Chubb Travel Insurance

Policy Wordings (Individual Policy)

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb.

Insured.

SM

are protected trademarks of Chubb. Published 02/2022

2

Contents

Benefit Schedule .................................................................................................... 3

Important Information Regarding This Policy ...................................................... 6

Part 1 Interpretation................................................................................................6

Part 2 Eligibility......................................................................................................12

Part 3 Scope And Limits Of Cover And Benefits ...................................................13

Part 4 General Exclusions......................................................................................15

Part 5 Special Conditions .......................................................................................17

Part 6 General Conditions......................................................................................18

Part 7 Benefits........................................................................................................21

Complaints ............................................................................................................63

Privacy Notice .......................................................................................................64

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

3

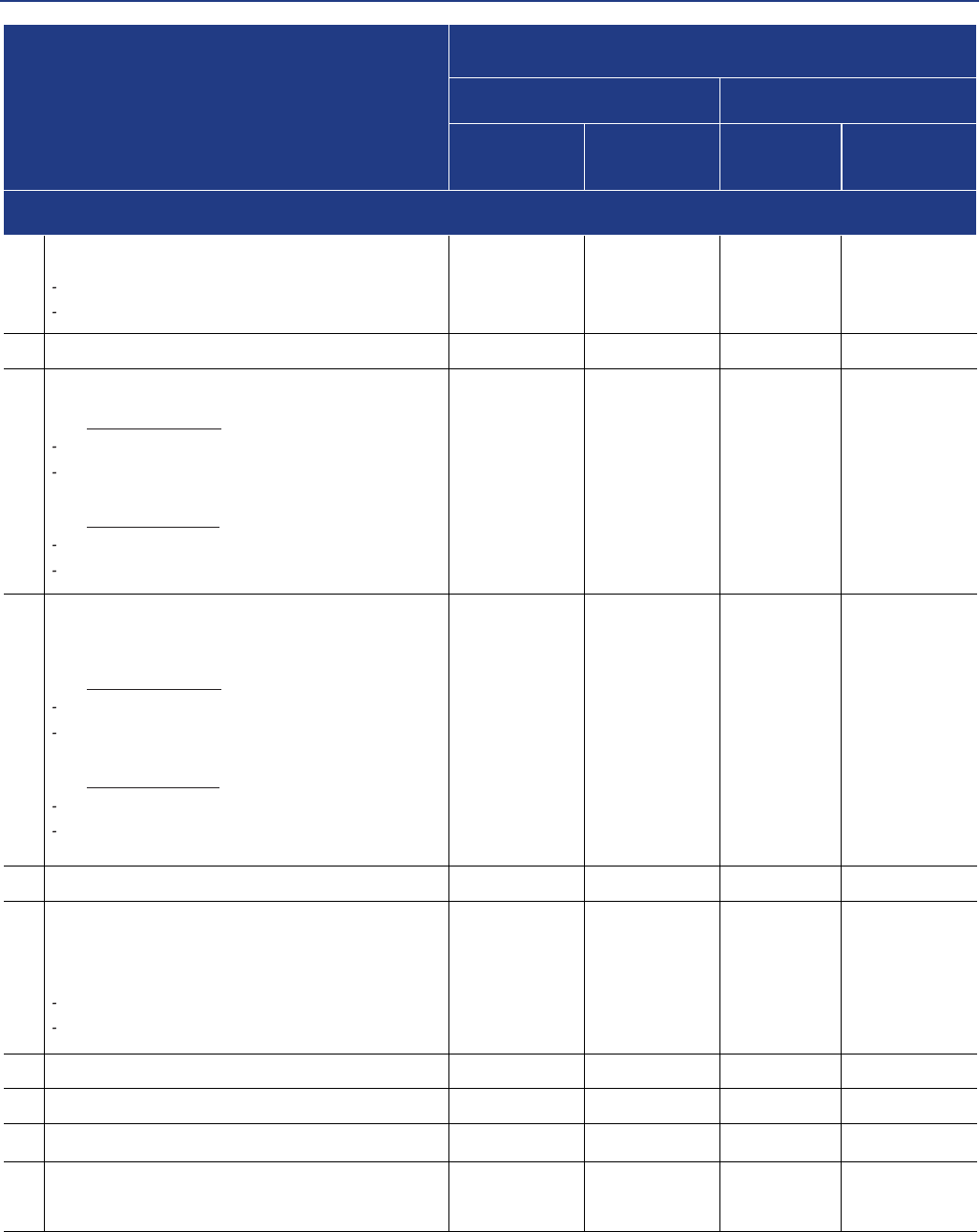

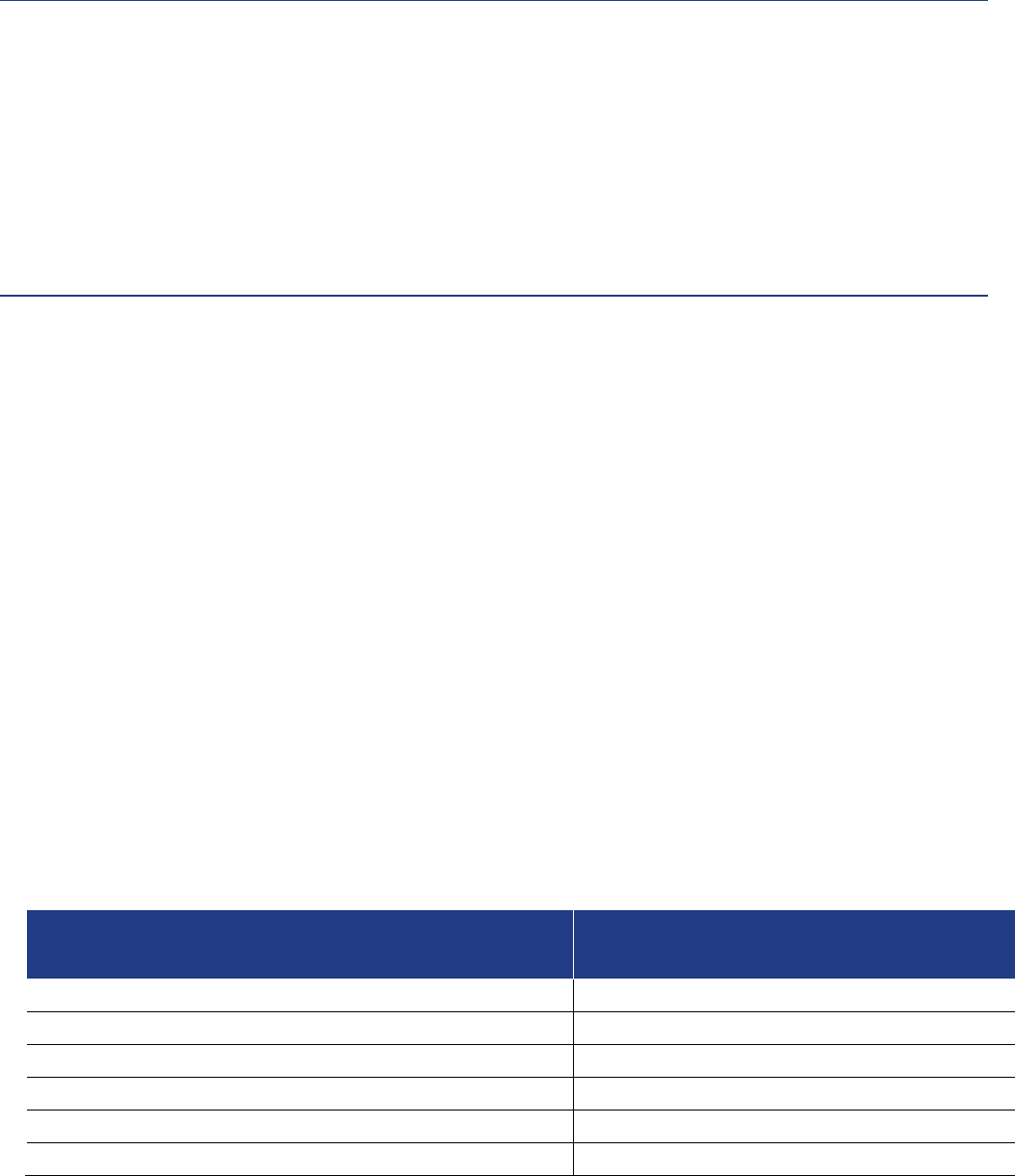

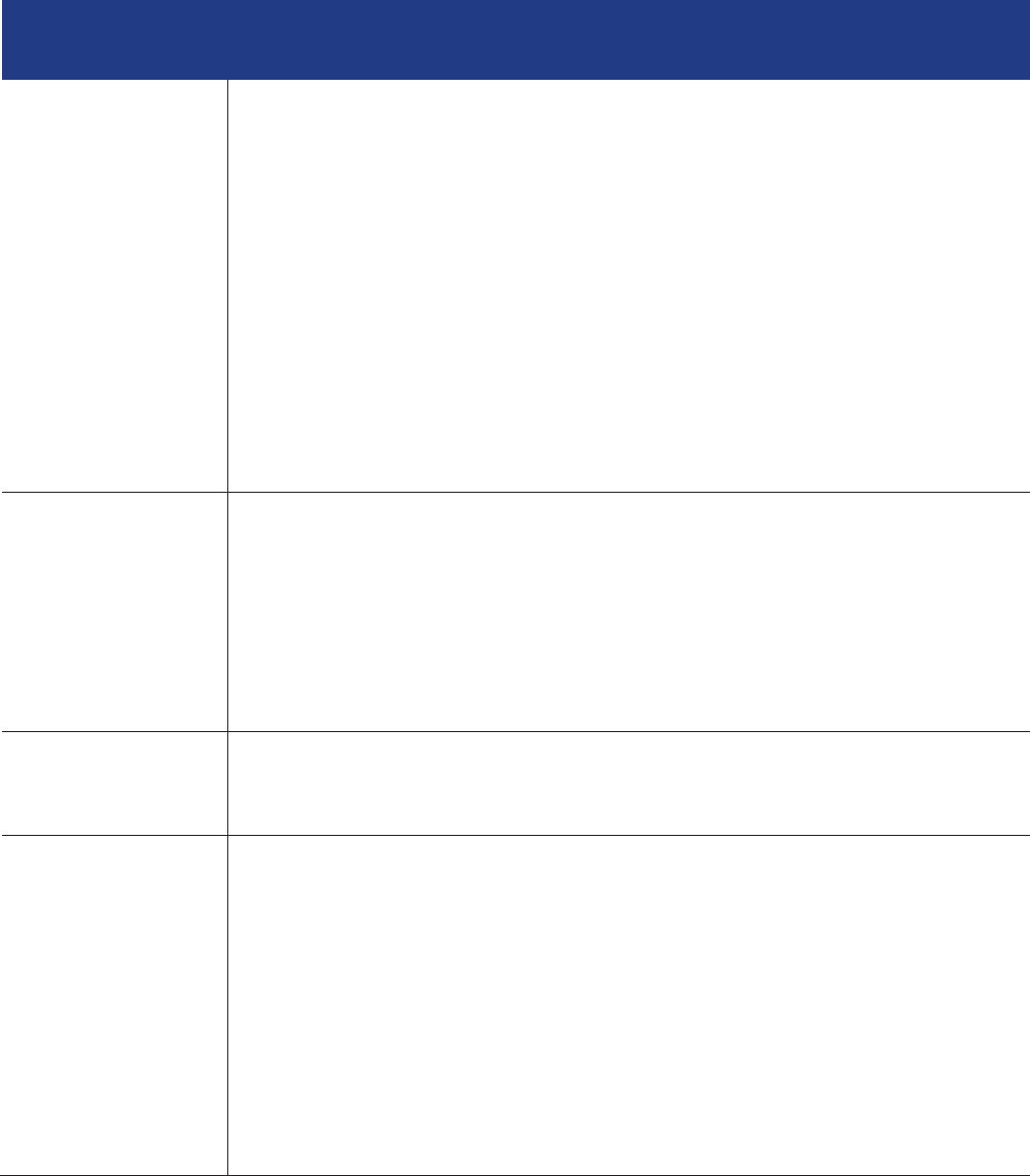

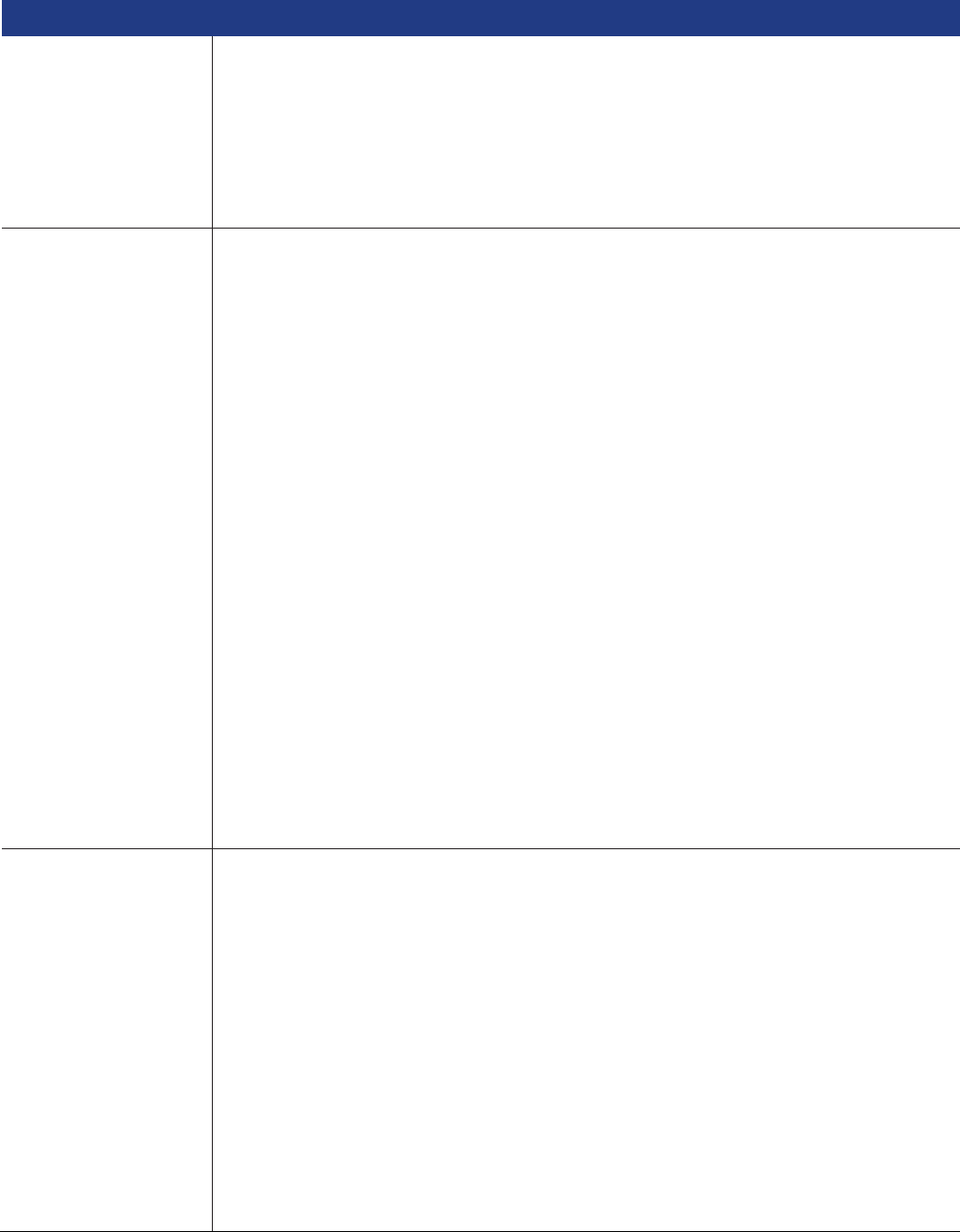

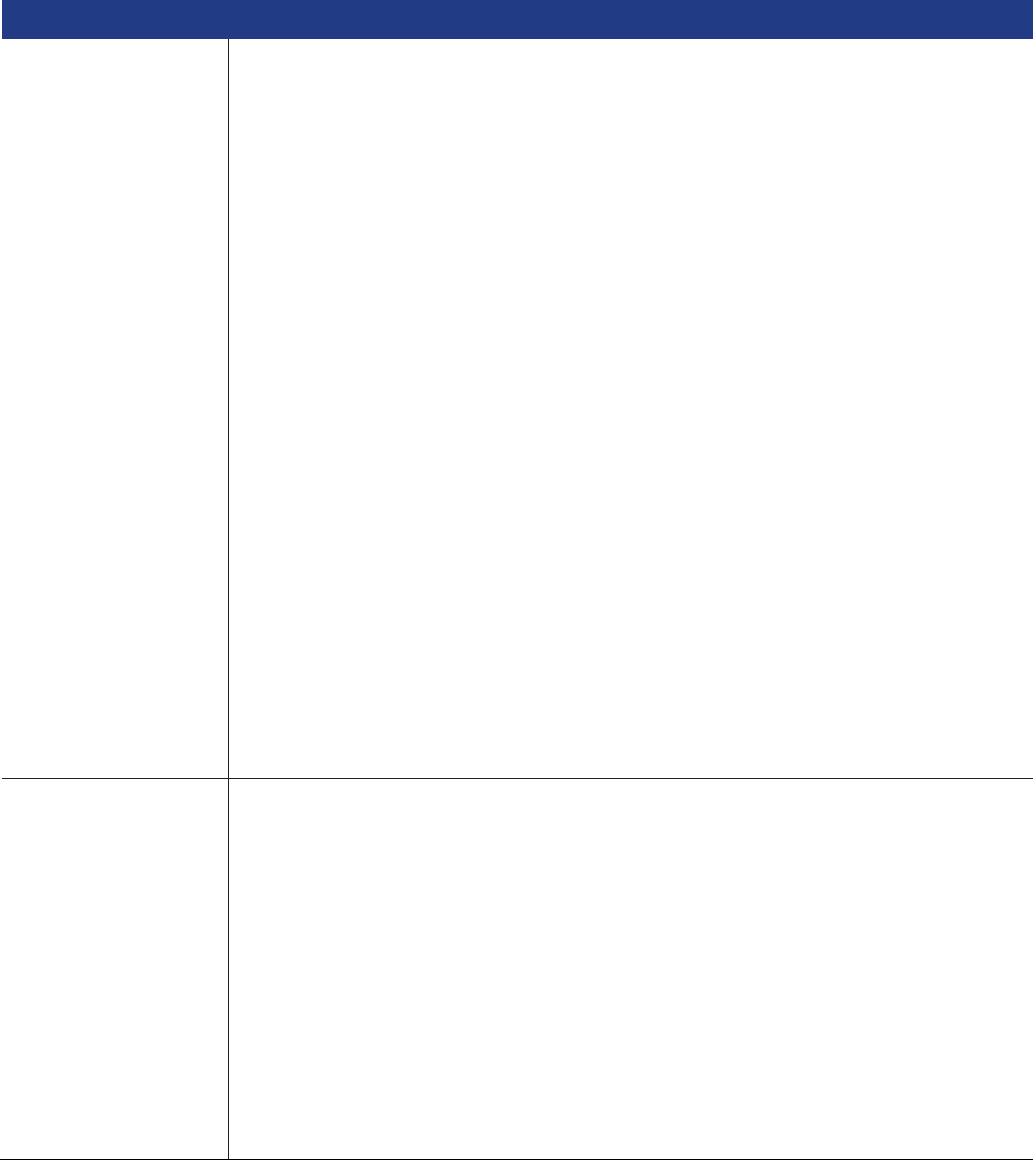

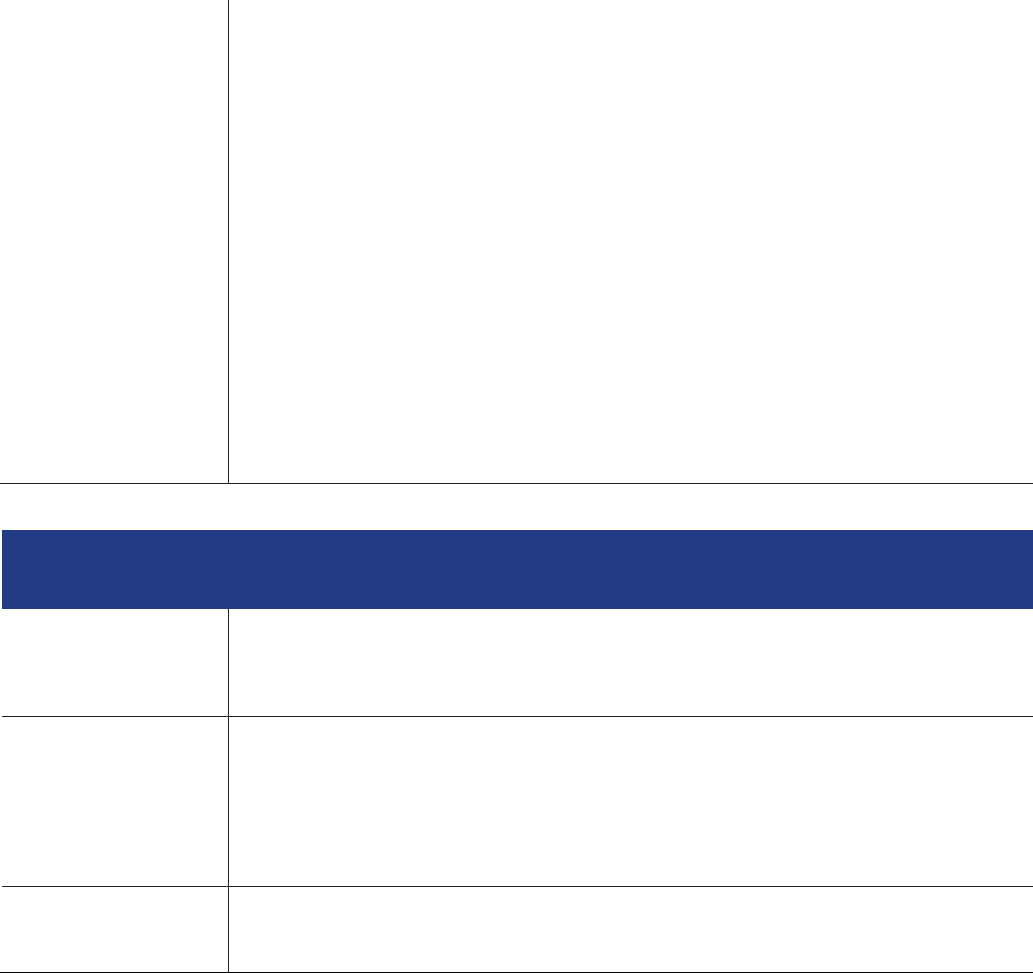

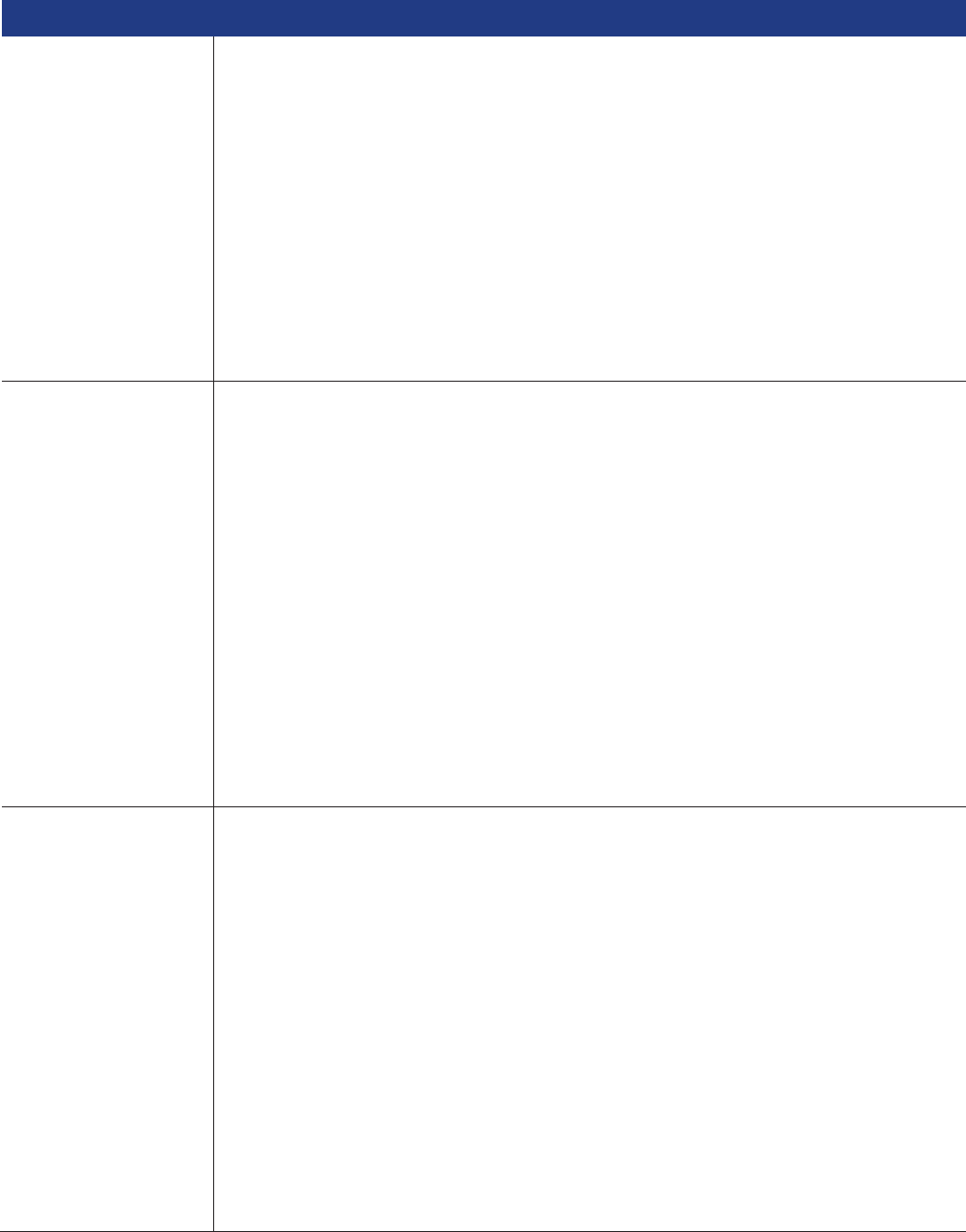

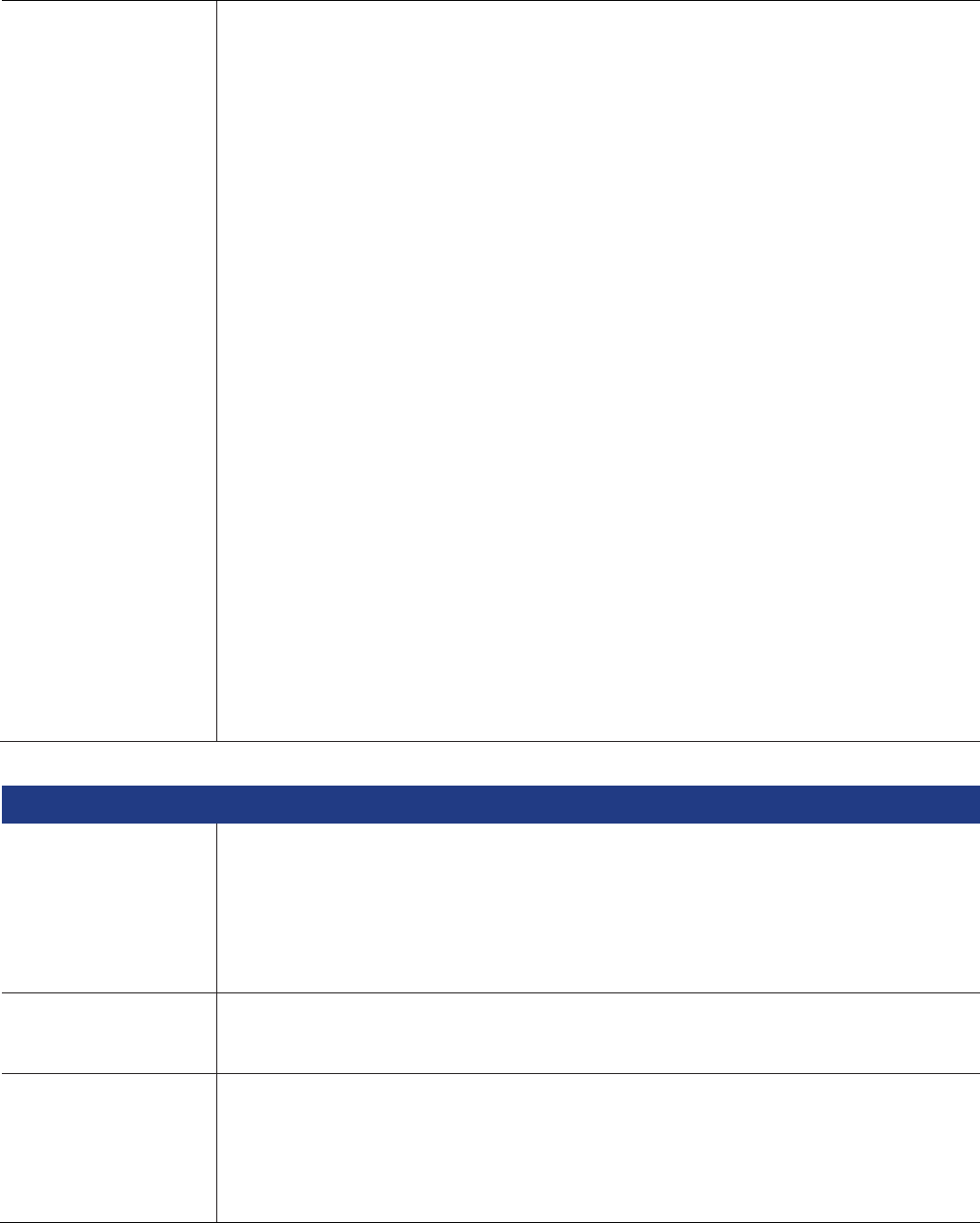

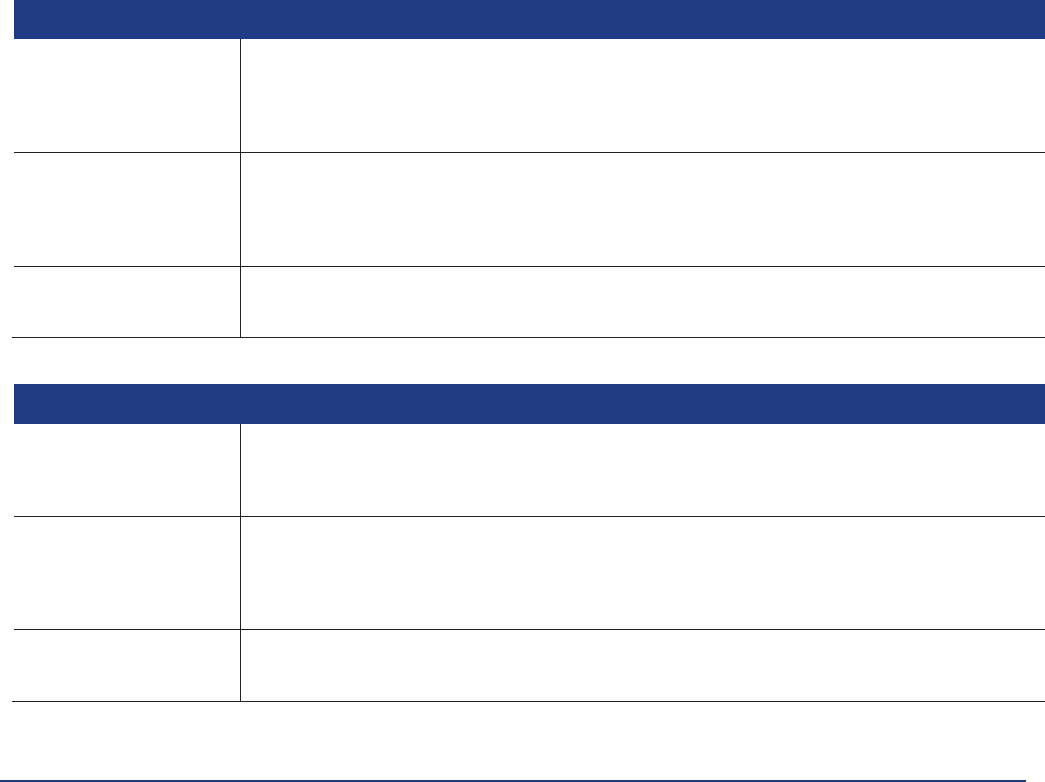

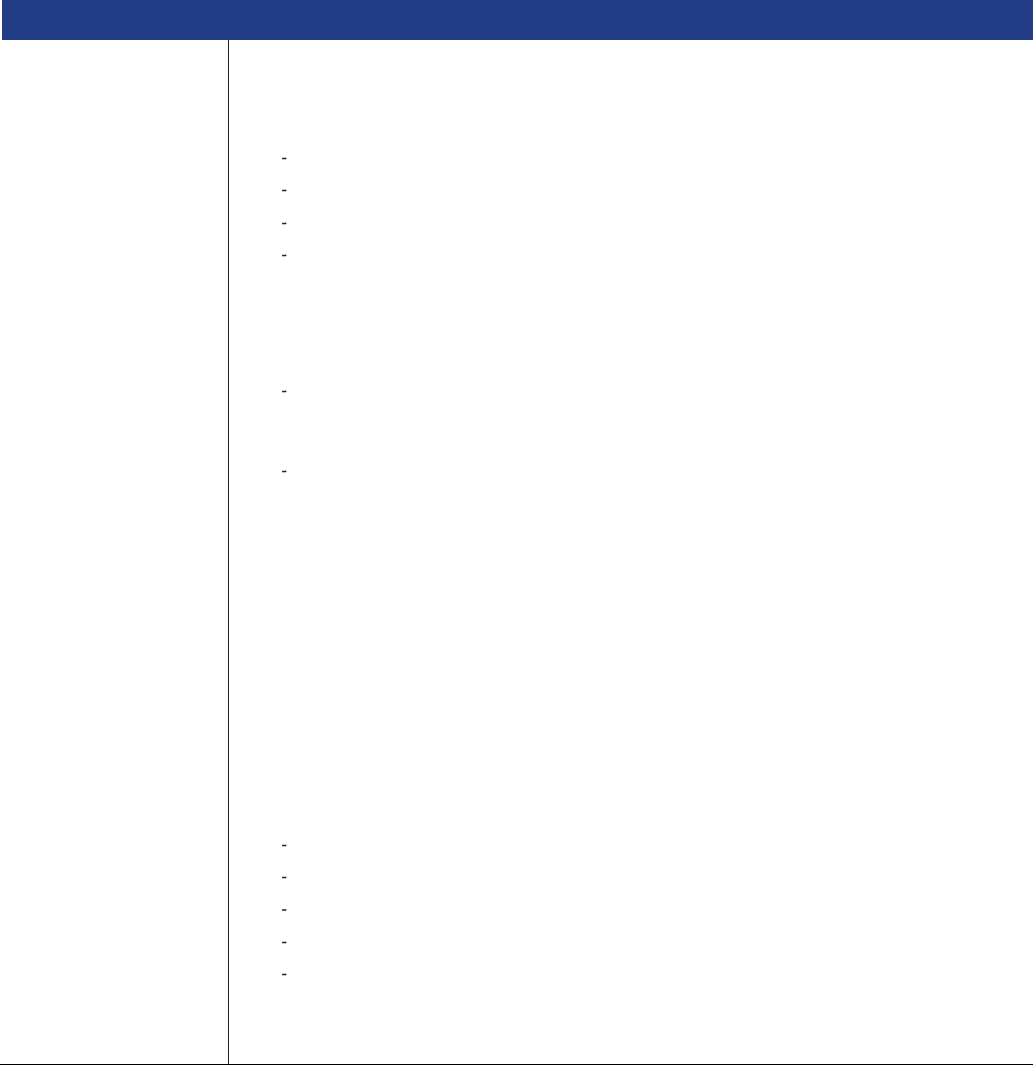

Benefit Schedule

Benefits

Maximum Sum Insured (RM)

International

Domestic

First

Executive

First

Executive

Personal Accident

1

Accidental Death and Permanent Disablement

Adult

Child

325,000

81,250

300,000

75,000

200,000

50,000

100,000

25,000

2

Child Education Fund

15,000

10,000

N/A

N/A

3

Medical Expenses

a) Due to Accident

Up to age 69 years

Above age 70 years

b) Due to Sickness

Up to age 69 years

Above age 70 years

2,000,000

500,000

1,000,000

150,000

800,000

300,000

450,000

100,000

25,000

(due to

accident &

up to age 80

years only)

20,000

(due to

accident & up

to age 80 years

only)

4

Follow Up Medical Expenses In Malaysia

(up to 30 days)

a) Due to Accident

Up to age 69 years

Above age 70 years

b) Due to Sickness

Up to age 69 years

Above age 70 years

100,000

50,000

50,000

25,000

50,000

25,000

25,000

12,500

N/A

N/A

5

Alternative Treatment

1,000

500

N/A

N/A

6

Daily Hospital Income

Max coverage day

Up to age 69 years

Above age 70 years

60 days

350 per day

100 per day

60 days

250 per day

100 per day

30 days

100 per day

50 per day

30 days

100 per day

50 per day

7

Compassionate Visit

10,000

10,000

2,000

1,000

8

Child Guard

10,000

10,000

2,000

1,000

9

Emergency Medical Evacuation & Repatriation

Unlimited

Unlimited

150,000

100,000

10

Repatriation of Mortal Remains

(Include Burial & Cremation expenses)

Unlimited

Unlimited

150,000

100,000

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

4

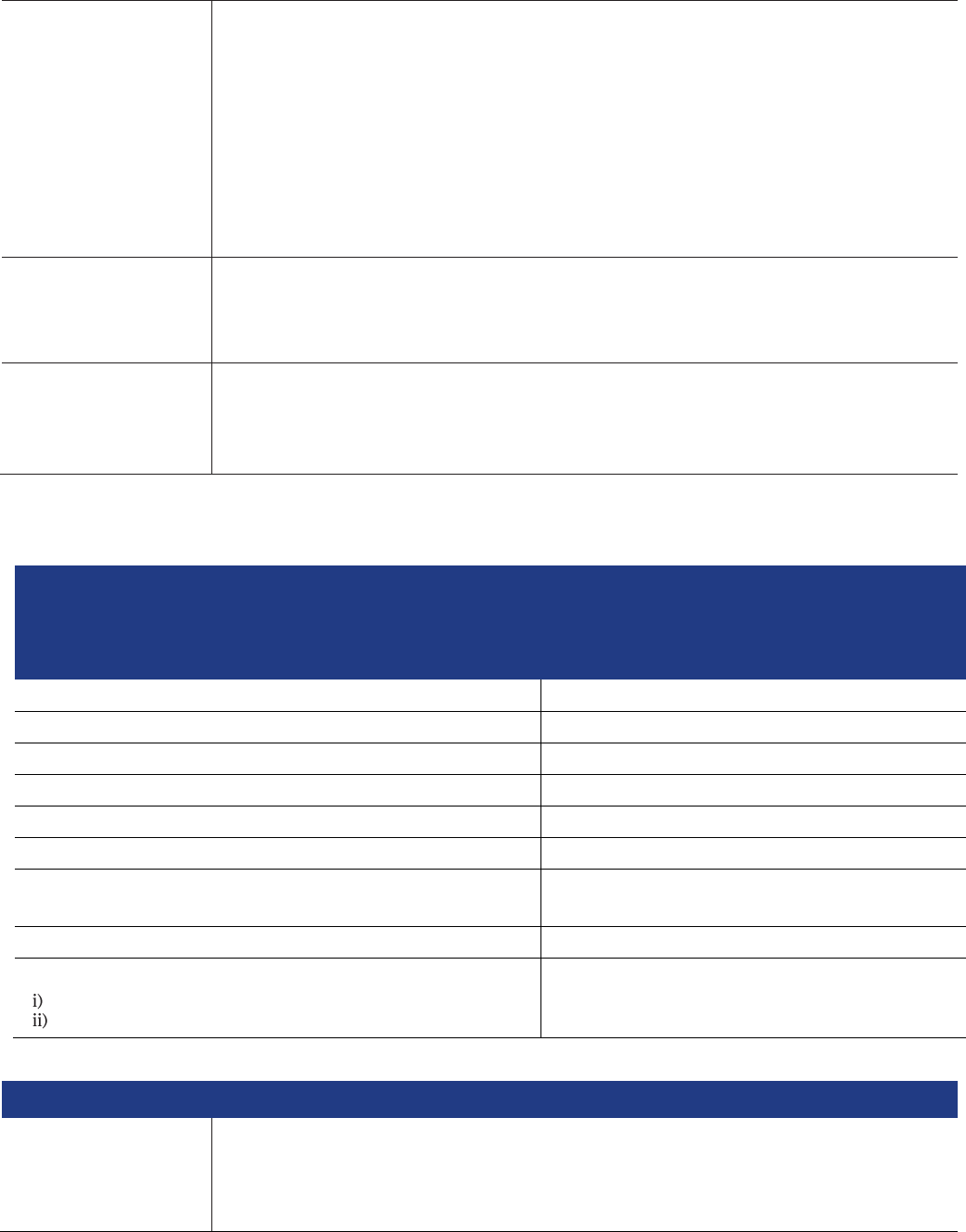

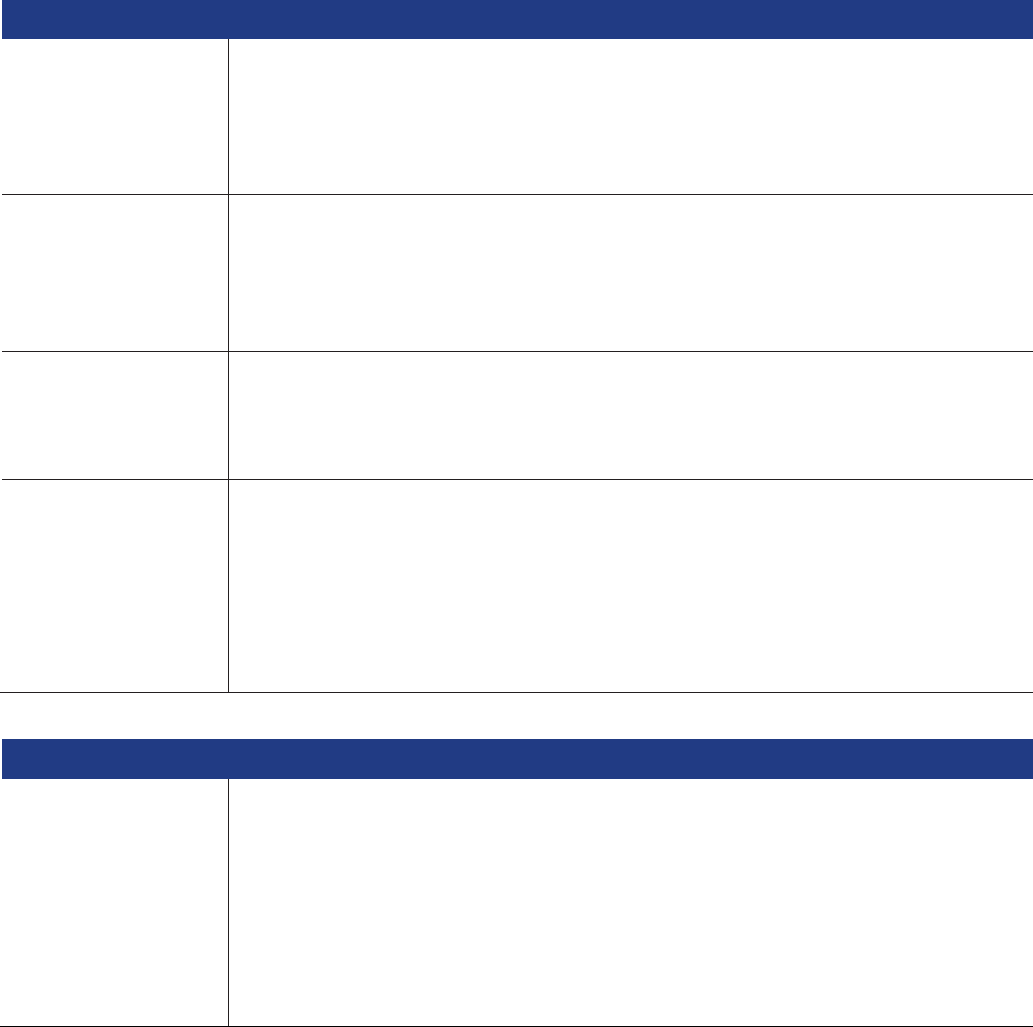

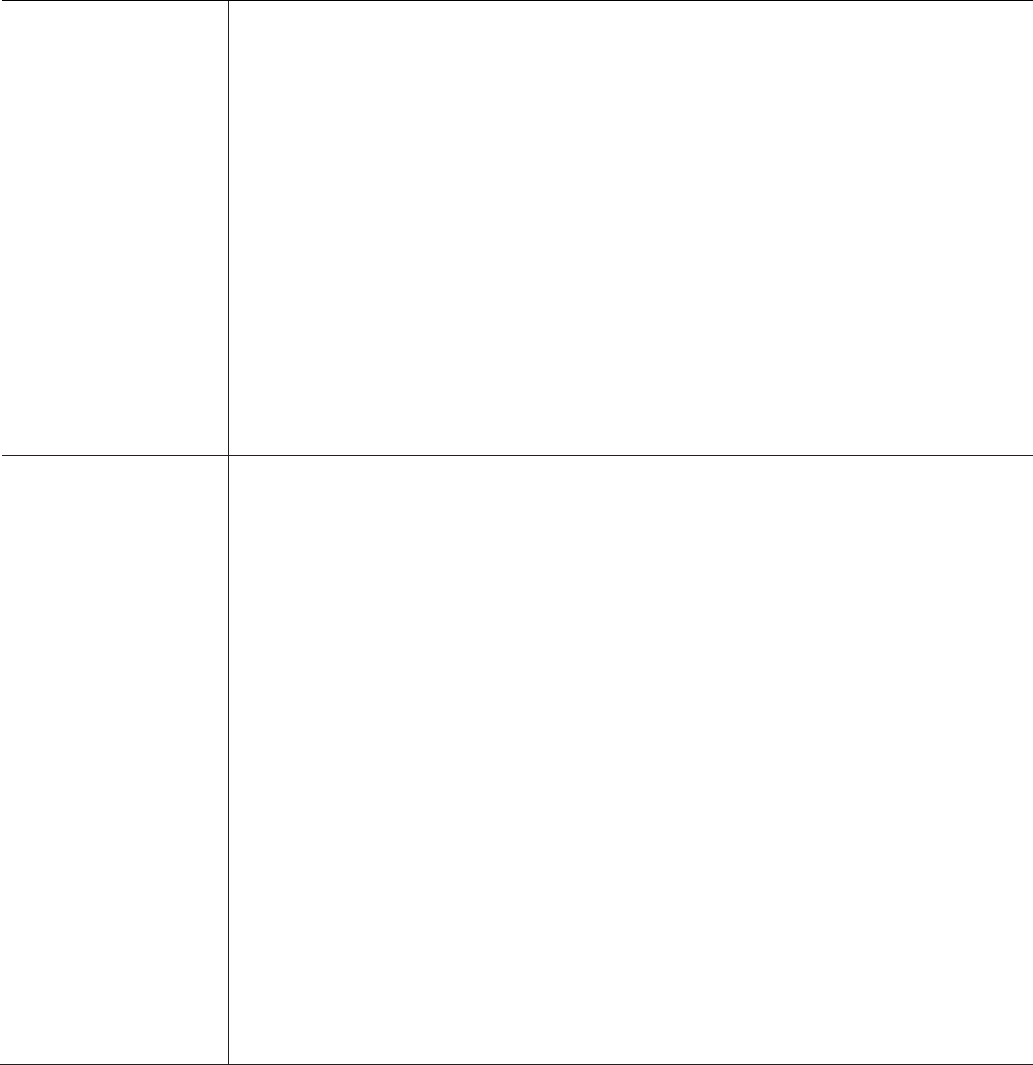

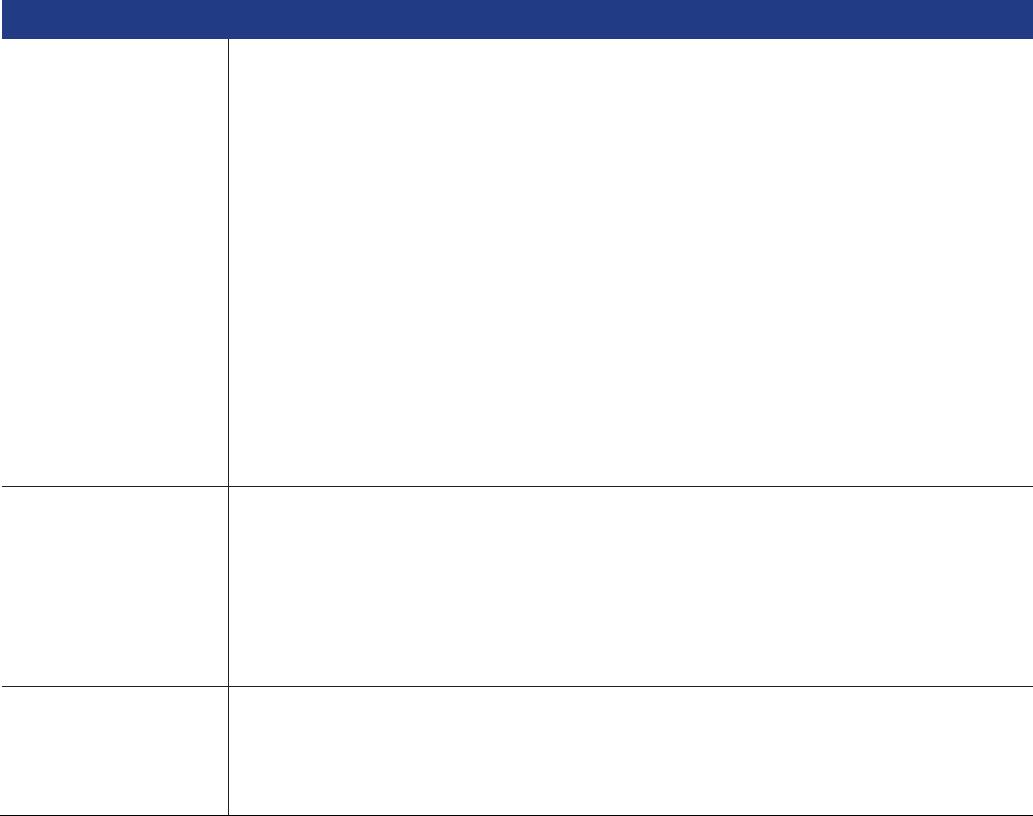

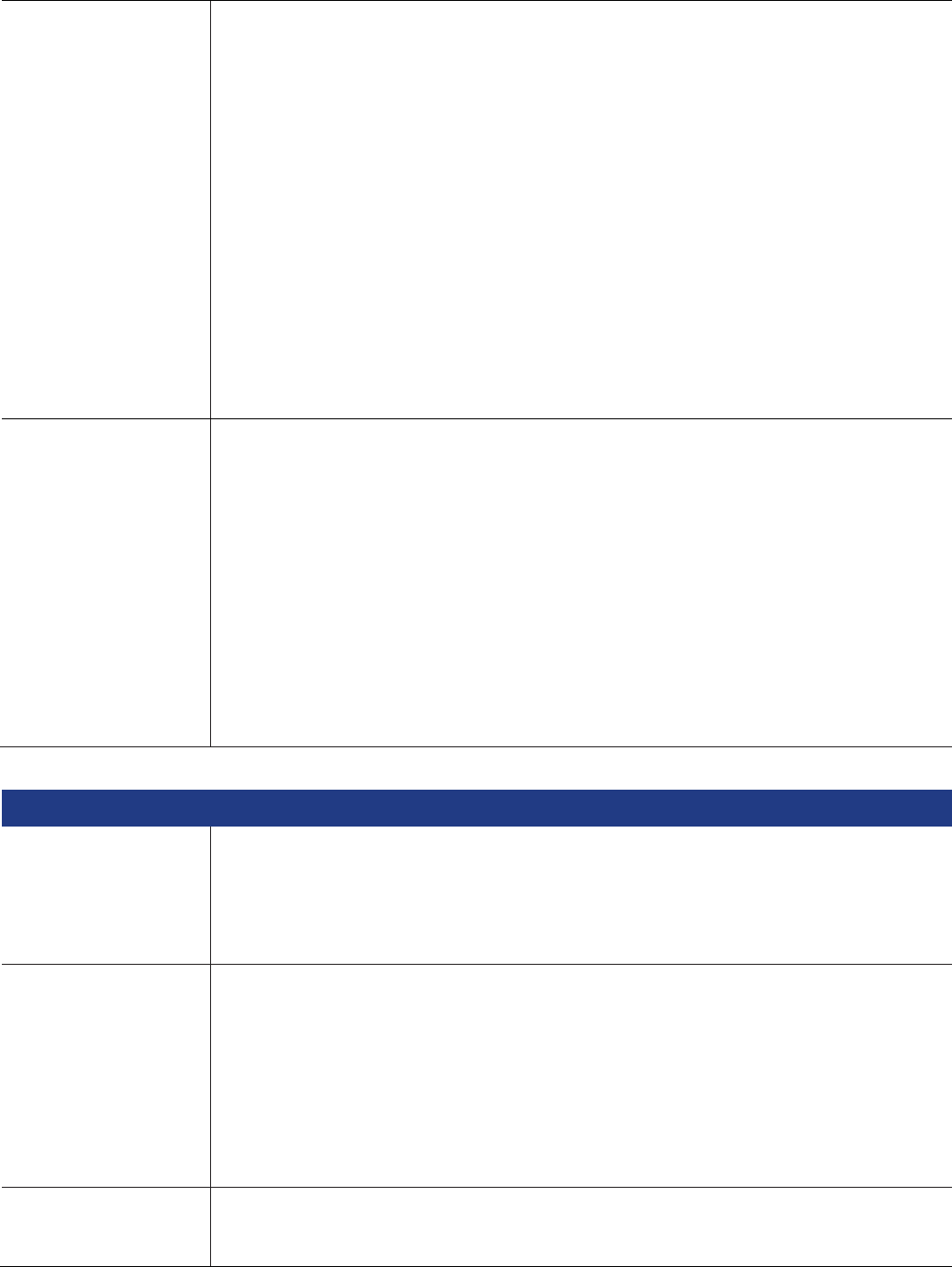

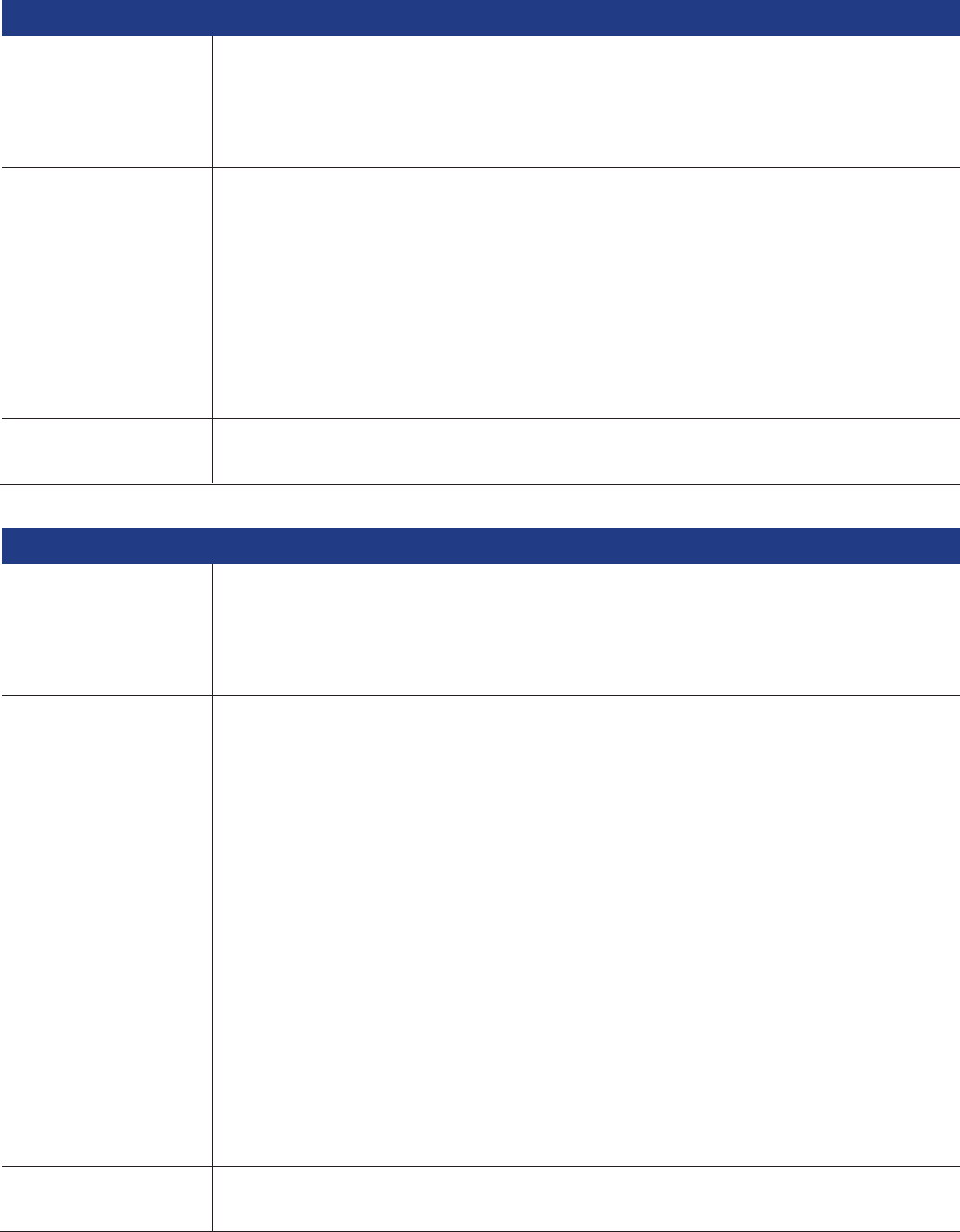

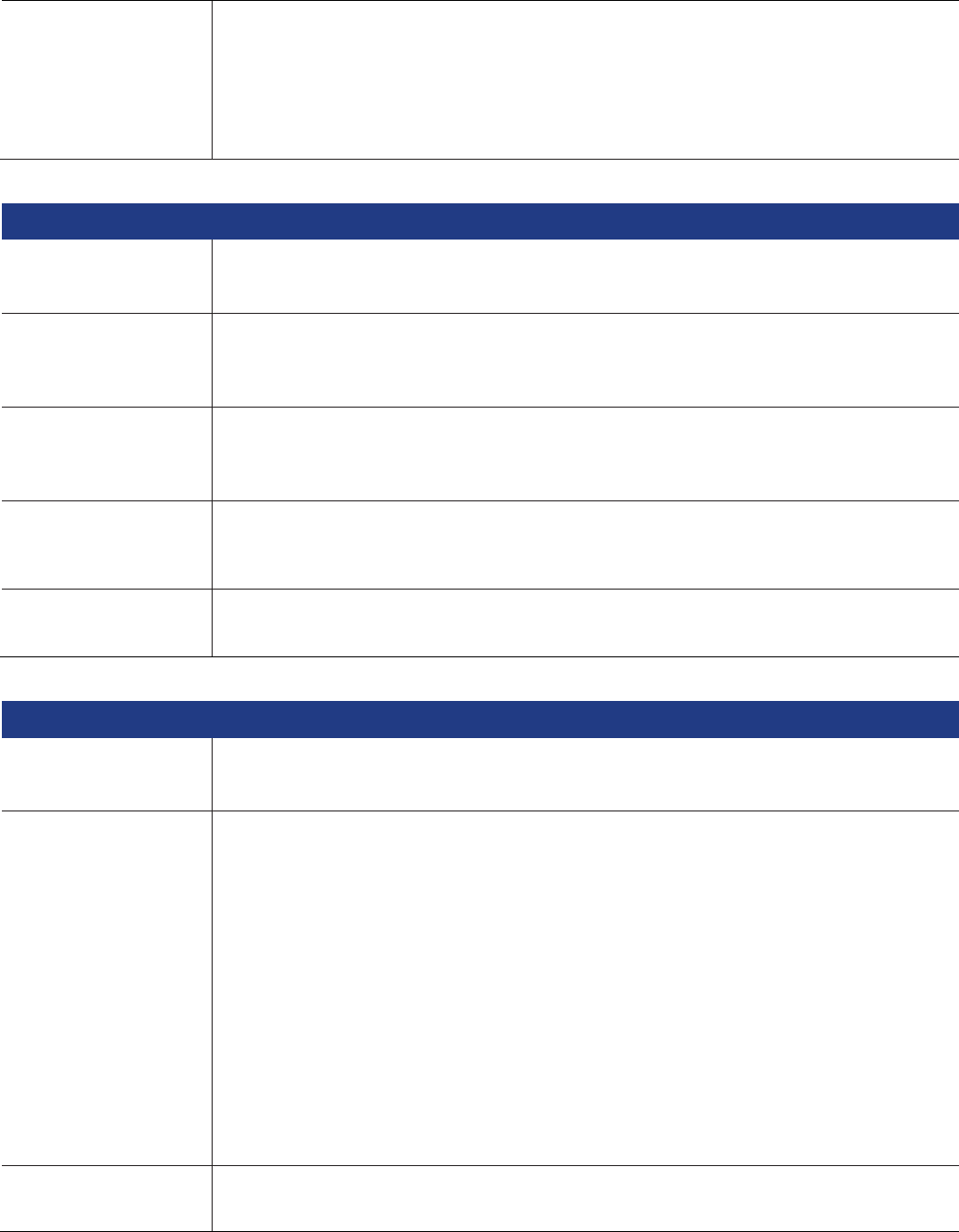

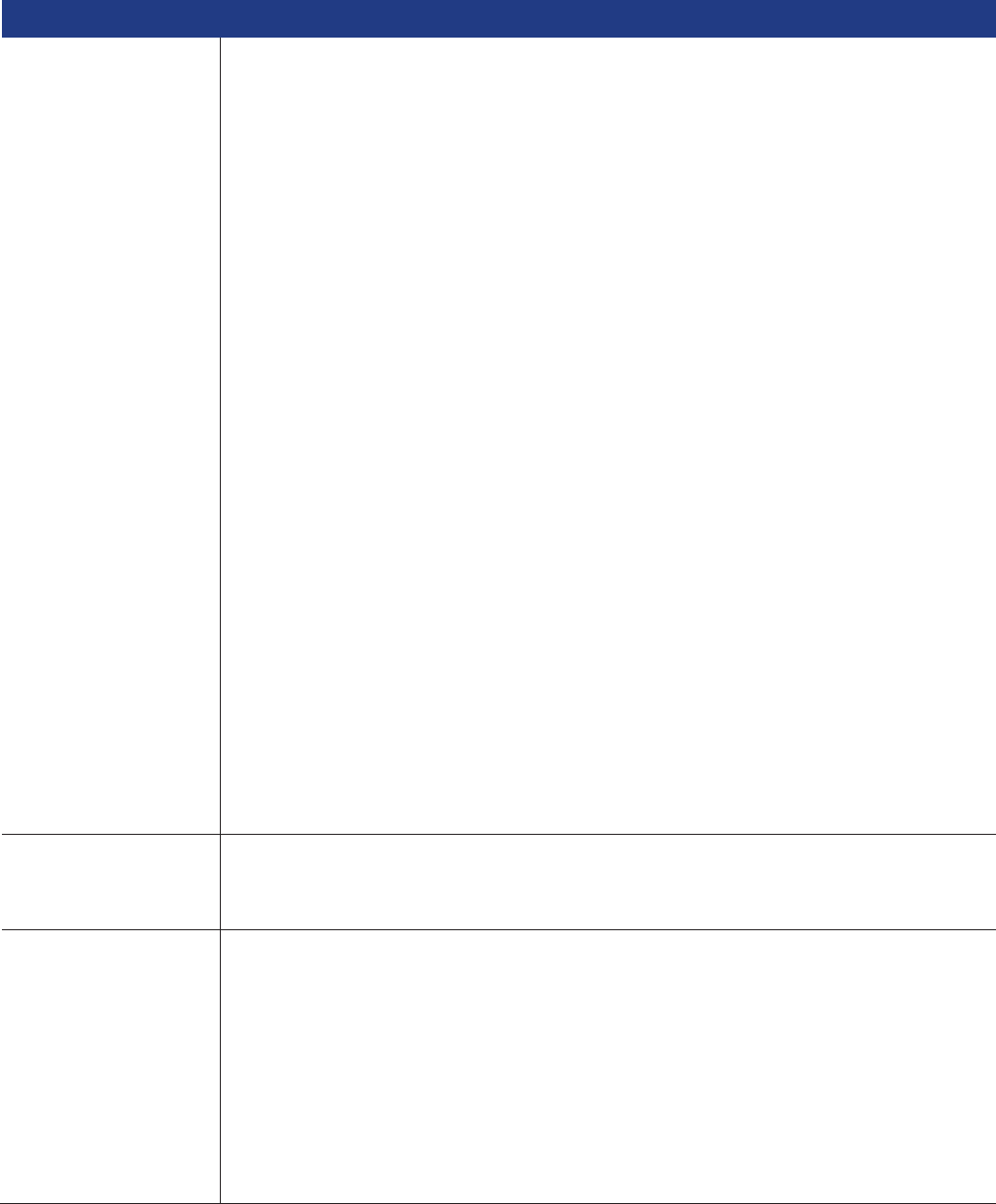

Travel Inconvenience

11

Travel Cancellation

a) Cancellation Expenses

b) Postponement Expenses

Actual Cost

1,000

50,000

500

2,000

N/A

1,500

N/A

12

Travel Curtailment

Actual Cost

50,000

2,000

1,500

13

Travel Disruption

2,000

1,000

N/A

N/A

14

Loss or Damage of Personal Belongings &

Baggage

a) Any one article limit

b) Portable Computer

Max Limit

500

1,500

7,500

500

1,000

5,000

500

N/A

2,000

500

N/A

1,000

15

Loss or Damage to Travel Documents

7,500

5,000

N/A

N/A

16

Loss of Personal Money*

750

750

N/A

N/A

17

Fraudulent Use of Lost Credit Card

1,000

500

N/A

N/A

18

Baggage Delay (every 6 consecutive hours)

a) Max Limit (Overseas)

Per family limit

b) Max Limit (Malaysia)

Per family limit

200

1,000

3,000

400

1,200

200

800

2,400

200

600

200

N/A

N/A

1,000

N/A

150

N/A

N/A

600

N/A

19

Travel Delay (every 6 consecutive hours)

Max Limit

200

4,000

200

3,600

200

1,000

150

600

20

Travel Misconnection (every 6 consecutive

hours)

Max Limit

200

1,000

200

600

N/A

N/A

21

Travel Re-Route (every 6 consecutive hours)

Max Limit

200

1,000

200

600

N/A

N/A

22

Travel Overbook (every 6 consecutive hours)

Max Limit

200

1,000

200

600

N/A

N/A

23

Missed Departure (every 6 consecutive hours)

Max Limit

200

1,000

200

600

N/A

N/A

24

Hijacking Inconvenience (every 24

consecutive hours)

Max Limit

400

800

400

800

N/A

N/A

25

Personal Liability

1,500,000

1,000,000

500,000

250,000

26

Emergency Mobile Phone Charges

150

100

N/A

N/A

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

5

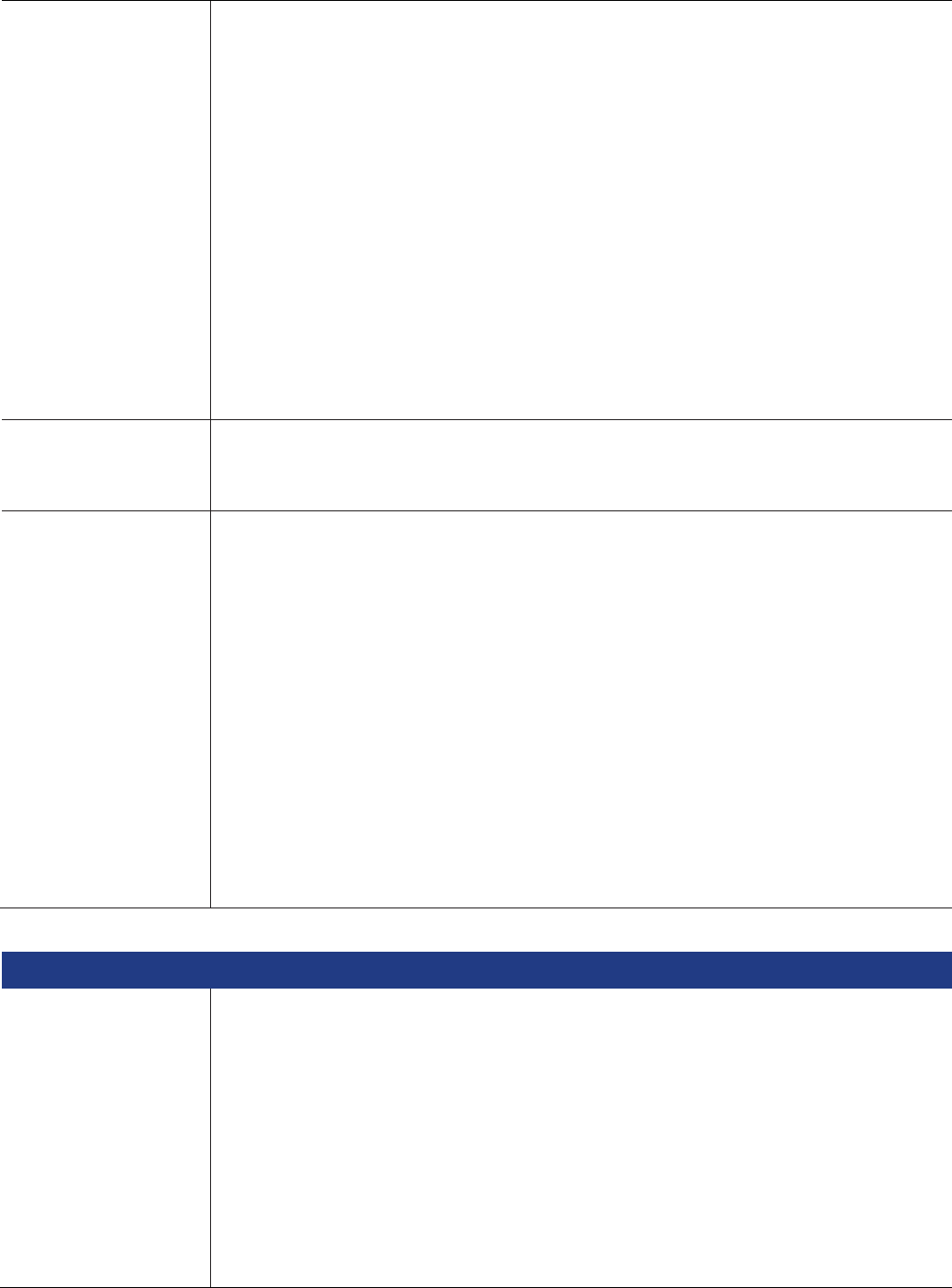

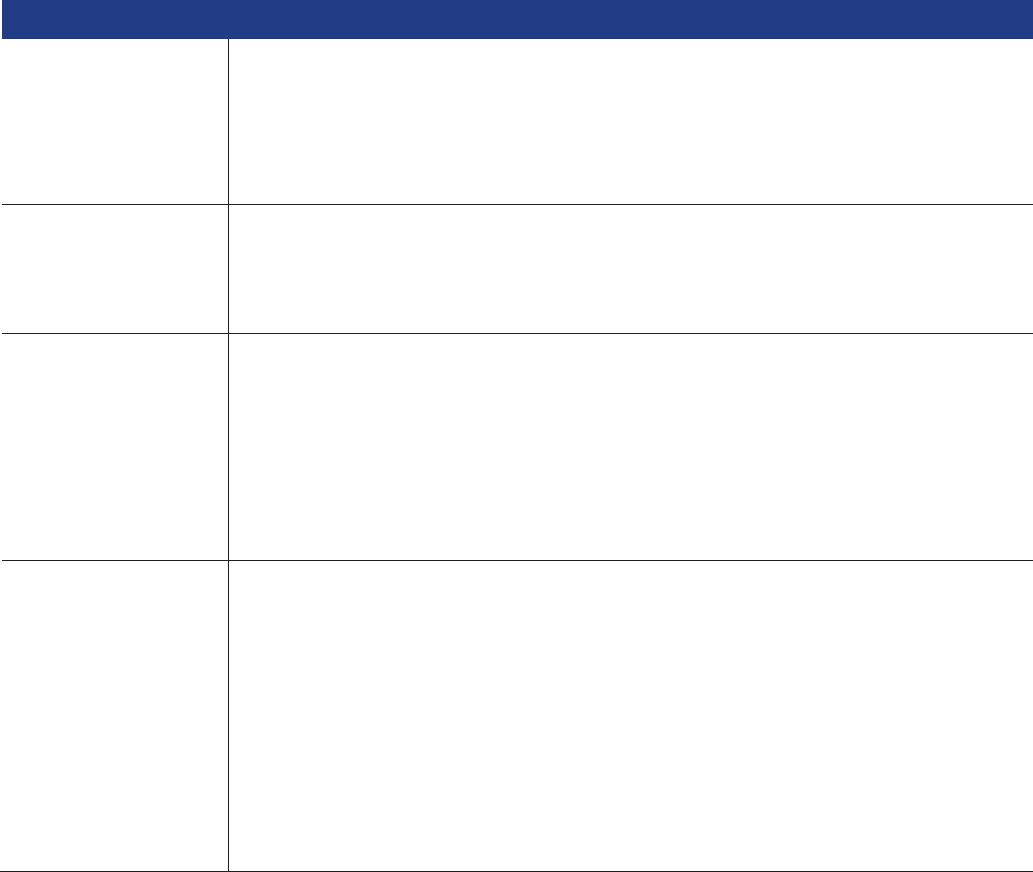

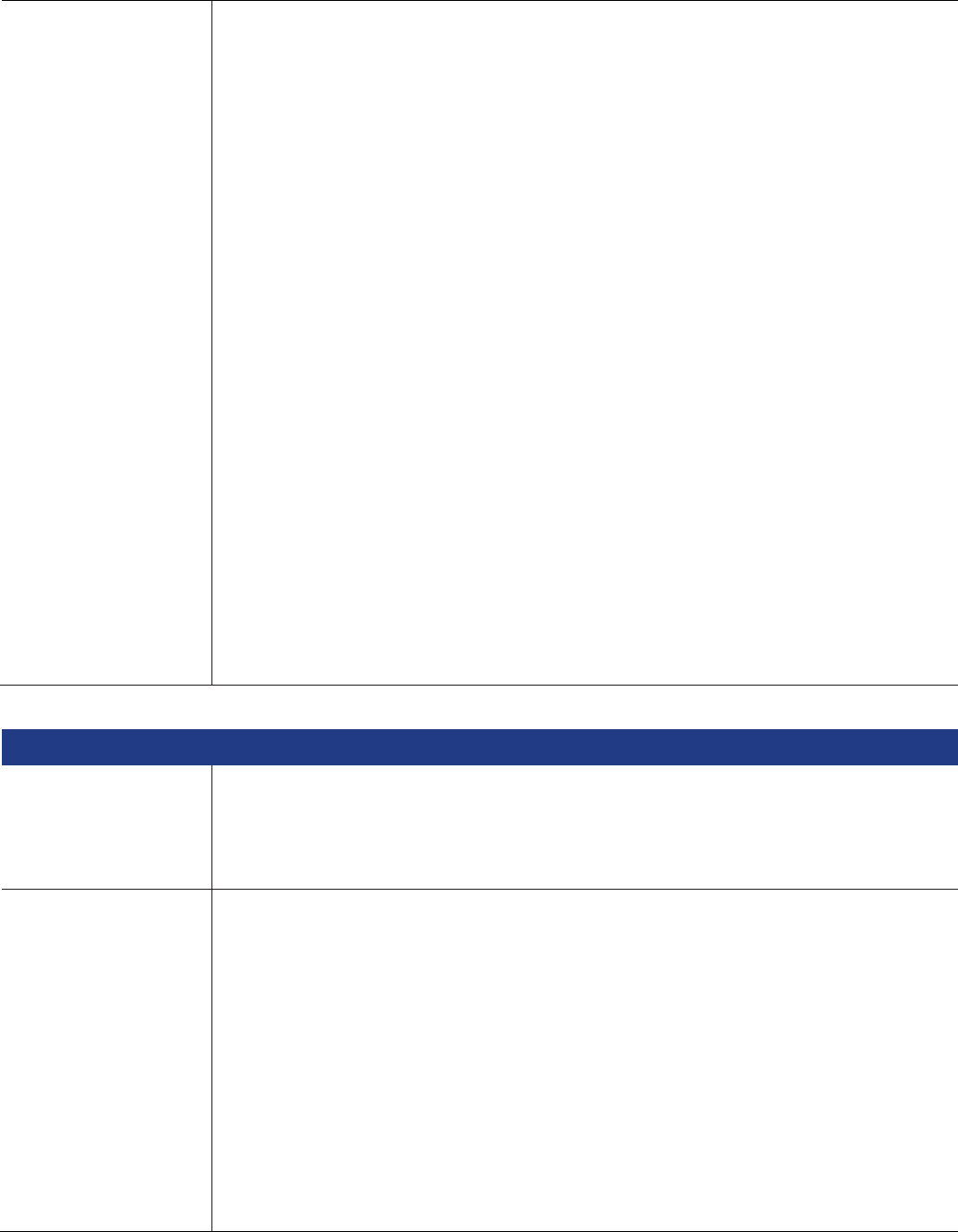

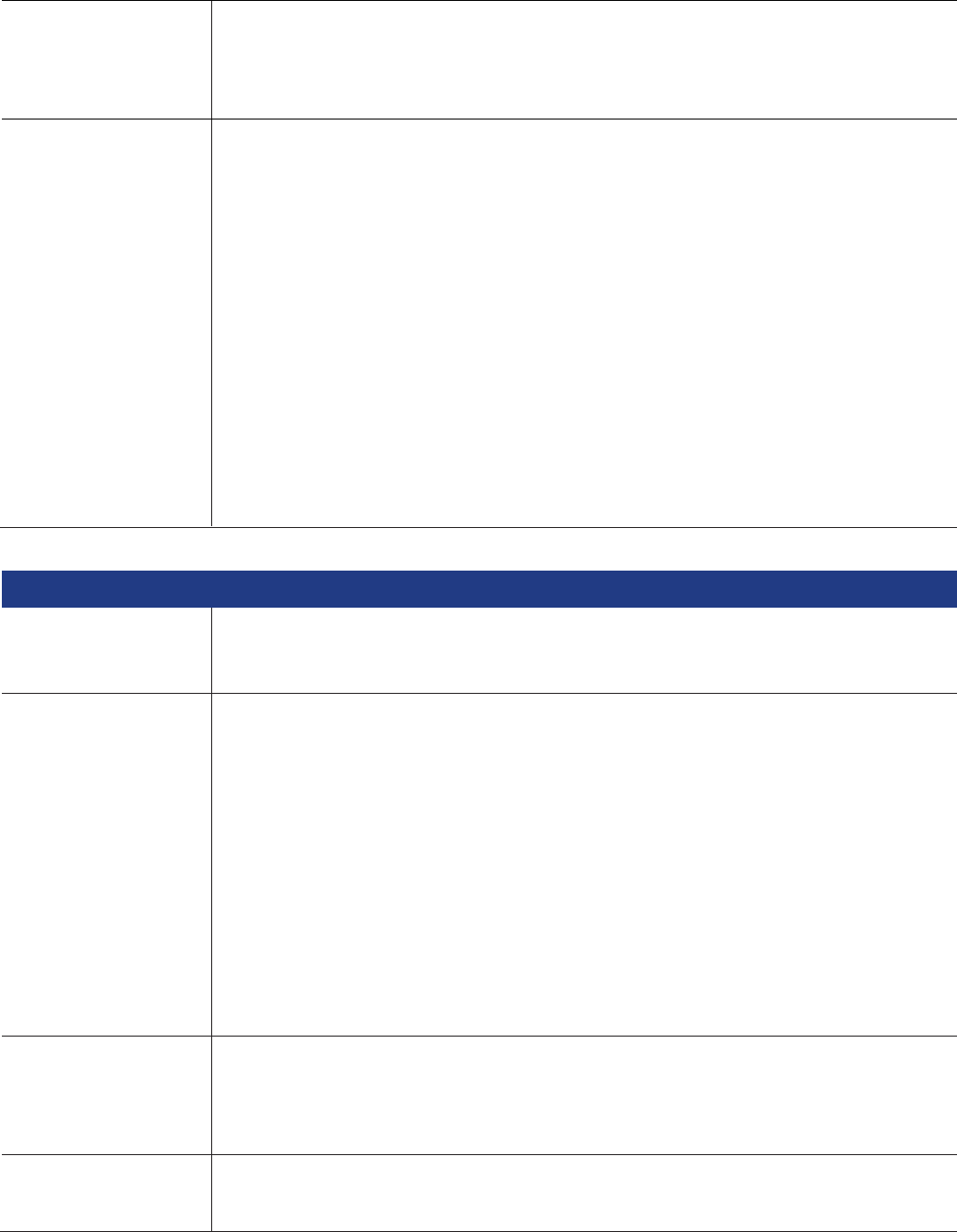

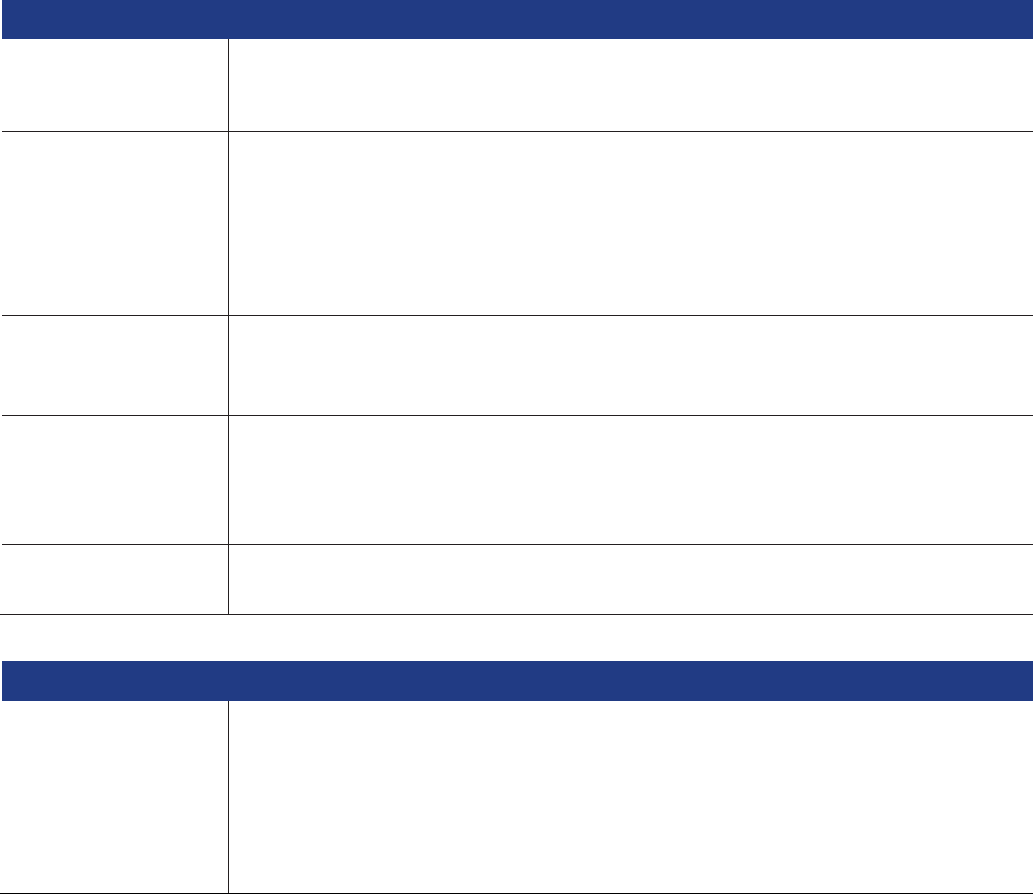

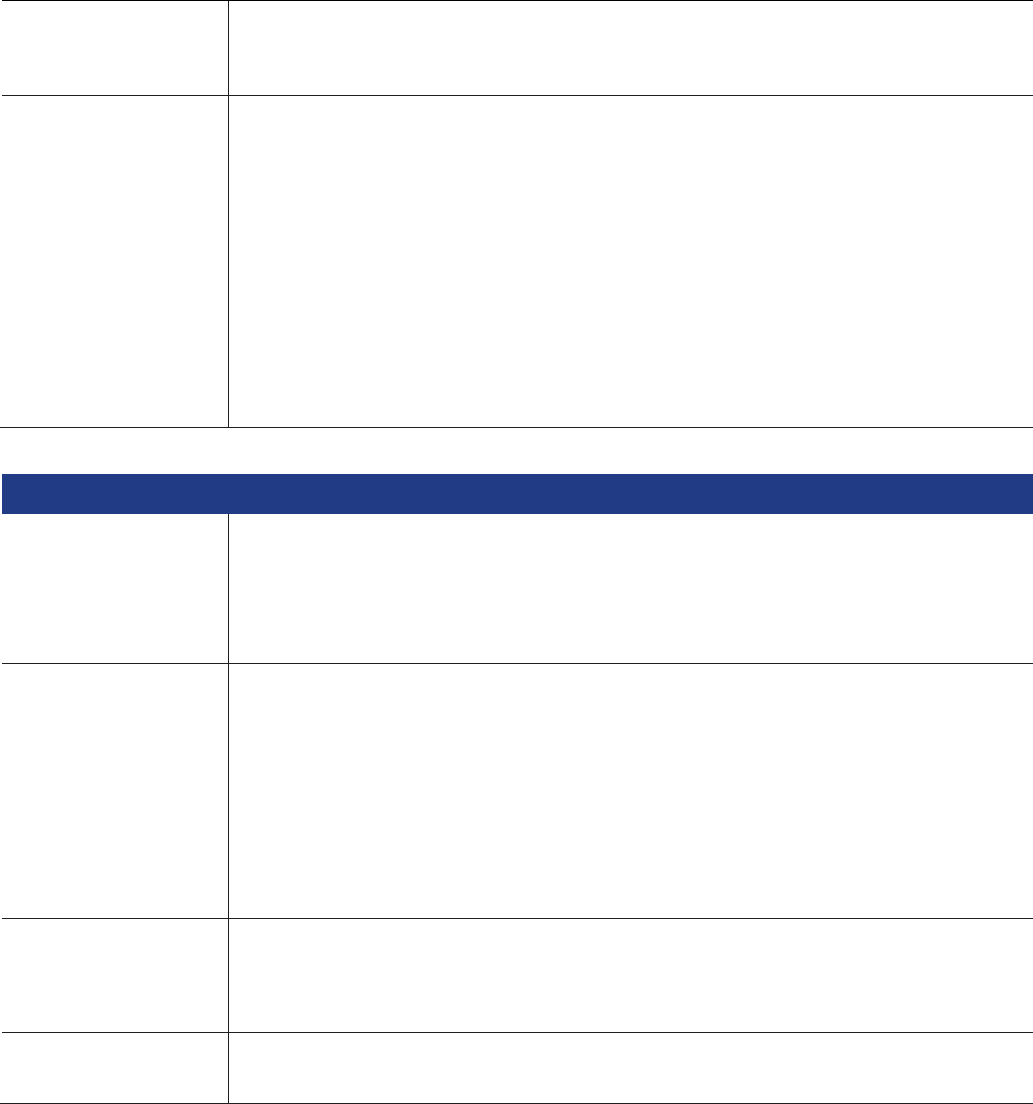

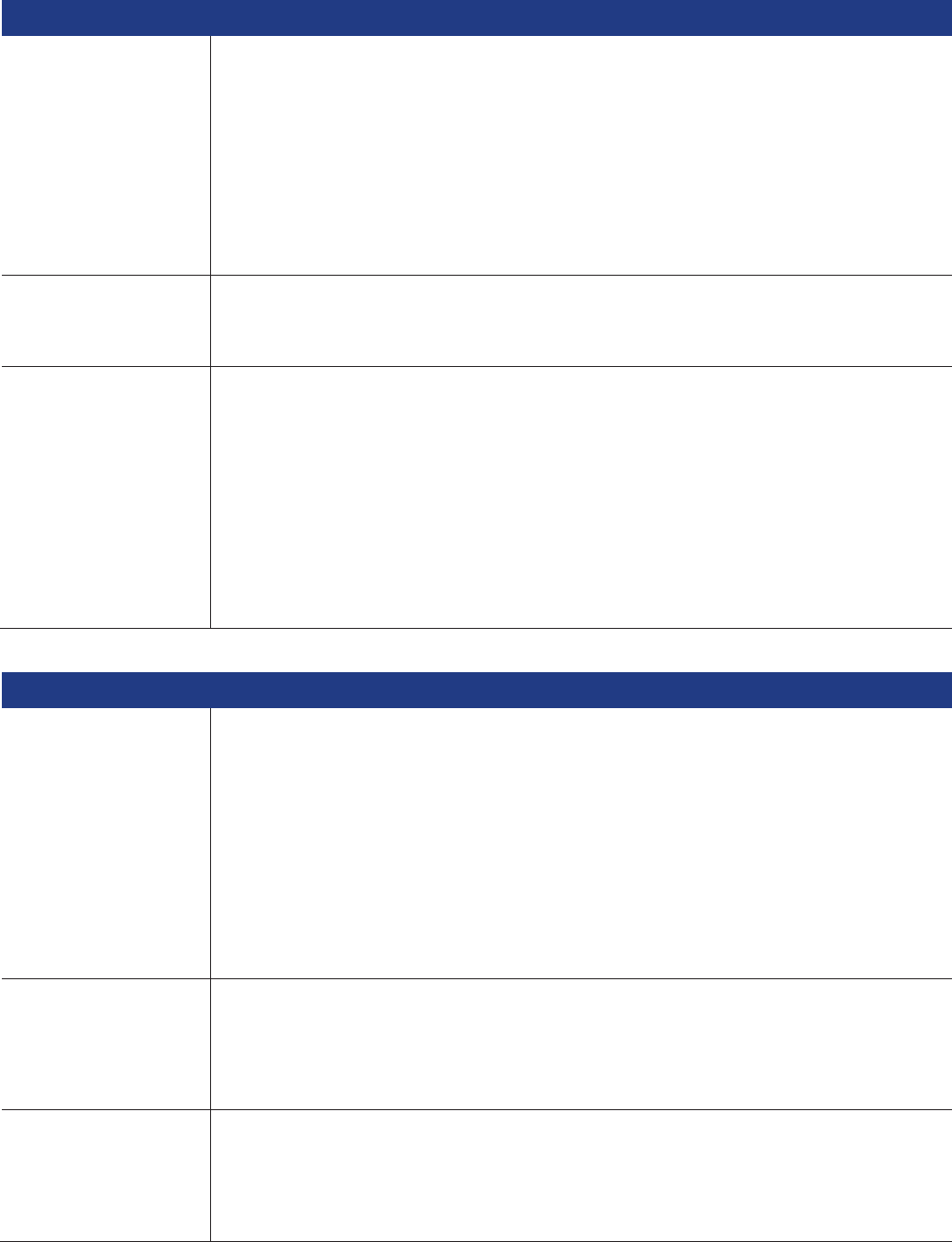

Lifestyle

27

Golf Benefit

a) Hole In One

b) Loss of golf equipment due to Theft

c) Unused golf green fees due to Bodily

Injury or sickness

1,000

1,000

1,000

N/A

250

500

250

N/A

28

Home Inconvenience Allowance

Any one article limit

5,000

500

3,000

500

500

N/A

29

Pet Care (amount per 24 hour)

Max Limit

50

100

50

50

N/A

N/A

Others

30

Terrorism Extension

Included

Included

Included

Included

31

Chubb Assistance Benefits

24 Hours Telephone Access

Medical Assistance

Travel Assistance

Included

Included

Included

Included

Benefits Extended to Cover COVID-19

32

Medical Expenses due to Sickness

Up to age 69 years

Above age 70 years

450,000

450,000

450,000

450,000

N/A

N/A

33

Emergency Medical Evacuation & Repatriation

Unlimited

Unlimited

N/A

N/A

34

Repatriation of Mortal Remains

Unlimited

Unlimited

N/A

N/A

35

Daily Hospital Income

Max coverage day

Up to age 69 years

Above age 70 years

60 days

350 per day

100 per day

60 days

250 per day

100 per day

N/A

N/A

36

Travel Cancellation

50,000

50,000

N/A

N/A

37

Travel Curtailment

50,000

50,000

N/A

N/A

Optional: Add-On Benefit (with additional premium)

Cruise Pack

38

Cruise Pack

a) Excursion Tour Cancellation

b) Excursion Tour Curtailment

c) Cruise Re-Route

Actual Cost

Actual Cost

2,000

50,000

50,000

2,000

N/A

N/A

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

6

Chubb Travel Insurance Policy

Important Information Regarding This Policy

The Policy

1. This Policy, all written proposals, Certificate of Insurance and endorsements (if any) that We may

issue from time to time sets out the entire rights and obligations between You and Us under the

Policy. This Policy is issued in consideration of the information, answers and disclosures provided.

2. In return for You paying Us the premium, We will insure You for the Benefits to the extent provided

in this Policy, subject to the terms, conditions, definitions and exclusions contained in this Policy and

Certificate of Insurance.

Please read the Policy

3. It is important that You carefully read and understand this Policy and Certificate of Insurance

because they describe the terms, conditions and exclusions that apply to the insurance under this

Policy.

Checking the Policy

4. Please check the Policy and/or Certificate of Insurance to make sure all the information on them is

correct. Please let Us know immediately if any alterations are needed. Please contact Us if there is a

change of address or account details.

Part 1 – Interpretation

Section 1 - Definitions

Accident or Accidental means a sudden, unforeseen and fortuitous event.

Act of Terrorism means any actual or threatened use of force or violence directed at or causing damage,

injury, harm or disruption, or commission of an act dangerous to human life or property, against any

individual, property or government, which the stated or unstated objective of pursuing economic, ethnic,

nationalistic, political, racial or religious interests, whether such interests are declared or not. Robberies or

other criminal acts, primarily committed for personal gain and acts arising primarily from prior personal

relationships between perpetrator(s) and victim(s) shall not be considered Act of Terrorism. Act of Terrorism

shall also include any act, which is verified or recognized by the (relevant) government as an act of terrorism.

Annual Policy means a Coverage issued for the selected plan where the Insured Person can make an

unlimited number of Journeys to the selected Zone of travel during the Period of Insurance.

Benefit means the respective benefit, as stated in the Benefit Schedule and according to the type of plan

stated in Your Certificate of Insurance, payable by Us under the terms and conditions of this Policy in respect

of each event or loss covered by this Policy.

Benefit Schedule means the document which is incorporated and forms part of this Policy which contains

details of the Benefits for this Policy, according to the type of plan stated in the Certificate of Insurance.

Bodily Injury means Accidental injury sustained resulting solely, directly and independently of all other

causes from an Accident and caused by external, violent and visible means.

Cancellation Expenses means loss of deposits, advance payments for Journey or accommodation or other

charges, which are either forfeited, deemed non-refundable or levied due to the cancellation of the Journey,

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

7

resulting from a Specified Cause under Part 7 – Section 11 or COVID-19 Specified Cause under Part 7 –

Section 36.

Certificate of Insurance means the document entitled Certificate of Insurance issued to the Policyholder

to confirm that the Insured Person have been accepted according to the terms and conditions of this Policy.

The Certificate of Insurance contains details specific to the Insured Person and forms part of this Policy.

Child(ren) means the Policyholder’s legal unmarried dependent child(ren), including stepchild(ren) and/or

legally adopted child(ren) who is/are at least thirty (30) days old and not older than eighteen (18) years old

(or twenty-three (23) years old if studying full-time in a recognized tertiary institution), on the

commencement of the Period Of Insurance.

Civil Commotion means a disturbance, commotion or disorder created by civilians usually against a

governing body or the policies thereof.

Claimant means the Insured Person, the Nominee, or any other person, as the case may be, who is legally

entitled to claim the Policy Benefits, according to the terms and conditions of the Policy and/or in law.

Common Carrier means any land, sea or air carrier operated under a license for the transportation of fare

paying passengers, and which has fixed and established routes only. It does not include taxi or private car, nor

does it mean any such carrier if chartered or arranged as part of a tour even if such services are regularly

scheduled.

Communicable Disease Outbreak or Communicable Disease means a disease that may be

transmitted directly or indirectly by one person or animal to another by any means due to a virus, bacteria or

other microorganism and that leads to:

(i) the imposition of quarantine or restriction in movement of people or animals by any national or

international body or agency; or

(ii) a travel advisory or warning being issued by a national or international body or agency.

Compulsory Quarantine means the Insured Person is quarantined in a facility appointed by the

government authorities for at least one (1) full day until discharged. Compulsory Quarantine does not mean

the closure of borders by a government or travel body, the enforcement of social distancing measures, a stay at

home notice, or a period of isolation or social distancing required either before Your departure or at Your

destination Overseas.

Confined or Confinement means confinement in a Hospital for at least a Day as a resident in-patient

(other than for day surgery) upon the advice of and under the regular care and attendance of a Physician and

for this purpose. Day shall mean a period for which the Hospital charges for room and board.

Coverage means the cover provided to the Insured Person named in the Certificate of Insurance under this

Policy.

COVID-19 refers to the strain of Novel Coronavirus 2019 classified in February 2020 by the World Health

Organisation (WHO) as “Coronavirus Disease 2019 (COVID-19)” or any mutation or variation thereof or any

related strain), contracted and commencing whilst this Policy is in force and results, directly and

independently of all other such causes.

Critical Medical Condition means a medical condition suffered by the Insured Person which is

determined to be life-threatening by the Physician treating the Insured Person :

a) For Overseas Journey : as a result of Bodily Injury or Sickness ;

b) For Domestic Journey : as a result of Bodily Injury.

Cruise means travel or accommodation on a ship, sailing vessel (other than a private sailing vessel or a

privately registered vessel), boat or river cruise (other than a day trip which do not involve over-night

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

8

accommodation), which is owned and operated by a registered company, during all or part of the Insured

Person’s Journey.

Death means death occurring solely, directly and independently of all other causes, as a result of a Bodily

Injury.

Dental Expenses means reasonable and necessary charges for emergency dental treatment due to Bodily

Injury to natural tooth/teeth caused by an Accident, carried out by a Dentist, medically necessary to treat the

Insured Person’s condition that has manifested whilst the Insured Person is on a Journey, including charges

for medical supplies or services, not exceeding the usual level of charges for similar treatment, supplies or

medical services in the locality where the expense is incurred and does not include charges that would not

have been made if no insurance existed.

Dentist means a legally licensed dentist or dental surgeon qualified by a medical degree and duly registered

to practice dentistry and who, in rendering treatment, is practicing within the scope of his licensing and

training in the geographical area of practice. Dentist shall not include the Insured Person, the Spouse or any

of his/her Family Member.

Designated Facility means facility that the local government has authorised to provide quarantine services

to those diagnosed with COVID-19.

Destination means the place(s) where the Insured Person expects to travel to on the Journey, as shown on

the travel itinerary.

Domestic means anywhere within Malaysia only.

Extreme Sports and Sporting Activities means any sports or sporting activities that presents a high level

of inherent danger (i.e. involves a high level of expertise, exceptional physical exertion, highly specialised gear

or stunts) including but not limited to big wave surfing, private white water rafting grade 4 and above,

canoeing down rapids, cliff jumping, horse jumping, ultra-marathons, biathlons, triathlons, and stunt riding.

This Extreme Sports and Sporting Activities does not mean usual tourist activities that are accessible to the

general public without restriction (other than height or general health or fitness warnings) and which are

provided by a recognised local tour operator but always providing that the Insured Person is acting under the

guidance and supervision of qualified guides and/ or instructors of the tour operators when carrying out such

tourist activities.

Family Member means the Insured Person’s Spouse, parents, parents-in-law, grandparents, grandparents-

in-law, great grandparents, great grandparents-in-law, Child(ren), daughter-in-law, son-in-law, brothers or

sisters, brother-in-law, sister-in-law, grandchild(ren), step-brother, step-sister, step-parents, Guardian.

Family Plan under Annual and/or Single Trip Policy shall comprise:

a) the Policyholder;

b) the Policyholder’s Spouse; and/or

c) the Policyholder’s Child(ren)

Notwithstanding anything to the contrary set forth in this Policy, the Child(ren) covered under a Family

Plan must be accompanied by the Policyholder or his/her Spouse for any Journey made during the Period

of Insurance.

Financial Default means either the complete suspension of operation due to financial circumstances

whether or not bankruptcy/liquidation petition is filed; or partial suspension of operations following a filling

of a bankruptcy/liquidation petition.

Fully Vaccinated means the Insured Person has completed the recommended or required doses of vaccine

approved or recognized by the Government of Malaysia, or the relevant authority including the Ministry of

Health of Malaysia.

Guardian means an individual who has legal guardianship over a Child(ren) before he/she reaches the age of

eighteen (18).

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

9

Home means the Insured Person’s usual place of residence in Malaysia.

Hospital means a legally constituted establishment operated pursuant to the laws of the country in which it

is based, which holds a license as a hospital (if licensing is required in the state or government jurisdiction)

and meets the following requirements:

a) operates primarily for the reception, care and medicare and treatment of sick, ailing or injured persons as

in-patients;

b) provides full-time nursing service by and under the supervision of a staff of Nurses;

c) has a staff of one or more Physicians available at all times;

d) maintains organized facilities for the medical diagnosis and treatment of such persons, and provides

(where appropriate) facilities for major surgery within the confines of the establishment or in facilities

controlled by the established; and

e) is not primarily a clinic, nursing, rest or convalescent home or similar establishment and is not, other than

incidentally, a place for alcoholics or drug addicts.

and Hospital shall not include the following:

a) a mental institution; an institution confined primarily to the treatment of psychiatric disease including

sub-normally; the psychiatric department of a Hospital;

b) a place for the aged; a rest home; a place for drug addicts or alcoholics;

c) a health hydro or nature cure clinic; a special unit of a hospital used primarily as a place for drug addicts

or alcoholics, or as a nursing, convalescent, rehabilitation, extended-care facility or rest home;

d) any establishment which provides Traditional or Complementary Medicine or Treatment.

Insured Person(s) means the Policyholder, and/or the Spouse and/or the Child(ren) (as the case may be)

named in the Certificate of Insurance, who satisfy the applicable eligibility requirements and with respect to

premium which has been paid.

Journey means any trip undertaken by the Insured Person within the Period of Insurance which is :

i) One Way Journey means a one-way trip made by the Insured Person from Malaysia to a Destination

Overseas, and shall commence on the later of the following:

- 12.00 a.m. on the commencement of the Period of Insurance; or

- the time the Insured Person leaves his/her Home or usual place of employment in Malaysia to proceed

directly to the place of embarkation in Malaysia to commence the trip;

and shall terminate on the earlier of the following :

- 11.59 p.m. on the expiry date of the Period of Insurance; or

- the time the Insured Person leaves the airport in the Destination country.

ii) Return Journey means a return trip made by the Insured Person from Malaysia to a Destination

(Overseas or Domestic) and back, and shall commence on the later of the following:

- 12.00 a.m. on the commencement of the Period of Insurance; or

- twenty-four (24) hours prior to the Insured Person’s scheduled departure time from Malaysia provided the

Insured Person is in direct transit between his/her Home and the Overseas departure point in Malaysia; or

- from the time the Insured Person leaves his/her Home or usual place of employment in Malaysia (excluding

daily commute to and from the Insured Person’s usual place of employment or work and involves him/her

traveling more than fifty (50) kilometres from his/her Home for at least one (1) paid overnight stay, to

commence the trip;

and shall terminate on the earlier of the following :

- 11.59 p.m. on the expiry date of the Period of Insurance specified in the Certificate of Insurance; or

- twenty-four (24) hours after the Insured Person is cleared to pass through the arrival immigration check-

point in Malaysia solely for the purpose of direct transit to his/her Home or usual place of employment in

Malaysia.

- the time the Insured Person returns to his/her Home or usual place of employment in Malaysia.

Loss of Hearing means total and irrecoverable loss of hearing which is beyond remedy by surgical or other

treatment.

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

10

Loss of Limb means total and irrecoverable functional disablement which is beyond remedy by surgical or

other treatment, or loss by complete and permanent physical severance, of a hand at or above the wrist or a

foot at or above the ankle.

Loss of Sight means the total and irrecoverable loss of all sight in any eye rendering the Insured Person

absolutely blind in that eye and beyond remedy by surgical or other treatment.

Loss of Speech means total and irrecoverable loss of speech which is beyond remedy by surgical or other

treatment.

Medical Expenses means Usual, Reasonable and Customary Medical Expenses necessarily and reasonably

incurred in the medical or surgical treatment of :

a) For Overseas Journey : Bodily Injury or Sickness covered by this Policy ;

b) For Domestic Journey : Bodily Injury covered by this Policy.

Mountaineering or Trekking means the ascent or descent of a mountain (including mountain trekking)

3,000 meters above sea level ordinarily necessitating the use of specified equipment including but not limited

to crampons, pickaxes, anchors, bolts, carabineers and lead-rope or top-rope anchoring equipment, as well as

any form of abseiling or rock climbing activities necessitating the use of ropes and other climbing equipment.

Natural Disasters means extreme weather conditions (including but not limited to typhoons, hurricanes,

cyclones or tornadoes), naturally occurring wildfires, floods, tsunamis, volcanic eruptions, earthquakes,

landslides or other convulsion of nature or by consequences of any of the occurrences mentioned above.

Nominee means a person that the Policyholder has nominated pursuant to Schedule 10 of Financial

Services Act 2013 to receive the Policy Benefits payable under the Certificate of Insurance upon the Accidental

Death or Permanent Total Disablement of the Insured Person.

Nurse means any qualified or trainee nurse or general nurse duly registered pursuant to the laws of the

country in which the nurse is employed.

Overseas means anywhere outside Malaysia, but excluding Cuba.

Period of Insurance means the period during which the Coverage under this Policy is effective, as stated in

the Certificate of Insurance.

Permanent Disablement means disablement that results solely, directly and independently of all other

causes, from Bodily Injury and which occurs within one hundred and eighty (180) consecutives days of the

Accident in which such Bodily Injury was sustained, and:

a) falls into one of the categories listed in the Table of Benefits under Section 1 of Part 7; and

b) is a disablement which, having lasted for a continuous and uninterrupted period of at least twelve (12)

month, is at the expiry of that period, beyond hope of improvement.

Permanent Total Disablement means disablement that result solely, directly and independently of all

other causes, from Bodily Injury which occurs within one hundred and eighty (180) consecutive days of the

Accident in which such Bodily Injury was sustained, which, having lasted for at least twelve (12) consecutive

months, will in all probability, entirely prevents the Insured Person from engaging in gainful employment of

any and every kind for the remainder of his/her life and from which there is no hope of improvement.

Physician means a legally licensed medical practitioner qualified by a medical degree and duly registered to

practice allopathic medicine and who, in rendering treatment, is practicing within the scope of his licensing

and training in the geographical area of practice. Physician shall not include the Insured Person, the Spouse or

any of his/her Family Member.

Policy means this policy wording, with the Benefit Schedule and the Certificate of Insurance, and any other

documents We may issue that We advise will form part of the Policy.

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

11

Policyholder means the person who is named in the Certificate of Insurance as the Policyholder and who

pays the premium to Us in respect of the Insured Person(s).

Pre-existing Condition(s) means any condition which the Insured Person has reasonable knowledge of, in

the twelve (12) months prior to the commencement of the Period of Insurance. The Insured Person is

considered to have reasonable knowledge of a pre-existing condition where the condition is one for which:

a) he/she has received or are receiving medical treatment, diagnosis, consultation or prescribed drugs, or

b) medical advice, diagnosis, care or treatment was recommended by a Physician, or

c) clear and distinct symptoms are or were evident, or

d) its existence would have been apparent to a reasonable person in the circumstances.

Riot means the act of any person taking part together with others in any disturbance of the public peace

(whether in connection with a strike or lock-out or not) or the action of any lawfully constituted governmental

authority in suppressing or attempting to suppress any such disturbance or in minimizing the consequences

of such disturbance.

Scheduled Departure Date means the date on which the Insured Person is scheduled to depart on a

Journey as set out in the travel itinerary or travel ticket.

Serious Bodily Injury or Serious Sickness means:

a) For Overseas Journey: Bodily Injury or Sickness which causes the Insured Person to be Confined in a

Hospital Overseas for more than five (5) consecutive days and certified in writing by a Physician.

b) For Domestic Journey: Serious Bodily Injury means Bodily Injury which causes the Insured Person to be

Confined in a Hospital within Malaysia for more than five (5) consecutive days and certified in writing by a

Physician.

For the avoidance of doubt, Serious Sickness shall exclude any illness arising from COVID-19.

Sickness means physical condition marked by a pathological deviation from the normal healthy state as

verified by a Physician which requires immediate treatment by a Physician and which is not a Bodily Injury.

For an Overseas Journey, this condition must be contracted or manifested whilst Overseas during the

Overseas Journey. For the avoidance of doubt, Sickness shall exclude any illness arising from COVID-19.

Single Trip Policy means a policy issued for the selected plan where the Insured Person can only make and

will only be covered under this Policy for a single Journey to the selected Zone of travel during the Period of

Insurance.

Spouse means the legal spouse, as recognized under applicable Malaysian laws. For the purpose of this

Policy, a Common Law marriage is not considered a legal marriage.

Strike means the willful act of any striker or locked-out worker done in furtherance of a strike or in resistance

to a lock-out; or the action of any lawfully constituted authority in preventing or attempting to prevent any

such act or in minimizing the consequences of any such act.

Temporary Medical & Quarantine Facility means any government temporary facility established to

confine, isolate, hold or treat individuals diagnosed with COVID-19.

Traditional or Complementary Medicine or Treatment means any medicine or treatment provided by

religious medical practice, homeopathy, chiropractic, osteopathy and/or any other alternative traditional or

complementary medicine or treatment.

Travel Companion means a person who has travel bookings to accompany the Insured Person on the entire

Journey. A Travel Companion must be a person who is separately insured under a leisure travel insurance

policy underwritten by Us for the same Journey.

Traditional Physician means a legally licensed traditional medicine practitioner (including an

acupuncturist or bonesetter) duly registered and practising within the scope of his licensing and training in

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

12

the geographical area of practice. Traditional Physician shall not include the Insured Person, the Spouse or

any of his/her Family Member.

Usual, Reasonable and Customary Medical Expenses means charges for treatment, supplies or

medical services medically necessary to treat the Insured Person’s condition, does not exceed the usual level of

charges for similar treatment, supplies or medical services in the locality where the expense is incurred and

does not include charges that would not have been made if no insurance existed.

We/Our/Us means Chubb Insurance Malaysia Berhad, Registration Number : 197001000564 (9827-A).

You/Your means the applicable Insured Person.

Zone means:

Zone 1: Australia, Bangladesh, Brunei, Cambodia, China (excluding Tibet and Mongolia), Hong Kong SAR,

India, Indonesia, Japan, Korea, Laos, Macau SAR, Maldives, Myanmar, New Zealand, Pakistan, Philippines,

Singapore, Sri Lanka, Taiwan, Thailand, Vietnam.

Zone 2 : Worldwide including Zone 1 (excluding USA, Canada, Middle East, Nepal, Tibet, Mongolia & Cuba)

Zone 3 : Worldwide (excluding Cuba)

Domestic : Within Malaysia and travelling more than 50km from place of residence.

Part 2 – Eligibility

1. To be eligible for cover under this Policy for Overseas Journeys:

a) The Insured Person and/or his/her Spouse (where Family Plan is chosen) must be a Malaysian,

Malaysian Permanent Resident, or holder of a valid (issued by the authorities in Malaysia) work

permit, employment pass, dependent pass, long-term social visit pass, or student pass, and be at least

eighteen (18) years of age on the commencement of the Period of Insurance and/or upon renewal;

b) the Child(ren) (where Family Plan is chosen), must be:

i) a Malaysian, Malaysian Permanent Resident, or holder of a valid (issued by the authorities in

Malaysia) dependent pass or student pass;

ii) at least thirty (30) days of age and not more than eighteen (18) years old (or twenty-three (23)

years old if studying full-time in a recognized tertiary institution) on the commencement of

the Period of Insurance;

iii) unmarried; and

iv) unemployed.

2. To be eligible for cover under this Policy for Domestic Journeys:

a) The Insured Person and/or his/her Spouse (where Family Plan is chosen) must be a Malaysian,

Malaysian Permanent Resident, or holder of a valid (issued by the authorities in Malaysia) work

permit, employment pass, dependent pass, long-term social visit pass, or student pass, and be at least

eighteen (18) years of age up to eighty (80) years of age on the commencement of the Period of

Insurance;

b) the Child(ren) (where Family Plan is chosen), must be:

i) a Malaysian, Malaysian Permanent Resident, or holder of a valid (issued by the authorities in

Malaysia) dependent pass or student pass;

ii) at least thirty (30) days of age and not more than eighteen (18) years old (or twenty-three (23)

years old if studying full-time in a recognized tertiary institution) on the commencement of

the Period of Insurance;

iii) unmarried; and

iv) unemployed.

3. In the event that the Insured Person is below the age of eighteen (18) years old when purchasing this

policy, the Insured Person’s parent or Guardian must enter into this contract of insurance with Us on

his/her behalf.

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

13

4. The Insured Person is only allowed to take up One Way Journey insurance if he/she is a student going

Overseas for education or he/she is emigrating.

Part 3 – Scope and Limits Of Cover And Benefits

Section 1 - Commencement of Coverage

1. Single Trip Policy

a) Coverage under Section 11 of Part 7 for Cancellation Expenses is effective upon the issuance of the

Certificate of Insurance and terminates on commencement of the planned Journey from Malaysia (for

Overseas Journey) or from the Insured Person’s Home (for Domestic Journey).

b) Coverage under Section 11 of Part 7 for Postponement Expenses is effective upon the issuance of

Certificate of Insurance and terminates upon postponement of the planned Overseas Journey.

c) Coverage under Section 36 of Part 7 for Travel Cancellation due to COVID-19 is effective upon the

issuance of the Certificate of Insurance or within fifteen (15) days prior to the Scheduled Departure

Date, whichever is later and shall cease on the commencement of the Journey.

For all other Sections, Coverage commences upon commencement of the planned Journey.

2. Annual Policy

a) Coverage under Section 11 of Part 7 for Cancellation Expenses is effective upon the date and time You

confirmed the booking for the Journey (Overseas or Domestic).

Section 2 - Limits Of Coverage

1. All the Coverages under this Policy shall terminate automatically on the earliest of the following events:

i) Upon the expiry of any Period of Insurance;

ii) Upon the Policyholder ceasing to satisfy any of the eligibility requirements set out herein;

iii) Upon the Policyholder’s death;

iv) Upon the Insured Person’s return to Malaysia (for Overseas Journey) or the Insured Person’s Home

(for Domestic Journey).

2. All the Coverages under this Policy shall terminate automatically for the Spouse and/or the Child(ren) on

the earliest of the following events:

i) Upon the Spouse and/or the Child(ren) ceasing to satisfy any of the eligibility requirements set out

herein;

ii) Upon the Spouse and/or the Child(ren)’s death.

3. In the event the Insured Person’s Coverage under this Policy is terminated under Clause 1 above, the

entire Policy and Coverage for all other Insured Persons, the Spouse and/or Child(ren) in the same

Certificate of Insurance (if any) will terminate automatically.

4. Unless otherwise provided in an appropriate endorsement, the Insured Person, the Spouse and/or the

Child(ren) shall only be covered:

a) if this Policy is an Annual Policy:

i) For Overseas Journey : for the first ninety (90) consecutive days of any Journey, and We shall not

be liable in respect of any loss occurring after 12.00 a.m. on the ninety first (91st) day after

commencement of any Journey, or termination of the Coverage under Clause 1 above, whichever

is earlier;

ii) For Domestic Journey : for the first thirty (30) consecutive days of any Journey, and We shall not

be liable in respect of any loss occurring after 12.00 a.m. on the thirty first (31st) day after

commencement of any Journey, or termination of the Coverage under Clause 1 above, whichever

is earlier;

b) if this Policy is a Single Trip Policy:

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

14

i) For Overseas Journey : for the first one hundred and eighty-three (183) consecutive days of any

Journey, and We shall not be liable in respect of any loss occurring after 12.00 a.m. on the one

hundred and eighty fourth (184th) day after commencement of any Journey, or termination of the

Coverage under Clause 1 above, whichever is earlier;

ii) For Domestic Journey : for the first thirty (30) consecutive days of any Journey, and We shall not

be liable in respect of any loss occurring after 12.00 a.m. on the thirty first (31st) day after

commencement of any Journey, or termination of the Coverage under Clause 1 above, whichever

is earlier;

5. The scope of Coverage and Benefits under this Policy shall be limited to the Zone stated in the Certificate of

Insurance where the countries included in the Zone is stated under the definition.

Section 3 - Optional Add-on Benefits

Optional Add-on benefits available to include cover which are excluded in the core plans.

If the Insured Person’s Journey includes any of the following, the Policy will only respond to claims arising

from the cover where the Insured Person has purchased the relevant optional add-on benefits as stated on the

Certificate of Insurance :

a) Cruise Pack: If the Insured Person is going on a Cruise during the Journey, the Insured Person will need

to select this benefit pack to include cover for all claims related to the Cruise.

b) Annual Domestic cover: This cover can only be selected if the Insured Person has purchased the Annual

Policy for Overseas Journey. The conditions applicable to Annual Policy under Part 5 Section 1 of this

policy shall apply to this Annual Domestic Cover Add-on Benefit.

Section 4 – Automatic Policy Extension

1. In the event that the Insured Person, as a ticket holding passenger on a scheduled Common Carrier, is

being prevented from completing the return leg of a Return Journey within the Period of Insurance, as a

result of:

a) his/her Critical Medical Condition; or

b) the scheduled Common Carrier in which the Insured Person is traveling being unavoidably delayed

due to Strike or industrial actions, adverse weather conditions or mechanical

breakdown/derangement of the Common Carrier or due to grounding of an aircraft as a result of

mechanical or structural defect;

the Period of Insurance shall be automatically extended for up to a period of:

a) fourteen (14) days without additional premium for Overseas Journey;

b) seven (7) days without additional premium for Domestic Journey.

2. In the event that the Insured Person and the Travel Companion are being prevented from completing the

return leg of a Return Journey within the Period of Insurance as a result of him/her being Confined in:

a) for Overseas Journey - Hospital Overseas at the expiry of the Policy whilst during the Journey, the

Period of Insurance shall be automatically extended for up to thirty (30) days without additional

premium;

b) for Domestic Journey - Hospital within Malaysia at the expiry of the Policy whilst during the Journey,

the Period of Insurance shall be automatically extended for up to seven (7) days without additional

premium.

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

15

Part 4 – General Exclusions

This Policy does not cover, and We will not in any event be liable to pay any claims arising directly or

indirectly from, caused by, a consequence of, arising in connection with or contributed to by any of the

following:

1. Any Pre-existing Conditions or congenital conditions.

2. Any condition, which is or results from or is a complication of infection with Human Deficiency Syndrome

(‘HIV’), any variance including Acquired Immune Deficiency Syndrome (‘AIDS’), and AIDS Related

Complications (‘ARC’), or any opportunistic infections and/or malignant neoplasm (tumor) found in the

presence of HIV, AIDS or ARC.

3. Any condition which is, results from or a complication of pregnancy, childbirth, miscarriage (except

miscarriage due to Bodily Injury as direct result of an Accident as covered under Section 3 of Part 7) or

abortion.

4. Any condition which is, results from or a complication of suicide or attempted suicide or intentional self-

injury.

5. Illnesses or disorders of a psychological nature, mental and nervous disorders, including but not limited to

insanity.

6. Any condition which results from or is a complication of any venereal disease.

7. The alcohol content in the blood and/or urine samples exceeding the limit permitted by law of the country

in which the Bodily Injury occurred or drugs not prescribed by a Physician and not for treatment of drug

addiction.

8. Declared or undeclared war or any act of war, invasion, act of foreign enemy, hostilities, civil war,

rebellion, revolution, insurrection, military or usurped power.

9. Loss, destruction or damage to any property whatsoever or any loss or expense whatsoever arising there

from or any consequential loss directly or indirectly caused or contributed to or arising from ionizing

radiations or contamination by radio-activity from any nuclear fuel or from any nuclear waste from the

combustion of nuclear fuel.

10. Any willful or intentional acts of the Insured Person whether sane or insane, self-inflicted injury, suicide

pacts or agreements or any attempts thereat, provoked homicide or assault.

11. The Insured Person acting as a law enforcement officer, emergency medical or fire service personnel, civil

defense personnel or military personnel of any country or international authority, whether full-time

service or as a volunteer.

12. The Insured Person engaging in aviation, other than as a fare-paying passenger in, boarding and alighting

from any fixed-wing aircraft provided and operated by a regularly scheduled airline or private

unscheduled air chartered company which is duly licensed for the regular transportation of fare-paying

passengers or in a helicopter provided and operated by an airline which is duly licensed for the regular

transportation of fare-paying passengers, provided such helicopter is operated only between established

commercial airports and/or licensed heliports.

13. Illegal acts (or omissions) by the Insured Person or his/her executors, administrators, legal heirs or

personal representatives.

14. Loss resulting directly or directly from action taken by any government authorities including confiscation,

seizure, destruction and restriction.

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

16

15. Any loss or expenses which is, directly or indirectly, caused by, a consequence of, arises in connection with

or is contributed to by the Insured Person undertaking any Journey against the advice of a Physician or for

the purpose of seeking medical attention.

16. Any prohibition or breach of government regulation or any failure by the Insured Person to take

reasonable precautions to avoid a claim under this Policy following the warning of any intended Strike,

Riot or Civil Commotion through or by general mass media.

17. The Insured Person not taking all reasonable efforts to safeguard his/her property or to avoid any injury

or minimize any claim under the Policy.

18. Whilst engaging in naval, military or air force service or operation or testing of any kind of conveyance or

being employed as a manual worker or whilst engaging in offshore activities like diving, oil-rigging,

mining or aerial photography or handling of explosive or loss of or damage to hired or leased equipment,

overseas secondment as part of the Insured Person’s occupation, working holiday makers visa, Return

Journey for student studying overseas (full period or short period).

19. Any loss or expenses which arises in connection with or is contributed by the Insured Person undertaking

any Journey against the travel advice of the Ministry of Foreign Affair of Malaysia or the Ministry of

Health of Malaysia, in relation to actual or threatened Riot, Strike or Civil Commotion, war or warlike

situation, outbreak of disease or unsafe health conditions, or impending Natural Disasters, to the country

or territory of the Insured Person’s Destination, unless the Journey had already commenced prior to the

issuance of the travel advice. This shall not apply in respect of travel advice based solely on the COVID-19

(or any mutation or variation thereof or any related strain) and/or it’s outbreak.

20. Any Communicable Disease Outbreak or any fear or threat of a Communicable Disease Outbreak unless

expressly included at the date of inception or renewal of this Policy.

21. The Insured Person not being Fully Vaccinated against COVID-19.

22. Consequential loss or damage of any kind.

23. Any losses caused by terrorist attacks by nuclear, chemical and/or biological substances.

24. The Insured Person’s direct participation in any Act of Terrorism.

25. The Insured Person riding/driving without a valid driving license.

26. We will not (under any Sections) pay for claims arising directly or indirectly from any losses or expenses

with respect to Cuba.

27. The Insured Person participating or engaging in :

a) Extreme Sports and Sporting Activities ;

b) Practicing for, taking part in or training in any speed contest or racing, any professional competitions

or sports or any sports in which You would earn or could earn or receive remuneration, sponsorships,

donations or any form of financial rewards ;

c) Racing, other than on foot but this does not include ultra-marathons, biathlons or triathlons ;

d) Off-piste skiing, ski-jumping, ski-bob racing, skiing off-trail, free-style skiing, and use of bob sleighs ;

e) Mountaineering or Trekking ;

f) Scuba diving unless the Insured Person holds a PADI certification (or similar recognized qualification)

or when diving with a qualified instructor. In these situations, the maximum depth that this Policy

covers is specified under his/her PADI certification (or similar qualification) but no deeper than thirty

(30) metres and the Insured Person must not be diving alone ;

g) Private hunting trips ;

h) Winter sports : snowboarding, snow tubing, snow rafting, snow mobiling, glacier walking with a

qualified guide ;

i) Biking sports : mountain biking, quad biking, expedition bicycle or motor touring, motor biking ;

j) 4-wheel driving adventures.

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

17

28. For Domestic Journey : Sickness, illness, diseases or any bacterial infection other than bacterial infection

that is the direct result of accidental cut or wound.

Part 4.1 Sanctions Exclusion Applicable to this Policy

This insurance does not apply to the extent that trade or economic sanctions or other laws or regulations

prohibit us from providing insurance, including, but not limited to, the payment of claims. All other terms

and conditions of the policy remain unchanged.

Chubb Insurance Malaysia Berhad is a subsidiary/branch of a US company and Chubb Limited, a NYSE listed

company. Consequently, Chubb Insurance Malaysia Berhad is subject to certain US laws and regulations in

addition to EU, UN and Malaysia sanctions restrictions which may prohibit it from providing cover or paying

claims to certain individuals or entities or insuring certain types of activities related to certain countries such

as Cuba.

Part 5 – Special Conditions

Section 1 – Conditions Applicable To Annual Policy Only

1. Cancellation By Us

a) We may cancel this Policy at any time by giving fourteen (14) days’ notice in writing delivered to the

Policyholder or mailed to the Policyholder’s last address as shown in Our records stating when thereafter such

cancellation shall be effective.

b) We may cancel the Insured Person’s Coverage under this Policy at any time by giving fourteen (14) days’

notice in writing delivered to the Policyholder who has purchased the Coverage or mailed to the Policyholder’s

last address as shown in Our records, provided no claim has arisen during the current Period of Insurance. In

the event of such cancellation, We will return the pro-rata portion of any premium paid.

There will be no refund if a claim has been made during the Period of Insurance.

Such cancellation shall be without prejudice to any event giving rise to a claim under this Policy prior to the

cancellation date. In the event of any such claim, We shall be entitled to recover all premiums refunded and

set-off such amounts from any claim payable by Us.

2. Cancellation By the Policyholder

a) The Policyholder may cancel this Policy at any time by giving fourteen (14) days’ notice in writing delivered

to Us. In the event of such cancellation, and provided no claim has arisen during the current Period of

Insurance, We will provide a refund to the Policyholder who has purchased the Coverage, computed in

accordance with the applicable percentage indicated below.

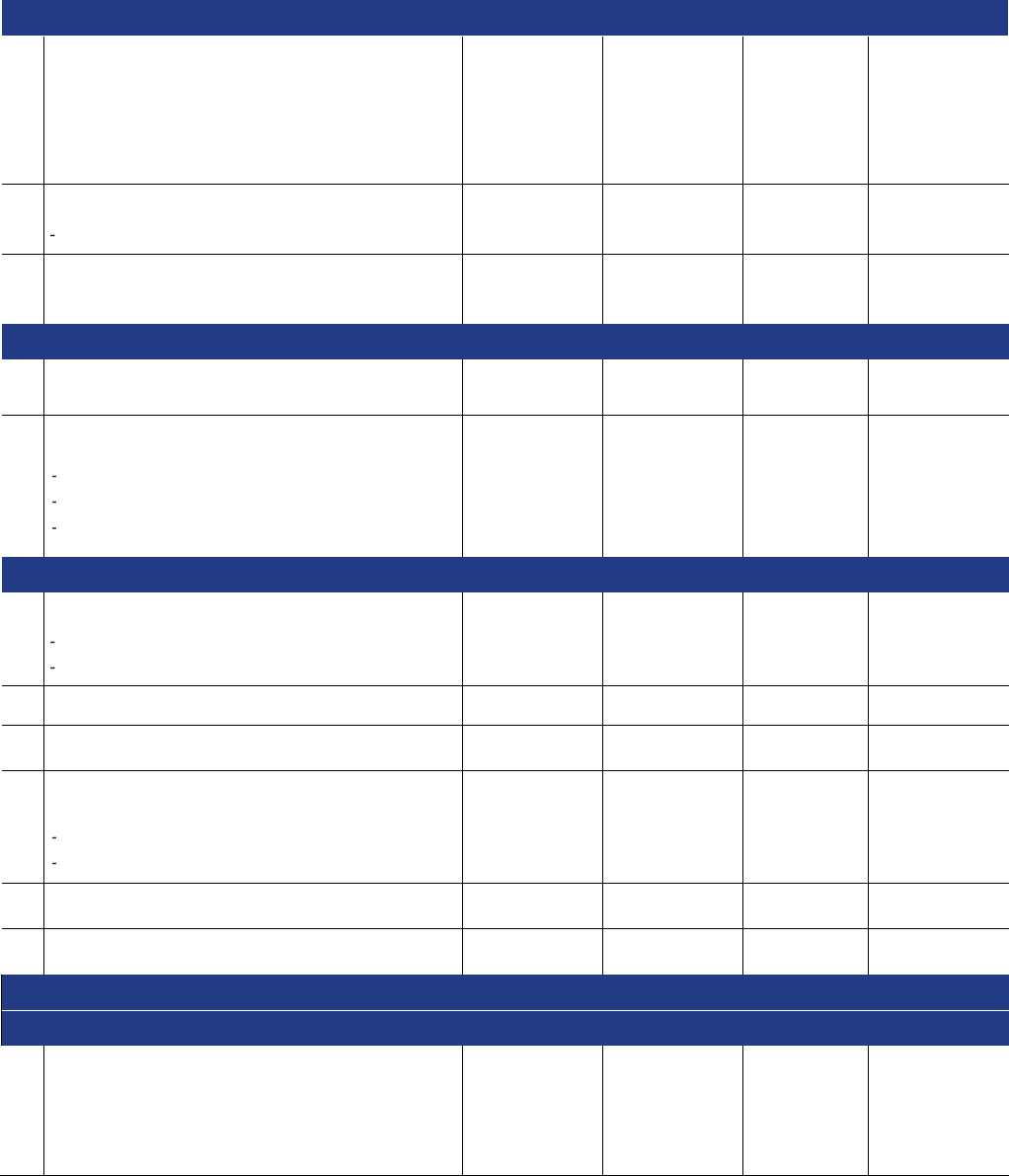

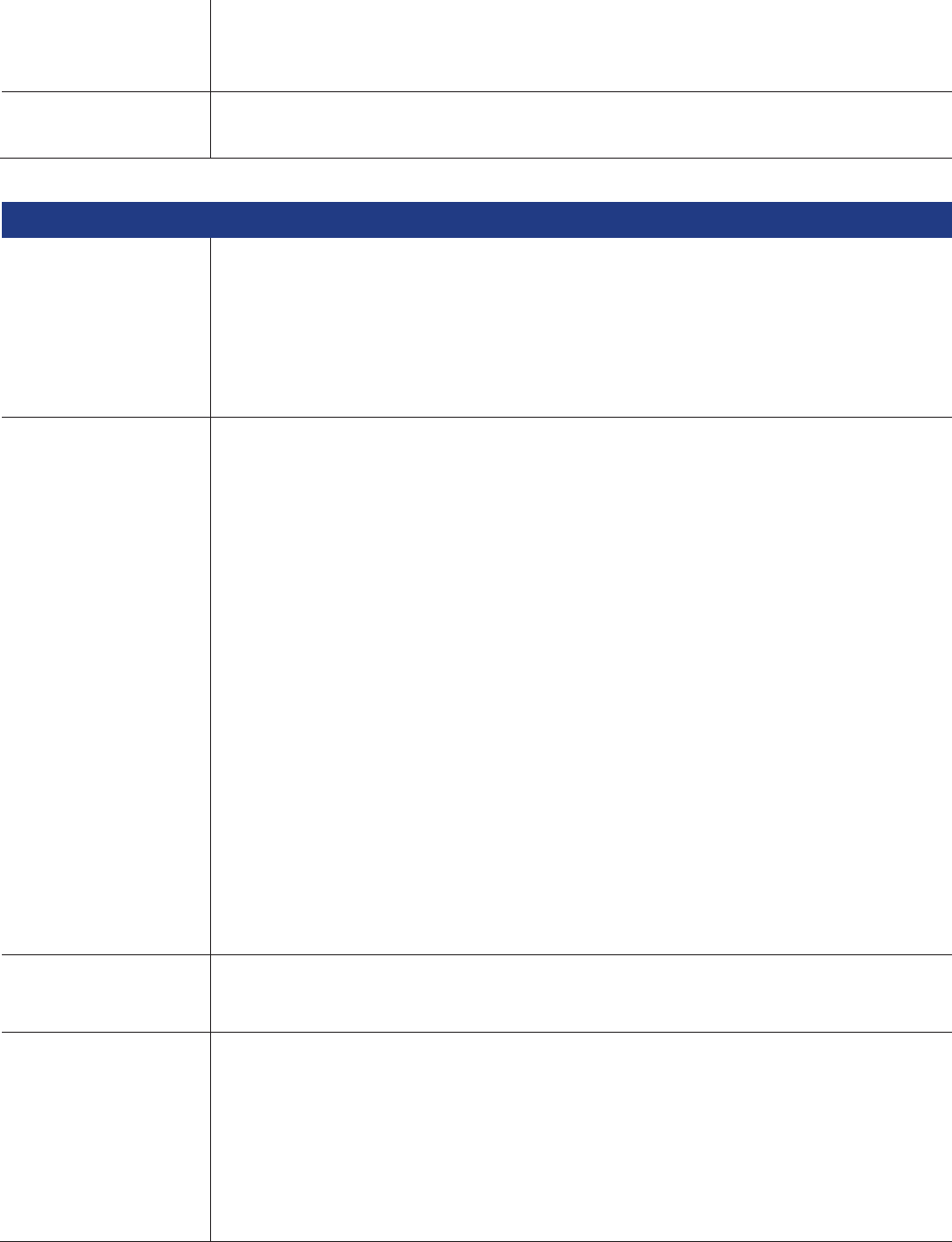

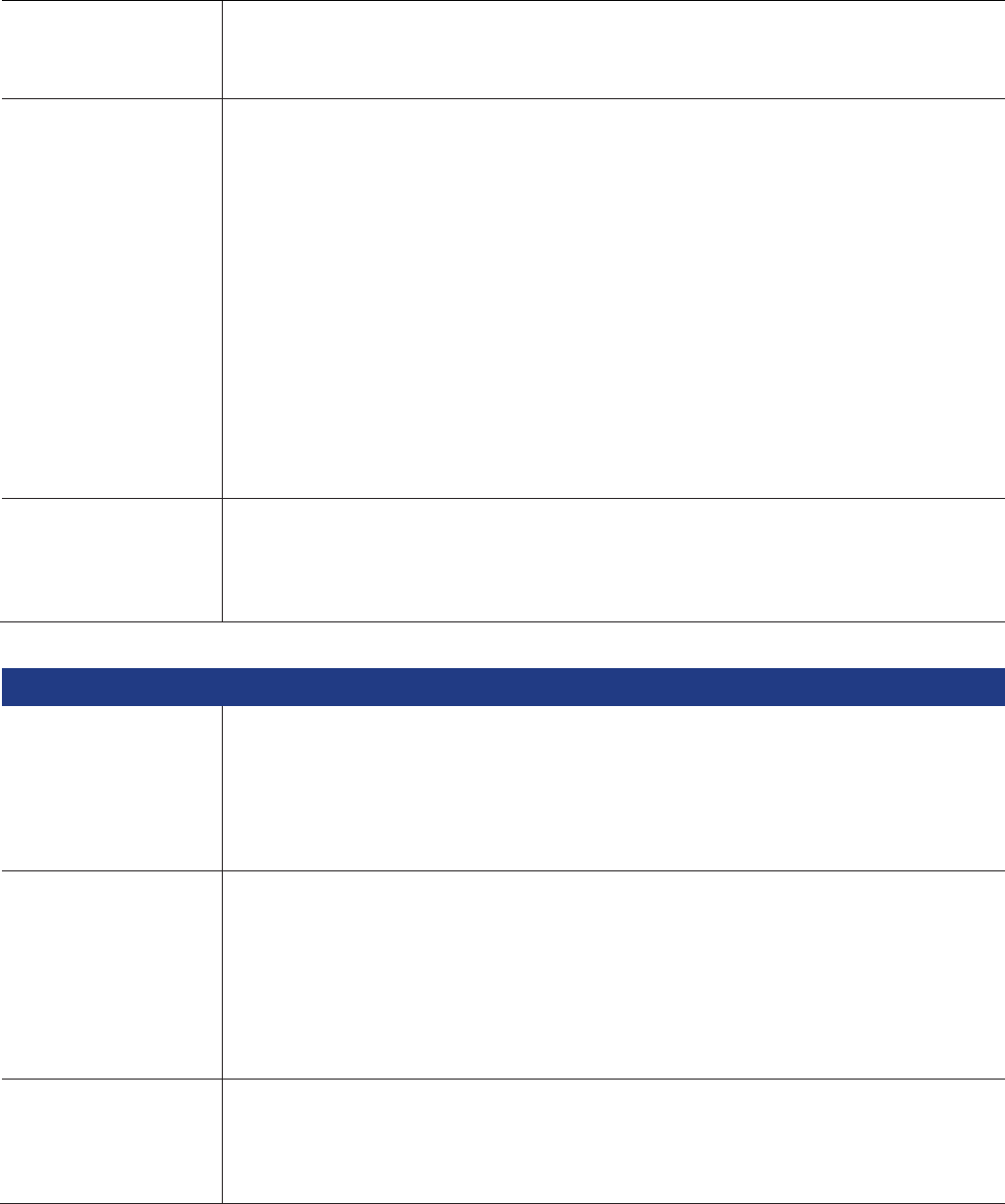

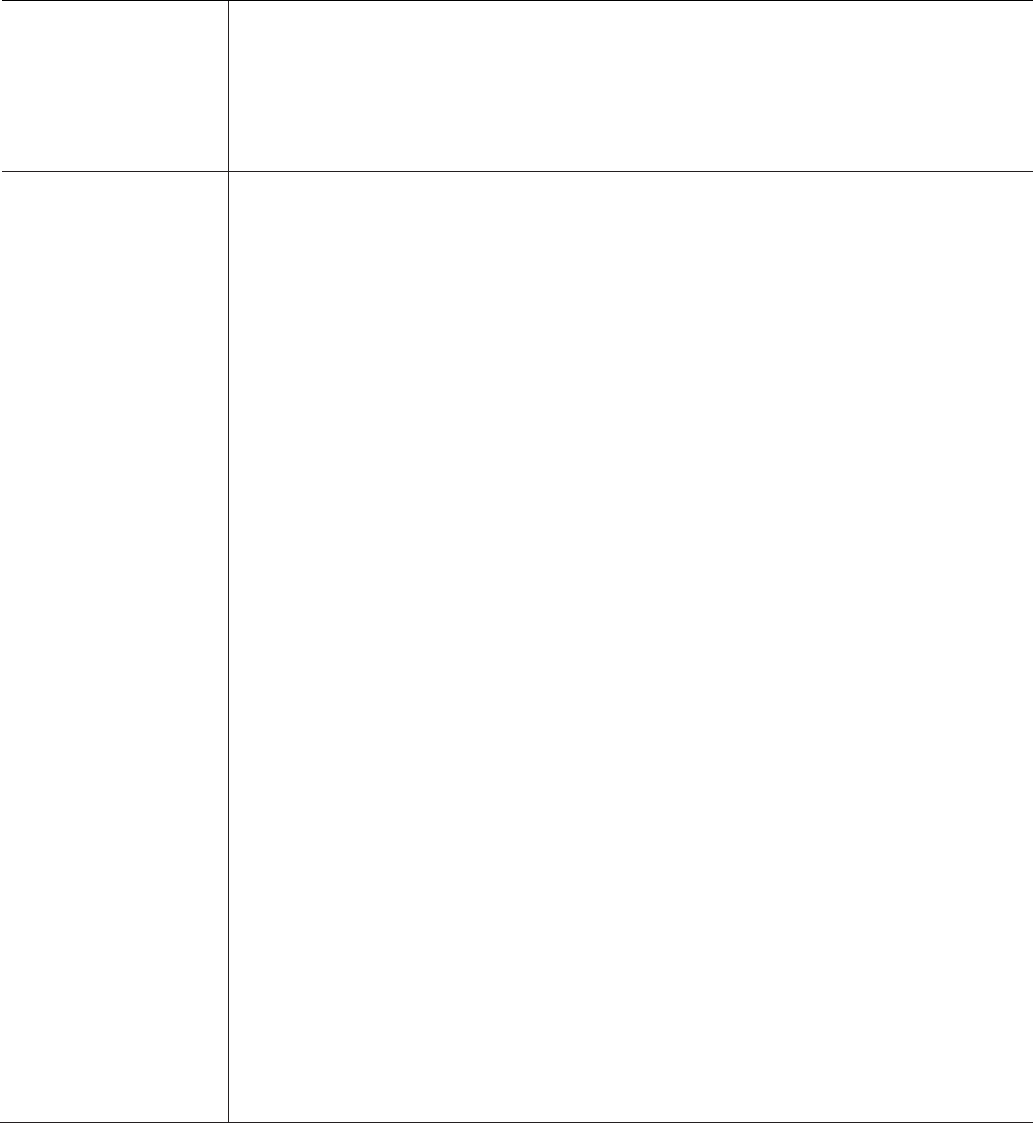

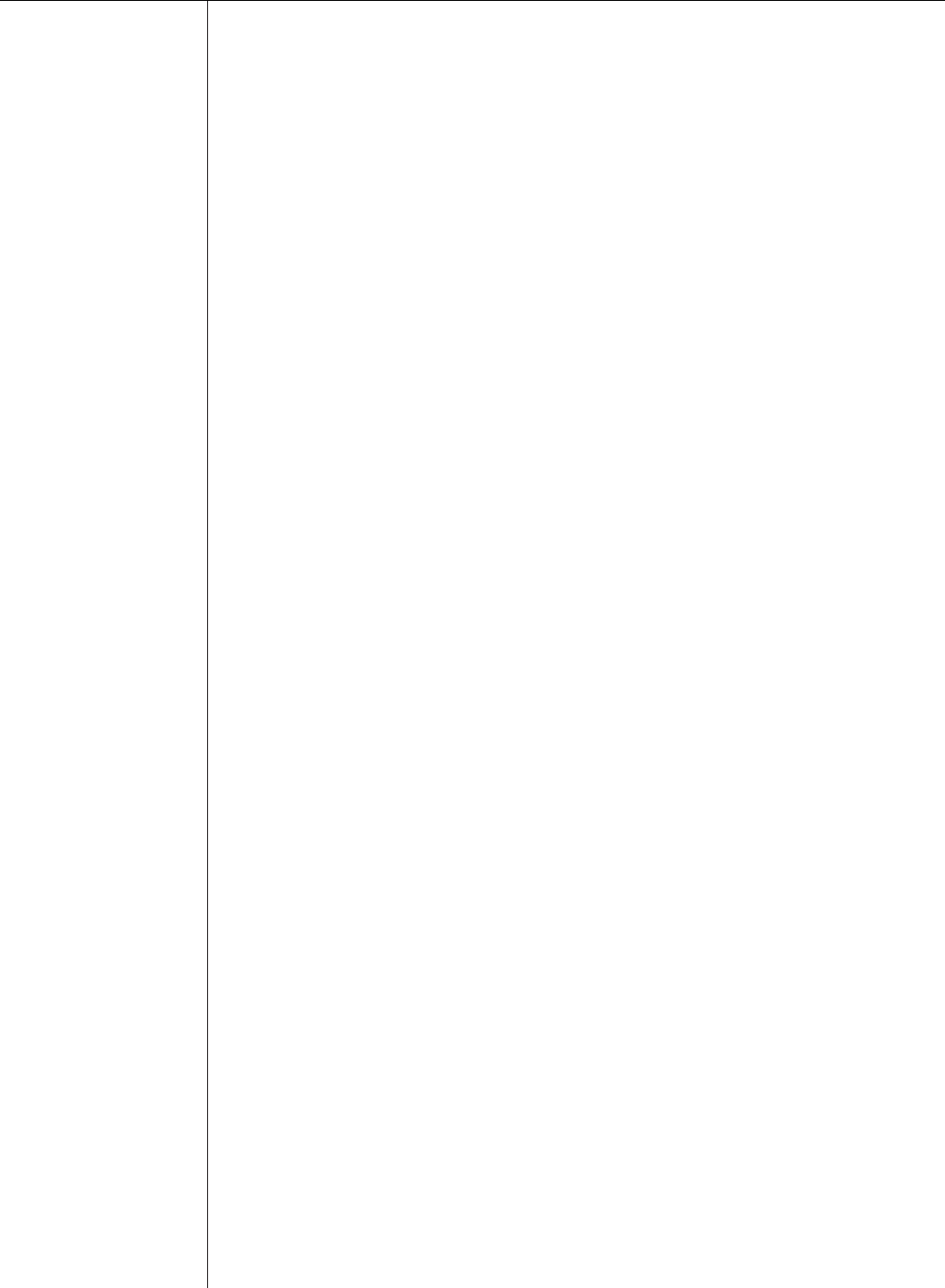

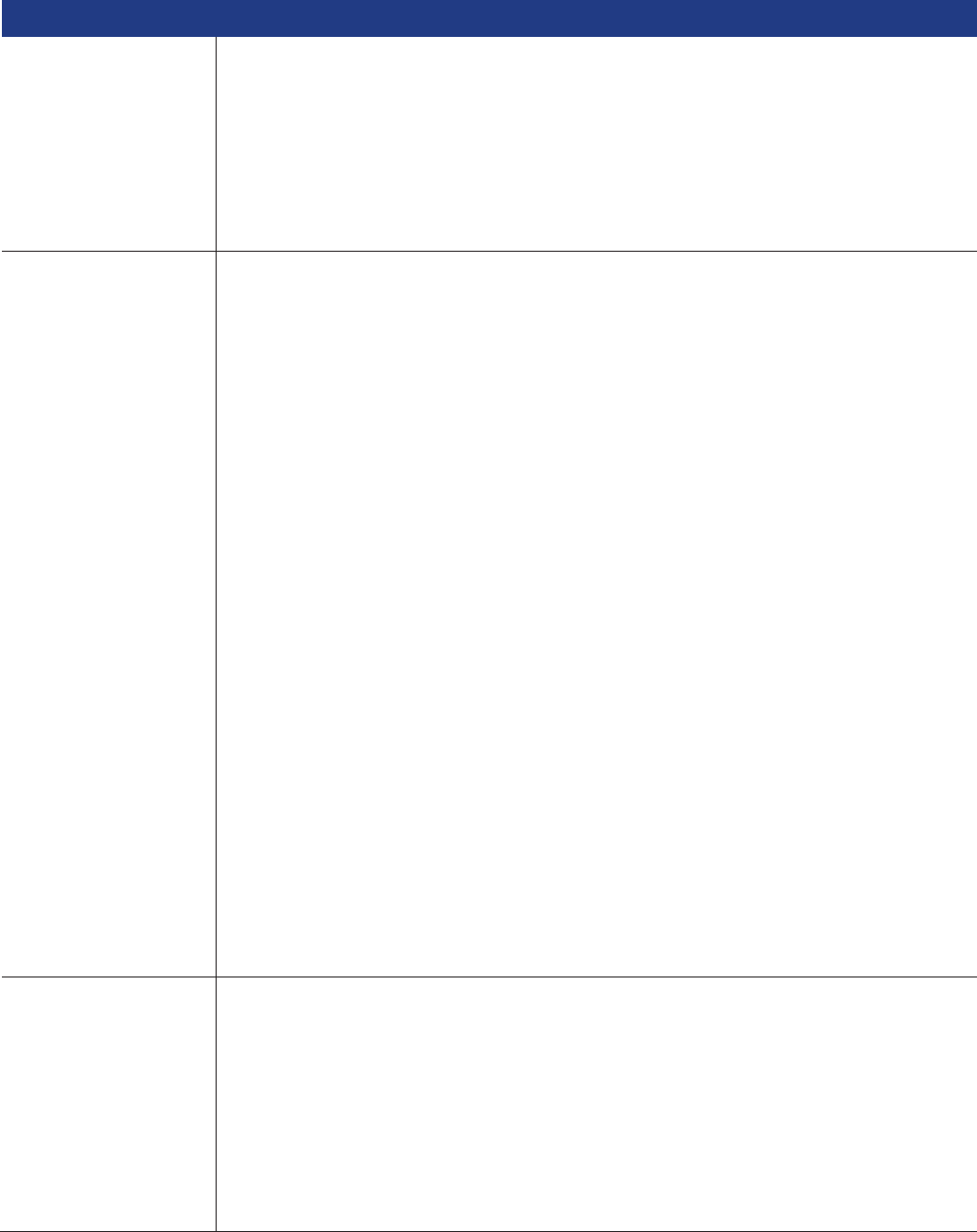

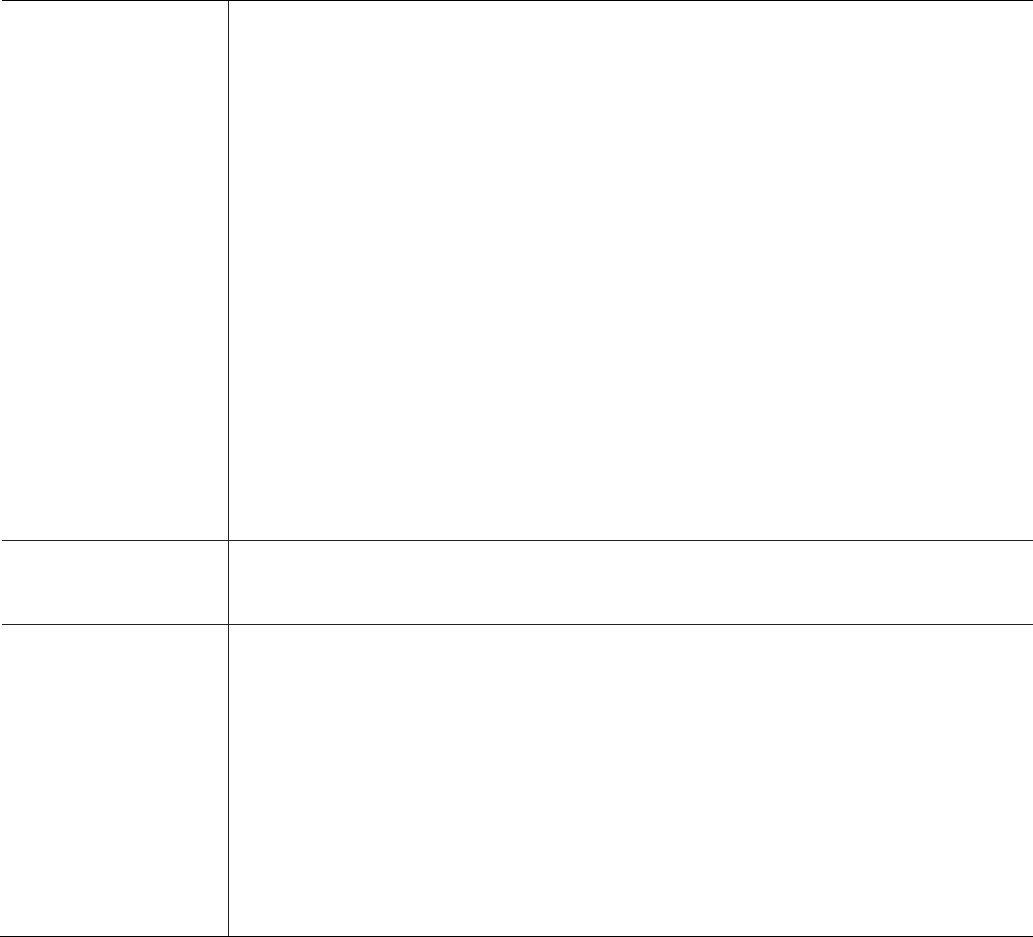

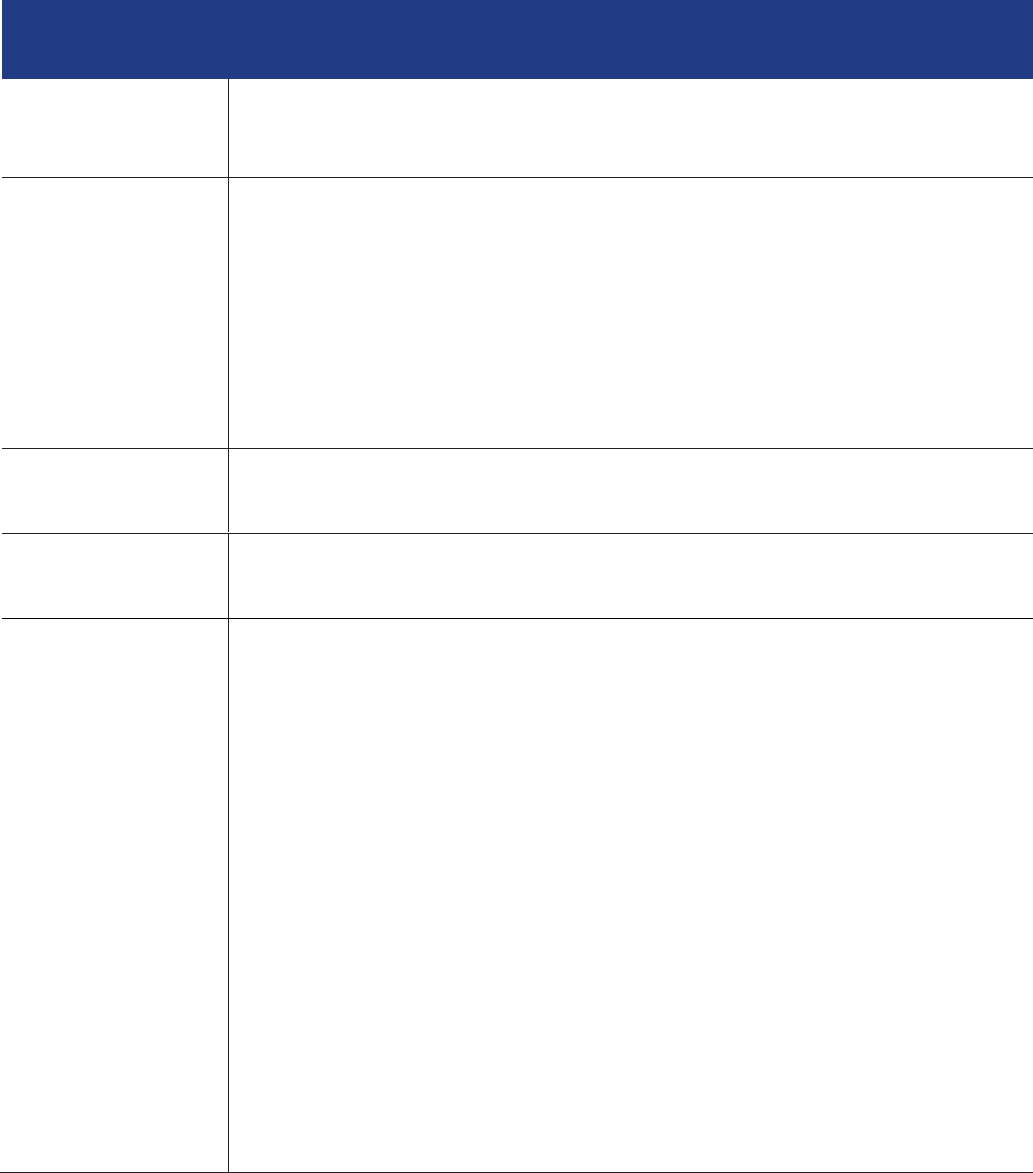

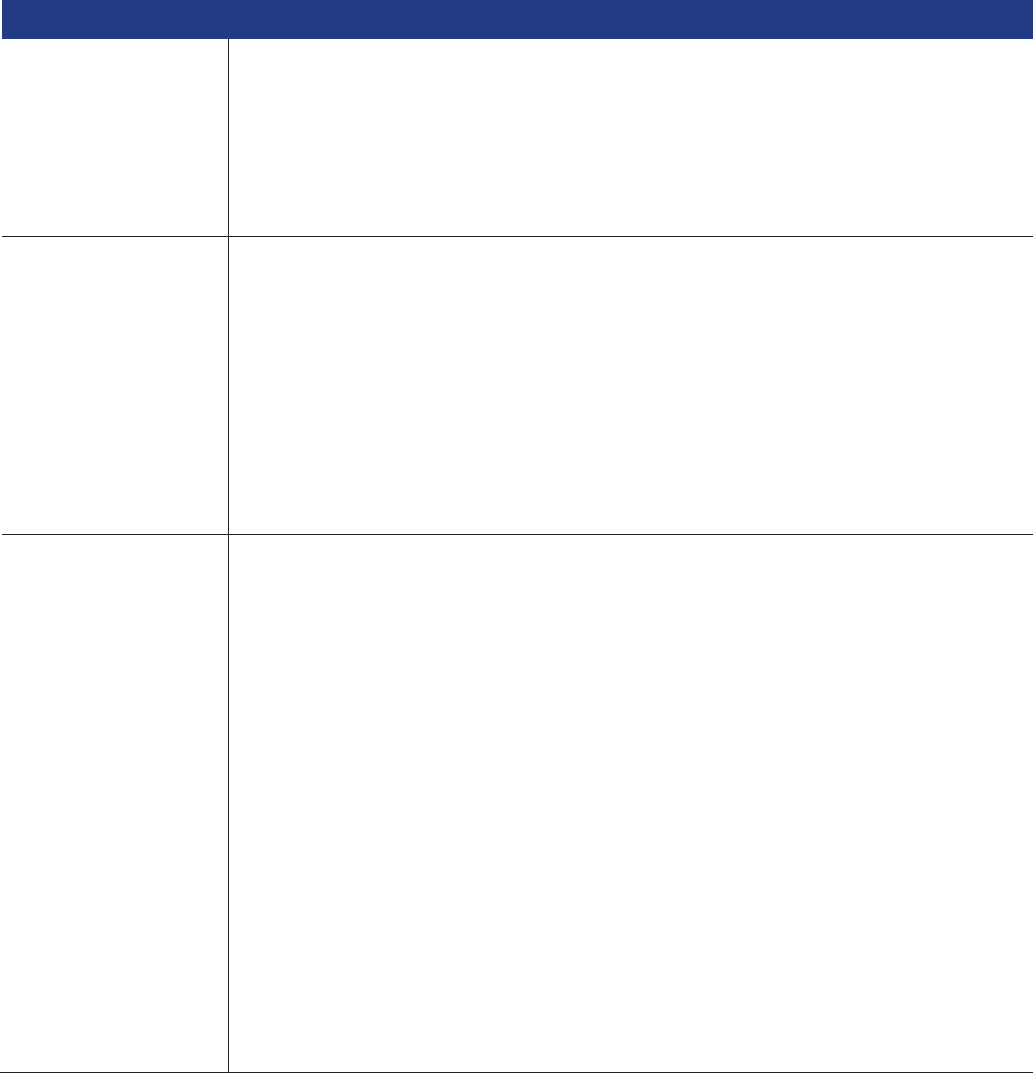

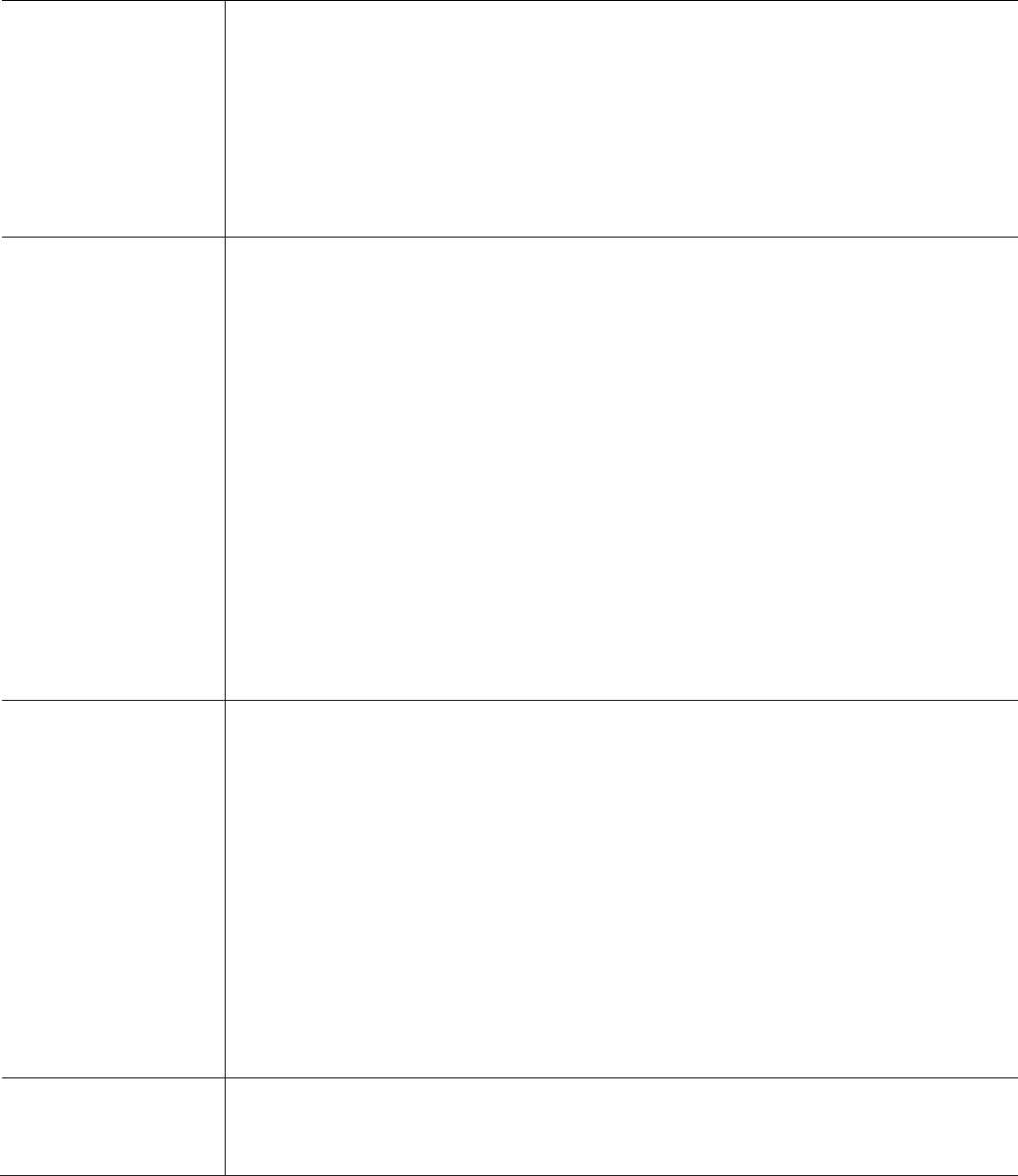

Policy Period in Force (up to)

Refund of Annual Premium

2 Months (Minimum)

60%

3 Months

50%

4 Months

40%

5 Months

30%

6 Months

25%

Period exceeding 6 Months

No refund

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

18

3. Addition Of Insured Person

No person shall be covered by this Policy unless such person is specifically named as an Insured Person and

evidenced by a written endorsement to this Policy. Additional premium will be charged for each additional

Insured Person included under this Policy after the commencement of the Period of Insurance or at the time

of renewal of this Policy.

4. Renewal

Subject to the terms and conditions of this Policy, the Coverage under the Policy may be renewed by payment

of premium in advance or in accordance to the Payment Before Cover Warranty as applicable at our premium

rate in force at the time of renewal. To avoid doubt, the Coverage(s) for the Spouse and/or Child(ren) shall

terminate and cease to be renewable upon non-fulfilment of the eligibility requirements stated in Part 2

above.

5. Age Limit Eligibility

Further to the eligibility requirements stated in Part 2 above, for Annual Policy, the age eligibility for the

Insured Person to qualify for cover is between age eighteen (18) years old and seventy (70) years old at the

time the Insured Person applies for this insurance, with policy renewal up to the age of eighty (80) years old

for the Insured Person and/or the Spouse only. To avoid doubt, the Coverage(s) for the Spouse and/or

Child(ren) shall terminate and cease to be renewable upon non-fulfilment of the eligibility requirements

stated in Part 2 above.

Section 2 – Extension and Expansion of Coverage

Subject to Our prior written approval, the Insured Person may at any time, during the Period of Insurance and

prior to commencement of any Journey, obtain an expansion of the geographical coverage from “Zone 1” to

“Zone 2” or “Zone 3”, or from “Zone 2” to “Zone 3”, by notifying Us of the desired change and paying the

appropriate additional premium.

If, whilst the Insured Person is on a Journey and due to unforeseen circumstances require an extension of the

Period of Insurance, We may at Our discretion, either approve or reject the Insured Person’s request. Any

such approval must be in writing. If We approve and agree to extend the Period of Insurance, Our approval

shall be subjected to an additional premium and the Insured Person’s confirmation that there is no known

claim/event which may give rise to a potential claim under this Policy prior to the said request. We will also

not be liable for any claim arising from, or in connection with any loss/event that had occurred prior to the

extension of Period of Insurance.

If We approve, an endorsement noting the change in Period of Insurance and/or geographical coverage shall

be issued to the Insured Person.

Section 3 – Conditions Applicable To Single Policy Only

a) We may cancel the Coverage under this Policy at any time by giving the Policyholder fourteen (14) days’

notice in writing delivered to him/her or mailed to the his/her last address as shown in Our records, if the

Insured Person has breached any laws or the terms and conditions of this Policy. In the event of such

cancellation, We will provide refund of premium without interest, and provided no claim has arisen during

the Period of Insurance.

b) The Policyholder may cancel the Coverage under this Policy at any time by giving written notice to Us. In

the event of such cancellation, We will provide refund of premium without interest to the Policyholder who

has purchased the Coverage, provided the Period of Insurance stated on the Certificate of Insurance has not

commenced and no claim has arisen.

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

19

Part 6 – General Conditions

1. Payment Before Cover Warranty

It is hereby agreed and declared that the total premium due must be paid and actually received in full by Us

(or the intermediary through whom the Coverage was effected) on or before the commencement date of the

Coverage under the Policy, renewal certificate, Certificate of Insurance, or endorsement.

In the event that the total premium due is not paid and actually received in full by Us (or the intermediary

through whom the Coverage was effected) on or before the commencement date referred to above, then the

Coverage, renewal certificate, Certificate of Insurance and endorsement shall not attach and no benefits

whatsoever shall be payable by Us. Any payment received thereafter shall be of no effect whatsoever as cover

never attached on the Policy, renewal certificate, Certificate of Insurance or endorsement.

2. Entire Contract, Changes

This Policy, the Certificate of Insurance, the Benefit Schedule, and any amendments or endorsements shall

constitute the entire contract of insurance. No change to the terms and conditions of this Policy shall be valid

unless approved in writing by Our authorized representative and such approval shall be endorsed hereon or

attached hereto. No broker or agent has the authority to amend or to waive any of the terms and conditions of

this Policy.

3. Conditions Precedent To Liability

The due observance and fulfilment of the terms, provisions and conditions of this Policy by the Insured

Person and in so far as they relate to anything to be done or complied with by te Insured Person shall be

conditions precedent to Our liability to make any payment under this Policy.

4. Legal Action

No action shall be brought to recover on the Coverage under this Policy prior to the expiration of sixty (60)

days after written proof of claim has been filed in accordance with the provisions of this Policy.

5. Misrepresentation

If the proposal or declaration (whether verbal or written) by the Insured Person is found to be deliberately or

recklessly untrue in any respect or if any material fact affecting the risk has been deliberately or recklessly

incorrectly stated or omitted, or if this insurance, or any renewal thereof shall have been obtained through any

deliberate or reckless misstatement, misrepresentation or suppression, or if any claim made shall be

fraudulent or exaggerated, or if any false declaration or statement shall be made in support of such claim, then

in any of these cases, the Coverages under this Policy, or any affected Certificate of Insurance, shall be void.

6. Your Duty To Us

You must take reasonable care:

a) not to make a misrepresentation to Us when answering any questions We may ask;

b) when renewing this Policy or any Coverage, not to make a misrepresentation to Us in answering any

questions, or confirming or amending any matter previously disclosed to Us in relation to this Policy or

such coverage; and

c) to disclose to Us any matter, other than what We have asked in (a) and (b) above, that You know to be

relevant to Our decision on whether to accept the risk or not and the rates and terms to be applied.

Breach of Your duty as stated above may result in Us avoiding the Policy or affected Certificate of

Insurance and refusing all claims, or the terms of the Policy or affected Certificate of Insurance being

varied, and/or the amount to be paid on a claim being proportionately reduced, depending on the type of

misrepresentation or non-disclosure and the effect of the said misrepresentation or non-disclosure.

You also have a duty to tell Us immediately if at any time after your Coverage has been entered into, varied or

renewed with Us, any of the information You give on Your proposal form or enrolment form is inaccurate or

has changed.

Breach of such duties as stated above may result in Us voiding Your Coverage under the Policy and refusing all

claims, or the amount to be paid on a claim being proportionately reduced, depending on the type of

misrepresentation or non-disclosure and the effect of the said misrepresentation or non-disclosure, in

accordance with Schedule 9 of the Financial Services Act 2013.

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

20

7. Claims Procedure

On the happening of any occurrence likely to give rise to a claim under this Policy, the Claimant must give Us

written notice as soon as possible and, in any event, within thirty (30) days after the date of occurrence to Our

Claims Department, Wisma Chubb, 38 Jalan Sultan Ismail, 50250 Kuala Lumpur.

If the Claimant wishes to make a claim, the Claimant must:

a) complete a claim form (claim forms are available from Us);

b) attach to the claim form:

i) original receipts for any expenses that are being claimed;

ii) any reports that have been obtained from the police, a carrier or other authorities about an Accident,

loss or damage; and

iii) any other documentary evidence required by Us under the Coverage.

c) provide Us with the completed claim form and accompanying documents within thirty (30) days of the loss

taking place which gives rise to a claim; and

d) give Us at the Claimant’s expense all medical and other certificates/ reports/ documents and evidence

required by Us that is reasonably required to assess the claim.

We may have the Insured Person medically examined at Our expense when and as often as We may

reasonably require after a claim has been made. We may also arrange an autopsy if We reasonably require one

and it is not forbidden by law.

8. Payment Of Benefits

Payment of any benefit under this Policy is subject to the Definitions, exclusions, and all other terms and

conditions pertinent to the benefits.

Benefits payable under this Policy shall be paid to the Policyholder who has purchased the Coverage. Benefits

payable under this Policy in respect of any claims by or on behalf of any Spouse and/or Child(ren) insured

hereunder shall be paid to the Policyholder who had purchased the Coverage, provided that such Policyholder

had insurable interest on the life of the Spouse and/or the Child(ren).

Any benefits payable under this Policy in the event of the Insured Person’s Death shall be paid to the Insured

Person’s nominee or to the person We are required to pay under the law, if there is no such nominee.

9. Interpretation

This Policy, including the application, Certificate of Insurance, endorsement, and amendments, if any shall be

read together as one contract and any word or expression to which a specific meaning has been attached shall,

unless the context otherwise requires, bear that specific meaning wherever it may appear.

In the event of any inconsistencies between the Bahasa Malaysia version and the English version of this

Policy, the English version shall prevail.

10. Termination For Non-Payment Of Premium

This Policy or any Certificate of Insurance shall be deemed to have been void from date of issue if the

premium is not paid.

11. Our Right After A Claim

We shall be allowed to conduct in the Insured Person’s name and on the Insured Person’s behalf the defense

or settlement of any legal action and take proceedings at Our own benefit but in the Insured Person’s name to

recover compensation from any third party in respect of anything covered by the Coverage under this Policy.

12. Multiple Policies

The Insured Person can only be covered under one leisure travel insurance policy underwritten by Us for the

same Journey. Any additional leisure travel insurance policies underwritten by Us that is/are taken up by the

Insured Person will be void.

13. Compliance With Policy Provisions

Failure to comply with any of the provisions contained in this Policy shall invalidate all claims hereunder.

14. Contribution

In the event the Insured Person becomes entitled to a refund of or reimbursement of all or part of such

expenses from any other source, or if there is in place any other insurance against the events covered under

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

21

this Policy, We will only be liable for the excess of the amount recoverable from such other source or

insurance.

15. Jurisdiction

All disputes relating to the Coverage under this Policy must be submitted to the exclusive jurisdiction of the

courts in Malaysia.

16. Notice Of Trust Or Assignment And Third Party Rights

We shall not be bound or be affected by any notice of any trust, charge, lien, assignment or other dealing with

or in relation to this Policy.

A person who is not a party to this Policy contract shall have no right to enforce any of its terms.

17. Governing Law

This Policy shall be governed by and interpreted in accordance with Malaysian law.

18. Interest

No amounts payable by Us under this Policy shall carry interest unless provided by law.

19. Currency And Exchange Rate

Premiums and Benefits payable under this Policy shall be in Malaysian Ringgit. In the event reimbursement

of any Benefits under this Policy are based on bills in a currency other than Malaysia Ringgit, We shall pay the

reimbursement in Malaysia Ringgit based on the quoted exchange rate (open market rate if a free market,

official rate if not a free market) at the date the charges are incurred.

20. Clerical Error

A clerical error by Us shall not invalidate insurance otherwise validly in force, nor continue insurance

otherwise not validly in force.

Part 7 – Benefits

We will only pay for one (1) Benefit under the respective Sections below:

a) For Overseas Journey:

i) Section 11 (a) Cancellation Expenses or 11 (b) Postponement Expenses ;

ii) Section 14 or 18 or 27B;

iii) Sections 19 or 20 or 21 or 22 or 23.

b) For Domestic Journey:

i) Section 11 or Section 12;

ii) Sections 14 or Section 18 or Section 27B.

Core Benefits

Section 1 – Accidental Death and Permanent Disablement

What Is Covered

If, during the Period of Insurance, whilst You are on a Journey, You sustain

Bodily Injury which results in Death or Permanent Disablement within one

hundred and eighty (180) days from the date of the Accident.

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

22

Additional

Conditions

The occurrence of Death or any specific Permanent Disablement for which is

payable under this Section shall at once terminate all insurance under the Policy, but

such termination shall be without prejudice to any other claim originating from the

Accident causing such Death or Permanent Disablement.

No payment will be made under any circumstances for more than one of the items

stated in the Table of Benefits above. Where You suffer more than one type of

Permanent Disablement in the same Accident, Our liability under this Section shall

be limited to one payment for the type of Permanent Disablement which, of all the

Permanent Disablement actually suffered, attracts the largest percentage stated in

the Table of Benefits below.

What We Will Pay

We will pay to Your nominee or to the person We are required to pay to under the

law if there is no such nominee, the compensation according to the scale stated in

the Table of Benefits below and up to a maximum relevant Benefit amount specified

in the Benefit Schedule, subject to the terms and conditions of this Policy.

What Is Not

Covered

In addition to Part 4 – General Exclusions, this Policy does not cover, and We will

not in any event be liable in respect of any claim under this Section, which is directly

or indirectly, caused by, a consequence of, arises in connection with or contributed

to by Sickness.

Table of Benefits

Loss Event

Compensation payable % of maximum

sum insured specified in the Benefit

Schedule

Accidental Death

100%

Permanent Total Disablement

100%

Loss of Speech and Loss of Hearing in both ears

100%

Loss of Sight in both eyes

100%

Loss of Limbs to at least two Limbs

100%

Loss of Limb to one Limb

50%

Total and irrecoverable loss of lens of at least one eye,

which is beyond remedy by surgical or other treatment

50%

Loss of Speech

50%

Total and Permanent Loss of Hearing in

both Ears

one Ear

50%

15%

Section 2 – Child Education Fund (applicable to Overseas Return Journey only)

What Is Covered

If, during the Period of Insurance, whilst You are on a Journey, You sustain Bodily

Injury which results in Death for which a benefit is payable under Section 1 –

Personal Accident, and You have Child(ren) enrolled as a full-time student in a

recognized learning institution.

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

23

What We Will Pay

We will pay up to the relevant Benefit amount specified in the Benefit Schedule for

each surviving Child up to a maximum of four (4) Children subject to the terms and

conditions of this Policy.

What Is Not

Covered

Please refer to Part 4 – General Exclusions.

Section 3 – Medical Expenses

What Is Covered

If, during the Period of Insurance, whilst You are on a Journey:

a) For Overseas Journey : You incur Medical Expenses Overseas as a direct

result of Bodily Injury or Sickness or Dental Expenses as a direct result of

Accidental Injury.

b) For Domestic Journey : You incur Medical Expenses as a direct result of

Bodily Injury or Dental Expenses as a direct result of Accidental Injury.

Additional

Conditions

For the avoidance of doubt, in the event You become entitled to a refund of or

reimbursement of all or part of such expenses from any other source, or if there is

in place any other insurance against the events covered under this Section, We will

only be liable for the excess of the amount recoverable from such other source or

insurance.

a) For Overseas Journey : We have the option of returning You to Malaysia, if the

cost of the Overseas Medical Expenses, Dental Expenses and/or additional

expenses that may be covered under other Benefits in this Policy are likely to

exceed the cost of returning You to Malaysia, subject always to medical advice

provided by Chubb Assistance. If We return You to Malaysia, any claim for

continuation of treatment in Malaysia shall be subject to the terms and the

maximum relevant Benefit amount specified under Section 4 – Follow-up

Medical Expenses in Malaysia. We also have the option of evacuating You to the

nearest Hospital in another country if the necessary treatment and/or facility is

not available in the immediate vicinity.

b) For Domestic Journey : You should seek necessary medical treatment at any

registered clinic or Hospital within twenty-four (24) hours of the Accident

causing the Bodily Injury.

If You are above the age of seventy (70) years old, at the time of the Bodily Injury

or Sickness, the maximum amount of the relevant Benefit payable under this

Section shall be the respective amount specified in the Benefit Schedule for Your

and/or Your Spouse’s age category.

Additional

Definitions

Home Country means any country of which You are a citizen or a permanent

resident and excludes Malaysia.

What We Will Pay

a) For Medical Expenses, only the medical, hospital, surgical treatment

necessarily incurred as a direct result of Bodily Injury or Sickness (for Overseas

Journey), or Bodily Injury (for Domestic Journey) contracted by You during the

Period of Insurance. The treatment must be given by a Physician.

b) For Dental Expenses, only the emergency dental treatment as a direct result of

Bodily Injury to sound natural teeth occurring during the Period of Insurance.

The treatment must be given by a Dentist. This is applicable only when You are

Overseas.

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb

®

, its respective logos and Chubb. Insured.

SM

are protected trademarks of

Chubb. Published 02/2022

24

What Is Not

Covered

In addition to Part 4 – General Exclusions, this Policy does not cover, and We will

not in any event be liable in respect of any claim under this Section, which is directly

or indirectly, caused by, a consequence of, arises in connection with or contributed

to by any of the following:

1. Any expenses incurred for prostheses, contact lenses, spectacles, hearing aids,

dentures or medical equipment.

2. Any expenses relating to any treatment not prescribed by a Physician or Dentist

(as the case may be).

3. Any expenses incurred in relation to traditional treatment or treatment by a

Traditional Physician.

For Overseas Journey:

i) Any expenses relating to any treatment for Bodily Injury or Sickness where such

treatment was sought and/or received more than sixty (60) days from the time

the Bodily Injury or Sickness was first sustained.

ii) Surgery or medical treatment which in the opinion of the Physician or Dentist

(as the case may be) treating You can be reasonably delayed until Your return to

Malaysia.

iii) Any further expenses incurred by You if We wish to return You to Malaysia but

You refuse (where in the opinion of the treating Physician or Dentist (as the case

may be) and Chubb Assistance You are fit to travel).

iv) Any treatment obtained in Your Home Country, unless specifically provided for

under this Policy.

v) Any Bodily Injury or Sickness that occurred before the commencement of Your

Journey.

For Domestic Journey:

i) Any expenses relating to any treatment for Bodily Injury where such treatment

was sought and/or received after twenty-four (24) hours from the Bodily Injury

was first sustained.

ii) Surgery or medical treatment which in the opinion of the Physician or Dentist

(as the case may be) treating You can be reasonably delayed until Your return to

Your Home.

iii) Any further expenses incurred by You if We wish to return You to Your Home

but You refuse (where in the opinion of the treating Physician or Dentist (as the

case may be) and Chubb Assistance that You are fit to travel).

iv) Any treatment obtained in Your Home, unless specifically provided for under

this Policy.

v) Any Bodily Injury that occurred before the commencement of Your Journey.