, accrued pension costs, and bonds

payable.

At December 31, 2007, the CTA had $1,750,421,000 in capital lease obligations outstanding, a

0.5% increase from December 31, 2006. The net pension obligation at December 31, 2007 was

$908,609,000, a 21.5% increase from December 31, 2006. The increase in net pension obligation

is primarily due to contributions that are less than the actuarially determined amount. The

other postemployment healthcare benefit liability (OPEB) at December 31, 2007 was

$659,729,000 a 28.0% increase from December 31, 2006. The increase in OPEB at December 31,

2007 is due to the rising cost of healthcare.

At December 31, 2006, the CTA had $1,741,828,000 in capital lease obligations outstanding, a

0.3% increase from December 31, 2005. The net pension obligation at December 31, 2006 was

$748,020,000, and the other postemployment healthcare benefit liability (OPEB) was

$515,374,000, a combined increase of 23.6% from December 31, 2005. The increase in net

pension obligation and postemployment healthcare liability is primarily because the CTA

contributes to the employee pension plans based on the requirements of union contracts rather

than an actuarial determined amount.

CHICAGO TRANSIT AUTHORITY

MANAGEMENT’S DISCUSSION AND ANALYSIS

December 31, 2007 and 2006

(Continued)

12.

More detailed information about the CTA’s long-term debt and pension obligation is presented

in the notes to the financial statements.

Economic Factors and Next Year’s Budget

The CTA adopted a proposed 2008 Annual Budget on November 7, 2007 that includes

significant service reductions, fare increases, and layoffs in order to bridge a projected $158.0

million shortfall. This budget was then submitted to the RTA and approved by the RTA on

December 14, 2007. Subsequent to the approval of the “doomsday budget” the Illinois state

legislature passed legislation increasing funding to transit. As such, RTA has issued new

funding marks to CTA and CTA is in process of amending its budget to cancel the service cuts,

fare increase and reflect the new funding. The proposed budget amendment provides for

operating expenses of $1,162,666,234. The proposed operating budget amendment increase of

6.3% over the 2007 actual results is primarily due to higher healthcare, pension, fuel, and power

costs. Comparatively, the U.S. City Average Annual Consumer Price Index (CPI) grew by 2.8%

for 2007. The primary economic indicators impacting ridership and operating funds is area

employment and retail sales. CTA’s public funding is primarily based on sales tax. The 2007

annual unemployment rate for the City of Chicago ended the year at 4.9%, compared to 4.5% at

the end of 2006. National unemployment also ended the year at 4.8% in December 2007 and

4.6% annual. Employment in the Chicago metropolitan division was 3,934,596 at the end of

2007. This represents an increase of 30,362 jobs since the end of 2006.

CTA renegotiated a five year labor contract for 2007 – 2011 that provides for wage increases of

3.0% in 2007, 2008 and 2009 and 3.5% in 2010 and 2011. The new contract also provides for

increased contributions to the pension fund and implements an employee contribution for

retiree healthcare.

Budgeted system-generated revenues for 2008 are $540,835,000 and are lower than the 2007

actual results by $4,800,000. This projected decrease over 2007 actual revenues is due to

implementation of the senior free ride program required by legislation passed in January 2008.

CTA will begin offering free rides to senior citizens on March 17, 2008. This program is

projected to reduce CTA’s revenue in 2008 by $17,500,000.

CHICAGO TRANSIT AUTHORITY

MANAGEMENT’S DISCUSSION AND ANALYSIS

December 31, 2007 and 2006

(Continued)

13.

New Legislation

On January 18, 2008, Public Act 95-708 became law. This legislation provides funding for CTA

operations, pension and retiree healthcare from four sources: 1) a 0.25 percent increase in the

RTA sales tax in each of the six counties, 2) a $1.50 per $500 of transfer price increase in the City

of Chicago’s Real Property Transfer Tax, 3) an additional 5% state match on the real estate

transfer tax and all sales tax receipts except for the replacement and use tax, and 4) a 25% state

match on the new sales tax and real estate transfer tax. The proceeds from the increase in the

RTA sales tax will be used to fund some existing programs such as ADA paratransit services, as

well as some new initiatives such as the Suburban Community Mobility Fund and the

Innovation, Coordination and Enhancement Fund. The balance of these additional proceeds

along with the 5% state match on: existing, additional sales tax and real estate transfer tax; and

the state 25% match on the new sales tax will be divided among the CTA (48%), Metra (39%)

and Pace (13%) according to the statutory formula. On February 6, 2008, the Chicago City

Council authorized an increase in the Real Property Transfer Tax in the amount of $1.50 per

$500 of transfer price, the proceeds of which (after deducting costs associated with collection)

will be entirely directed to the CTA. Additionally the state 25% match on the real estate transfer

tax will be entirely directed to CTA as well. After financing debt service for pension and retiree

healthcare in the amount of approximately $124 million annually, and taking into consideration

the potential fluctuations in the Real Property Transfer Tax, the combination of these two

revenue sources are expected to yield approximately $104 million annually for CTA operations

in the short-term, with a potential for growth as the economy rebounds.

Pursuant to Public Act 94-839, the CTA was required to make contributions to its retirement

system in an amount which, together with the contributions of its participants, interest earned

on investments and other income, were sufficient to bring the total assets of the retirement

system up to 90% of its total actuarial liabilities by the end of fiscal year 2058. This legislation

also required the RTA to monitor the payment by the CTA of its required retirement system

contributions. If the CTA’s contributions were more than one month overdue, the RTA would

pay the amount of the overdue contributions directly to the trustee of the CTA’s retirement

system out of moneys otherwise payable by the RTA to the CTA.

Public Act 95-708 modified this directive slightly and added a number of other requirements.

First, a new Retirement Plan Trust will be created to manage the Retirement Plan assets.

Second, CTA contributions have been increased from 6% to 12%, and employee contributions

have been increased from 3% to 6%. Third, in addition to the requirement that the Retirement

Plan be 90% funded by 2059, there is a new requirement that the Retirement Plan be funded at a

minimum of 60% by September 15, 2009. Any deviation from the stated projections could result

in a directive from the State of Illinois Auditor General to increase the CTA and employee

contributions. Fourth, Public Act 95-708 authorized the CTA to issue $1.349 billion in pension

obligation bonds to fund the Retirement Plan. Finally, the legislation provides that CTA will

have no future responsibility for retiree healthcare costs after the bond funding.

CHICAGO TRANSIT AUTHORITY

MANAGEMENT’S DISCUSSION AND ANALYSIS

December 31, 2007 and 2006

14.

Public Act 95-708 also addressed retiree healthcare. In addition to the separation between

pension and healthcare that was mandated by Public Act 94-839, Public Act 95-708 provides

funding and benefit changes to the retiree healthcare benefits. First, all CTA employees will be

required to contribute 3% of their compensation into the new retiree healthcare trust. Second,

all employees will be eligible for retiree healthcare, but after January 18, 2008, only those

employees who retire at or after the age of 55 with 10 years of continuous service will actually

receive the benefit. Third, retiree, dependent and survivor premiums can be raised up to 45% of

the premium cost. Finally, the CTA has been given the authorization to issue $640 million in

pension obligation bonds to fund the healthcare trust.

The Chicago Transit Board has not yet approved the issuance of these bonds, however the CTA

is preparing for this issuance predicated on the assumption that the bonds will be repaid with

the proceeds of the additional funds provided to the CTA from the legislation.

Contacting the CTA’s Financial Management

This financial report is designed to provide our bondholders, patrons, and other interested

parties with a general overview of the CTA’s finances and to demonstrate the CTA’s

accountability for the money it receives. If you have questions about this report or need

additional financial information, contact the Chicago Transit Authority’s Finance Division, P.O.

Box 7565, Chicago, IL 60680-7565.

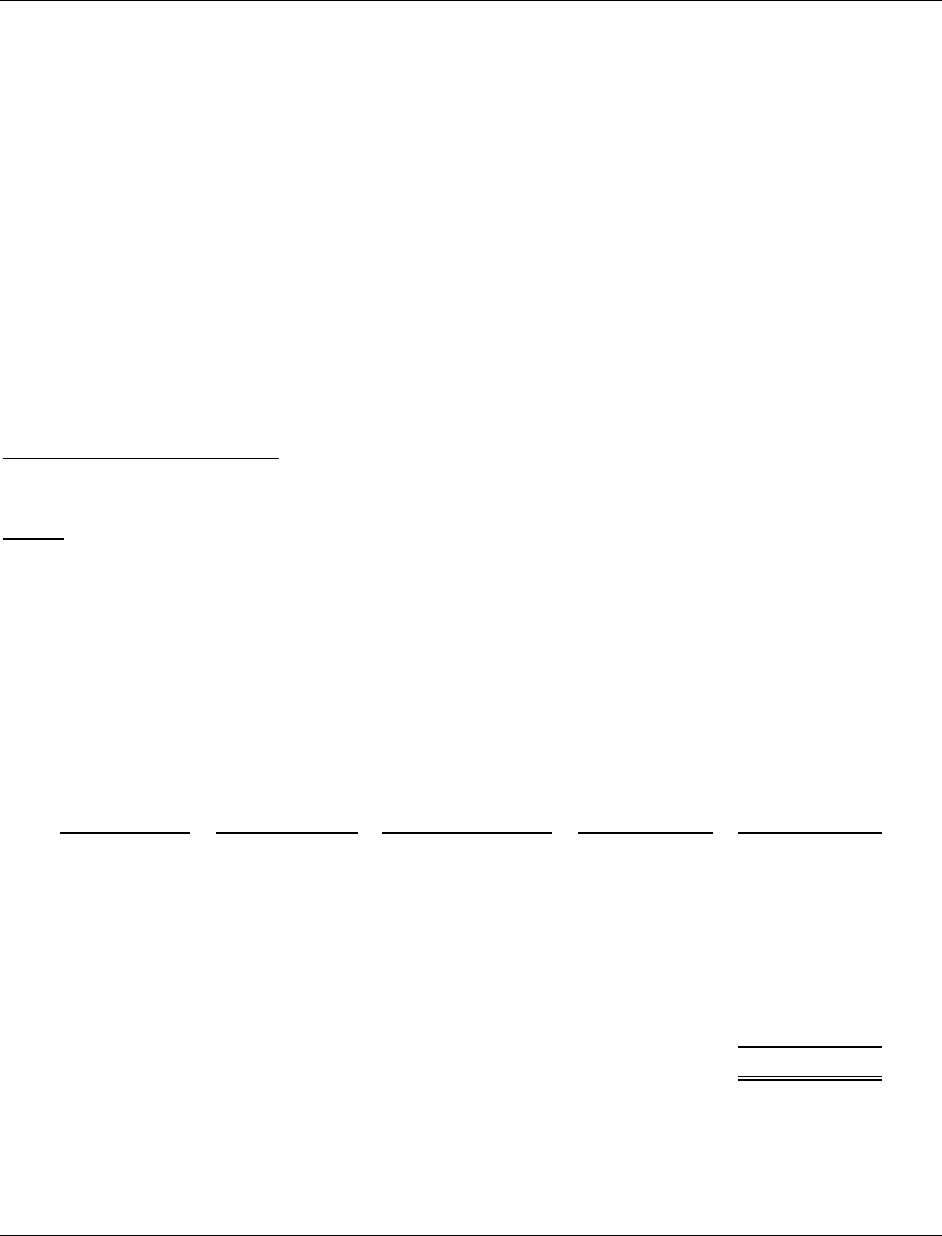

CHICAGO TRANSIT AUTHORITY

Business-T

yp

e Activities

Balance Sheets

December 31, 2007 and 2006

(

In thousands of dollars

)

Assets 2007 2006

Current assets:

Cash and cash e

q

uivalents 130,802$ 27,736$

Investment

s

900 10,914

Total cash, cash e

q

uivalents, and investments 131,702 38,650

Grants receivable:

Due from the RTA 87,809 144,507

Ca

p

ital im

p

rovement

p

ro

j

ects from federal and state sources 4,974 8,912

Unbilled work in

p

ro

g

ress 158,725 106,686

Other 1,485

1

Total

g

rants receivable 252,993 260,106

Accounts receivable, net 28,080 37,193

Materials and su

pp

lies, net 78,412 77,516

Pre

p

aid ex

p

enses and other assets 5,139 5,126

Total current assets 496,326 418,591

Restricted cash and investments:

Bond

p

roceeds held b

y

trustee 112,557 400,523

Restricted b

y

RTA 20,302 23,201

Restricted for in

j

ur

y

and dama

g

e reserve 109,057 83,180

Restricted assets for re

p

a

y

ment of leasin

g

commitments 1,699,448 1,683,505

Total restricted assets 1,941,364 2,190,409

Other assets:

Cash and investments held b

y

trustee for su

pp

lemental retirement

p

la

n

138 96

Bond issue costs 7,192 7,916

Net

p

ension asset 7,847 8,089

Total other assets 15,177 16,101

Ca

p

ital assets:

Ca

p

ital assets not bein

g

de

p

reciated:

Land 119,257 119,419

Construction in

p

rocess 666,046 694,234

Total ca

p

ital assets not bein

g

de

p

reciated 785,303 813,653

Ca

p

ital assets bein

g

de

p

reciated:

Land im

p

rovements 20,954 19,141

Buildin

g

s 1,734,898 1,549,652

Trans

p

ortation vehicles 2,068,102 1,971,486

Elevated structures, tracks, tunnels, and

p

ower s

y

stem 1,462,301 1,349,446

Si

g

nals 864,781 724,628

Other e

q

ui

p

ment 527,025 480,797

Less accumulated de

p

reciation

(

4,017,658

)

(

3,706,632

)

Total ca

p

ital assets bein

g

de

p

reciated, net 2,660,403 2,388,518

Total ca

p

ital assets, net 3,445,706 3,202,171

Total assets 5,898,573$ 5,827,272$

(Continued)

15.

CHICAGO TRANSIT AUTHORITY

Business-T

y

pe Activities

Balance Sheets

December 31, 2007 and 2006

(In thousands of dollars)

2007

2006

Liabilities and Net Assets

Current liabilities:

Account pa

y

able and accrued expenses 172,190$ 123,719$

Accrued pa

y

roll, vacation pa

y

, and related liabilities 99,626 98,925

Accrued interest pa

y

able 3,480 3,458

Advances, deposits, and other 49,552 9,333

Advances from RTA 20,302 23,201

Deferred passen

g

er revenue 29,273 29,290

Other deferred revenue 2,705 992

Deferred operatin

g

assistance 24,602 23,273

Current portion of self-insurance claims 74,795 63,411

Current portion of capital lease obli

g

ations 206,765 107,226

Current portion of bonds pa

y

able 27,475 18,410

Total current liabilities 710,765 501,238

Lon

g

-term liabilities:

Self-insurance claims, less current portion 117,955 102,432

Capital lease obli

g

ations, less current portion 1,543,656 1,634,602

Premium on capital lease obli

g

ation 5,721 6,062

Deferred revenue – leasin

g

transactions 37,235 41,497

Bonds pa

y

able 461,410 488,885

Premium on bonds pa

y

able 36,902 41,060

Accrued pension costs (net pension obli

g

ation) 908,609 748,020

Other Post-Emplo

y

ment Healthcare Liabilit

y

659,729 515,374

Other lon

g

-term liabilities 4,333 4,579

Total lon

g

-term liabilities 3,775,550 3,582,511

Total liabilities 4,486,315 4,083,749

Net assets:

Invested in capital assets, net of related debt 2,912,748 2,933,473

Restricted for pa

y

ment of leasehold obli

g

ations 37,992 33,017

Restricted for debt service 32,233 31,379

Restricted b

y

RTA for future operations and capital improvements 5,430 5,818

Unrestricted (deficit) (1,576,145)

(1,260,164)

Total net assets 1,412,258 1,743,523

Total liabilities and net assets 5,898,573$ 5,827,272$

See accompanying notes to financial statements. 16.

CHICAGO TRANSIT AUTHORIT

Y

Business-Type Activitie

s

Statements of Revenues, Expenses, and Changes in Net Assets

Years ended December 31, 2007 and 200

6

(In thousands of dollars)

2007

2006

Operating revenues:

Fare box revenue 253,987$ 276,408$

Pass revenue 203,313

185,809

Total fare box and pass revenu

e

457,300 462,217

Advertising and concessions 23,164 24,402

Other revenue 12,886

6,404

Total operating revenue

s

493,350 493,023

Operating expenses:

Labor and fringe benefits 1,112,290 1,047,445

Materials and supplie

s

84,178 83,150

Fuel 71,181 57,470

Electric powe

r

28,141 22,268

Purchase of security services 31,363 30,831

Purchase of paratransit - 28,415

Maintenance and repairs, utilities, rent, and othe

r

69,465 48,288

1,396,618 1,317,867

Provisions for injuries and damages 16,224 26,266

Provision for depreciatio

n

387,738 376,910

Total operating expense

s

1,800,580 1,721,043

Operating expenses in excess of operating revenue

s

(1,307,230) (1,228,020)

Nonoperating revenues (expenses):

Public funding from the RT

A

548,249 524,056

Reduced-fare subsidies 33,308 29,604

Operating grant revenu

e

3,740 13,143

Contributions from local government agencie

s

5,000 5,000

Investment incom

e

16,207 36,079

Gain on sale of assets 27 28

Recognition of leasing transaction proceed

s

4,262 4,262

Interest expense on bonds (15,718) (14,557)

Interest revenue from leasing transaction

s

120,795 118,559

Interest expense on leasing transaction

s

(115,819) (113,753)

Total nonoperating revenues, ne

t

600,051 602,421

Change in net assets before capital contribution

s

(707,179) (625,599)

Capital contributions 375,914

522,040

Change in net assets (331,265) (103,559)

Total net assets – beginning of yea

r

1,743,523 1,847,082

Total net assets – end of yea

r

1,412,258$ 1,743,523$

See accompanying notes to financial statements. 17.

CHICAGO TRANSIT AUTHORITY

Business-Type Activities

Statements of Cash Flows

Years ended December 31, 2007 and 2006

(In thousands of dollars)

2007

2006

Cash flows from operating activities:

Cash received from fares 457,283$ 468,319$

Payments to employees (786,524) (798,078)

Payments to suppliers (264,857) (293,570)

Other receipts 87,095

19,616

Net cash flows provided by (used in) operating activities (507,003) (603,713)

Cash flows from noncapital financing activities:

Public funding from the RTA 591,161 500,776

Reduced-fare subsidies 48,423 29,745

Operating grant revenue 3,740 13,143

Contributions from local governmental agencies 5,000

5,000

Net cash flows provided by (used in) noncapital

financing activities 648,324

548,664

Cash flows from capital and related financing activities:

Interest income from assets restricted for payment o

f

leasehold obligations 120,795 118,559

Interest expense on bonds (19,130) (19,220)

Decrease in restricted assets for repayment of leasing commitments (15,943) (33,737)

Repayment of lease/leaseback obligations (107,226) (84,822)

Proceeds from capital leases - 98,016

Payment of capital lease obligations - (4,000)

Payment to escrow agent for refunded capital lease obligations - (116,599)

Proceeds from issuance of bonds - 291,377

Proceeds from other long-term liabilities (246) (611)

Repayment of bonds payable (18,410) (103,740)

Payments for acquisition and construction of capital assets (613,772) (553,908)

Proceeds from the sale of property and equipment 1,075 1,537

Capital grants 326,329

503,832

Net cash flows provided by (used in) capital and related

financing activities (326,528)

96,684

Cash flows from investing activities:

Purchases of unrestricted investments (900) (10,914)

Proceeds from maturity of unrestricted investments 10,914 28,211

Restricted cash and investment accounts:

Purchases and withdrawals (11,077,990) (5,854,660)

Proceeds from maturities and deposits 11,340,042 5,741,689

Investment revenue 16,207

36,079

Net cash flows provided by (used in) investing activities 288,273 (59,595)

Net increase (decrease) in cash and cash equivalents 103,066 (17,960)

Cash and cash equivalents – beginning of year 27,736

45,696

Cash and cash equivalents – end of yea

r

130,802$ 27,736$

(Continued) 18.

CHICAGO TRANSIT AUTHORITY

Business-T

y

pe Activities

Statements of Cash Flows

Years ended December 31, 2007 and 2006

(In thousands of dollars)

2007

2006

Reconciliation of expenses in excess of operatin

g

revenue to

net cash used in operatin

g

activities:

Operatin

g

expenses in excess of operatin

g

revenue (1,307,230)$ (1,228,020)$

Ad

j

ustments to reconcile operatin

g

expenses in excess of

operatin

g

revenues to net cash used in operatin

g

activities:

Depreciatio

n

387,738 376,910

(Increase) decrease in assets:

Accounts receivable 9,113 (10,005)

Materials and supplies (896) 6,092

Prepaid expenses and other assets (13) (262)

Net pension asset 242 42

Increase (decrease) in liabilities:

Accounts pa

y

able and accrued expenses 29,581 (2,524)

Accrued pa

y

roll, vacation pa

y

, and related liabilities 701 11,050

Self-insurance reserves 26,907 (3,115)

Deferred passen

g

er revenue (17) 6,102

Other deferred revenue 1,713 207

Advances, deposits, and other 40,219 (1,392)

Accrued pension costs and OPEB 304,939

241,202

Net cash flows used in operatin

g

activities (507,003)$ (603,713)$

Noncash investin

g

and financin

g

activities:

Reco

g

nition of leasin

g

proceeds 4,262$ 4,262$

Decrease in deferred revenue – leasin

g

transactions (4,262) (4,262)

Accretion of interest on lease/leaseback obli

g

ations 115,819 113,753

Retirement of full

y

depreciated capital assets 76,962 59,066

See accompanying notes to financial statements. 19.

CHICAGO TRANSIT AUTHORITY

Fiduciar

y

Activities

Statements of Fiduciar

y

Net Assets

Open Supplemental Retirement Plan

December 31, 2007 and 2006

(In thousands of dollars)

2007

2006

Assets:

Contributions from emplo

y

ees 23$ 3$

Investments at fair value:

Short-term investments 808 813

Government a

g

encies 5,653 5,571

Common stoc

k

13,024 12,620

Total investments at fair value 19,485 19,004

Receivables 3 -

Securities lendin

g

collateral 11,679 2,127

Total assets 31,190 21,134

Liabilities:

Accounts pa

y

able and other liabilities 55 70

Securities lendin

g

collateral obli

g

ation 11,679 2,127

Total liabilities 11,734 2,197

Net assets held in trust for pension benefits (an unaudited

schedule of fundin

g

pro

g

ress is included on pa

g

e 50) 19,456$ 18,937$

See accompanying notes to financial statements. 20.

CHICAGO TRANSIT AUTHORITY

Fiduciar

y

Activities

Statements of Chan

g

es in Fiduciar

y

Net Assets

Open Supplemental Retirement Plan

Years ended December 31, 2007 and 2006

(In thousands of dollars)

2007

2006

Additions:

Contributions:

Emplo

y

ee 141$ 269$

Total contributions 141 269

Investment income:

Net increase in fair value of investments 369 1,460

Investment income 563

534

Total investment income 932 1,994

Total additions 1,073 2,263

Deductions:

Benefits paid to participants or beneficiaries 386 250

Trust fees 168

121

Total deductions 554 371

Net increase 519 1,892

Net assets held in trust for pension benefits:

Be

g

innin

g

of

y

ear 18,937 17,045

End of

y

ear 19,456$ 18,937$

See accompanying notes to financial statements. 21.

CHICAGO TRANSIT AUTHORITY

NOTES TO FINANCIAL STATEMENTS

December 31, 2007 and 2006

(Continued)

22.

NOTE 1 - ORGANIZATION

The Chicago Transit Authority (CTA) was formed in 1945 pursuant to the Metropolitan

Transportation Authority Act passed by the Illinois Legislature. The CTA was established as an

independent governmental agency (an Illinois municipal corporation) “separate and apart from

all other government agencies” to consolidate Chicago’s public and private mass transit

carriers. The City Council of the City of Chicago has granted the CTA the exclusive right to

operate a transportation system for the transportation of passengers within the City of Chicago.

The Regional Transportation Authority Act (the Act) provides for the funding of public

transportation in the six-county region of Northeastern Illinois. The Act established a regional

oversight board, the Regional Transportation Authority (RTA), and designated three service

boards (CTA, Commuter Rail Board, and Suburban Bus Board). The Act requires, among other

things, that the RTA approve the annual budget of the CTA, that the CTA obtain agreement

from local governmental units to provide an annual monetary contribution of at least $5,000,000

for public transportation, and that the CTA (collectively with the other service boards) finance

at least 50% of its operating costs, excluding depreciation and certain other items, from

system-generated sources on a budgetary basis.

Financial Reporting Entity

: As defined by U.S. generally accepted accounting principles

(GAAP), the financial reporting entity consists of a primary government, as well as its

component units, which are legally separate organizations for which the elected officials of the

primary government are financially accountable. Financial accountability is defined as:

1) Appointment of a voting majority of the component unit’s board and either (a) the ability

to impose will by the primary government or (b) the possibility that the component unit

will provide a financial benefit to or impose a financial burden on the primary

government; or

2) Fiscal dependency on the primary government.

Based upon the application of these criteria, the CTA has no component units and is not a

component unit of any other entity.

The CTA participates in the Employees’ Retirement Plan, which is a single-employer, defined

benefit pension plan covering substantially all full-time permanent union and nonunion

employees. The Employees’ Plan is governed by the terms of the employees’ collective

bargaining agreement. The fund established to administer the Employees’ Retirement Plan is

not a fiduciary fund or a component unit of the CTA. This fund is a legal entity separate and

distinct from the CTA. This fund is administered by its own oversight committee, of which the

CTA appoints half the members, over which the CTA has no direct authority and assumes no

fiduciary responsibility. Accordingly, the accounts of this fund are not included in the

accompanying financial statements.

CHICAGO TRANSIT AUTHORITY

NOTES TO FINANCIAL STATEMENTS

December 31, 2007 and 2006

(Continued)

23.

NOTE 1 - ORGANIZATION (Continued)

The CTA administers supplemental retirement plans that are separate, defined benefit pension

plans for selected individuals. The supplemental retirement plans provide benefits to

employees of the CTA in certain employment classifications. The supplemental retirement

plans consist of the: (1) board member plan, (2) closed supplemental plan for members retired

or terminated from employment before March 2005, including early retirement incentive, and

(3) open supplemental plan for members retiring or terminating after March 2005. The CTA

received qualification under Section 401(a) of the Internal Revenue Code for the supplemental

plan and established a qualified trust during 2005 for members retiring after March 2005 (Open

Supplemental Retirement Plan). The Open Supplemental Retirement Plan is reported in a

fiduciary fund, whereas the activities for the closed and board plans are included in the

financial statements of the CTA’s business-type activities.

The CTA is not considered a component unit of the RTA because the CTA maintains separate

management, exercises control over all operations, and is fiscally independent from the RTA.

Because governing authority of the CTA is entrusted to the Chicago Transit Board, comprising

four members appointed by the Mayor of the City of Chicago and three members appointed by

the Governor of the State of Illinois, the CTA is not financially accountable to the RTA and is not

included as a component unit in the RTA’s financial statements, but is combined in pro forma

statements with the RTA, as statutorily required.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting

: The basic financial statements provide information about the CTA’s

business-type and fiduciary (Open Supplemental Retirement Plan) activities. Separate

statements for each category—business-type and fiduciary—are presented. The basic financial

statements are reported using the economic resources measurement focus and the accrual basis

of accounting. Revenues are recorded when earned, and expenses are recorded when a liability

is incurred, regardless of the timing of the related cash flows. On an accrual basis, revenues

from operating activities are recognized in the fiscal year that the operations are provided;

revenue from grants is recognized in the fiscal year in which all eligibility requirements have

been satisfied; and revenue from investments is recognized when earned.

The financial statements for the CTA’s business-type activities are used to account for the CTA’s

activities that are financed and operated in a manner similar to a private business enterprise.

Accordingly, the CTA maintains its records on the accrual basis of accounting. Revenues from

operations, investments, and other sources are recorded when earned. Expenses (including

depreciation and amortization) of providing services to the public are accrued when incurred.

Under this basis, revenues are recognized in the period in which they are earned, expenses are

recognized in the period in which they are incurred, depreciation of assets is recognized, and all

assets and liabilities associated with the operation of the CTA are included in the balance sheet.

CHICAGO TRANSIT AUTHORITY

NOTES TO FINANCIAL STATEMENTS

December 31, 2007 and 2006

(Continued)

24.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The principal operating revenues of the CTA are bus and rail passenger fares. The CTA also

recognizes as operating revenue the rental fees received from concessionaires, the fees collected

from advertisements on CTA property, and miscellaneous operating revenues. Operating

expenses for the CTA include the costs of operating the mass transit system, administrative

expenses, and depreciation on capital assets. All revenues and expenses not meeting this

definition are reported as nonoperating revenues and expenses.

Nonexchange transactions, in which the CTA receives value without directly giving equal value

in return, include grants from federal, state, and local governments. On an accrual basis,

revenue from grants is recognized in the fiscal year in which all eligibility requirements have

been satisfied. Eligibility requirements include timing requirements, which specify the year

when the resources are required to be used or the fiscal year when use is first permitted, and

expenditure requirements, in which the resources are provided to the CTA on a reimbursement

basis.

Pursuant to GASB Statement No. 20, Accounting and Financial Reporting for Proprietary Funds and

Other Governmental Entities that Use Proprietary Fund Accounting, the CTA applies Financial

Accounting Standards Board pronouncements and Accounting Principles Board opinions

issued on or before November 30, 1989, unless those pronouncements conflict with or contradict

GASB pronouncements, in which case, GASB prevails, and all of the GASB pronouncements

issued subsequently.

The financial statements for the fiduciary activities are used to account for the assets held by the

CTA in trust for the payment of future retirement benefits under the Open Supplemental

Retirement Plan. The assets of the Open Supplemental Retirement Plan cannot be used to

support CTA operations.

Cash and Cash Equivalents

: Cash and cash equivalents consist of cash on hand, demand

deposits, and short-term investments with maturities when purchased of three months or less.

Investments

: Investments, including the supplemental retirement plan assets, are reported at

fair value based on quoted market prices and valuations provided by external investment

managers.

Chapter 30, Paragraph 235/2 of the Illinois Compiled Statutes authorizes the CTA to invest in

obligations of the United States Treasury and United States agencies, direct obligations of any

bank, repurchase agreements, commercial paper rated within the highest classification set by

two standard rating services, or money market mutual funds investing in obligations of the

United States Treasury and United States agencies.

CHICAGO TRANSIT AUTHORITY

NOTES TO FINANCIAL STATEMENTS

December 31, 2007 and 2006

(Continued)

25.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Restricted Assets: The CTA entered into various lease/leaseback agreements in fiscal years

1995 through 2003. These agreements, which provide certain cash and tax benefits to the third

party, also provide for a trust established by the CTA to lease the related capital assets to an

equity investor trust, which would then lease the capital assets back to another trust established

by the CTA under a separate lease. The CTA received certain funds as prepayment by the

equity investor trust. These funds have been deposited in designated investment accounts

sufficient to meet the payments required under the leases and are recorded as assets restricted

for repayment of leasing commitments.

In 2004 and 2006, the CTA issued Capital Grant Receipt Revenue Bonds. The proceeds from

each sale were placed in trust accounts restricted for financing the costs of capital improvement

projects associated with each issuance.

In 2003, the Public Building Commission of Chicago (PBC) issued revenue bonds for the benefit

of the CTA. The proceeds from the sale were placed in trust accounts restricted for financing

the costs of acquisition of real property and construction of a building, and facilities, including

certain furniture, fixtures, and equipment. The real property, building and facilities, and all

furniture, fixtures, and equipment are owned by the PBC and leased to the CTA for use as its

headquarters. In 2006, the PBC issued refunding revenue bonds to refund all outstanding Series

2003 bonds.

In 2003, the CTA reached an agreement with the RTA to provide advance funding of capital

projects. Funds received as an advance are restricted for future capital projects, subject to RTA

approval.

The CTA maintained cash and investment balances to fund the annual injury and damage

obligations that are required to be designated under provisions of Section 39 of the

Metropolitan Transportation Authority Act.

Materials and Supplies: Materials and supplies are stated at the lower of average cost or market

value and consist principally of maintenance, supplies, and repair parts.

Capital Assets: All capital assets are stated at cost. Capital assets are defined as assets which

(1) have a useful life of more than one year and a unit cost of more than $5,000, (2) have a unit

cost of $5,000 or less, but which are part of a network or system conversion, or (3) were

purchased with grant money. The cost of maintenance and repairs is charged to operations as

incurred. Interest is capitalized on constructed capital assets. The amount of interest to be

capitalized is calculated by offsetting interest expense incurred from the date of the borrowing

until completion of the project with interest earned on invested proceeds over the same period.

Capitalized interest cost is amortized on the same basis as the related asset is depreciated.

Capitalized interest expense was $9,565,000 and $2,510,000 during the years ended

December 31, 2007 and 2006, respectively.

CHICAGO TRANSIT AUTHORITY

NOTES TO FINANCIAL STATEMENTS

December 31, 2007 and 2006

(Continued)

26.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

The provision for depreciation of transportation property and equipment is calculated under

the straight-line method using the respective estimated useful lives of major asset

classifications, as follows:

Years

Buildings 40

Elevated structures, tracks, tunnels, and power system 20-40

Transportation vehicles:

Bus 12

Rail 25

Signals 10-20

Other equipment 3-10

A full month’s depreciation is taken in the month after an asset is placed in service. When

property and equipment are disposed, depreciation is removed from the respective accounts

and the resulting gain or loss, if any, is recorded.

The transportation system operated by the CTA includes certain facilities owned by others. The

CTA has the exclusive right to operate these facilities under the terms of the authorizing

legislation and other agreements.

Self-insurance

: The CTA is self-insured for various risks of loss, including public liability and

property damage, workers’ compensation, and health benefit claims, as more fully described in

note 11. A liability for each self-insured risk is provided based upon the present value of the

estimated ultimate cost of settling claims using a case-by-case review and historical experience.

A liability for claims incurred but not reported is also provided.

Compensated Absences

: Substantially all employees receive compensation for vacations,

holidays, illness, and certain other qualifying absences. The number of days compensated for

the various categories of absence is based generally on length of service. Vacation leave that has

been earned but not paid has been accrued in the accompanying financial statements.

Compensation for holidays, illness, and other qualifying absences is not accrued in the

accompanying financial statements because rights to such compensation amounts do not

accumulate or vest.

Under GASB Statement No. 16, Accounting for Compensated Absences, applicable

salary-related employer obligations are accrued in addition to the compensated absences

liability. This amount is recorded as a portion of the accrued payroll, vacation pay, and related

liabilities on the balance sheets.

Bond Premiums and Issuance Cost

: Bond premiums and issuance costs are deferred and

amortized over the life of the bonds using an effective interest method.

CHICAGO TRANSIT AUTHORITY

NOTES TO FINANCIAL STATEMENTS

December 31, 2007 and 2006

(Continued)

27.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Net Assets

: Equity is displayed in three components as follows:

Invested in Capital Assets, Net of Related Debt – This consists of capital assets, net of

accumulated depreciation, less the outstanding balances of any bonds, notes, or other

borrowings that are attributable to the acquisition, construction, or improvement of those

assets.

Restricted – This consists of net assets that are legally restricted by outside parties or by law

through constitutional provisions or enabling legislation. When both restricted and

unrestricted resources are available for use, generally it is the CTA’s policy to use restricted

resources first, and then unrestricted resources when they are needed.

Unrestricted – This consists of net assets that do not meet the definition of “restricted” or

“invested in capital assets, net of related debt.”

Retirement Plan

: The CTA has a retirement plan for all nontemporary, full-time employees

with service greater than one year. Pension expense recorded by the CTA includes a provision

for current service costs and the amortization of past service cost over a period of

approximately 30 years.

Fare Box and Pass Revenues

: Fare box and pass revenues are recorded as revenue at the time

services are performed.

Classification of Revenues

: The CTA has classified its revenues as either operating or

nonoperating. Operating revenues include activities that have the characteristics of exchange

transactions, including bus and rail passenger fares, rental fees received from concessionaires,

the fees collected from advertisements on CTA property, and miscellaneous operating revenues.

Nonoperating revenue includes activities that have the characteristics of nonexchange

transactions, such as federal, state, and local grants and contracts.

Unbilled Work In Progress

: Unbilled Work in Progress represents grant expense that has not

been billed to the funding agencies as of yearend. This would include contract retentions,

accruals and expenditures for which, due to requisitioning restrictions of the agencies or the

timing of the expenditures, reimbursement is requested in a subsequent period.

Estimates

: The preparation of financial statements in conformity with U.S. generally accepted

accounting principles requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of

the date of the financial statements and the reported amounts of revenues and expenses during

the reporting period. Actual results may differ from those estimates.

CHICAGO TRANSIT AUTHORITY

NOTES TO FINANCIAL STATEMENTS

December 31, 2007 and 2006

(Continued)

28.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Reclassifications

: Certain amounts from the prior year have been reclassified to conform to the

current year presentation.

Recent Pronouncements

: In July 2004, GASB issued Statement No. 45, Accounting and Financial

Reporting by Employers for Postemployment Benefits Other Than Pensions

. This Statement

establishes accounting and financial reporting standards for employers that participate in a

defined benefit “other postemployment benefit” (OPEB) plan. Specifically, the CTA is required

to measure and disclose an amount for annual OPEB cost on the accrual basis for health and

insurance benefits that will be provided to retired CTA employees in future years. The CTA is

also required to record a net OPEB obligation, which is defined as the cumulative difference

between annual OPEB cost and the employer’s contributions to a plan, including the OPEB

liability or asset at transition, if any. The CTA implemented Statement No. 45 beginning with

the year ended December 31, 2007.

NOTE 3 - BUDGET AND BUDGETARY BASIS OF ACCOUNTING

The CTA is required under Section 4.01 of the Regional Transportation Authority Act to submit

for approval an annual budget to the RTA by November 15 prior to the commencement of each

fiscal year. The budget is prepared on a basis consistent with generally accepted accounting

principles, except for the exclusion of certain income and expenses. For 2007 and 2006, these

amounts include provision for injuries and damage in excess of (or under) budget, depreciation

expense, pension expense in excess of pension contributions, revenue from leasing transactions,

interest income and expense from sale/leaseback transactions, and capital contributions.

The Act requires that expenditures for operations and maintenance in excess of budget cannot

be made without approval of the Chicago Transit Board. All annual appropriations lapse at

fiscal year-end. The RTA, in accordance with the RTA Act, has approved for budgetary basis

presentation the CTA’s recognition of the amount of the injury and damage reserve and pension

contribution, funded by the RTA in the approved annual budget. Provisions in excess of the

approved annual budget that are unfunded are excluded from the recovery ratio calculation.

The RTA funds the budgets of the service boards rather than the actual operating expenses in

excess of system-generated revenue. Favorable variances from budget remain as deferred

operating assistance to the CTA, and can be used in future years with RTA approval.

The RTA approves the proposed budget based on a number of criteria:

• That the budget is in balance with regard to anticipated revenues from all sources,

including operating subsidies and the costs of providing services and funding operating

deficits;

CHICAGO TRANSIT AUTHORITY

NOTES TO FINANCIAL STATEMENTS

December 31, 2007 and 2006

(Continued)

29.

NOTE 3 - BUDGET AND BUDGETARY BASIS OF ACCOUNTING (Continued)

• That the budget provides for sufficient cash balances to pay, with reasonable

promptness, costs and expenses when due;

• That the budget provides for the CTA to meet its required system-generated revenue

recovery ratio; and

• That the budget is reasonable, prepared in accordance with sound financial practices and

complies with such other RTA requirements as the RTA Board of Directors may

establish.

The RTA monitors the CTA’s performance against the budget on a quarterly basis. If, in the

judgment of the RTA, this performance is not substantially in accordance with the CTA’s

budget for such period, the RTA shall so advise the CTA and the CTA must, within the period

specified by the RTA, submit a revised budget to bring the CTA into compliance with the

budgetary requirements listed above.

NOTE 4 - BUDGETED PUBLIC FUNDING FROM THE REGIONAL TRANSPORTATION

AUTHORITY AND THE STATE OF ILLINOIS

As discussed in note 1, the Act established the RTA as a regional oversight board and defined

the sources of funding to the RTA. Under the Act, each service board is entitled to a portion of

the funds collected by the RTA. The allocation of these funds to each service board is based on

various methods as defined in the Act. Sales tax is allocated based upon a statutory formula,

while discretionary funds are allocated based on the RTA’s discretion.

The funding “marks” represent the amount of funds that each Service Board can expect to

receive from the RTA and other sources. During 2007, the RTA amended the funding marks

and directed the CTA to amend the budget. The amended 2007 funding “marks” include $83.9

million of capital funding for operations.

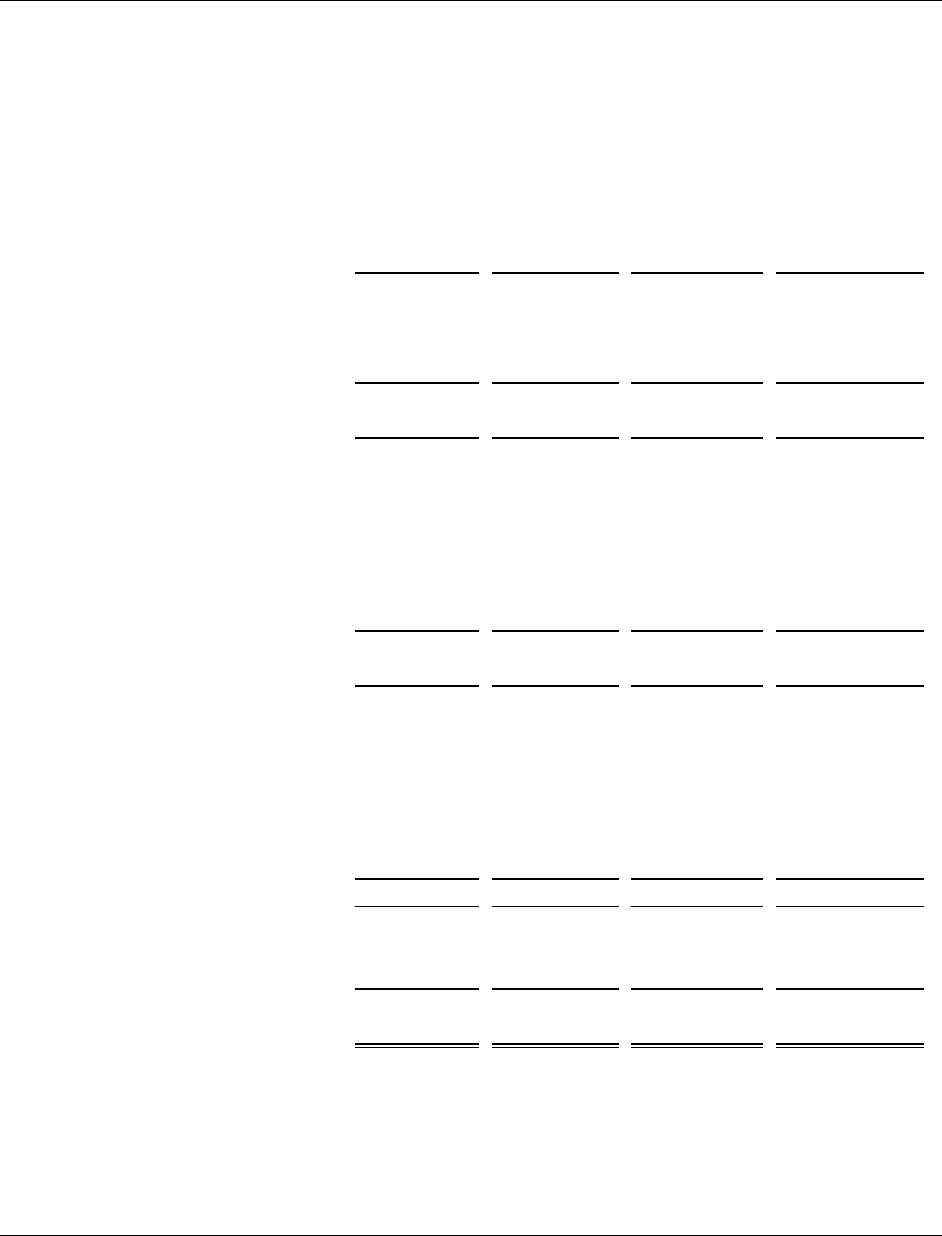

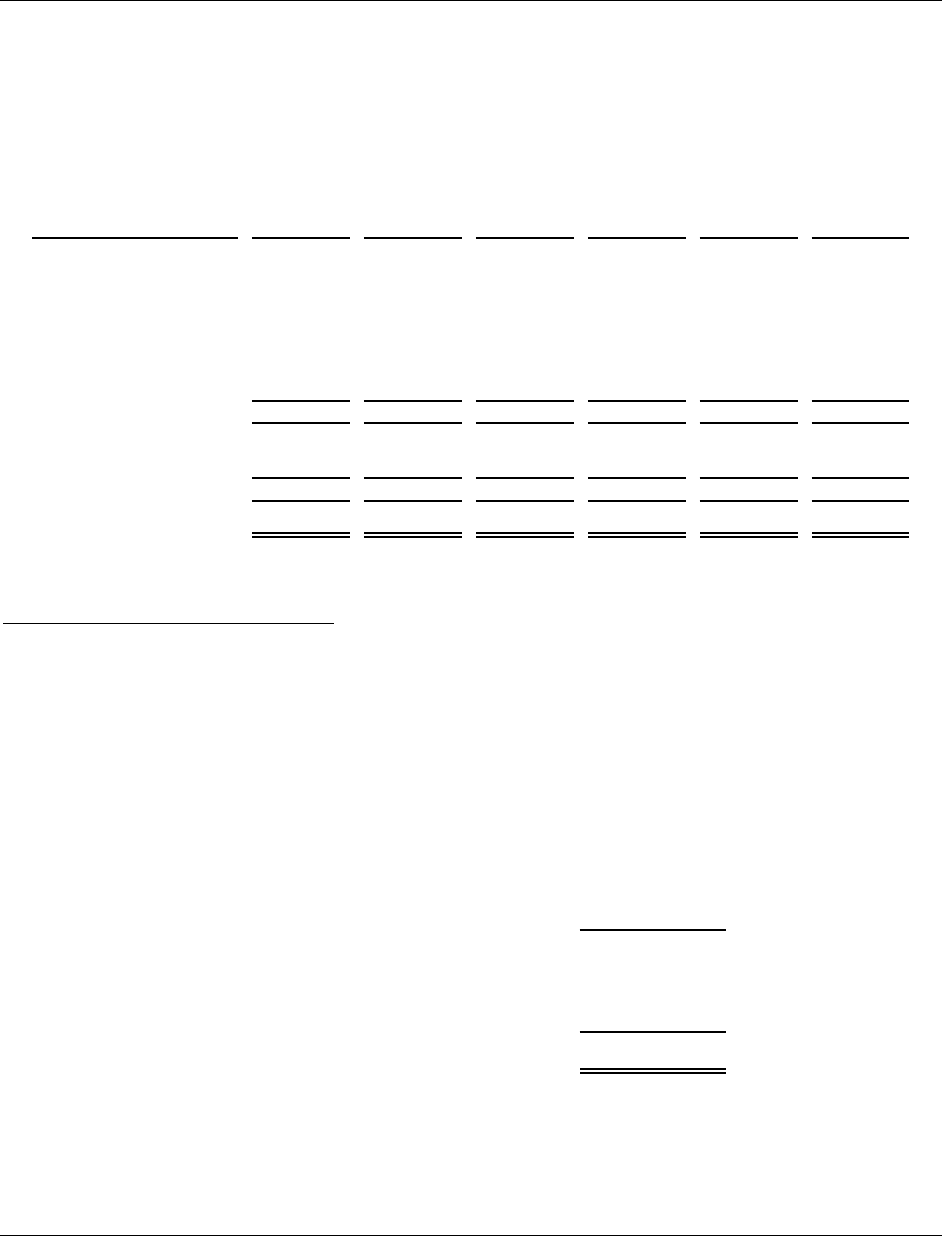

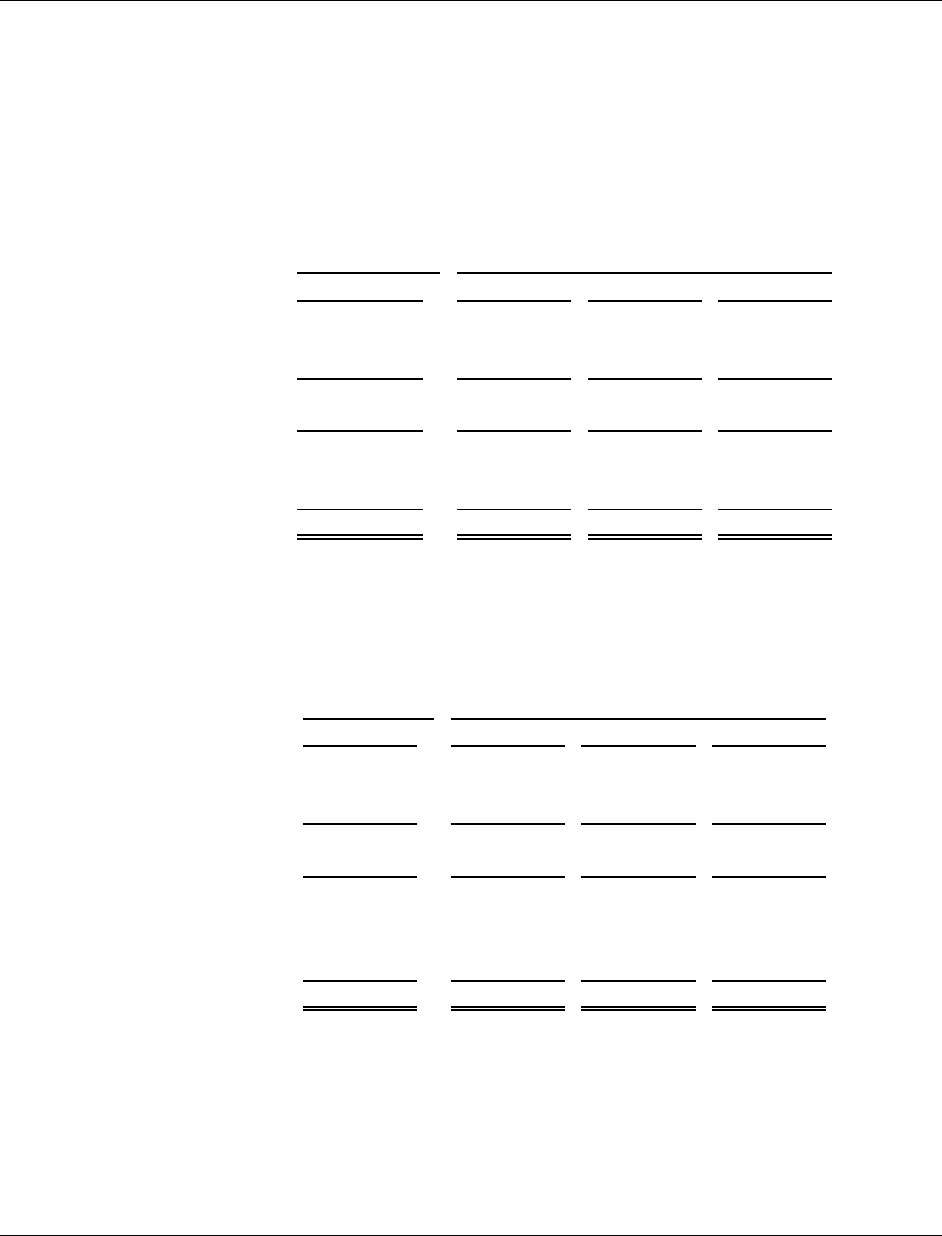

The components of the budgeted operating funding from the RTA were as follows (in

thousands of dollars):

2007 2006

Illinois state sales tax allocation 295,098$ 284,636$

Public Transportation Fund/RTA discretionar

y

fundin

g

/other 253,151 239,420

Total 548,249$ 524,056$

Red

uced-fare subsidies received from the State of Illinois were $33,308,000 and $29,604,000

during the years ended December 31, 2007 and 2006, respectively, for discounted services

provided to the elderly, disabled, or student riders.

CHICAGO TRANSIT AUTHORITY

NOTES TO FINANCIAL STATEMENTS

December 31, 2007 and 2006

(Continued)

30.

NOTE 5 - CASH, CASH EQUIVALENTS, AND INVESTMENTS

Cash, Cash Equivalents, and Investments of the Business-type Activities

: Cash, cash

equivalents, and investments are reported in the balance sheets of the business-type activities as

follows as of December 31, 2007 and 2006 (in thousands):

2007 2006

Current assets:

Cash and cash equivalents 130,802$ 27,736$

Investments 900 10,914

Restricted cash and investments:

Bond proceeds held by trustee 112,557 400,523

Restricted by RTA 20,302 23,201

Restricted for injury and damage reserve 109,057 83,180

Other assets:

Cash and investments for supplemental

retirement plan 138 96

Total 373,756$ 545,650$

Cash, cash equivalents, and investments of the business-type activities consist of the following

as of December 31, 2007 and 2006 (in thousands):

2007 2006

Investments:

Certificates of deposit 4,020$ 4,020$

Guaranteed investment contracts 44,508 291,377

Money market mutual funds 47,062 34,864

Repurchase agreements 95,935 126,485

U.S. government agencies 93,035 49,589

U.S. Treasury bills - 10,015

Commercial paper 79,896 39,972

Total investments 364,456 556,322

Deposits with financial institutions 9,300 (10,672)

Total deposits and investments 373,756$ 545,650$

CHICAGO TRANSIT AUTHORITY

NOTES TO FINANCIAL STATEMENTS

December 31, 2007 and 2006

(Continued)

31.

NOTE 5 - CASH, CASH EQUIVALENTS, AND INVESTMENTS (Continued)

Investment Policy: CTA investments are made in accordance with the Public Funds Investment

Act (30 ILCS 235/1) (the Act) and, as required under the Act, the Chicago Transit Authority

Investment Policy (the Investment Policy). The Investment Policy does not apply to the

Employees Retirement Plan, which is a separate legal entity. Additionally, the CTA Investment

Policy does not apply to the Supplemental Retirement Plan, which is directed by the Employee

Retirement Review Committee.

In accordance with the Act and the Investment Policy, CTA invests in the following types of

securities:

1.

United States Treasury Securities (Bonds, Notes, Certificates of Indebtedness, and Bills).

CTA may invest in obligations of the United States government, which are guaranteed by

the full faith and credit of the United States of America as to principal and interest.

2.

United States Agencies. CTA may invest, bonds, notes, debentures, or other similar

obligations of the United States or its agencies. Agencies include: (a) federal land banks,

federal intermediate credit banks, banks for cooperative, federal farm credit bank, or

other entities authorized to issue debt obligations under the Farm Credit Act of 1971, as

amended; (b) federal home loan banks and the federal home loan mortgage corporation;

and (c) any other agency created by an act of Congress.

3.

Bank Deposits. CTA may invest in interest-bearing savings accounts, interest-bearing

certificates of deposit, or interest-bearing time deposits or other investments constituting

direct obligations of any bank as defined by the Illinois Banking Act (205 ILCS 5/1 et

seq.), provided that any such bank must be insured by the Federal Deposit Insurance

Corporation (the FDIC).

4.

Commercial Paper. CTA may invest in short-term obligations (commercial paper) of

corporations organized in the United States with assets exceeding $500 million, provided

that: (a) such obligations are at the time of purchase at the highest classification

established by at least two standard rating services and which mature not later than 180

days from the date of purchase; and (b) such purchases do not exceed 10% of the

corporation’s outstanding obligations.

5.

Mutual Funds. CTA may invest in mutual funds which invest exclusively in United

States government obligations and agencies.

6.

Discount Obligations. CTA may invest in short-term discount obligations of the Federal

National Mortgage Association.

7.

Investment Pool. CTA may invest in a Public Treasurers’ Investment Pool created under

Section 17 of the State Treasurer Act (15 ILCS 505/17).

CHICAGO TRANSIT AUTHORITY

NOTES TO FINANCIAL STATEMENTS

December 31, 2007 and 2006

(Continued)

32.

NOTE 5 - CASH, CASH EQUIVALENTS, AND INVESTMENTS (Continued)

1. Repurchase Agreements. CTA may invest in repurchase agreements for securities that

are authorized investments under the Investment Policy, subject to all of the

requirements of the Act, provided that: (a) the securities shall be held by an authorized

custodial bank; and (b) each transaction must be entered into under terms of an

authorized master repurchase agreement.

2. Investment Certificates. CTA may invest in investment certificates issued by

FDIC-insured savings banks or FDIC-insured savings and loan associations.

Custodial Credit Risk

: Custodial credit risk for deposits is the risk that in the event of a

financial institution failure, the CTA’s deposits may not be returned. The CTA’s investment

policy requires that deposits which exceed the amount insured by the FDIC be collateralized, at

the rate of 102% of such deposits, by bonds, notes, certificates of indebtedness, treasury bills or

other securities which are guaranteed by the full faith and credit of the U.S. government. As of

December 31, 2007 and 2006 the CTA’s bank balances of $16,085,000 and $258,000 were subject

to custodial credit risk as they were neither insured nor collateralized.

Interest Rate Risk

: Interest rate risk is the risk that the fair value of the CTA’s investments will

decrease as a result of an increase in interest rates. As a means of limiting its exposure to fair

value losses arising from rising interest rates, the Investment Policy limits the term of

investments as follows:

Instrument type Term of investment

U.S. treasuries 3 years